.png)

USA Week Ahead:

-

Monday 11am ET: Inflation Expectations

-

Thursday 8:30 ET: Weekly Jobless Claims

-

Friday 10am ET: Existing Home Sales

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math minded people here, pardon any typos.

THE BIG PICTURE THEMES:

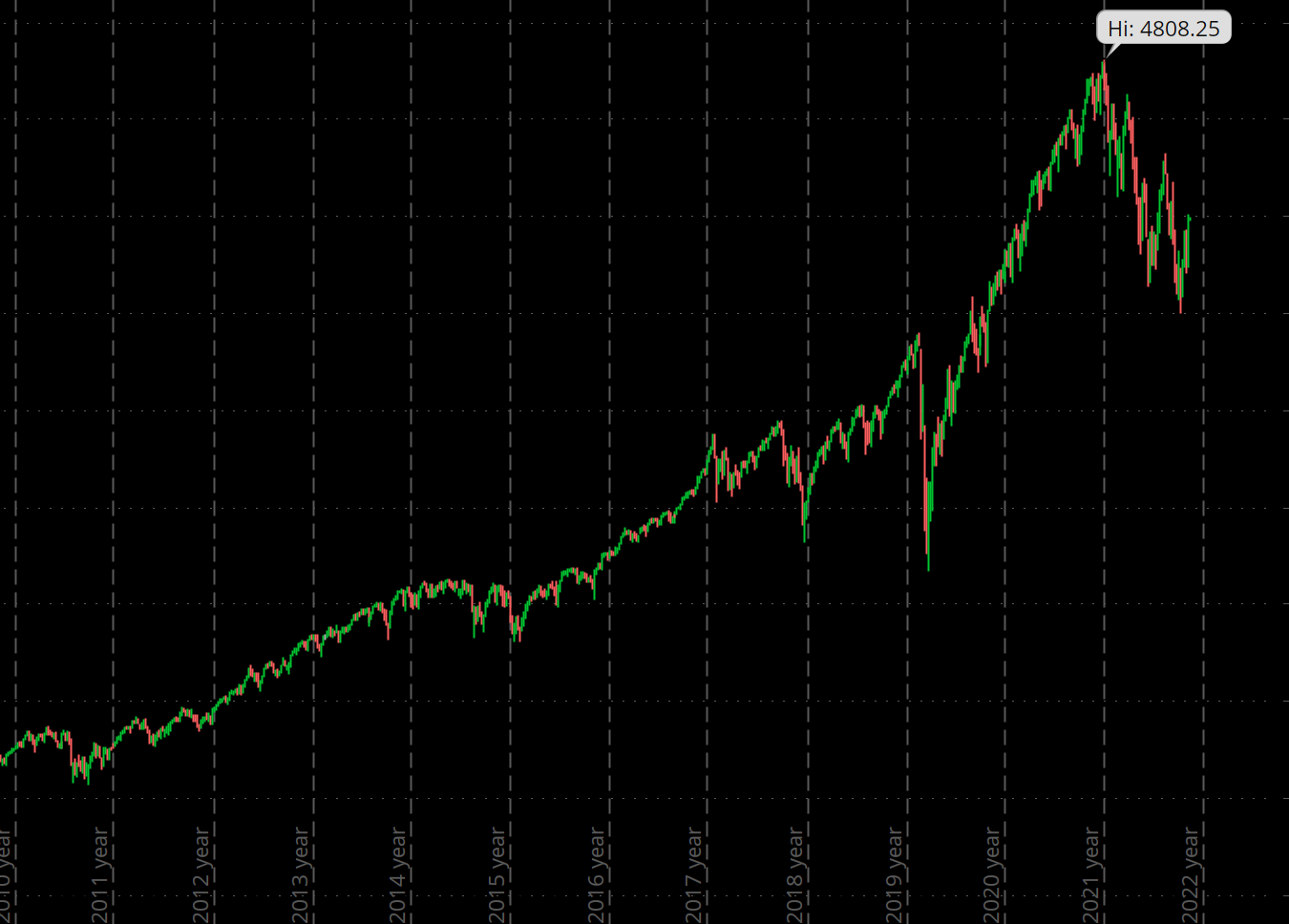

In the macro space, we saw a massive rally on the back of the CPI print.

Headline CPI came in at 7.7% yoy (VS 7.9% expected) while core CPI was 6.3% yoy (VS 6.5% expected). A lot of the aggressive rally in risk-assets on essentially “in-line” CPI, is because, the housing component is the main driver of CPI this month and hosing has a big lag component.

True CPI is much lower when projecting accurate housing affects.

That said, this rally feels like a bear market rally, none-the-less. Bull markets don’t rally +5% on the back of a economic release. They instead grind higher in a MEASURED fashion.

This bear market doesn’t look like it’s done with, despite the rally on Friday.

Crypto:

Let’s leave macro aside for now, because crypto was the massive headliner last week.

FTX’s implosion is going to have a ton of consequences.

-

Potential demonization of crypto space politically

-

Daisy chain of balance sheet capital short-falls for various institutions

-

Leadership vacuum for the Solana ecosystem and blockchain.

I think right now, crypto is headed lower. This week we will likely see more damage surface.

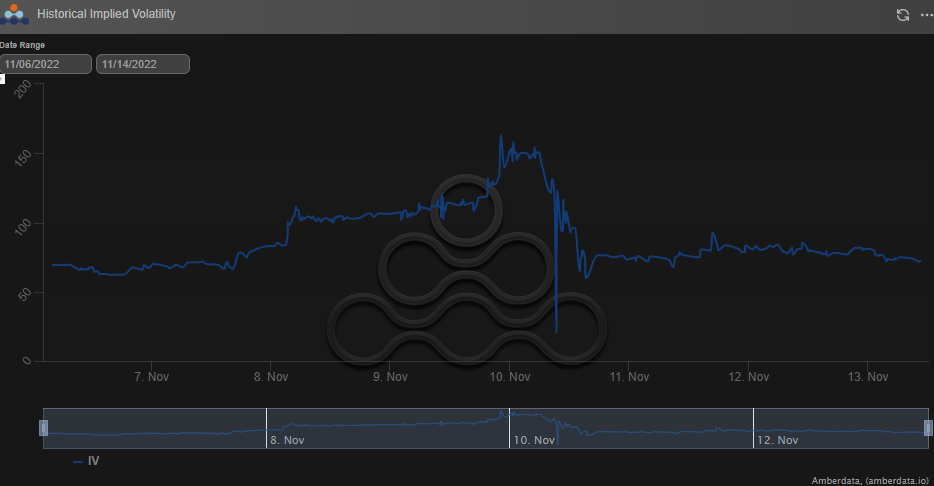

Crypto volatility is going to remain elevated and it’s a REALLY BAD IDEA to get sucked in to short-vol ideas because IV is high.

IV is high but RV is high as well… and from a perspective of this intertwined relationship RV is cheap… There’s a lot of JUMP risk in this low liquidity environment.

BTC: $16,402 -22.72%

ETH :$1,220 -24.18%

SOL: $13.68 -60.43%

DVOL: Deribit’s volatility index

SOL - (365-days w/ spot line chart)

DVol has exploded higher as FTX imploded. Alameda Research (FTX’s sister company) is rumored to hold SOLANA and SOLANA ecosystem tokens on their balance sheet.

A leadership vacuum, coming “sell-wall”, and potentially distressed SOL ecosystem protocols due to lost funds on FTX, hurt the price of SOL and its future prospects as a viable chain.

PLEASE VERIFY: Sources are saying that several of the companies that Alameda invested in were given a stipulation to hold their treasuries on FTX as part of their investment terms.

