.png)

-

Thursday 8:30 am - Q4 GDP First Estimate

-

Friday 8:30 am ET - Core PCE

-

Friday 10 am ET - UMich Inflation Expectations

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math minded people here, pardon any typos.

THE BIG PICTURE THEMES:

Cryptocurrencies have shown a lot of momentum and relative strength against equities last week.

Although equities severally dropped intra-week, BTC held firm. Later in the week equities recovered some lost ground, while BTC legged higher into the weekend.

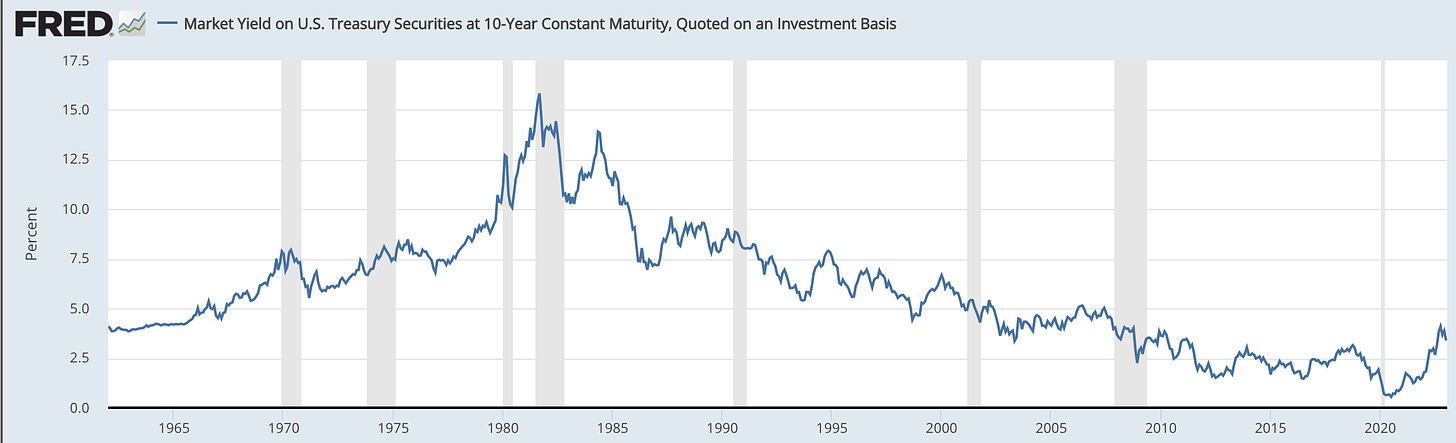

GOLD is another asset showing a lot of strength as yields are coming down in treasuries.

BTC and GOLD seem to be responding to a rally in bonds (drop in yields), which could continue, given the potential for even further drops in treasury yields, as long as CPI behaves.

BTC: $22,763 +7.65%

ETH :$1,639 +4.57%

SOL: $24.62 +6%

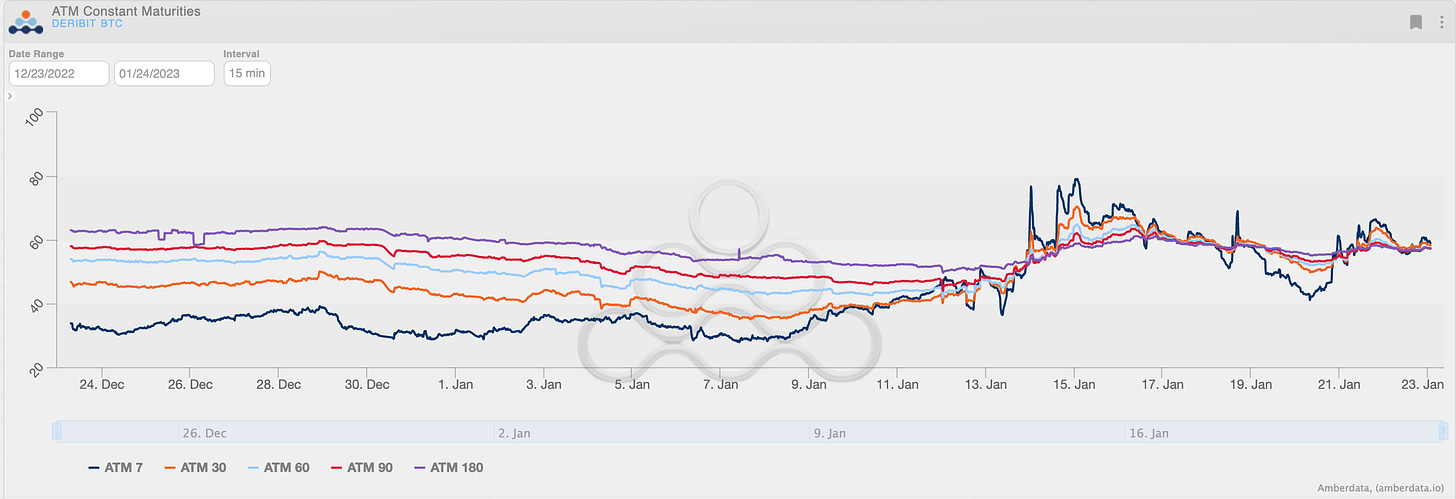

TERM STRUCTURE

(Jan. 22nd, 2023 - BTC Term Structure - Deribit)

The term structure is confirming as strong positive spot/vol. correlation.

We’re seeing explosive upside moves that keep pushing the term structure into Backwardation.

Further, in the flow, OTM calls have been especially active this past week.

Given this clear relationship, we can then look at the RR-Skew (see below) for opportunity in the wings.

