-

Monday 5:00pm ET - Fed Gov. Jefferson speaks

-

Tuesday 9:00am ET - S&P Case-Shiller home price index

-

Tuesday 10:00am ET - Fed Gov. Barr testifies to Senate on banks

-

Wednesday 10:00am ET - Fed Gov. Barr testifies to House on banks

-

Thursday 8:30am ET - GDP (2nd revision)

-

Friday 8:30am ET - PCE Index

-

Friday - Fed Govs: Waller speaks, Williams speaks, Cook speaks

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math minded people here, pardon any typos.

THE BIG PICTURE THEMES:

This week we have the Fed’s preferred inflation measure (PCE index) to be released on Friday. We also have a lot of Fed govs. making speaking appearances.

Last week the Fed raised rates by +25bps, which was the consensus estimate, in order to maintain credibility around inflation while also acknowledging the delicate US banking situation.

Forward guidance around future rate hikes was in-line with December’s view, which has gotten slightly more hawkish after January’s monster NFP report. The Fed now estimates only one more potential hike for the terminal rate.

The big questions outstanding are whether the banking situation worsens, CPI & PCE soften, and finally, does the BTFP program create QE-like effects to offset QT?

The Fed updated their balance sheet ... now ~two-thirds of QT has been reversed. pic.twitter.com/mmaeLJuV2i

— Jim Bianco biancoresearch.eth (@biancoresearch) March 23, 2023

In crypto, the rate hike of +25bps didn’t catapult BTC prices even higher, but the overall situation is bullish for crypto. Especially if the Fed is eventually forced to target a higher inflation level, something like 2% → 3%.

That said, BTC prices could see headwinds if the economy plunges into recession as BTC is finding its place as either a “risk asset” or a “monetary alternative”.

