Crypto Options Analytics, Nov 26th, 2023: Feds Beige Book & Crypto Vol

USA Week Ahead:

-

Tuesday 9am ET -S&P Case Shiller 20-cities

-

Tuesday 2pm ET - Fed Govs speak throughout the day

-

Wednesday 8:30am - GDP (1st Revision)

-

Wednesday 2pm - Beige Book

-

Thursday 8:30am - PCE

-

Friday 10am - ISM

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH, and Lyra and may change their holdings anytime.

CRYPTO OPTIONS MACRO THEMES:

This week, we will see the Fed’s “Beige Book” on Wednesday. The Beige book is good for indications of economic trends, inflationary pressures, and potential changes in monetary policy. That said, the Fed has been very clear that they find the economy more resilient than expected, but are staying aware and balanced by both the risk of too much hawkishness vs too much dovishness.

TL:DR - the beige book isn’t likely to bring any new information as the Fed is data dependent and looking at new data releases.

Thursday’s PCE number is likely going to be the biggest driver of volatility this week.

Chart: (VIX 1yr Daily chart)

VIX is currently at annual lows, but might be able to “uptick” this week, as the market returns from the holiday and low liquidity trading from last week gets adjusted.

The trend, going into EOY, is likely low vol & risk-on; however, any uptick in Vol this week could be a nice fade.

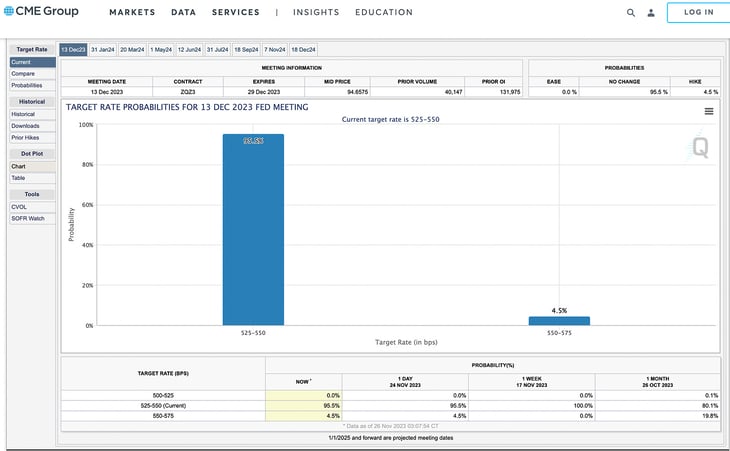

December 13th FOMC meeting is lining up to be a non-event as well, which supports the idea of EOY calm.

US rate stability into EOY would be constructive for BTC prices, although BTC is mostly moving around spot ETF rumors, politics and regulatory headlines.

Over the next week, however, I expect some “counter flows” to the holiday week rally.

BTC: $37,615 (+1.7% / 7-day)

ETH :$2,079 (+4.8% / 7-day)

Chart: (BTC Daily Spot Prices - Coinbase.com)

Bitcoin spot prices want to rally higher… this chart looks bullish and constructive… but without a catalysts for a breakout to $40k, we’re getting a lot of short-term false moves.

This is translating to low realized volatility on a day-to-day basis, but traders are keeping IV bid in anticipation of the breakout move.

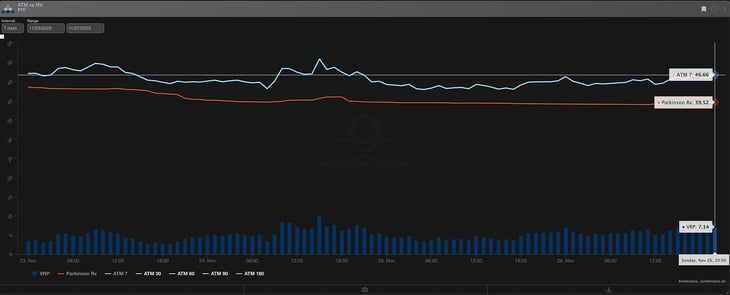

Chart: (IV RV 7-DTE)