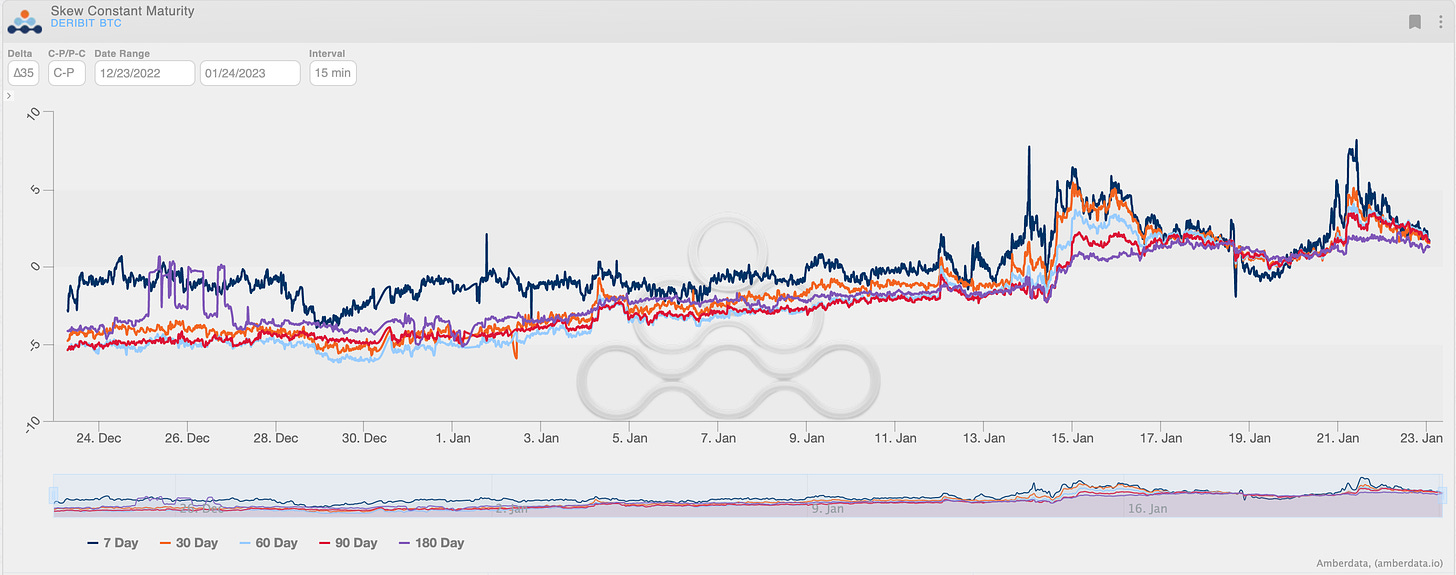

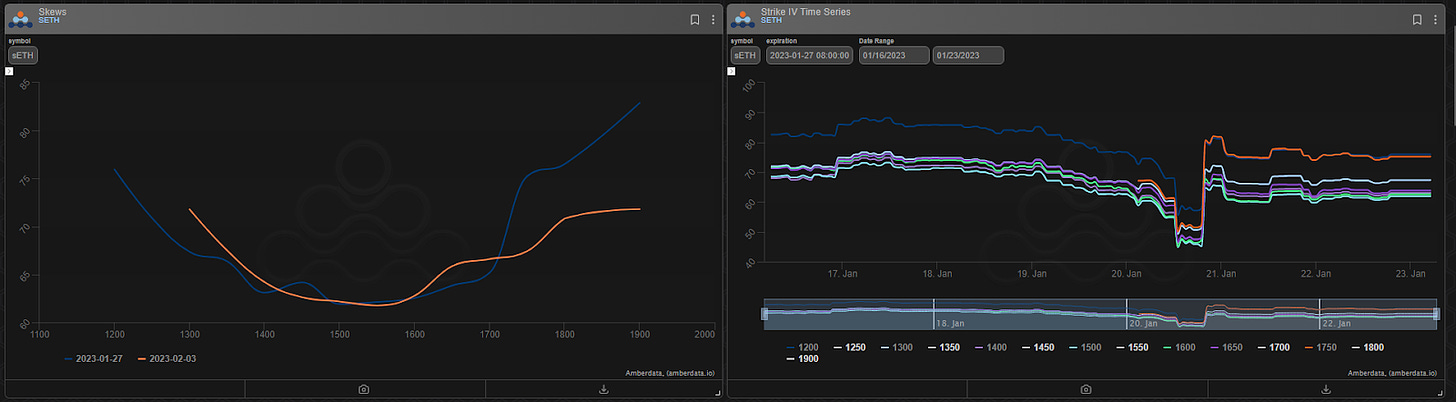

SKEWS

(Jan. 22nd, 2023 - BTC RR SKEW (C-P) ∆25 - Deribit)

Here’s something very interesting to me and provides an opportunity on the surface.

Generally speaking, short-term skews can take a WIDE range of shapes, they are the most fluid. Long-term RR-Skew reflects established trends.

When BTC was stuck around $21k last week, IV dropped and the term structure went into Contango, but 7-day RR-Skew dropping below 0 was a surprise to me.

The spot/vol. relationship still seemed valid.

Further, the long-term RR-Skew remained elevated into positive territory, which arguably is the most justified to remain NEGATIVE given the strongly established spot/vol. trends of 2022.

There’s opportunity here.

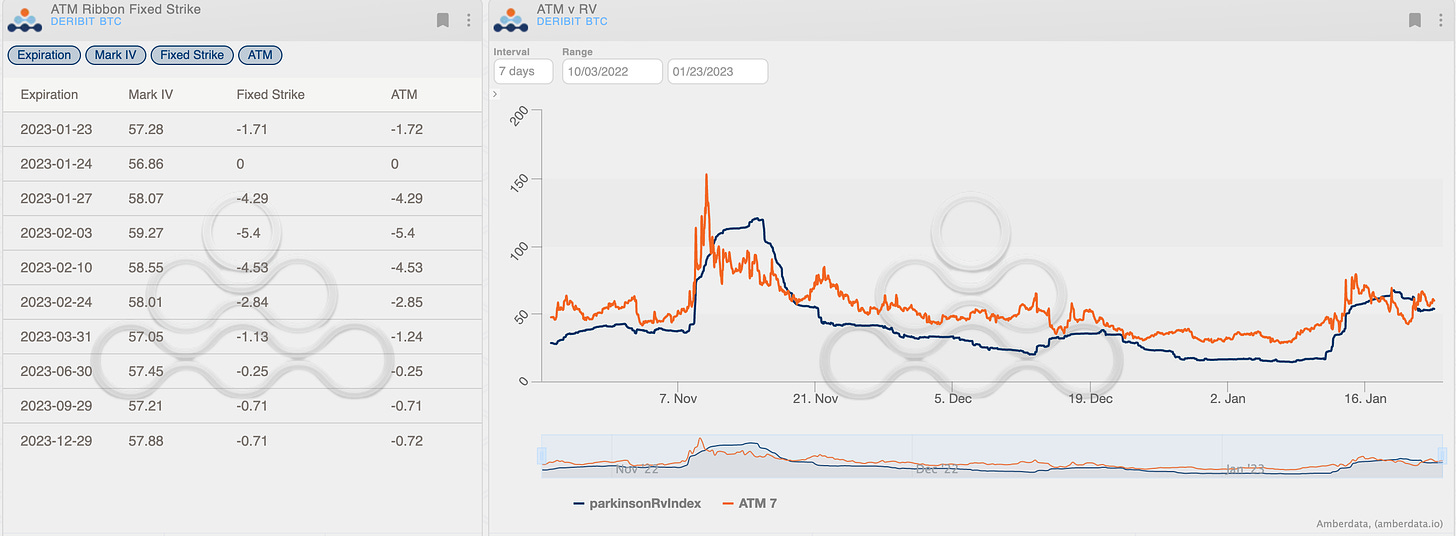

VOLATILITY PREMIUM

(Jan. 22nd, 2023 - BTC IV-RV)

Realized volatility is paying option-holders nicely, coming out from decade lows.