BTC: $27,853 -1.64%

ETH :$1,767 -3.17%

SOL: $20.95 -5.94%

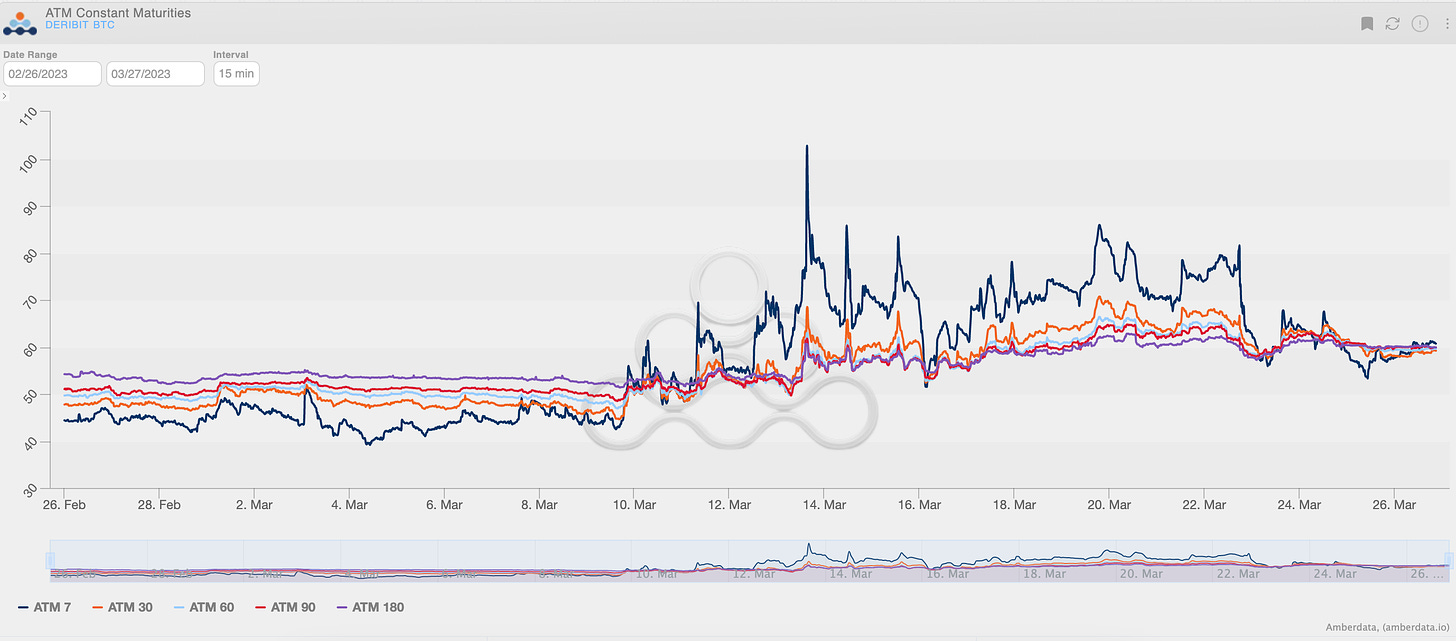

TERM STRUCTURE

(March 26th, 2023 - BTC Term Structure - Deribit)

The term structure is into a “flat” profile, post FOMC. I like to think of this as “undecided” volatility as BTC decides if it’s going to consolidate or pull-back slightly - likely bringing IV into Contango with it- or going to resume its rally higher, to say, $30k likely triggering backwardation in the term structure once again.