— Autism Capital 🧩 (@AutismCapital) November 13, 2022

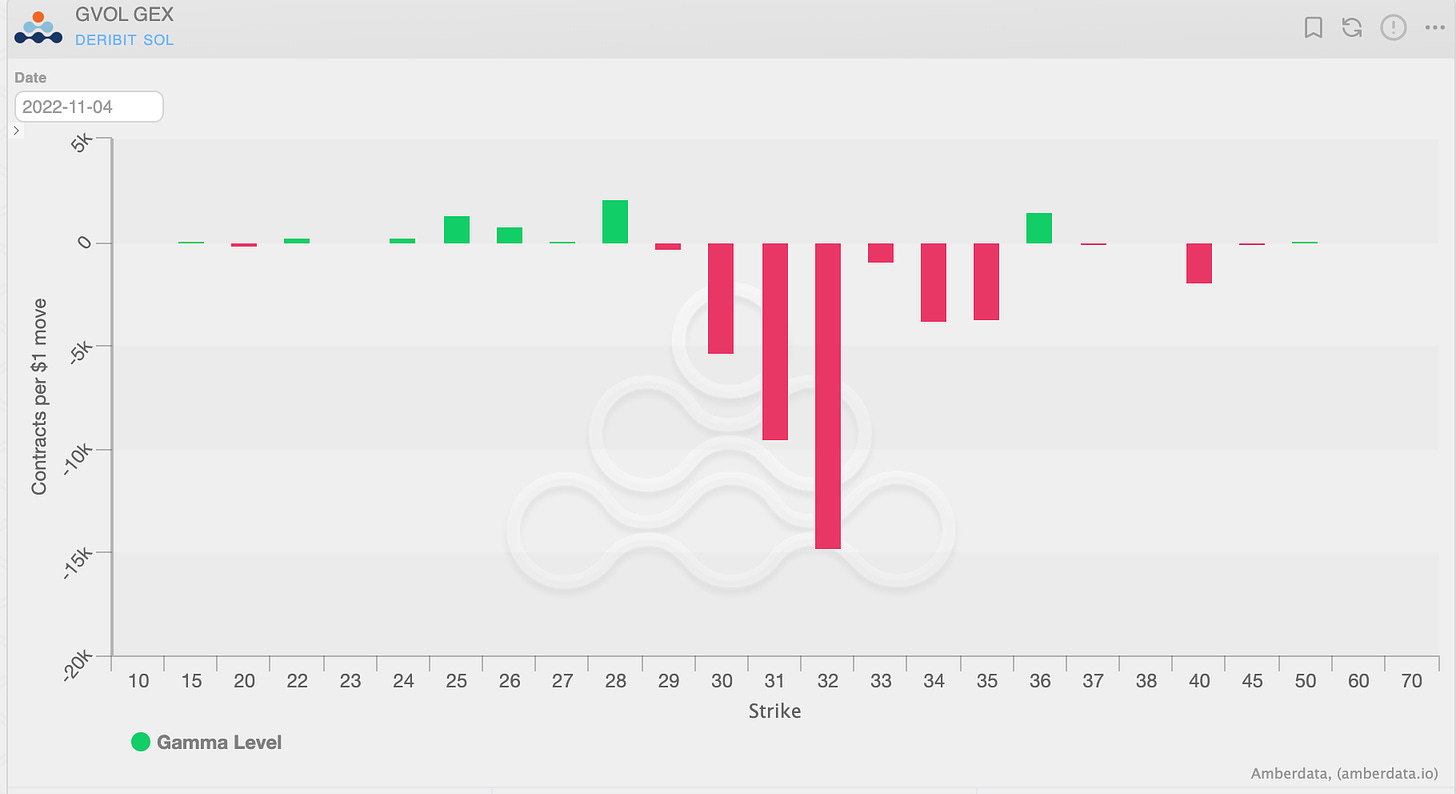

GVOL

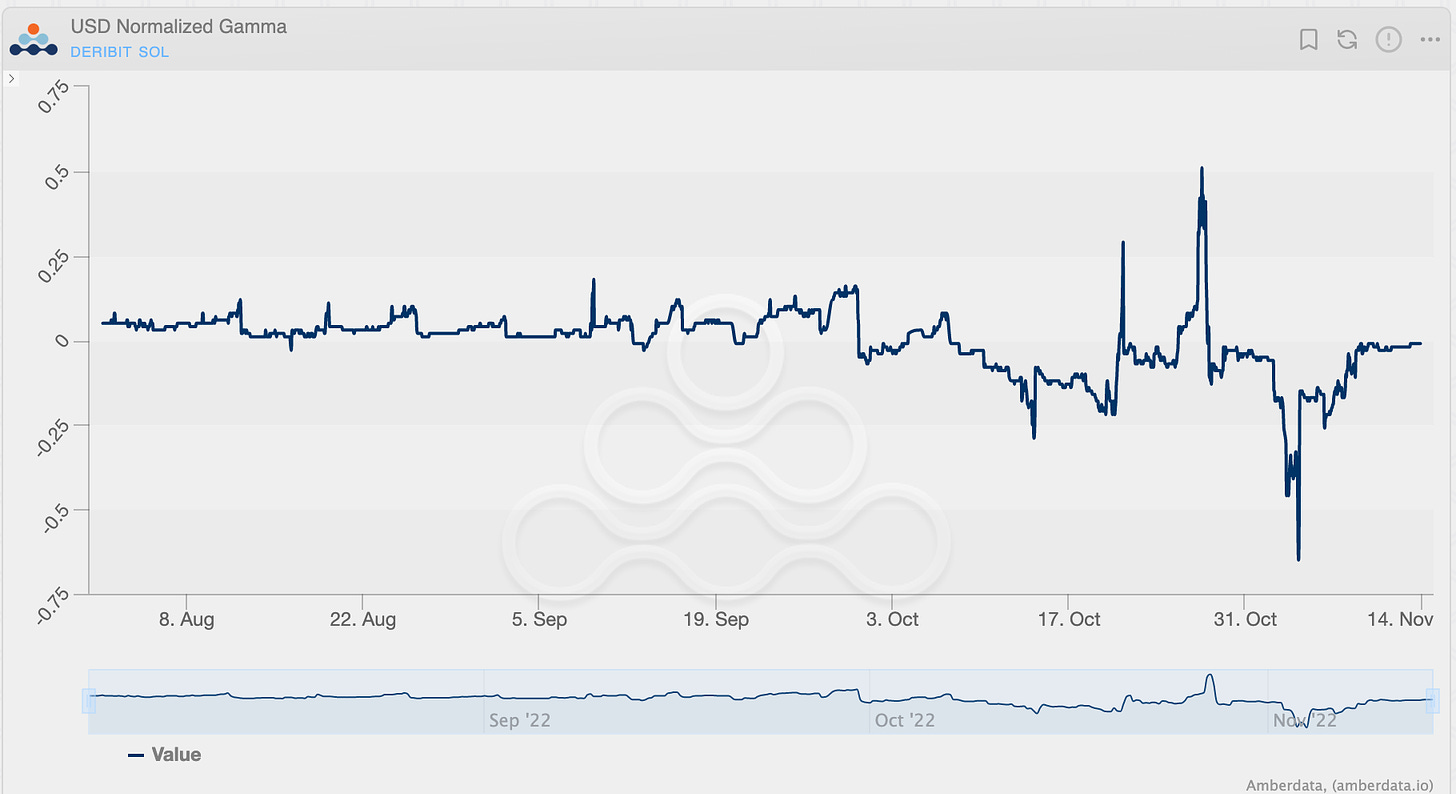

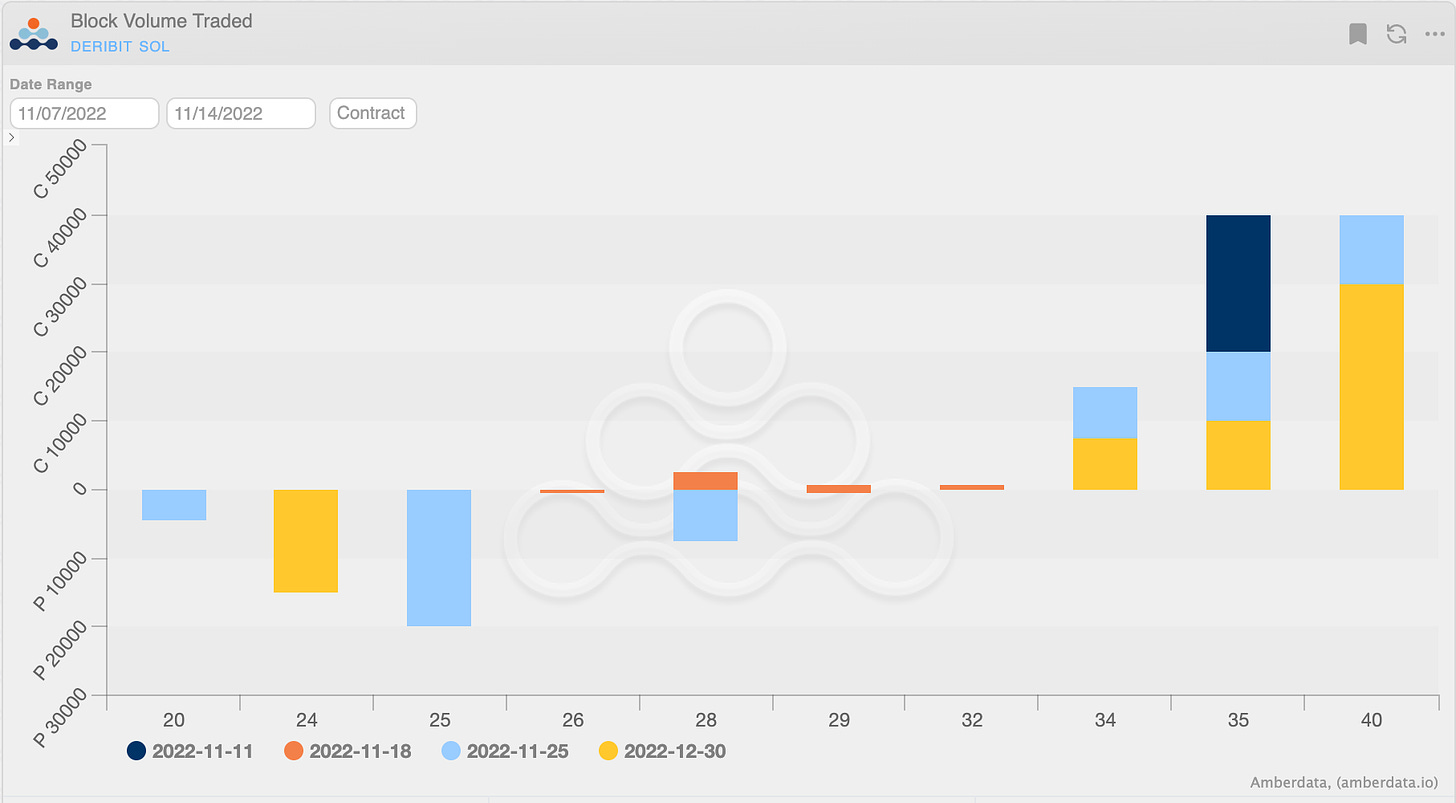

As SOL prices broke below $20, then $15, we can see a massive dislocation between the SOL perp and cash markets.

