.png)

-

Monday 11am ET: Inflation Expectations

-

Tuesday 9am ET: Jerome Powell speaks in Sweden

-

Thursday 7:30am ET: Fed members speak

-

Thursday 8:30am ET: CPI

-

Friday 10am: Inflation Expectations

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math minded people here, pardon any typos.

THE BIG PICTURE THEMES:

Happy New Year everyone!

The first week of trading ignited with a spark of optimism.

While the job market remains strong overall, hourly wages came in below forecast in last week’s NFP report.

The mix of lower wages and better unemployment numbers (3.5%) is a goldilocks scenario… Soft landing?

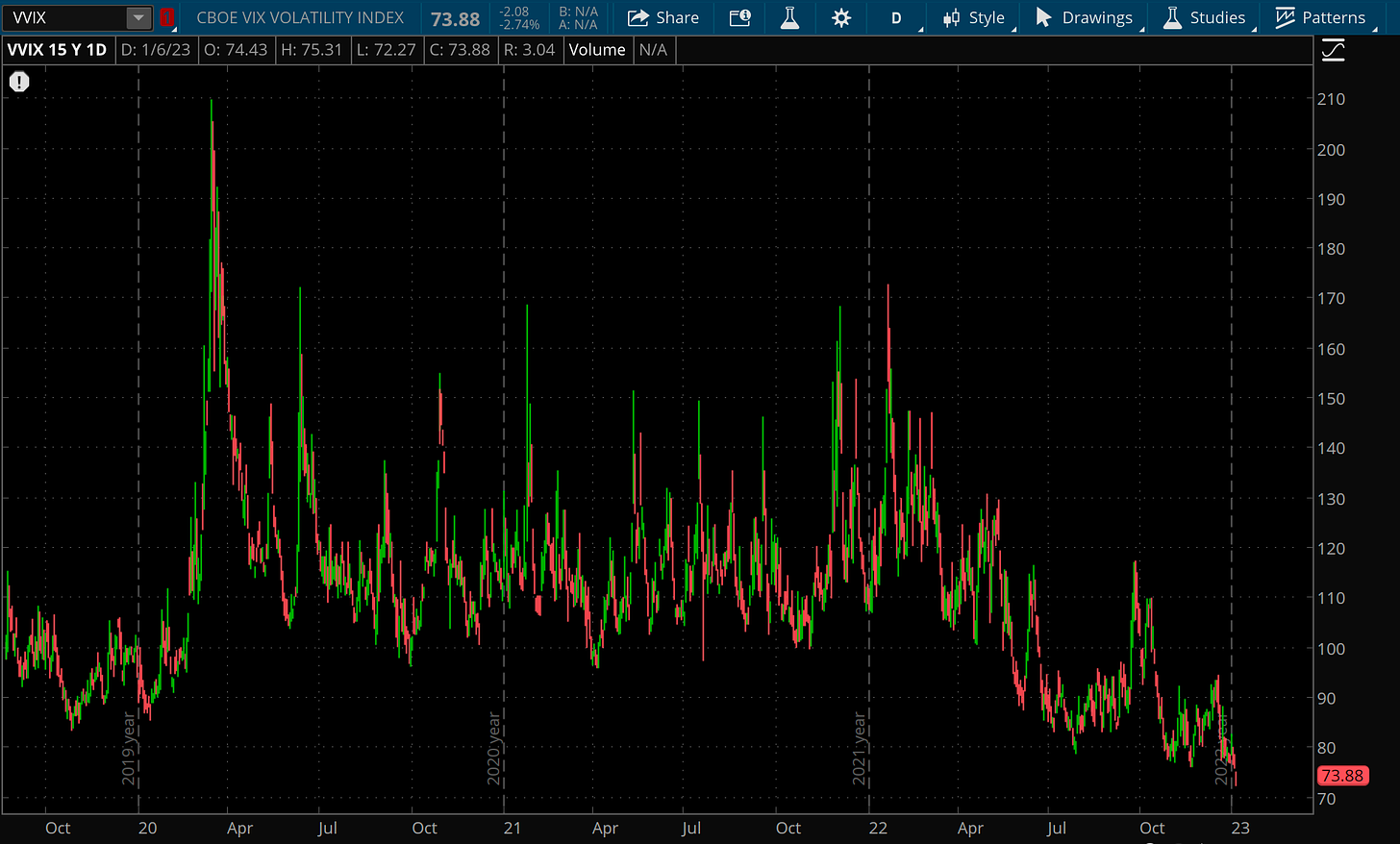

VVIX (VIX of VIX options) is making new lows with a reading of 73.88.

This is massively cheap and suggests that buying VIX puts when the VIX is still above 21pts could be a decent trade here.

