.png)

-

Monday 10:30am ET - Fed Gov. Jefferson Speaks

-

Tuesday 9:00am ET - Case Shiller Home Price Index

-

Wednesday 9:00am ET - Fed Gov. Kashkari & Goolsbee Speak

-

Friday 11am & 3p ET - Fed Gov. Logan & Bowman Speak

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math minded people here, pardon any typos.

THE BIG PICTURE THEMES:

Risk assets displayed renewed weakness last week as bond yields moved higher, given that more rate hikes seem to be on the table.

Last week we saw the release of the Fed “minutes” from the most recent meeting. "Minutes” are released with a lag, post FOMC, and a lot of strong economic data has been released after these discussions.

The “minutes” are telling, as all Fed members were at least aligned to do rate increases of 25bps, but a small segment is still concerned about ending a higher rate regime too soon, favoring 50bps hikes.

All this was before the recent strong jobs data.

We’re seeing bond yields, FX and precious metals reflect this reality, while crypto remains strong, on an island of its own.

Despite that fact, BTC did have a small pull-back last week.

Economic data this week will be interesting. Tuesday, we have the Case Shiller Index releasing housing price data; this might move markets - as housing is very sensitive to rates - providing clues to Fed efforts.

We also have multiple Fed members speaking throughout the week; their talks will likely move markets as it brings more clarity.

From a technical perspective, BTC charts don’t look broken to me and the bull-run isn’t violated, in my opinion.

I’d expect a pickup in price velocity below $22k or above $25k, in either direction.

BTC: $23,450 -4.56%

ETH :$1,634 -3.27%

SOL: $23.11 -8.98%

TERM STRUCTURE

(Feb. 26th, 2023 - BTC Term Structure - Deribit)

The term structure has steepened a lot last week. The momentum for higher prices disappointed.

As prices pick a direction (below $22k or above $25k), traders are selling vol., anticipating some sideways activity while BTC makes up its mind.

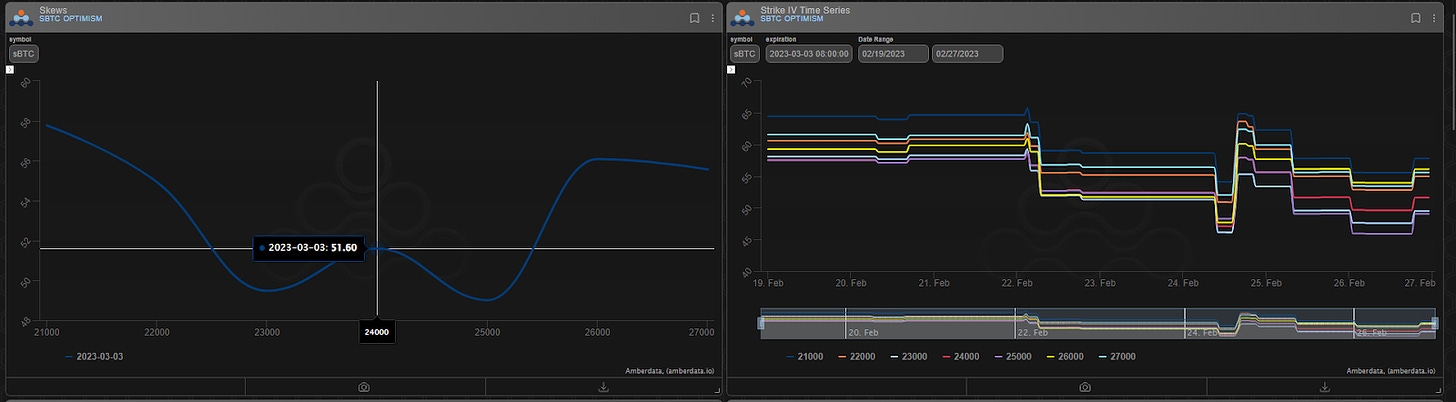

SKEWS

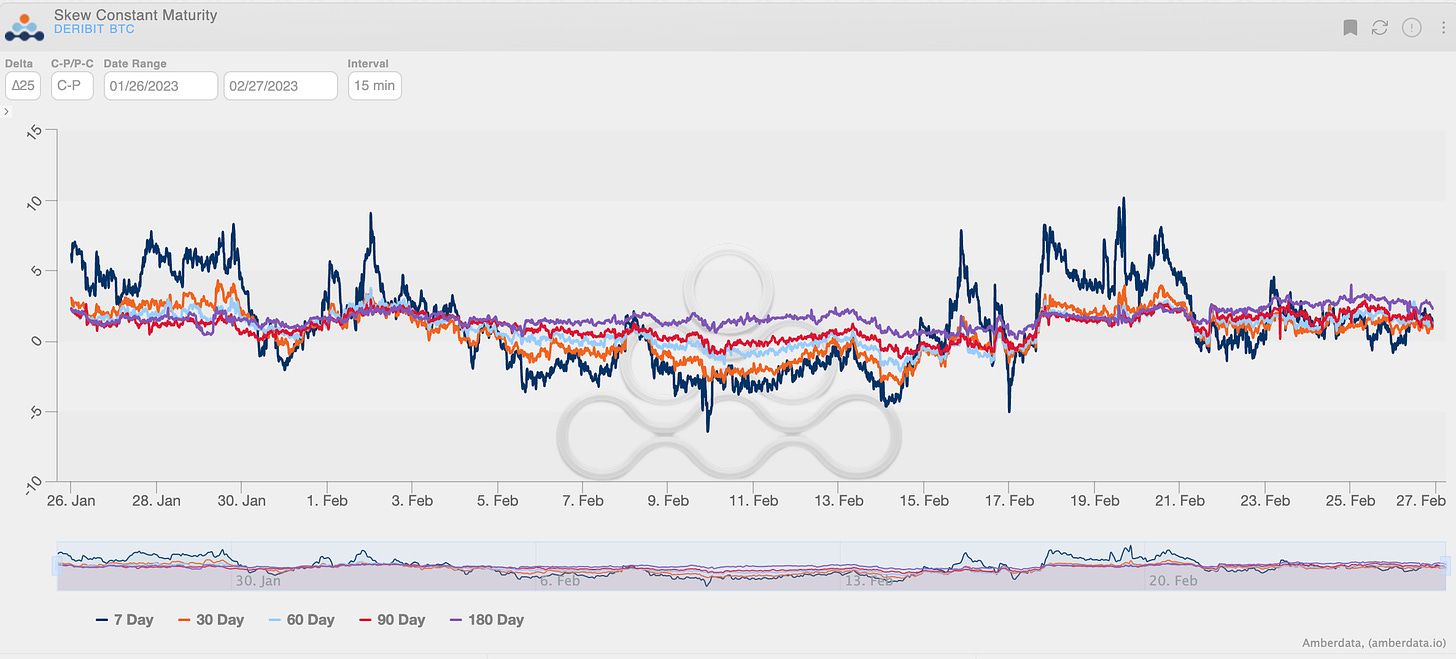

(Feb. 26th, 2023 - BTC RR SKEW (C-P) ∆25 - Deribit)

