Growing adoption of NFTs has led to an interesting intersection with DeFi and has garnered the new combined name NFTFi.

NFTFi protocols have a wide range and include NFT Perpetuals (cc: https://nftperp.xyz/ ), NFT Options (cc: https://www.hook.xyz/ ), Peer-to-Peer (P2P) Lending (cc: https://www.nftfi.com/ ), pooled liquidity models (cc: https://nftx.io/ ), and fractionalized NFTs (cc: https://fractional.art/). This subset of NFTs has shown consistent growth, development, and innovation for new ways to access liquidity for relatively illiquid assets.

Today, we will dive into the NFTFi Loan originations. In the NFTFi Protocol, NFT owners use the assets (NFTs) they own to access liquidity by receiving secured and peer-to-peer wETH and DAI loans from liquidity providers in a completely trustless manner. NFT liquidity providers use NFTfi to earn attractive yields or — in the case of loan defaults — to obtain NFTs at a steep discount to their market value.

Adoption

Below is a visual of cumulative loan volume by NFT collection over time. As expected, we did not see loan volume pick-up speed until the second half of 2021 when the NFT wave hit. Over 40,000 ETH (>$50,000,000 at current prices) in loan volume occurred in the top 3 collections since the inception of the protocol. We can see that the majority of loan volume is occurring around the Yuga Labs collections (BAYC, MAYC, Punks) and Artblocks. The visual below shows the cumulative loan volume of collections.

Given the Peer-to-Peer design of NFTFi, loans are over-collateralized, meaning the price of the loan is usually lower than the value of the NFT. This is an important distinction when operating in a decentralized lending environment. Because blockchains are transparent, with the right data we can look deeper into these borrowers and investigate which are the most creditworthy.

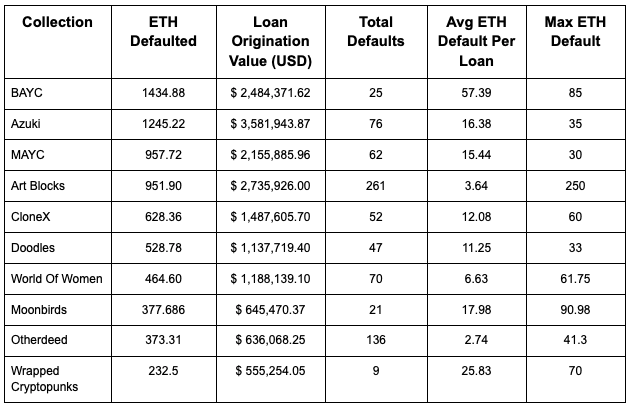

Let’s look at which Top 10 NFT collections have had the most defaulted loans. Across the top ten collections, there are over 7,200 ETH across more than 700 loans. The NFT collection with the highest amount of total defaults was Art Blocks, which is expected as the collection size is significantly larger than others.

The single largest loan to default was an ArtBlocks loan on an NFT project called The Eternal Pump by Dmitri Cherniak.

A 250 ETH loan was given on this token on 01-12-2022

(0x6360177403095c7af8be3172356040cb917bfb88680879e33f2d463dc9b0f6d5). This loan was ~$800,000 on the day of origination. It was eventually liquidated on 04-13-2022

(0x97ca11133034c33df6e25757bcfdd54391481dcd6805a304558722d9722f73c5) with the borrower now sitting on 250 ETH and the lender ending up with the NFT above.

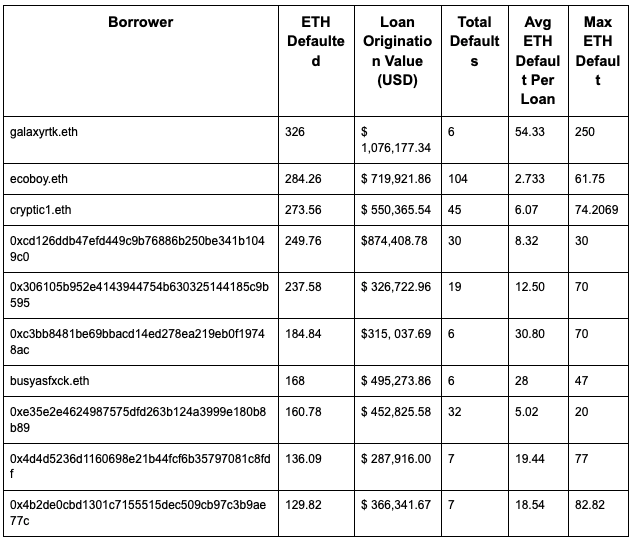

Now let’s explore the individual borrowers to understand how many addresses defaulted on their loan, which of the borrowers are the least creditworthy, and if being creditworthy on a blockchain even matters.

The largest borrower has borrowed and failed to pay back over $1,000,000 in ETH over the course of their 6 loans. But does this even matter? Well, let’s consider the reasons for the loan from the lender’s perspective. Some lenders may be looking at these loans as an opportunity to accumulate NFTs at a discounted rate if the borrower defaults and hope to accumulate yield on their ETH for the duration of the loan. Either way, it is important for lenders to understand that they have a risk of ending up with an NFT that is relatively illiquid. Lenders should be knowledgeable of the NFT market dynamics of the NFTs they are providing loans for.

Having visibility into the risks and probability of a borrower defaulting is also an important consideration. Thankfully, the blockchain data above allows us to quantify the risk of borrowers, but is there a future where we see an on-chain credit scoring system? Considering the freedom to transact in a P2P lending market, only about 10% of loans actually default. NFTFi alone has done over 20,000 loans since the protocol’s inception.

Another reason I choose to focus on NFT loans is because I expect we will see many real-world assets and collectibles being issued on-chain as NFTs. For example, 4k.com is a protocol that custodies and ensures valuable collectibles such as Rolexes, sneakers, and UniSocks. NFT lending will expand past digital art and be used for access to liquidity for real-world items being brought on-chain.

I wanted to know more, so I asked the founder of 4k.com: “What problem are you trying to solve by issuing IRL assets on-chain? What value does it have to owners of those assets?” His response was:

“The collectibles market is a massive industry, worth hundreds of billions of dollars annually; however, there is currently little financial tooling for collectors. This makes it difficult for them to borrow against or finance their collections. Bringing collectibles on-chain can lower fees and friction for trading and speculating on these assets, making them more accessible for retail investors.

Financializing collectibles lead to a more efficient market. Not only would this benefit collectors and consumers alike, but also the manufacturers and sellers. This creates a win-win situation for all stakeholders. Not to mention that access is limited for people in certain countries. Adding collectibles to the blockchain means breaking down geographic barriers and allowing people to globally participate in the market.

Aside from all of this, current marketplaces have exorbitant fees, making it almost impossible to make a profit. The current inefficiency of the market is a disadvantage for people who wish to borrow against their collections or speculate on their assets. Bringing assets on-chain means unlocking the true value of collectibles by enabling transactions that are faster, and more efficient, increasing liquidity, and helping to create a more stable market. Collectibles are relatable and familiar. This could be beneficial for retail investors who may not have a deep understanding of traditional investment tools but are knowledgeable about the collectibles market. In the case of a Rolex, a watch collector would be able to borrow against their collection or generate yield.” - @megatron, Founder, and CEO of 4k.com

Personally, I remain optimistic about the growing financial protocols around the NFT space.

-Pat Doyle, Director of Product (Blockchain) at Amberdata