Amberdata Digital Asset Snapshot: Bitcoin’s Reaction to Fed Rate Cut & SEC Updates

In this week’s Amberdata Digital Asset Snapshot, we explore the latest market developments, including the Fed’s rate cut sparking a Bitcoin rally, the SEC’s approval of BlackRock’s Bitcoin ETF options, and key insights into Bitcoin and Ethereum market trends. Additionally, don't miss our recent AD Derivatives Newsletter covering BTC volatility and institutional flows, and highlights such as our Stablecoins & Digital Commodities Dashboards, Binance ETH-USDT analysis, and our new partnership with Derive. Find all these updates at the end of this newsletter.

News:

- Fed’s Rate Cut Sparks Bitcoin Rally: The Fed cut rates by 50 bps, boosting Bitcoin’s price. More cuts are expected, signaling a potentially bullish Q4, though caution remains due to inflation concerns.

- BlackRock Bitcoin ETF Options Approved: The SEC approved options trading for BlackRock’s Bitcoin ETF. This could drive more institutional interest and lead to a gamma squeeze, pushing Bitcoin prices higher.

- Kamala Harris Comments on Crypto: VP Kamala Harris voiced support for innovation and clearer crypto regulations. Reactions are mixed, with some seeing it as progress, while others compare it to previous cautious policies.

Market Analysis:

- BTC & ETH Net Flows: Bitcoin remains stable despite $600 million in outflows, while Ethereum struggles with $75 million in outflows, signaling weaker investor confidence in ETH.

- BTC Puell Multiple Signals Supply Tightening: Low miner profitability points to reduced Bitcoin supply in the market, which could create upward pressure on prices.

- NUPL Rebound Shows Bullish Sentiment: The rise in NUPL shows more Bitcoin holders in profit, reducing selling pressure and supporting a more bullish market outlook.

- Bitcoin HODLers Show Market Strength: Long-term holders are accumulating, signaling strong market confidence and limiting potential downside.

News

Fed’s Rate Cut Sparks Bitcoin Rally with Caution Ahead

On September 18, 2024, the Federal Reserve cut interest rates by 50 basis points (bps), lowering the federal funds rate to a range of 4.75% to 5%. This aggressive move, signaling the start of an easing cycle, has sparked optimism in the markets, including Bitcoin (BTC), which rallied by 1.9% to $64,253 following the announcement. The decision reflects the Fed's growing concerns over economic risks, such as stagnating job growth and rising unemployment, while also aiming to manage inflation. The Fed’s larger-than-expected cut is seen as a strong push toward monetary easing, with further cuts expected into 2025.

At Amberdata, we expect an additional 75 bps in rate cuts by the end of 2024, driven by rising 10-year Treasury yields (currently at 3.8%) and elevated borrowing costs. Market odds now show a 60% likelihood of a 50 bps cut at the Fed's November 7 meeting, followed by another 25 bps cut in December. With inflation slowing but economic data remaining middling, the situation is complex, and upcoming jobs data on October 4 and November 1 will be key in shaping the Fed's decisions. These cuts aim to align policy with market expectations and ease financial conditions amid this mixed economic backdrop. Crypto volatility is more closely tied to interest rate changes than underlying macro conditions in the short to medium term, meaning inflation remains the critical factor influencing market movements and rate decisions.

While the rate cut is largely seen as bullish for Bitcoin, offering support for speculative assets like cryptocurrencies, there is a note of caution. Michelle Bowman, a member of the Federal Open Market Committee (FOMC), voted against the 50 bps cut, advocating instead for a smaller 25 bps reduction. Bowman expressed concerns that a larger cut might be viewed as a premature victory over inflation, potentially stoking unnecessary demand in an economy that remains strong. Her cautionary stance underscores the risks of easing too aggressively before inflation is fully under control.

Despite this cautious note, Bitcoin has reacted positively to the Fed’s decision, although it remains shy of breaking the key $65,000 resistance level. While the broader market welcomes the rate cut, Bitcoin’s price action reflects the mixed sentiment, as it hovers near critical technical levels. Investors are now looking ahead to Fed Chair Jerome Powell’s upcoming speech and further economic data to assess how sustained the bullish momentum might be for Bitcoin. For more details on the Fed's decision, you can read the full FOMC release.

