Crypto Options Analytics, Oct 22nd, 2023: BTC, Gold, and Market Trends

USA Week Ahead:

-

Tuesday 9 am ET - S&P Case-Shiller home price index (20 cities)

-

Thursday 8:30 am ET- GDP

-

Friday 8:30 am ET- PCE

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH, and Lyra and may change their holdings anytime.

CRYPTO OPTIONS MACRO THEMES:

Rates are the biggest mover in macro right now but,surprisingly, rate sensitive assets, such as Gold, are also seeing bullish momentum… this bodes well for BTC.

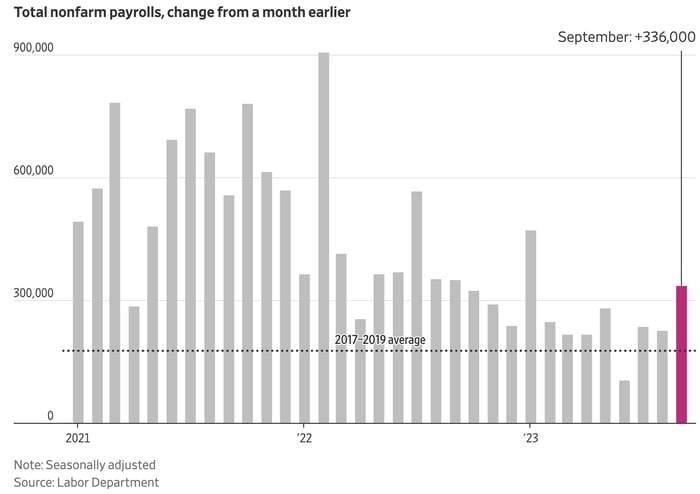

Earlier this month we had a strong NFP report that created more jobs than expected by economists. This was an initial trigger for bond yields to rise.

The jobs report was quickly followed by the terror attack on Israel which created a bid for Gold.

Bond yields are bear steepening, as long-term yields lead the way higher.

War spending is traditionally inflationary and the Fed is simultaneously talking about pausing rate hikes as they view higher long-term yields equivalent to short-term rate hikes.

If the bond market is truly pricing-in war-time spending (inflationary) and the fed is pausing (inflationary) while the economy remains robust (inflationary),this would naturally make gold rally (inflationary hedge).

Of course, CPI data has been improving lately and we must see if these new current-events alter the path of CPI.

BTC remains an even more interesting asset, given “perfect-mobility”, inflation hedge, and government agnostic wealth preservation.

I think the move in Gold is a strong “tell” for BTC.

Lastly, combine the optimism around the BTC ETF and the Ripple lawsuit and altogether this strikes me as very bullish developments for BTC as a whole.

BTC: $29,975 (+10.2% / 7-day)

ETH :$1,655 (+6.1% / 7-day)

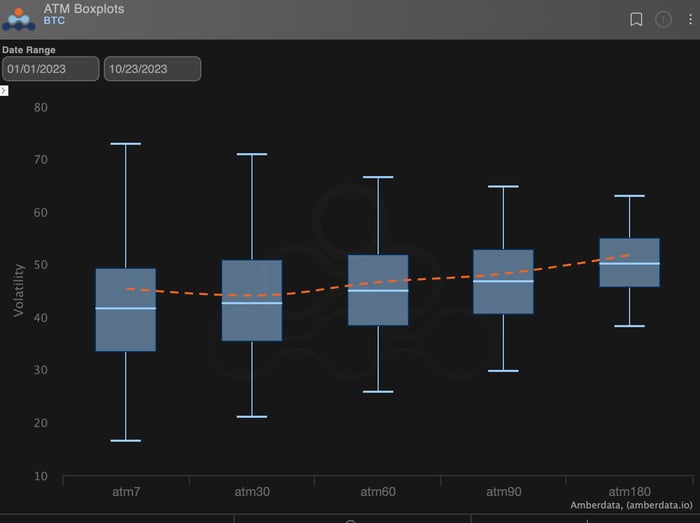

(BTC distribution of the term structure YTD)

Bitcoin is being priced like something is going to move in the short-term.

This is one of the flattest term structures we’ve seen recently.

