Crypto Options Analytics, Oct 1st, 2023: ETF and volatility insights

USA Week Ahead:

-

Monday 10a ET- ISM manufacturing

-

Wednesday 8:15a ET- ADP Employment

-

Wednesday 10a ET- ISM Services

-

Friday 8:30am - NFP

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH, and Lyra and may change their holdings anytime.

MACRO THEMES:

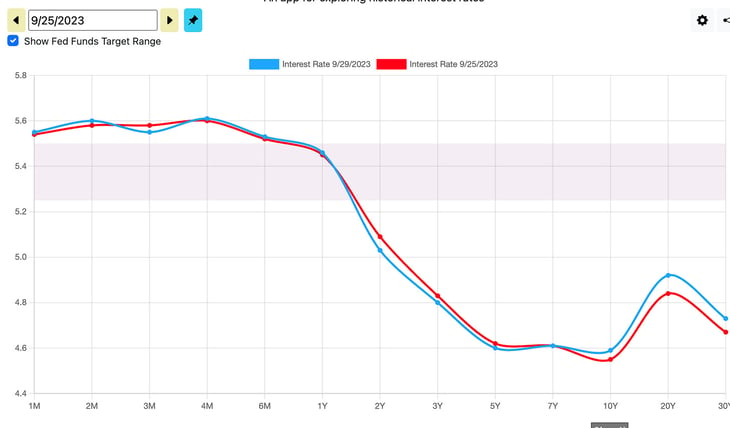

US Rates!

We’re seeing a massive move higher in longer-term US rates week-over-week.

That has been a catalyst for risk-off sentiment and a dollar rally.

What’s great to see is the relative strength in crypto despite this move higher in rate.

I’d expect higher rates to drag on crypto spot prices, but so far, that hasn’t been the case.

This week we have NFP which could bring a bad “print” causing relief in this bond market selling and equity market drag.

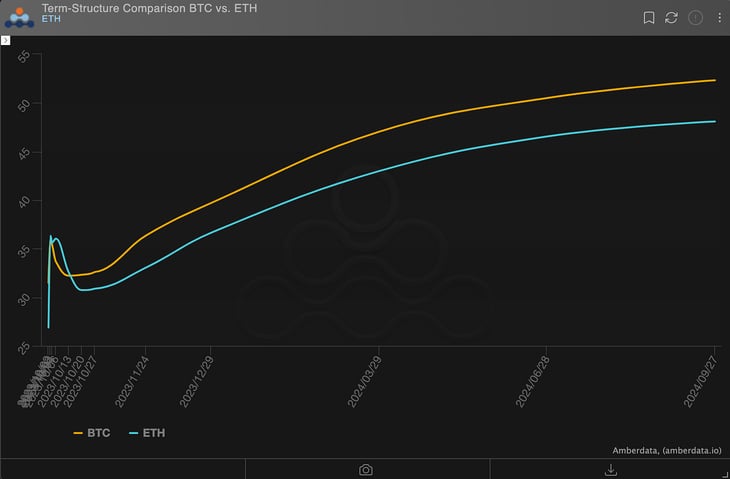

BTC: $28,124 (+7.8% / 7-day)

ETH :$1,728 (+9.9% / 7-day)

The biggest theme and source of activity this past week was around the ETF news.

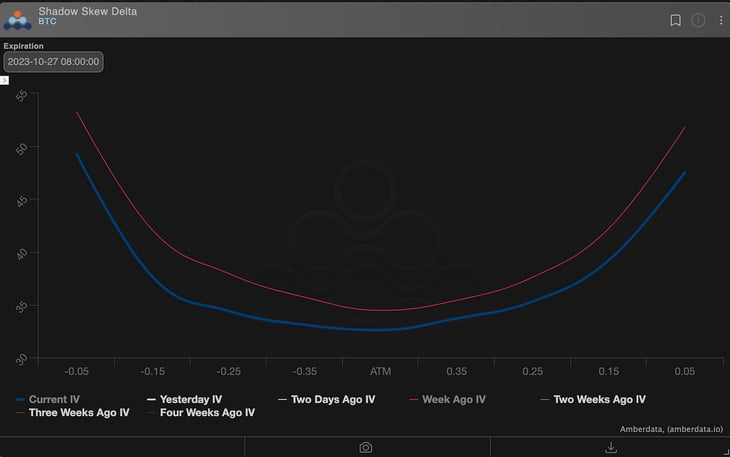

Delays for BTC’s spot ETF removed some of the enthusiasm for BTC’s 10/27 expiration cycle.

Vol trader’s had previously hoped that some good news or anticipation in October would spark some activity, but now that the timeline has been extended, IV has lost it’s October kink.