SEC Approves BlackRock Bitcoin ETF Options, Signaling Institutional Demand

The U.S. Securities and Exchange Commission (SEC) has approved the listing and trading of options on BlackRock’s iShares Bitcoin Trust (IBIT), marking a pivotal moment for Bitcoin’s integration into traditional financial markets. These physically settled options allow investors to buy or sell Bitcoin at a predetermined price, offering more tools for managing exposure to the flagship cryptocurrency. This approval could lead to increased liquidity in the Bitcoin market and paves the way for further Bitcoin ETF products from major firms. The SEC emphasized that this move introduces enhanced market surveillance to ensure orderly trading, while the flexibility of these American-style options could attract both retail and institutional investors.

The approval of Bitcoin ETF options is expected to boost institutional interest, particularly due to the potential for a gamma squeeze, where rising demand for options forces market makers to purchase more Bitcoin to hedge their positions, pushing prices higher. As Jeff Park, head of alpha strategies at Bitwise, highlighted, these options introduce regulated leverage on a supply-constrained asset like Bitcoin, which could amplify price movements. Park pointed out that long-dated out-of-the-money (OTM) call options could offer significant upside for investors, further increasing demand for these financial products .

The implications for the Bitcoin market are profound. With more liquidity entering the market, additional Bitcoin ETF-based products are expected, including premium income ETFs and tail-risk strategies, according to ETF expert Nate Geraci. This approval continues the trend of expanding regulated financial products for Bitcoin, pushing it closer to mainstream financial integration. Investors are now equipped with more sophisticated tools for managing Bitcoin's inherent volatility while benefiting from the growth of the Bitcoin options market.

Kamala Harris’ First Comments on Crypto Draw Mixed Reactions

At a Manhattan donor event, Vice President Kamala Harris voiced her support for emerging technologies like AI and cryptocurrency, pledging to foster innovation while ensuring consumer and investor protections through clear regulations. This marked her first crypto-related remarks since launching her presidential campaign, positioning her alongside rival Donald Trump, who has been more vocal in supporting the sector. Harris emphasized the need for a safe, transparent business environment to drive growth in these industries.

The reaction was mixed. Uniswap CEO Hayden Adams welcomed her comments as a positive step, while others, like Galaxy Research head Alex Thorne, felt they mirrored the Biden administration's cautious stance. Industry figures also noted that Trump's administration had appointed regulators more favorable to crypto, in contrast to the current environment .

While Harris' remarks briefly boosted Bitcoin by 2.3%, many in the industry await more specific policy details. Her pledge to encourage innovation offers potential for more crypto-friendly regulation, but further clarity is expected with upcoming economic proposals from her campaign.

Market Analysis

BTC & ETH ETF Net Flows - BTC Resilient Despite Outflows; ETH Struggles

In the past week, both BTC and ETH faced significant net outflows, reflecting a cautious sentiment among investors. Ethereum registered a notable outflow of $75 million, bringing its total to $6.89 billion after several weeks of underperformance. Bitcoin, while experiencing the largest net outflow at just under $600 million, has fared relatively better given the context, with total Bitcoin ETFs now valued at approximately $57.9 billion, equating to around 921,000 BTC.

These trends highlight a shifting landscape where investor confidence in Ethereum appears to wane, while Bitcoin remains a more stable asset despite the outflows. The substantial outflows could indicate a broader market hesitation as traders reassess their positions amid ongoing macroeconomic uncertainties. Additionally, the sustained interest in Bitcoin ETFs suggests that institutional investors continue to view Bitcoin as a long-term asset, even in the face of short-term volatility.

BTC Puell Multiple - Bullish Signal, Supply Tightening Ahead

The Puell Multiple, a key indicator of miner profitability, continues to provide valuable insights into market cycles and price movements for Bitcoin. Currently, the multiple sits below 0.4, suggesting a bullish outlook as it indicates that miners are operating at a loss. Historically, when the Puell Multiple is between 4.0 and 8.0, Bitcoin prices tend to reach new peaks; conversely, values below 0.6 often signal potential price rebounds.

With the multiple remaining low, we can expect reduced supply from miners, as less profitable operations may choose to hold onto their Bitcoin rather than sell at a loss. This reduction in supply could create upward pressure on prices, especially if demand remains steady or increases. While a value of 1.0 indicates profitability for miners, the current readings below 0.4 suggest that support at liquidity levels seen during the summer may still be holding firm.

The implications of a persistently low Puell Multiple are significant: as miner selling slows, we may see a tightening of available Bitcoin in the market, potentially leading to upward price movements as scarcity effects take hold.

NUPL Rebound - Profitability Rising, Bullish Sentiment Building

The Net Unrealized Profit/Loss (NUPL), an essential on-chain metric for evaluating market sentiment, has risen from 0.4 at the start of September to 0.5, signaling a notable shift in confidence among Bitcoin holders. NUPL reflects the network's unrealized gains and losses, with values above 0 indicating that a larger share of participants are holding Bitcoin in profit. This bounce suggests that a growing number of investors are increasingly comfortable holding onto their Bitcoin, anticipating further upside.