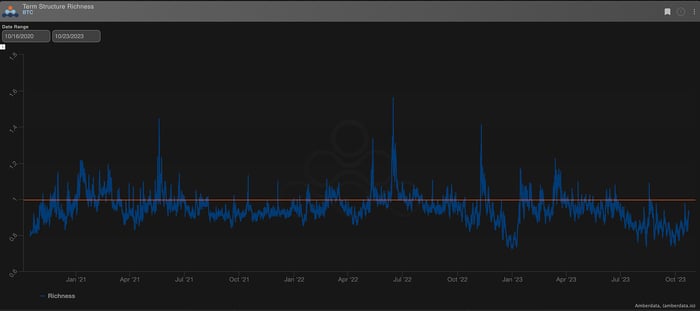

Chart: (BTC Term structure richness)

Looking at the term structure richness chart, we can see that post SVB the term structure flipped into backwardation; but since April a steepening Contango structure has been dominant.

I can’t help but carry the positive delta bias into this week, especially given the weekend price action and macro reaction in Gold.

That said, what’s interesting in the volatility landscape is actually found in the PUT side of the ladder.

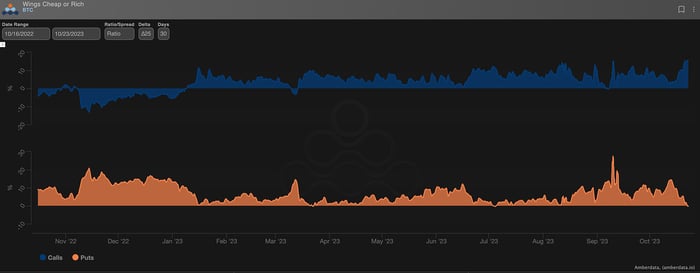

Chart: (BTC 30-DTE ∆25/ATM -1.00 IV% Ratio)

We can see that 30-DTE IV for ∆25 Puts is about the same at the ATM IV.

This is a very FLAT put skew and it provides a lot of interesting opportunity for those looking to hedge a long delta bias.

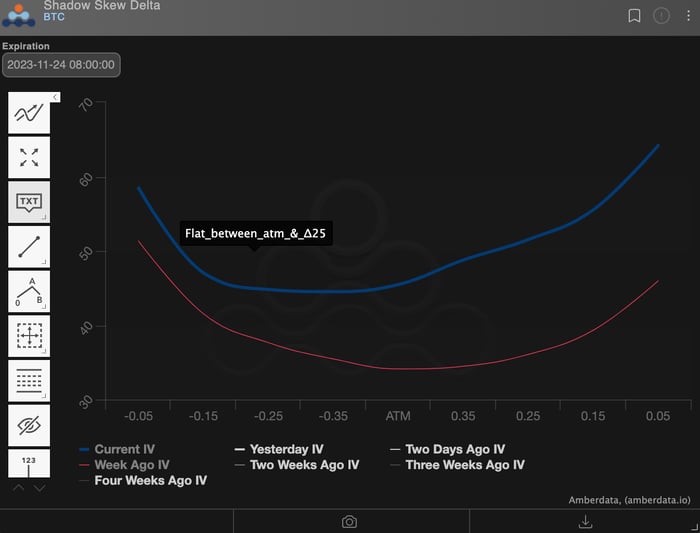

Chart: (11/24 EXP Skew evolution W/W in delta space)

As Implied volatility has risen week over week, we can see that the call wing of the ladder has led most of the charge, while the put wing has greatly underperformed in the -∆25 space.

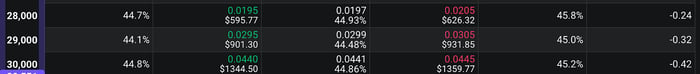

Now that the put wing is flat, traders can construct interesting 1x2 trade structures (long the 2) and buy the underlying BTC on a hedged basis. (-1/30k & +2/28k)

This seems like the most interesting way, safely, get long BTC in size.

Also, given the flat term structure, any drop in IV will likely be concentrated in the front-end of the curve. 30-DTE will likely see less impact but it’s something to be aware of.

Trading some premium away via a few OTM short-term calls could be an additional leg, given the current pricing.