SOL was trading at nearly a $4 discount to cash markets, essentially creating a (-8,000% APY) funding cost for short traders.

This is likely due to a massive liquidation, combined with potential delta hedging flows.

We can see in the option markets that dealers were net short gamma a few days before the Solana meltdown.

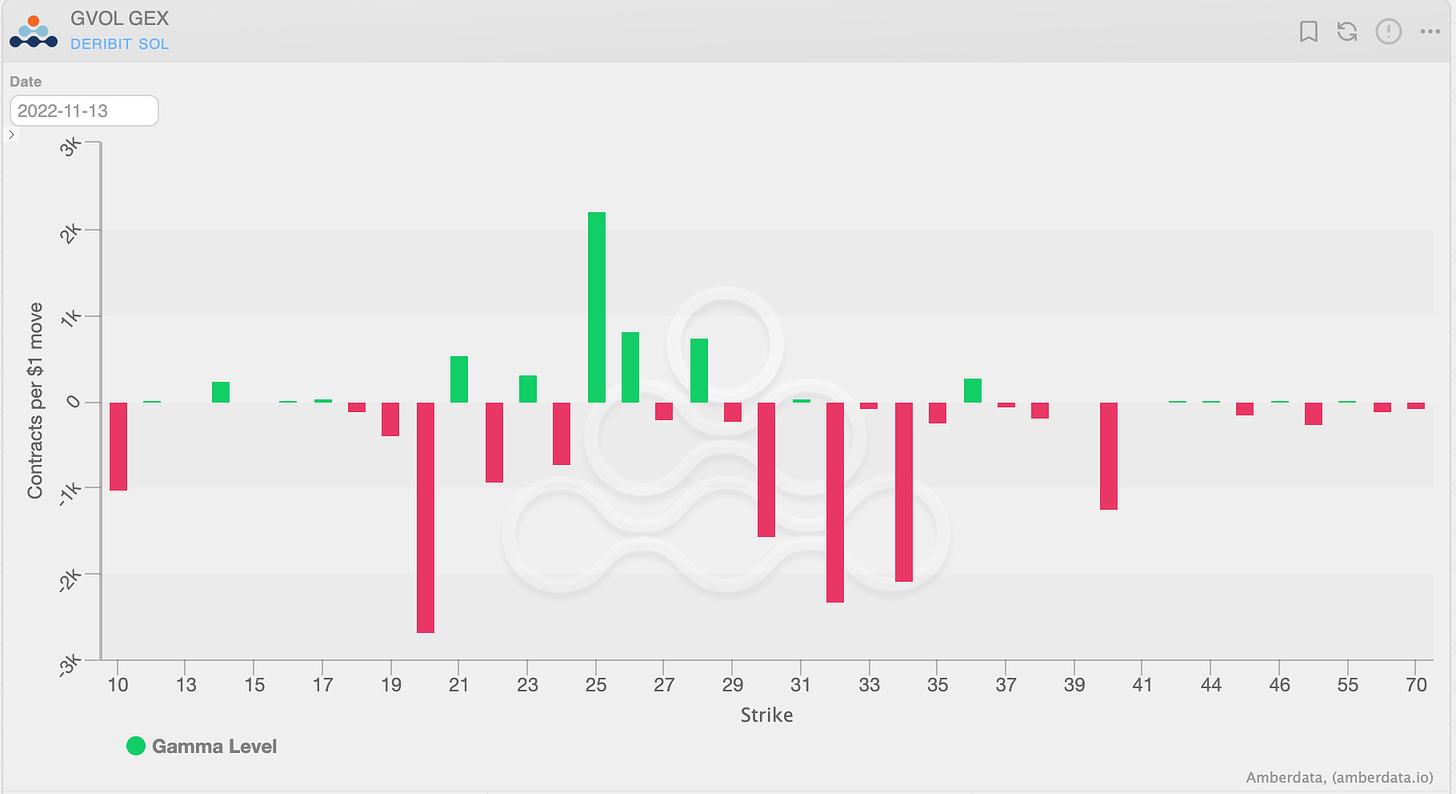

Today, Gamma exposure is net flat between $10 and $20.

Beyond those levels, either way, dealers will need to substantially hedge delta exposure and this could lead to another round of dislocations between the SOL-Perp and Cash market.