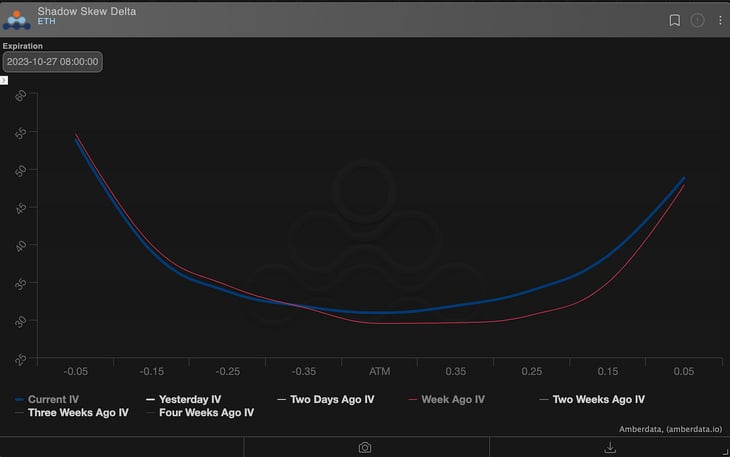

However, ETH ETF news has now kicked in. The idea, although rather predictable, is we could soon see approval for a BITO like ETF in Ethereum.

This is different from the spot ETF and instead would create an ETF that trade CME Ethereum futures as the underlying.

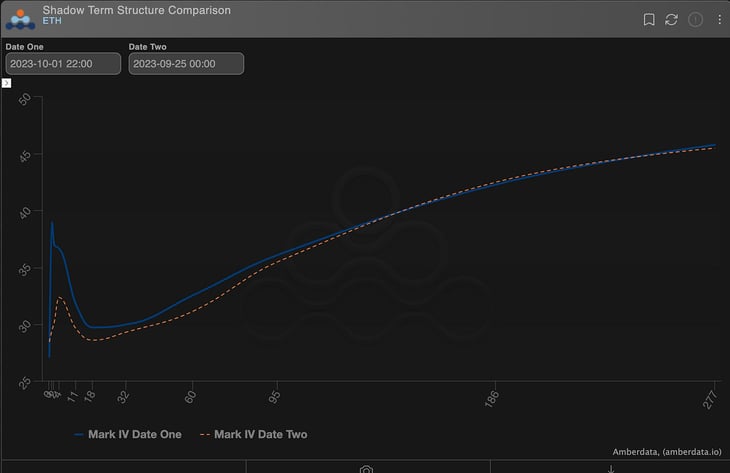

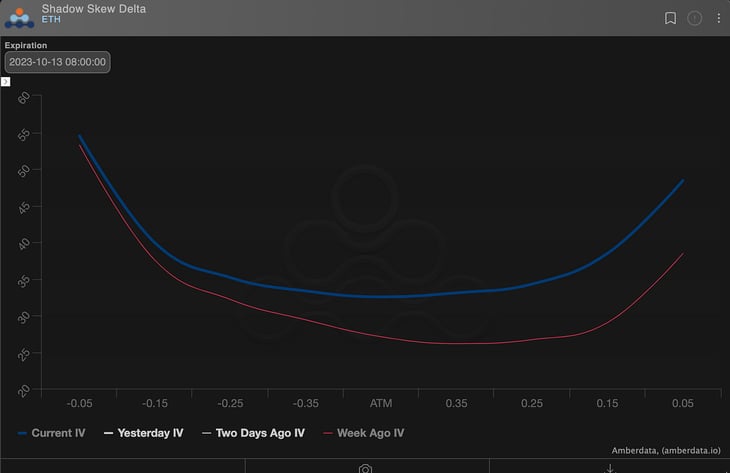

We can see however that most of the ETH vol buying was located in the front-end of the expiration curve.

Short-term options rallied much more. We can see the 10/13 expiration move substantially week-over-week.

I expect this ETH relative volatility pop to be rather short-lived give this fundamental catalyst.

The reason there is any excitement around the BTC SPOT etf is because BITO isn’t a clean product to trade. It’s a derivative of a derivative, with listed option derivates on top of it.

Derivative^3. Eh.

By that logic, the excitement around a BITO like Ethereum ETF seems non-compelling to me.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

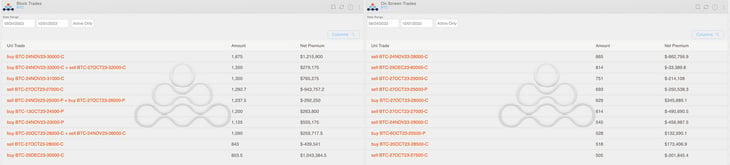

The overview of the week has been as follows: short gamma positions on the screen vs. bullish vega on blocks.

