Crypto Options Analytics, Jan 22, 2024: BTC Post-ETF & ETH Vol Anomaly

USA Week Ahead:

-

Wednesday 9:45am ET - PMI

-

Thursday 8:30am - Q4 GPD Prelim

-

Friday 8:30am - Fed Speakers throughout

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH, and Lyra and may change their holdings anytime

CRYPTO OPTIONS MACRO THEMES:

BTC: $41,298 (-2.2% / 7-day)

ETH :$2,437 (-2.3% / 7-day)

BTC is currently testing its post-ETF approval range. I believe that this bearishness is nothing more than a short-term fluctuation.

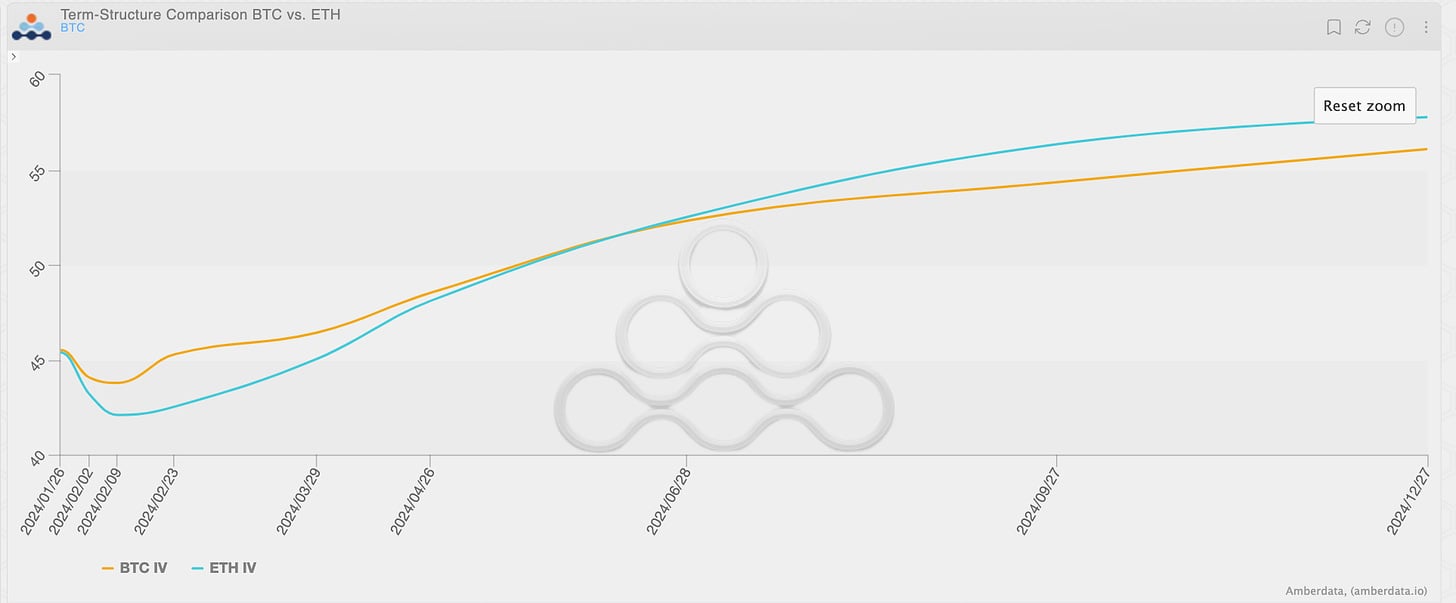

From a volatility perspective, the market is looking at the BTC halving as the next major volatility event.

We can observe that Deribit's recently listed April expiration exhibits a volatility kink.

Personally, I fail to comprehend the rationale behind a volatility kink during the BTC halving. Paying a premium for volatility seems reasonable for unforeseeable events, but not for well-established, clearly foreseeable, and easily accounted-for events. This appears inefficient to me.

What's even more intriguing, however, is that the April volatility anomaly is even more pronounced in the Ethereum term structure. Observe the greater discount in volatility before the April expiration and the larger premium after the April expiration.

This is what currently piques my interest in the crypto volatility surface.

Weekly Review @Gravity5ucks

A week of perfect range between supports ($40k) and resistances ($44k), consolidated over the last 6 weeks, even though the spot at $40k has effectively diminished certainty about support resilience.

