When a tree falls in the forest, the only one who hears it is the one swinging the axe. In July of 2023, stablecoin prices on centralized exchanges underwent a significant depeg. In the chaos of regulation noise, a major arbitrage opportunity was all but forgotten about.

Stablecoin Prices

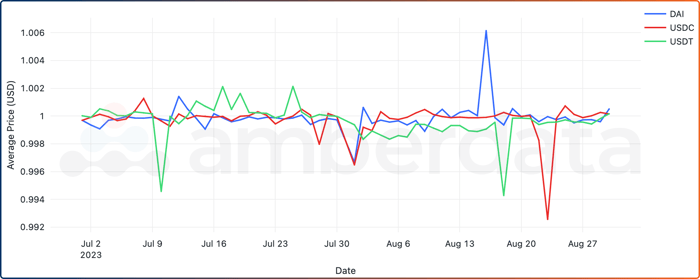

Eagle-eyed investors still frequently use stablecoins for marginal yield on arbitrage opportunities. Relatively small depeg events are common and often short-lived, but significant 2023 events like USDC in March or USDT in August are still frequent enough for more slothlike investors to evaluate risk-to-reward ratios.

USDC, DAI, USDT DEX prices based on WETH pair exchange rates between July and August 2023.

During the summer of 2023, several stablecoins such as USDC, USDT, and DAI were affected by market movements. June, July, and August brought news from United States regulators like the U.S. House Financial Services Committee and the Securities and Exchange Commission (SEC), who hit Binance with multiple charges.

Stablecoin Prices on CEXs

Aggregating stablecoin prices across all CEXs shows a peculiar story.

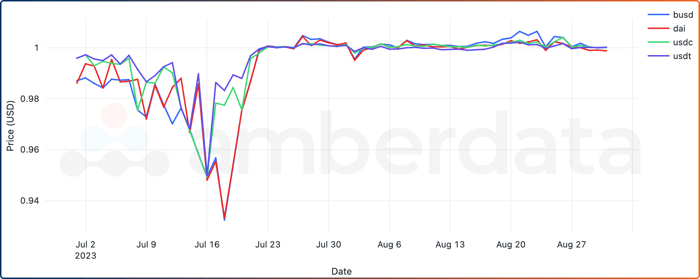

Average stablecoin prices on CEXes for BUSD, DAI, USDC, AND USDT between July and August 2023.

Despite the relative stability of stablecoins, in mid-July of 2023, they all experienced significant and sustained de-pegs across multiple days. USDC and USDT recovered 2-3 days faster than DAI and BUSD, who appear to have dropped furthest from their pegs.

Stablecoin USD Pairs

To highlight the difference between CEXs and DEXs we looked at USD trading pairs, which are currently unique to centralized exchanges.

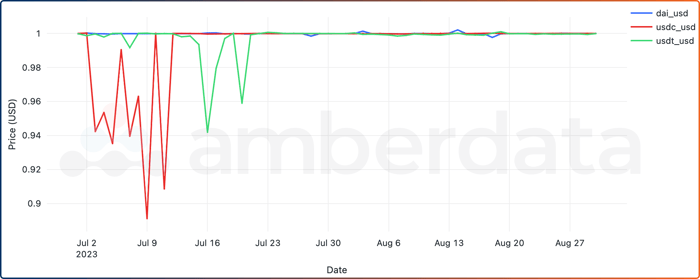

Average stablecoin-fiat pair prices on CEXs for DAI/USD, USDC/USD, and USDT/USD between July and August 2023.

USD pairs for USDC and USDT highlight a major depeg in the early July weeks, while DAI/USD did not appear to be affected. We can surmise that DAI’s depeg occurred differently than that of USDC and USDT, but why did CEXs have such large price discrepancies from decentralized exchanges?

Binance at the Forefront

As previously mentioned, this summer saw several centralized exchanges at the forefront of regulation and enforcement actions. It seems that SEC charges against Binance and its entities hit the United States the hardest. Binance has also recently announced it is ending support for BUSD.

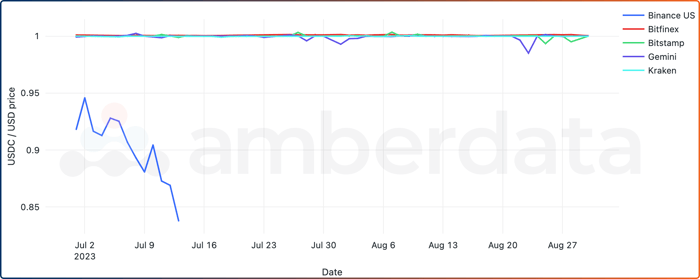

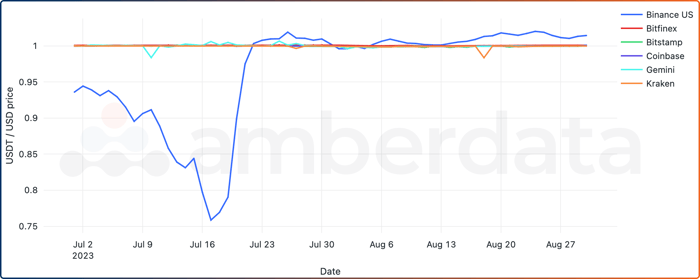

USDC/USD trading pair prices between July and August 2023 across multiple exchanges.

