Earlier this week I created a Twitter Thread outlining my point of view on crypto volatility trading in response to a message I received this week. I thought it would make a great blog, so I am reproducing it here, enjoy!

1/🧵 VOL. TRADING

— AD Derivatives (formerly GVol) (@genesisvol) November 14, 2022

I received a very interesting message today, regarding this week's Vol. Trading newsletter.

This has inspired me to post my thinking and intuition around vol. trading.

(Others can disagree and make valid arguments, this is just how I think)

2/🧵

— AD Derivatives (formerly GVol) (@genesisvol) November 14, 2022

COMMENT:

"With everything going on due to FTX, vol. markets are going nuts. Vol. is high!

Yet, in your newsletter you recommend NOT selling vol...

If we don't sell vol. now, then when it's historically high, then are you supposed to sell it?"

Markets are volatile due to the last weeks fiasco. When Volatility is high this doesn't always indicate it is the right trade to make.

3/🧵

— AD Derivatives (formerly GVol) (@genesisvol) November 14, 2022

The concept makes sense on the at initial glance.

Vol is high, historically speaking.

= SELL HIGH

Or vol. is low, historically speaking.

= BUY LOW

Historically speaking BUT everything needs to be taken into consideration.

4/🧵

— AD Derivatives (formerly GVol) (@genesisvol) November 14, 2022

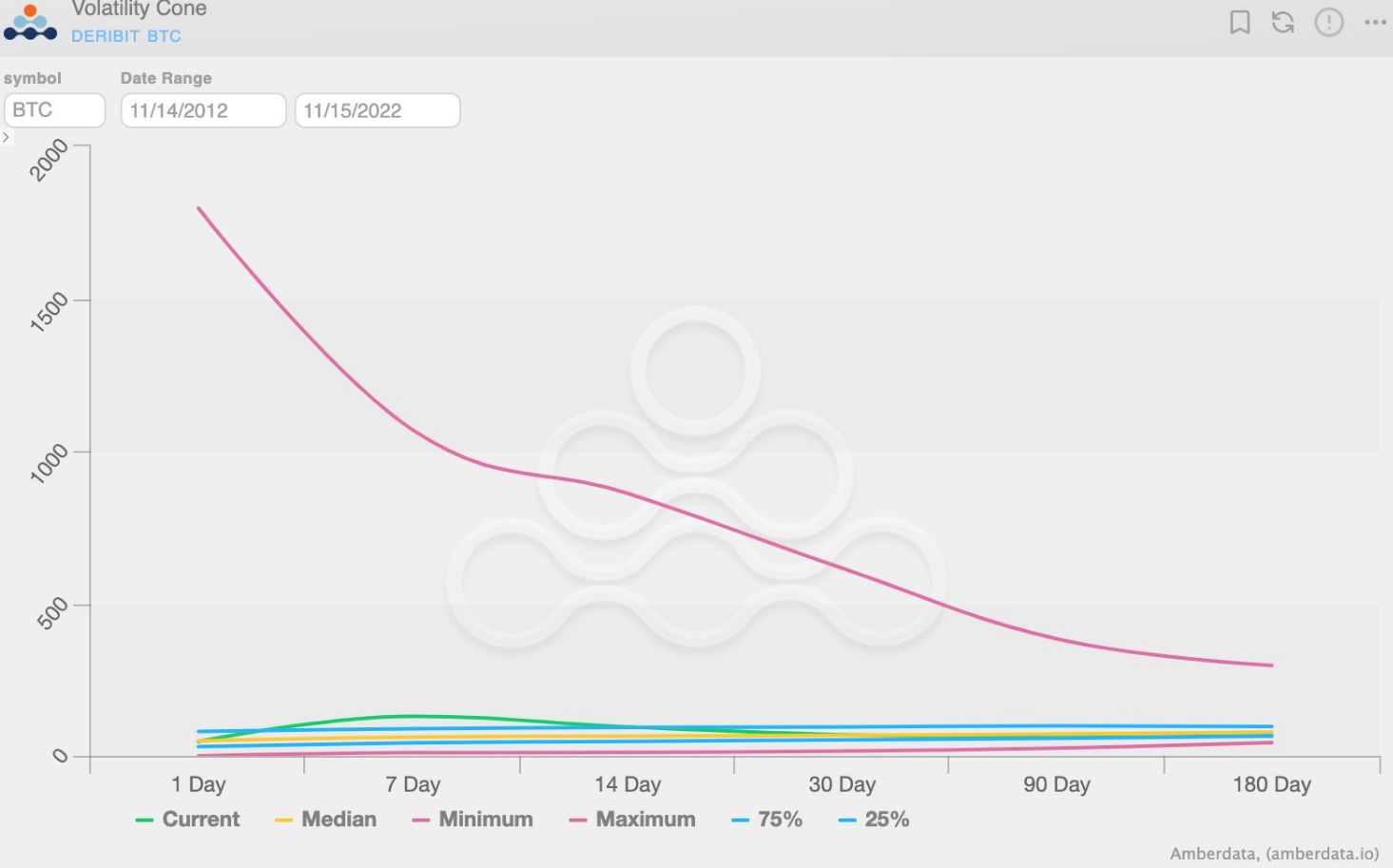

The attractive component about Vol. trading, is the mean reversion.

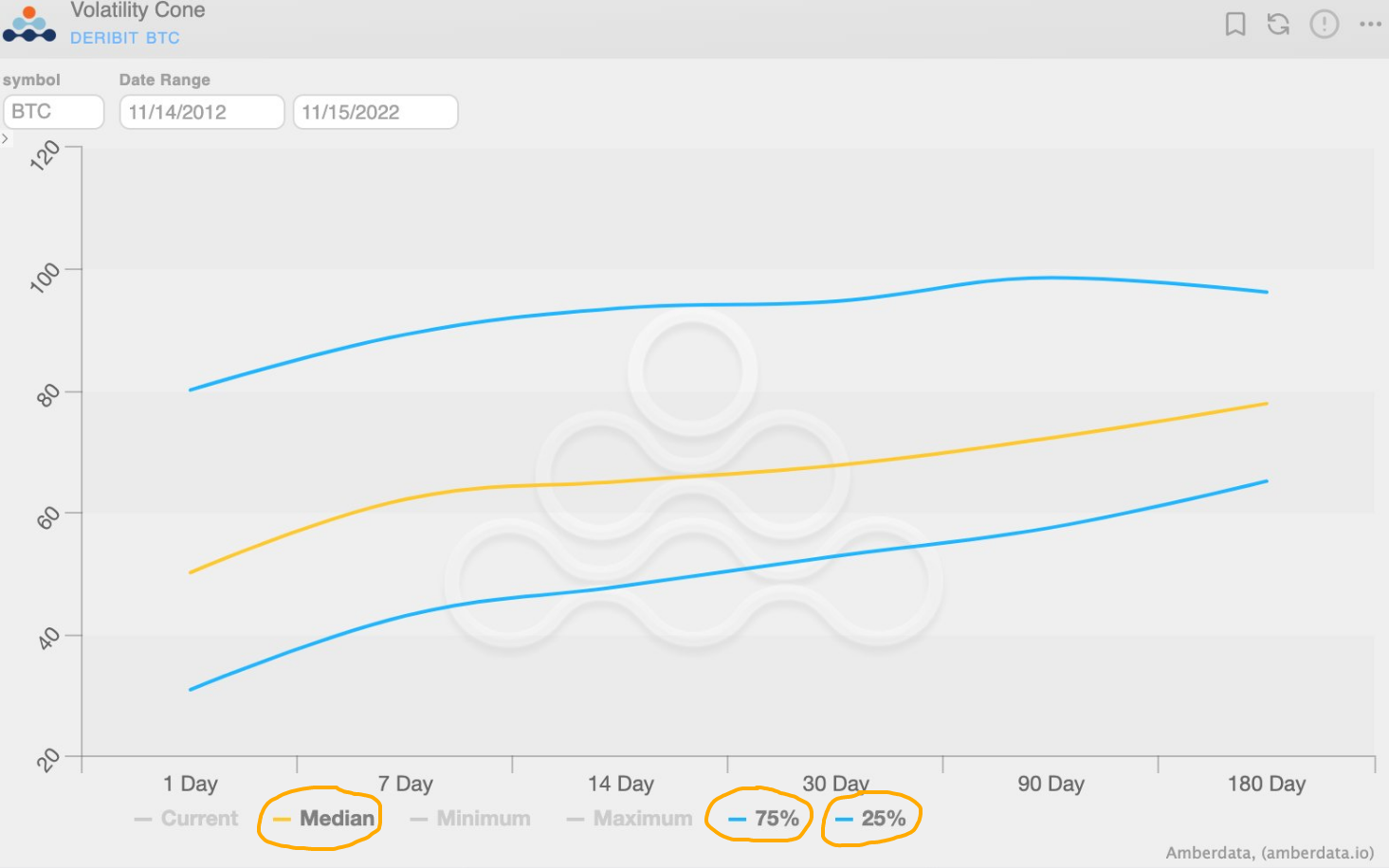

(L) chart shows 10yrs of BTC HV.

