Amberdata Digital Asset Snapshot: ETFs, Stablecoins, & Market Positioning

.png)

Our comprehensive weekly coverage of price action and volatility, trading volumes and market structure (orderbook depth/spreads), derivatives markets (open interest, funding rates, long/short positioning, term structure/basis), institutional flows (Bitcoin ETFs, stablecoin supply across chains), and DeFi credit markets (lending protocol TVL, utilization, liquidations).

News

- Morgan Stanley Files for Bitcoin and Solana ETFs: Morgan Stanley submitted filings to the U.S. SEC to launch ETFs linked to BTC and SOL, signaling a step-up in big-bank participation as traditional finance expands beyond custody and prime services into mainstream investment wrappers.

- XRP ETFs Attract Record Inflows: Spot XRP ETFs have amassed $1.3 billion in assets in just 50 days without a single day of net outflows, with CNBC labeling XRP the "new cryptocurrency darling" as institutional demand continues building through regulated wrappers.

- CLARITY Act Advances Toward Senate Vote: White House crypto adviser David Sacks confirmed Senate hearings on the CLARITY Act market structure bill are expected in January, with the legislation set to clarify SEC/CFTC jurisdiction and create a framework for digital asset regulation.

- UK and EU Tax Reporting Regimes Activate: From January 1, the UK began rolling out the OECD's Cryptoasset Reporting Framework (CARF) while the EU's DAC8 framework entered into force, expanding automatic tax information exchange to crypto assets and raising compliance requirements for service providers.

- Truebit Protocol Suffers $26M Exploit: Security researchers flagged the first major crypto hack of 2026 as hackers drained approximately 8,535 ETH ($26M) from the Truebit protocol, continuing the trend of smart contract exploits and keeping attention on protocol security standards.

- Bitfinex Hacker Released Early Under First Step Act: Ilya Lichtenstein, convicted for laundering proceeds tied to the 2016 Bitfinex bitcoin hack, was released early from federal prison on January 2 after serving just under one year of his five-year sentence under Trump-era prison reform rules.

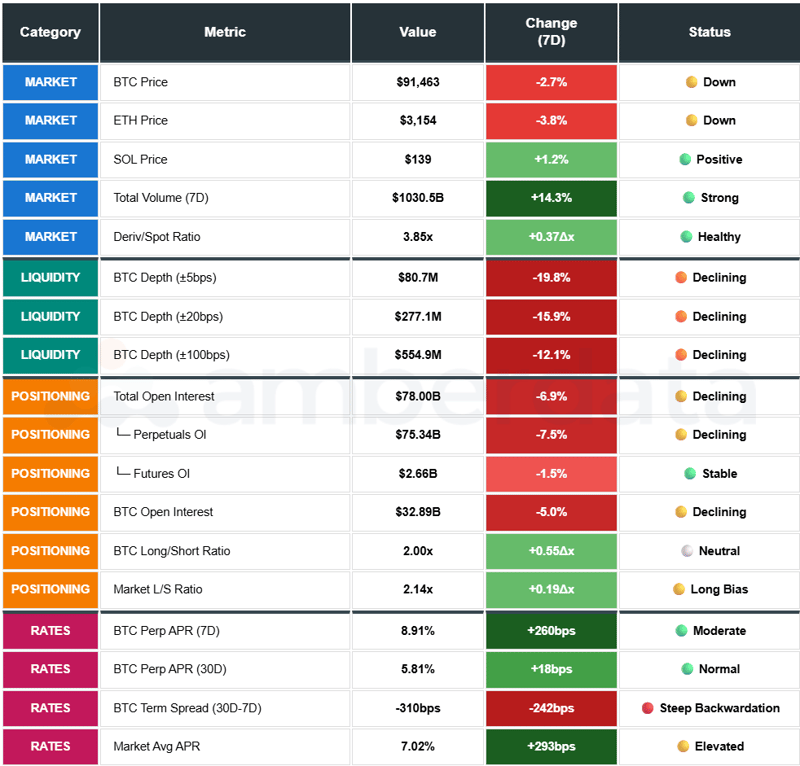

Market Analytics

Consolidation Week, Rally Pauses: Digital assets pulled back after the strong New Year rally as BTC declined -2.7% to $91,163 and ETH fell -3.8% to $3,091. SOL was the standout performer, gaining +1.2% to $138.98 while most alts corrected sharply: UNI -13.2%, XRP -12.4%, DOGE -9.3%, AVAX -6.2%, LINK -4.9%. BNB held relatively steady at -0.2%. Open interest contracted -6.9% to $78.0B as traders took profits following the prior week's expansion.

Derivatives Signal Healthy Correction: Open interest fell -6.9% to $78.00B (-$5.79B notional) as positions were reduced, with BTC OI -5.0% to $32.89B and ETH OI -9.9% to $20.58B. SOL bucked the trend at +5.2% to $4.54B. Funding rates remain elevated with BTC at +0.68% (93.3% APR), ETH +0.60% (82.7% APR), SOL +0.55% (75.5% APR). L/S ratios increased modestly: BTC 2.00x (+0.25), ETH 2.25x (+0.15), indicating dip-buying rather than panic liquidations.