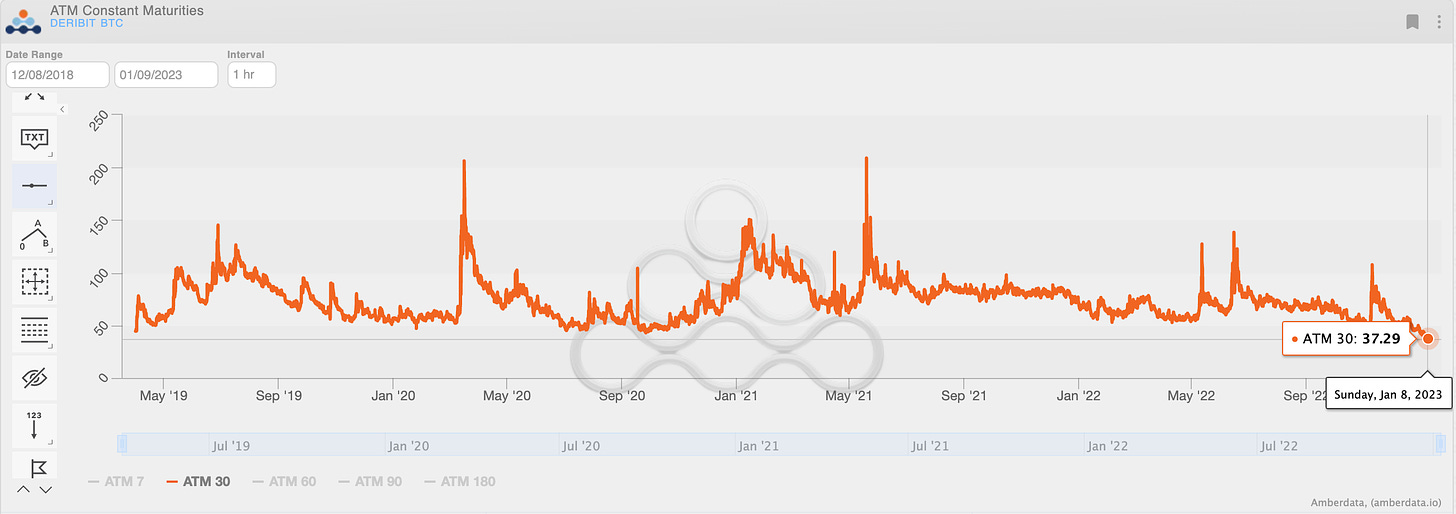

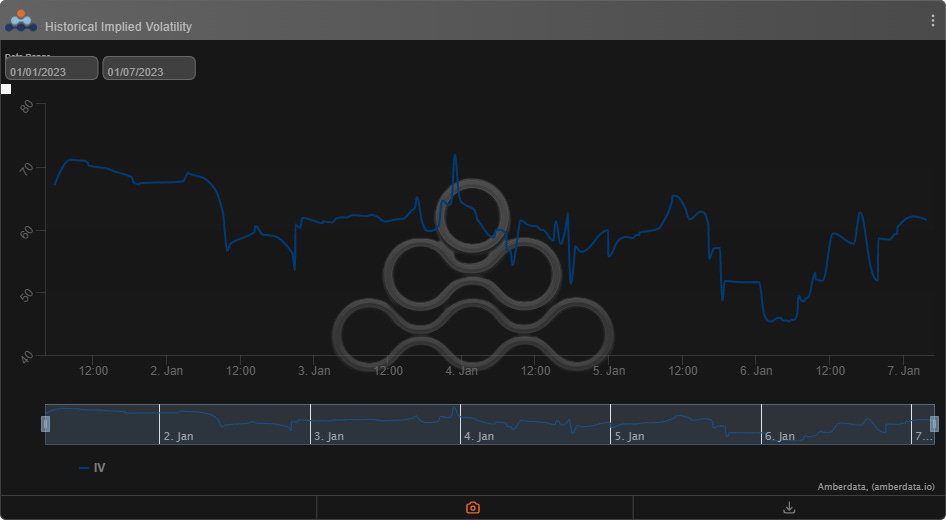

Crypto Vol. is even MORE fascinating.

30-day ATM IV for BTC is the lowest seen in our ENTIRE dataset at Amberdata Derivatives.

Notice that 30-day ATM vol. is below anything since April 1st 2019, coming in at a reading of 37.29%

This is totally justified because BTC RV is even MORE dismal!

This upcoming week we do have a CPI release on Thursday. This is likely to move markets.

BTC: $17,138 +3.02%

ETH :$1,287 +7.28%

SOL: $14.69 +47.88%

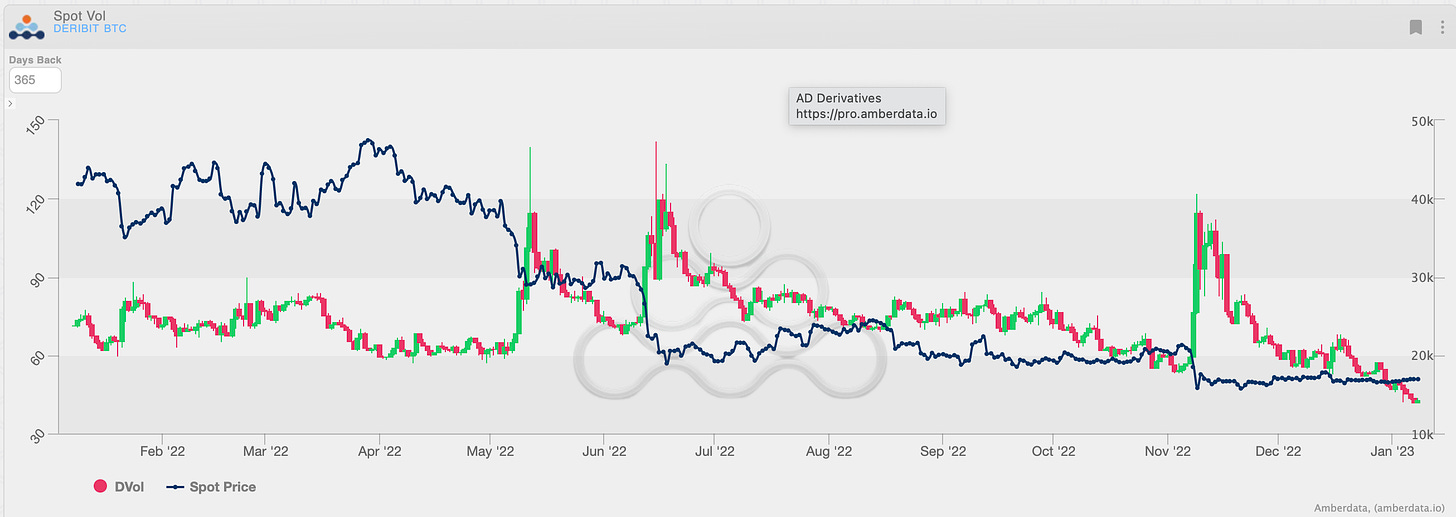

DVOL: Deribit’s volatility index

BTC - (365-days w/ spot line chart)

The lower vol. trend and price consolidation is evident here.

We could actually see the return of some upside RV volatility should CPI come in soft on Thursday.

That said, 30-day day IV is still much above 7-day IV, which is still high above 7-day RV.

Not to mention the option skew priced into DVOL.

Taken together, there is likely more “Justifiable” DVol downside.

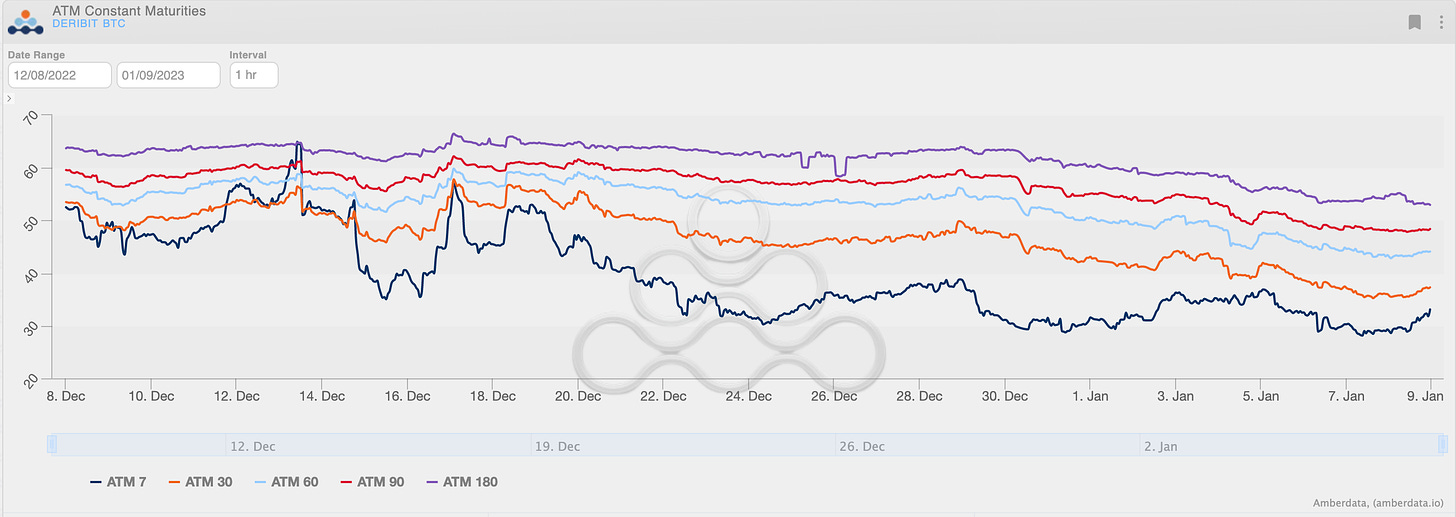

TERM STRUCTURE

(Jan. 8th, 2023 - BTC Term Structure - Deribit)

We can see the term structure price in strong Contango across expirations.