The skew has completely clustered around symmetry.

BTC option traders are unsure of which direction price “shocks” will come from.

This has really been the theme of the past couple weeks: BTC spot prices going their own way, defying larger macro asset risk-off trends, but traders aren’t sure that this can continue.

VOLATILITY PREMIUM

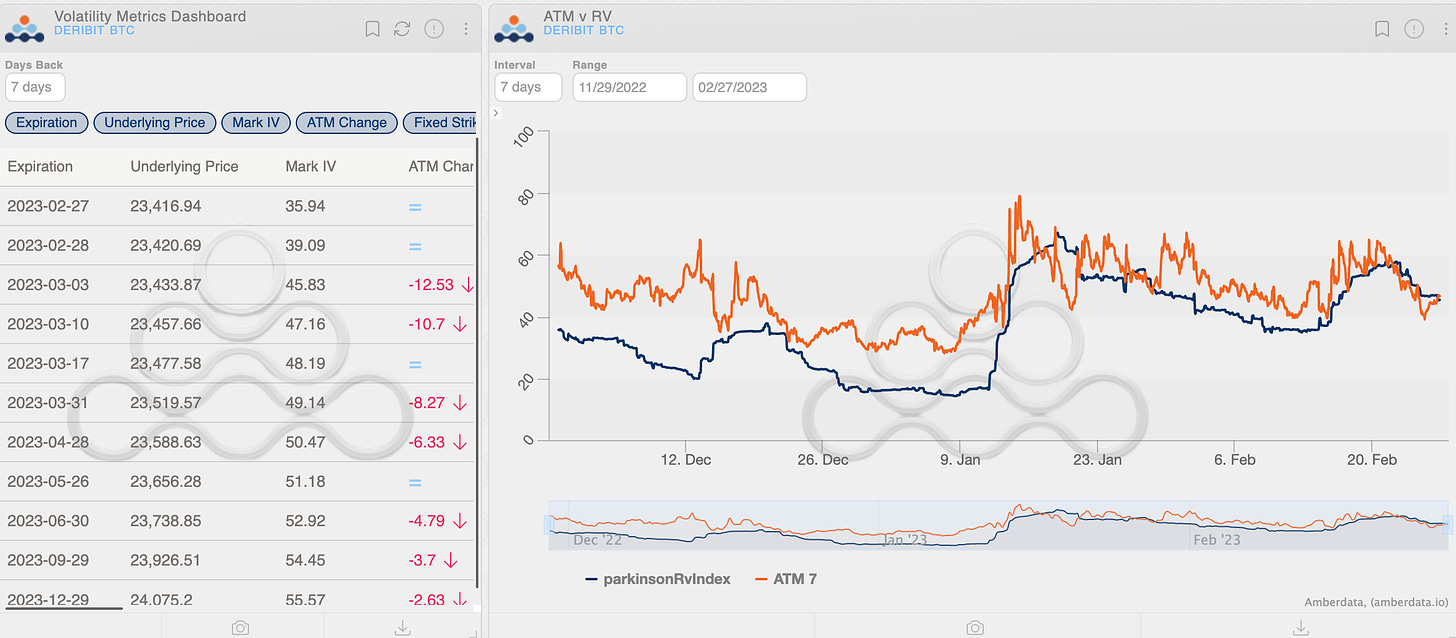

(Feb. 26th, 2023 - BTC IV-RV)

Volatility has dropped in tandem for both IV and RV.

IV isn’t expensive here and option traders seem confident that RV is headed lower.

My thinking here is contingent.

I don’t think options are expensive at all and long options still seem interesting to me; however, the ($22k or above $25k) levels seem like logical velocity escape zones.

I think once we get beyond those levels, especially if the macro is also supportive, there will be a continuation with momentum.

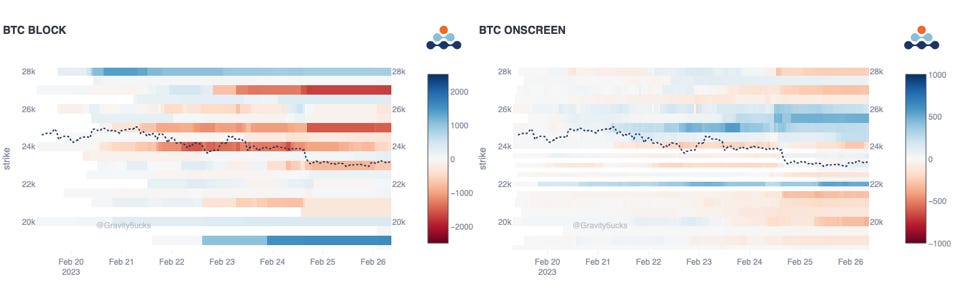

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

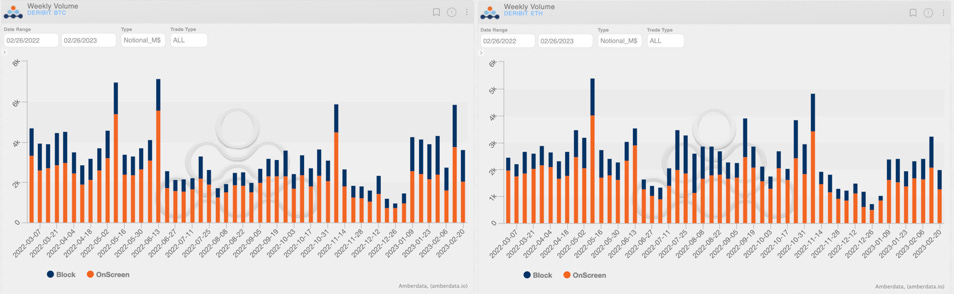

(BTC vs ETH Weekly Volumes Notional - Options Deribit Historical Section)

The latest attacks on the $25k resistance have exhausted buyers.