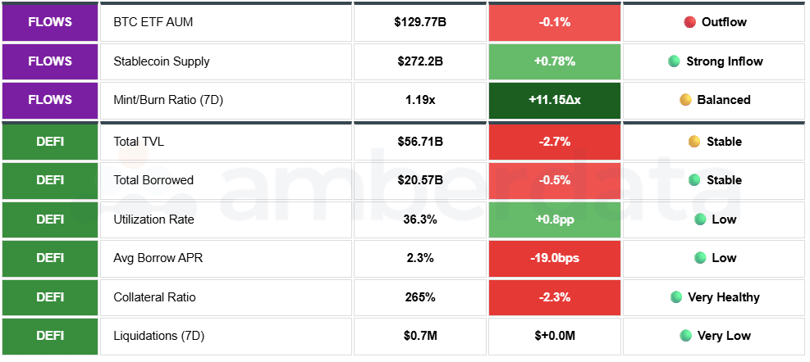

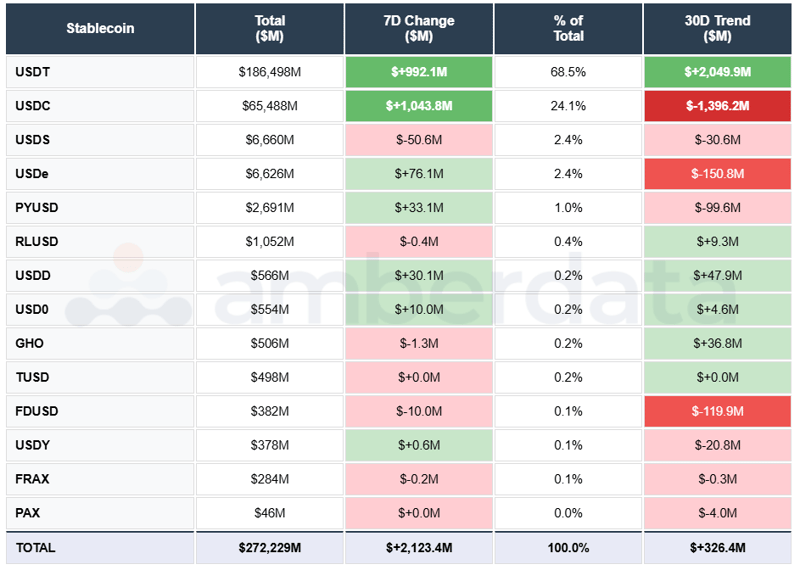

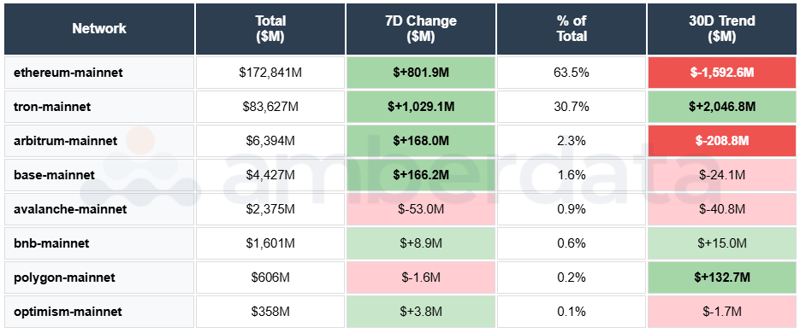

Mixed Institutional Signals: Bitcoin ETFs recorded -$103.6M in net outflows for the week, with Grayscale -$170.3M and 21Shares -$45.4M partially offset by Fidelity +$107.6M. However, stablecoin supply surged +$2.12B to $272.2B with both USDC (+$1.04B) and USDT (+$992M) seeing significant mints - dry powder building for potential re-entry. DeFi TVL stable at $56.1B with minimal liquidations at just $0.7M.

Forward Outlook: Healthy consolidation after strong rally. Bullish: elevated funding rates, L/S expansion into weakness (dip-buying), massive stablecoin inflows building dry powder. Cautious: ETF outflows, OI contraction, price weakness across most assets. Key level: $90k support critical - a break below could trigger accelerated deleveraging. Current regime: consolidation with constructive underpinnings.

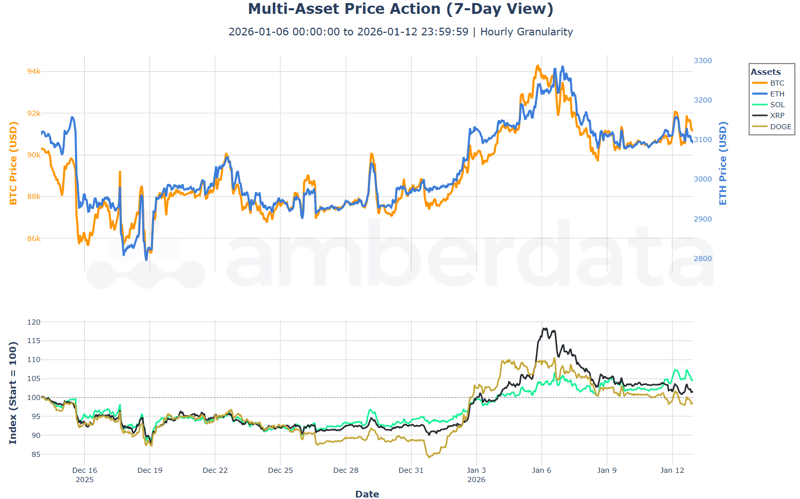

PRICES, VOLATILITY, AND VOLUMES

Broad Correction, SOL Outperforms: BTC declined -2.7% to $91,163 after briefly touching $94,422 early in the week, giving back a portion of the New Year gains. ETH underperformed at -3.8% to $3,091, continuing its relative weakness versus BTC. SOL was the sole major gainer at +1.2% to $138.98, showing resilience amid the broader pullback. Alts saw sharper corrections: UNI led losses at -13.2%, followed by XRP -12.4%, DOGE -9.3%, AVAX -6.2%, LINK -4.9%, AAVE -3.6%, WLFI -2.5%. BNB held firm at -0.2%.

Volume Expands Despite Price Weakness: Total volumes rose +14.3% WoW to $1,030.5B comprising $212.3B spot and $818.2B derivatives. The derivatives/spot ratio increased to 3.85x (+0.37x WoW) indicating heightened speculative activity during the correction - traders actively repositioning rather than stepping away. Volume expansion on downside moves often signals capitulation or strong hands accumulating from weak hands.

