Crypto Options Analytics, Sept 17th, 2023: BTC & ETH Trends

-

Wednesday 2:00 pm - FOMC

-

Thursday - BOJ Rate Decision

-

Friday 8:30 am - Fed Speakers throughout the day

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH and Lyra and may change their holdings anytime.

MACRO THEMES:

Last week the ECB raised rates to 4% but signaled this might be the last rate increase needed, instead opting for holding rates “higher longer”.

At the G20 meeting the BOJ signaled they would be “open to ending” negative rates. Ueda said the BOJ would likely have enough information to make that decision by EOY.

This week we have the FOMC rate decision, along with the BOJ rate decision the following day.

The Fed has been very adamant about remaining “data dependent” and signaling the ability to “hold rates higher for longer”. To me this means the Fed can navigate this week’s FOMC meeting by keeping rates unchanged but signaling rates will remain elevated while they monitor economic releases.

In my opinion this would make the FOMC meeting a low volatility event.

BTC: $26,470 (+2.4% / 7-day)

ETH :$1,618 (-0.1% / 7-day)

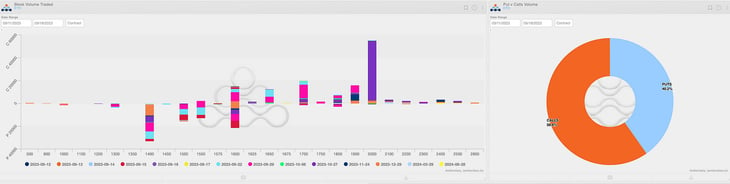

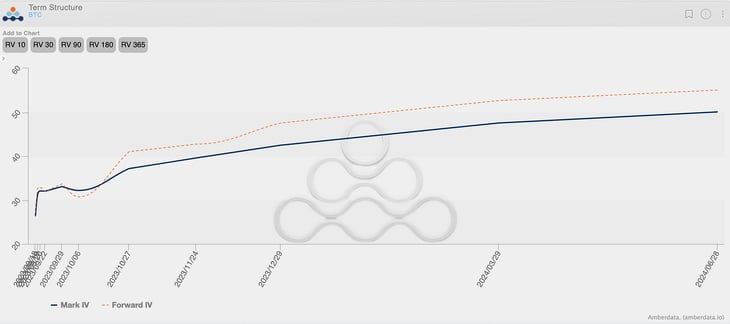

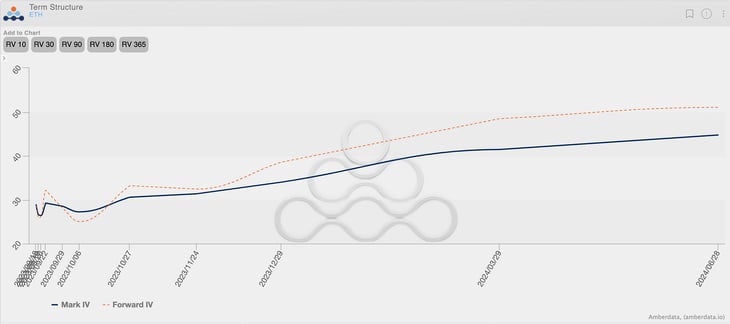

Looking at the volatility term structure for both BTC and ETH, it’s interesting to see the Oct. Expiration “kink” higher in BTC forward volatility, which isn’t pronounced the same way in ETH.

We can imagine this is a reflection of demand for BTC optionality given we’d expect more clarity around the Spot Bitcoin ETF, going into EOY.

(BTC vs ETH term structures)

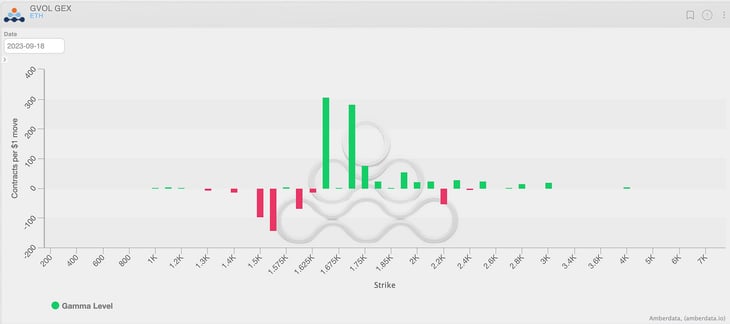

The dealer gamma profiles are quite different between the two assets as well. Supply of optionality continues to dominate in ETH (below) while BTC has a must more mixed profile (above).

