Analyzing NFT Projects Using Non-Traditional Metrics and Techniques

NFT trading took off in a big way over the last year and with the growth of this new asset class, unique trading opportunities presented themselves. The non-fungible nature of these assets provides interesting ways to understand the asset class and analyze the market. In this post, we’ll discuss a few key, non-traditional metrics you can use focusing on the CryptoPunk market. However keep in mind that this analysis can be applied to any NFT project.

There are, of course, traditional metrics to analyze NFT projects like volume, floor price and metadata metrics, and while they are all important, let’s explore some non-traditional ways to view NFT projects.

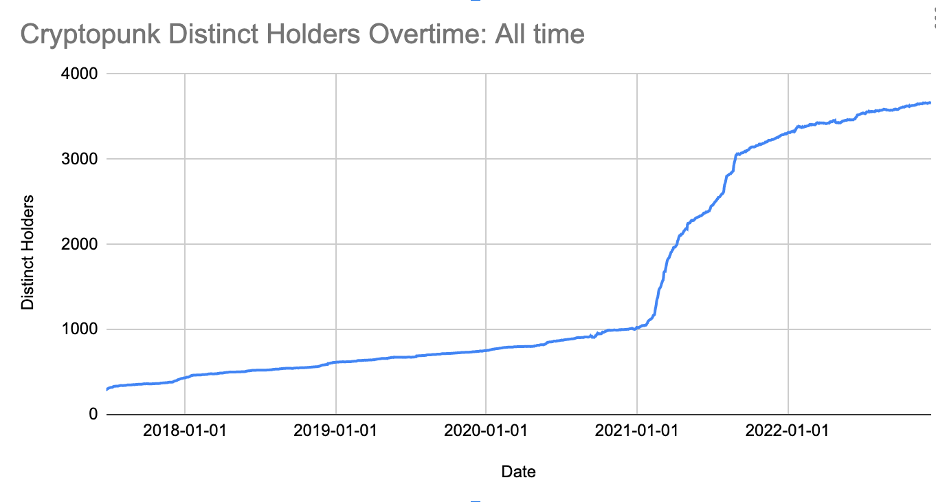

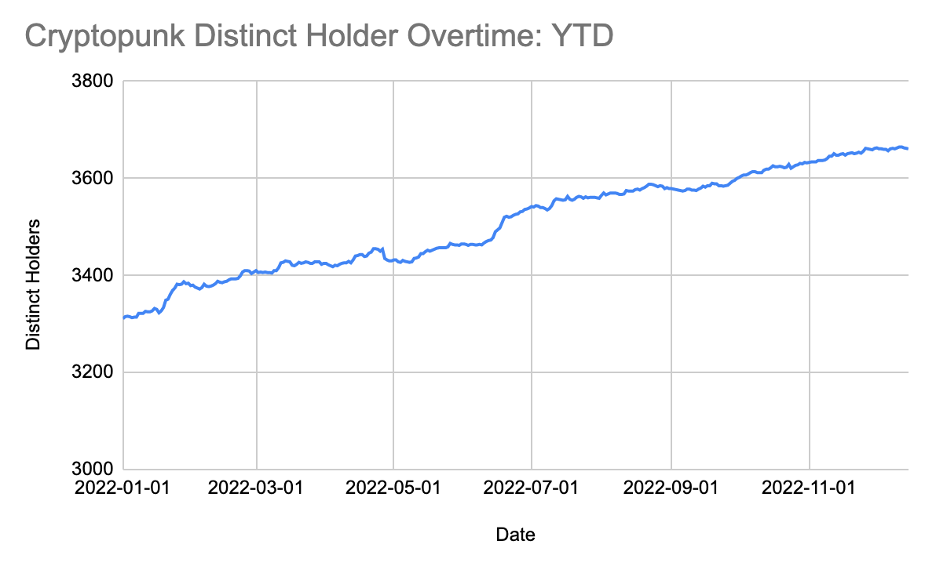

Total Unique Holders

This metric is a great way to understand the distribution of holders. For example, does this NFT project have a heavy concentration among a few large holders or is it more uniformly distributed across wallets? A heavy concentration of holders could have a large impact on price by pushing down floor price. Of course, this isn't a perfect metric since holders can spread NFTs across multiple wallets they own, but directionally it can provide good information.