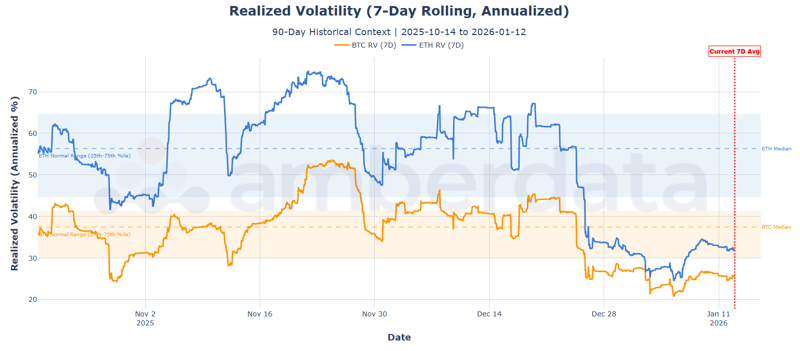

Volatility Rises but Remains Subdued: BTC realized volatility increased to 34.5% (7D), still below the 37.5% 90-day median and classified as LOW regime. ETH volatility at 41.8% similarly remains below its 56.4% median. Alt vols elevated: WLFI 102.1%, DOGE 73.8%, UNI 70.1%, XRP 67.4%, AAVE 65.5% - reflecting the sharper corrections in smaller caps.

Forward Signals: Watch for BTC holding $90k support with declining volume as consolidation confirmation. SOL relative strength suggests potential rotation opportunity if the broader market stabilizes. Volatility compression despite price weakness could precede directional resolution.

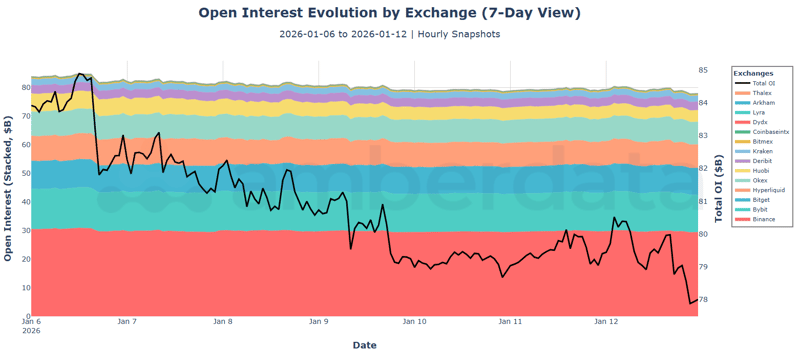

OPEN INTEREST

OI Contracts as Traders Reduce Risk: Total open interest fell -6.9% WoW to $78.00B (-$5.79B notional), reversing a significant portion of the prior week's expansion. BTC OI declined -5.0% to $32.89B, ETH saw steeper reduction at -9.9% to $20.58B. Combined BTC+ETH concentration at 68.6% of total OI. Market structure remains perpetual-heavy at 96.6% perps versus 3.4% dated futures. The orderly OI reduction without price collapse suggests healthy profit-taking rather than forced liquidations.

SOL Bucks the Trend: SOL OI expanded +5.2% to $4.54B even as price held gains - traders adding exposure to the relative outperformer. XRP saw sharp OI reduction at -16.8% to $1.85B matching its -12.4% price decline. DOGE -17.7%, SUI -22.4%, ZEC -24.8% showed aggressive deleveraging in higher-beta names. The divergence between SOL (OI up, price up) and others (OI down, price down) highlights selective positioning.

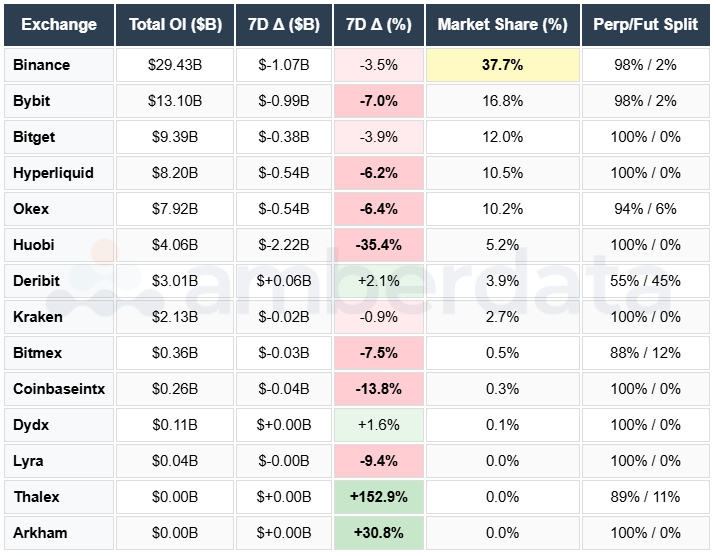

Venue Flows Uniformly Negative: All major centralized exchanges saw OI decline: Huobi led outflows at -35.4% ($4.06B remaining), Coinbase International -13.8%, Bitmex -7.5%, Bybit -7.0%, Hyperliquid -6.2%, OKX -6.4%, Bitget -3.9%, Binance -3.5% ($29.43B as largest venue). Only Deribit gained +2.1% as options hedging activity increased amid volatility.

Forward Signals: Watch for OI stabilization above $75B as a deleveraging completion signal. SOL OI expansion into strength suggests continued outperformance potential. ETH's -9.9% OI decline versus -3.8% price move indicates aggressive position reduction - potential for sharp recovery if sentiment shifts.