(R) isolates the "interquartile Range"

50% of the time... HV LIVES VERY tight range.

We know it's going back there at SOME POINT... We just don't fully agree on "WHEN" pic.twitter.com/ZtdOlxkfCC

Attractive component when vol trading is the mean reversion.

Chart (Volatility Cone) shows the 10yrs of BTC HV.

Chart (Volatility Cone) isolates the "interquartile range"

5/🧵

— AD Derivatives (formerly GVol) (@genesisvol) November 14, 2022

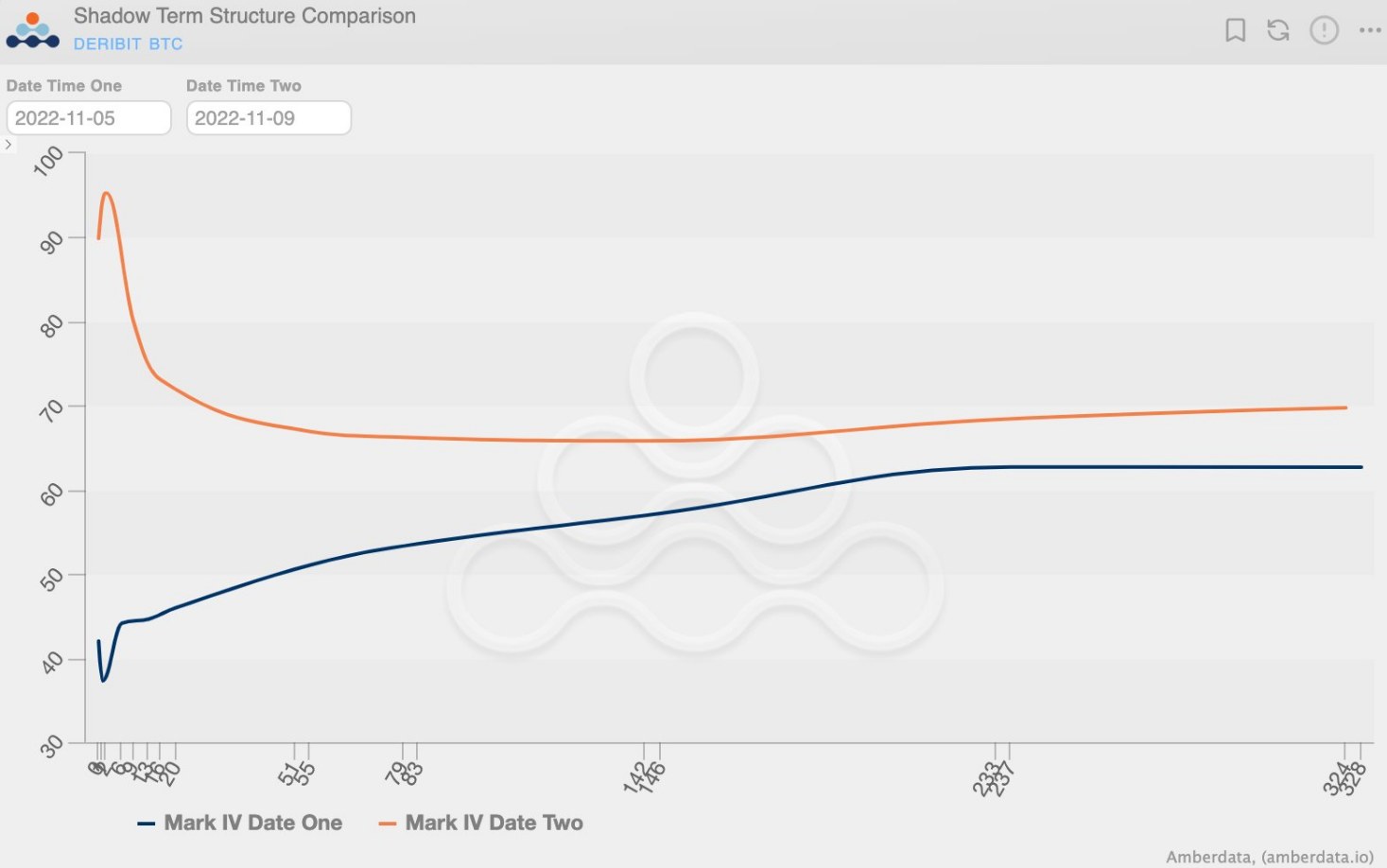

Because the future is "CERTAIN" (give or take) the timing becomes crucial.