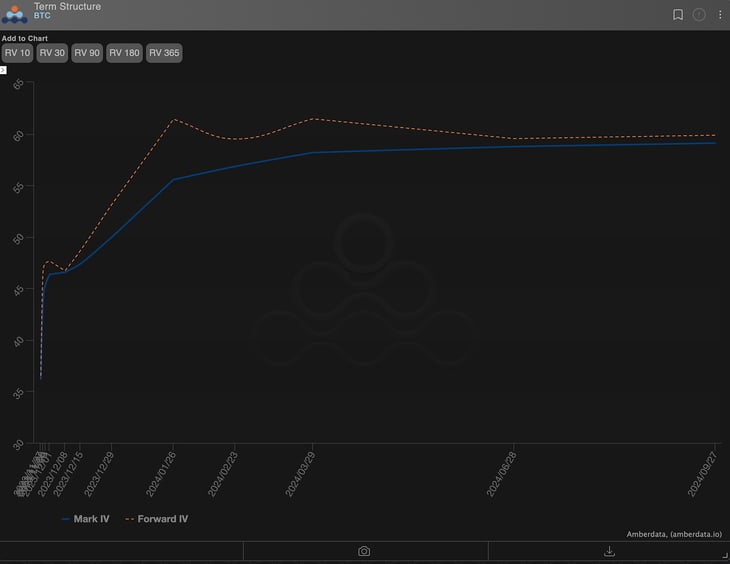

Chart: (BTC Term Structure)

The term structure is pricing-in a significant IV “cliff” as weekly options approach expiration.

This “throw-away” effect has been consistent the past few weeks. I would expect this to continue, making a great opportunity for selling “weekend volatility” as the chances of a Spot ETF are much lower.

Chart: (BTC gamma profile)

Looking at the gamma profile… a positive ETF news catalyst would likely move prices into the $42k-$43k price range. We can see a clear “air-pocket” here.

Again, crypto vol is a small space, likely too small to have hedging effects take us to $43k… but the positioning itself is what’s telling around the price psychology.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

The massive monthly closure slipped away without disruptions.

The implied volatility term structure remained unchanged over the course of a week.

Will this calm last?