This week we have witnessed the unwind of 24FEB positions. Theta killing. With the spot slipping into more neutral ground, market participants sold $25k-$27k calls and, unlike the past two weeks, some opened new protective positions with puts. Longer maturities saw interest for 10delta calls.

On screen, the focus was all for the 3MAR expiry, with evidence in the head map of short $24k, long $22k.

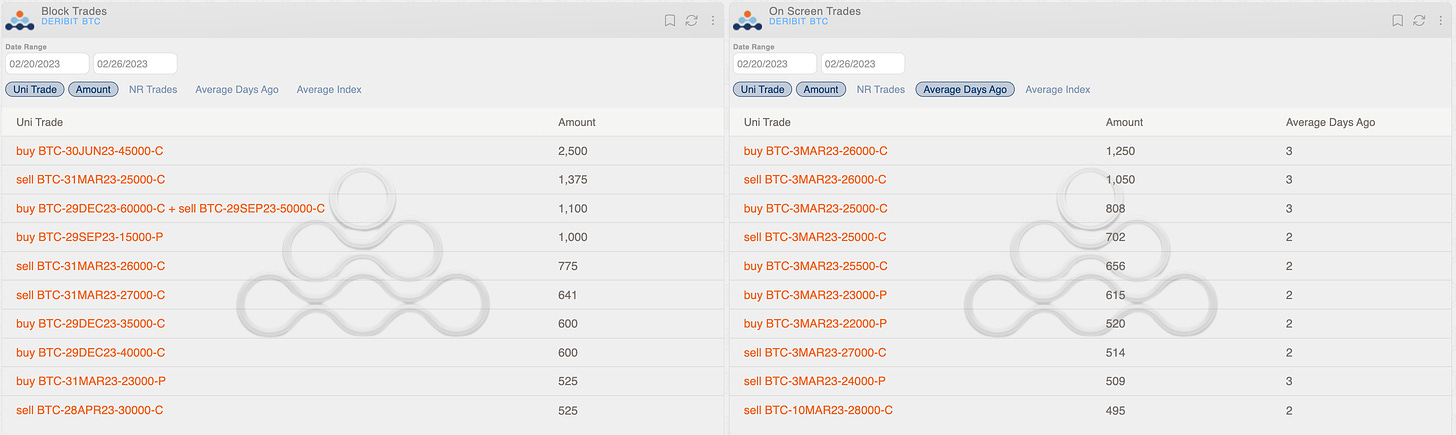

(BTC AD Direction tables with uni_trade - Options Scanner section)

(BTC AD Heatmaps - Weekly Cumulative Net Volumes)

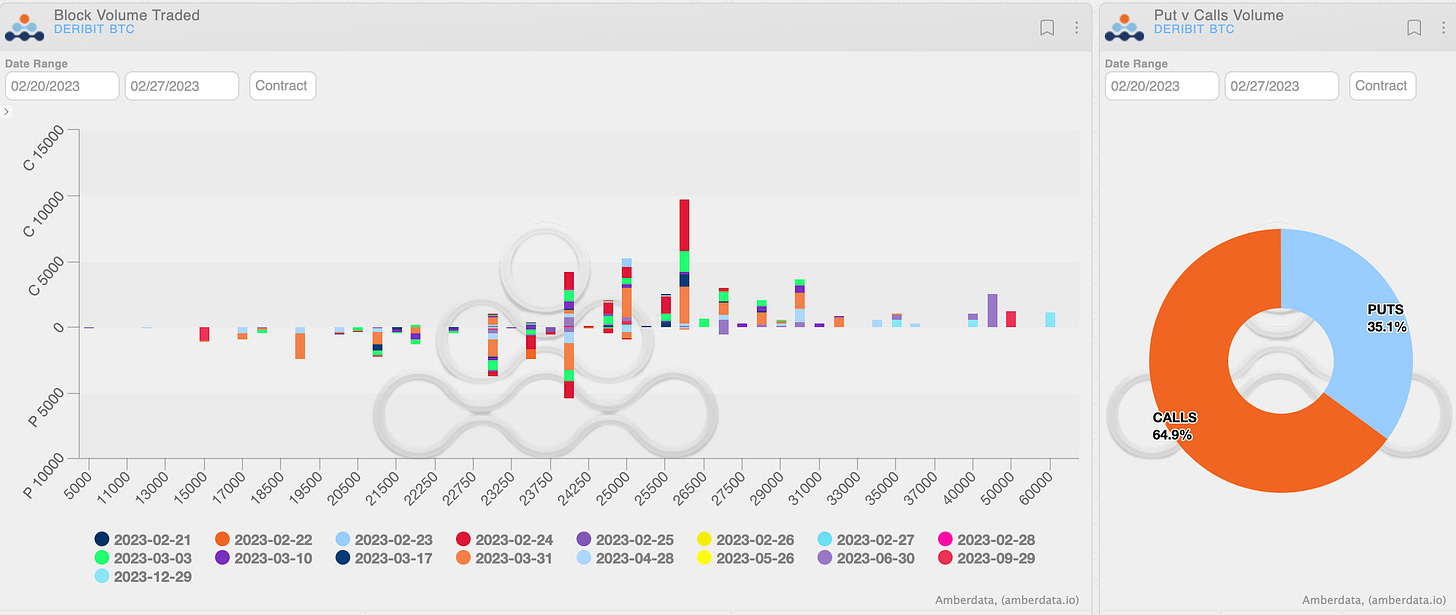

Paradigm Block Insights (20Feb - 26Feb)

Higher rates from hawkish PCE / consumer spending data led to a risk-off week, with UST 2-year yields rising from 4.6% to 4.82%. Data suggests the Fed needs to act further to slow down the economy and control inflation.

