Stablecoins designed to maintain a peg with a fiat currency have become a key pillar of the crypto economy. From being used for remittances to providing safe havens during periods of high volatility, the total stablecoin supply on Ethereum has reached over $70 billion.

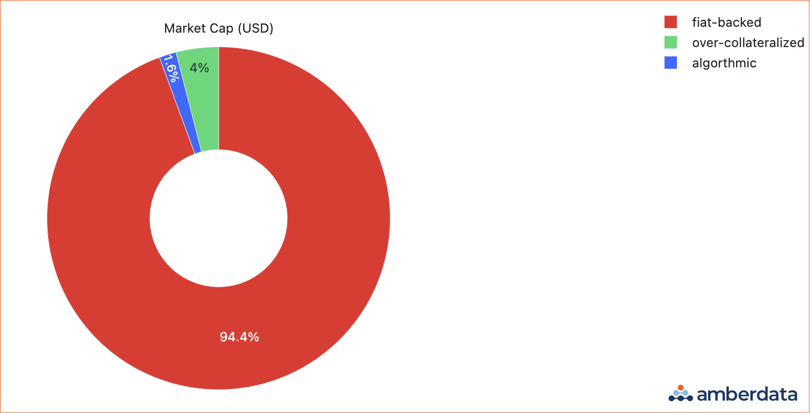

Market Cap dominance by stablecoin type as of August 30, 2023

Market Cap dominance by stablecoin type as of August 30, 2023

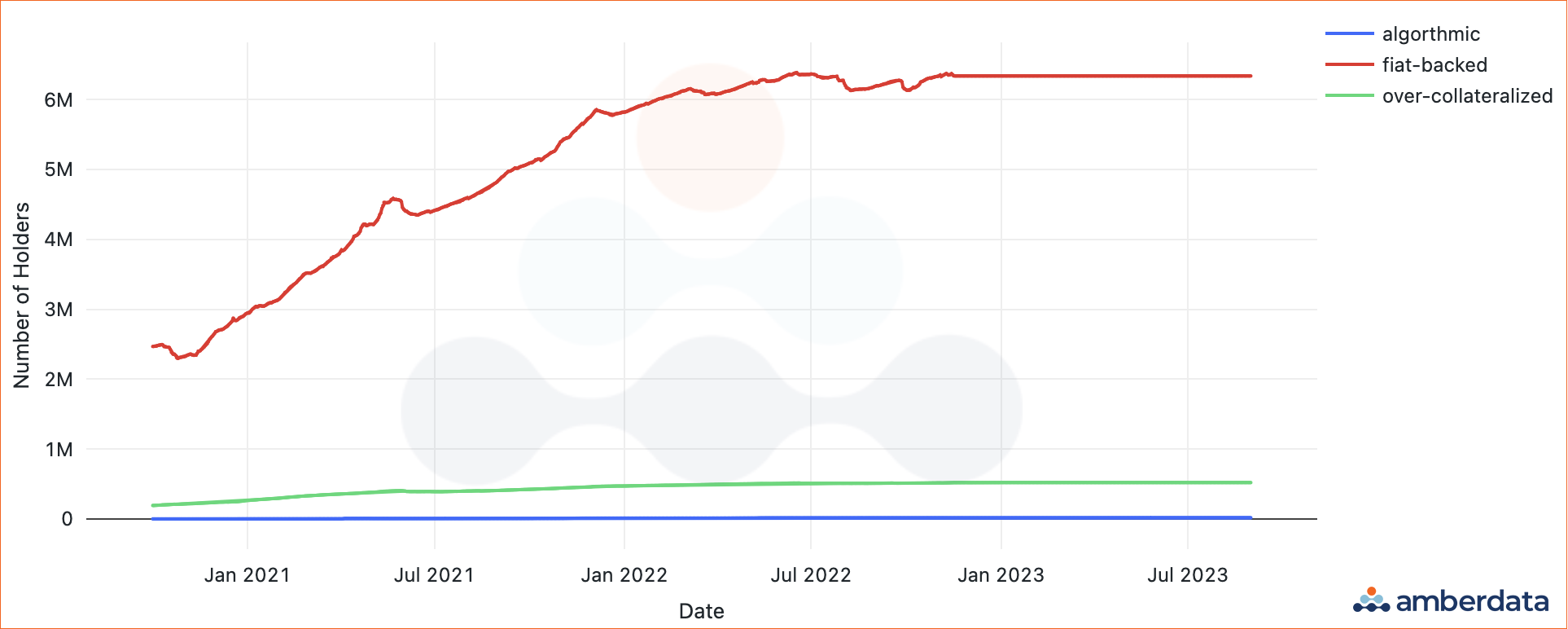

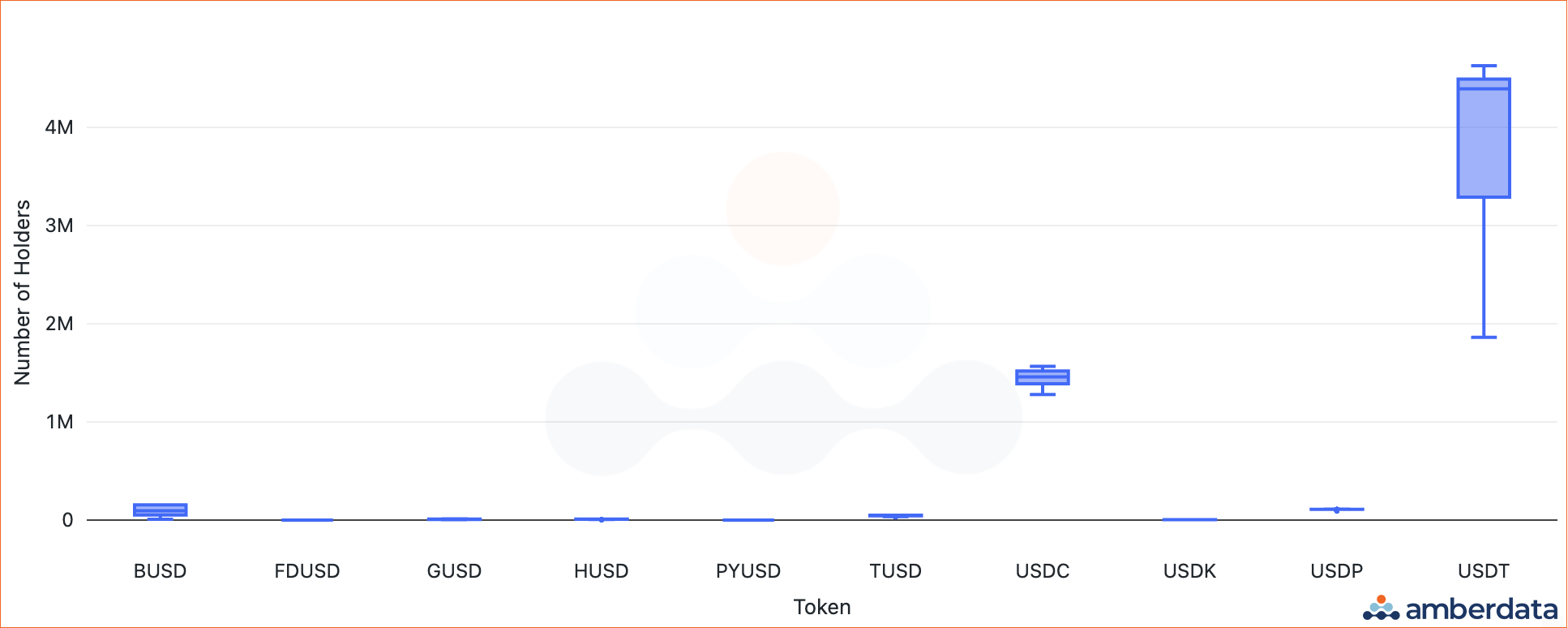

Daily token holder dispersion (between October 2020 and August 30)

Daily token holder dispersion (between October 2020 and August 30)

There are three main types of stablecoins:

-

Fiat-backed stablecoins (or “fiat-collateralized” stablecoins): backed by fiat currencies, often a reserve or liquid collateral.

-

Over-collateralized stablecoins (or “anchored” stablecoins): often backed by a basket of currencies, which may or may not include other stablecoins or digital assets.

-