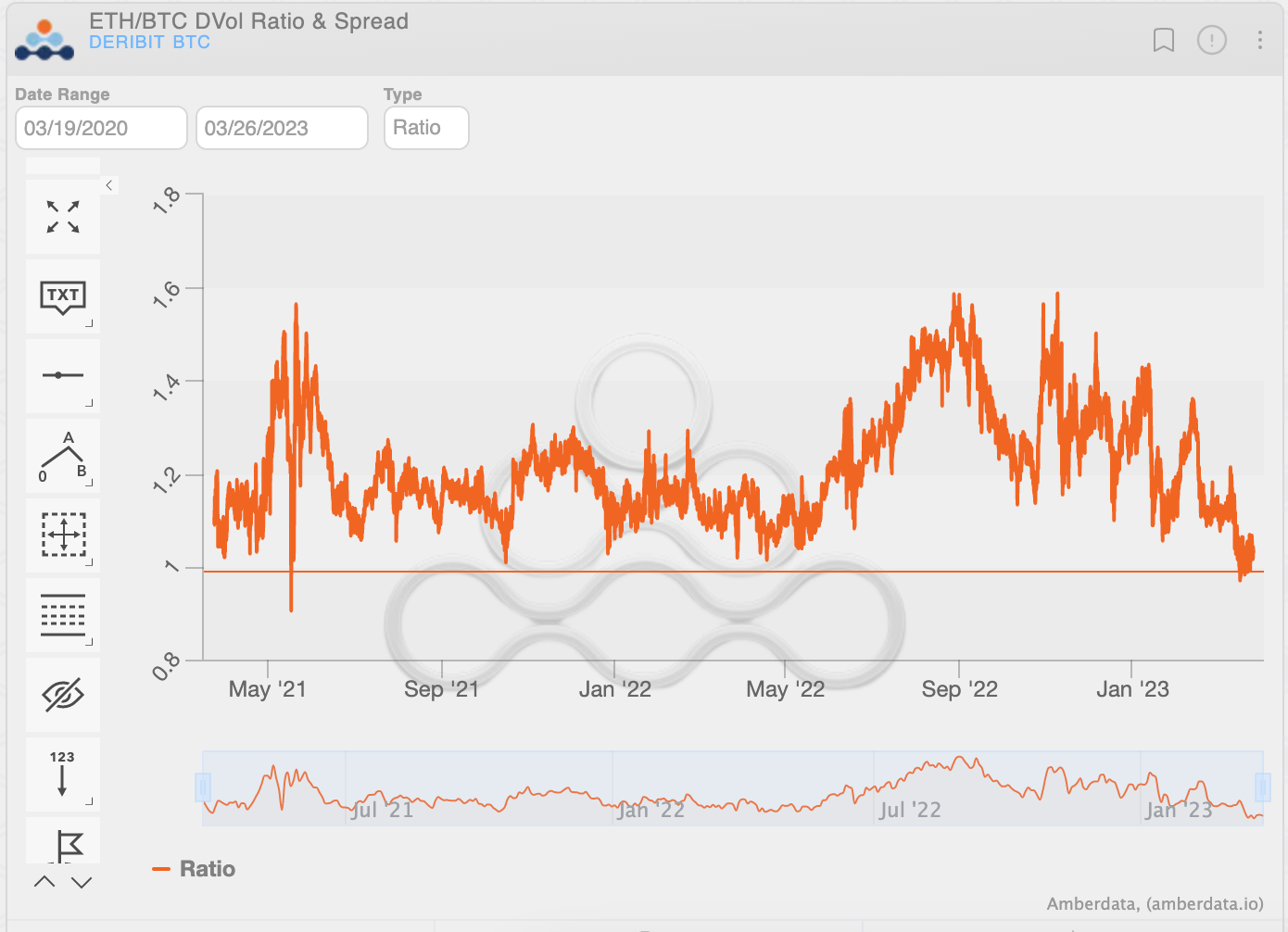

Another interesting element right now is the relative volatility between BTC and ETH.

The chart above depicts ETH “DVOL” (Deribit’s volatility index) divided by BTC “DVOL”.

Rarely has this relative volatility been so tight, with a reading of about 1.0.

As long as BTC keeps leading the crypto move higher this is justified, but should BTC consolidate or move lower, we’d likely see ETH DVOL resume its typical premium.

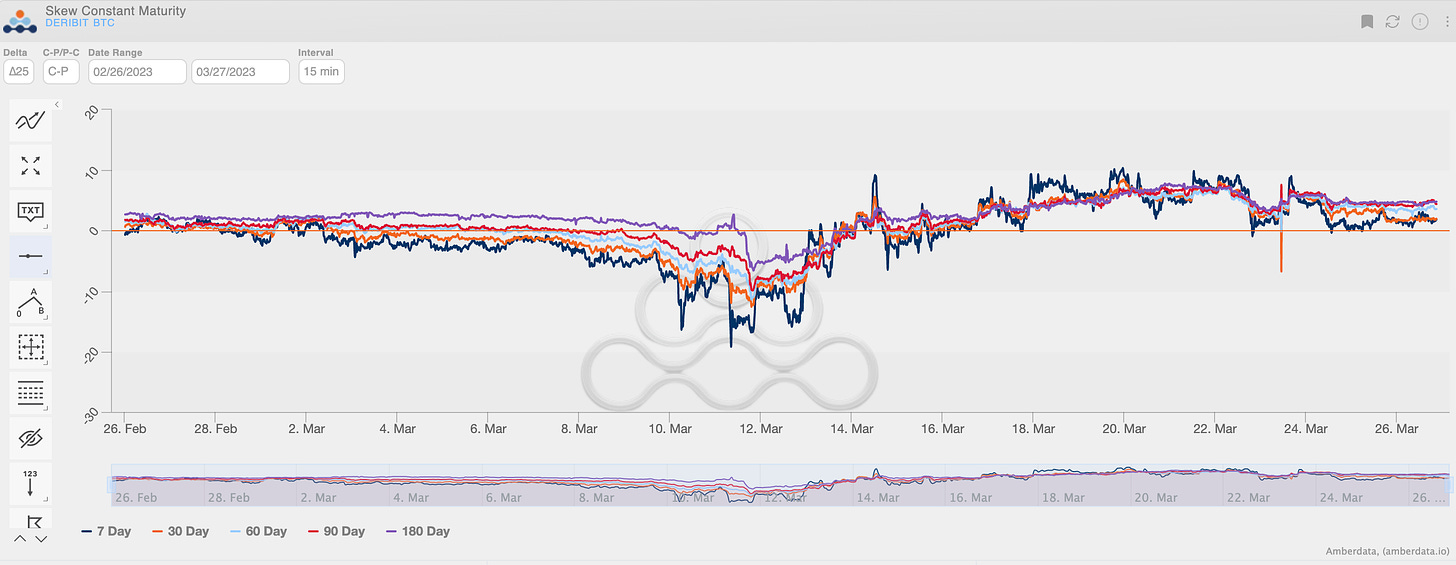

SKEWS

(March 26th, 2023 - BTC RR SKEW (C-P) ∆25 - Deribit)

All the expirations are now solidly back into the positive RR-Skew territory.

This type of RR-Skew is similar to, say, Gold right now, but inverse to equities and other “risk assets”.

To me, this provides some opportunity in the RR-Skew space as part of a broader portfolio context.

As mentioned earlier, the big question right now is whether BTC continues to trade as a “monetary asset” or a “risk asset”.

This non-stable relationship creates an interesting vol. profile and a unique diversification.