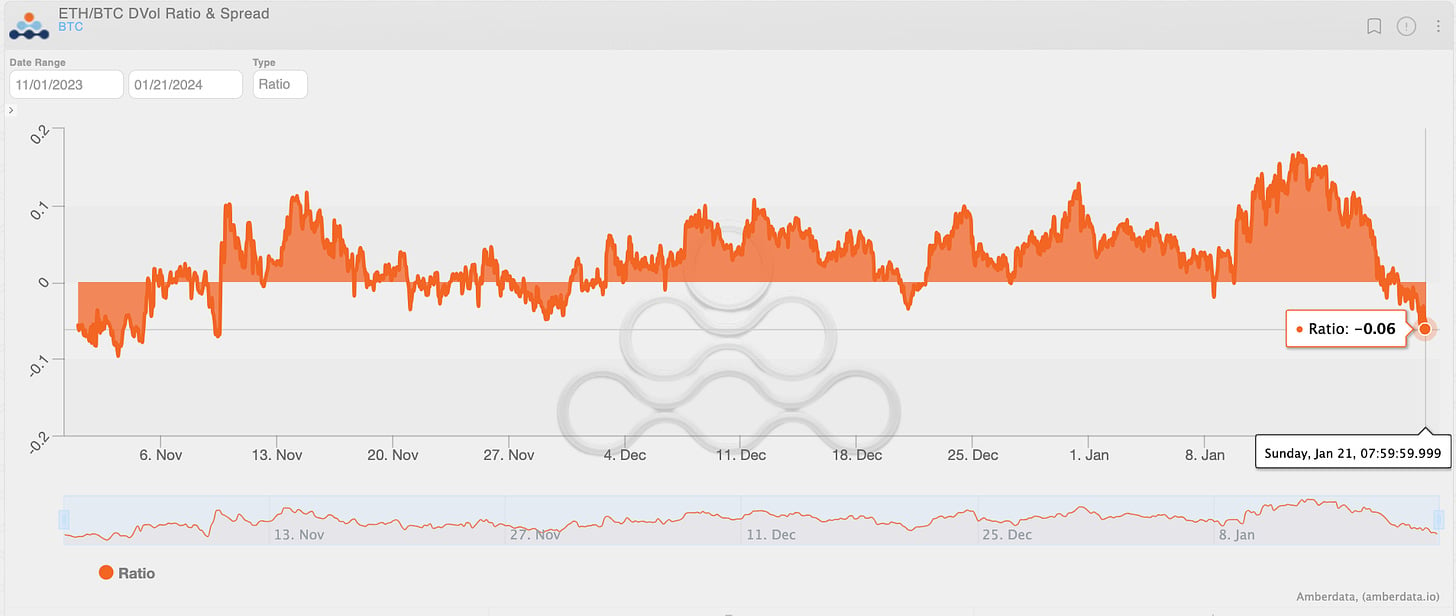

Ethereum follows in tandem, maintaining a stable ratio throughout the week at its highest values in the last 4 months.

Chart: (Binance BTCUSDT Price)

Chart: (Binance ETHUSDT Price)

Option market volumes aren't sky-high, but still, the impact in terms of IV has been gigantic. In fact, the news of the week has been the comeback of the serial "call writer" on Ethereum, bringing the volatility ratio between the two coins to its lowest, evident across the entire term structure.

Chart: (BTC vs ETH DVol Ratio & Spread)

Chart: (BTC vs ETH Term Structure)