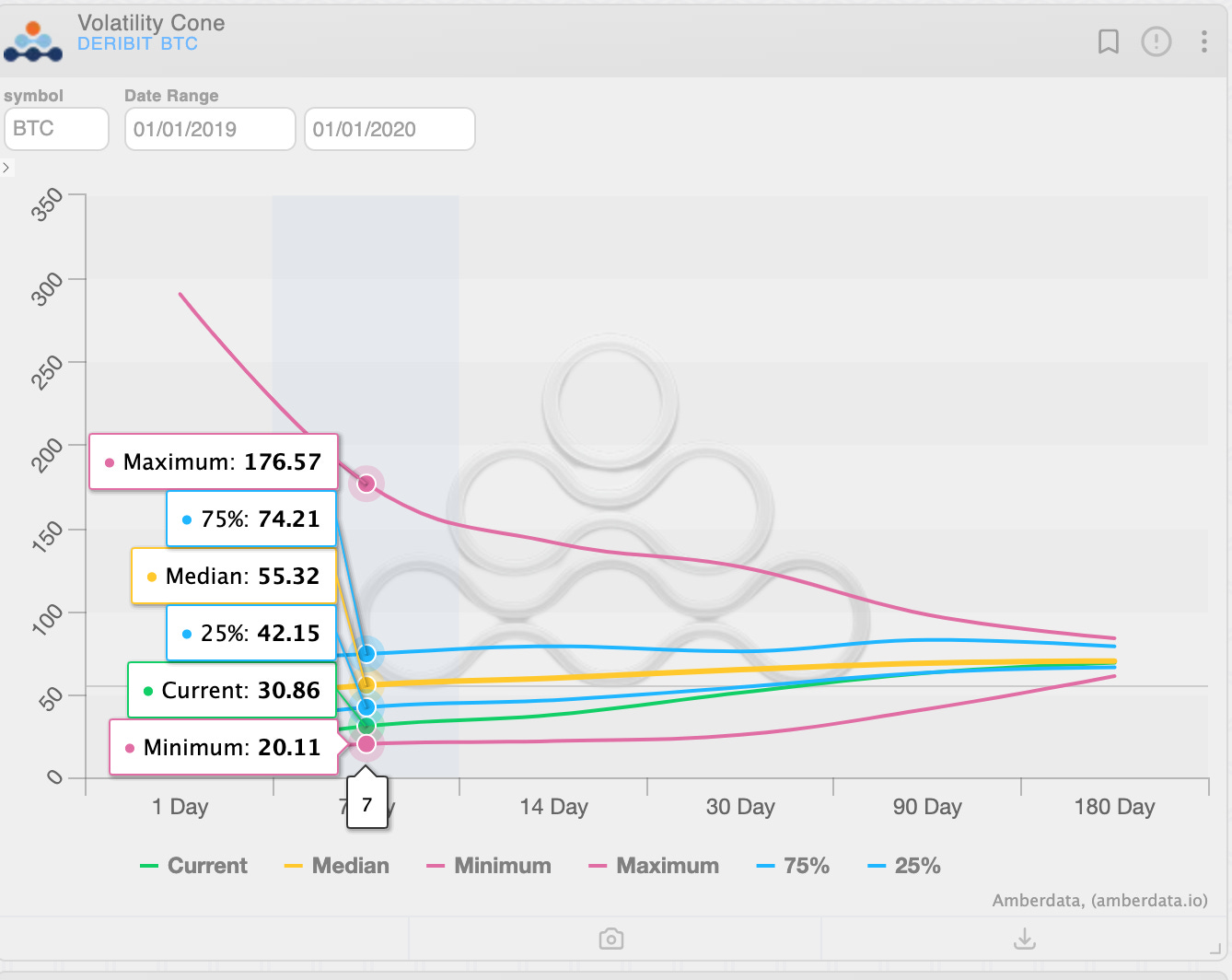

Using 2019 as a template for 2023 - a year the previous bear market ended - we can see that median RV was 55% for 7-day measurements throughout.

This is currently where we’re priced… This is a decent template to assume “fair value”.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

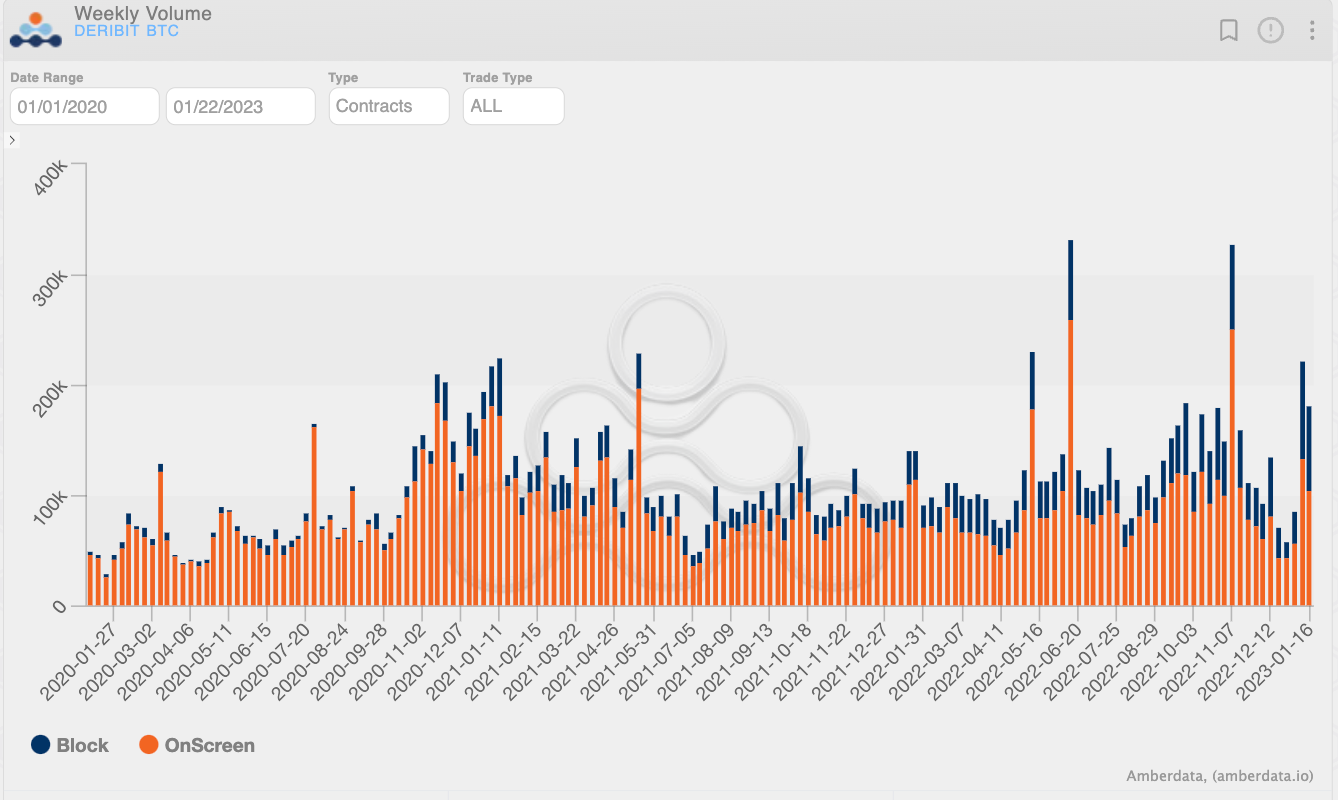

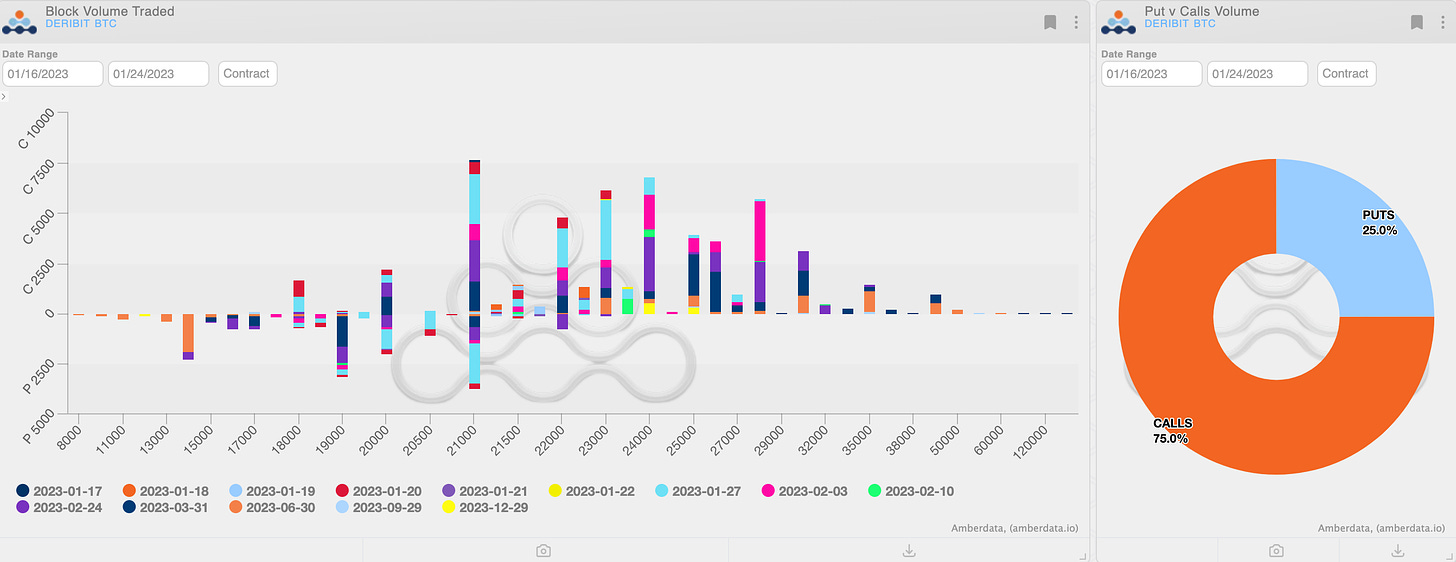

Weekly volumes that confirm absolute attention towards the options market, with levels that match the first weeks of 2021 when price went parabolic.