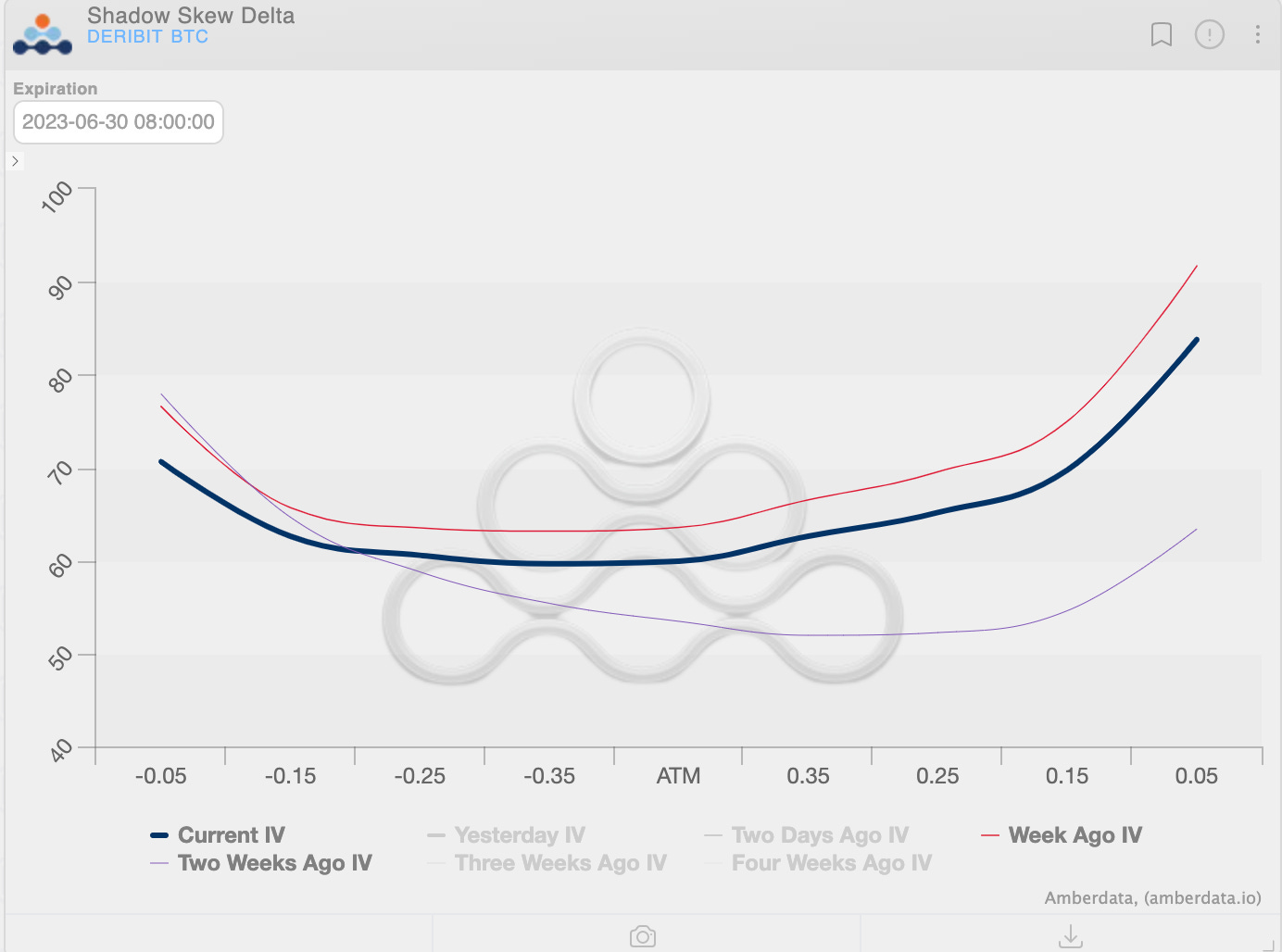

We can see something like the June expiration call wing start to relax post FOMC, as the vol. catalyst passes by and the momentum behind BTC’s rally pauses.

Should the momentum continue to pause, or BTC suffer a pull-back, we could see the call wing drop much lower, to a level seen about 2-weeks ago.