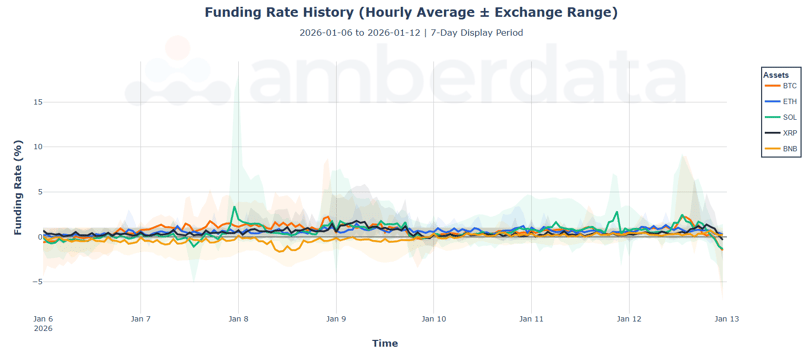

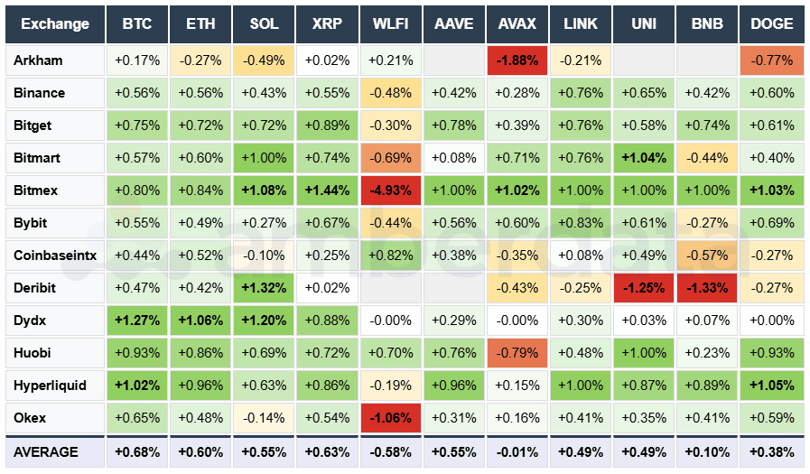

FUNDING RATES

Majors Remain Elevated Despite Correction: BTC funding averaged +0.68% (93.3% APR annualized), ETH +0.60% (82.7% APR), SOL +0.55% (75.5% APR) over the 7D period - all significantly higher than the prior week despite price weakness. Market-wide average at +0.35% (48.5% APR) shows longs continue paying shorts, indicating persistent bullish positioning even through the correction. This divergence between falling prices and rising funding suggests dip-buying behavior.

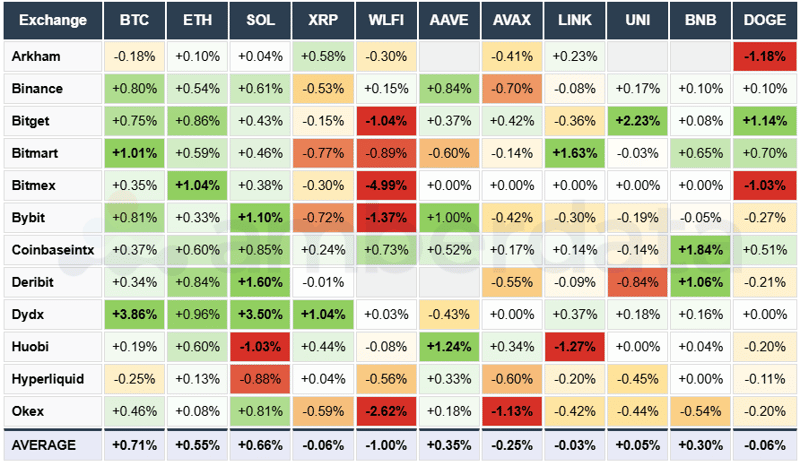

WLFI Deeply Negative, Alt Funding Mixed: WLFI continues as the notable outlier with -0.58% average funding (-1.00% WoW change), with Bitmex WLFI at -4.93% showing extreme venue-specific short pressure. XRP funding was strong at +0.63% despite a -12.4% price decline. dYdX showed elevated rates: BTC +1.27%, ETH +1.06%, SOL +1.20%. Hyperliquid consistently high across assets. Wide exchange dispersion indicates fragmented positioning.

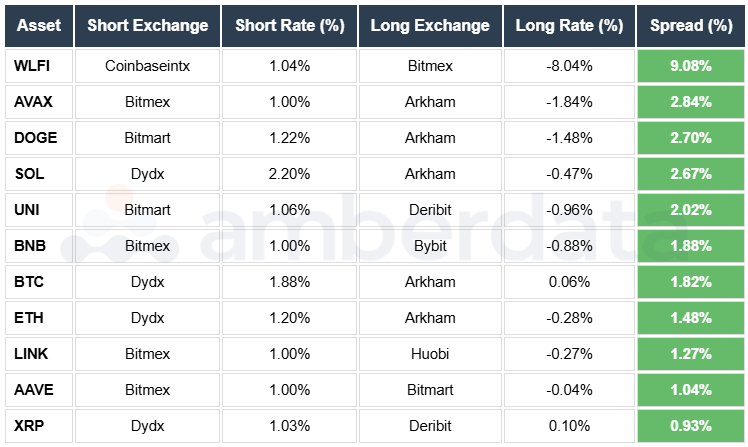

Arbitrage Opportunities Expand: Intra-exchange funding divergence widened significantly. Top spreads: WLFI 9.08% (short Coinbase Intl/long Bitmex), AVAX 2.84% (short Bitmex/long Arkham), DOGE 2.70% (short Bitmart/long Arkham), BTC 2.47%. The WLFI spread at 9% presents an exceptional arbitrage opportunity for those with cross-venue infrastructure.

Forward Signals: Watch for funding compression below +0.50% as a cooling signal. Elevated funding with falling prices is historically bullish - shorts paying to maintain positions while price declines often precede sharp reversals. Current regime: strong positive funding despite correction, supports dip-buying thesis.