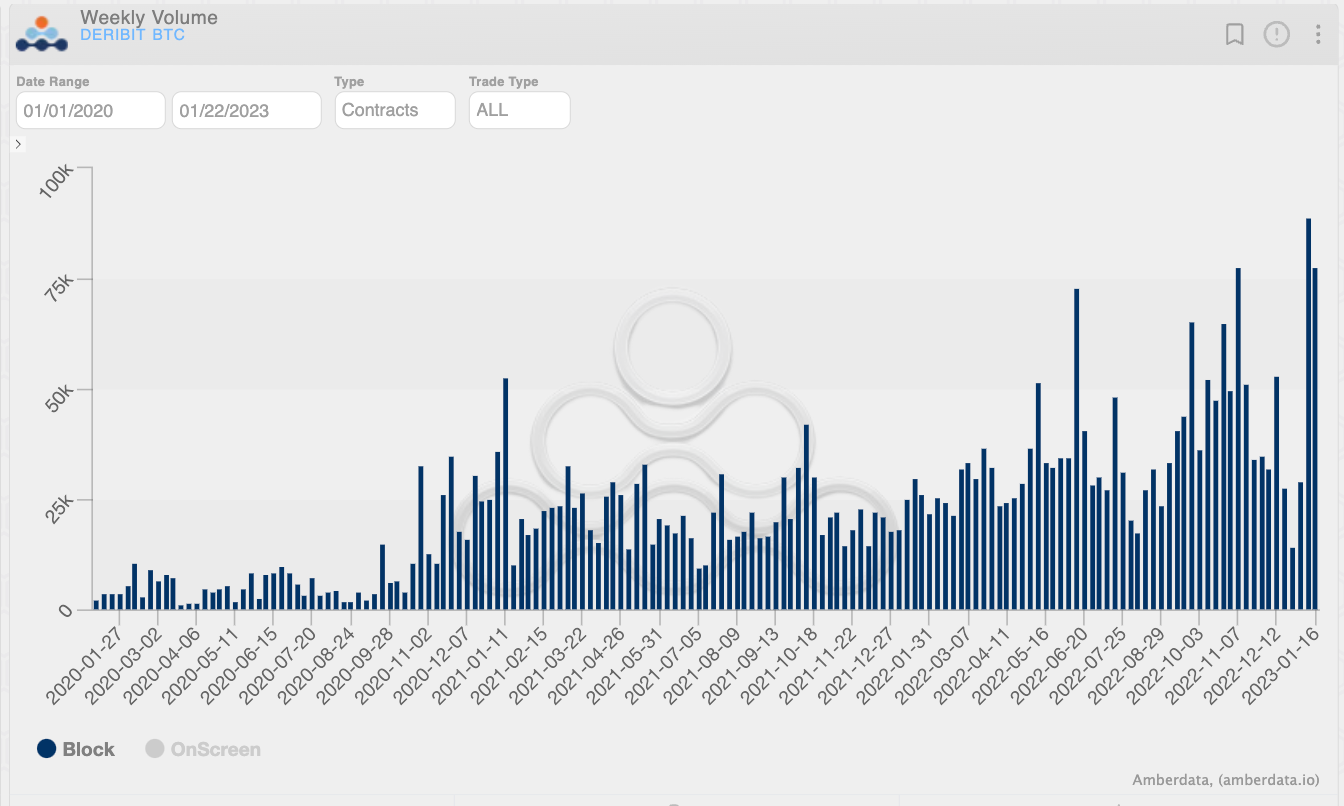

Blocks traded on Paradigm are at absolute highs. Amazing!

(BTC Weekly Volumes Contracts- Options Deribit Historical Section)

(BTC Weekly Volumes Contracts Block - Options Deribit Historical Section)

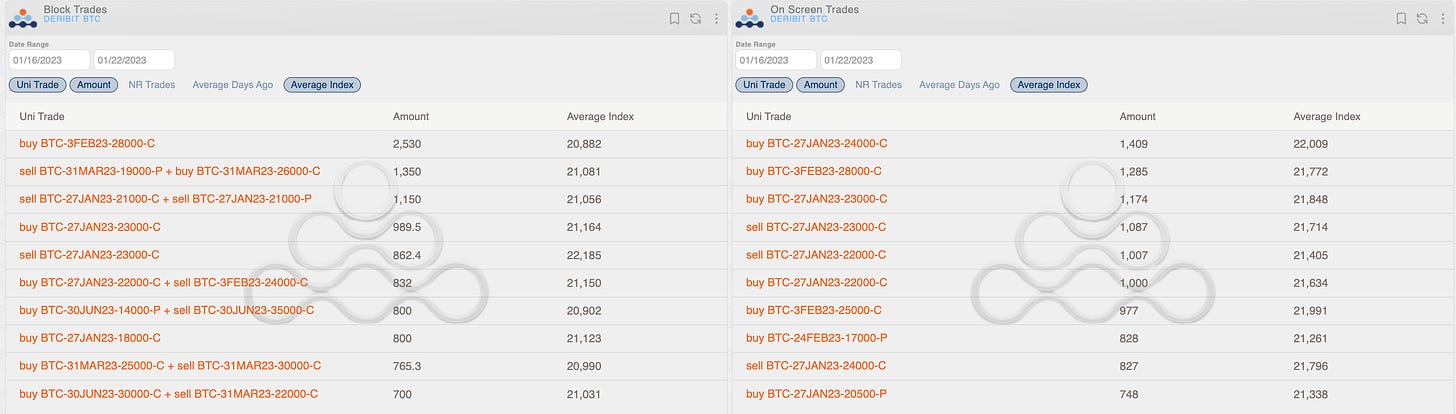

Among the “Top trades” of the week to be noted, the purchase of $28k call 3FEB and the sale of straddle $21k 27JAN after days of relative calm and just before the upward break of 22k.

Lastly, an interesting purchase on-screen on Deribit of 24k call.