This rise in NUPL typically aligns with reduced selling pressure, as participants in profit are less inclined to exit their positions prematurely. When more investors are in profit, it strengthens the market’s overall stability, as holders with unrealized gains have less incentive to sell. This could contribute to a more bullish environment, where increased confidence leads to lower supply entering the market. The current upward movement in NUPL reflects this dynamic, where more profitable holders could help reinforce price floors by retaining their Bitcoin instead of liquidating.

However, while rising NUPL is a positive signal, it’s essential to consider the broader market context. Should NUPL continue to rise sharply, there is the possibility of reaching a “euphoric” stage, where extreme confidence can lead to over-leveraging or price exuberance. For now, the steady increase signals improving sentiment and reduced selling pressure, but close monitoring of this trend is key to understanding when market conditions may become overheated.

Bitcoin HODL Behavior - Long-Term Holders Indicate Underlying Market Strength

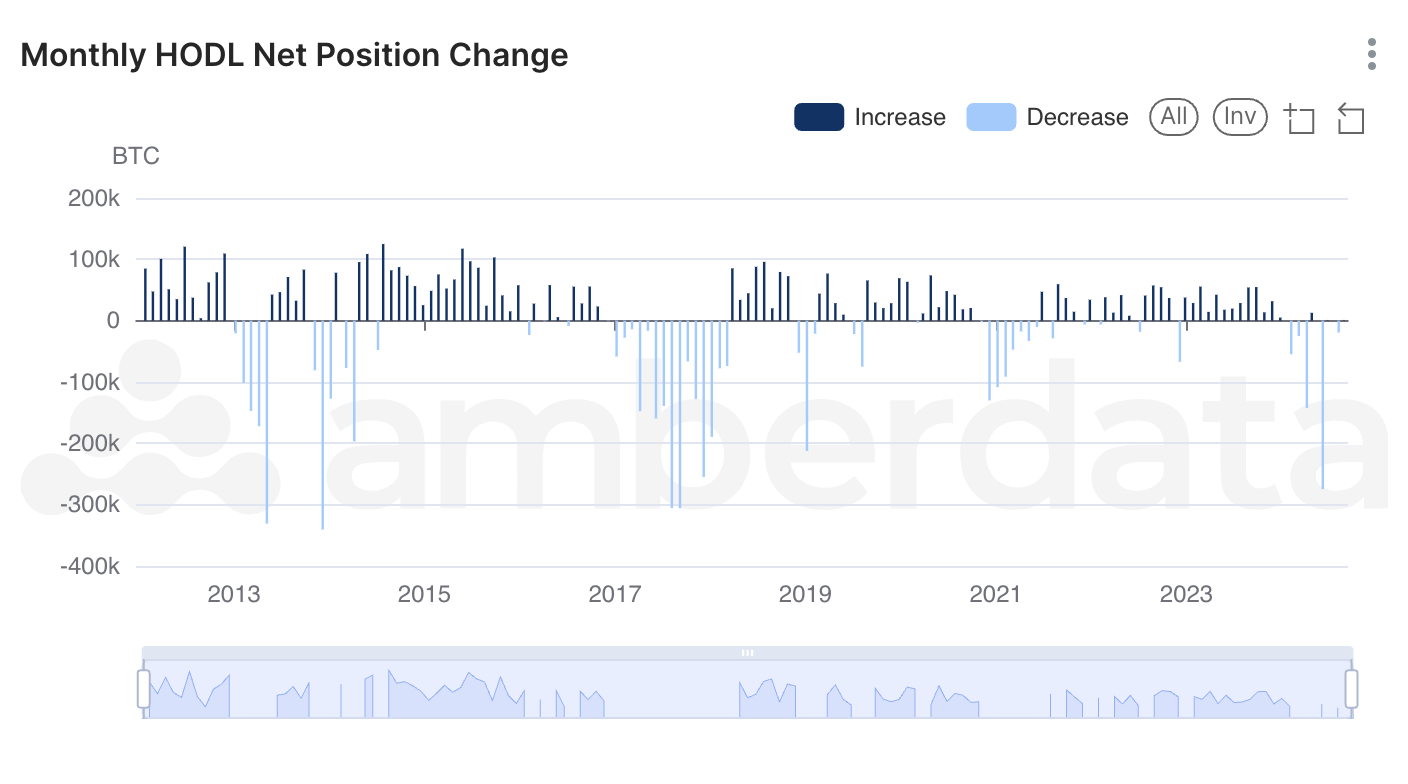

The Monthly HODL Net Position Change is a key indicator that measures the behavior of long-term Bitcoin holders, or "HODLers," by tracking whether they are accumulating or selling their coins. When the metric shows a positive change, it indicates that more coins are being held in wallets for the long term, suggesting confidence in future price appreciation. Conversely, a negative change signals that long-term holders are selling or moving their coins, often seen during periods of market uncertainty or profit-taking.