Current Funding Rates

Week on Week Funding Rates

Funding Rate Arbitrage

ORDERBOOK DEPTH

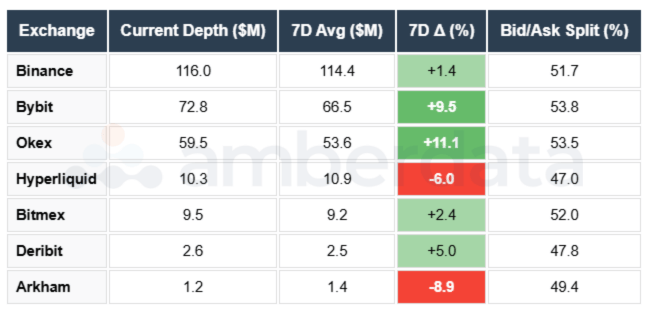

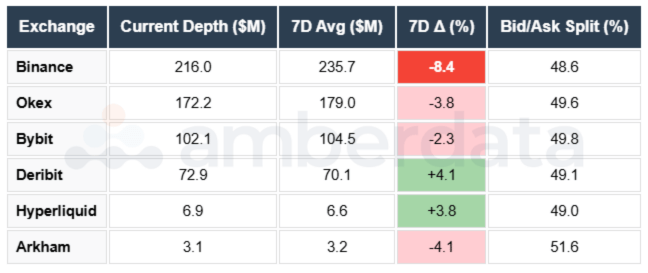

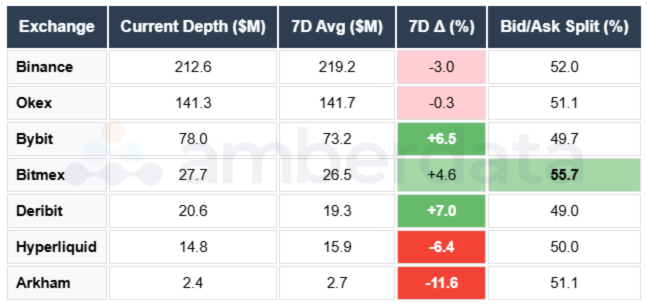

Liquidity Stable Through Correction: BTC depth at 100bps reached $554.9M (-3.2% vs 7D avg), ETH at $468.5M (+0.2%), SOL at $195.2M (+5.8%). Total major depth at $1.22B - market makers maintained liquidity provision despite price volatility. SOL showed the strongest liquidity build, consistent with its price outperformance and rising OI. The stability of orderbook depth during the correction suggests institutional presence and orderly market conditions.

Venue Distribution: BTC depth concentrated in Binance, Bybit, OKX - top three venues accounting for the majority of BTC liquidity. ETH distribution follows similar concentration. SOL depth expanded notably at +5.8%, attracting market maker capital as the asset showed relative strength. Cross-venue fragmentation allows for execution optimization when routing large orders intelligently.

Bid/Ask Balance Neutral: BTC at 50% bid / 50% ask (perfectly balanced), ETH at 52% bid / 48% ask (slight bid-heavy), SOL at 52% bid / 48% ask (slight bid-heavy). No significant directional asymmetry in market maker positioning. The slight bid-heavy positioning in ETH and SOL suggests market makers positioning for a potential bounce rather than further decline.

Forward Signals: Watch for depth contraction below $500M BTC as liquidity stress indicator. SOL depth expansion suggests continued institutional interest. Current regime: healthy liquidity conditions with balanced positioning, infrastructure supports both continuation and reversal scenarios.

BTC Depth![]()

ETH Depth

SOL Depth![]()

ORDERBOOK SPREADS

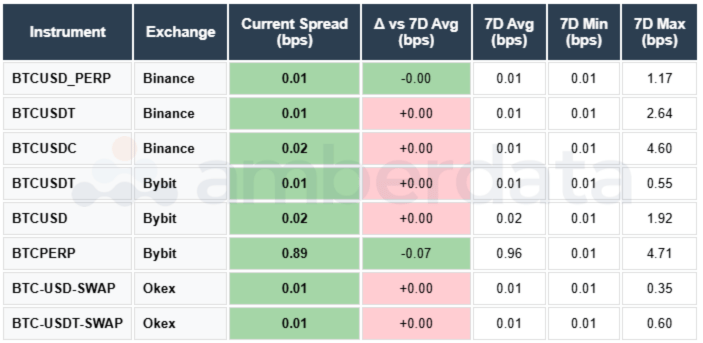

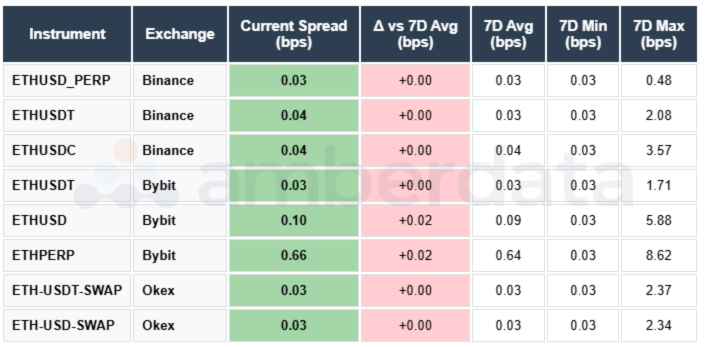

Sub-Basis Point Execution Maintained: BTC and ETH spreads remain exceptionally tight at 0.12 bps average each - effectively zero transaction cost for institutional-size orders despite the week's volatility. BTC tightest execution at 0.01 bps on Binance BTCUSD_PERP, ETH at 0.03 bps on Binance ETHUSD_PERP. Spread stability during price corrections demonstrates mature market structure and resilient market making.

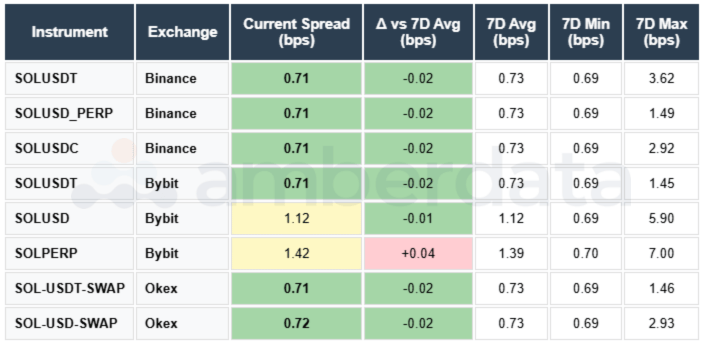

SOL Spreads Tighten: SOL average spread at 0.85 bps, improved from prior week and tightest among alts. OKX SOL-USDT-SWAP offers best execution at 0.71 bps while Bybit SOLPERP is the widest at 1.42 bps. Spread compression during SOL's relative outperformance confirms improving liquidity conditions and market maker confidence in the asset.