To me, this make the structures like the call +1/-2 interesting, as there’s a lot of juice implied here.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

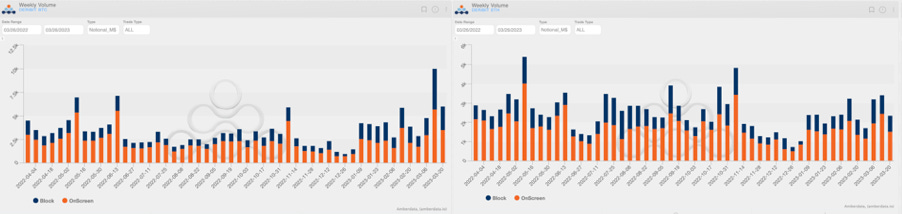

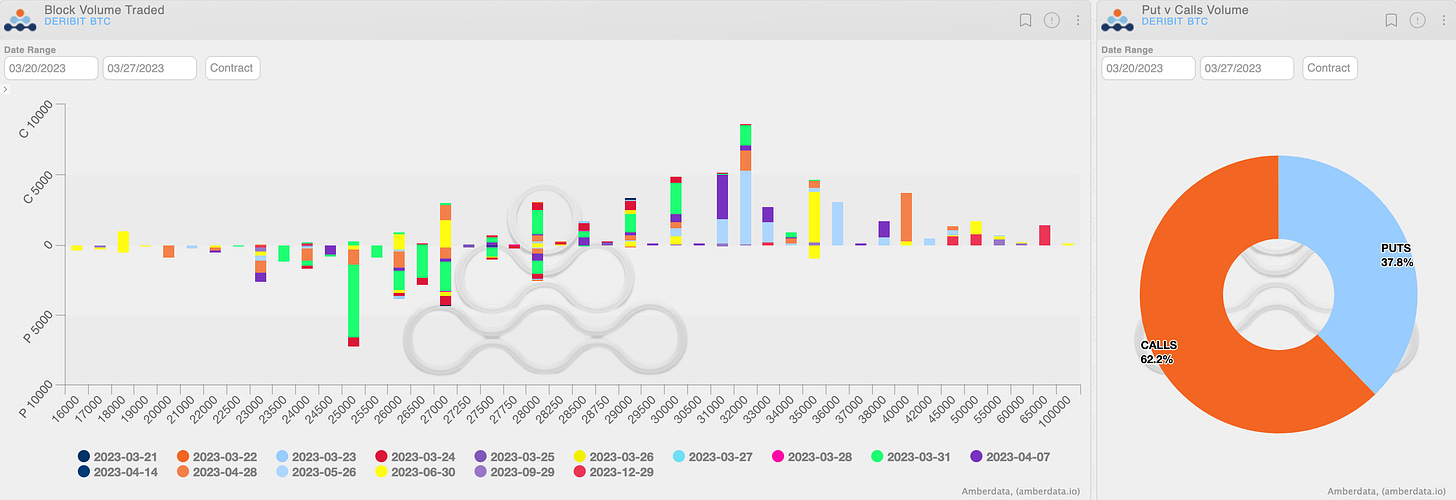

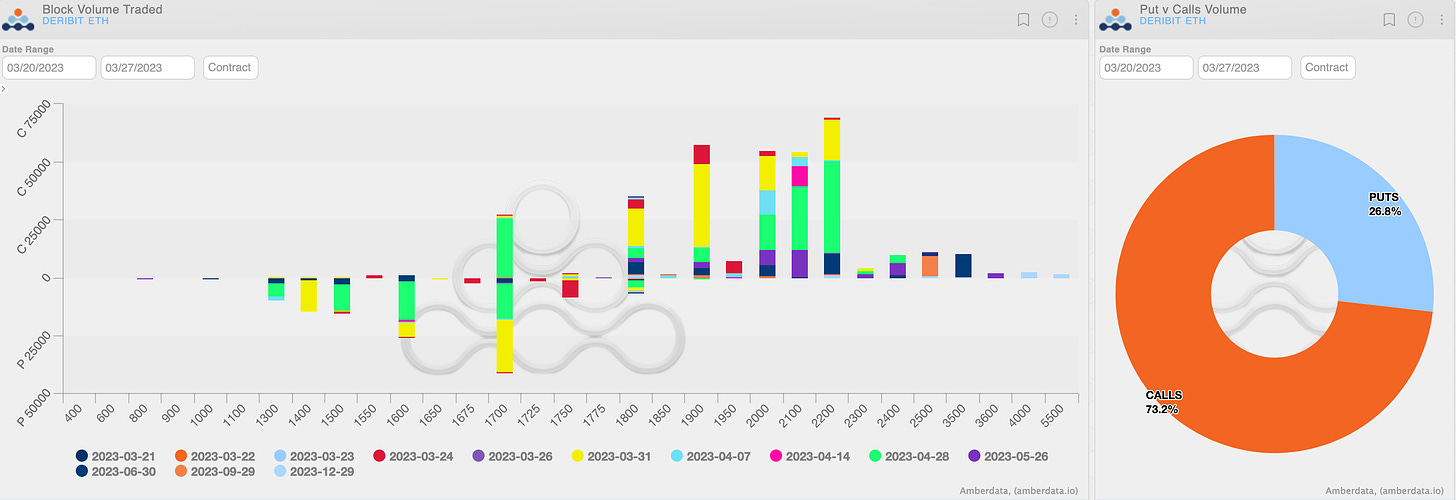

Another solid week for traded volumes, with over $5B for Bitcoin and $2B for Ethereum.

