- Monday after market close - First Republic Bank Earnings

- Tuesday 9a ET - S&P Case-Shiller Index (Home Prices)

- Tuesday 10a ET - Consumer Confidence

- Thursday 8:30a - GDP

- ⭐️ Friday 8:30a - Employment Cost & PCE

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math minded people here, pardon any typos.

THE BIG PICTURE THEMES: Fed Hikes, SVB Bank Crisis and Regulation.

The current bank run & inflation macro themes continue.

A lending pullback would slow down the economy.

Continued rate hikes depend on these bank dynamics and the trends for CPI/PCE and other inflation measures (such as house prices).

Quarterly figures from First Republic Bank are due to be reported Monday.

This is one of the hardest banks hit during the SVB crisis. This will provide key insight onto the continued extent of the crisis.

On Friday we will see PCE figures and the Q1 “Employment Cost Index”.

Fed officials have signaled they are likely to raise the fed-funds rate at their meeting May 2-3 to just above 5% before entertaining a pause.

These expectations for another hike lead to a rally in the USD against other fiat, precious metals and cryptos.

BTC has failed to hold above $30k and ETH has failed to hold above $2k.

Paper Gold (Futures, not physical bullion) is back below the $2k mark as well.

Outside of these macro themes, SEC regulatory enforcement is the other major source of news.

The SEC is set to rule on Grayscale’s application for an ETF product next month.

An ETF approval would be extremely positive for crypto spot prices and US crypto options trading and would quickly close the Grayscale Bitcoin-Trust discount.

These are the "Big Picture” themes I’m currently focused on.

BTC: $27,458 (-9.40% / 7-day)

ETH :$1,859 (-11.13% / 7-day)

SOL: $21.62 (-10.20% / 7-day)