Recently, the Monthly HODL Net Position Change has not shown the same level of consistent withdrawals typically seen during previous bearish periods. This suggests that long-term holders are not exiting their positions, despite ongoing market fluctuations. Instead, the data points to a stable or slightly positive HODLing trend, indicating that these experienced market participants see underlying support for Bitcoin’s price, even amid short-term volatility.

The implications of this behavior are significant. When long-term HODLers reduce selling, it stabilizes the market by lessening the supply available for trade, which can help prevent sharp price declines. The absence of large-scale withdrawals during this phase suggests a more robust market foundation, potentially limiting downside risk. If this trend continues, it could signal confidence in Bitcoin’s long-term prospects, providing further support for bullish sentiment as supply tightens.

Links

AmberLens: intelligence.amberdata.com

Recent from Amberdata

- Amberdata: Stablecoins & Digital Commodities Dashboards

- Amberdata: AD Derivatives Newsletter: Fed Rate Cut, BTC Vol & Institutional Flows

- Amberdata: AD Derivatives Podcast Feat Jake Ostrovskis, OTC at Wintermute

Spot Market

Spot market charts were built using the following endpoints:

- https://docs.amberdata.io/reference/market-metrics-exchanges-volumes-historical

- https://docs.amberdata.io/reference/market-metrics-exchanges-assets-volumes-historical

- https://docs.amberdata.io/reference/get-market-pairs

- https://docs.amberdata.io/reference/get-historical-ohlc

Futures

Futures/Swaps charts were built using the following endpoints:

- https://docs.amberdata.io/reference/futures-exchanges-pairs

- https://docs.amberdata.io/reference/futures-ohlcv-historical

- https://docs.amberdata.io/reference/futures-funding-rates-historical

- https://docs.amberdata.io/reference/futures-long-short-ratio-historical

- https://docs.amberdata.io/reference/swaps-exchanges-reference

- https://docs.amberdata.io/reference/swaps-ohlcv-historical

- https://docs.amberdata.io/reference/swaps-funding-rates-historical

DeFi DEXs

DeFi DEX charts were built using the following endpoints:

- https://docs.amberdata.io/reference/defi-dex-liquidity

- https://docs.amberdata.io/reference/defi-dex-metrics

- https://docs.amberdata.io/reference/defi-impermanent-loss

DeFi Borrow/Lend

DeFi lending charts were built using the following endpoints:

- https://docs.amberdata.io/reference/defi-lending-protocol-lens

- https://docs.amberdata.io/reference/defi-lending-asset-lens

Networks

Network charts were built using the following endpoints:

- https://docs.amberdata.io/reference/blockchains-metrics-latest

- https://docs.amberdata.io/reference/transactions-metrics-historical

- https://docs.amberdata.io/reference/get-historical-transaction-volume

Disclaimers

The information contained in this report is provided by Amberdata solely for educational and informational purposes. The contents of this report should not be construed as financial, investment, legal, tax, or any other form of professional advice. Amberdata does not provide personalized recommendations; any opinions or suggestions expressed in this report are for general informational purposes only.

Although Amberdata has made every effort to ensure the accuracy and completeness of the information provided, it cannot be held responsible for any errors, omissions, inaccuracies, or outdated information. Market conditions, regulations, and laws are subject to change, and readers should perform their own research and consult with a qualified professional before making any financial decisions or taking any actions based on the information provided in this report.

Past performance is not indicative of future results, and any investments discussed or mentioned in this report may not be suitable for all individuals or circumstances. Investing involves risks, and the value of investments can go up or down. Amberdata disclaims any liability for any loss or damage that may arise from the use of, or reliance on, the information contained in this report.

By accessing and using the information provided in this report, you agree to indemnify and hold harmless Amberdata, its affiliates, and their respective officers, directors, employees, and agents from and against any and all claims, losses, liabilities, damages, or expenses (including reasonable attorney’s fees) arising from your use of or reliance on the information contained herein.

Copyright © 2024 Amberdata. All rights reserved.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...