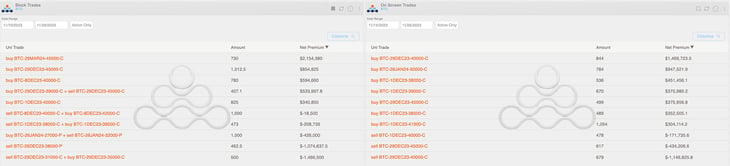

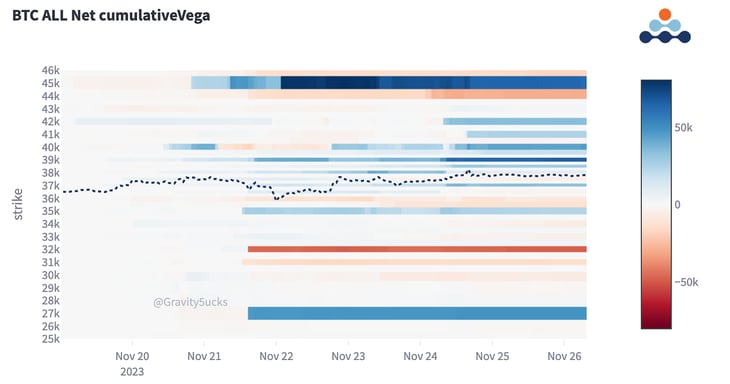

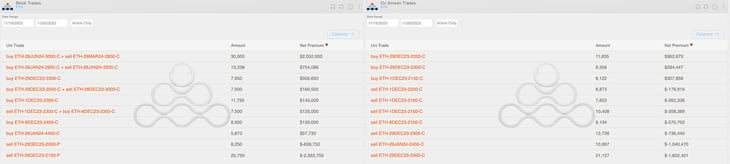

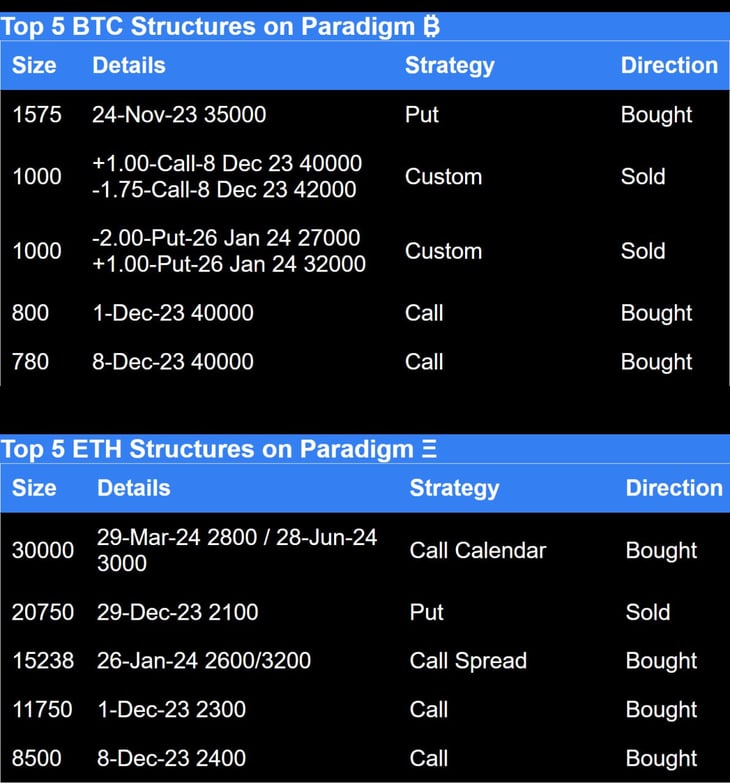

The accumulation of calls continues, even in call spreads. The sale of a put spread -$32k/+$27k in January suggests the overall sentiment.

Chart: (BTC Weekly Top Trades)

Chart: (BTC Heatmap Vega)

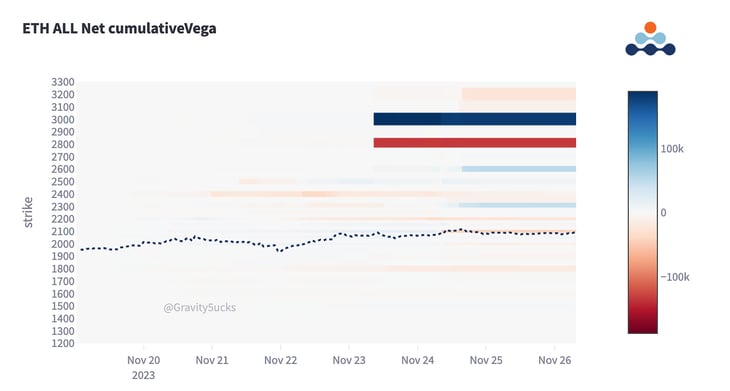

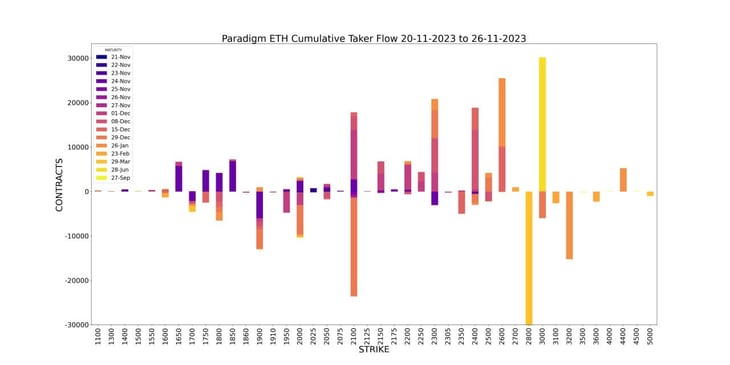

We also observe buys of call spreads and put sales for Ethereum (even more pronounced than in Bitcoin). The diagonal dominates the heatmap in terms of Vega.