On the Bitcoin front, the focus on-screen was on selling monthly calls for October with strikes at $27k-$28k-$29k. However, in contrast to recent weeks, the bulk of the volume was seen in blocks, with long positions on November $30k calls and buy-to-close on December 30k calls suggesting a bullish outlook in the medium term.

(BTC Options Scanner Top Trades)

(BTC Options Scanner Volume Oi Ratioed)

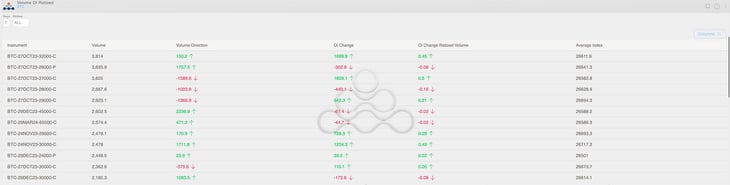

A similar scenario is also observed for Ethereum, with the buy-to-close of October 1.9k and December 2.0k, but this time accompanied by a mixed and two-way call’s flow in November.

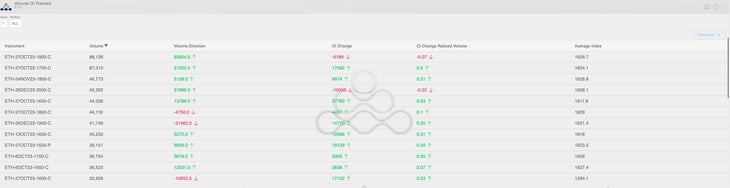

(ETH Options Scanner Top Trades)

(ETH Options Scanner Volume OI Ratioed)

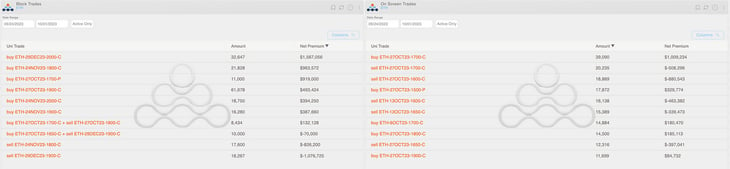

Paradigm's Week In Review (Sept 25 - Oct 1)

Nov upside buying

New #TBP w/ Amberdata!

Paradigm RFQ vs. Orderbook

BTC +4% / ETH +6% / NDX +0.50%

BTC Flows 🌊

The large November topside buying vs. selling Oct flow continued this week, corresponding w/ BTC spot ETF approval delays

1. 1350x 27-Oct-23 32000 / 24-Nov-23 33000 Call Calendar bought

2. 1350x 24-Nov-23 31000 Call bought

Protection Buying 🌊

Takers bid for downside on Paradigm, prevalent in short dated 25 delta skews, which puts trade in line with calls in Oct/Nov.

1200x 29-Sep-23 24000 / 13-Oct-23 24500 Put Calendar bought

1175x 24-Nov-23 23000 Put bought

11000x 27-Oct-23 1700 Put bought

ETH Flows 🌊

1. 18750x 24-Nov-23 2000 Call bought

2. 16030x 24-Nov-23 1900 Call bought

3. 11000x 27-Oct-23 1700 Put bought

4. 10000x 27-Oct-23 1650 / 29-Dec-23 1900 Call Calendar sold

5. 8046x 27-Oct-23 1700/1800 Call Spread bought

The newest #TBP just aired with @Gravity5ucks from @Amberdataio, and it's 🔥

We chat about:

📊$ETH dealer profiles

⚖️Net Gamma rebalancing

🦔Using perps to hedge

🦣Large MM flows

👇

Paradigm Order Book vs. RFQ Liquidity Protocol. See how traders use both to maximize PNL 🔥

1/ The utilization of our OB features in Option block trading is on the rise.

— Paradigm (@tradeparadigm) September 28, 2023

But, what sets it apart from the RFQ method? 🤔

Let's take a closer look. 👇🧵 pic.twitter.com/7G9k1WyhnE

Hit us up on Telegram! 🙏

Daily Commentary✍️ http://pdgm.co/edge

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

Bybit x Paradigm Futures Spread Trade Tape

Crypto markets found their way higher throughout the week. ETH ended the week 5.68%, and oSQTH ended the week at 10.36%.

Volatility

oSQTH IV was incredibly active this week, making a few round trips from the 60s to the 30s.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $212.5k

September 20th saw the most volume, with a daily total of $68.91k traded.

Crab Strategy

Crab saw gains during the week ending at +1.41% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...