.png)

Since the genesis block of Ethereum, decentralized autonomous organizations, or DAOs, have represented the dream of organizing individuals around a common cause in a decentralized manner. Great progress has been made since the early days of the Ethereum network to grow the nascent DAO space - from improving tooling needed to build a DAO, to coordinating votes both on and off chain, and analytics into DAO treasury management. That being said, one DAO that stands out among the rest: Nouns.

Nouns are considered to be the gold standard of DAOs. Nouns, an NFT collection that is governed by Nouns DAO, auction off 1 NFT (a Noun) every day, and its proceeds are placed into the Nouns Treasury. Nouns holders, also referred to as Nouners, propose and vote on how to use the funds in the treasury.

The DAO has used the treasury to donate to charities, create Nouns comic books, make real Nouns designer sunglasses, fund a Nouns skateboard brand, stake ETH to generate yield on the treasury, and even support a Nouns eSports team. Currently, the DAO has a treasury of around 28,000 ETH ($44m).

Nouns address a few core problems with the concept of DAOs. Many DAOs raise funding through either a token sale or a primary NFT sale. This turns problematic as it becomes a battle of who has the most capital to deploy in a primary sale or NFT drop. To solve this issue, Nouns focuses on a slow growth model – “One Noun, every day, forever.” This is fundamental as it allows the DAO to steadily grow and to learn along the way, which leads to stronger DAO coordination in the future.

Additionally, having slow perpetual funding allows Nouns to prioritize how funds get deployed, track how well teams execute their funded proposal and allows the DAO to coordinate voting, proposals, and engagement.

DAOs also test the boundaries of social contracts. Because DAOs are decentralized, it is hard to guarantee the execution of a proposal or track and monitor funding. Nouns solves this by embracing the open source and decentralized nature of blockchain and understanding that operating a DAO means that they will not conform to web2 standards. Nouns’ artwork is public domain or CC0, meaning anyone can use it without needing licensing. Additionally, each Noun is stored fully on the blockchain, which means that the artwork has no external dependencies and can live on as long as Ethereum exists.

So, how is Nouns DAO doing? To understand this, we explored Amberdata’s on-chain data and investigated voter turn-out for proposals and overall user growth.

Nouns Auction Participation:

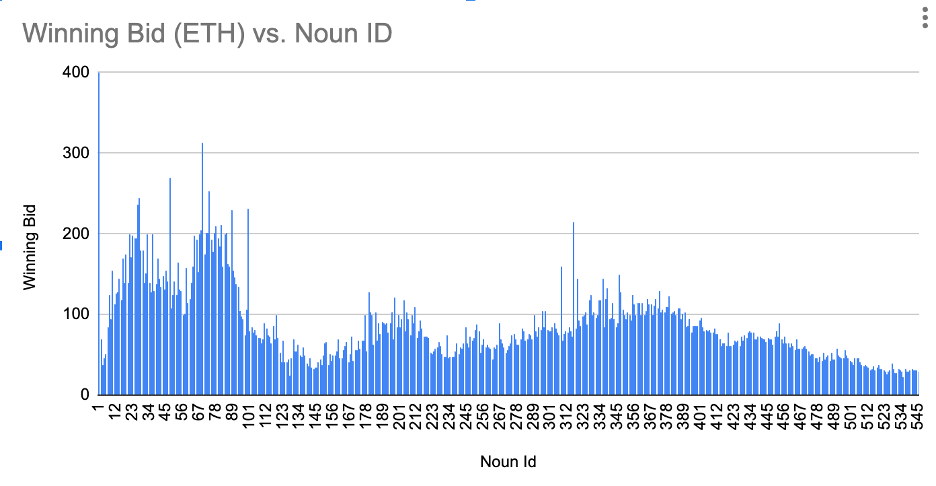

Noun NFT prices have come down significantly since its launch. The first 100 Nouns were selling for as high as 100+ ETH, and now are going for about 30 ETH. This seems healthy – entry to the DAO is still pricy, but this lower entry point prevents all control from being only whales and allows DAO membership to grow.