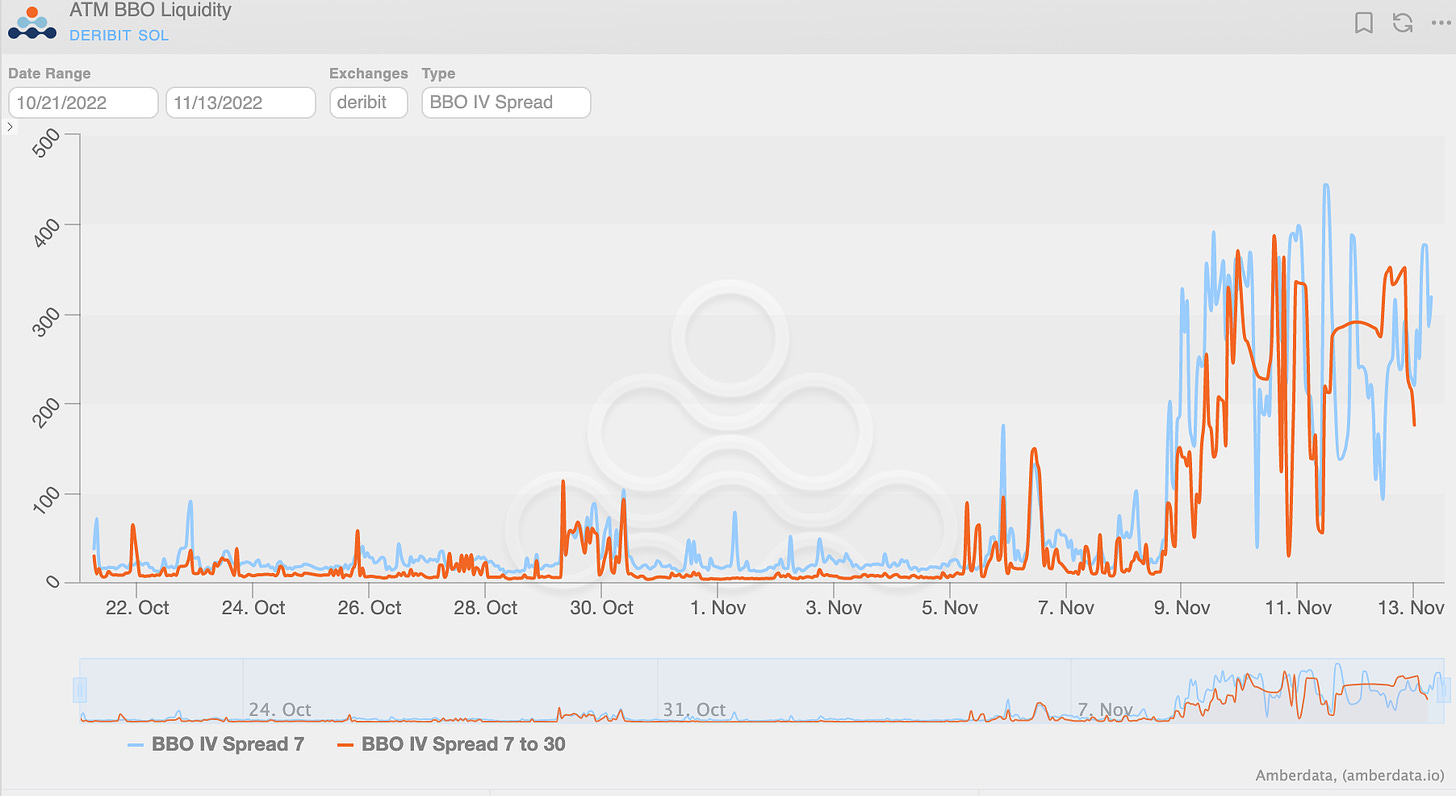

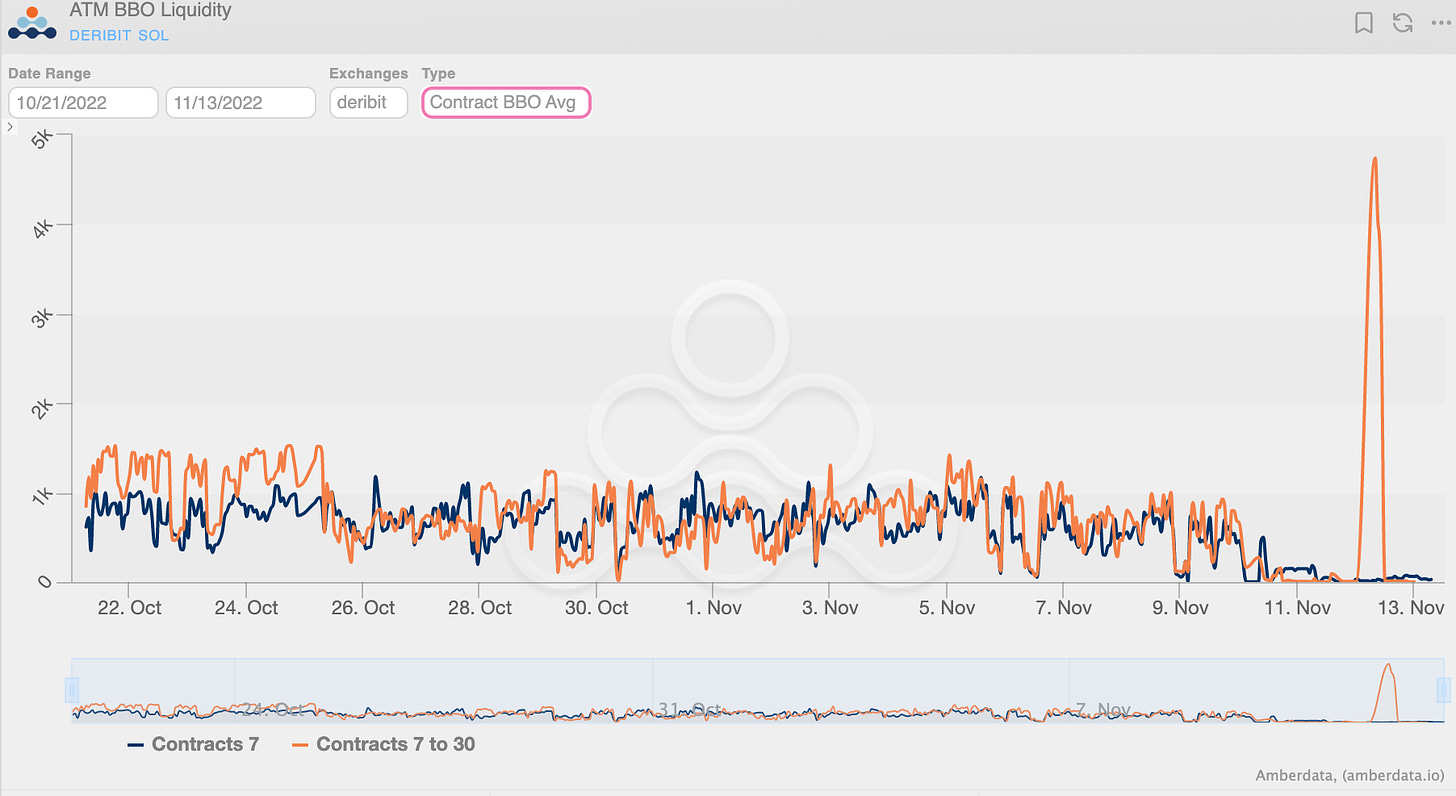

Liquidity quickly dried-up during the Solana meltdown as well.

The chart below shows the average spreads of ATM options for given expirations.

We can also see now that the number of contracts on the BBO is quickly dwindling down to nothing.

Deribit also announced that they are pausing new option listings for SOLANA options.

It’s important to note that this is another leadership vacuum for the SOLANA ecosystem.

There’s likely a reduced desire to MM on a coin like SOL. MM’s might have been affected themselves with custody funds on FTX.

Despite the extremely wide spreads (usually great for MMs), the complete uncertainty surrounding the FTX situation, it’s hard to gauge a “JUMP” risk in SOL.

Where does that leave us now?

This is the kind of environment where things are broken. Don’t get lured into short-vol. ideas, that’s my current bias.

SOL price action is now more BINARY in my opinion. This is also true, but to a lesser extent, for BTC and ETH.

We’re likely going to see HUGE news-driven price jumps, either direction, for these cryptos. Combine this with thin markets, and the ability to delta hedge short-vol. position disappears.

I’m inclined to look for long vol. positions.

My bias is also short-delta; I can’t imagine this being the bottom of a bear market for crypto and upside FOMO quietly resuming tomorrow… We’re likely a year or more away from complete digestion of all this fallout.

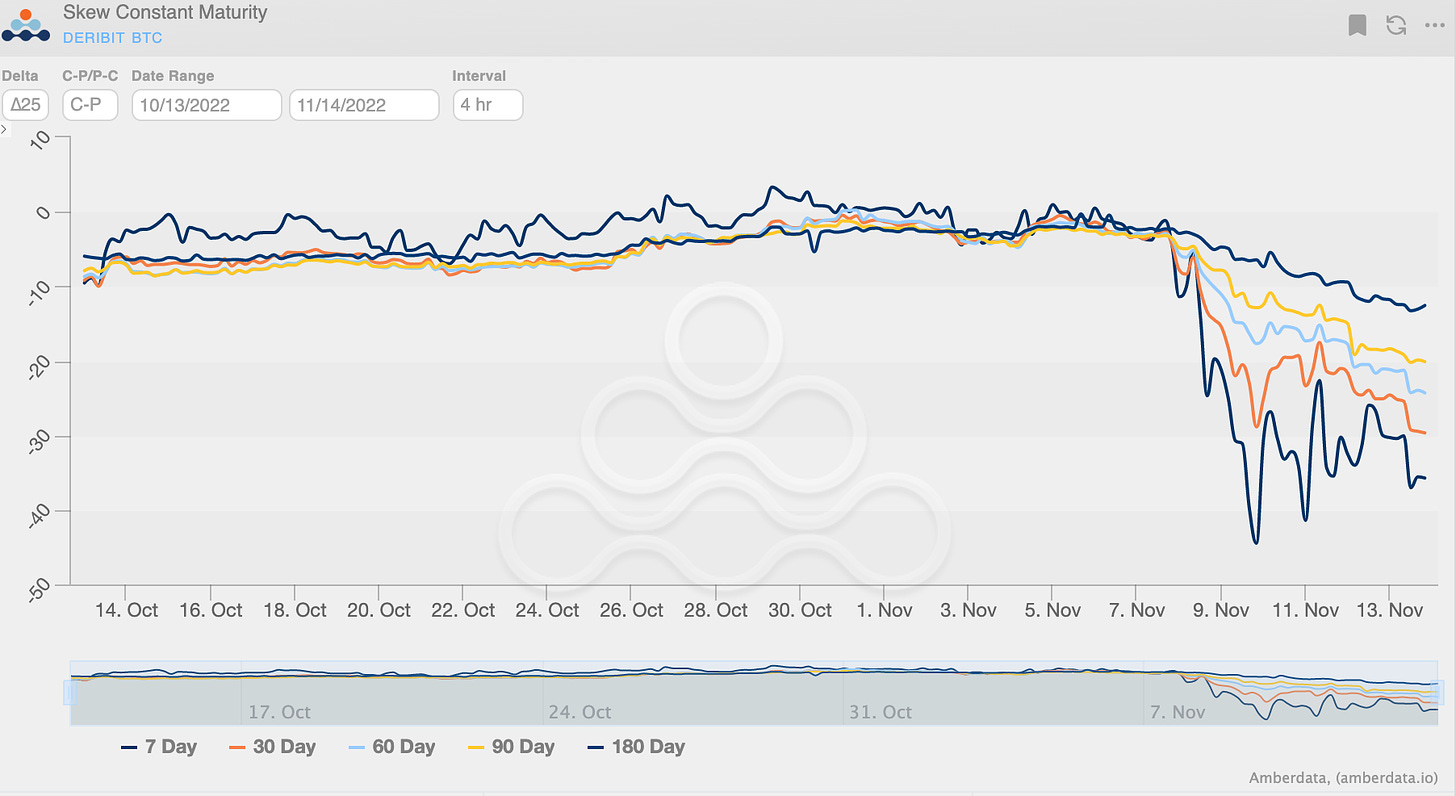

BTC ∆25 Skew

BTC’s option skew is extended and affords traders a decent opportunity to buy put spreads, capturing higher IV for the short OTM option.