Venue Dispersion Stable: Bybit PERP contracts consistently widest across assets (BTC 0.89 bps, ETH 0.66 bps, SOL 1.42 bps) compared to USDT swaps. Binance and OKX USDT pairs offer the tightest execution. All spreads showed marginal tightening versus 7D averages, indicating healthy competition among market makers even during volatile conditions.

Forward Signals: Watch for spread widening above 0.5 bps on BTC/ETH as liquidity stress indicator. SOL spread compression below 0.80 bps signals continued institutional adoption. Current regime: excellent execution conditions with tight stable spreads, no liquidity stress despite price correction.

BTC Spreads![]()

ETH Spreads

SOL Spreads![]()

LONG/SHORT RATIO

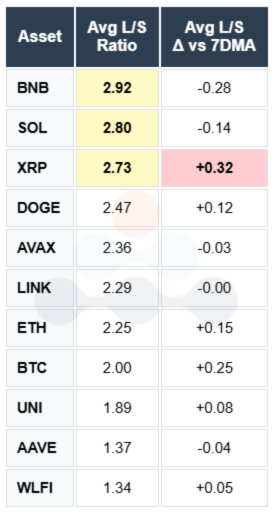

Dip-Buying Evident in Major L/S Expansion: BTC L/S ratio increased to 2.00x (+0.25 vs 7DMA), ETH to 2.25x (+0.15), indicating traders added long exposure into the correction rather than capitulating. This is textbook dip-buying behavior - falling prices with rising long positioning suggests conviction in eventual recovery. XRP also saw significant L/S expansion to 2.73x (+0.32) despite its -12.4% price decline.

Alt Positioning Mixed: BNB remains elevated at 2.92x (-0.28) - still long-biased but moderating. SOL at 2.80x (-0.14) shows slight reduction despite positive price action. DOGE expanded to 2.47x (+0.12), AVAX stable at 2.36x (-0.03), LINK at 2.29x (flat). The divergence between major L/S expansion and selective alt reduction indicates discriminating capital deployment.

Crowding Risk Moderated: No assets currently in extreme crowding territory (>3.5x). BNB at 2.92x and SOL at 2.80x remain the most crowded but below warning thresholds. AAVE 1.37x and WLFI 1.34x showing lowest L/S ratios - minimal long crowding and room for position building.

Forward Signals: Watch for BTC/ETH L/S compression as a capitulation signal - current expansion is bullish. XRP +0.32 expansion despite -12.4% price decline represents aggressive dip-buying, potential for sharp recovery if sentiment shifts. Current regime supports a recovery thesis with strong hands accumulating.

TERM STRUCTURE / BASIS

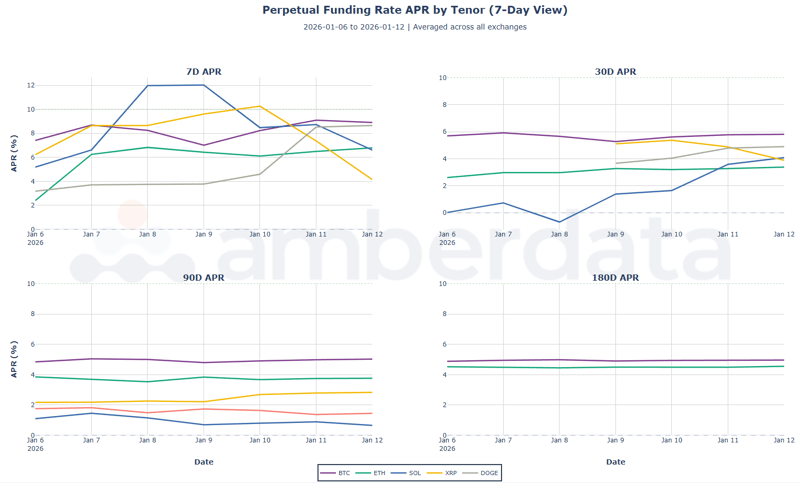

BTC Basis Strengthens: BTC 7D APR at 8.91% (+0.7 bps vs 7DMA) - elevated and strengthening despite price weakness, indicating persistent demand for leveraged long exposure. 30D APR at 5.81%, 90D at 5.03%, 180D at 4.96% shows relatively flat term structure. The strengthening near-term basis with falling prices is bullish divergence - carry traders remain confident in upside.

ETH Basis Positive: ETH 7D APR at 6.79% (+0.9 bps), 30D at 3.38%, 90D at 3.76%, 180D at 4.55% displays healthy term structure. Near-term basis strengthening despite price underperformance signals conviction among basis traders. The upward-sloping longer-term curve indicates market expects sustained contango.

Alt Basis Divergence: SOL 7D APR at 6.61% (-1.9 bps) with 30D at 4.09% - slight weakening but still attractive. XRP 7D at 4.15% (-3.7 bps) showing more pronounced basis compression alongside its sharp price decline. DOGE 7D at 8.65% (+3.5 bps) highest among tracked alts, strengthening rapidly. Basis divergence across alts reflects differentiated conviction levels.

Forward Signals: Watch for BTC basis compression below 5% APR as conviction weakening signal. Current elevated basis (8.91%) with falling prices is historically bullish - expensive to short, cheap to buy spot. Carry trade remains moderately attractive at 6-9% APR across majors.