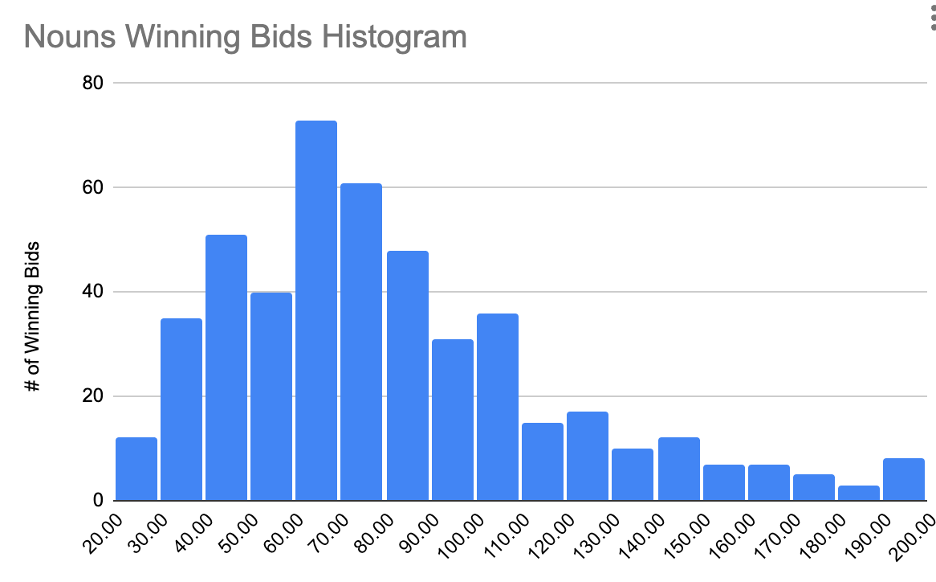

As shown in the graph below, the average winning bid of a Noun is around 87 ETH, but winning bids have gone as high as 313 ETH and as low as 22 ETH.

Figure 1: Average Noun winning bid

Figure 2: Winning bid histogram

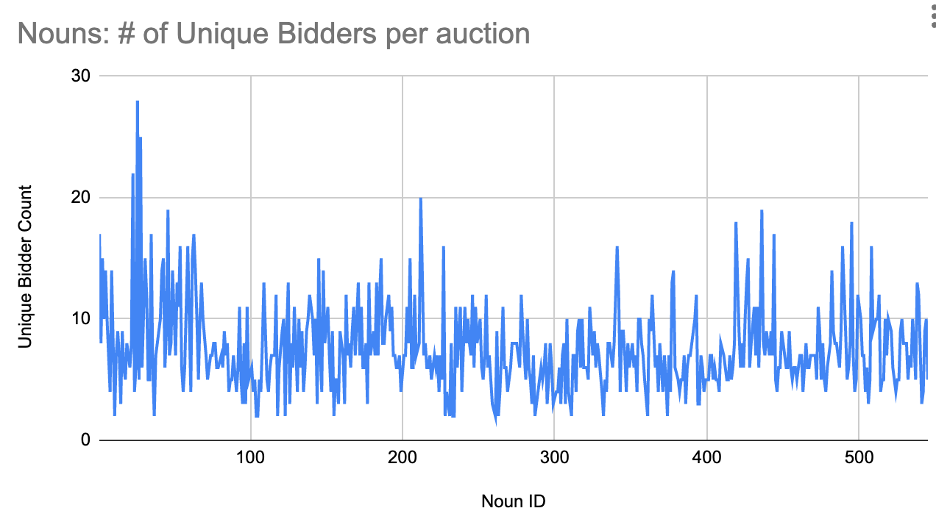

Even with the price of a Noun coming down significantly since the project’s inception, there is still constant bidding action (on average 7.5 unique wallets bidding per auction). The graph below illustrates the number of unique bidders per auction.