There’s a uniformity in “roll-down” across all expirations.

Given the upside price action and likely continued lower vol. (at least without some sort of catalyst) traders could find some value in medium-term upside call-flies, as BTC grinds it’s way back into the 20k-handle.

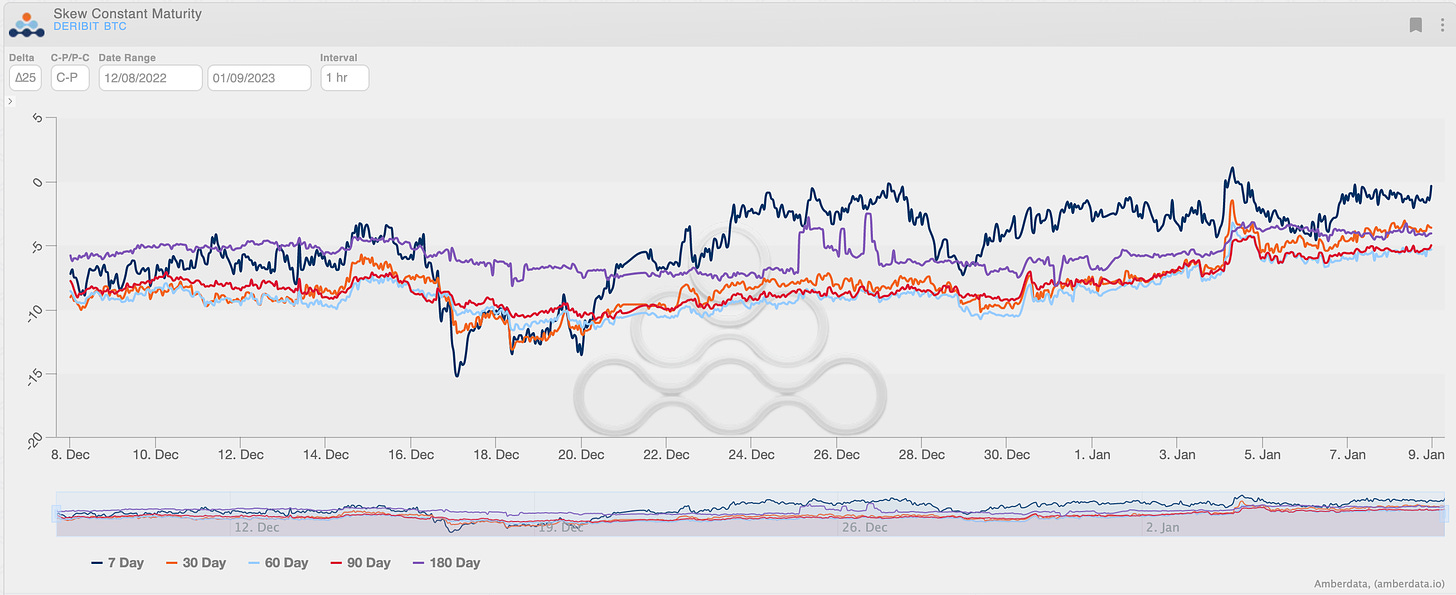

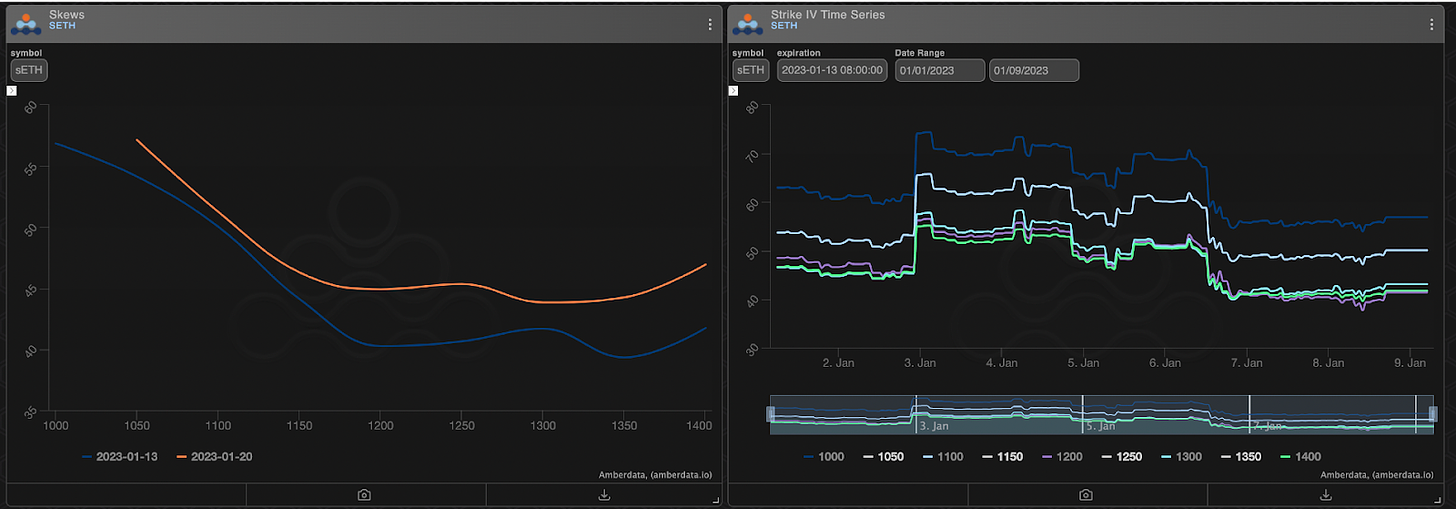

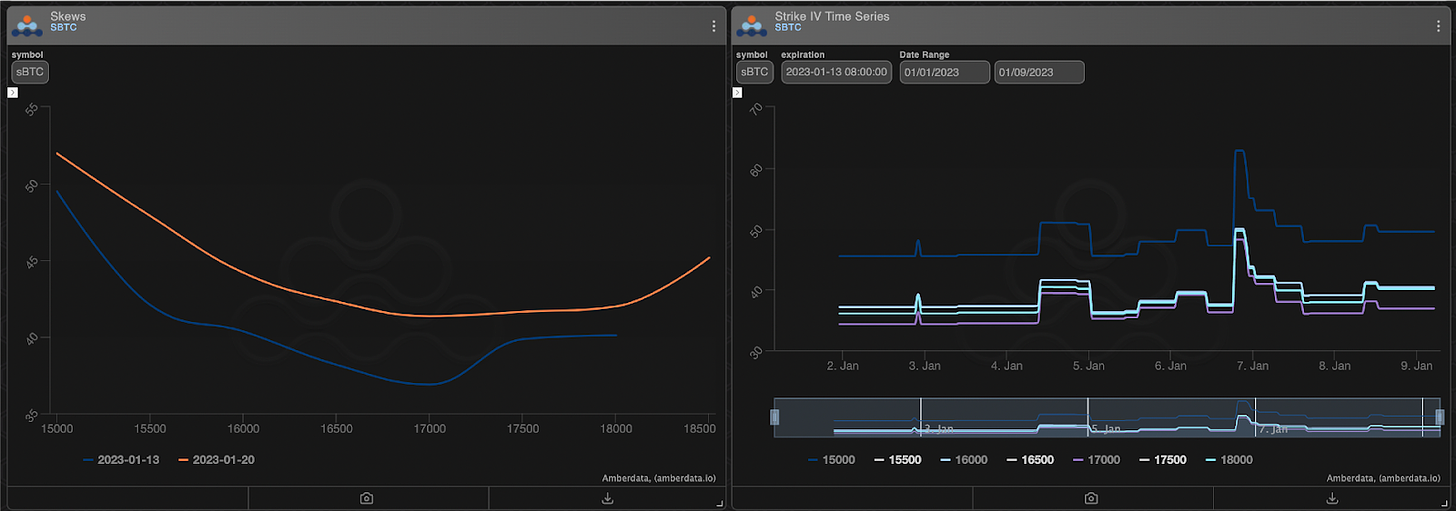

SKEWS

(Jan. 8th, 2023 - BTC RR SKEW (C-P) ∆25 - Deribit)

Options skews are starting to head back towards a symmetry.

We can see this trend for all expirations as BTC spot prices move sideways and trade in equilibrium… this RR-Skew shows options traders pricing that a future vol. catalysts could also come from the bullish side.