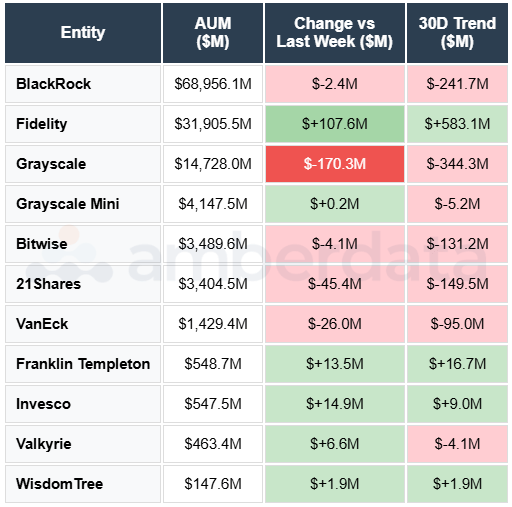

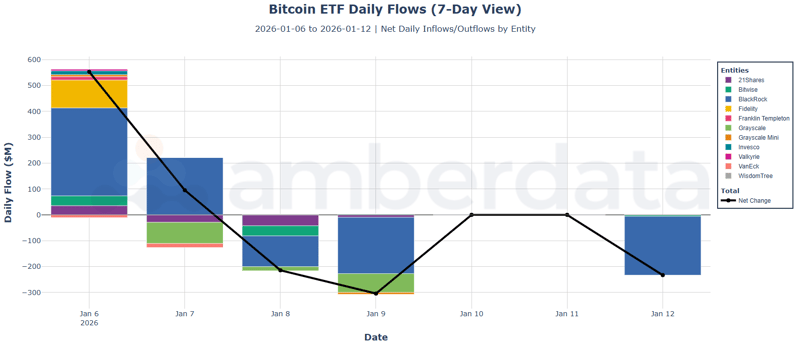

BITCOIN ETF FLOWS

Weekly Flows Turn Negative: Bitcoin ETFs recorded -$103.6M in net outflows over 7 days, reversing the prior week's positive momentum. Daily breakdown: Jan 6 +$552.8M, Jan 7 +$95.2M, Jan 8 -$214.3M, Jan 9 -$304.3M, Jan 10-11 flat (weekend), Jan 12 -$233.0M. The week started strong but deteriorated sharply mid-week as prices declined, with the final trading day seeing significant outflows.

Grayscale Outflows Accelerate: Grayscale's GBTC saw -$170.3M in outflows, the largest single-issuer reduction. 21Shares -$45.4M, VanEck -$26.0M, Bitwise -$4.1M, BlackRock -$2.4M (marginal). Fidelity was the notable exception at +$107.6M, continuing to attract capital even during the correction. Invesco +$14.9M, Franklin Templeton +$13.5M also saw modest inflows.

AUM Declines to $129.8B: Total ETF AUM at $129.77B, down from $134.2B the prior week driven by combined outflows and price depreciation. BlackRock leads at $68.96B (53.1% market share), Fidelity $31.91B (24.6%), Grayscale $14.73B (11.3%). 30D trend remains negative at -$360.2M, indicating sustained distribution pressure over the past month.

Forward Signals: Watch for daily inflows returning above $100M as sentiment reversal signal. Fidelity's continued accumulation during weakness suggests institutional conviction. Grayscale outflows appear structural (fee differential) rather than sentiment-driven. Current regime: distribution pressure but Fidelity divergence is constructive.

STABLECOIN FLOWS

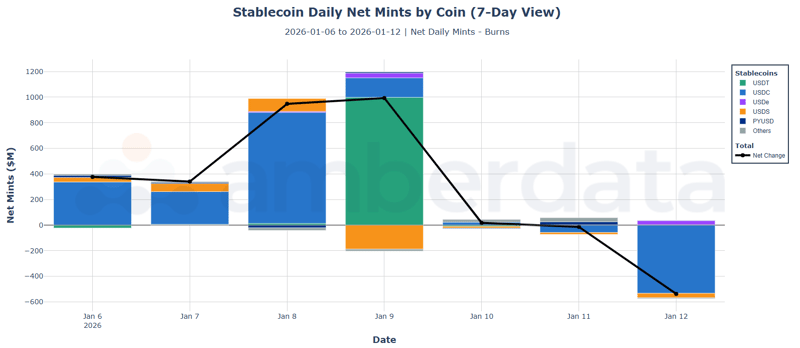

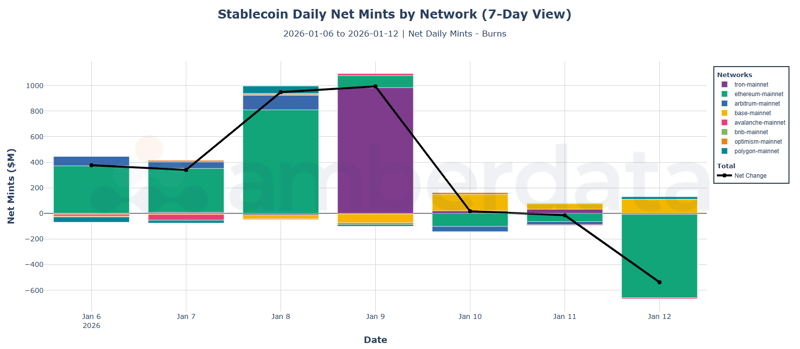

Massive Weekly Expansion: Total stablecoin supply reached $272.23B with +$2,123.4M net mints for the week - the largest weekly expansion in months. This stands in stark contrast to ETF outflows and price weakness, indicating significant capital is positioning for re-entry. Both major stablecoins saw inflows: USDC +$1,043.8M and USDT +$992.1M. USDe +$76.1M, PYUSD +$33.1M. Only USDS saw modest burns at -$50.6M.

Network Flows Favor Tron and Ethereum: Tron dominated network inflows at +$1,029.1M, cementing its position as the primary offshore USDT settlement layer. Ethereum mainnet saw +$801.9M - a reversal from prior week's outflows. Arbitrum +$168.0M, Base +$166.2M as L2 ecosystems attracted capital. Only Avalanche (-$53.0M) and Polygon (-$1.6M) saw outflows. Broad network expansion signals ecosystem-wide capital formation.

Supply Composition Shifts: USDT dominance at 68.5% ($186.5B), USDC 24.1% ($65.5B), USDS 2.4% ($6.7B), USDe 2.4% ($6.6B). The simultaneous USDT and USDC expansion is notable - typically these move inversely. Parallel inflows suggest both retail/offshore (USDT) and institutional/regulated (USDC) capital building positions. Total $272B dry powder represents substantial sidelined capital.

Forward Signals: Watch for stablecoin deployment (burns) as risk-on confirmation. $2.1B weekly inflow is exceptionally bullish for the medium-term outlook - this capital will eventually deploy. Current regime: massive dry powder accumulation, strongly supports recovery thesis once selling pressure exhausts.

