Amberdata Crypto Snapshot: Regulatory Challenges & Trading Insights

While Binance.US undergoes yet another CEO departure, Binance faces layoffs, and FTX has received its expected court approval to sell assets. Binance.US has been under significant stress since March’s CFTC lawsuit and June’s SEC lawsuit with allegations over numerous violations. The exchange has gone from a 5% market share to less than 0.1% and has shut off US payment rails and USD trading pairs. Meanwhile, global exchange Binance continues to deal with US regulatory issues and has lost several executives over the last year. With FTX’s approval to sell $3.4 billion worth of tokens, including a reported $1.6 billion of Solana (around ~16% of the network's outstanding supply), this bad news continues to illustrate how many punches the market can handle. The thinly traded industry will have to hold out a bit longer before seeing any recovery.

Almost entirely forgotten during the U.S. regulation-by-enforcement spree by the SEC is the United Kingdom, which has made headway toward supervisory clarification. In June, King Charles approved the Financial Services and Markets Act. This officially classifies all crypto as a regulated activity, has supervisory authority over crypto promotions, and brings stablecoins into payment rules. Given the UK's strict mandates for financial services, the authority over advertising is particularly interesting, especially since it may be compounded given the perceived increased risk of cryptocurrencies. The Financial Conduct Authority (FCA) will require clear risk warnings and the removal of promotions such as “refer a friend” bonuses, which are popular for exchanges. The FCA will also require rules that vary depending on the marketing’s target audience. This raises the question: Does DeFi in the UK require KYC? These new marketing rules begin October 8th.

Crypto Spot Market

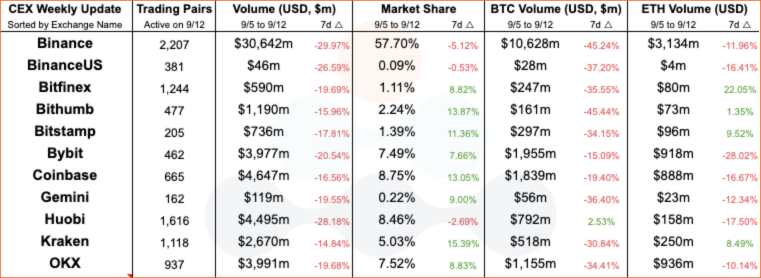

Centralized Exchange (CEX) comparisons from weeks 09/11/2023 and 09/04/2023.

Centralized Exchange (CEX) comparisons from weeks 09/11/2023 and 09/04/2023.

The court approval for FTX asset liquidation certainly instills some fear into the marketplace as the estate was permitted to liquidate $100 million a week. However, centralized exchanges such as Coinbase, Bybit, and Huobi regularly see $100M in transactions a day on the BTC/USD (or USDT or USDC) trading pairs. Amberdata’s Director Of Derivatives Greg Magadini says: “Ultimately, this isn't going to have much impact. BTC's 24-hour volume between spot and derivatives markets is over $45B, so a $100M supply overhang can easily be swallowed by the market. Further, a supply event like this doesn't change the underlying fundamental value to the BTC investor base.”

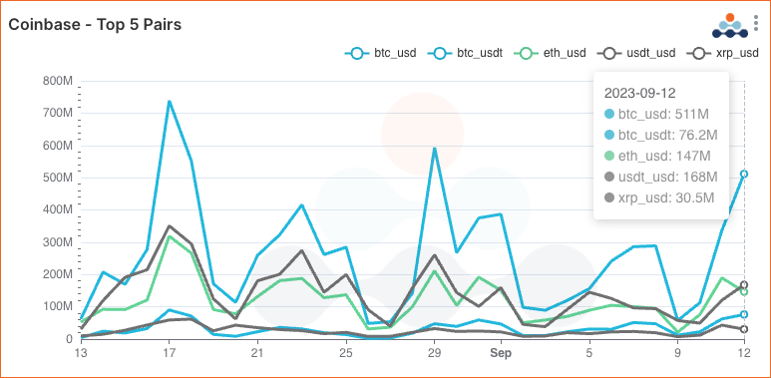

Coinbase’s top 5 trading pairs by volume over the last 30 days.