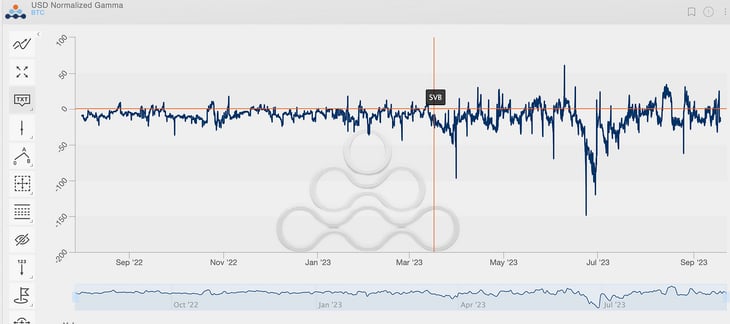

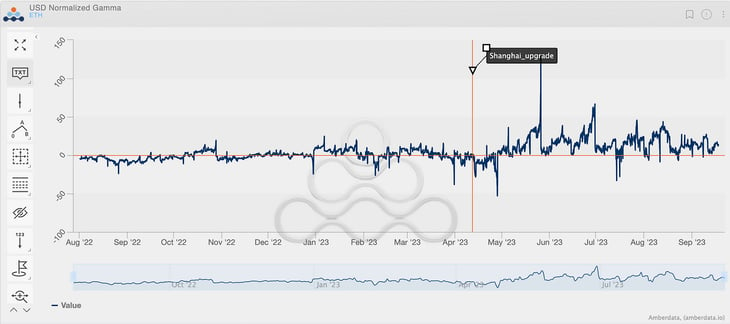

Comparing the time series of net gamma exposure side-by-side, we can see ETH dealer inventory become positive in response to the Shanghai upgrade, while for Bitcoin it was the inverse.

Dealers were stuck with short gamma, post SVB as demand for BTC exposure and optionality quickly kicked-in in response to the banking crisis.

(BTC)

(ETH)

This trend remains strong and the inventories have continued to display inverse profiles.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

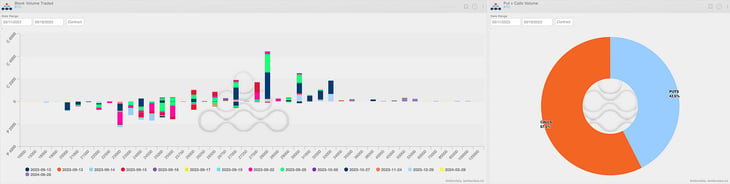

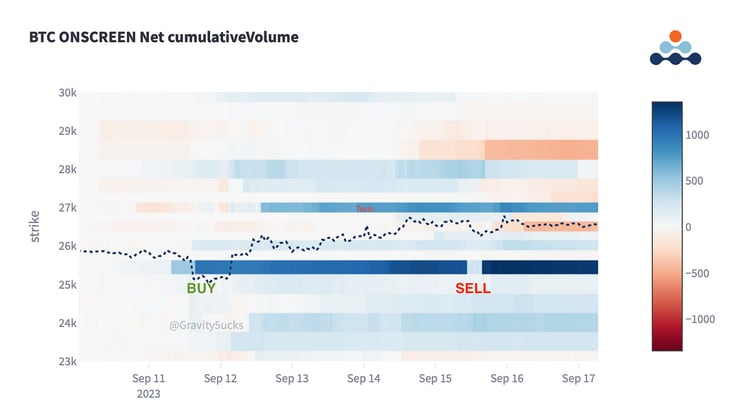

In a low-volume overall context, the positive trend of on-screen flow continues on Deribit.

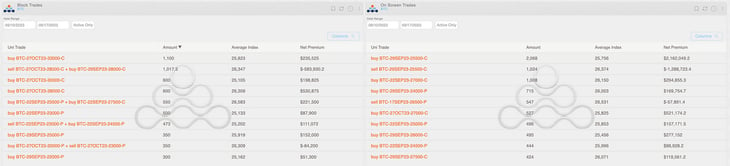

(BTC Options Scanner Top Trades)

This week, we witnessed a complete buy-and-sell cycle on SEP calls $25.5k, bought and sold within a few days.

https://x.com/DeribitInsights/status/1702993192159686709

All well-highlighted in the heatmap.

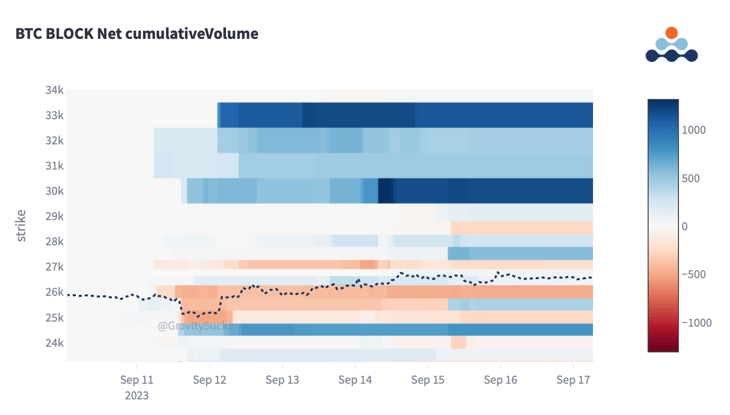

Looking at the blocks, the flow has been skewed towards buying upside convexity in the $30k-$33k range, although with the price at the low $25k, some volume has also been recorded in put-spreads.

Finally, worth noting is the buy-to-close SEP $28k and sell-to-open OCT $28k, resulting in a net premium received of nearly $600k.

Paradigm Block Insights

BTC upside buying continues

ETH upside covering

Bybit Options Fee Discount!