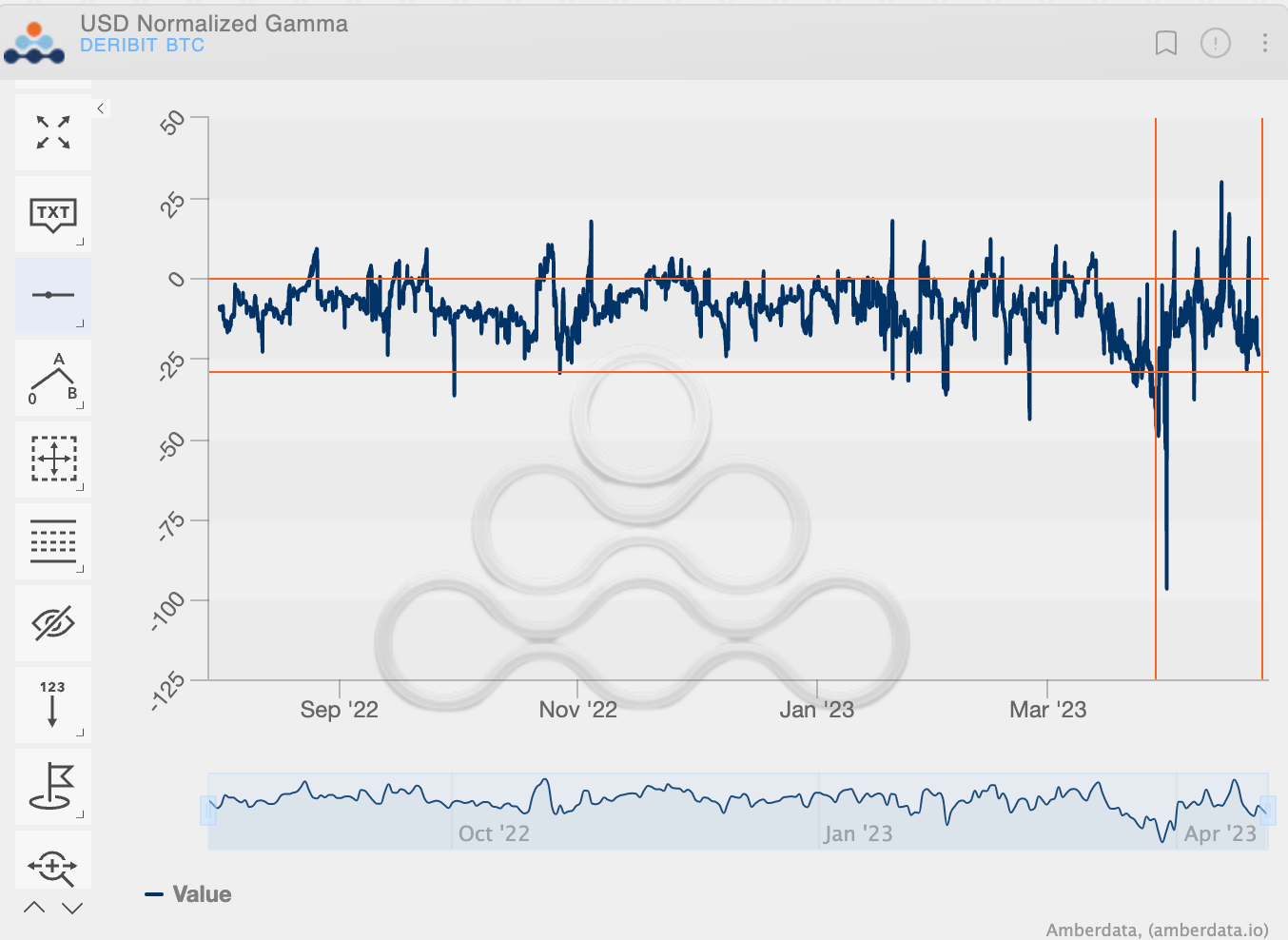

BTC Dealer Gamma Positioning

BTC’s breakout year and last week’s pullback seem to be accompanied by Vol traders chasing momentum.

As BTC raced towards $28k at the end of March, dealers were short a lot of gamma ATM. (See third chart down).

Last week’s pullback stuck dealers with the same kind of short inventory as BTC dropped back down to $27.5k (See 2nd chart down).

Overall, we can see that the recent trend in BTC “Normalized Gamma” shows dealers getting short a lot of Gamma - with only a brief positive gamma inventory seen after the March quarterly expiration.

(March 28th, 2023 - BTC GVOL GEX - Deribit)

(March 28th, 2023 - BTC GVOL GEX - Deribit)This type of activity is going to pay dealers, should spot prices calm down.

There’s an argument to be made that the macro themes explained above are currently in a “wait and see” period.

We’re talking about a 25bps hike at most; bank earnings are providing some sort of “resolution” to the banking crisis status and the spot ETF decision is about a month away.

With BTC prices hovering near the highly watched “$30k level”, further upside likely needs to be preceded by a consolidation phase.

What about further downside activity?

Can we see a BTC spot crash without a massive USD rally? Does it feel like current sentiment is conducive to a USD rally?