USDC/USD trading pairs plummeted on Binance as far as $0.84, while USDT/USD trading pairs hit almost $0.75.

USDT/USD trading pair prices between July and August 2023 across multiple exchanges.

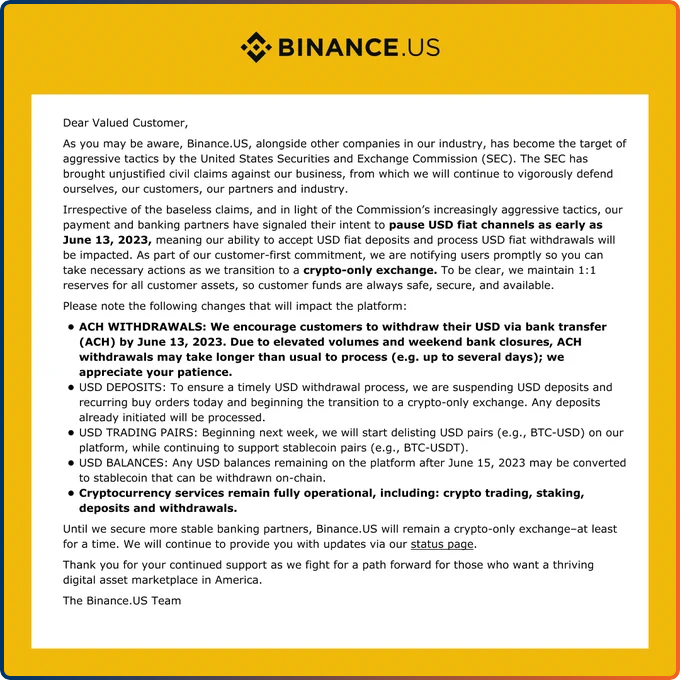

The Binance chaos started with a tweet storm from Binance.US on June 5th addressing the SEC charges and igniting their defense against them. The following day, another statement on X (Twitter) was made in an attempt to reassure customers that funds were “safe and secure.” This statement also hit back at the SEC for a lack of clarity. A second tweet followed an hour later which attacked the SEC for their regulation by enforcement actions seen throughout the year. Finally, two days later on June 8th, the exchange announced changes to its U.S. business model by pausing USD withdrawals, suspending USD deposits, delisting USD pairs, and transitioning to a crypto-only trading platform.

Statement from Binance US on June 8, 2023.

The transition from a fiat exchange to crypto-only is a fundamental shift in business. CEXs often operate as custodial solutions for traders who cannot use decentralized wallets due to corporate charters or a lack of technological ability. Many also use centralized exchanges’ custodial solutions for large transactions for preferential treatment or liquidity benefits. Most often, centralized exchanges offer a way to convert fiat currency to crypto and act as a service to onboard funds into the decentralized world.

The Lost Depeg

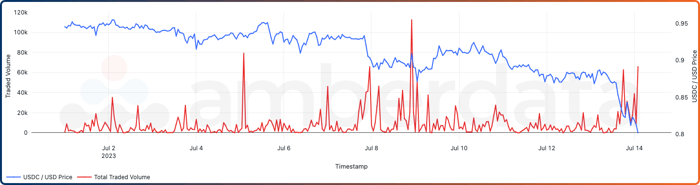

Binance US USDC/USD price and volumes between July 1 and July 14.

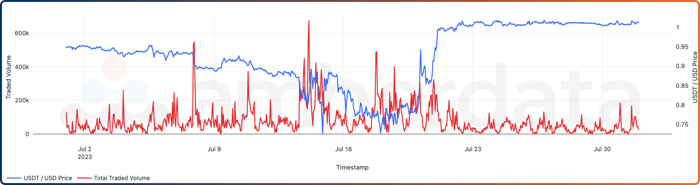

Binance US USDT/USD price and volumes between July 1 and July 31.

Using Binance US trade data, we see that when the volume for the USDC/USD and USDT/USD trading pair spiked, the trading pairs also experienced large price crashes. This indicates that these sell transactions had a major effect on liquidity and price. Support for the USDC/USD trading pair finally ended on July 14th, while USDT/USD continued to be supported. On July 18th, the USDT/USD peg began to slowly climb back to normal.

After seeing the spread of USDC/USD between Binance US and every other exchange, it is easy to imagine a way to leverage this scenario. Given the transition to crypto-to-crypto, few took advantage of the arbitrage opportunities, and the continued support of the USDT/USD trading pair was a massive arbitrage opportunity that few caught. The lost stablecoin depeg can teach us a lot about centralized exchanges and provides traders with an opportunity to capitalize in the future.

Download the complete research report here:

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...