Algorithmic stablecoins (or “reflexive” stablecoins): governed by algorithm (or algorithms) which adjusts the token’s supply based on demand; may or may not be supported by any type of collateral.

This primer focuses on fiat-backed stablecoins. We will provide an overview of the biggest USD stablecoins, discuss their major defining moments, and closely examine what happens when tokens depeg.

Market Cap dominance by stablecoin type (as of August 30, 2023)

Market Cap dominance by stablecoin type (as of August 30, 2023)

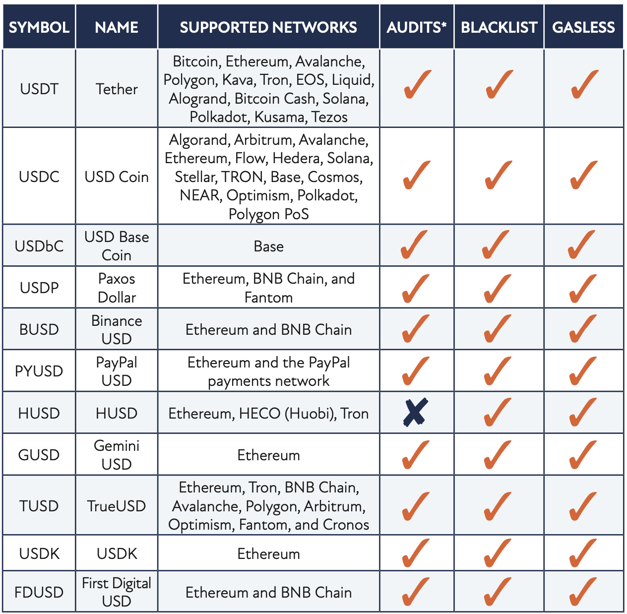

In addition to how stablecoins are categorized, there are some other important characteristics to consider when evaluating these assets.

- Centralization and governance: Governance structures of stablecoins range from being a fully decentralized and unmanaged token to a single signer administrator. The governance structure can be a source of risk for many who prefer not to be involved with anonymous developers or overzealous compliance and legal teams.