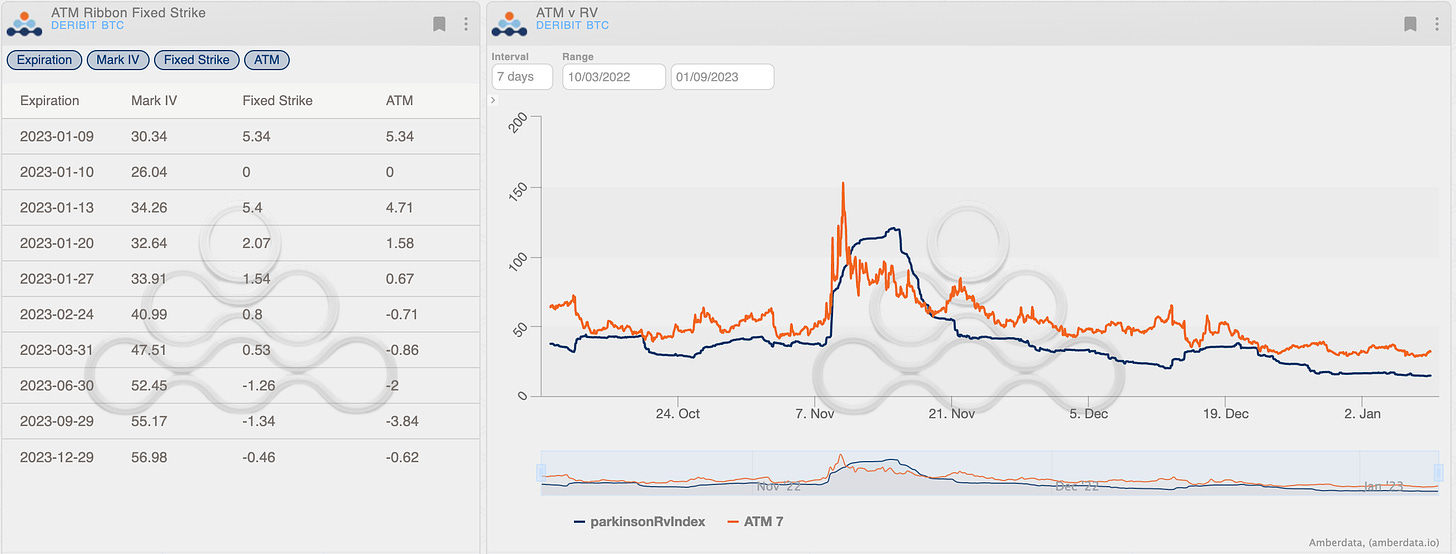

VOLATILITY PREMIUM

(Jan. 8th, 2023 - BTC IV-RV)

This is the most dismal BTC vol. I’ve ever witnessed.

The VRP is nearly 15-points for 7-day options.

The 7-day RV is trading in the 15% handle while 7-day options are trading in the 30% IV range.

One thing to keep in mind when trading these 7-day options in a low vol. environment is the quick change in potential gamma profiles.

Regardless of spot price action, an OTM option will quickly become near ATM as Vol. jumps from 30% → 45%… just keep that in mind.