Token 2049 Singapore 🥳🎉

BTC +3% / ETH +1% / NDX -1.5%

BTC Flows 🌊

Upside buyers on Paradigm focused on October this week scooping below calls, large 15Sep call blocks went up ahead of US CPI.

1100x 27-Oct-23 33000 Call bought

925x 15-Sep-23 27500 Call bought

575x 27-Oct-23 28000 Call bought

550x 27-Oct-23 30000 Call bought

ETH Flows 🌊

Relatively quiet week for ETH flows given, certainly reflected in sideways price action, significant spread between BTC and ETH IVs across the term structure.

6000x 29-Dec-23 1400 Put bought

4625x 22-Sep-23 1500/1400 Put Spread bought

4500x 15-Sep-23 1600 / 22-Sep-23 1550 Put Calendar bought

4000x 29-Sep-23 1900 Call bought

4000x 15-Sep-23 1500 Put bought

Overwriter Flows

“Overwriter” entity who blocks directly with Deribit or trades via screens was active today (Sunday 9/17), printing the below in BTC and ETH:

Size Oct ETH upside bought back to close.

Traders have baked in no change to the FF rate ahead of this weeks FOMC, per CME’s Fedwatch tool.

Bybit Options

Traders can receive the highest option fee tier on Bybit for 1 month now! 👇

https://twitter.com/Bybit_Official/status/1701234141570670674

Check out our new Blog with @Blockscholes !

https://twitter.com/tradeparadigm/status/1701619502574874878

Thank you to our clients and friends for all of your support and for attending our Token2049 event in Singapore! 🔥

https://twitter.com/tradeparadigm/status/1702168155106537891

Hit us up on Telegram! 🙏

Daily Commentary✍️ http://pdgm.co/edge

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

Bybit x Paradigm Futures Spread Trade Tape:

https://t.me/paradigm_bybit_fspd

BTC

ETH

The Squeethcosystem Report

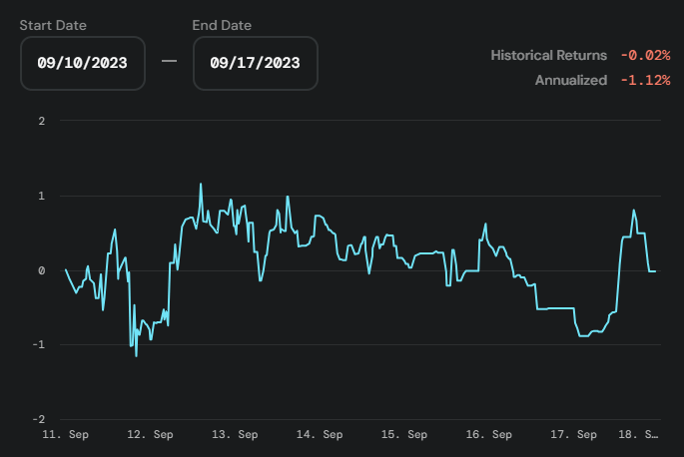

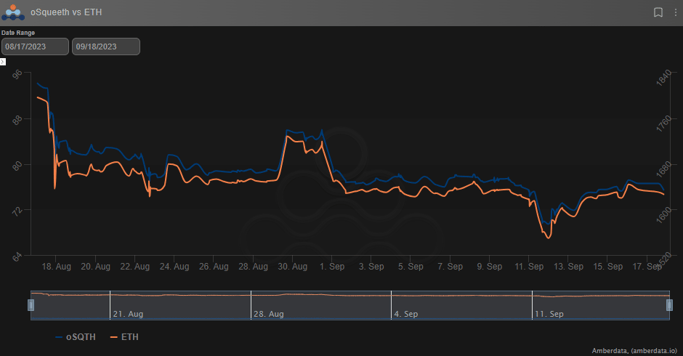

Crypto markets remained active this week with very little to show for it. ETH ended the week -0.21%, oSQTH ended the week -1.94%.

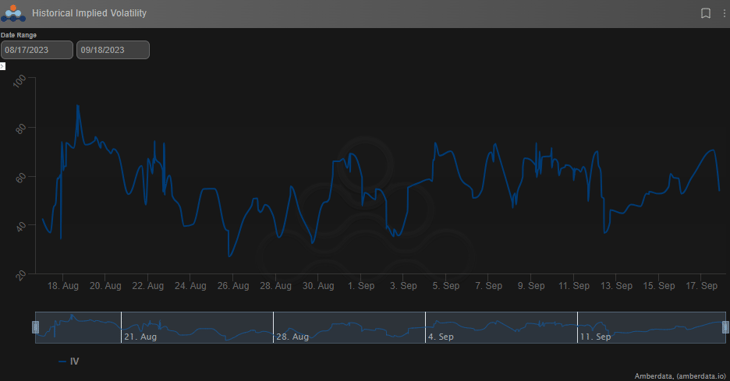

Volatility

oSQTH IV was incredibly active this week trading in the mid 30s just to round trip back to the mid 50s to end the week.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $737.7k

September 17th saw the most volume, with a daily total of $218.57k traded.

Crab Strategy

Crab saw slight declines during the week ending at -0.02% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...