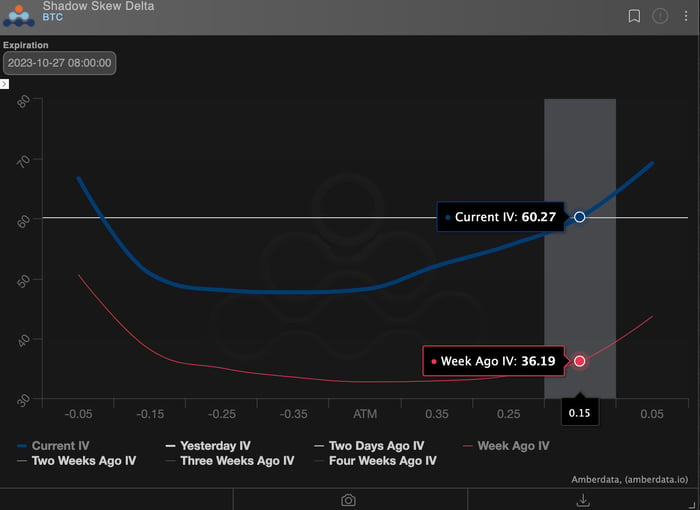

A massive move in IV W/W.

Chart: (10/27 EXP Skew evolution W/W in delta space)

Chart: (BTC 7-DTE ATM IV W/W)

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

Interest has taken a turn from last week, returning to “BTC is king" (as it has always been).

This time last year, the predominant topic of discussion revolved around the “flippening" in the options space.

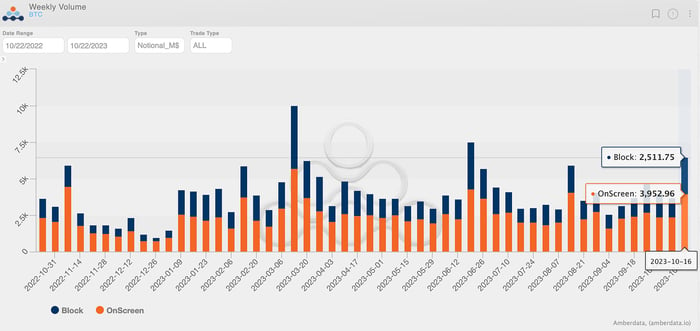

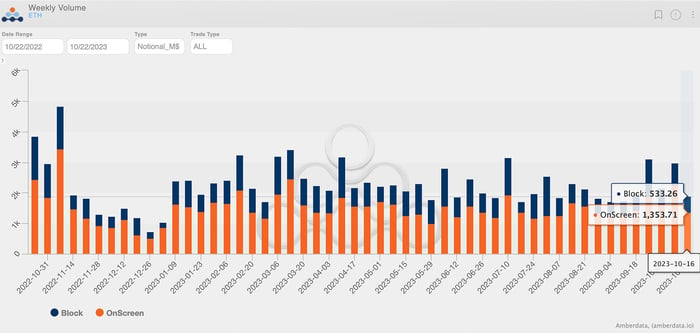

However, the reality is that we've witnessed the “tripling”: BTC is trading three times the volumes compared to ETH (the same is valid for the general market cap).

Chart: (BTC Weekly Volumes)

Chart: (ETH Weekly Volumes)

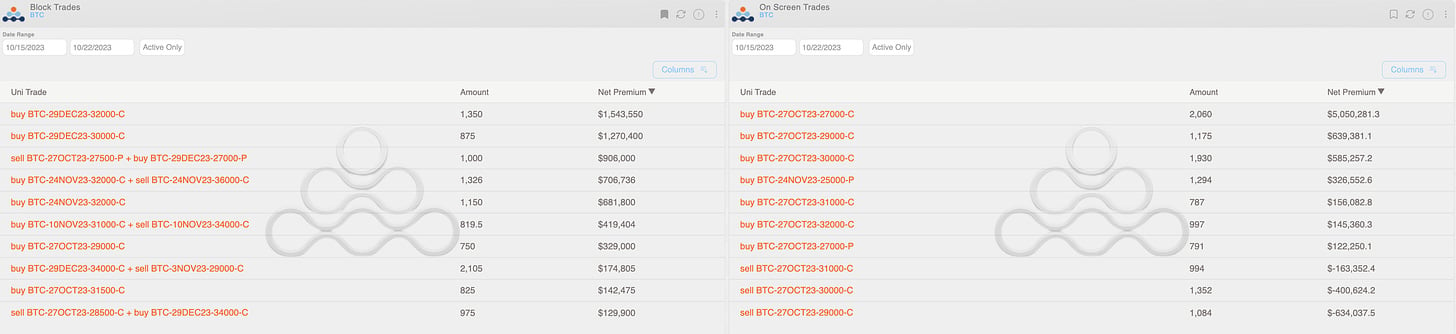

What stands out when observing the main trades of the week is certainly the buy-back of $27k calls with the monthly expiration of October.