BTC -7.5% / ETH -6.7% / NDX -1.9%

Spot/vol correlation remains strong… 2022 playbooks out the window.

1M ATMs down from 58v to 46v WoW, with the sharpest decline in implieds occurring on Friday post-PCE, as spot fell -3.5%. 1M VRP has collapsed, with implieds now trading inline with realized.

Friday’s systematic option supply partially helps explain the significant vol selloff. However, we also saw a good amount of tactical selling from fast money ahead of the weekend. Notable prints below:

- 600x BTC 31Mar 25k calls sold

- 250x BTC 3Mar 18k/20.5k/27k/30k iron condor (sold body / bot wings)

- 10k ETH 26May 1500 puts sold

June flows, in our view, are the most interesting; the largest BTC blocks were short ATMs and long upside wings.

2500x June 45k Calls bot (~60k vega)

500x Jun 27k Straddle sold (-$55k vega)

250x Jun 24k Straddle sold (-$28k vega)

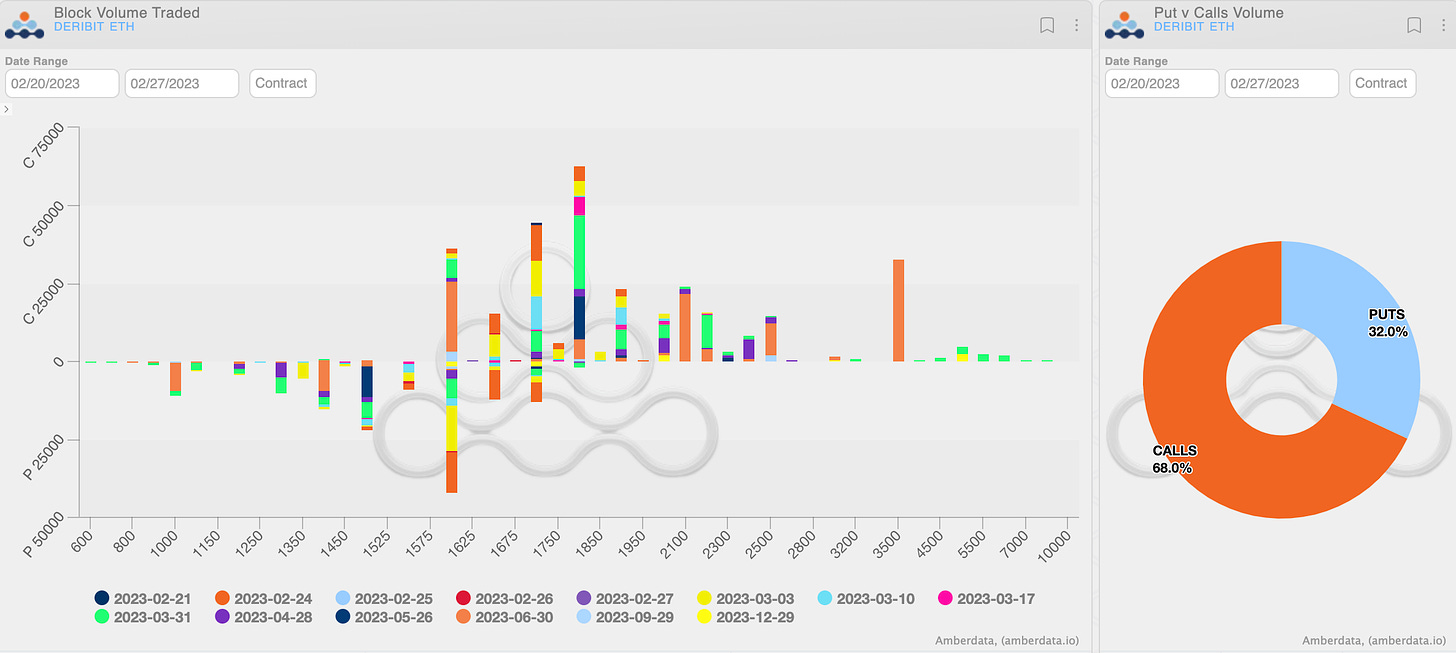

ETH Jun 1x3s back in focus…these convexity trades have been popular for higher vega at higher levels of spot and vol.

These structures make sense with spot back in the middle of the range, absolute implieds in low 50s, and positive spot/vol correlation.

10k June 2500 / 3500 1x3 call spread (sell 1x / buy 3x).

🔊 The Big Picture

New episode of TBP is out! 🔥

Have you ever wondered what time / days of week crypto options are the busiest? The breakdown of multi-leg vs. single-leg blocks? Some proprietary crypto data covered below!