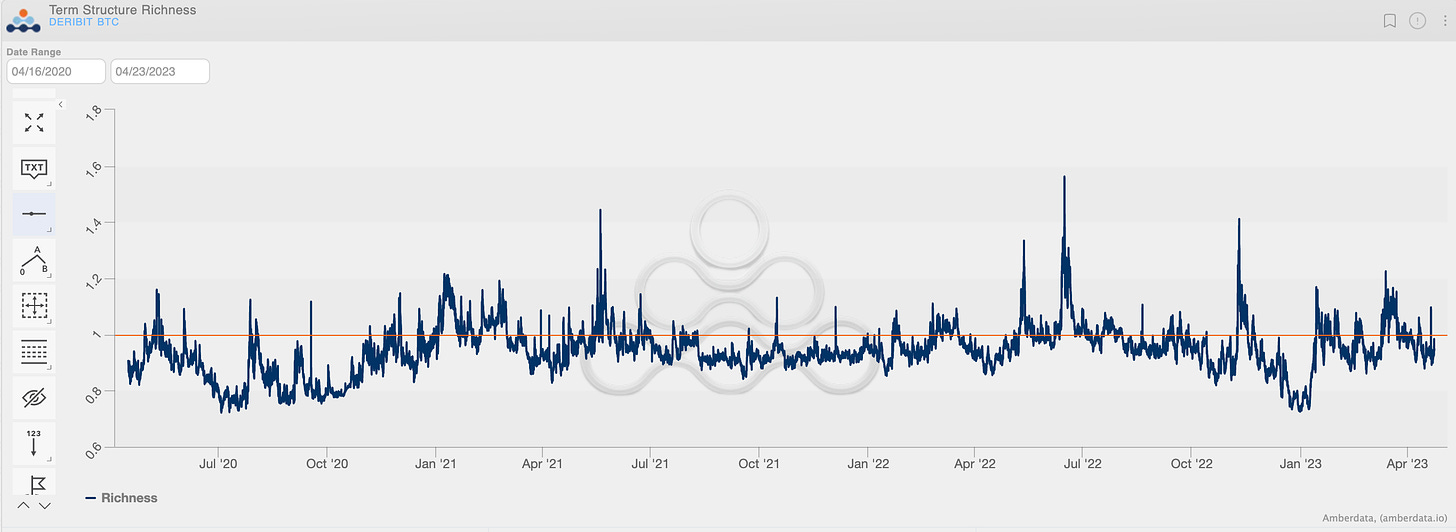

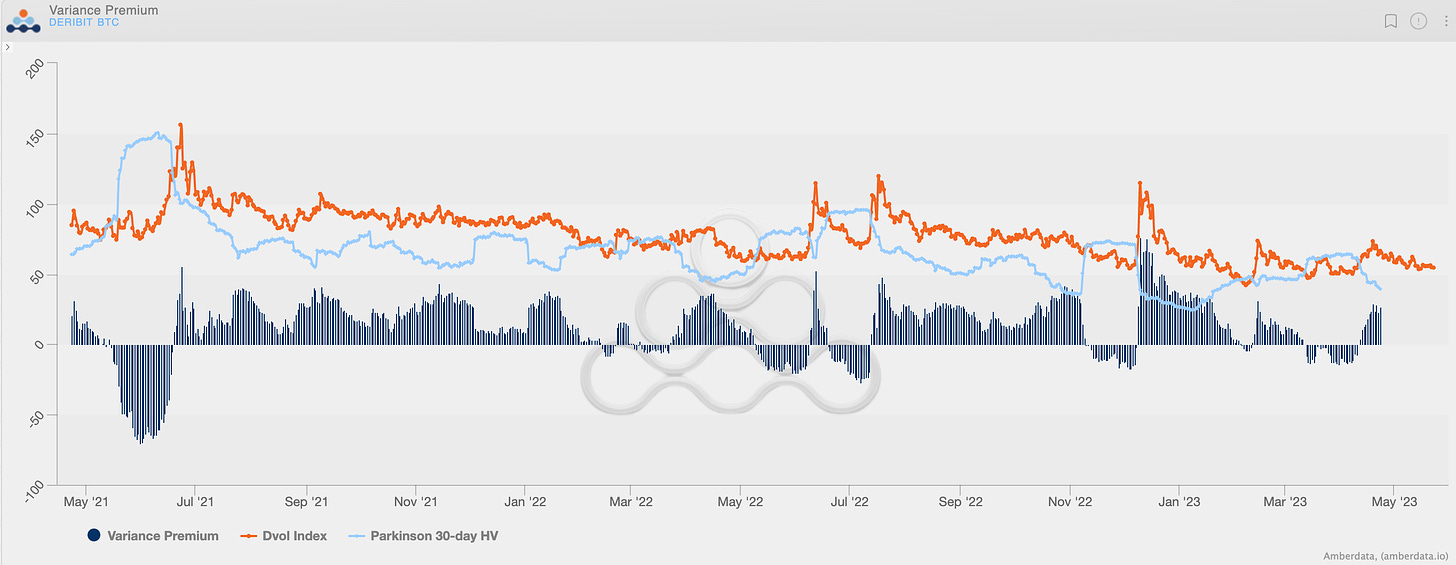

Adding the current VRP and the current term structure richness to these macro themes suggests to me that BTC vol could continue to calm down and “takers” are likely too eager to buy vol.

We could easily see Contango steepen here and an overall shift lower in IV.