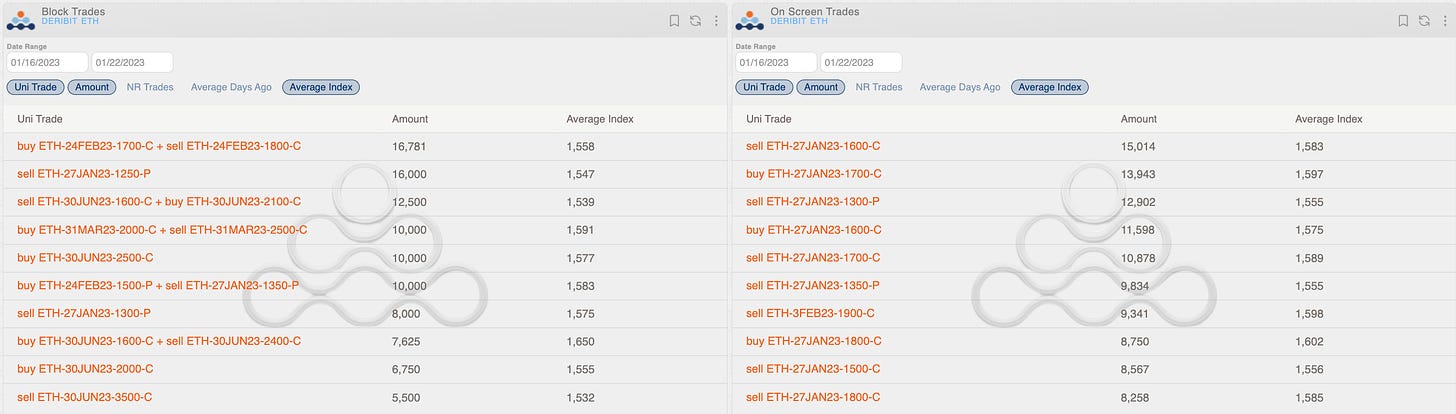

(BTC AD direction table with uni_trade - Options Scanner section)

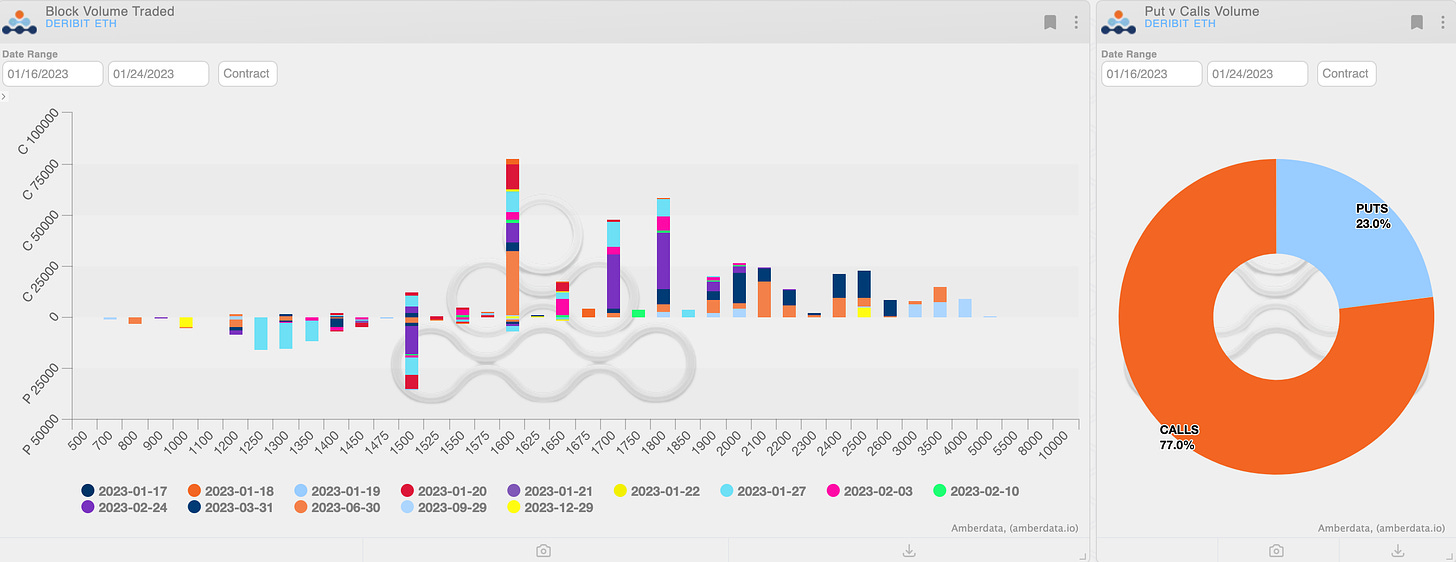

On Ethereum, a narrow call spread on February and a classic buy-the-dip with selling of puts $1250-$1350, when spot dipped around $1500 mid-week.

(ETH AD direction table with uni_trade - Options Scanner section)

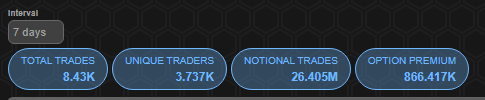

Paradigm Block Insights (16Jan - 22Jan)

Takers closing upside risk early in the week, which shifted back to resume topside buying on Thurs/Fri as spot rallied.

WTD: BTC +11% / ETH +7% / NDX +1%

YTD: BTC +39% / ETH +38%

Important to note: the significant shift in BTC skew. Short-dated 25 delta skew now 4-5 vols positive (Call - Put).

Vol markets pricing higher risk of gappy topside moves - similar to what we saw the past couple of weeks.

Heavy topside buying has left dealers short gamma, according to Genesis Volatility

GEX chart.

Perhaps more squeezy upside price action is to come. Check the prints below driving this dynamic.

BTC Flows

- 2530x 3-Feb-23 28k Call bot

- 1900x 27-Jan-23 23k Call bot

- 1129x 27-Jan-23 22k Call bot (through various calendar formats)

- 1000x 31-Mar-23 19k / 26k Bullish Risk Reversal bot

ETH Flows

Overall bullish flows of call spreads and closing of downside on the rally.

- 16656x 24-Feb-23 1700/1800 Call Spread bot

- 10000x 31-Mar-23 2000/2500 Call Spread bot

- 7625x 30-Jun-23 1600/2400 Call Spread bot

Downside closed out and rolling of puts:

- 16000x 27-Jan-23 1250 Put sold

- 8000x 27-Jan-23 1300 Put sold

- 10000x 27-Jan-23 1350 / 24-Feb-23 1500 Put Calendar bot

We had an amazing conversation with Simon Nursey and @hankimchii from @QCPCapital

this week.

It was a pleasure to discuss the options markets with some of the best in the game!