BTC

ETH

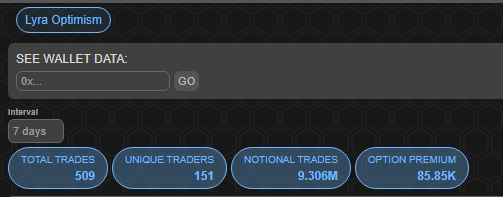

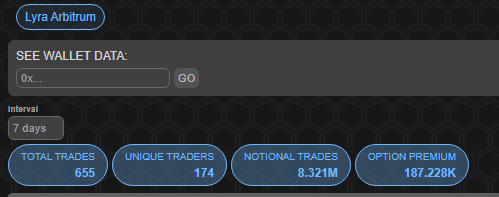

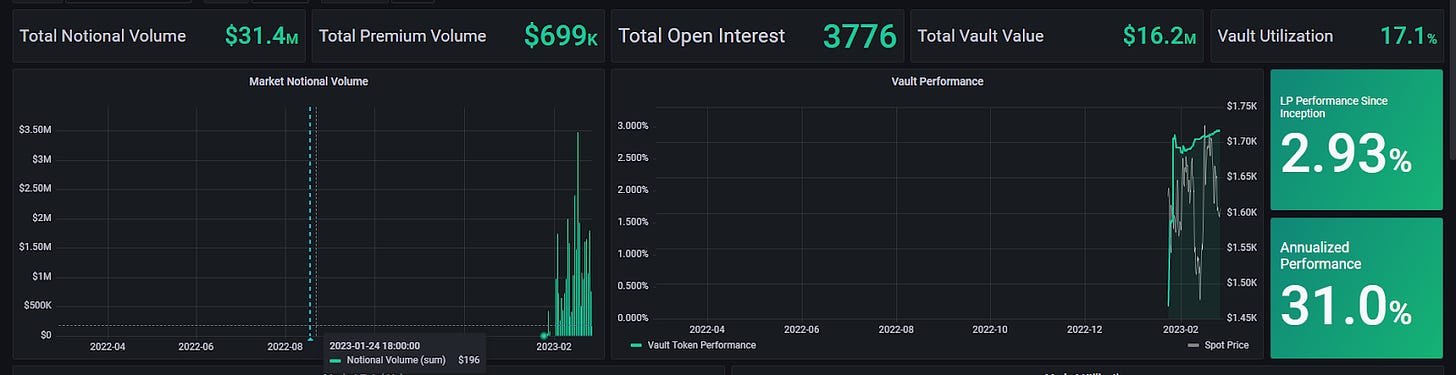

Lyra Weekly Review

We NOW support @lyrafinance's latest V2 release on Arbitrum along with a full suite of features on the AD Derivatives App.

— Amberdata.io 📊📈 (@Amberdataio) February 17, 2023

Read more about Lyra's latest V2 release here 👇 https://t.co/d2XiWPfaQn

Access on our app, go to DeFi ➡ Lyra ➡ Arbitrum👇 https://t.co/DHF5xQu8l1 pic.twitter.com/Y2NCCm2UKM

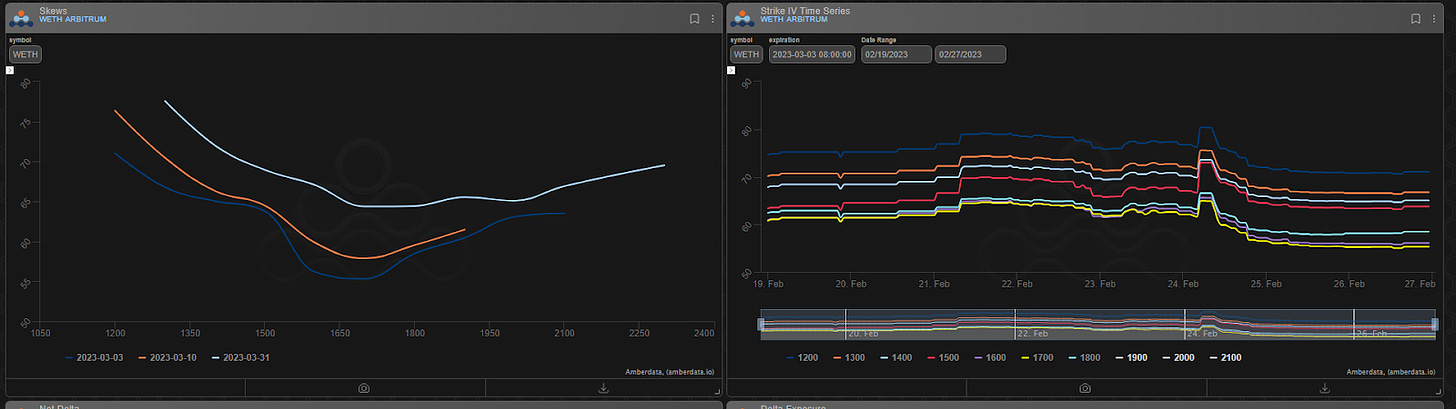

Volatility

Current ATM IV is ~55% in ETH, down around 10 points on the week as RV has failed to keep up once again. Markets are back in contango with a slight discount to the call skew.