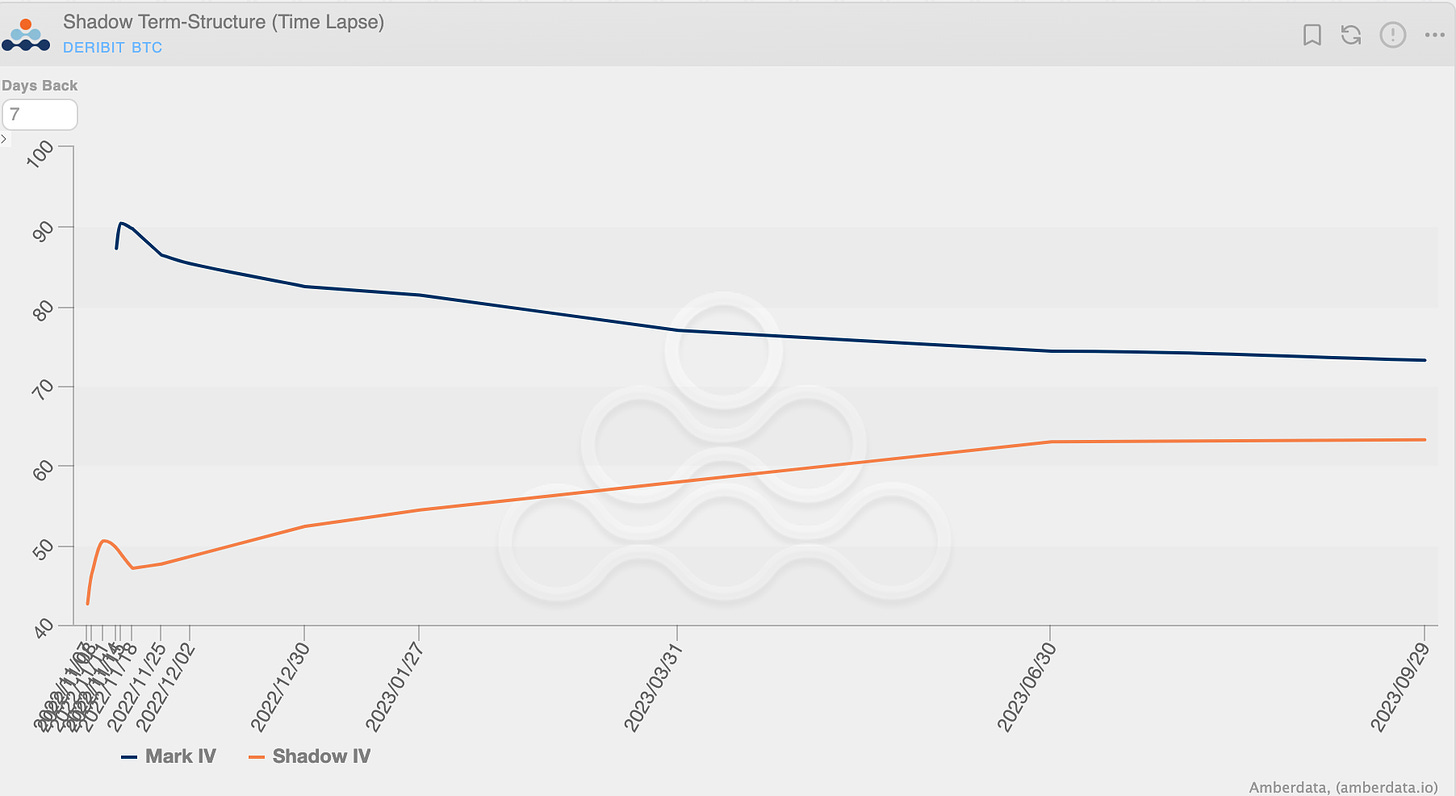

The overall term-structure has flipped from Contango to Backwardation. Currently, the Backwardation is about flat.

7-day IV priced around 90% implies a dollar weekly standard deviation of +/- $2k, when BTC is $16,400.

This doesn’t seem overly priced to me, going into this week.

We’re likely going to see more developments this week, especially as rumors of further insolvencies (think crypto.com and other exchanges passing coins around to “prove” reserves)

It appears that some exchanges are potentially faking proof of reserves audits with each other's funds (???)

— Dylan LeClair 🟠 (@DylanLeClair_) November 13, 2022

CZ has once again chimed in, which will exacerbate a potential run on reserves.

What a clusterfuck.

Steady lads. pic.twitter.com/MbNARVRRAn

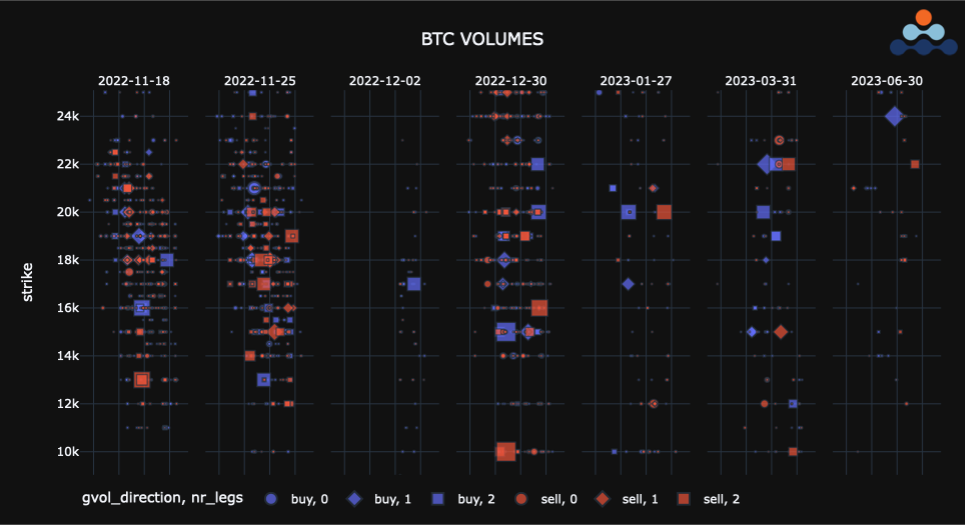

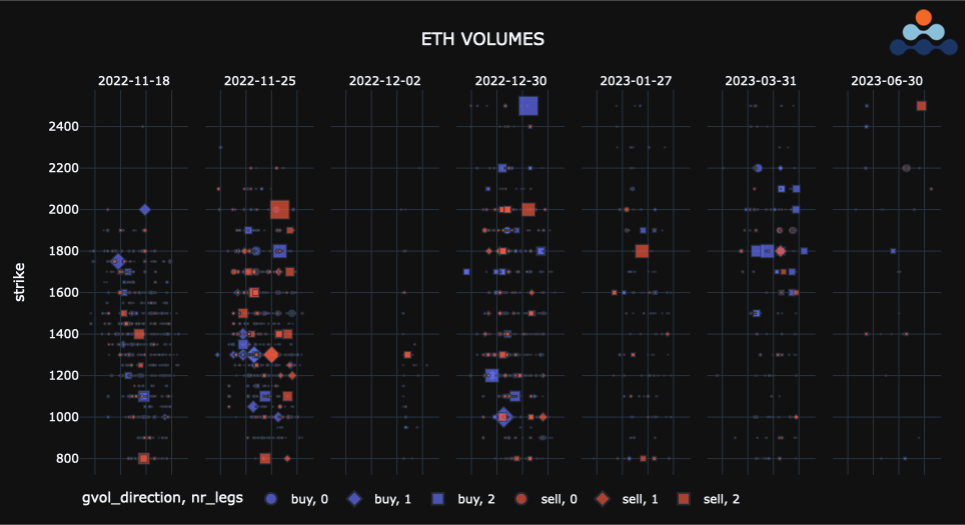

PROPRIETARY “GVOL-DIRECTION” FLOWS - @fb_gravitysucks

“GVOL-DIRECTION” FLOWS

Crazy week, with volumes at the highest levels of the year and with Bitcoin dominating (+40% of notional $M volumes compared to ETH).

As I always repeat during these hectic periods, it is very difficult to decipher the flow for the many profit-taking and trades dictated by book management, rather than by precise directional vision.

Profit-taking at $17k on Bitcoin and $1.3k on Ethereum are important indications on the levels of short-term “support”, at least psychological.