- Audits and transparency: Transparency regarding backed assets (primarily for tokens with fiat backing and over-collateralized tokens) helps ensure that stablecoins are backed as claimed. A common form of transparency comes in the form of “attestations”, in which a declaration of evidence is provided. These attestations are sometimes validated by a third-party “opinion”, however attestations are often unsupported by any third party and should not always be taken at face value. An “audit” is much more valid, and proof of financial reserves (depending on the methodology) can be useful for risk mitigation. It’s important to note: Attestations are not audits, and opinions do not qualify as independent audits, nor can they be considered completely independent.

-

Regulatory considerations: Stablecoins, especially fiat-backed stablecoins, can fall under the scrutiny of various regulatory bodies governing the fiat currency (or currencies) underlying the peg. Understanding the regulatory situation and the significance of any scrutiny helps users navigate available options and their levels of associated risk.

-

Supported networks: As stablecoins grow in popularity and different use cases arise, launching on new chains has been another angle stablecoin issuers have used to grow their user base and capture market share. However, this comes with trade-offs, as each network has nuances, and some are more prone to unwanted exploits such as oracle exploits or network bugs. If building strategies that cross networks, users should know which networks a stablecoin is supported on.

-

Supported exchanges: Not every exchange will support each stablecoin. There are competitive advantages to not supporting certain stablecoins, especially for those that compete with existing products. There was some shock and awe last year when Binance announced that they would remove support for three different stablecoins (USDC, USDP, and TUSD) by converting all stablecoins held on the exchange to their own BUSD. This plan did not fully form, as the exchange continued to support USDC and even recently integrated USDC deposits and withdrawals for the Arbitrum network (not to mention BUSD’s ongoing SEC case and the recently announced termination of BUSD). In any case, exchanges have differing levels of liquidity for supported stablecoins, so users should keep in mind their preferred entry (on-ramp) and exit (off-ramp) points and plan accordingly. Transaction fees and slippage to convert funds between a liquid and illiquid pair can quickly turn a profitable strategy into a losing one.

-

Blacklist functionality: Blacklists give contract administrators the ability to freeze funds or prevent an address from transacting with a given token. Token blacklists are becoming popular as a way to prevent the movement of exploited funds by malicious actors. However, this function can be used in ways that do not always support the users’ philosophies, such as when Circle (issuer of USDC) blacklisted 45 Ethereum addresses after OFAC regulatory actions against Tornado Cash. Users should keep in mind the levers possessed by stablecoin issuers that may support or undermine their use case.

-

Gasless transactions: Gasless transactions can be a convenient feature for users. On-chain gas fees are paid by a third party such as a payment provider or an exchange. However, these gasless transactions are not without risks: bad actors have accumulated over $68 million from an exploit on Ethereum alone. It is critical to never sign a transaction, even commonplace “Connect to” signatures, without understanding the implications. Many digital assets and popular stablecoins have this feature built into their smart contracts, so signing a malicious signature request can lead to a bad actor draining the entirety of a user’s wallet without them even realizing it happened.

-

Peg stabilizing methods: Stablecoins can and often do move in price away from their peg. For example, USDT, a US dollar stablecoin, has been lower than its $1 peg for the last month after a Curve pool imbalance (the token has otherwise continued to operate normally). Mechanisms available to stablecoins for depeg mitigation vary widely from adjusting the supply, altering collateral, or implementing governance decisions. If the mechanisms in place fail to perform or do not exist, the stablecoin may never return to its peg or the market.