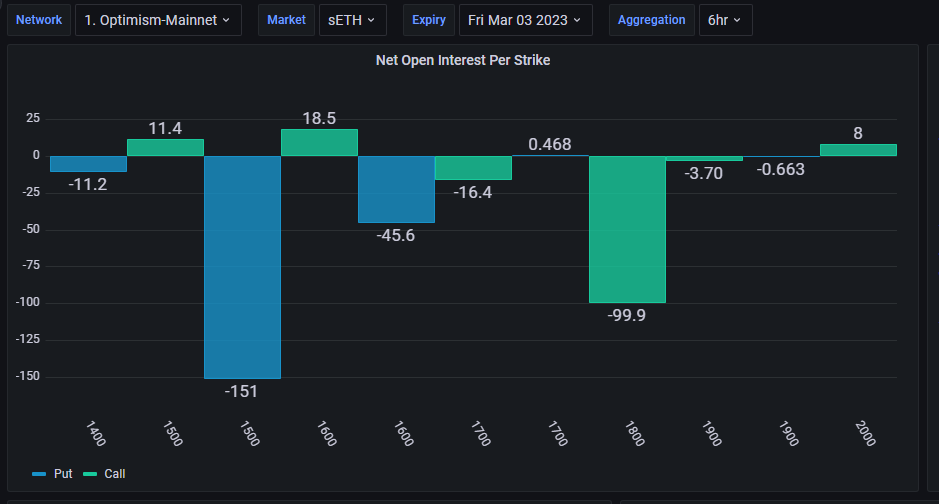

Trading

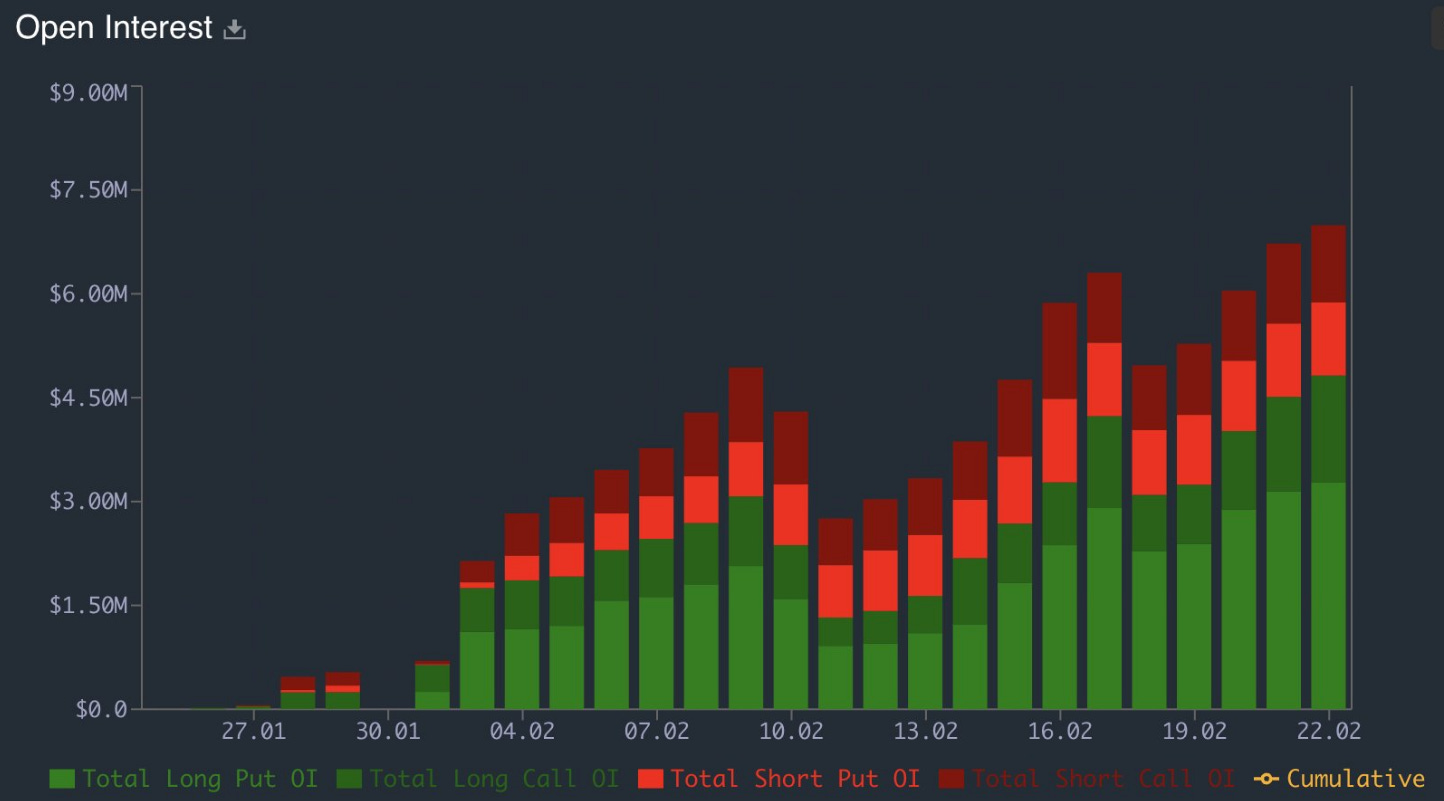

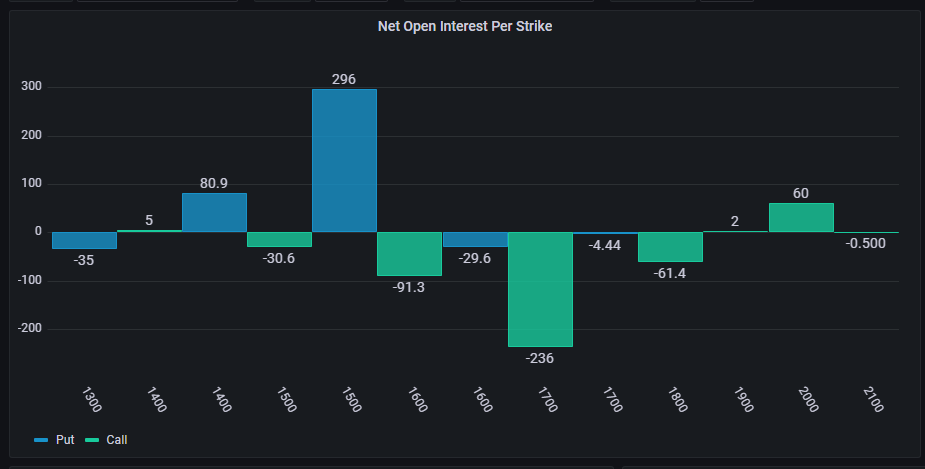

Trading on Arbitrum and Optimism creates a new opportunity for arbitragers to balance skew and IV cross-chain. Arbitrum options are currently sitting a t a premium to CEXs without any DOVs executing. Trading has slowed on a choppy market but we expect this to pick up as traders position themselves for the Shanghai upgrade. TVL and Open Interest on Arbitrum continue to grow on Arbitrum as Lyra options hit a new all-time high in OI.