VOL. TRADING general rule:

The obvious trade, is expensive to hold!

HIGH: Short-vol. positions will "Rollup" and gain IV (Orange)

LOW: LONG positions will "Rollup down" and lose IV (Blue) pic.twitter.com/cQtZ6v82wl

Always remember timing is crucial & the obvious trade is expensive to hold.

(Orange) represents short-vol. positions will "Rollup" and gain IV.

(Blue) represents LONG positions will "Rollup down" and love IV.

6/🧵

— AD Derivatives (formerly GVol) (@genesisvol) November 14, 2022

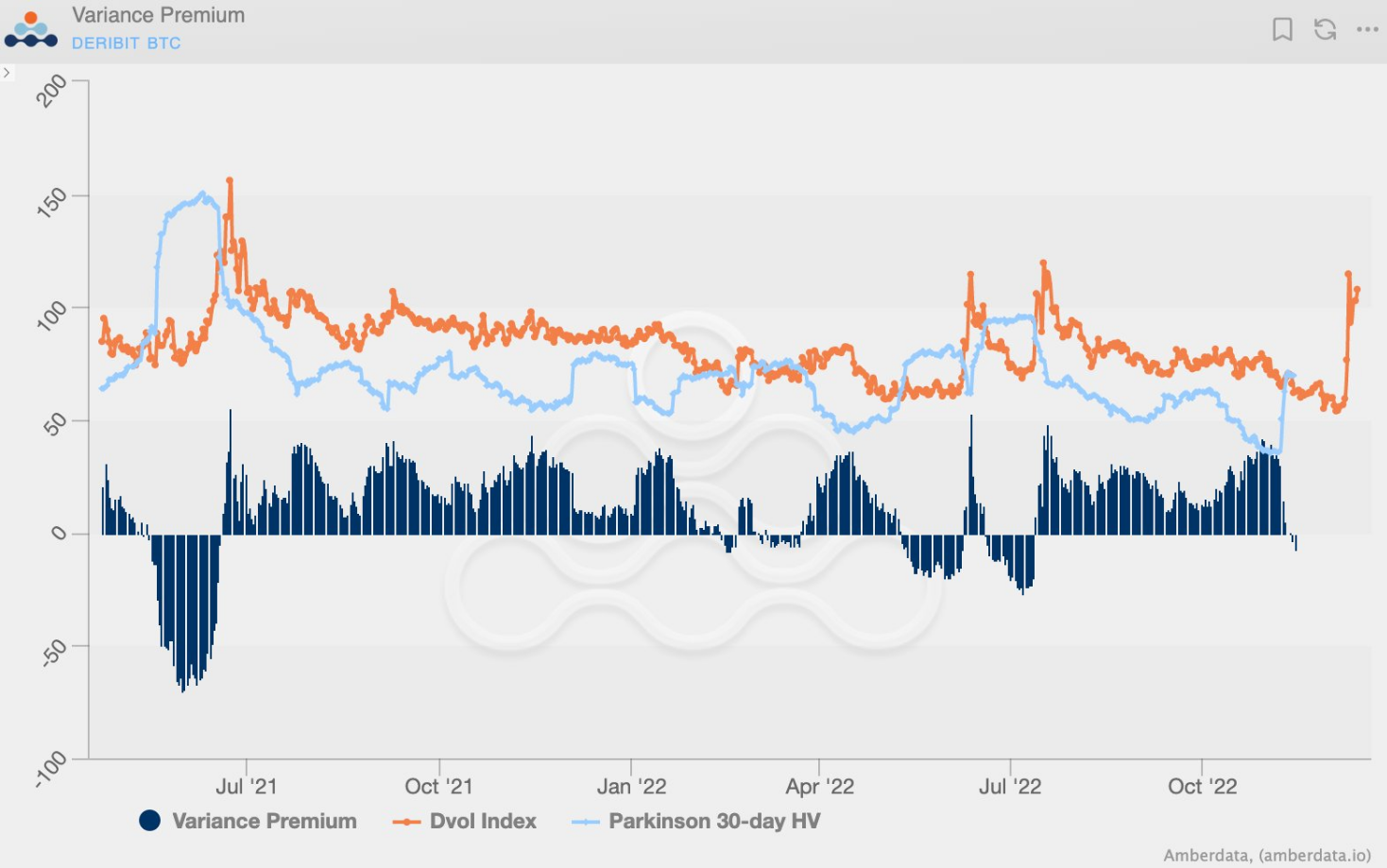

The same concept holds true for the VRP "Variance Risk Premium"

When vol. is high, the VRP is negative, favoring vol. buyers...

When vol. is low, the VRP is positive, favoring vol. sellers pic.twitter.com/VbgpQqgYio

Chart (Variance Premium) showing us when vol. is high the VRP is negative which favors vol buyers. When vol is low, the VRP is positive which favors vol sellers.

7/🧵

— AD Derivatives (formerly GVol) (@genesisvol) November 14, 2022

This creates interesting market environments!

Think about VIX Trading in 2017 (VS) 2020.

Let's look at a long vol. ETP for a proxy.

(We'll use UVXY as a proxy given it's uninterrupted history, unlike VXX)

Creating interesting market environments creates interesting trading strategies.

8/🧵

— AD Derivatives (formerly GVol) (@genesisvol) November 14, 2022

We can see that as VIX bounced between 9-17, UVXY got completely crushed lower.

This is due to term structure Contango, as noted before.

"ROLL DOWN" makes LONG Vol., extremely expensive, but people do it, because one day, vol will "mean revert"

(They're just early) pic.twitter.com/tcmP8dIiXn

2017 VIX bounced between 9-17

2017 UVXY falling below $500

9/🧵

— AD Derivatives (formerly GVol) (@genesisvol) November 14, 2022

2020 was the opposite.

VIX was expensive.

Shorting looks enticing.

But "The obvious trade" is expensive to CARRY.

2017: UVXY drops $8000 -> $450 (-94.38%)

2020: Shorting the PERFECT timing high, $1300 -> $100 EOY = (-92.31%) pic.twitter.com/rya7nHjdbo

2020 VIX

2020 UVXY falling below $120

10/🧵