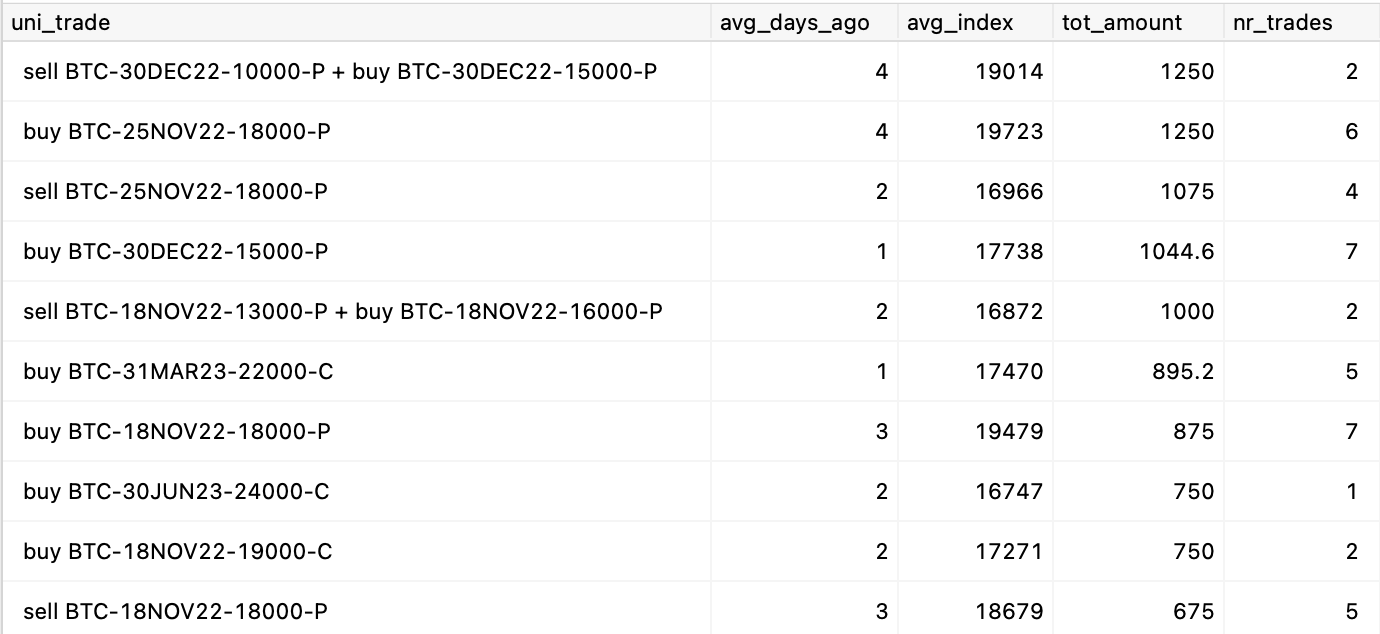

On Bitcoin, the protection positions have been concentrated on 18NOV/25NOV maturities in strikes from $18k to $14k, while OTC the 30DEC $15k-$10k put spread is the largest trade of the week.

The “time-suspended”, where everything and everyone seems to be waiting for something, does not encourage taking positions.

When the dust has settled, I expect a normalization of the term structure, with the volatility that will be hit hard.

If the “bear long winter” will rhyme with that of 2018, we will not have to marvel at a realized volatility on the low 20 and consequent level of iv.

(BTC Gvol direction table - Top 10 “Blocked uni_trades” of the week)

(BTC Gvol direction table - Top 10 “Deribit OnScreen uni_trades” of the week)

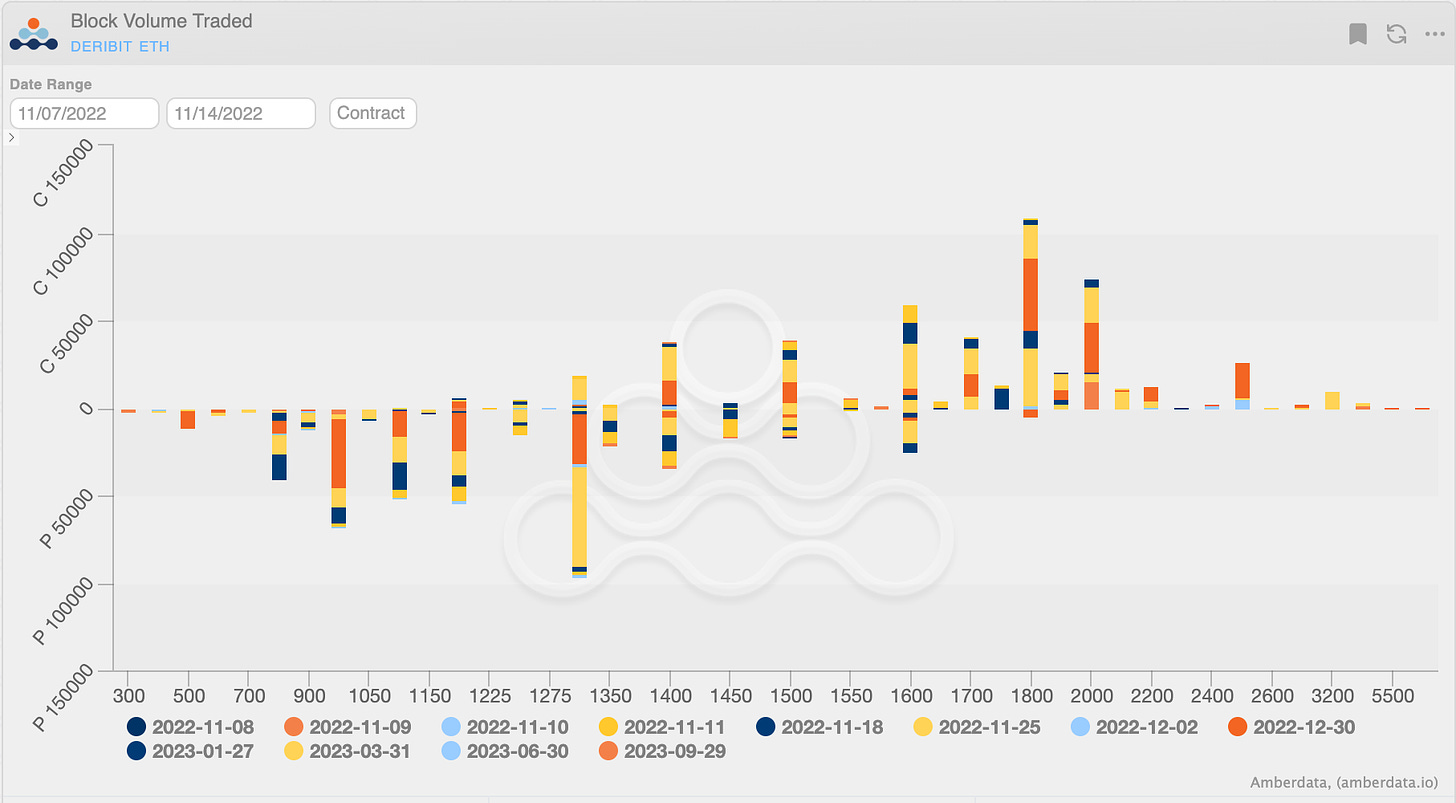

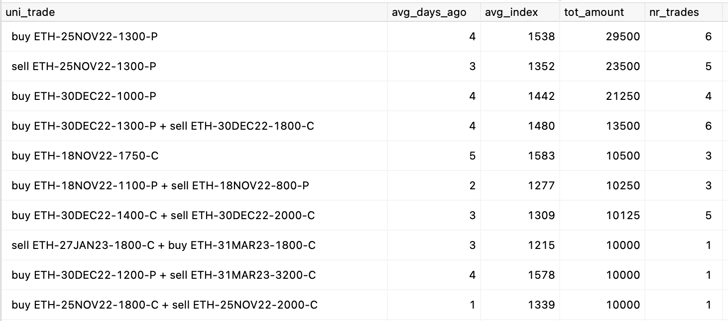

(ETH Gvol direction table - Top 10 “Blocked uni_trades” of the week)

(ETH Gvol direction table - Top 10 “Deribit OnScreen uni_trades” of the week)

(Gravity charts volumes - BTC - Weekly)

(Gravity charts volumes - ETH - Weekly)

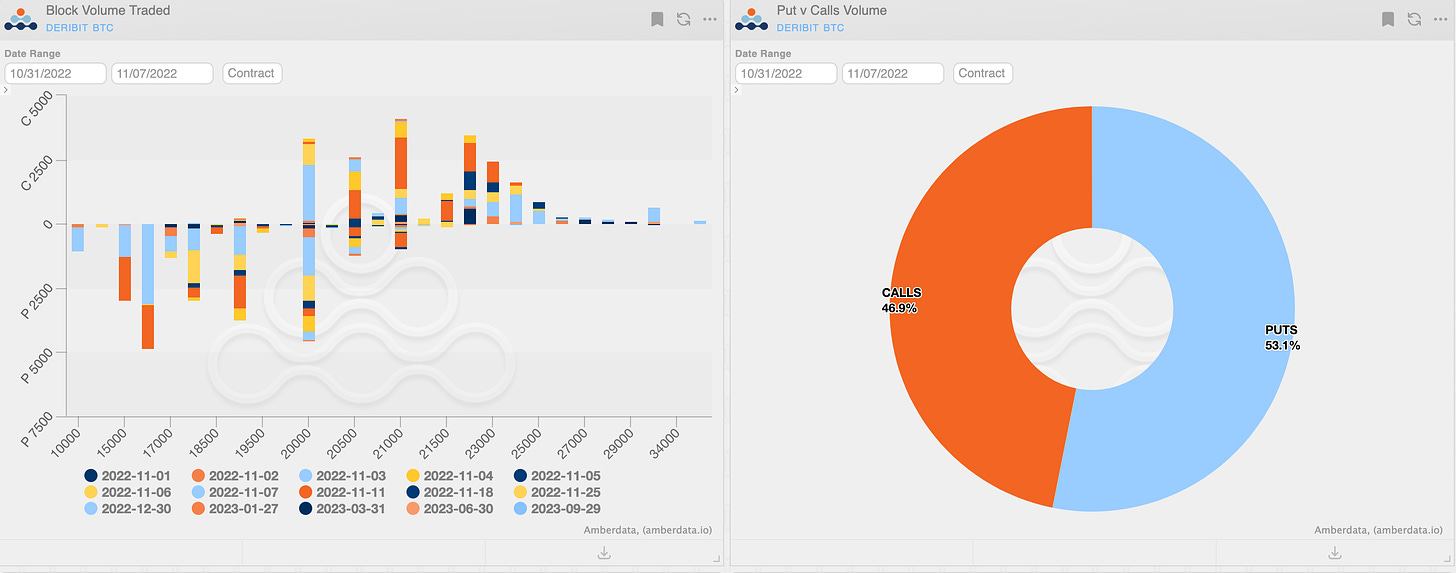

Paradigm Block Insights (7 Nov - 13 Nov)

Paradigm saw a one-way bid for downside, amidst the market turmoil this week. Liquidity was scarce during the turbulent price action. Please stay safe out there. 🙏

BTC -19% / ETH -20% / SOL -53% / NDX +8.6%

🌊 BTC Flows

📉 Strong bid for downside in the first half of the week as the roiling antipathy ensued. Really no surprise here, given the turmoil in the market and that the majority of taker interest has been buying of downside.

