Crypto Options Analytics Nov 19, 2023: Lower CPI & BTC remains bullish

USA Week Ahead:

-

Monday 12pm ET -Fed President Tom Barkin TV appearance

-

Tuesday 2pm ET - Minutes of Fed's Oct. 31-Nov. 1 FOMC meeting

-

Thursday - Holiday (Thanksgiving)

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH, and Lyra and may change their holdings anytime.

CRYPTO OPTIONS MACRO THEMES:

CPI has surprised to the downside, missing on both headline CPI (4% vs 4.1% exp) and core CPI (3.2% vs 3.3% exp) annualized values.

Lower CPI = Lower Rates (or at least a pause from the FED) and this should provide a tailwind to risk assets and BTC holders. That said, YTD BTC has been trading by its own rules with excitement around a spot ETF.

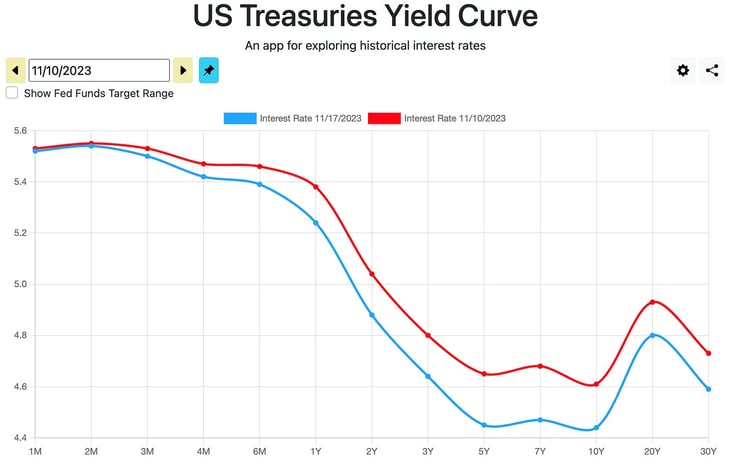

Yields have moved lower W/w, in response to CPI.

(https://www.ustreasuryyieldcurve.com/)

Stocks continued to close higher week-over-week and this upcoming week, we have NVDIA earnings on Tuesday, which could be a good catalyst for higher markets into EOY.

Chart: (VIX daily chart source:ToS)

Q4 holidays are typically low volatility times. The VIX in late NOV and DEC is usually expected to be lower, as closed markets mean less trading, which means less volatility and less volatility invites more risk taking.

I’d expect this week to be overall bullish for risk assets as prices trend higher.

Chart: (VVIX daily chart source:ToS)

BTC has been able to remain bullish, slowly climbing higher in anticipation of the ETF decision. I could continue to see BTC slowly climb higher, in a controlled fashion, as traders anticipate a “Green God Candle” from the SEC ETF decision.

BTC: $37,246 (+0.6% / 7-day)

ETH :$2,009 (-2.0% / 7-day)