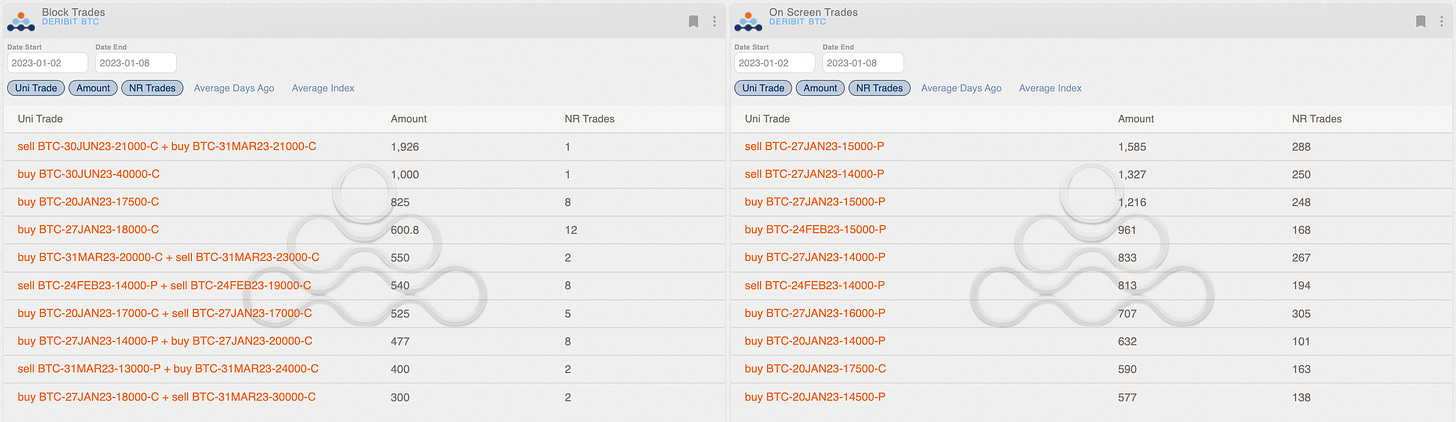

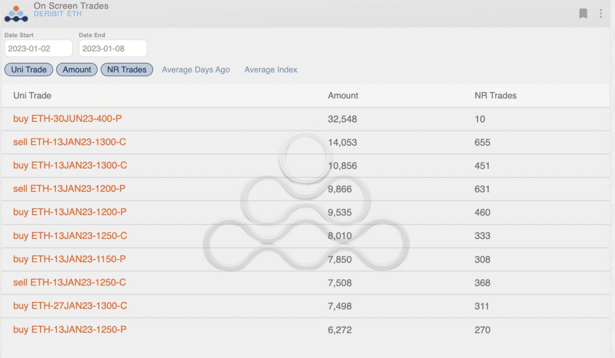

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

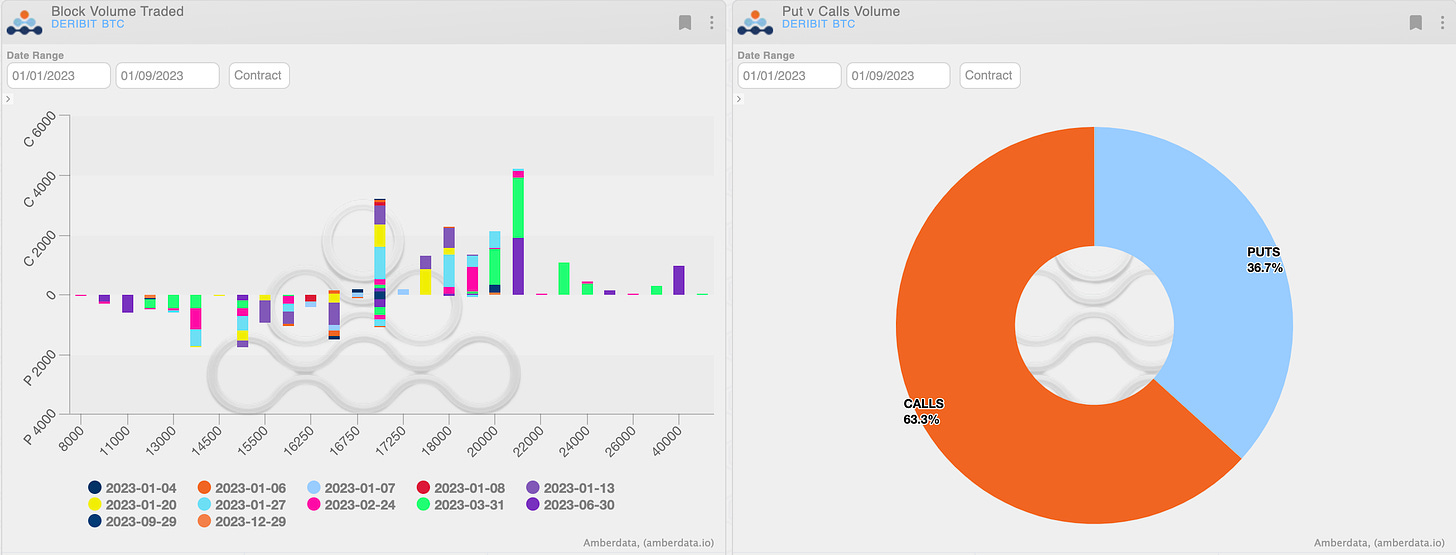

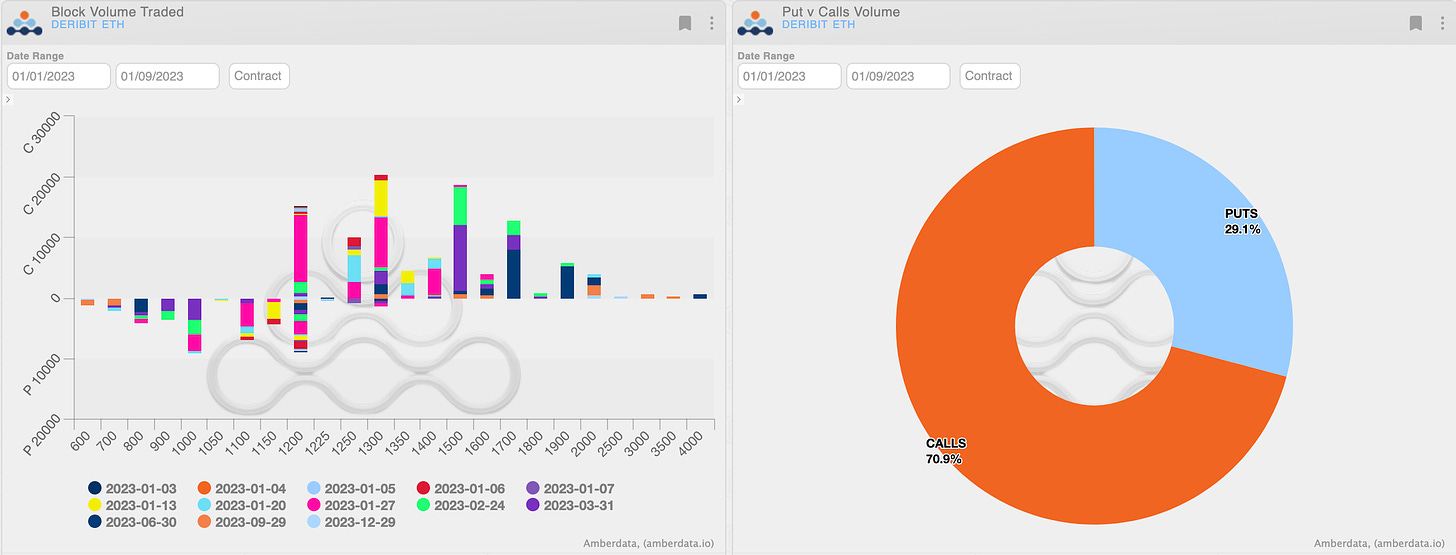

In the first week of the year vs 2022 trades are down 10% on bitcoin and more than 30% on ethereum. It is also interesting to note the persistent underperformance of the notional of ethereum down more than 45% vs bitcoin.