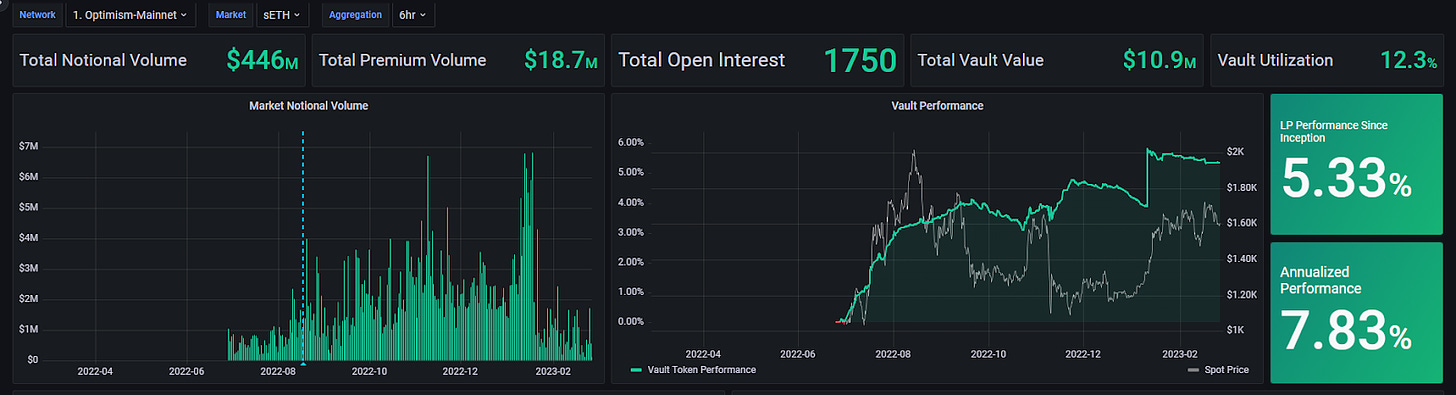

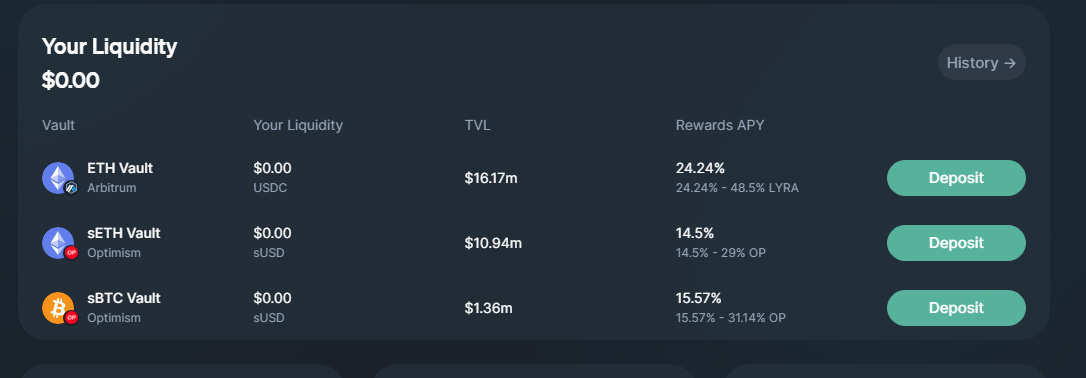

ETH Market-Making Vault

The ETH MMV on Optimism has returned +5.33% since its inception (June 28th, 2022), representing a weekly change of -0.01; annualized performance since inception is +7.83%. A new direct integration with Synthetix will lower fees paid in the Optimism MMVs and reduce reliance on a Treasury rebate program; this should greatly normalize returns in the MMV and reduce hedging fees to 10 BPs.

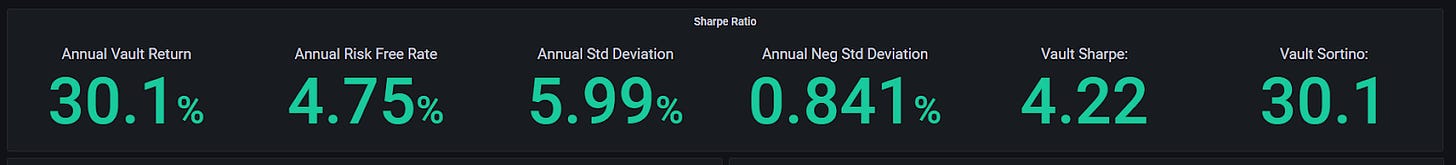

The ETH MMV on Arbitrum has returned +2.93% since its inception, representing a weekly change of +.07. Annualized performance since inception is +31.0% (since the pool is relatively new, annualized performance may be misleading)

Depositors earn an additional 14.5 rewards APY, boosted up to 29% for LYRA Stakers on Optimism or 24.24% boosted up to 48.5% for LYRA Stakers on Arbitrum (new).