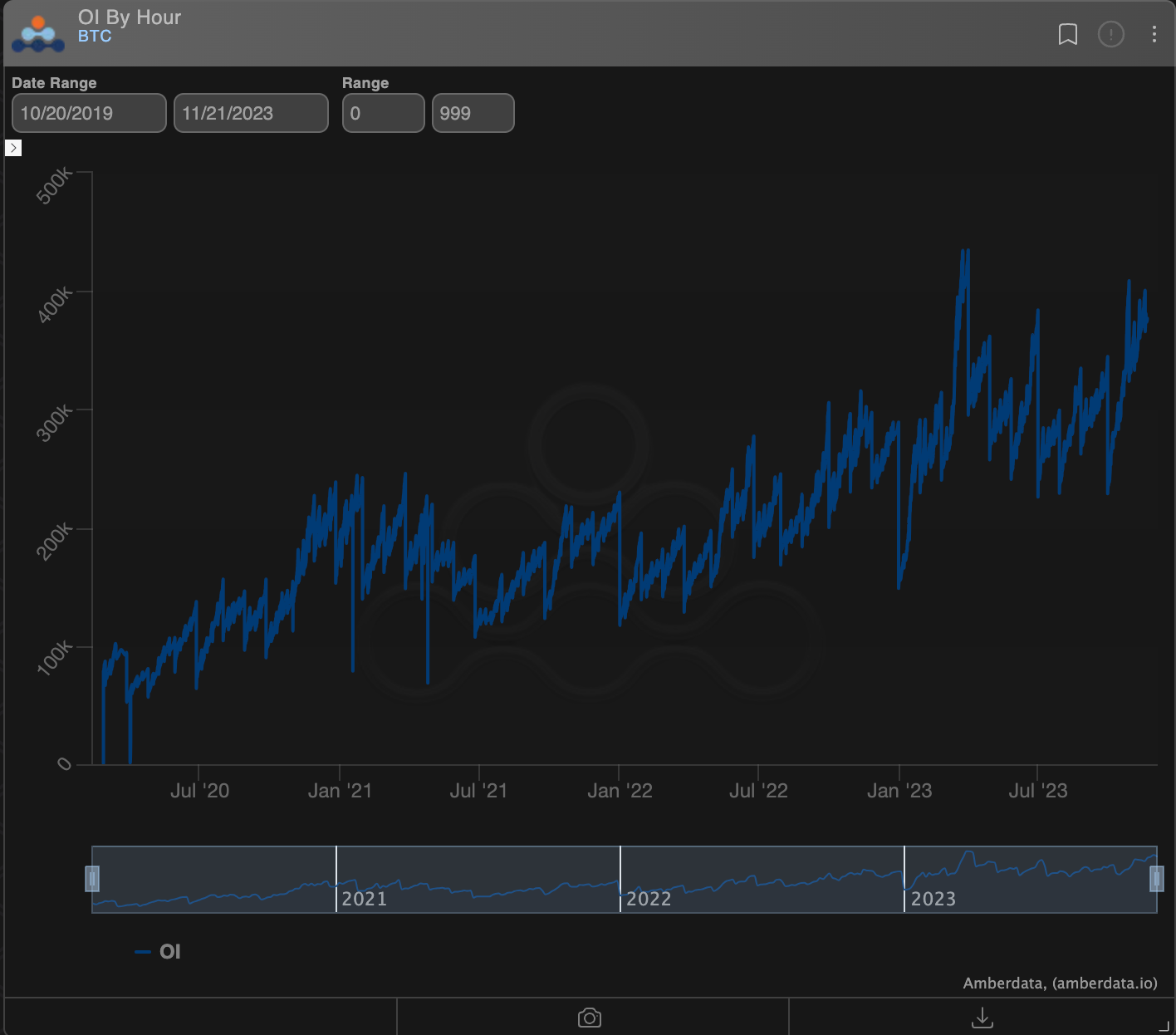

Chart: (BTC Deribit contract OI - 4yrs)

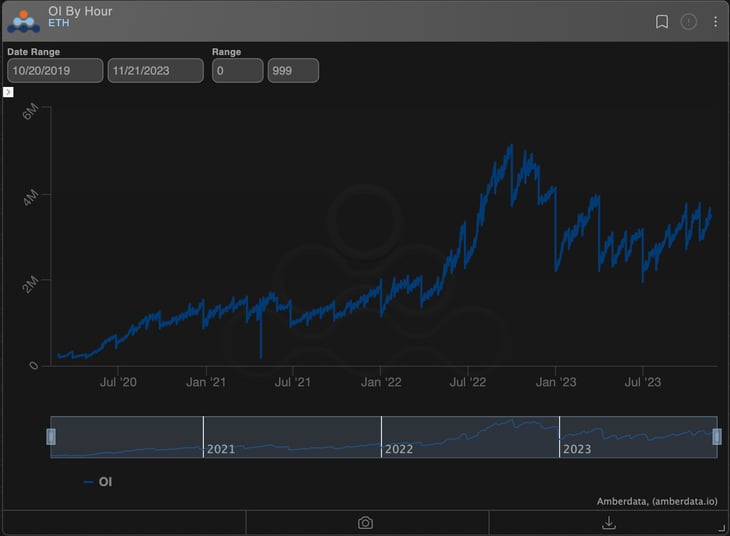

Chart: (ETH Deribit contract OI - 4yrs)

It’s interesting to look at the outstanding Deribit contract OI between BTC and ETH, over the past four years.

All-time OI outstanding (in contract units) was in response to the SVB banking crisis for BTC… but today, we’re steadily climbing back to those levels.

Ethereum, on the other-hand, hasn’t been able to achieve levels anywhere near the September 2022 PoS upgrade.