BTC

ETH

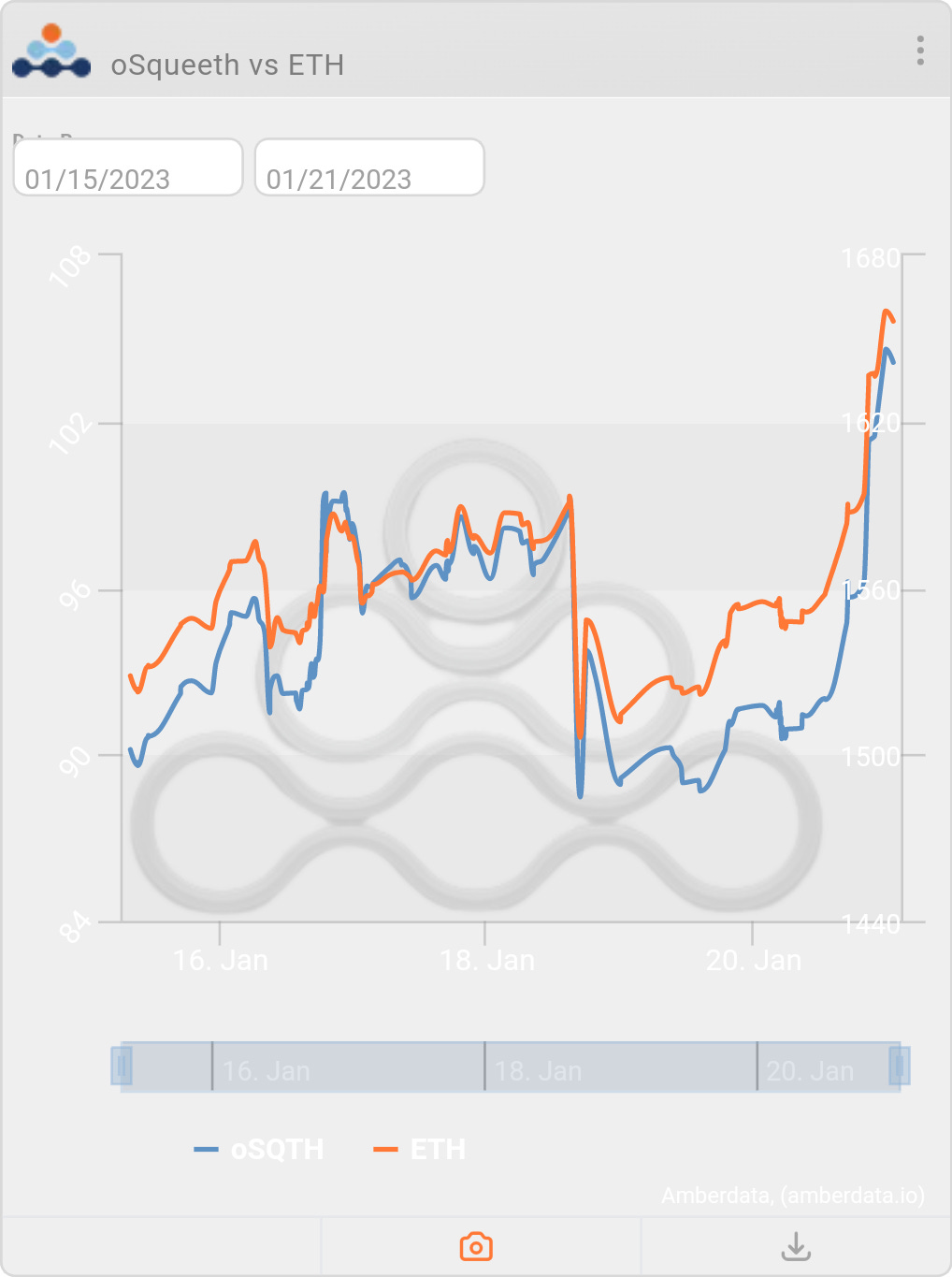

The Squeecosystem Report (1/15/23 - 1/21/23)

As the disbelief rally continues on the back of a better than expected macro environment, traders have forced buyers for the second week in a row. Spot markets continue to surprise upwards, with ETH ending the week +8.39% and oSQTH ending the week +15.48%.