(BTC vs ETH Weekly Volumes Notional - Options Deribit Historical Section)

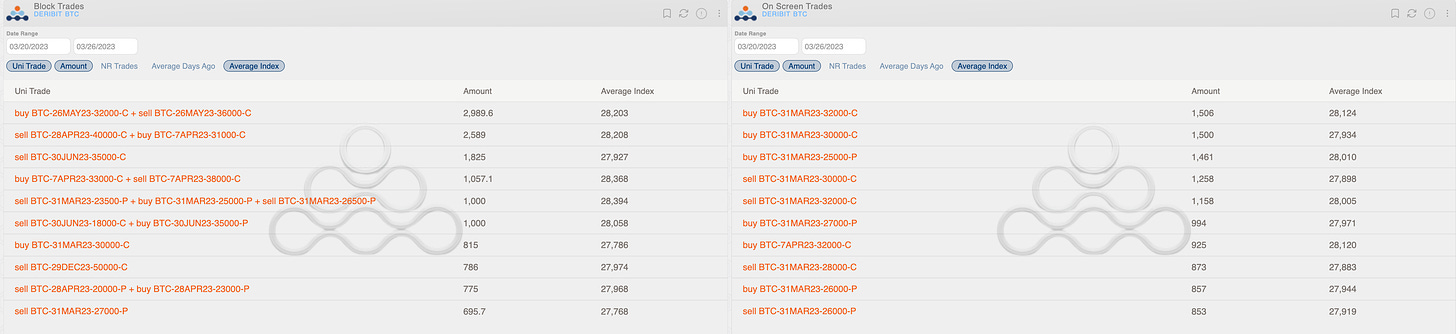

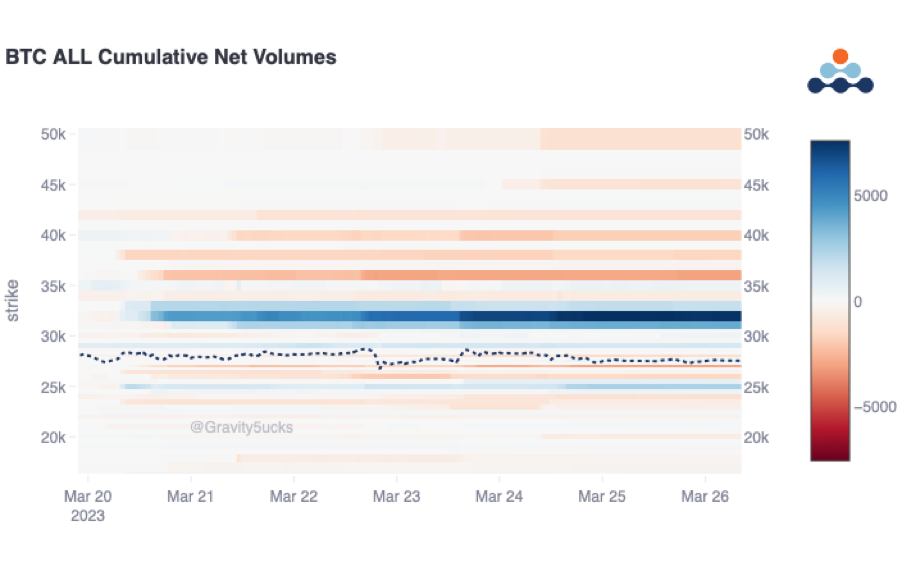

Mood in continuity with the previous one, with calls to dominate the flow: $31k/$32k/$33k strikes bought most of the time in spreads.