Bitcoin on-screen activity was focused on 14k/15k puts without a clear directionality with a two-way flow. On Paradigm the biggest trade was the short calendar Mar/Jun 21k, although looking at the impacts on open interest it can be a roll-forward of a naked-short position.

(BTC AD direction table with uni_trade - Options Scanner section)

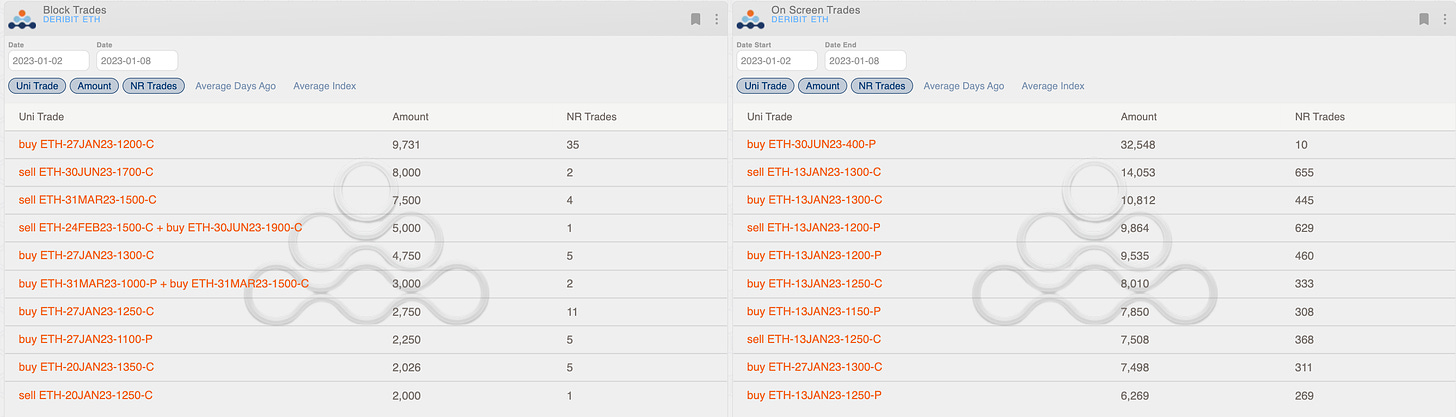

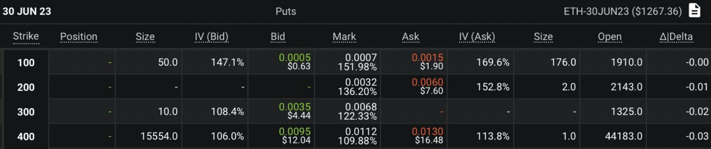

On ethereum the trade that made the most talk was the purchase of puts $400 on June 2023 made on-screen with a resting bid of 50k contracts (at the time of writing still present in the deribit book for 15k).

(ETH AD direction table with uni_trade - Options Scanner section)

The most talked about trade of the week was the on-screen BUY of #ETH puts $400 on June23 via a resting bid on @DeribitExchange.

— GravitySucks (@Gravity5ucks) January 8, 2023

Over 30k contracts already bought, 15k still remain in the orderbook.

As always the right direction of the trade is only on @genesisvol. pic.twitter.com/YzYpMWMejW

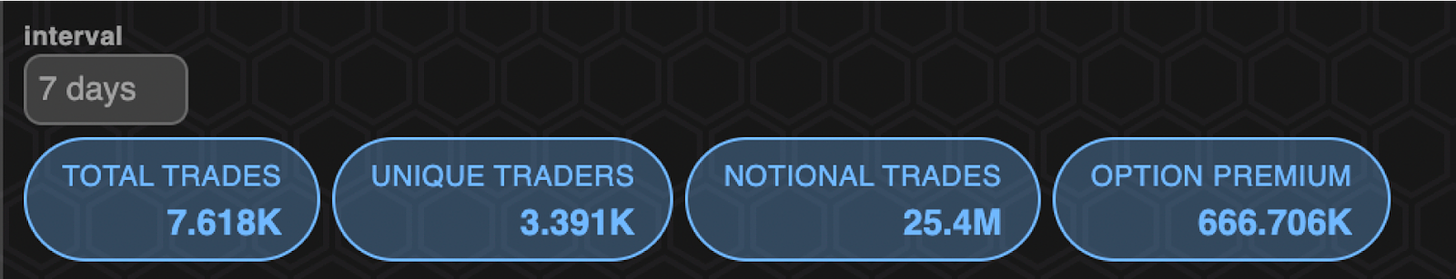

Paradigm Block Insights (02 Jan - 08 Jan)

Majors finish the week slightly higher. BTC and ETH short-dated call buying throughout the week on Paradigm.

BTC +1% / ETH +3.5% / NDX unch.

🌊BTC Flows

Given strike similarity, strangle trades below likely roll of short vol position. TS remains steep with 9v of rolldown between 24Feb and 27Jan (41v vs. 32v).

540x 24Feb 14k/19k Strangle sold

477x 27Jan 14k/20k Strangle bot

300x 20Jan 18k Call bot

Front-end vol buying continued on Friday with the below blocks printing. Carry on gamma remains brutal with 7d realized now at 14v.

825x 20Jan 17.5k Call

575x 27Jan 18k Call

Notable print went up on Deribit screens.

1926x 31Mar 21k / 30Jun 21k Call Calendar sold

We saw very similar flow in both BTC and ETH last month as well. Miner overwrite roll?

🌊ETH Flows

Primarily gamma buying on Paradigm this week with 27Jan calls in focus. Fwd. vol buying in Feb/Jun.

9250x 27Jan 1200 Call bot

5250x 27Jan 1300 Call bot

5000x 24Feb 1500 / 30Jun 1900 Call Calendar bot

A total of ~40k 30Jun 400 Puts bought on screen at .095 on Thurs/Fri/today.

A bid of 50k contracts was rested on screens early in the week. 10k size remains.

BTC

ETH

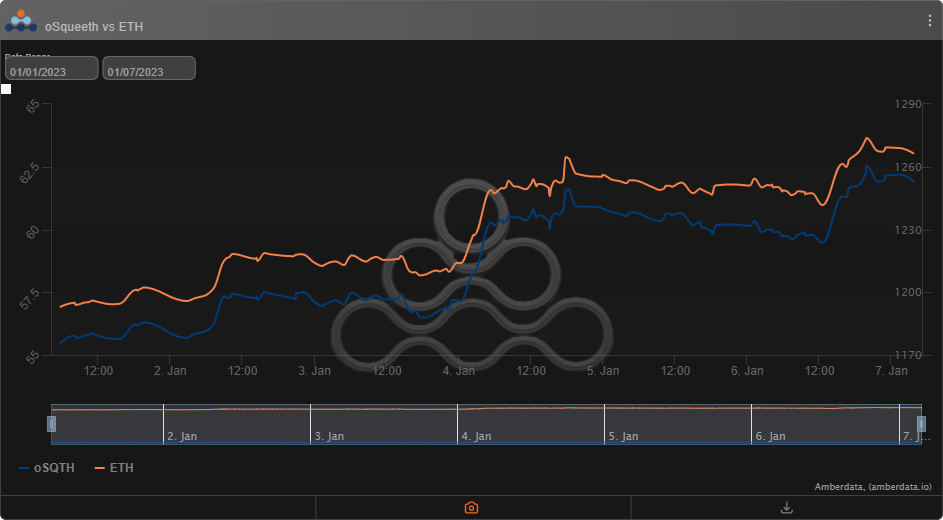

The Squeethosystem Report (1/01/23 - 1/07/23)

The first week of trading is in the books for 2023. Many traders remained “hands off the keys” waiting for clues on where smart money was placing bets. Vols continued lower on the back of the minutes and NFP leaving us with an interesting week into the CPI. ETH ended the week +6.15% and oSQTH ended the week +11.61%.