Coinbase’s top 5 trading pairs by volume over the last 30 days.

Looking at Coinbase’s trading pairs by trading volume over the last month, Coinbase’s top five pairs included BTC/USD, BTC/USDT, ETH/USD, USDT/USD, and XRP/USD. The top three trading pairs in the last 30 days each had over $100M in trading volume nearly every day. An interesting observation here is how Coinbase often operates as a fiat on-and-off ramp for its users, given that 4 of the 5 top trading pairs are USD. XRP/USD, the fifth-highest trading pair, was only recently re-listed on the exchange a few months ago after Ripple’s landmark win over the SEC lawsuit.

Note that Coinbase has also unified its USD and USDC order books.

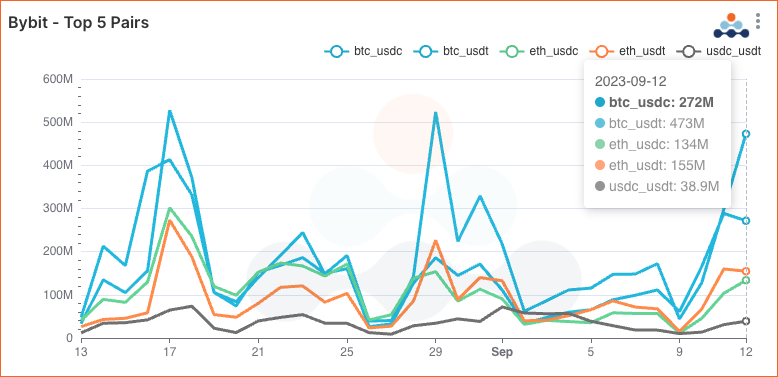

Bybit’s top 5 trading pairs by volume over the last 30 days.

Bybit’s top 5 trading pairs by volume over the last 30 days.

Bybit’s suspension of USD pairs back in March 2023 has barely affected the exchanges’ market share, with USDC and USDT trading pairs taking the top spots for daily trading volumes. Unsurprisingly, BTC and ETH are critical for the Dubai-based exchange, but what is most interesting is that users are fairly split between USDC and USDT usage. Keep an eye out for our stablecoin primers in the next few weeks to learn more about the differences between these stablecoins.

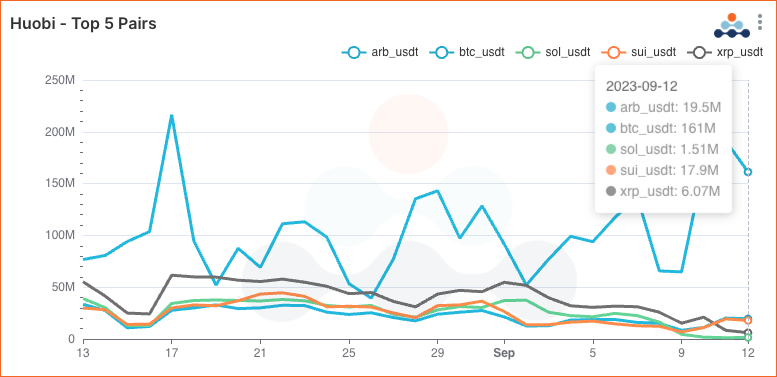

Huobi’s top 5 trading pairs by volume over the last 30 days.

Huobi’s top 5 trading pairs by volume over the last 30 days.

Asian-based exchange Huobi breaks the mold for these exchanges, which all have similar overall trading volumes and market share. Unlike Bybit and Coinbase, Huobi users are excluding trading USDT on the top trading pairs. Ether (ETH) also does not make a top five spot, instead being usurped by other network tokens: Arbiturm (ARB), Solana (SOL), Ripple (XRP), and Sui (SUI).