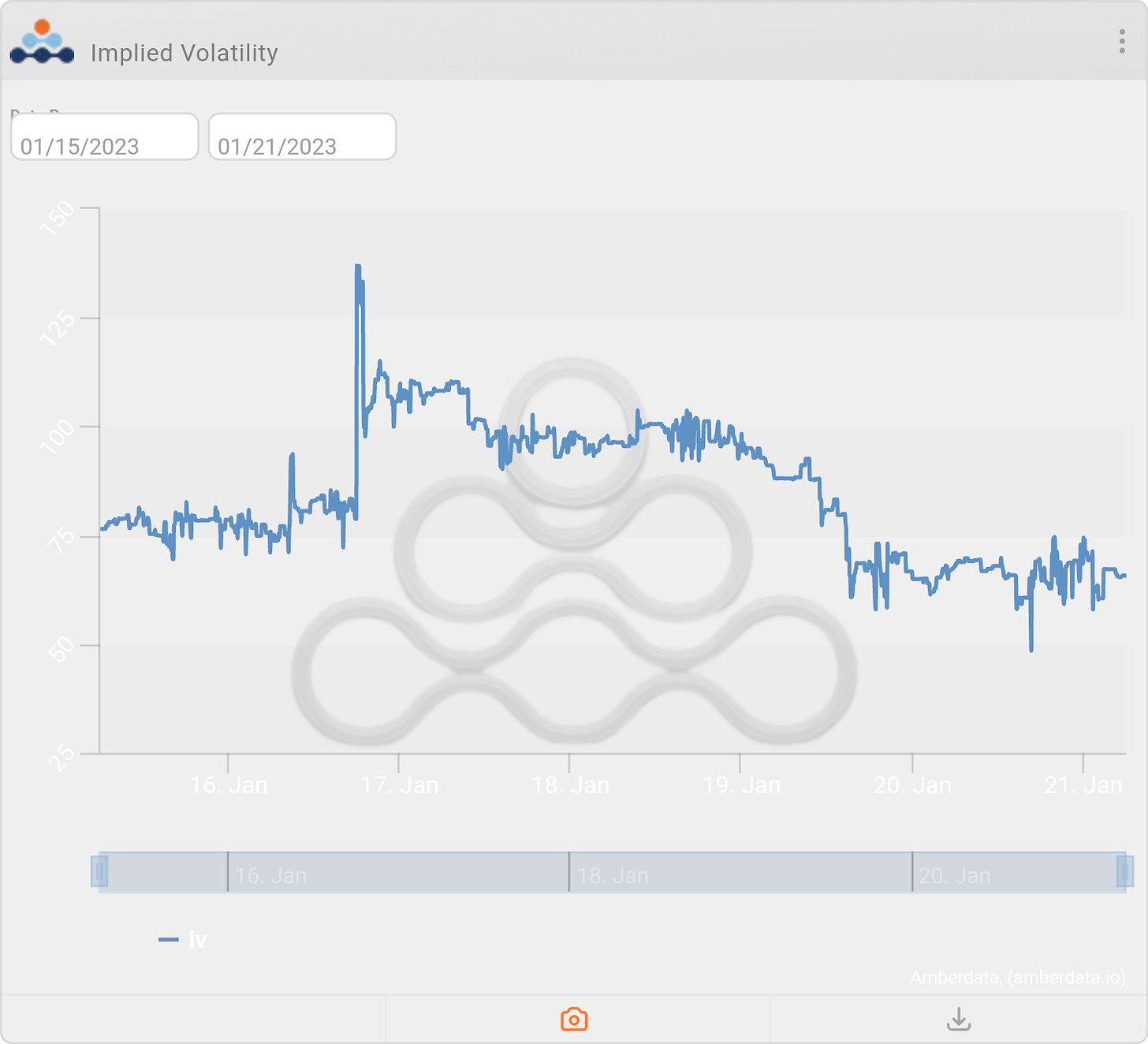

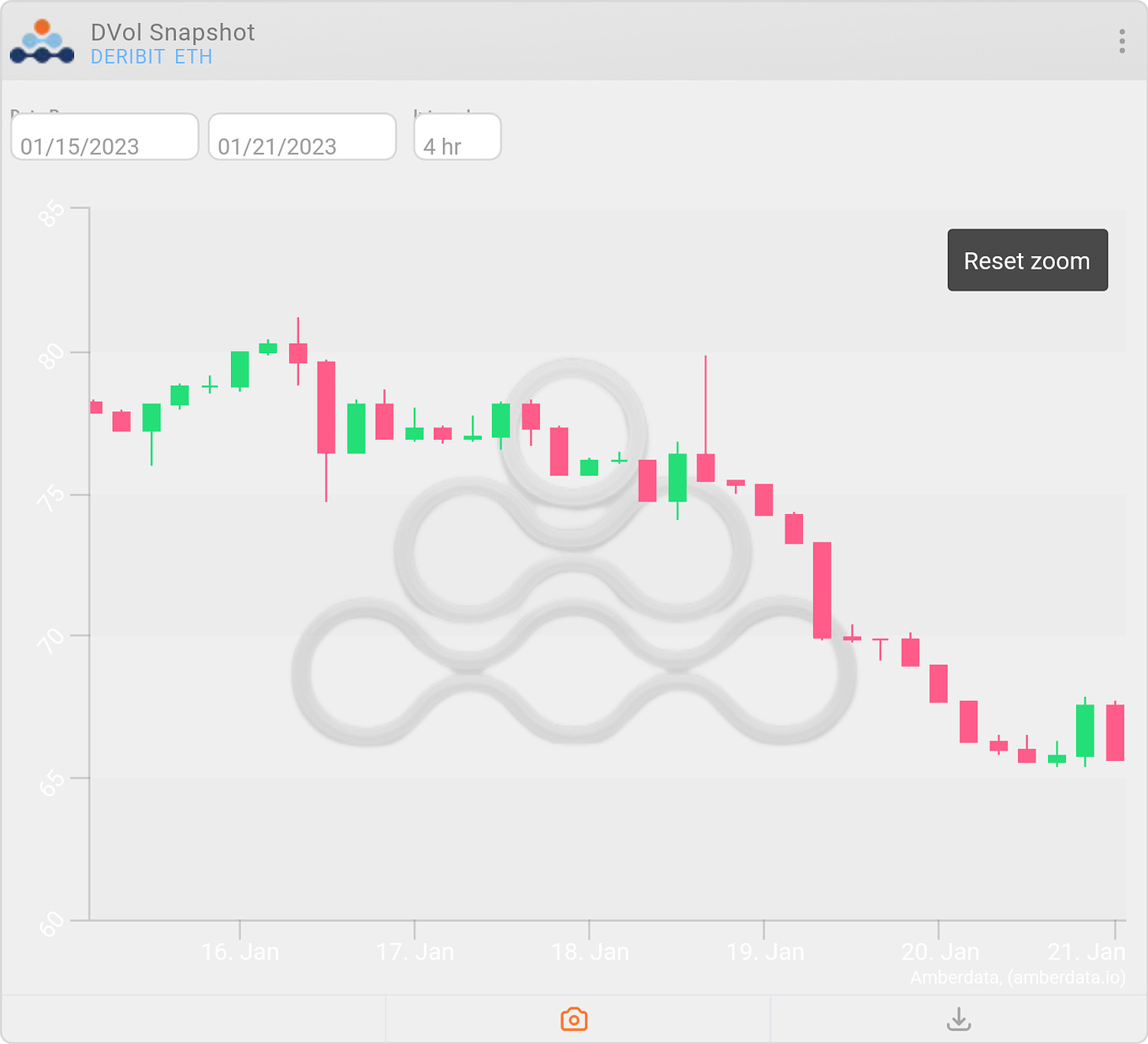

Volatility

This week, Squeeth IV was quite active. IV saw a quick uptick to +130% briefly on Jan. 16th; this provided great opportunities for traders to sell oSQTH vol or trade against its ref vol via Deribit ETH options.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $8.08m. January 16th saw the highest single-day volume, with a daily total of $2.32m traded.

Crab Strategy

Crab strategy bounced back, ending the week +1.92% in USDC terms.

Zen-Bull Strategy

Zen-Bull returned +0.71% for depositors in ETH terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

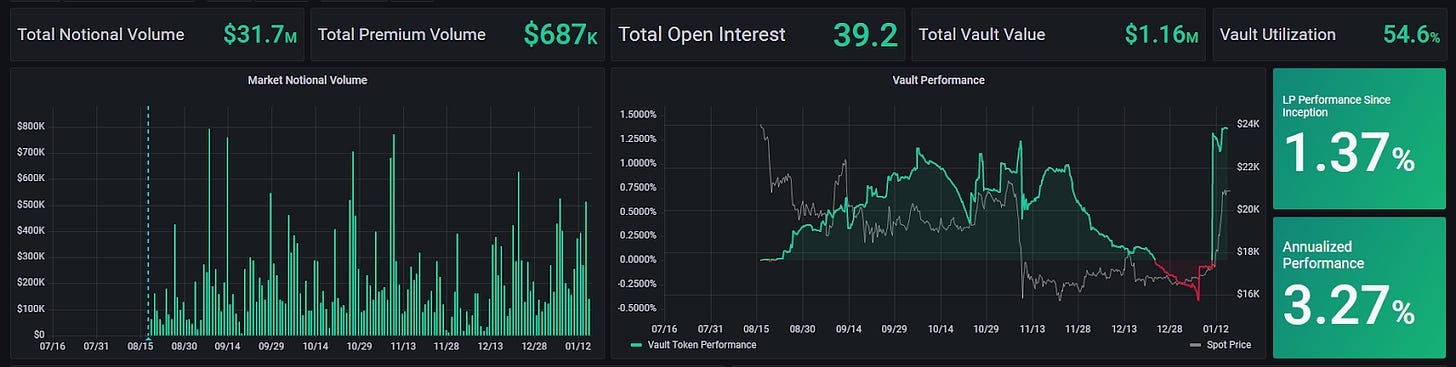

Lyra Weekly Review

Volatility

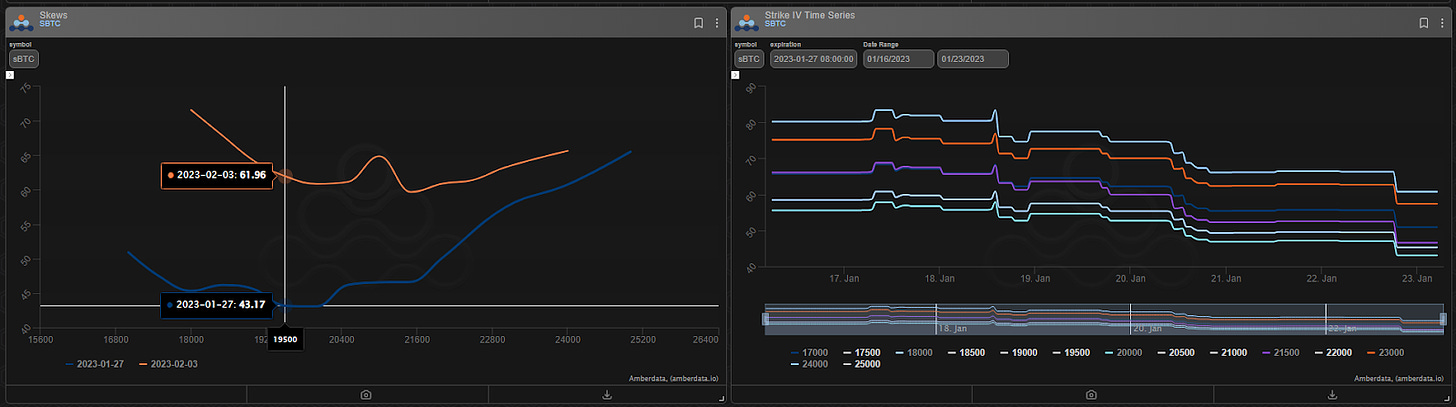

Current ATM IV is ~68% in ETH, normalizing to unchanged after a midweek spike. Upside volatility for the first time in some while gave the call skew some life and flipped the risk reversals to the call for a short time this week.

Trading

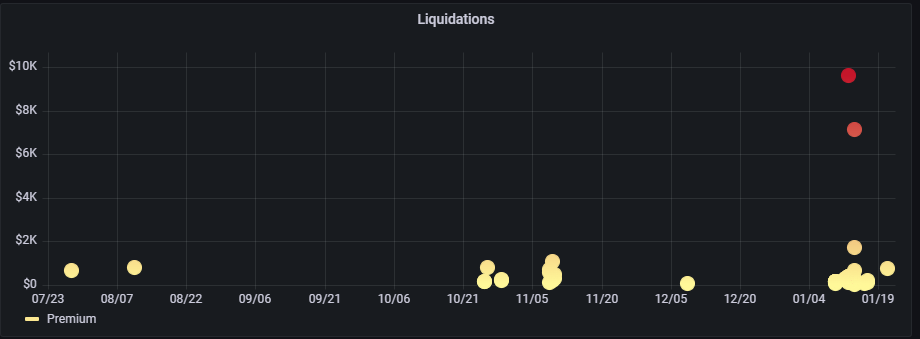

A surprise extension of this rally left many call sellers scrambling to cover and caused a big week for liquidations both at Lyra and across all exchanges.