1200x 25Nov 18000 Put bot

1100x 18Nov 18000 Put bot

1000x 30Dec 15000 / 10000 Put Spread bot

🌊 BTC Flows (cont.)

Later in the week, some of the outright put sales below were closes of positions entered on the leg lower on Tues/Wed, but also some fresh downside bot in BTC Dec 15k puts.

Bought 991x 30-Dec-22 15000 Put

Sold 900x 25-Nov-22 18000 Put

Sold 500x 30-Jun-23 16000/20000/24000 Call Fly

🌊ETH Flows

On the ETH side, the top blocks on Paradigm occurred on the downside, via buying of outright puts and a bearish risk reversal.

23000x 30-Dec-22 1000 Put bot

20000x 25 Nov 1300 Put bot

15000x 30Dec 1000 Put bot

15000x 30Dec 1300 / 1800 Bear Risk Reversal bot

🎀A successful @ribbonfinance auction on @tradeparadigm 🎉🎉

💥Average comparable beats to screen of 10% 🔥🔥 Boosting those vault yields 💪

🥳Congrats to our winners who were mostly ANON 🤫

Winners 🏆

🥇 @GenesisTrading

🥇 Various ANON

Same time next week 🫡

Hit us up on Telegram! 🙏

Daily Commentary✍️ http://pdgm.co/cmmntry

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

🧵7/7

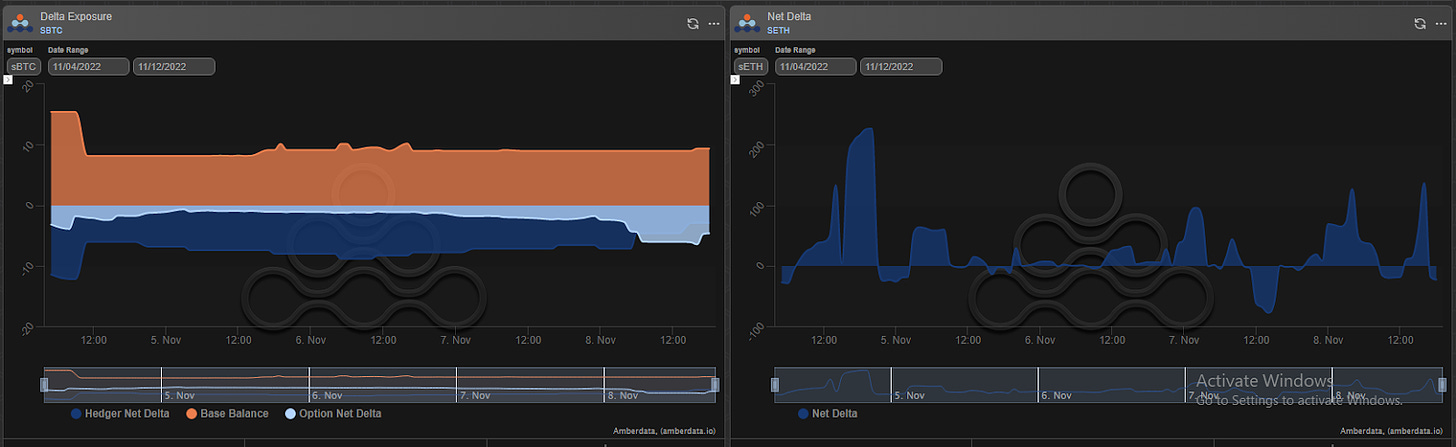

BTC

ETH

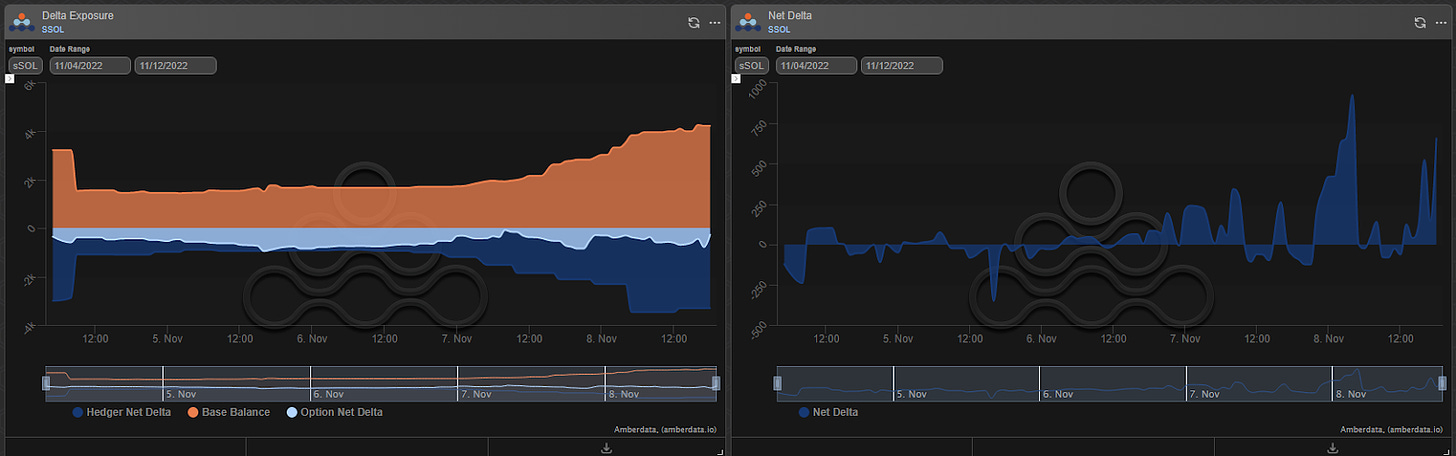

SOL

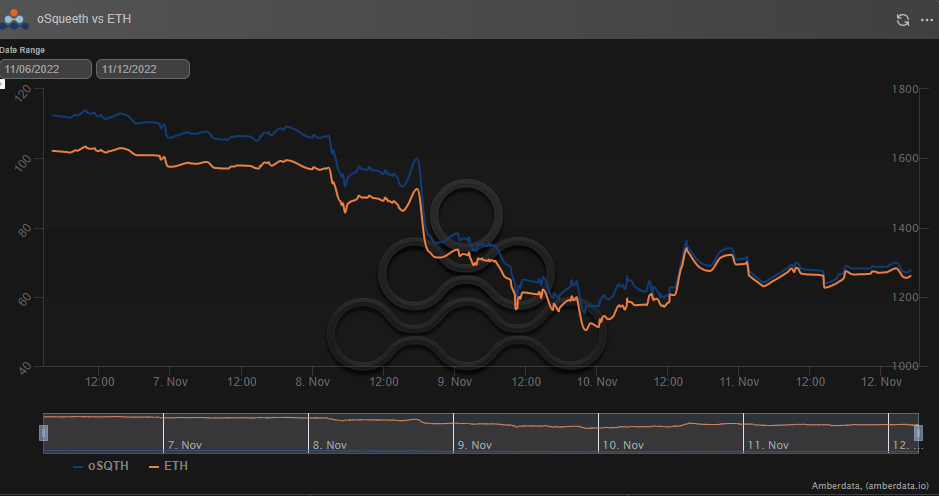

Squeeth: a Week in Review

The week that feels like it lasted years. With the collapse of FTX, many traders were left wondering how far can the contagion spread? ETH ended the week -22.29%, oSQTH ended the week 39.89%.

Volatility

Squeeth vol found a bid early in the week peaking at 163, and quickly found a way back to the mid 70s. This has created a great environment for traders to use oSQTH as a cheaper hedge and presented unique vol arbitrage opportunities.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $17.7m. November 5th saw the highest single day volume, with a daily total of $4.95m traded.

Crab Strategy

While the Crab was caught in what was a major volatility event, it survived. Returns since inception are still positive, and deposits still remain around 4,600 ETH. Crab gained 18.10% more ETH and ended the week down 5.39% in USD terms.

The Opyn team is excited to announce the launch of the front-end PnL date ranges! Now you can see how the Crab has done during certain times.