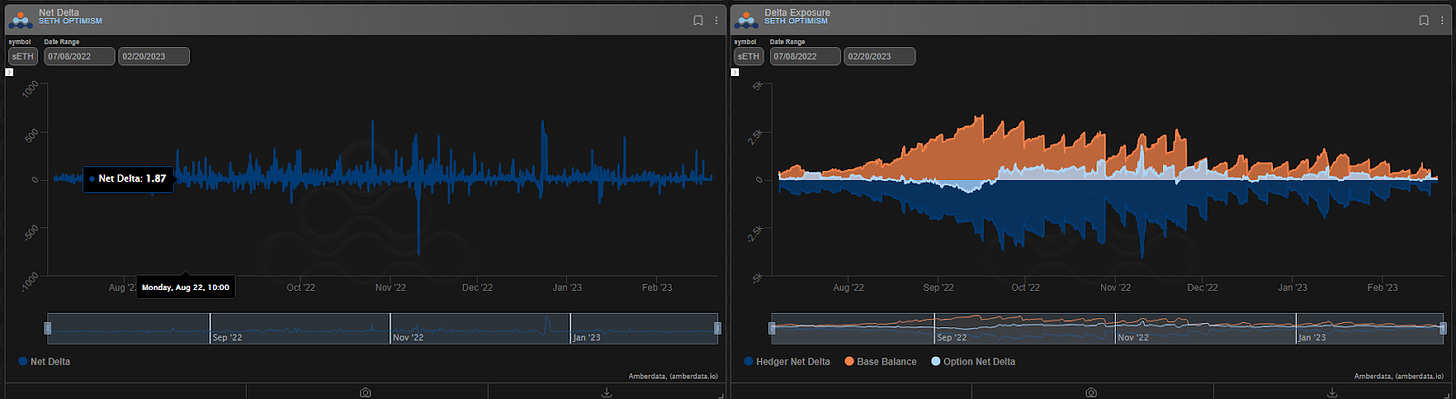

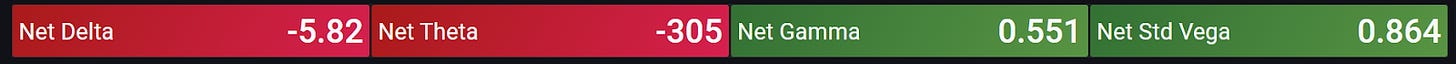

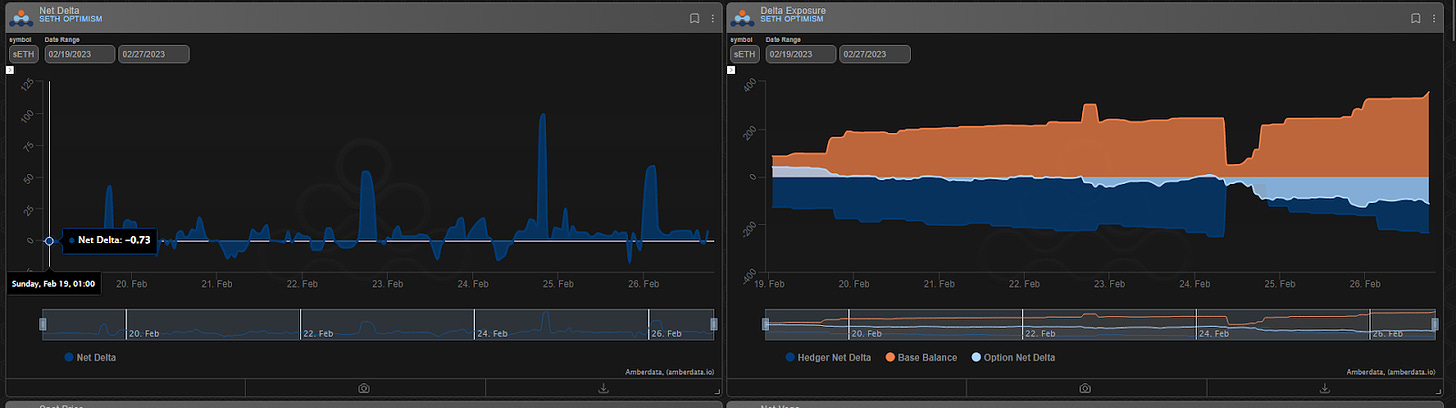

Net MMV Exposure:

Both ETH vaults are long gamma/vega, with Optimism holding more long units.

Optimism:

Arbitrum:

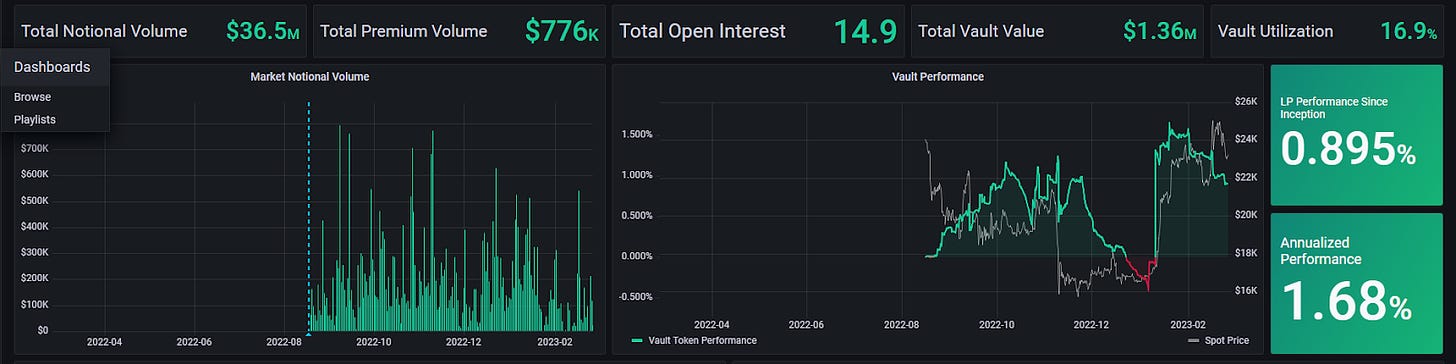

BTC Volatility

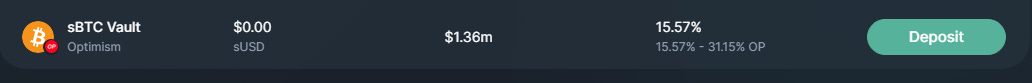

BTC Market-Making Vault

Lyra’s BTC MMV has returned +.895% since its inception (August 16th, 2022). This represents a weekly change of -.10%. Annualized performance since inception is +1.68%. This vault will also benefit greatly from Synthetix direct integration.

Depositors earn an additional 15.57% rewards APY (boosted up to 31.15% for LYRA Stakers)

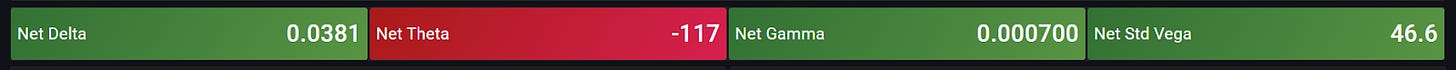

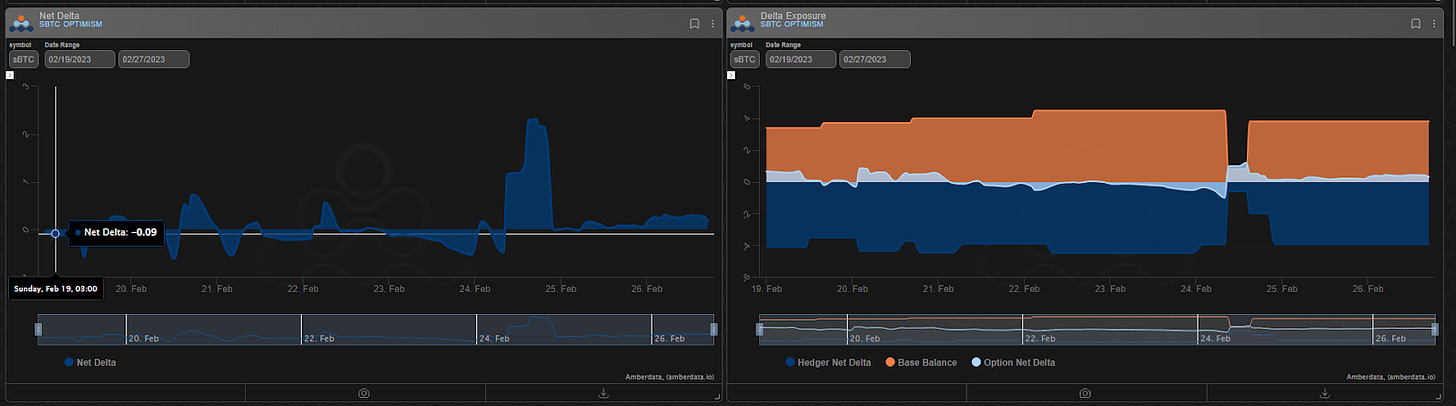

Net BTC MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...