Historically, the VRP is positive by a LARGE margin and when the world is relatively “stable” (at least now in the short-term) it’s hard to fight this premium.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

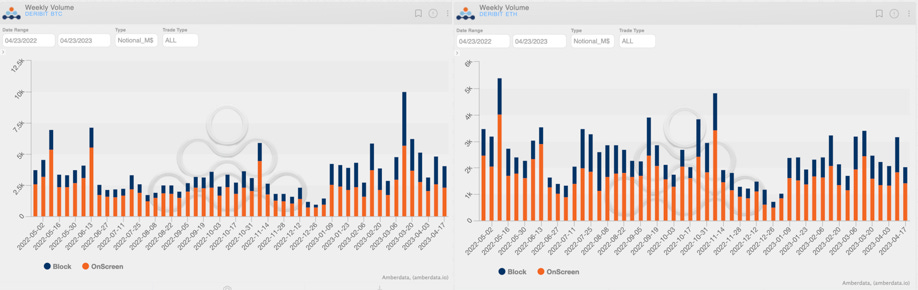

This week has been relatively uneventful in options market, with volumes staying consistent with the 2023 averages. The spot action and subdued IV have put a damper on trading activity.

In terms of volume, Bitcoin options continue to outpace Ethereum options with $4B volume compared to $2B.