DEFI LENDING

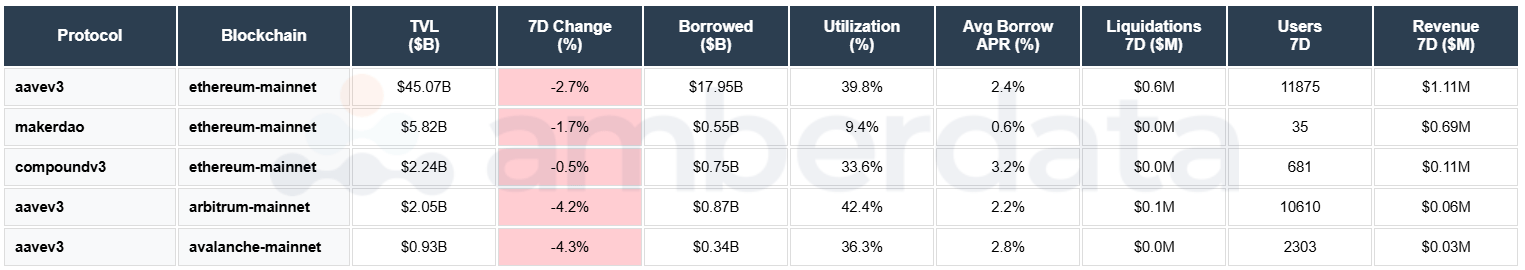

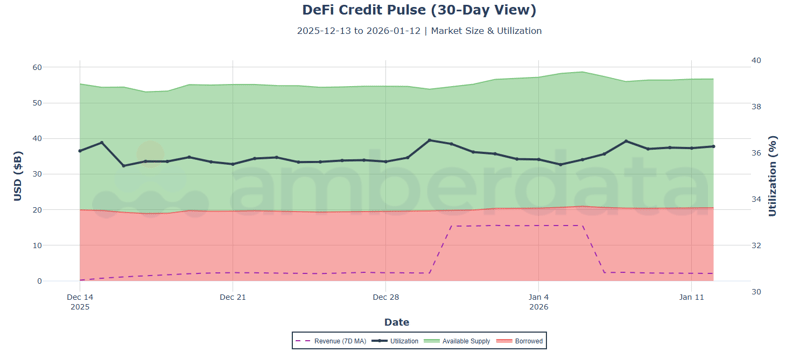

TVL Stable, Credit Healthy: Total DeFi lending TVL at $56.11B, down marginally from $58.27B the prior week but stable considering the broader correction. Aave v3 Ethereum dominates at $45.07B representing 80.3% of tracked lending capacity. Credit markets maintained stability through the price volatility, demonstrating ecosystem resilience and prudent risk management by borrowers.

Utilization Increases Slightly: Market-wide utilization at 36.5%, up +0.8pp as TVL declined slightly faster than borrowed amounts. Total borrowed at $20.45B against $56.11B deposits leaves $35.66B available lending capacity. Aave v3 Ethereum at 39.8% sits in a healthy range. Utilization increase indicates credit demand remained stable despite price weakness - borrowers not rushing to deleverage.

Liquidations Remain Minimal: 7D liquidations at just $0.7M - near-zero despite 3-13% price moves across assets. This confirms conservative LTV positioning and healthy collateral buffers. Users maintain prudent risk management, avoiding the liquidation cascades that characterized prior corrections. 25,504 active users generated $2.00M in protocol revenue.

Forward Signals: Watch for utilization rising above 40% as credit tightening signal, liquidations exceeding $5M as collateral stress indicator. Current structure: credit markets healthy and stable, no stress indicators present, leverage expanding in controlled manner supportive of orderly correction.

Full-Market Research. Institutional Depth. Derivatives, ETFs, on-chain, DEXs, microstructure, risk signals - and more. Subscribe at the bottom of our page for research that covers every corner of crypto and visit the Amberdata Research Blog.

Access Amberdata Intelligence for institutional-grade digital asset intelligence, or contact our team to discuss custom solutions.

Links & Resources

Platform

Recommended next reads

ETF Cost Basis Series

- Part 1/3: The $80,000 Floor (ETF Cost Basis)

- Part 2/3: Who Breaks First (ETF Cost Basis)

- Part 3/3: The Stress Test (ETF Cost Basis)

More key reads

- The ETF Exodus Decoded: Basis Arbitrage, Not Capitulation

- Bitcoin's Great Rotation: Who Bought the Dip and Why It Matters

- October 2025 Crash (7 charts): How $3.21B Vanished in 60 Seconds

- Beyond the Spread: Market Impact and Execution

Disclaimers

The information contained in this report is provided by Amberdata solely for educational and informational purposes. The contents of this report should not be construed as financial, investment, legal, tax, or any other form of professional advice. Amberdata does not provide personalized recommendations; any opinions or suggestions expressed in this report are for general informational purposes only.

Although Amberdata has made every effort to ensure the accuracy and completeness of the information provided, it cannot be held responsible for any errors, omissions, inaccuracies, or outdated information. Market conditions, regulations, and laws are subject to change, and readers should perform their own research and consult with a qualified professional before making any financial decisions or taking any actions based on the information provided in this report.

Past performance is not indicative of future results, and any investments discussed or mentioned in this report may not be suitable for all individuals or circumstances. Investing involves risks, and the value of investments can go up or down. Amberdata disclaims any liability for any loss or damage that may arise from the use of, or reliance on, the information contained in this report.

By accessing and using the information provided in this report, you agree to indemnify and hold harmless Amberdata, its affiliates, and their respective officers, directors, employees, and agents from and against any and all claims, losses, liabilities, damages, or expenses (including reasonable attorney's fees) arising from your use of or reliance on the information contained herein.

Copyright © 2026 Amberdata. All rights reserved.

Michael Marshall

Mike Marshall is Head of Research at Amberdata. He leads pioneering research initiatives at the forefront of blockchain and cryptocurrency analytics. Mike is a seasoned quantitative analyst with a 15-year track record in developing AI-driven trading algorithms and pioneering proprietary cryptocurrency strategies. His...