In the heat map you also notice a timid long for $25k puts.

To complete the view, some profit take for 31MAR $28k call and 30JUN23 $27k call, both evident in our new “Volume OI Ratioed” feature in the “Options scanner” section.

(BTC AD Direction tables with uni_trade - Options Scanner section)

(BTC Heatmap)

(BTC Volume OI Ratioed - Options Scanner Section)

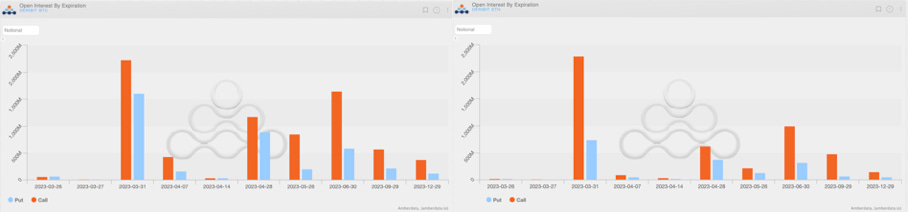

Around $3.5B for Bitcoin and $3B for Ethereum of notional will expire on Friday.

Notably, a similar expiration had a significant impact for Ethereum during the merge of the last summer, with a considerable volume of call spreads and call flies. The effect of this deadline on Ethereum's total open interest is noteworthy, as it represents approximately half of all opened contracts.

(BTC & ETH Open Interest By Expiration - Deribit Current Section)

Paradigm Block Insights (20Mar - 26Mar)

Crypto majors finished roughly unchanged this week, with BTC failing to break higher to 29k despite a significant post-FOMC spot reversal from 26700 to 28600. Upside option plays still strongly in focus.

BTC +1% / ETH +1% / SPX 1.7%

Peak-ish short gamma according to GVOL GEX index, coupled with terrible spot liquidity (even worst than post-FTX), has led to very whippy markets and strong demand for crypto options.

However, the option demand continues to concentrate in BTC vs. ETH. The only ETH “flippenings” we are talking about in 2023 is BTC > ETH implied vol spreads. ETH options taking a backseat… our clients not really talking about Shanghai.

Implied vols cratered on the post-FOMC selloff, creating attractive opportunities to re-initiate BTC upside flows after taking profit on the rally through 27k.

500x 31-Mar-23 30000 Call bought

500x 31-Mar-23 29000 Call bought

We are also seeing stronger demand for BTC call spreads due to elevated upside skew that has made wingy call sales screen quite attractively.

2150x 26-May-23 32000/36000 Call Spread bought

1050x 7-Apr-23 33000/38000 Call Spread bought

As a decent proxy, BTC 25-delta skews trade 3-4v calls > puts...certainly lower than earlier in the week on the rally, but we expect the elevated call implieds to remain a theme, given strong upside realized and the developing "digital gold" narrative.

ETH upside seeing more love as well (BTC upside has dominated), with 20k Apr bullish risk reversals trading on Thursday.

15000x 28-Apr-23 1600/2100 RRCall bought

5000x 28-Apr-23 1700/2200 RRCall bought

Earlier in the week:

10,000x 28-Apr-23 2200 Call bought

5,000x 26-May-23 2400 Call bought

New episode of TBP is out! 🔊

We discuss crypto vol markets with Chris Newhouse of GSR, as the BTC "Digital Gold" narrative gains more traction. We think incredibly low spot liquidity combined with dealer option exposures partially inform the current spot rally.