Volatility

Squeeth IV saw slow declines throughout the week benefitting Crab depositors.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $1.70m. January 4th saw the highest single-day volume, with a daily total of $533.23k traded.

Crab Strategy

Crab strategy continued to stack USDC for depositors ending the week +0.90%.

Zen-Bull Strategy

Zen-Bull continued to stack ETH for depositors ending the week +0.41% in ETH terms.

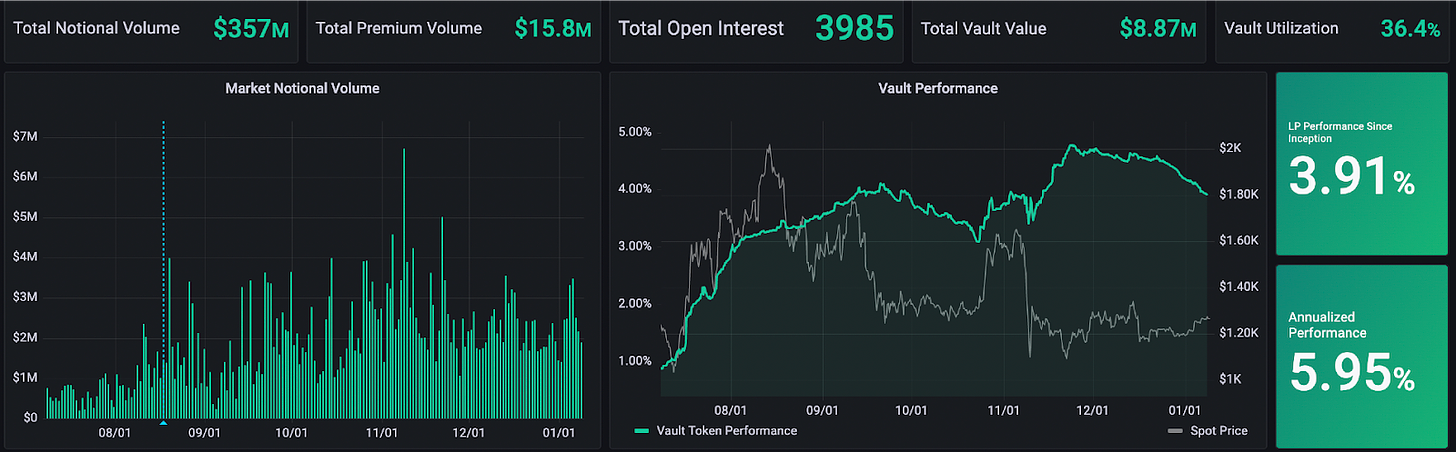

Lyra Weekly Review

Volatility

Current ATM IV is ~40% in ETH marking some of the lowest levels historically. Near-term vol has taken the largest hit while defi struggles to find option buyers.

Trading

A Lyra Grants recipient has published the first open-sourced, free arb bot to demonstrate how users can take advantage of arbitrage opportunities between Lyra and Deribit. Check out all the info here:

1/ Looking for low risk double digit yields on your ETH or BTC anon? 💵

— Ethboi_ 🦇🔊 (@EthBoi_) January 4, 2023

Lets talk about options arbitrage, and how you can arb between @lyrafinance & @DeribitExchange to get these juicy yields. 💰