Chart: (ETH Weekly Top Trades)

Chart: (ETH Heatmap Vega)

With the spot price grinding higher in a controlled fashion, and the market anticipating a probable but still uncertain future event, remaining exposed to optionality can be quite costly.

The max pain here is dying in a bullish environment by a thousand cuts.

Paradigm's Week In Review

BTC flat on the week with ETH outperforming♻️

Paradex hits $1 Billion in total Volume traded 🔥

BTC +0% / ETH +3.14% / NDX +0.5%

Paradigm Top Trades this Week 👇

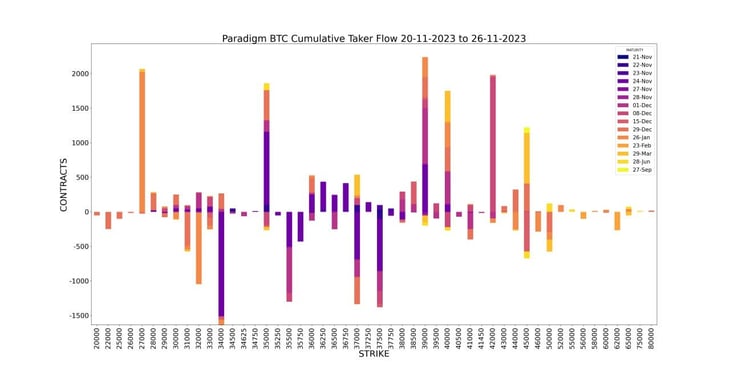

Weekly BTC Cumulative Taker Flow 🌊

Weekly ETH Cumulative Taker Flow 🌊

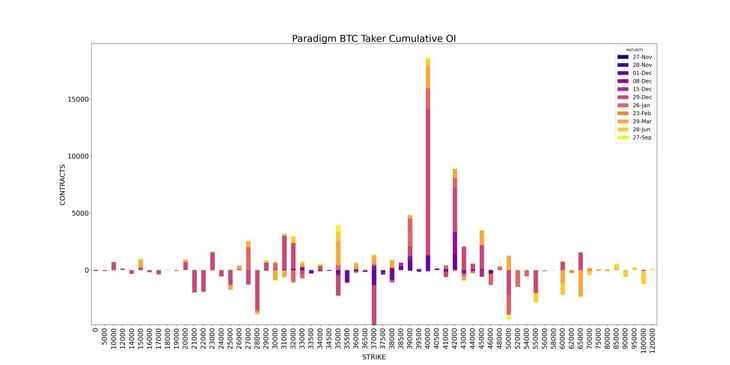

BTC Cumulative OI

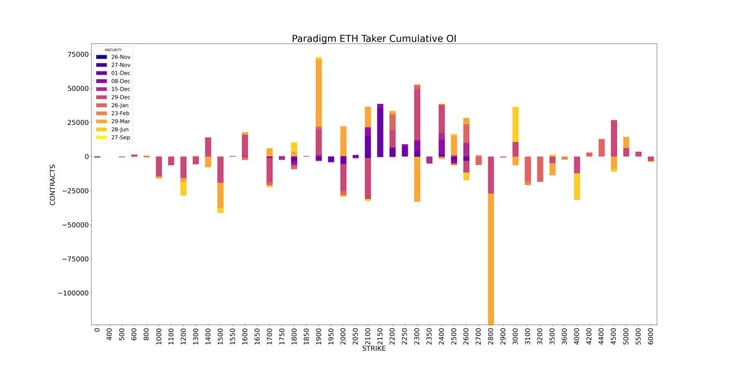

ETH Cumulative OI

TBP | Why ETH Volatility has Awakened, with SEBA Bank Switzerland. - Ep. 41

- ETH overwriter covers huge shorts; new Deribit margin requirements

- Swiss Regulation

- BTC vs. ETH vol

Tune in 👇

Paradex hits $1 Billion in total Volume 🔥

🔥 $1 Billion in total Volume traded to date! 🔥

— Paradex (@tradeparadex) November 24, 2023

LFG 💜🚀 pic.twitter.com/SU8SBanuoN

As always, you can hit us up from the below.