BTC

ETH

The Squeethcosystem Report (3/19/23 - 3/25/23)

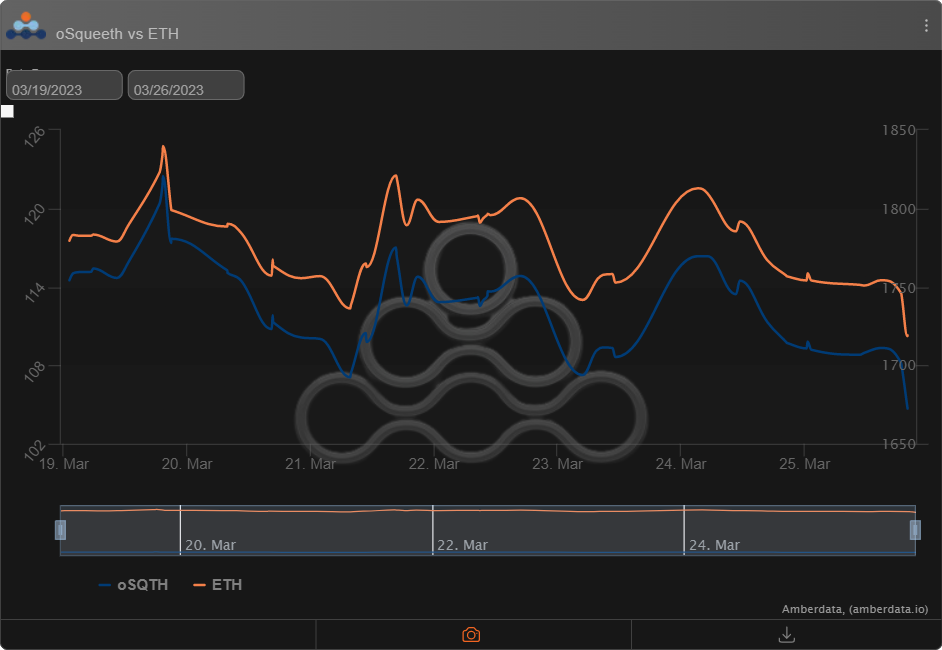

With all eyes on the FOMC, this week remained quiet as ETH continued in its current price range. ETH ended the week -3.37% and oSQTH ended the week -8.57%.

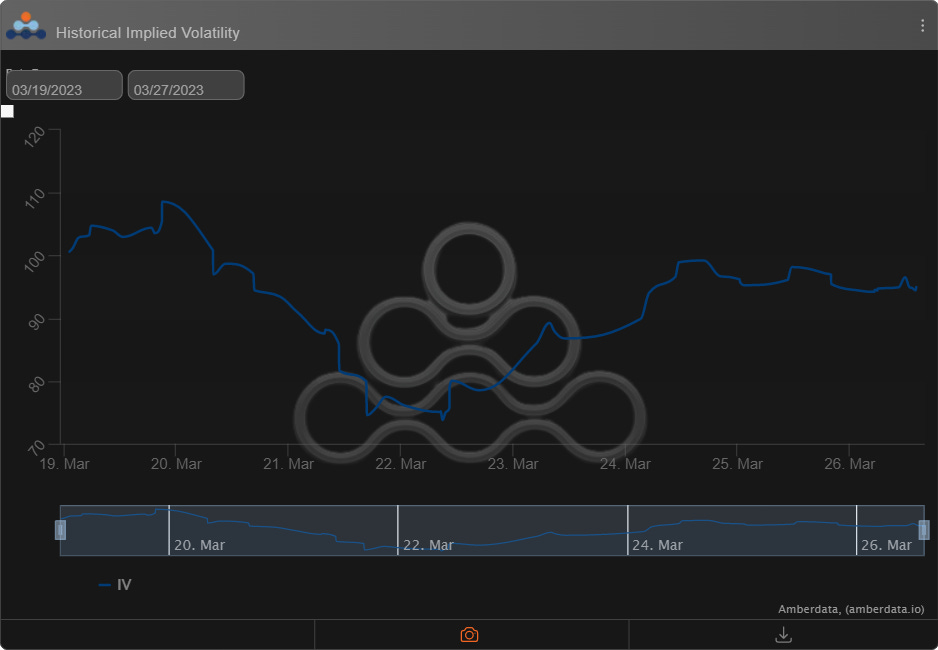

Volatility

Squeeth IV remained volatile this week, starting the week around 100% and quickly getting sold to 80% before finding its way back to 90%.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $4.5m. March 21st saw the highest volume, with a daily total of $1.05m traded. An additional $258k traded via OTC auctions this week.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...