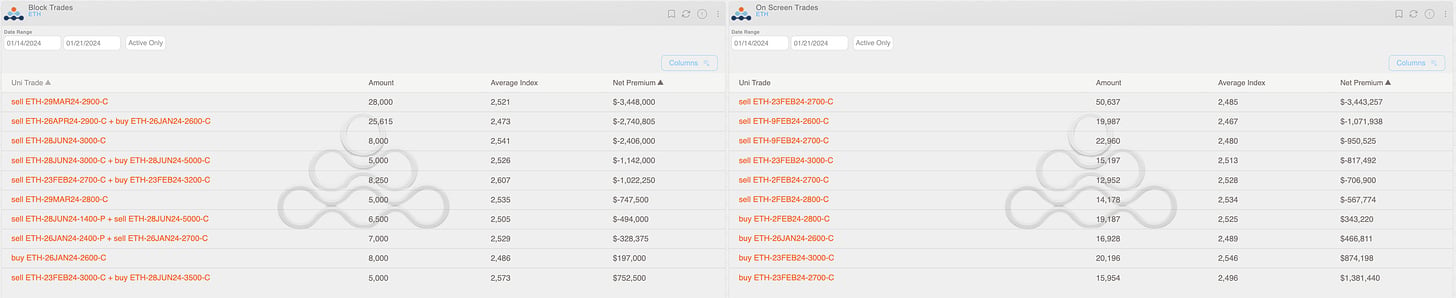

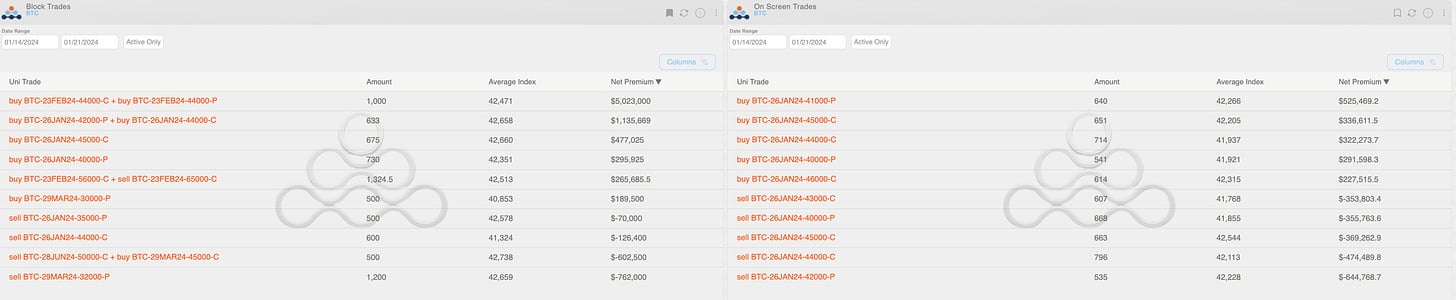

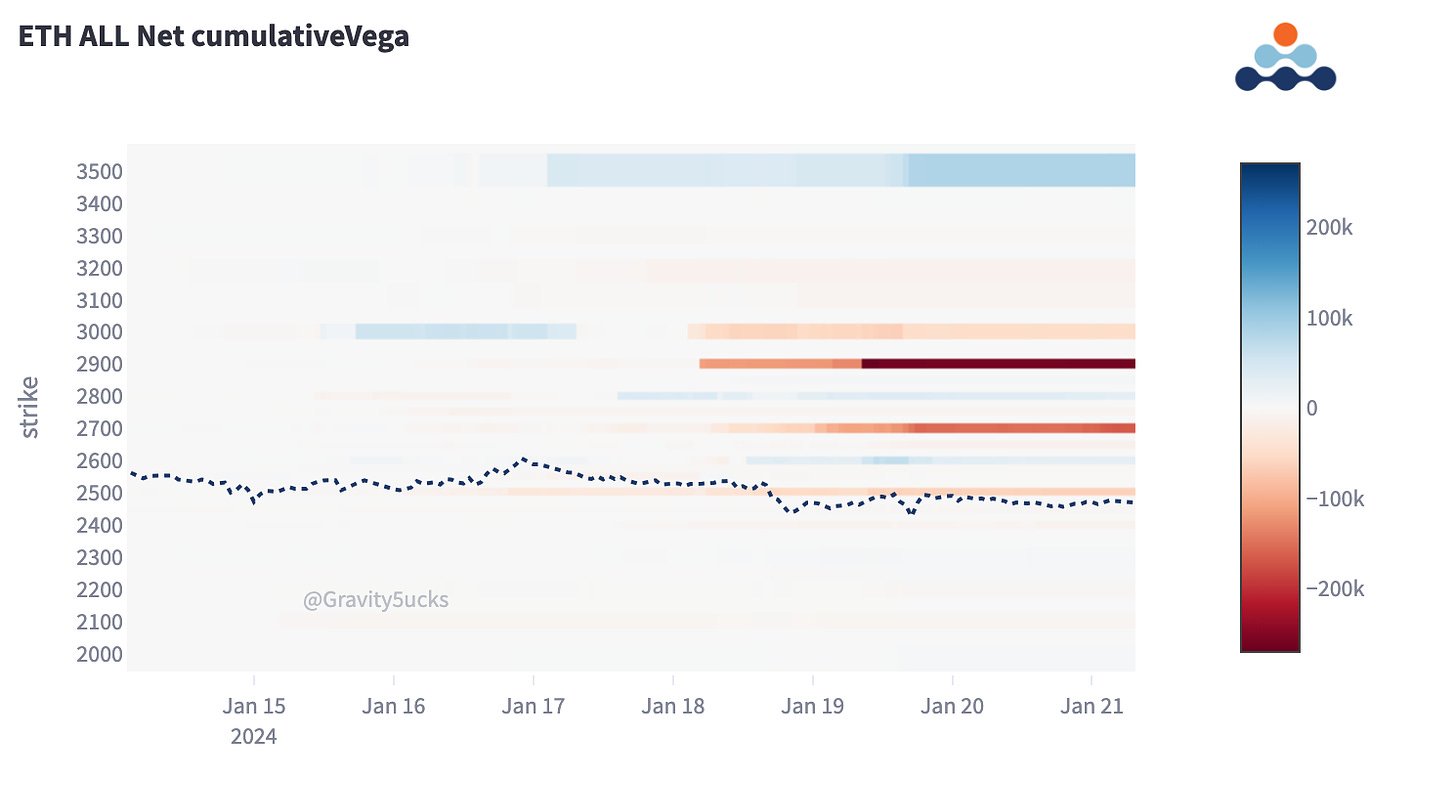

Specifically, the sale of $2.9k calls for March and April has captured the majority of the flow, but the hits also include the $2.6k, $2.7k, and $2.8k strikes in the February expiries.

On Bitcoin, we highlight the long straddle at $44k for the front monthly with a total premium paid exceeding $5M.

Chart: (ETH Top Trades)

Chart: (BTC Top Trades)