Hit us up on Telegram! 🙏

Paradigm Edge: Daily Commentary✍️ http://pdgm.co/edge

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

BTC

ETH

The Squeethcosystem Report

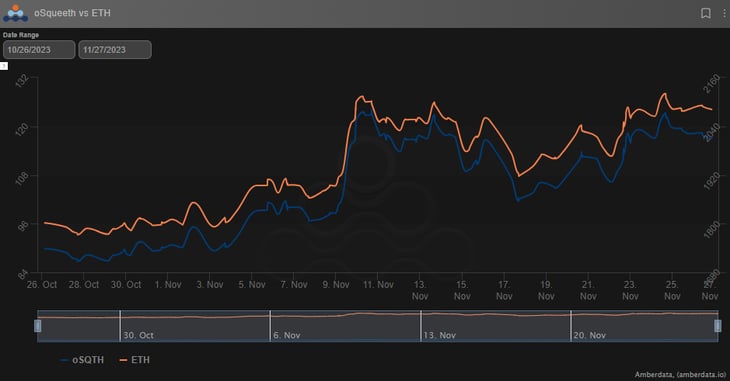

Crypto markets found their way lower throughout the week. ETH ended the week +6.18%, oSQTH ended the week +11.36%.

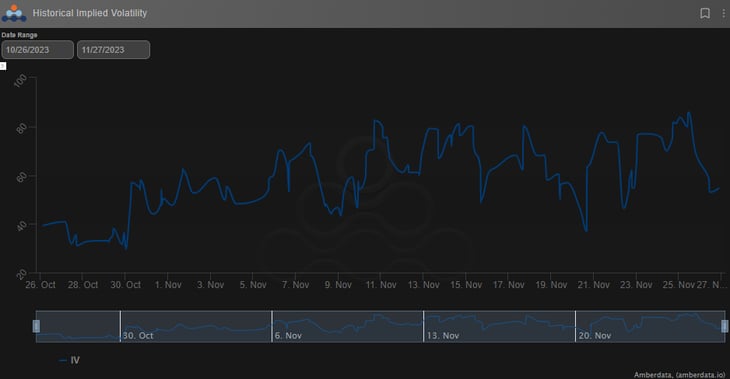

Volatility

oSQTH IV continued to remain volatile, trading in the mid 50s to the high 70s most of the week.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $289.31k

November 25th saw the most volume, with a daily total of $86.06k traded.

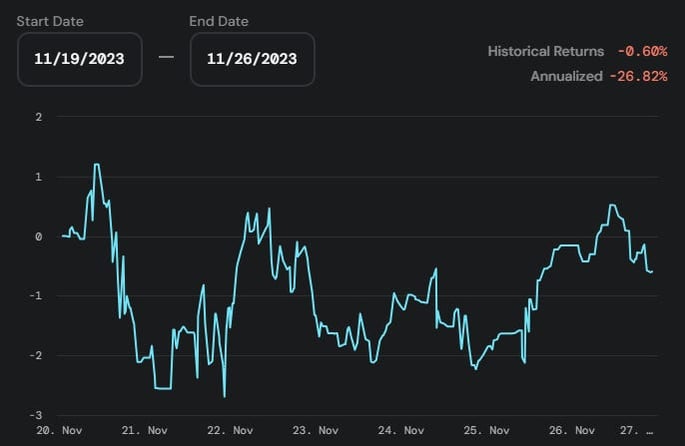

Crab Strategy

Crab saw declines during the week, ending at -0.60% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...