Did I also mention you can now do this using a tool I built? 🤖

🧵 Let's go 👇 pic.twitter.com/9qkhWXVpzA

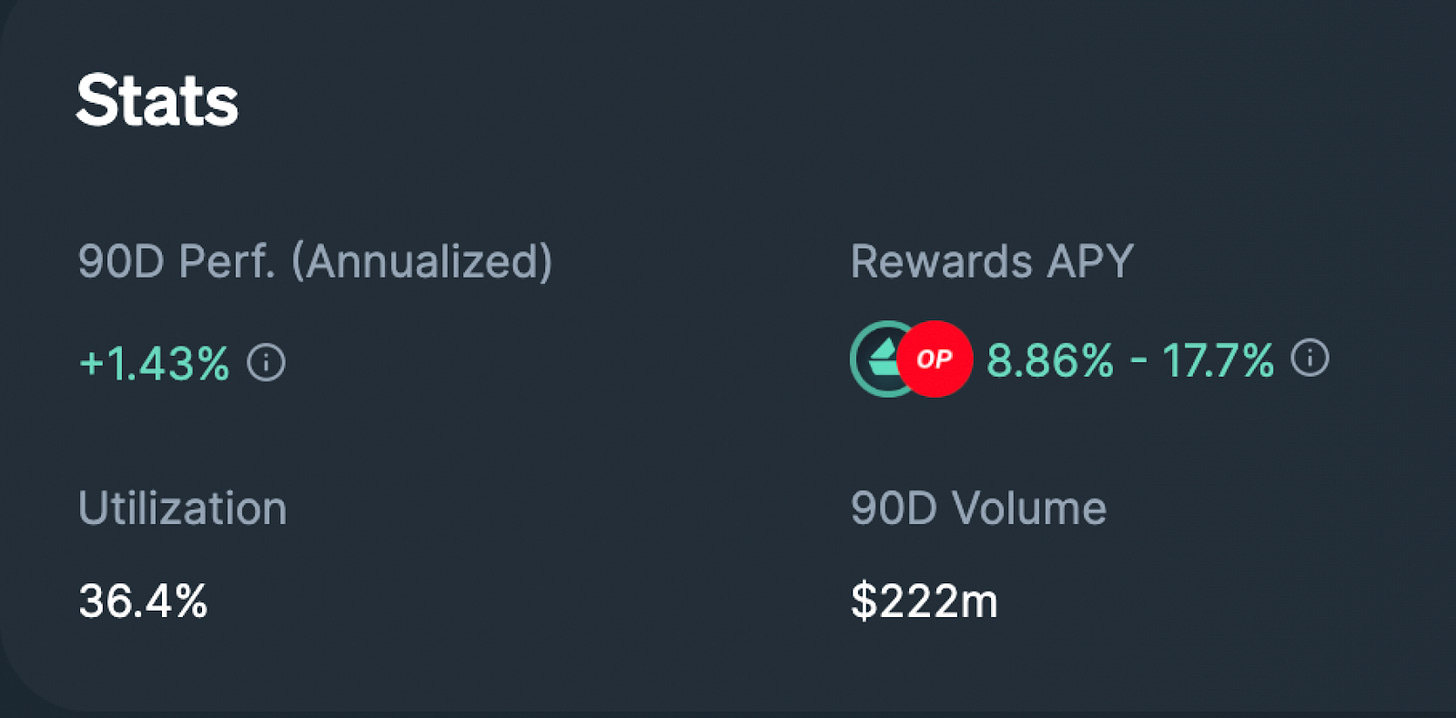

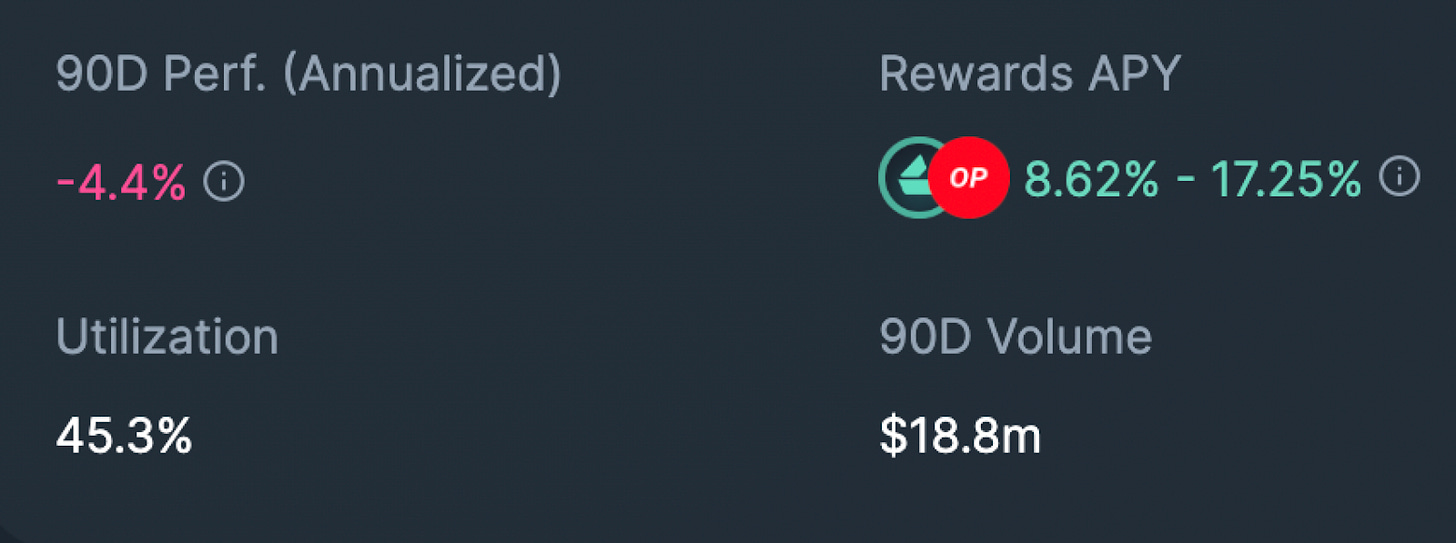

ETH Market-Making Vault

The ETH MMV has returned +3.91% since its inception (June 28th, 2022) representing a weekly change of -.28%. MMVs have struggled lately with high hedging fees and low realized volatility.

The 90-day performance annualized is +1.43%, annualized performance since inception is +5.95%. Depositors earn an additional 8.86% rewards APY (boosted up to 17.7% for LYRA Stakers).

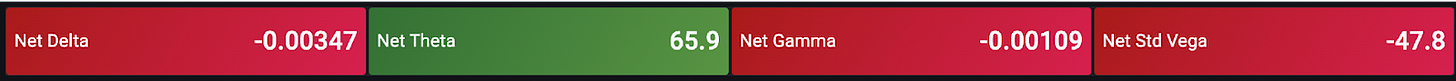

Net MMV Exposure:

BTC Volatility

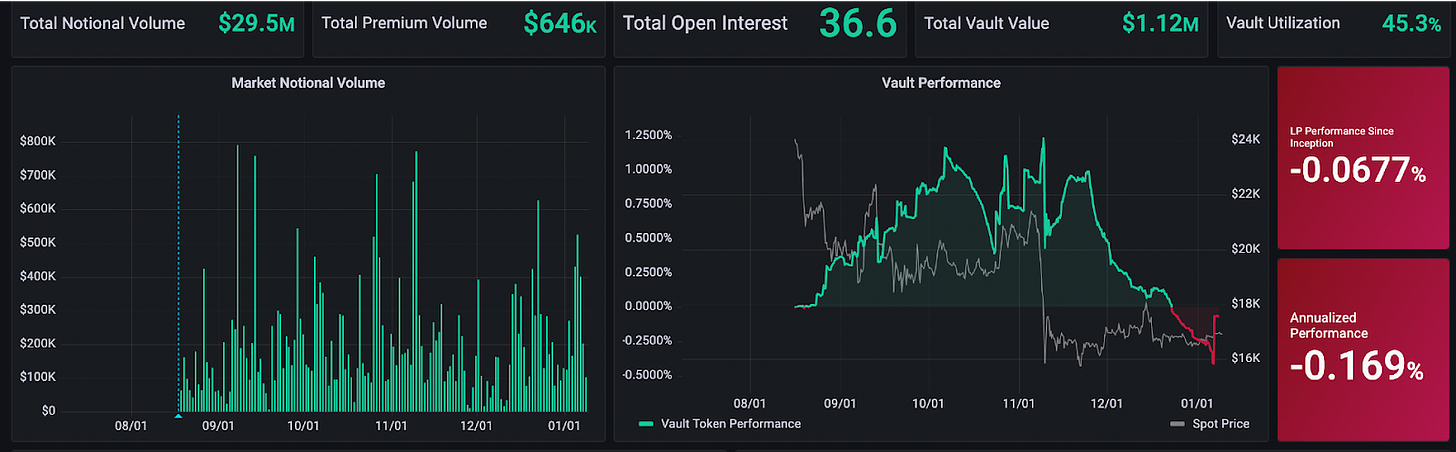

BTC Market-Making Vault

Lyra’s BTC MMV has returned -.0677% since its inception (August 16th, 2022). This represents a weekly change of +.1823%.

Depositors earn an additional 8.62% rewards APY (boosted up to 17.25% for LYRA Stakers)

Net MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here

If you would like more in-depth analysis, subscribe to AD Derivatives Newsletter & launch our app to utilize our tools for your trading strategies!

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...