— AD Derivatives (formerly GVol) (@genesisvol) November 14, 2022

You can see that in a high vol. environment, short-vol, EVEN IF TIMED PERFECTLY, barely matched the returns of shorting vol. in a low vol. environment.

Not to mention, the disaster that selling vol. too early brings.

11/🧵

— AD Derivatives (formerly GVol) (@genesisvol) November 14, 2022

Here's a good analogy for spot trading.

You're better off (in my trading opinion) buying an ALL TIME HIGH breakout... Then buying something that's trending down, because "ITS CHEAP".

This isn't Buy low, sell high.

Buy HIGH, sell HIGHER.

Or sell LOW, buy LOWER.

12/🧵

— AD Derivatives (formerly GVol) (@genesisvol) November 14, 2022

Closing thoughts,

Given this mental framework for vol. trading, we must next estimate "inflection" points.

Here fundamentals, and technicals, are worth considering.

13/🧵

— AD Derivatives (formerly GVol) (@genesisvol) November 14, 2022

Fundamentally, FTX contagion, isn't fully understood yet.

Therefore, there's a substantial probability that some crazy news is revealed this week... that move markets EVEN MORE.

14/🧵

— AD Derivatives (formerly GVol) (@genesisvol) November 14, 2022

Technically:

$15.9k isn't a big level with historic liquidity, such as, say, $10k which historically, a lot of people have traded in the past, and will likely become a liquidity pocket should we drop there.

We also know, that VOL. is a downside phenomenon today.

15/🧵

— AD Derivatives (formerly GVol) (@genesisvol) November 14, 2022

If you found this type of VOL thread helpful, please share & retweet.

I think vol trading is one of the most exciting areas of trading and if sharing my personal thoughts and opinions is helpful, i'll keep doing it.

Special thanks to @DeribitExchange @DeribitInsights

High Vol enviroments, short-vol, even if timing is perfectly barely match returns of shorting vol. The things to keep in mind when trading vol.

If you would like more in-depth analysis, subscribe to AD Derivatives Newsletter & launch our app to utilize our tools for your trading strategies!

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...