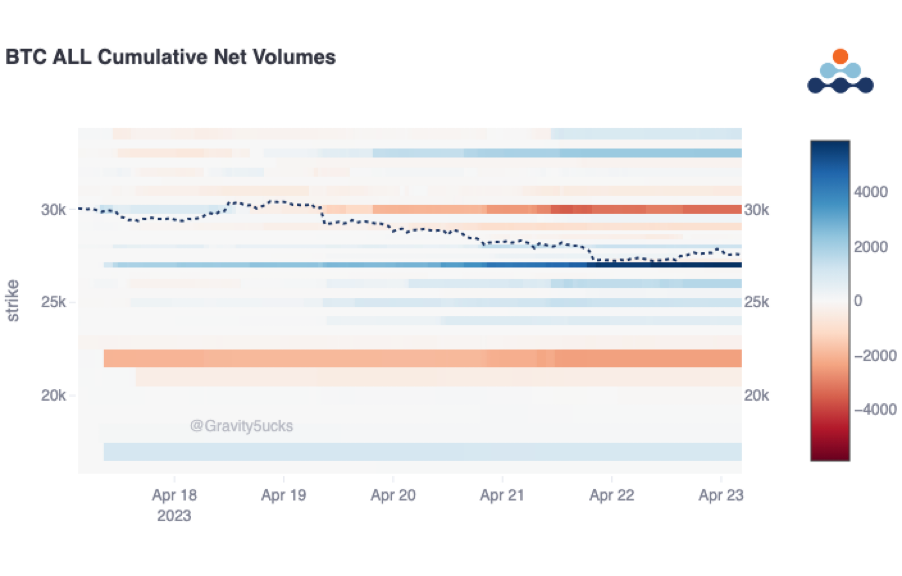

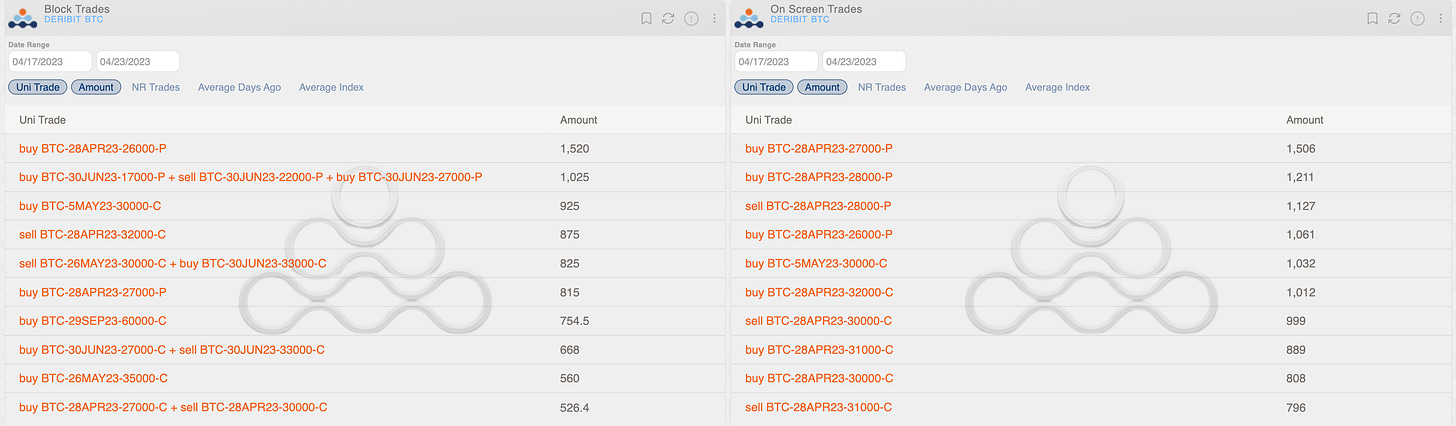

Despite a relatively average Bitcoin volume week, the intentions of traders were quite clear. A long put fly +$27k/-$22k/+$17k - which was bought early in the week when the spot price was still around $30k - indicated a high level of caution in the market, which proved to be prescient as the spot price later retreated by almost 10%.

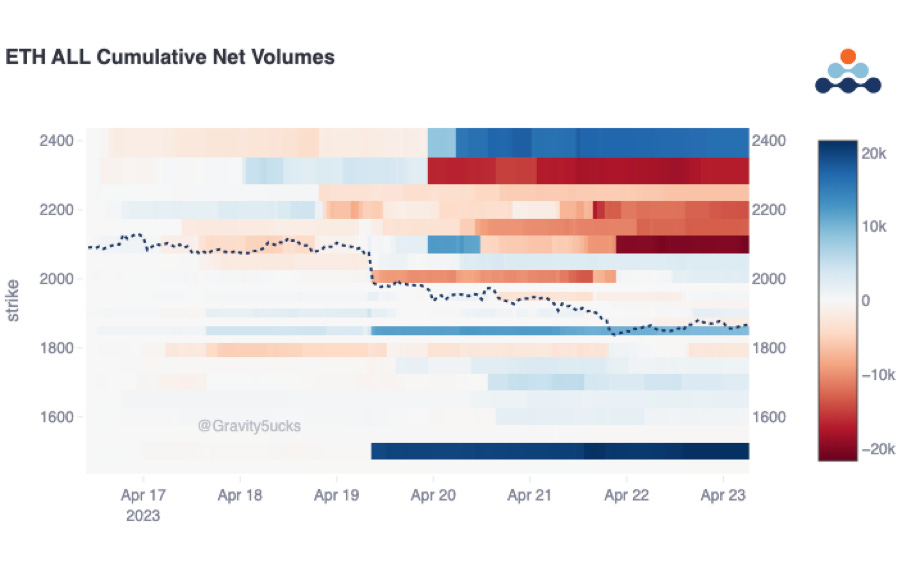

Later in the week, there were further signs of caution, with a short covers in the $27k strike and a more general selling of upside strikes to buy put protections in the strike range of $23k-$27k (well visible in the blue area below the spot and the orange area above in the heat map chart).

It’s also interesting to note a June $30k call rolled up with a 1x2 ratio at zero cost to increase vega exposure.