Part of the buy2close flow was generated by the Deribit engine (i.e."liquidations"), but my thesis is that it was mainly a manual intervention by the involved trader.

Regardless of the method, what is striking is that the total volume generated by the trade went bad when reaching over $5M.

Chart: (BTC Top trades)

The buy of naked calls in December, along with a long call spread in November/December, completes a rather bullish picture on Bitcoin, reflecting the positioning of traders as:

Chart: (BTC Top trades)

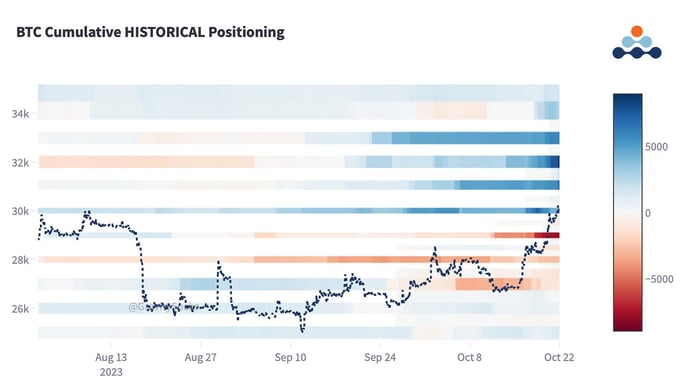

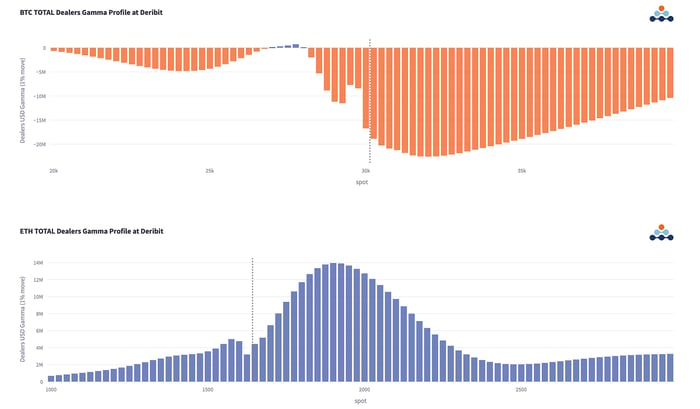

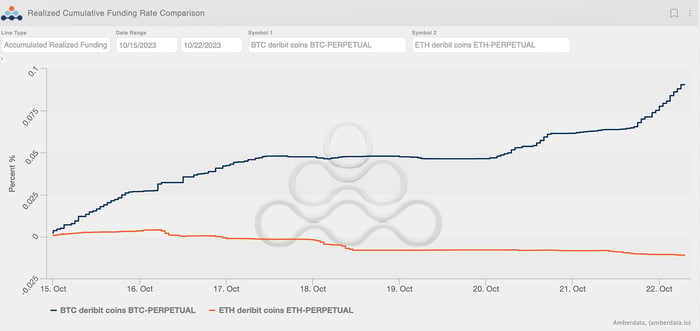

The gamma profiles continue to exhibit strong asymmetry, with dealers compelled to buy Bitcoin and sell Ethereum for every upward movement. Certainly, this element is influencing the ETH/BTC pair and funding on Deribit.

Chart: (BTC Top trades)

(Deribit Cumulative Funding)

Paradigm's Week In Review

Are we back?

Busy options flows alongside BTC’s 10% weekly rally!

Paradex volumes heating up! 🔥🔥🔥

Check out weekly flows, heatmaps and vol moves below!

BTC +10% / ETH +4.5% / NDX -3.5%

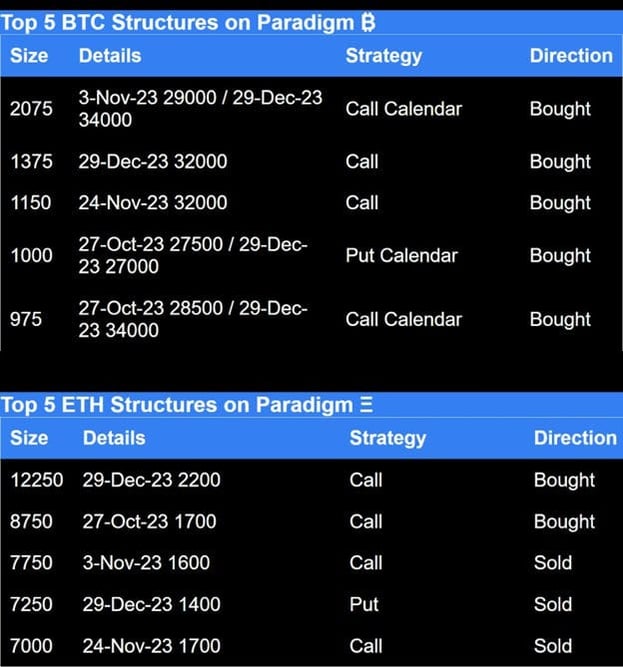

Paradigm Top Trades this Week 🔥👇

Nov/Dec BTC upside buying was a main theme.