DeFi DEXs

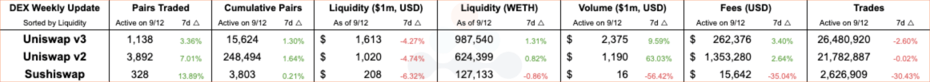

Decentralized Exchange (DEX) protocol from weeks 09/11/2023 and 09/04/2023.

Decentralized Exchange (DEX) protocol from weeks 09/11/2023 and 09/04/2023.

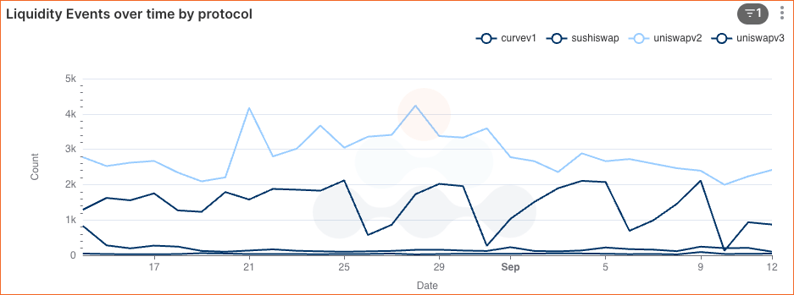

DEX liquidity event counts (add liquidity and remove liquidity) over the last 30 days.

DEX liquidity event counts (add liquidity and remove liquidity) over the last 30 days.

Uniswap v2 continues to be the most active DEX for token pools, nearly doubling Uniswap v3’s daily transaction count and far surpassing Curve and Sushiswap. With Uniswap v4 on the verge of release, Uniswap v2’s dominance shows that simplicity for LPs is preferred.

DeFi Lending/Borrowing

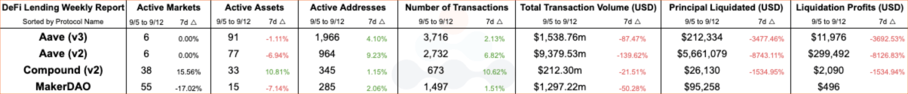

DeFi Lending protocol comparisons from weeks 09/11/2023 and 09/04/2023.

DeFi Lending protocol comparisons from weeks 09/11/2023 and 09/04/2023.

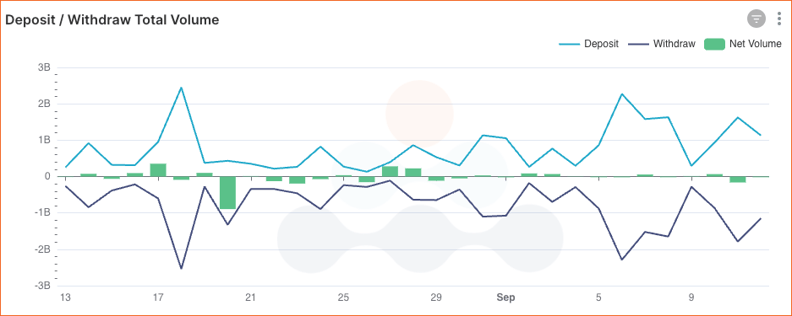

DeFi Lending total deposit and withdrawal volumes over the last 30 days.

DeFi Lending total deposit and withdrawal volumes over the last 30 days.

Deposit and withdrawal volumes across DeFi Lending protocols have remained stable for the beginning of September as investors seek yield and opportunities outside of Ethereum lending pools.

Networks

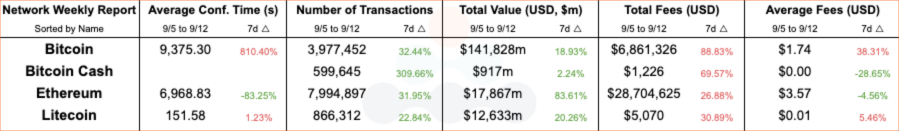

Network comparisons from weeks 09/11/2023 and 09/04/2023.