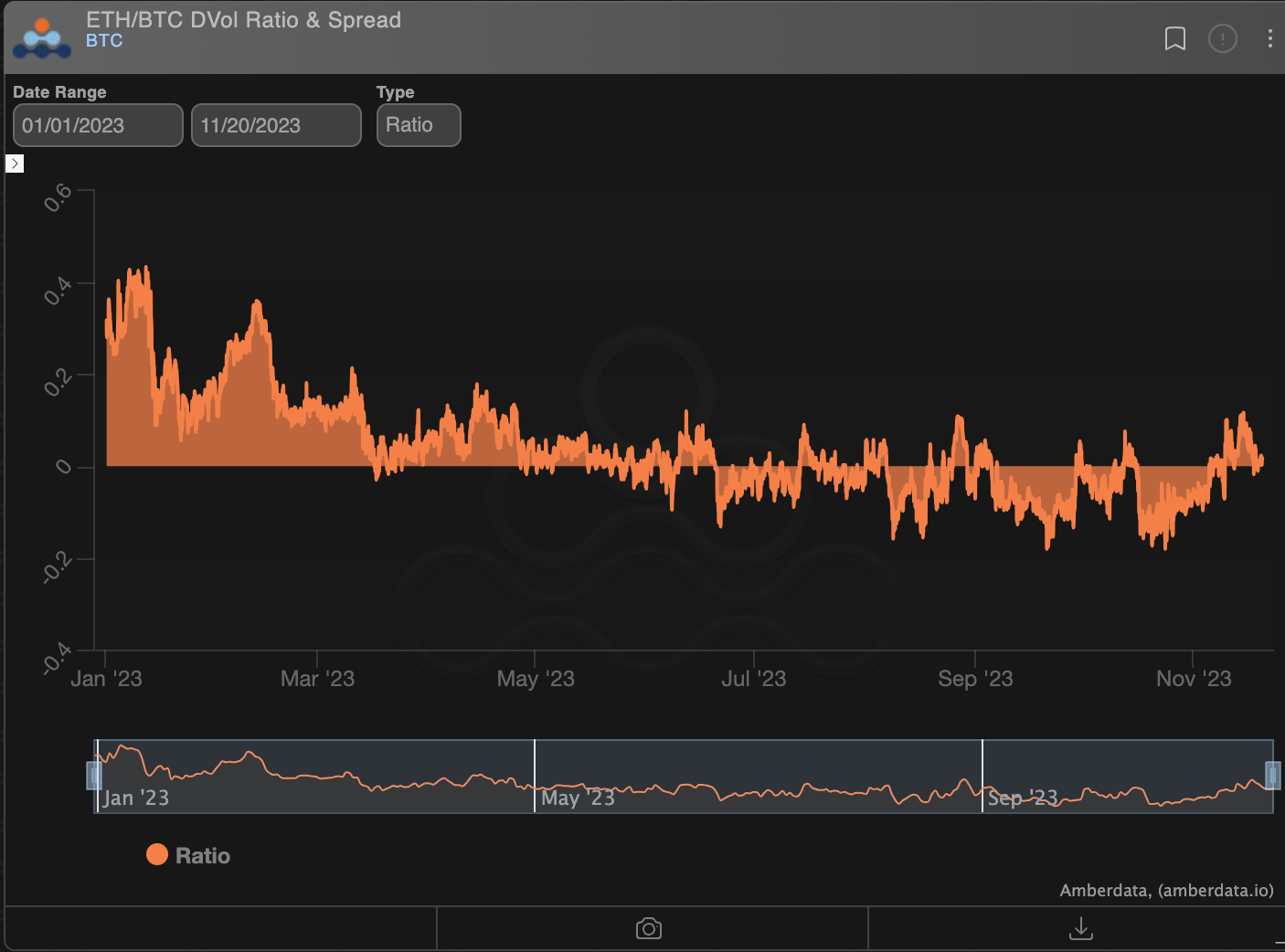

This big picture view, in terms of option market participation, could provide decent reasoning to “fade” the relative vol. inversion of ETH IV > BTC IV. Betting that BTC IV once again exceeds ETH IV for a short-term to medium-term trade.