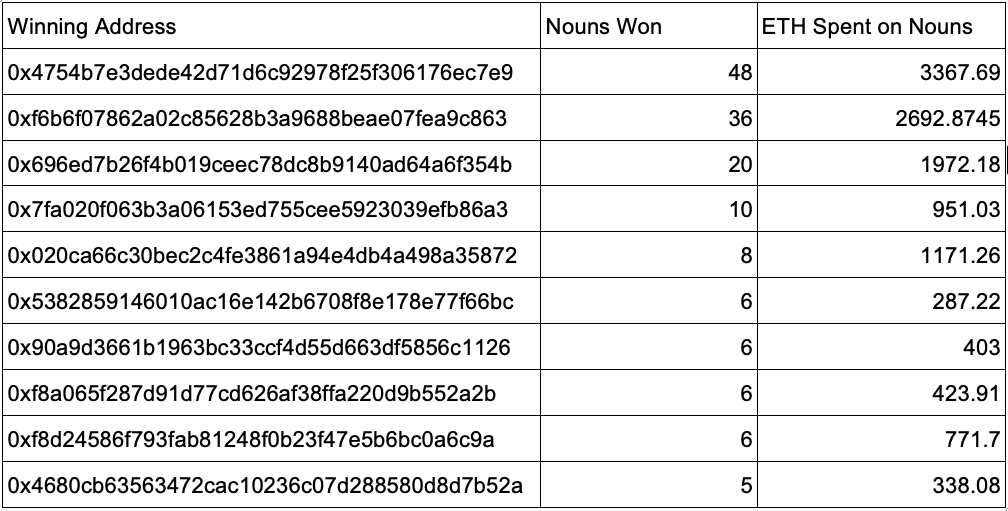

Let’s dive deeper and take a look at Nouns at a wallet level. It’s especially important to examine what wallets interact with a project, as concentrated voting power can skew the interest or mission of the DAO to a handful of users.

According to Figure 3, we can see that the top ten addresses that have won Nouns auctions have contributed 12,378 ETH to the treasury – roughly 40% of all treasury funds. However, these wallets only have 151 Nouns or 27% of the voting power, which is a comparatively healthy ratio. The daily auction mechanism introduces opportunity cost to a single wallet trying to accumulate Nouns at a rapid pace and distributes the ownership.

Nouns Voting Mechanisms

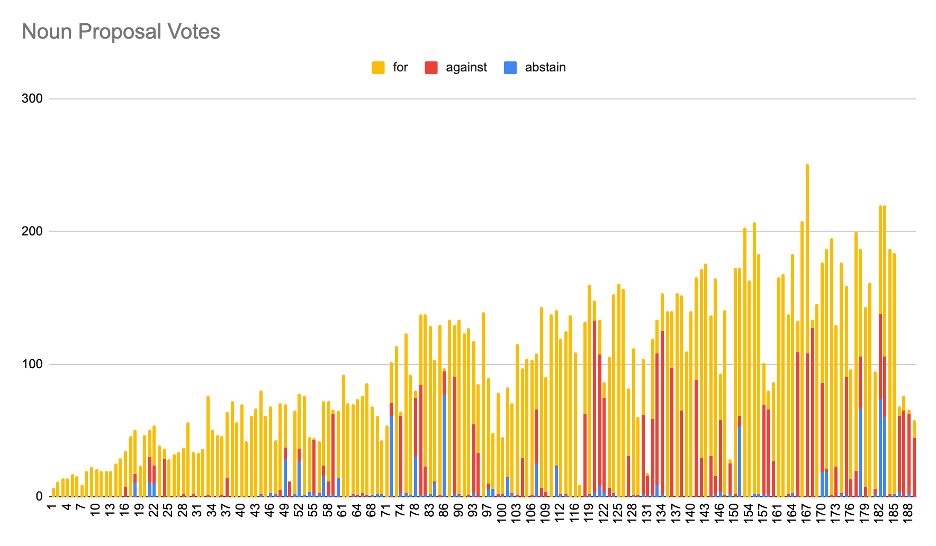

When a Nouns holder votes, 1 Noun NFT is the equivalent of one vote. Votes can be delegated to other wallets including non-Nouners. In Figure 4 below, we can see that as the population of Noun holders increases, so does voter participation. Most proposals received votes “For” the proposal, but often the votes depend on the monetary amount from the treasury.

The DAO has successfully funded 130+ proposals, entirely on the blockchain. For a project that is just over a year old and is completely bootstrapped, this shows tremendous traction for decentralized coordination, DAO execution, and a whole new sector.

This is just the beginning for Nouns DAO and DAOs in general. Right now, there isn’t a direct ROI in owning a Noun, but as my friend Will Price views the ROIs of Nouns:

(Treasury*illiquidity discount) + Value of community membership + Potential return on activities done collectively by the group + Call option on the brand becoming huge – Inefficiency tax.

Essentially, while owning an NFT reduces liquidity and DAOs require more coordination than centralized entities, the value of the talented community and projects that have been funded return value back to Nouns.

Although we are still in the early days of DAOs, Nouns has proven the ability to check boxes that have been challenging for DAOs in the past, such as perpetual funding, social coordination, governance and voting, memetics, and an overall crypto-native mission.

To learn more, visit https://nouns.wtf/.