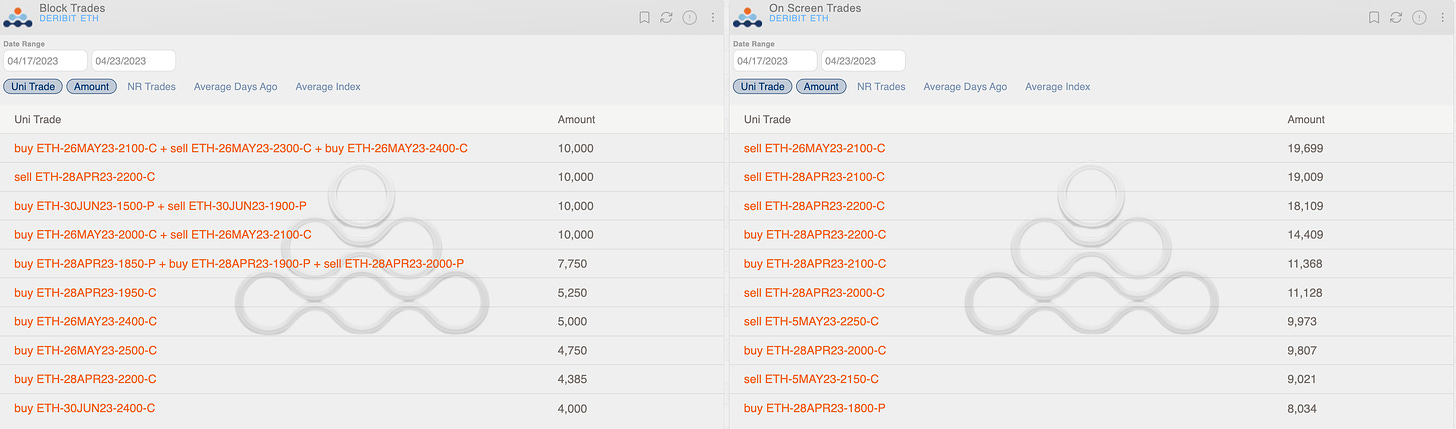

Ethereum presents a less distinct outlook, with several trades exhibiting divergent intentions. However, the heat map reveals a prevailing market sentiment akin to that observed in Bitcoin, where upside positions were sold in favor of long positions in lower strikes. The pivot point stands at $2k.