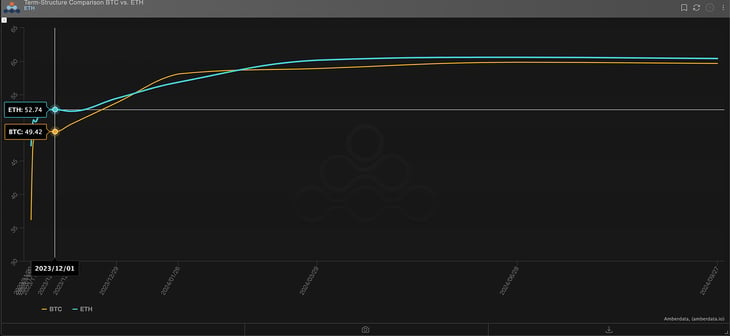

Chart: (BTC & ETH at-the-money term structure… with 2-week options focus)

Ultimately, realized volatility is the biggest driver of IV pricing. ETH, having a smaller market-cap, should be more volatile in the long-run. But in the short-term, a spot ETF is going to be approved for BTC first (if at all) and BTC will move more in response.

Also, let’s not forget that 2023 has seen a lot of investors willing to sell ETH covered calls, and the recent negative gamma positioning for dealers in ETH might be short-lived.

Chart: (ETH Net Gamma dealer exposure)

I don’t think this week, given the holidays, is going to be a SPOT ETF announcement week, but I do think the market grinds higher.

I think a short-term relative vol trade between BTC and ETH, over the next 2-weeks, could be interesting. Given the recent 2023 counter-trend moves.

Chart: (ETH-Dvol / BTC-Dvol 2023 YTD)

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

Bitcoin Derivatives Market

Selling gamma and buying vega.

Low leverage in futures.

Unless there are unexpected developments, the market will provide an opportunity to enjoy Thanksgiving, but warn your relatives that you might need to be at the screen during the Christmas holidays.

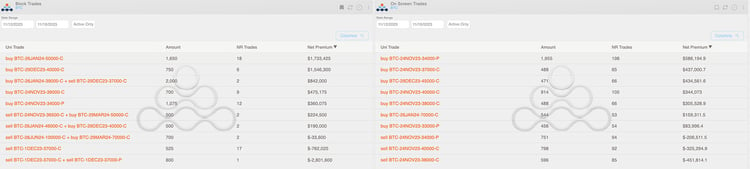

The most significant trades were executed in blocks, with the buy of $40k and $50k calls on December and January, offset by the massive sale of $37k straddle on December 1st for a premium of $2.8M received.

It's also worth noting the diagonal spread on December/January, -$37k/+$39k call.

Chart: (BTC Weekly Top Trades)

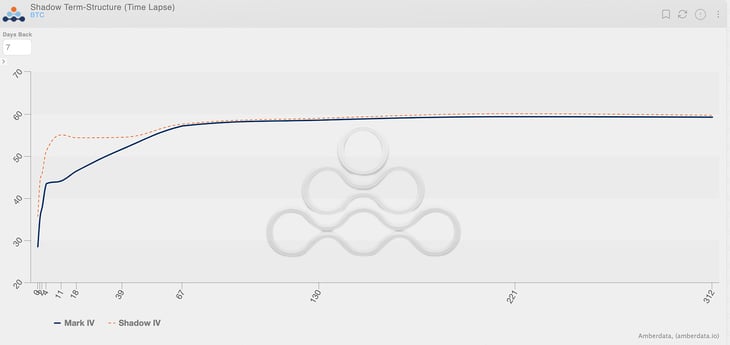

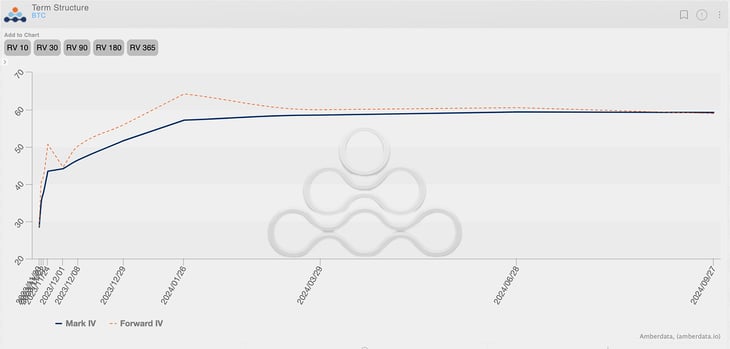

It's not surprising to observe the variation in the term structure, with the front heavily impacted by gamma sold, while the back remains firm. January is now where all eyes are focused, with the forward forming a pronounced kink, and it seems increasingly evident that all bets on the spot ETF approval will be there.