Fiat-Backed Stablecoins

Overview

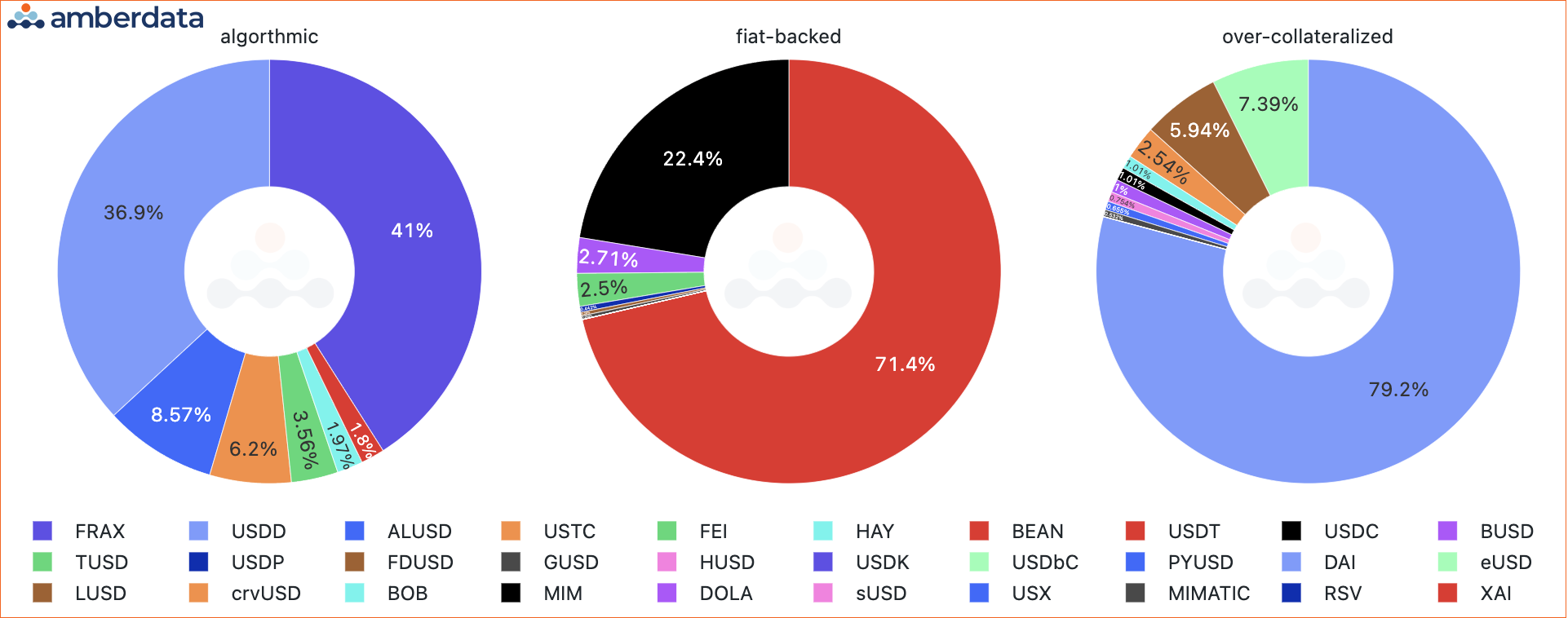

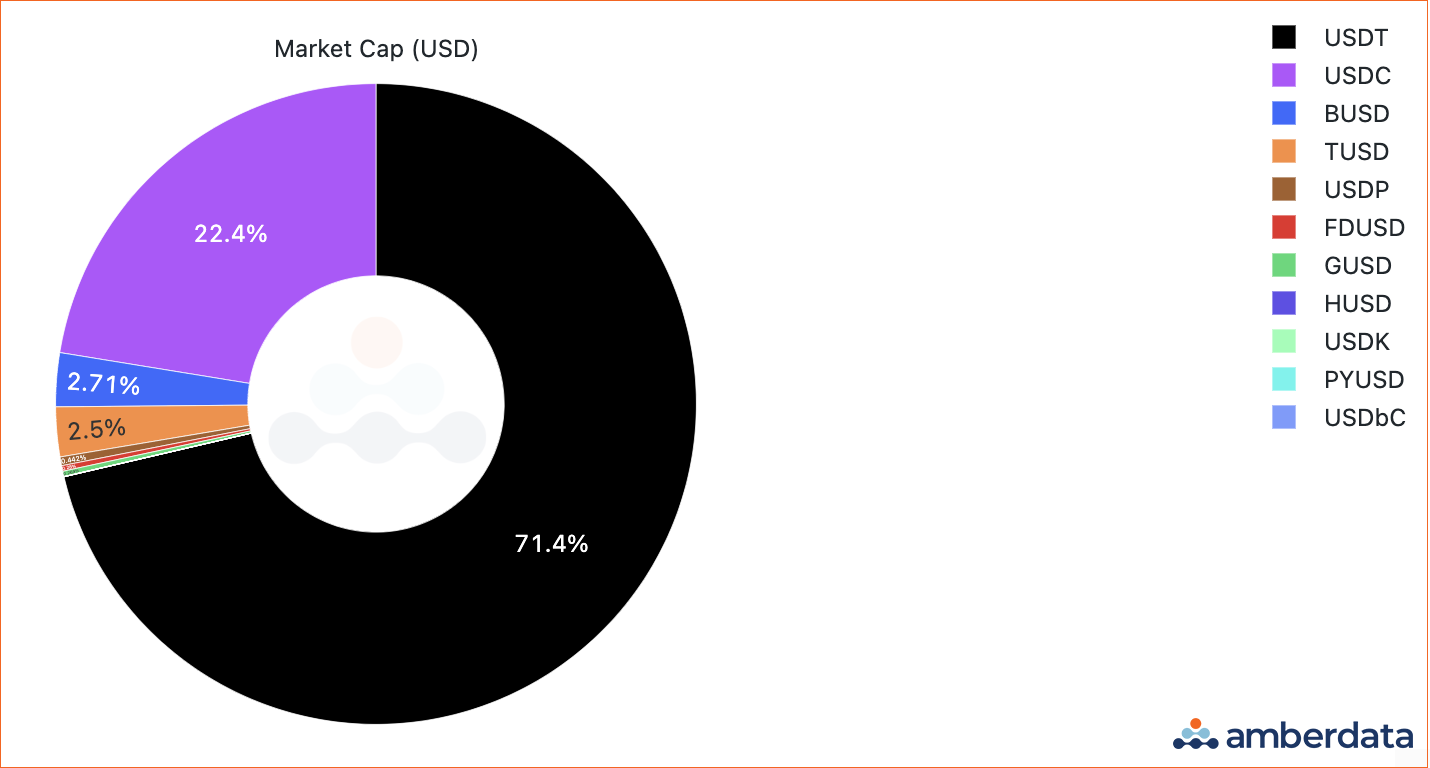

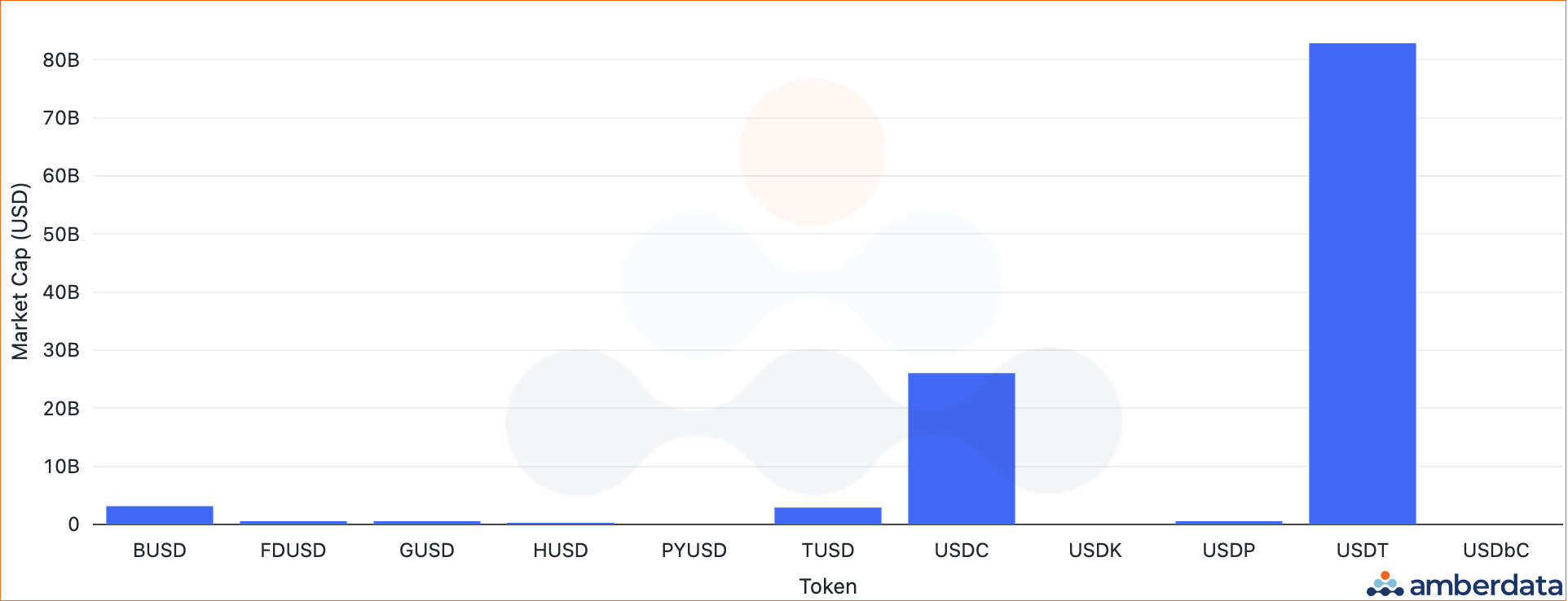

Market Cap dominance for fiat-backed stablecoins as of August 30, 2023

Market Cap dominance for fiat-backed stablecoins as of August 30, 2023

Market Cap for fiat-backed stablecoins as of August 30, 2023

Market Cap for fiat-backed stablecoins as of August 30, 2023

The fiat-backed stablecoin marketplace is heavily weighted towards USDT, with over 71% of the market capitalization for all fiat-backed stablecoins. USDT and USDC make up almost 94% of the market capitalization and around 88% of the entire stablecoin market capitalization. Being backed by fiat currency (or claiming to be) has given the market considerably more confidence in these stablecoins over other tokens. Additionally, their use as a reliable form of near-instant payment method and as a hedge against local inflation for many non-US token holders has been well received by the community.