Network comparisons from weeks 09/11/2023 and 09/04/2023.

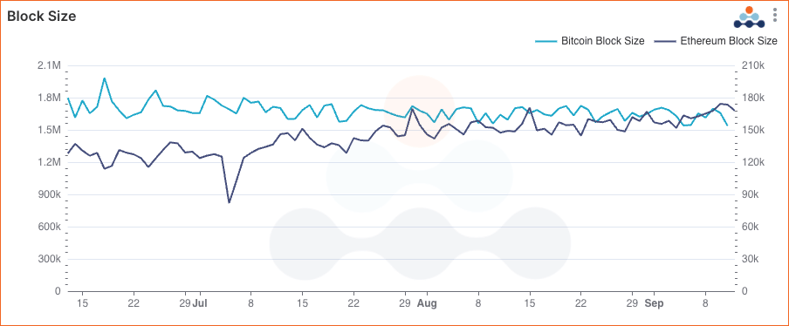

Block size for Ethereum and Bitcoin over the last 3 months.

Block size for Ethereum and Bitcoin over the last 3 months.

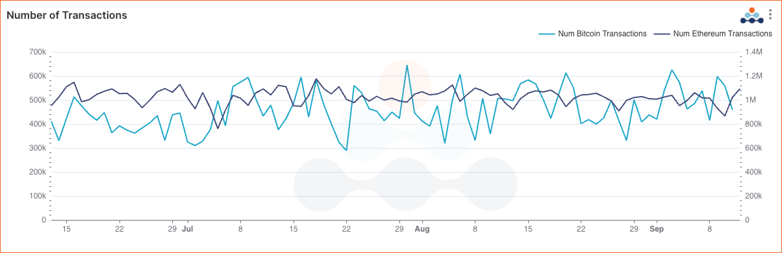

Transaction counts for Ethereum and Bitcoin over the last 3 months.

Transaction counts for Ethereum and Bitcoin over the last 3 months.

While Ethereum’s block sizes have continued to grow over the last 3 months, the network has not seen any major changes to daily transaction counts. The increasing block size is in line with a major Ethereum EIP (EIP-4844) introducing shard blob transactions. The EIP would introduce an even higher block size than the networks’ existing theoretical size (1.875M bytes) with the introduction of “blobs.” This would involve rollup block submitters with the ability to submit data into a “blob,” or a temporary data shard, rather than using call data. Since blobs are temporary data, they could allow rollups to scale significantly while reducing their costs and the ever-growing data requirements for nodes in the long term.

Links

Recent Coverage

- Amberdata and Coalition Greenwich: New Research Indicates 48% of Asset Managers and Hedge Funds Currently Have Digital Assets Under Management

Spot Market

Spot market charts were built using the following endpoints:

- https://docs.amberdata.io/reference/market-metrics-exchanges-volumes-historical

- https://docs.amberdata.io/reference/market-metrics-exchanges-assets-volumes-historical

- https://docs.amberdata.io/reference/get-market-pairs

Crypto Futures

Futures / Swaps charts were built using the following endpoints:

- https://docs.amberdata.io/reference/futures-exchanges-pairs

- https://docs.amberdata.io/reference/futures-ohlcv-historical

- https://docs.amberdata.io/reference/futures-funding-rates-historical

- https://docs.amberdata.io/reference/futures-long-short-ratio-historical

- https://docs.amberdata.io/reference/swaps-exchanges-reference

- https://docs.amberdata.io/reference/swaps-ohlcv-historical

- https://docs.amberdata.io/reference/swaps-funding-rates-historical

DeFi DEXs

DEX charts were built using the following endpoints:

- https://docs.amberdata.io/reference/defi-metrics-exchanges-historical

- https://docs.amberdata.io/reference/defi-liquidity-historical

DeFi Borrow/Lend

DeFi lending charts were built using the following endpoints:

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...