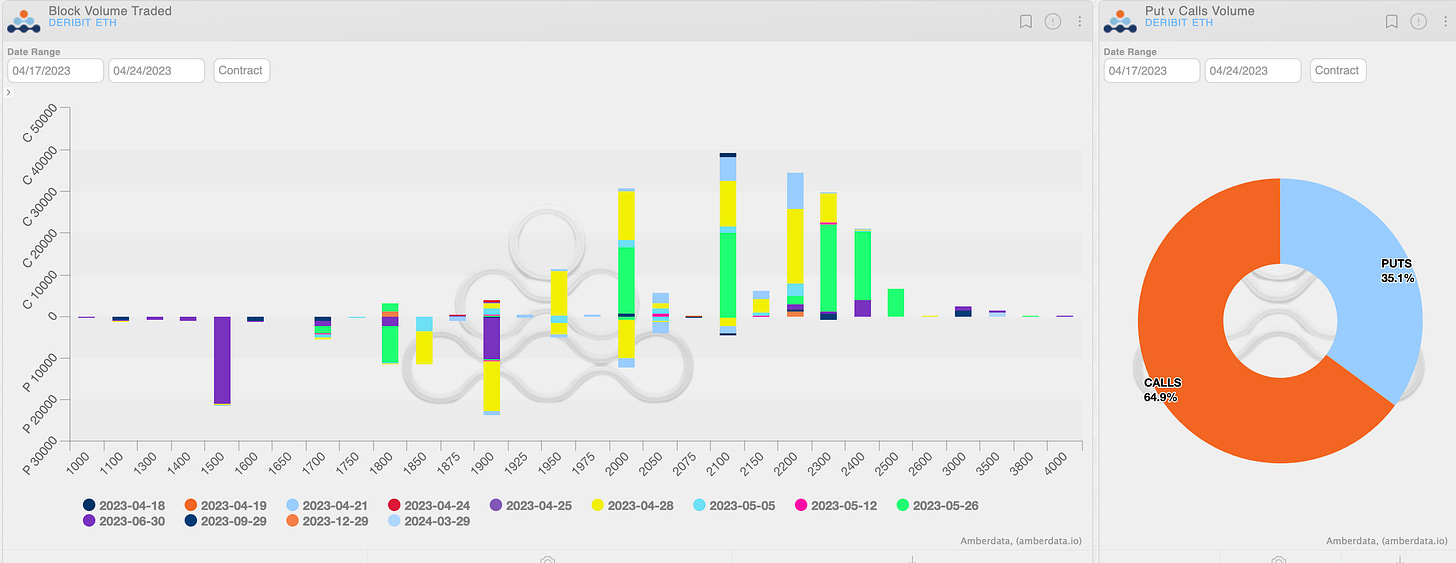

Paradigm Block Insights

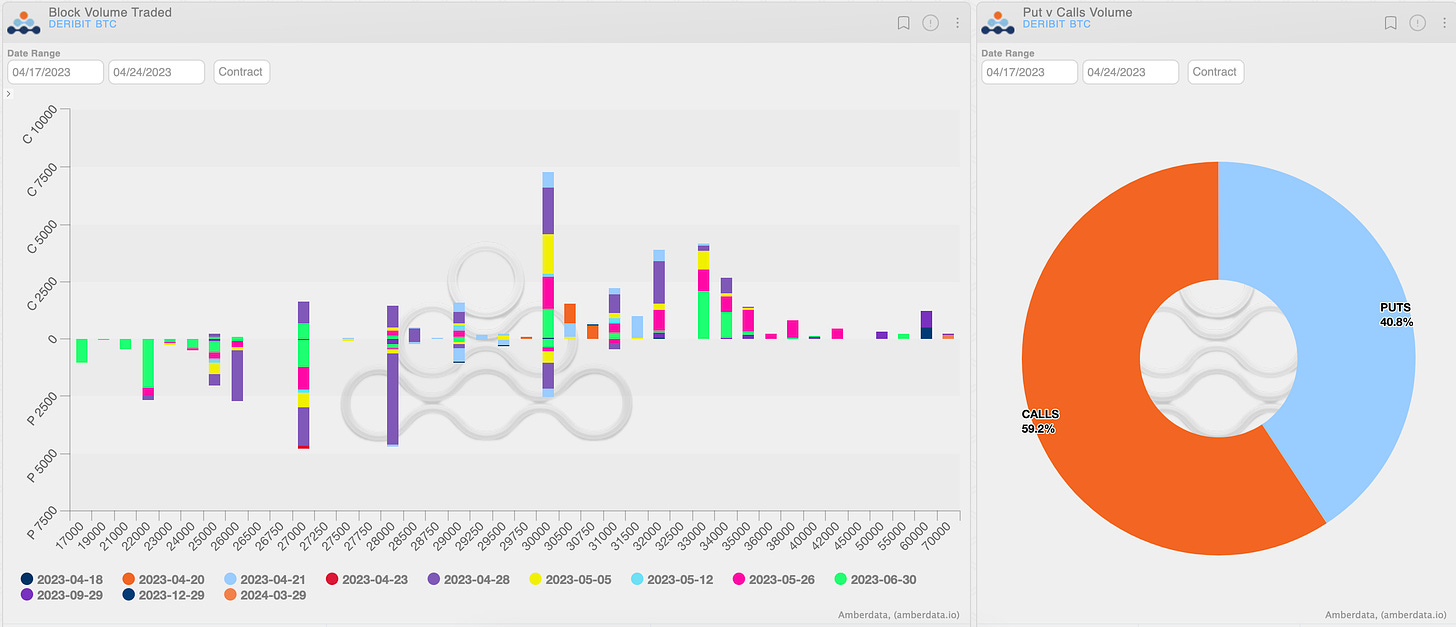

Tough week for majors with BTC breaking lower out of the 29-30k range. As has been the theme in 2023, positive spot / vol correlation held and implieds got hit on the selloff.

BTC -9% / ETH -12% / NDX -0.60%

BTC 🌊

Puts in focus this week, with protection buying and closing of downside throughout the week.

1000x 30-Jun-23 27000/22000/17000 Put Fly bought

750x 28-Apr-23 28000 Put sold

500x 28-Apr-23 26000 Put sold

Topside bid persists… we expect more outright upside buying if spot continues to chop at these levels.

825x 26-May-23 30000 / 30-Jun-23 33000 Call Calendar bought

755x 29-Sep-23 60000 Call bought

725x 5-May-23 30000 Call bought

400x 26-May-23 35000 Call bought

Implieds slid lower throughout the week amidst a 10%+ move lower in spot. 1m ATMs offered @ 52v and 1m 25d RR trades flat.

Takers sought to capitalize on this move Thursday, with strong interest to buy vol.

ETH 🌊

ETH flows quieter this week, with a bias towards convexity buying for the largest blocks.

10000x 30-Jun-23 1900/1500 1x2 Put Ratio (Buys 2x wings)

10000x 28-Apr-23 2200 Call sold

6300x 21-Apr-2200 Call bought

5000x 28-Apr-23 1950 Call bought

ETH implieds get whacked on the move lower, which has been the theme for crypto majors in 2023 outside of the SVB scare.