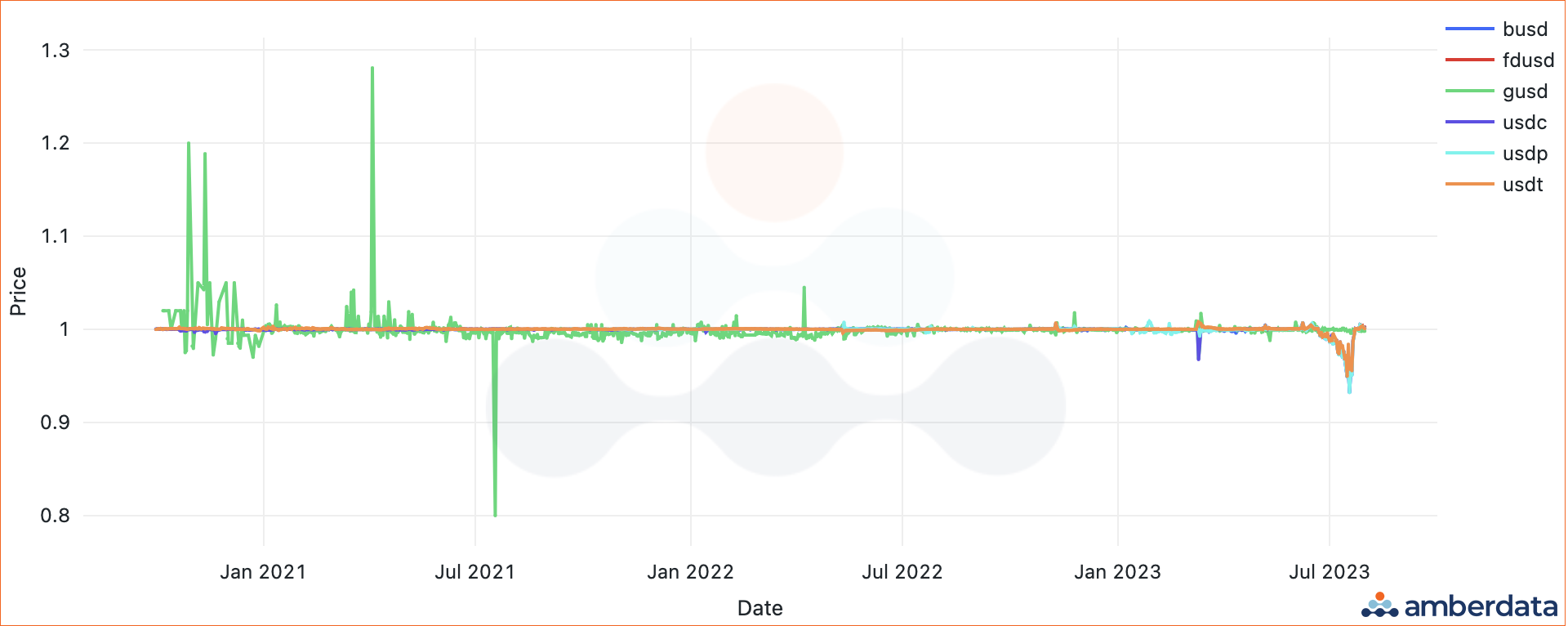

Fiat-backed stablecoin prices for select tokens from October 2020 to August 30, 2023

Fiat-backed stablecoin prices for select tokens from October 2020 to August 30, 2023

As mentioned, stablecoin prices don’t always maintain price stability, and almost every token has seen some type of depeg. Depegging events create strong arbitrage opportunities for quick traders and bots, but some stablecoins take longer than others to re-establish. For example, GUSD faced several ups and downs in its early days in the stablecoin marketplace but has since experienced far less price volatility.

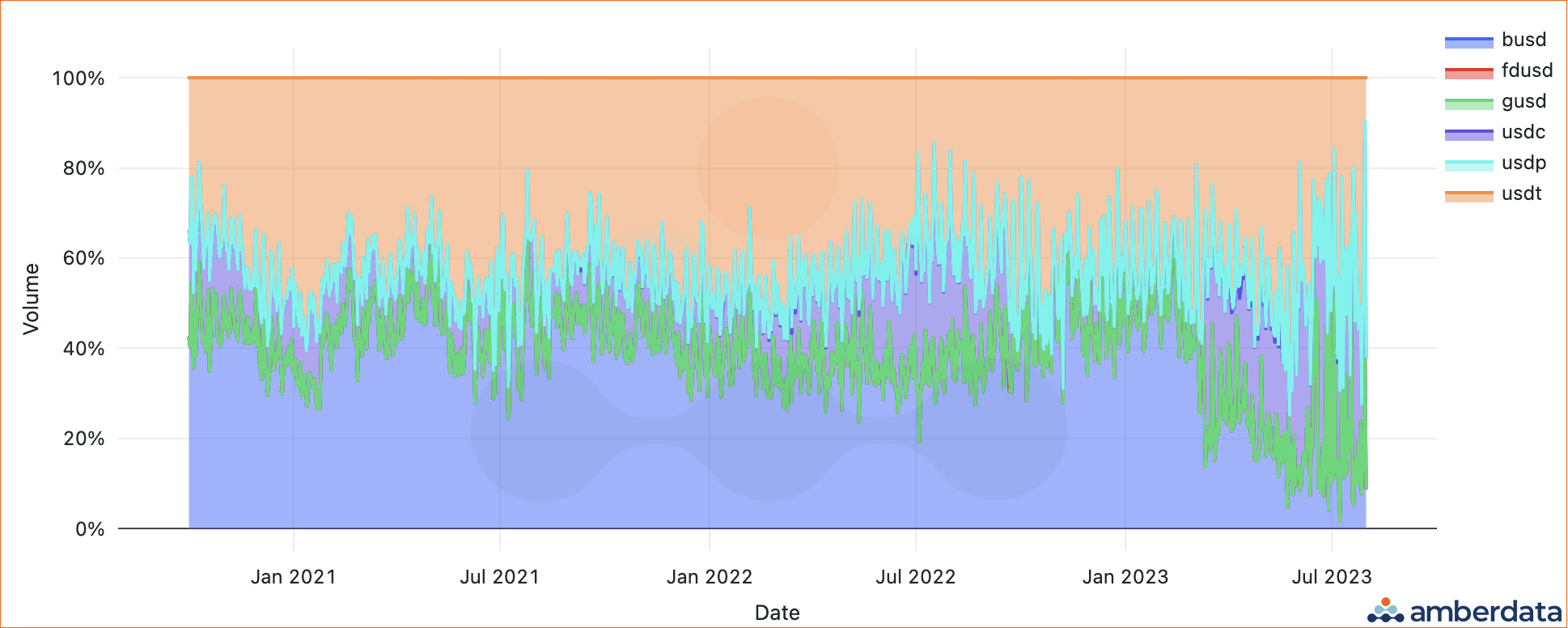

Spot trading volume market share for fiat-backed stablecoin select tokens from October 2020 to August 30, 2023