Here we can see the increase in CryptoPunk holders over time and how that has changed through different market cycles.

From 2017 to late 2020 we can see consistent linear growth. The impact of the NFT bull market of 2021 can be seen with an explosion of new holders. As the market settled down, we continued to see a slow upward trend, with ~1.2 new wallets holding a CryptoPunk each day in 2022.

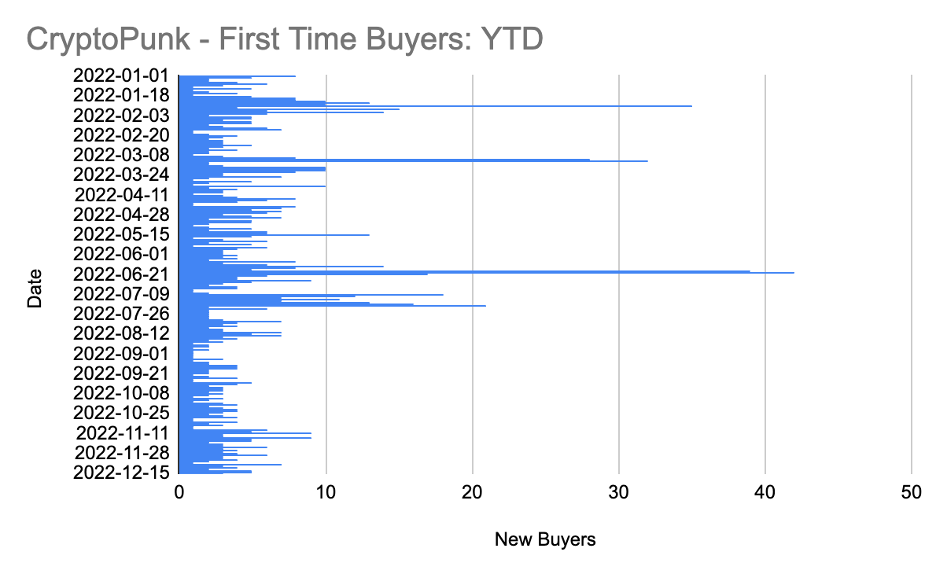

First time buyers

New wallets entering a project is another good way to gauge interest. Are we seeing the same wallets enter and exit positions, or are new wallets buying their first NFT in the project? This is a useful metric to view in parallel with holder growth. Think of this metric in the same way real estate investors would view first time home buyers. How confident are new buyers to enter this project?

OTC Activity

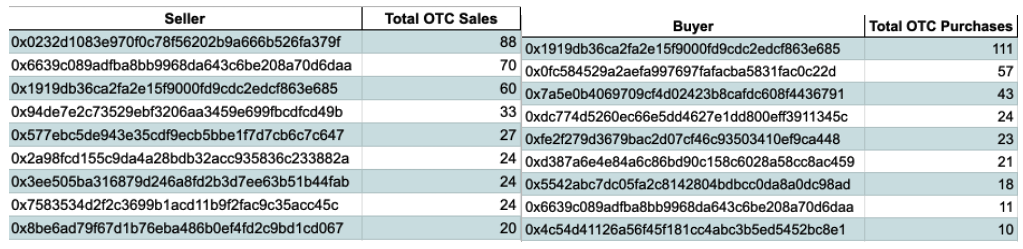

OTC flows can be monitored through the CryptoPunk contract. When a punk is offered for sale, you have the option to offer it to a specific wallet rather than to the entire market. This functionality is often used in pre negotiated sales. OTC activity can be a great way to monitor flows of more serious market participants and determine which wallets are actively market making. Below you can see which wallets are some of the most active in OTC trades.

Network Analysis

NFTs are an interesting asset class since they can be used as tools for access, identity, social signaling and more. The more activity a project has, the more the network of wallets that hold or have held a project grows. You can use graph-based analysis of a project to identify pockets of activity, identify wallet clusters and group wallets by value transacted. This network data provides a great exploratory tool for understanding dynamics in projects.

Explore more here.

These are just a few of the non-traditional metrics and techniques to look at the growing NFT ecosystem and analyze projects. In a future post, we’ll will explore the intersection of NFTs and DeFi or NFT-Fi.