The ATM curve trades under 60v out to Sep. Owning upside at these levels seems like strong risk-reward to play for spot rebound.

TBP | Invest In What You Use with Fasanara Digital! - Ep. 21

In this episode, join us as we sit down with Nikita Fadeev from Fasanara Digital ($3B AUM) to delve into the world of a Delta-neutral fund.

BTC

ETH

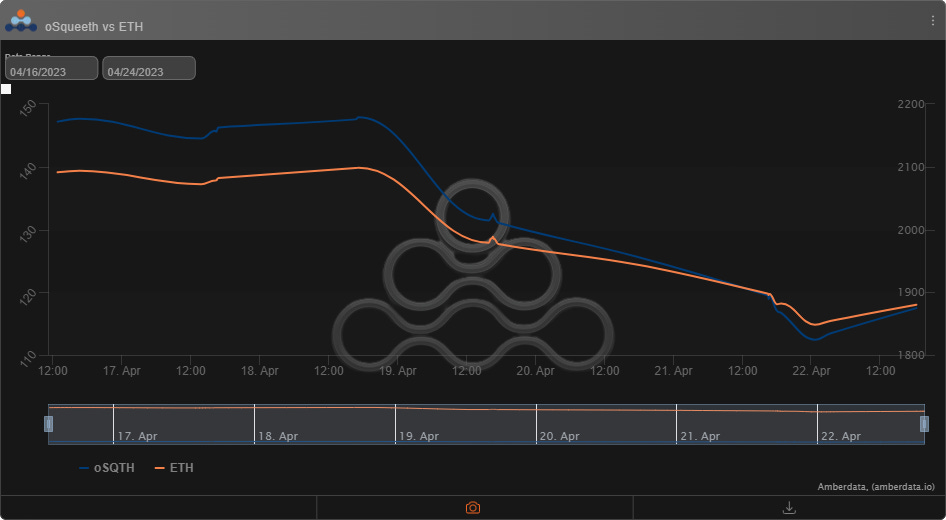

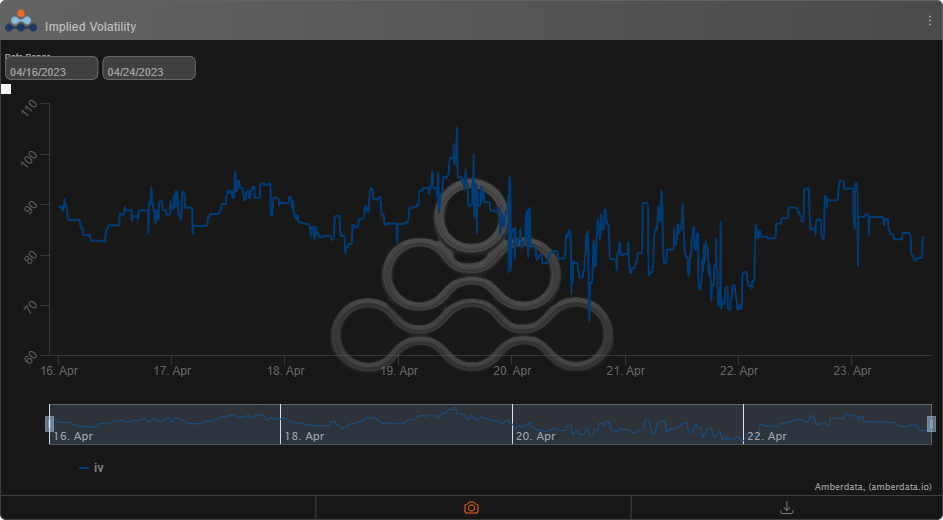

The Squeethcosystem Report (4/16/23 - 4/24/23)

As we head into earnings season in the broader traditional markets, the ETH rally finally took a breather. ETH ended the week -10%, and oSQTH ended the week roughly -20%

Volatility

Squeeth IV held range bound this week between 75 - 100.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $2.47m.

Crab Strategy

Crab ended the week at +1.10% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

Download the most recent BTC Vol Surface quarterly report below!

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...