Chart: (BTC Term Structure Change)

Chart: (BTC Term Structure)

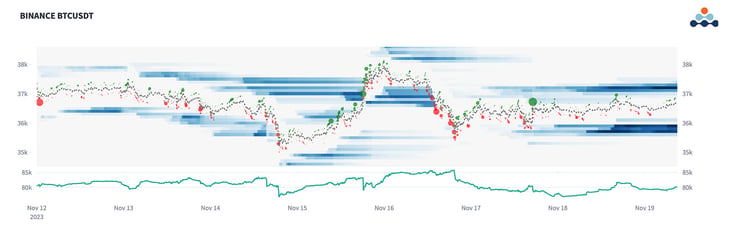

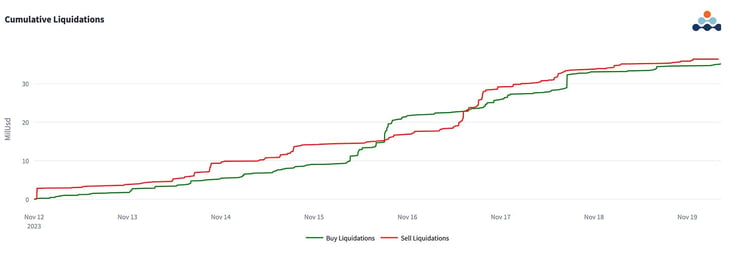

The futures market is not showing off, and analyzing Binance's BTCUSDT, we can see that the open/close prices and open interest are practically unchanged, with liquidations evenly distributed between longs and shorts.

Low leverage and a lack of clear position-taking seem to align well with what we've observed in the volatility market. Collecting theta sounds like a good strategy here.

Chart: (BTCUSDT Binance heatmap)

Chart: (BTCUSDT Binance liquidations)

Paradigm's Week In Review

BTC

ETH

The Squeethcosystem Report

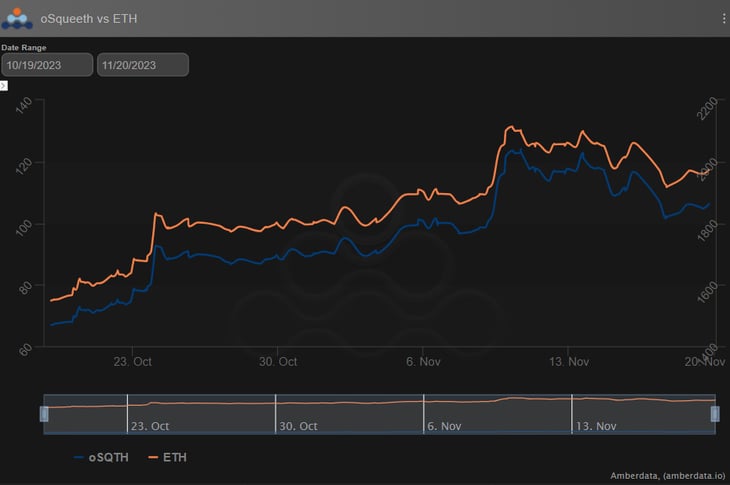

Crypto markets found their way lower throughout the week. ETH ended the week -2.76%, oSQTH ended the week -6.60%.

Volatility

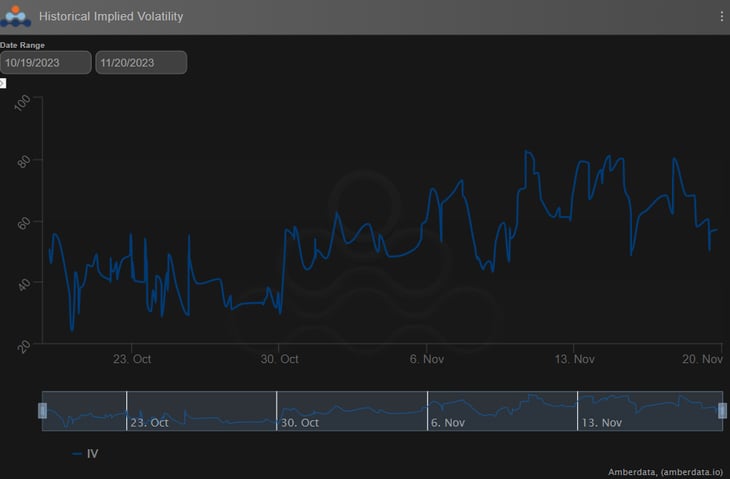

oSQTH IV continued to remain volatile, trading in the mid 60s to the high 70s most of the week.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $425.06k

November 14th saw the most volume, with a daily total of $189.45k traded.

Crab Strategy

Crab saw gains during the week ending at +2.25% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...