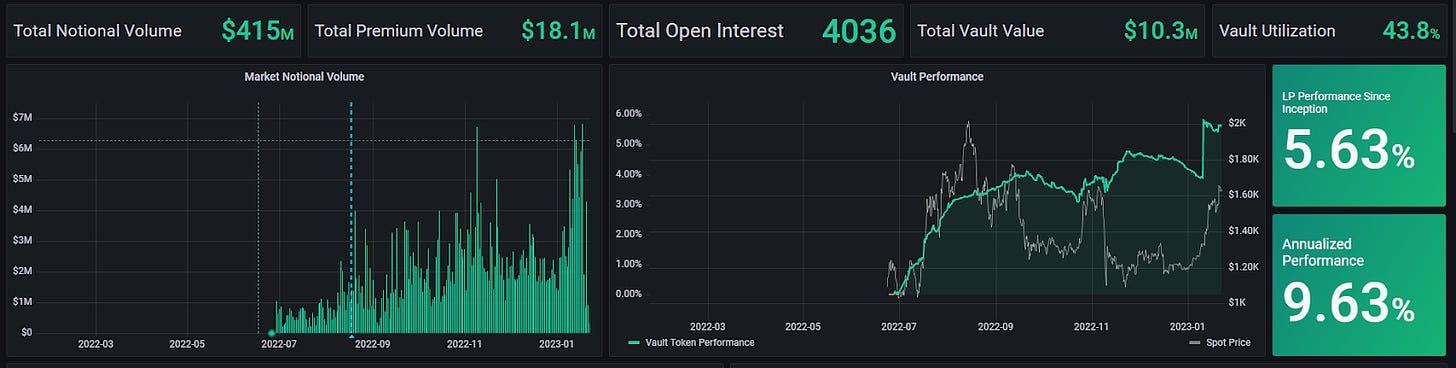

ETH Market-Making Vault

The ETH MMV has returned +5.63% since its inception (June 28th, 2022) representing a weekly change of -0.01. The MMVs managed to hang on to gains from last week. Annualized performance since inception is +9.63%

The ETH MMV boasts an impressive Sharpe Ratio of 1.79 despite some choppiness to returns caused by the rebate program. Lyra’s Avalon release in the coming weeks should help smooth returns and boost performance stats even higher. Cash collateralization of the AMM and hedging with perpetual futures will reduce fees paid by the MMV as much as 95% in the future deployment. You can read more about it here:

(3/4) The hedging fee it pays will also drop from 35bp to 10bp. In Avalon, Synthetix was providing rebates to the pools so they could trade with 10bp fees, but this caused the pool's performance to jump when rebates were deposited. Newport performance will be more consistent!

— Muir 🫡 (@muir_eth) January 12, 2023

Depositors earn an additional 16.1% rewards APY, boosted up to 32.2% for LYRA Stakers.

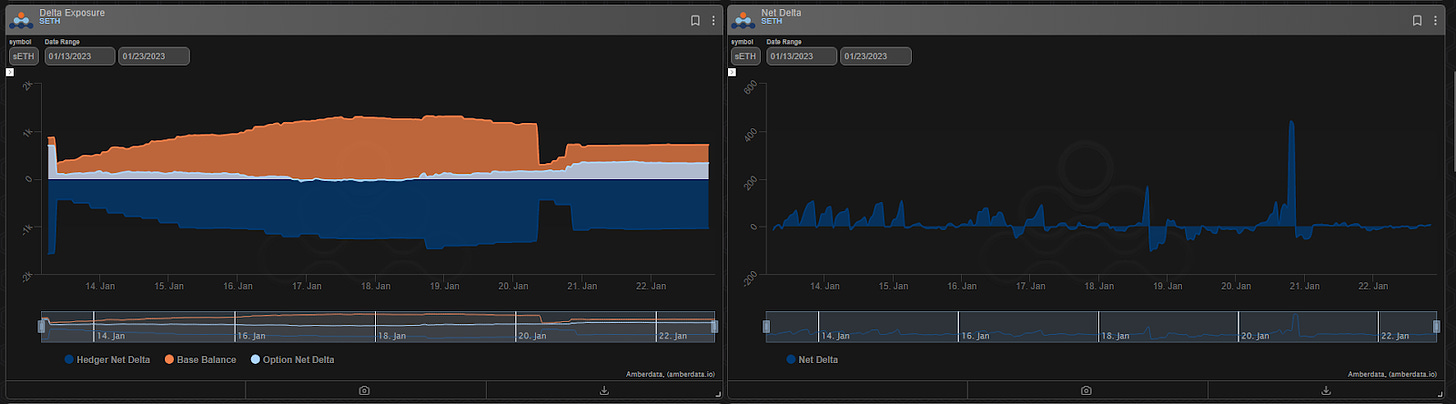

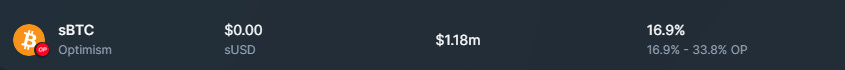

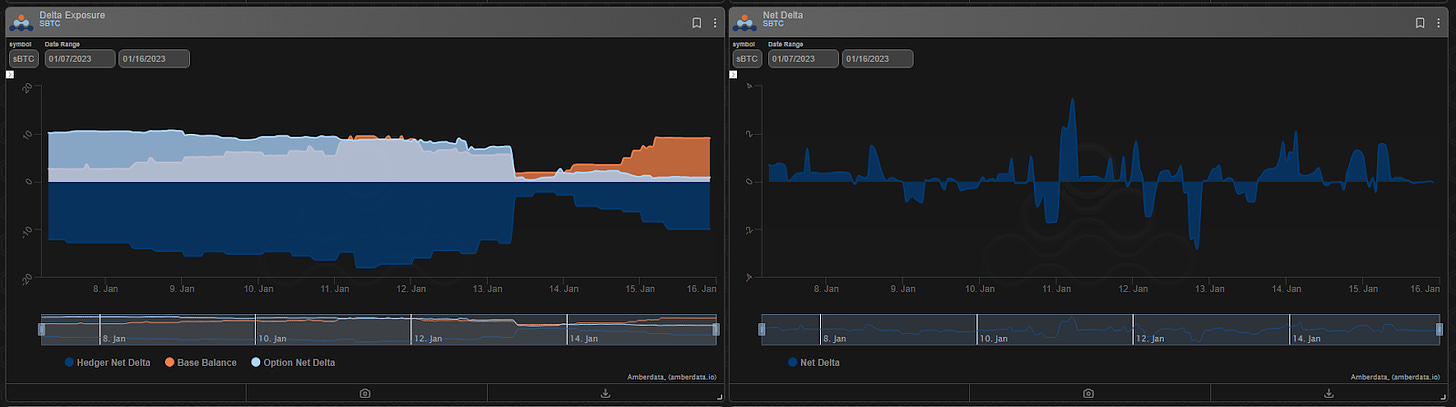

Net MMV Exposure:

BTC Volatility

BTC Market-Making Vault

Lyra’s BTC MMV has returned +1.51% since its inception (August 16th, 2022). This represents a weekly change of +.14%. Annualized performance since inception is +3.27%

Depositors earn an additional 16.9% rewards APY (boosted up to 33.8% for LYRA Stakers)

Net MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...