Spot trading volume market share for fiat-backed stablecoin select tokens from October 2020 to August 30, 2023

With stablecoins becoming a significant market for arbitrage, they are often a great starting point for new users on centralized exchanges (CEXs) to venture into DeFi. Fiat-backed tokens are generally more trusted to maintain their peg, and several stablecoins such as USDC, GUSD, and BUSD are issued by centralized exchanges and used as key trading pairs. Spot market trading volume provides insights into what types of users are buying or trading stablecoins, For example, Binance is the issuer of BUSD, and BUSD spot trading volumes show many non-US users trading this token.

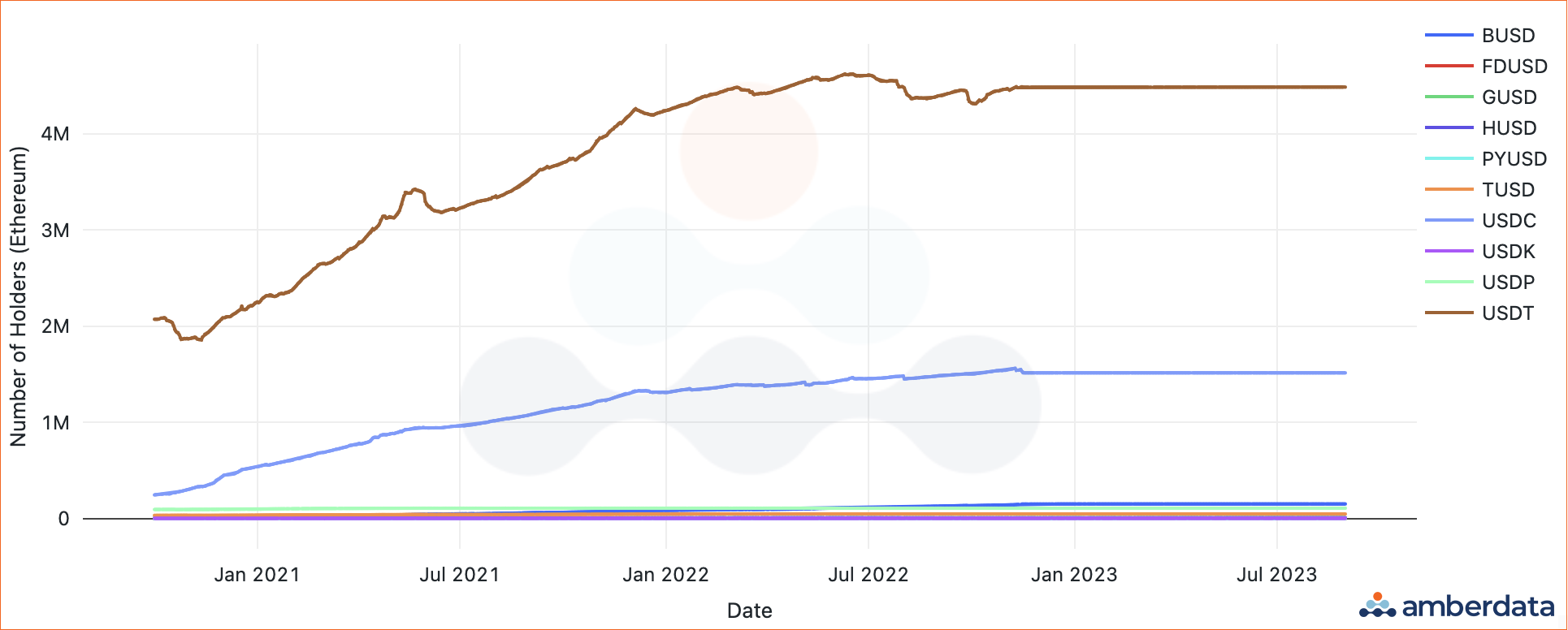

Daily number of holders for fiat-backed stablecoins on select tokens from October 2020 to August 30, 2023

Daily number of holders for fiat-backed stablecoins on select tokens from October 2020 to August 30, 2023

Despite issues surrounding unaudited reporting, many users leverage these stablecoins as a key part of their yield farming strategies. Several DEXs and DeFi lending protocols have stablecoin pools that are in the top five for total value locked (TVL) and trading volume. For example, Uniswap v2’s top three pools are the USDC/WETH pool, the WETH/USDT pool, and the USDC/USDT pool.

Daily holders’ dispersion of fiat-backed stablecoins on select tokens from October 2020 to August 30, 2023

Daily holders’ dispersion of fiat-backed stablecoins on select tokens from October 2020 to August 30, 2023

The number of stablecoin token holders in the last year across all stablecoins has remained relatively fixed. USDT grew considerably between October 2020 and October 2022 in terms of market capitalization and number of holders, but since the end of 2022 holder counts over the have flattened and remain in the range of 4.3 million addresses. The number of USDC holders has stayed around 1.5 million addresses since October 2022. And while BUSD's troubles over the last few months have seen holder counts drop, generally the fiat-backed stablecoin holder adoption has not changed too much since October 2022.