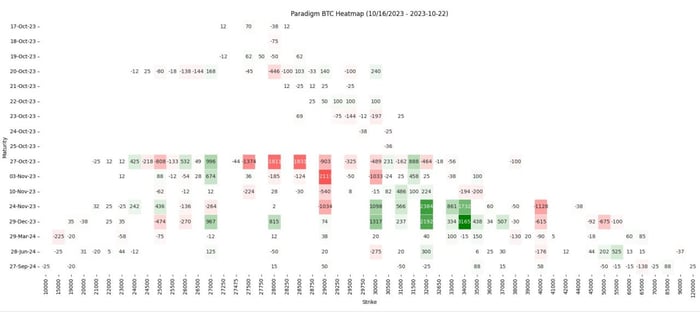

Weekly BTC Heatmap (taker perspective) 🌊

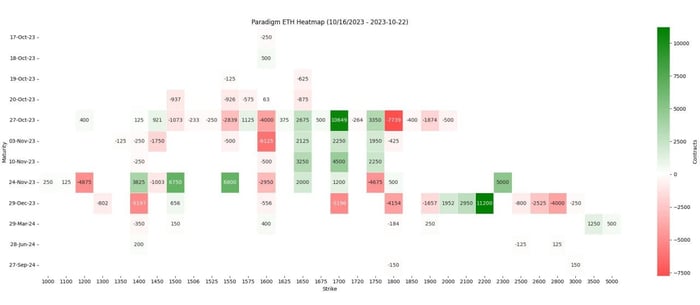

Weekly ETH Heatmap (taker perspective) 🌊

BTC Vol moves

Strong bid for BTC Nov/Dec topside, reflecting in 2 month IVs breaking through 45v. BTC RV, which has lagged vs. ETH recently, picked up steam w/ rally.

Paradex volumes going parabolic!

Doubling volumes every week makes for some nice chart porn 🚀 pic.twitter.com/4m2CWr6ZNS

— Paradex (@tradeparadex) October 22, 2023

Our latest Crypto Volatility review by @BlockScholes has just been released. 🔥

It's a deep dive into September's Volatility Premia and Relative Vol levels.

Dive in --->

Our latest Crypto Volatility review by @BlockScholes has just been released. 🔥

— Paradigm (@tradeparadigm) October 19, 2023

It's a deep dive into September's Volatility Premia and Relative Vol levels.

Dive in --->https://t.co/L2hd8r4csg

Hit us up on Telegram! 🙏

Paradigm Edge: Daily Commentary✍️ http://pdgm.co/edge

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

Bybit x Paradigm Futures Spread Trade Tape:

https://t.me/paradigm_bybit_fspd

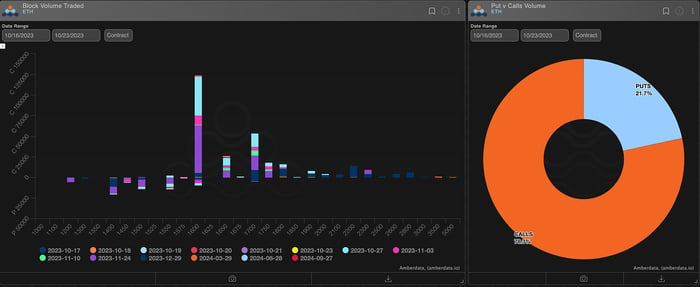

BTC

ETH

The Squeethcosystem Report (10/15/23 - 10/22/23)

Crypto markets found their way lower throughout the week. ETH ended the week -4.81%, oSQTH ended the week -9.88%.

Volatility

oSQTH IV continued to trade in a large range from the mid 20s - mid 40s.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $204.65k.

October 20th saw the most volume, with a daily total of $44.21k traded.

Crab Strategy

Crab saw gains during the week, ending at +0.58% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...