Twitter: https://twitter.com/opyn_

Discord: discord.gg/opyn

Volatility

In a shocking week, ETH IV spiked from ~75% to 150%+. Current ATM IV is sitting at ~120%, with puts having a significant bid, and near-term vol trading the highest.

Trading

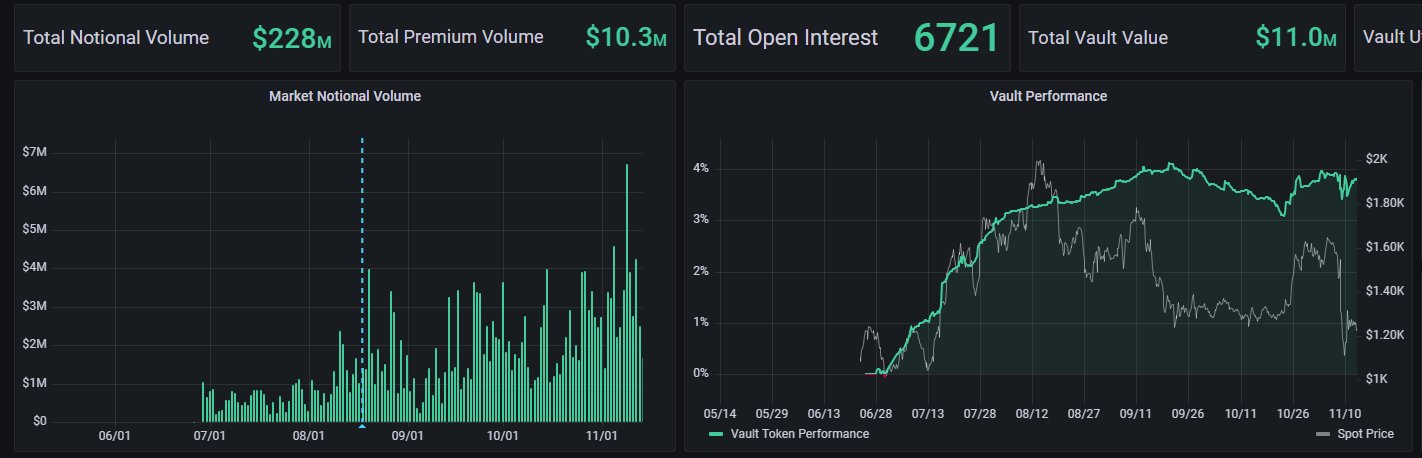

Demand for Lyra’s on-chain options saw an overwhelming surge this week. Lyra processed a record nearly $30 million in notional trades and $1.65m in premiums. Lyra’s markets remained on throughout the volatility, providing 2-sided markets for traders up to the vault's capacity, in an unparalleled trading experience this week. Even when fully utilized, Lyra’s traders are able to close their positions at any time.

ETH Market-Making Vault

Despite an incredibly volatile week and a short gamma position, the ETH MMV was able to hold on to the majority of its profits. The ETH MMV has returned 3.83% since its inception (June 28th, 2022) representing a weekly change of -.05%.

The 30-day performance annualized is +4.19%, annualized performance since inception is +9.74%. Depositors earn an additional 9.49% rewards APY (boosted up to 18.97% for LYRA Stakers).

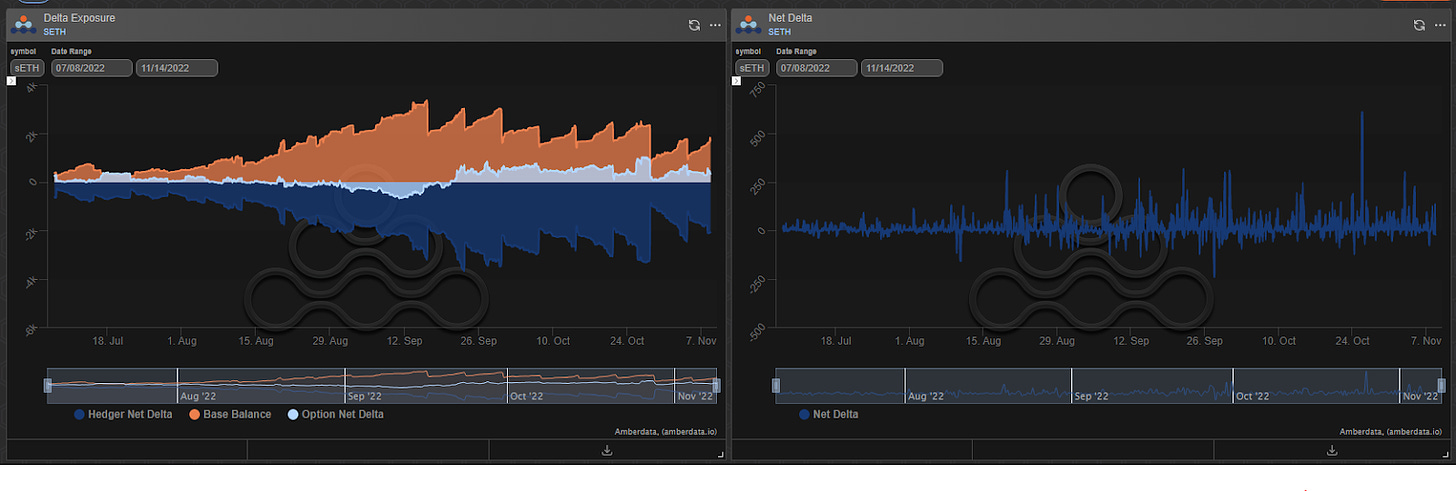

Net MMV Exposure:

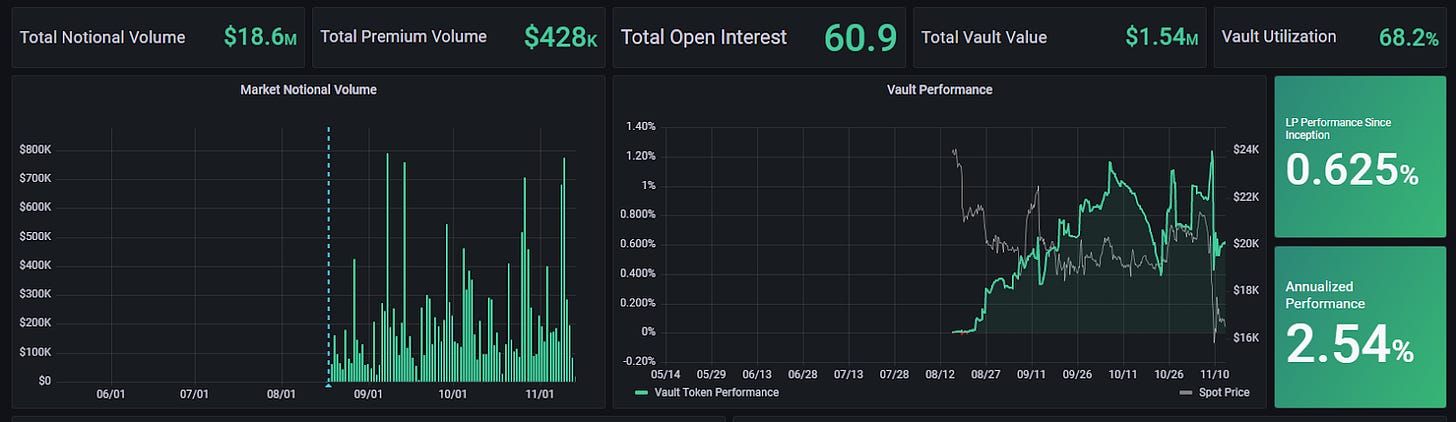

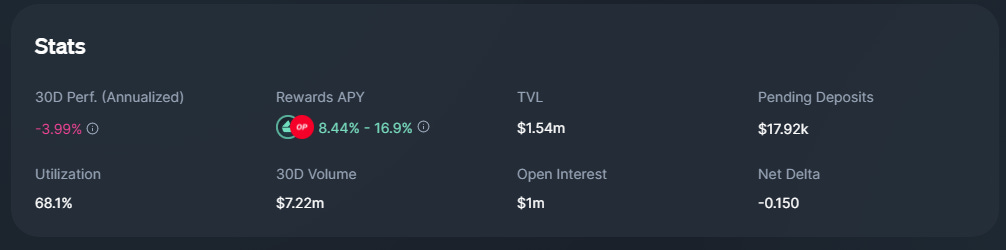

BTC Market-Making Vault

Lyra’s BTC MMV has returned .625% since its inception (August 16th, 2022). This represents a weekly change of -0.22%. Despite a drawdown from short gamma on recent moves, the MMV has maintained a positive pnl.

Depositors earn an additional 8.44% rewards APY (boosted up to 16.9% for LYRA Stakers)

Net MMV Exposure:

SOL Market-Making Vault

The unprecedented breakdown of the SOL market has led to losses for the SOL MMV. Lyra’s SOL MMV has returned -1.4% since inception (September 27th, 2022). The MMV functioned as intended throughout the volatility and 63% collapse in the SOL markets

Net MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...