*Audits refer to any public transparency reports such as an attestation, third-party audit, proof of reserve, or declaration.

Tether (USDT)

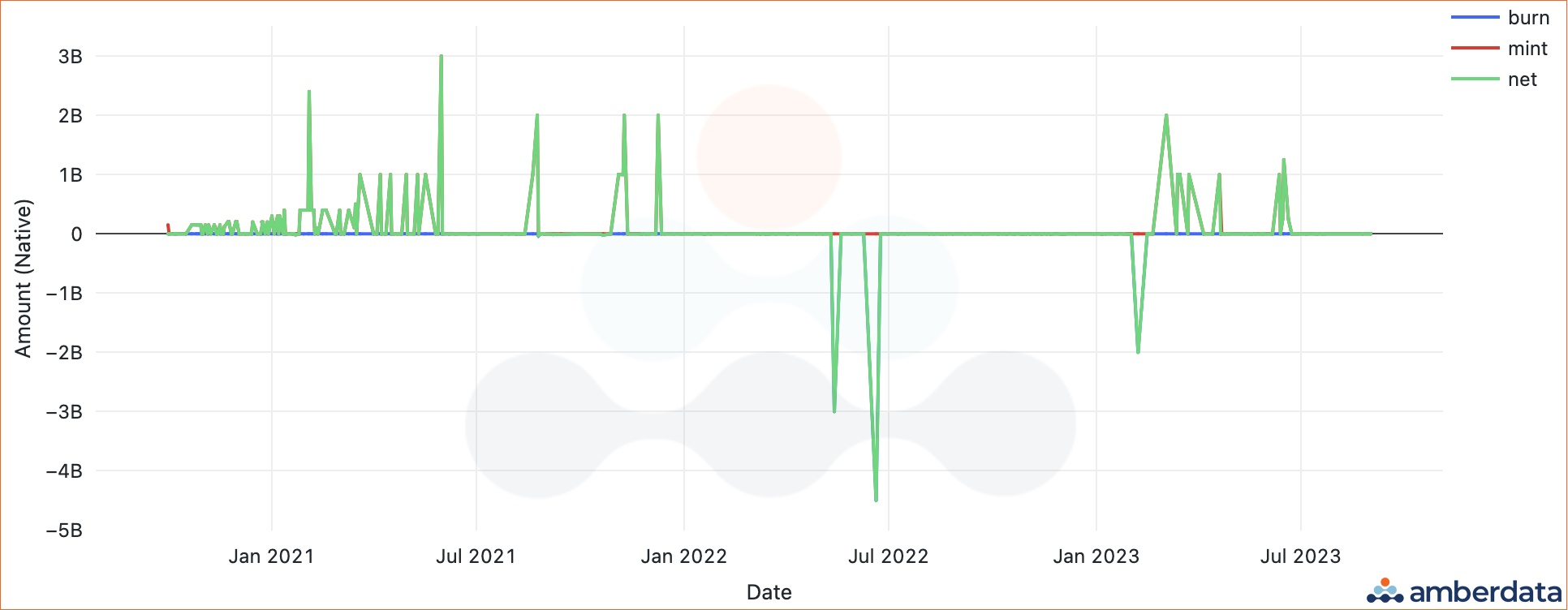

USDT market cap since October 2020

USDT market cap since October 2020

USDT market cap since October 2020

USDT market cap since October 2020

Tether (USDT) was launched in 2014 on the Bitcoin blockchain, along with EuroTether (euros) and YenTether (yen). Since the launch, Tether reports regular attestations, though they have never undergone an independent audit, but have an attestation opinion from BDO Italia. Tether has also had several allegations of price manipulation. In 2018, Bloomberg reported an investigation by U.S. federal prosecutors, and in 2021 they outlined insights into Tether’s operations, a settlement with the New York Attorney General, and the founder’s interpersonal connections. In 2017, almost $31 million USDT was allegedly stolen from the Treasury wallet, resulting in Tether creating a temporary “hard fork” and suspending the stolen tokens.

The latest attestation shows financial reserves consisting of 65% in US Treasury bills, 9% in money market funds, 0.1% in cash and bank deposits, 6.36% backed by secured loans, 3.78% held in precious metals, and 1.94% held in Bitcoin, as well as other funding types. Users should consider reserves, like several other features mentioned throughout this report, as another form of risk and note the gray areas stablecoin issuers often leverage to use phrases like “fiat- backed” and “audit.”

More recently, USDT has been facing a large depeg primarily caused by a major pool imbalance on Curve’s 3pool, which consists of USDT, USDC, and DAI stablecoins. The 3pool is a stablecoin pool that generally has a 33.3% split balance between the 3 tokens. However, traders selling large quantities of USDT for USDC and DAI have caused the pool to be over 72% USDT...

Learn more about Amberdata's Primer on Becoming a Fiat-Backed Stablecoin Maxi as this is just a subset of the report. In the rest of the report, we go through many more stablecoins including USDC, USDbC, USDP, BUSD, PYUSD, HUSD, GUSD, TUSD, USDK, and FDUSD!

Download the complete research report here:

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...