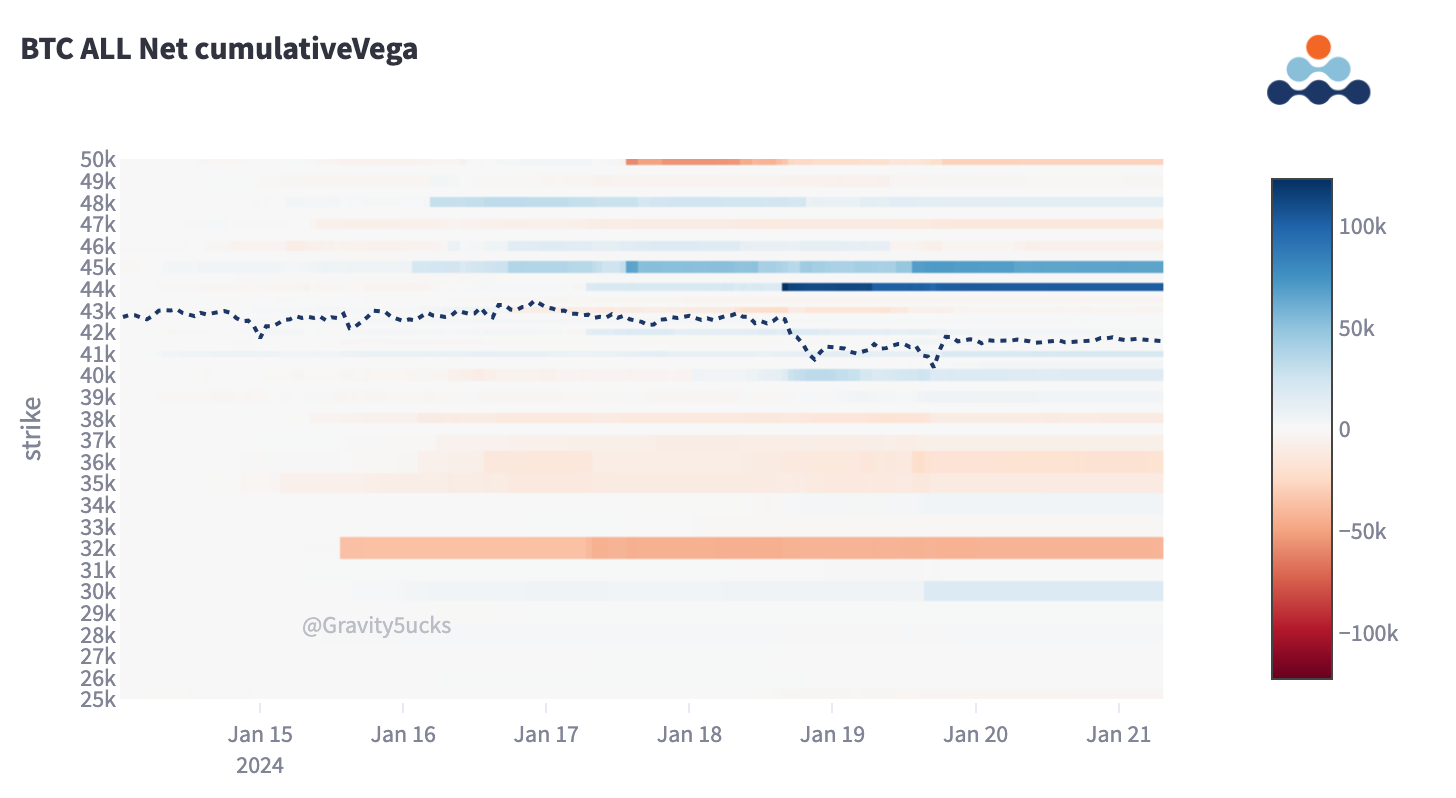

The vega impact of the flow favored Ethereum, with over $260k of vega sold just in the $2.9k strike.

Chart: (BTC Heatmap Flow Vega Term)

Chart: (ETH Heatmap Flow Vega Term)

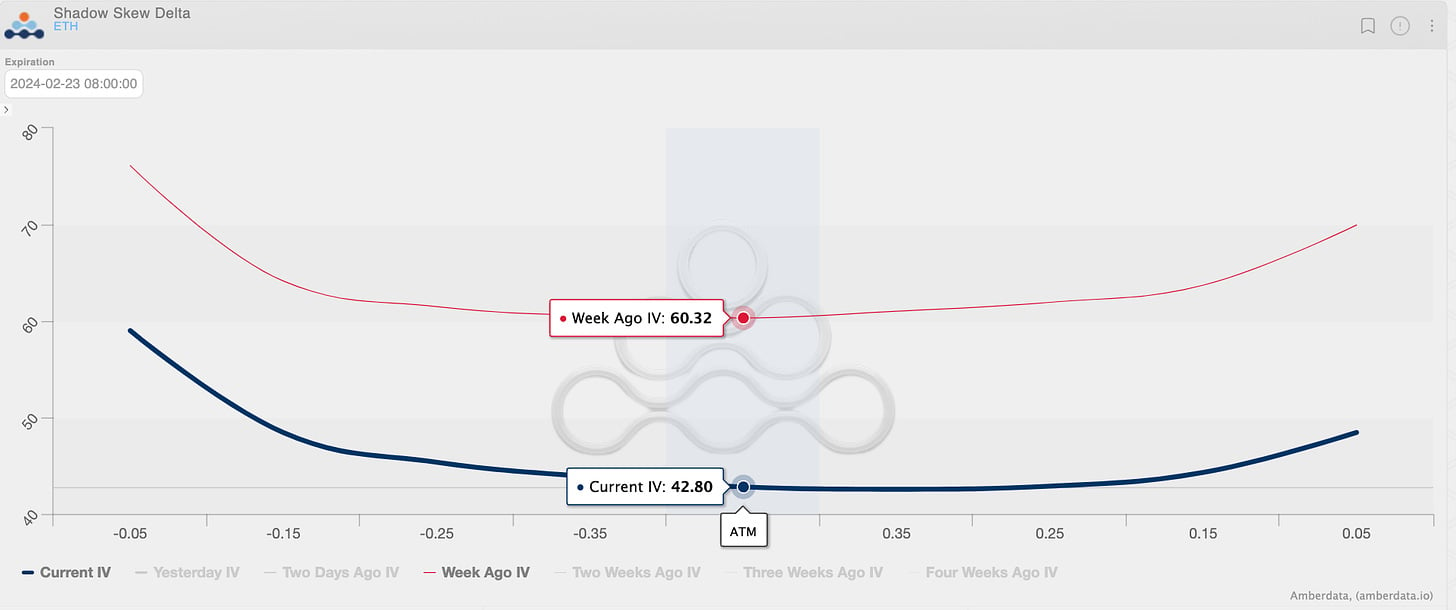

Even more pronounced is the impact when analyzing week-over-week skews in the front month. Bitcoin loses approximately 8 volatility percentage points, while Ethereum sheds almost 18 points!

The premium sucked away in the blink of an eye.

Chart: (BTC Skew Delta Comparison WoW)

Chart: (ETH Skew Delta Comparison WoW)

Paradigm's Week In Review

BTC

ETH

Opyn's Squeethcosystem Report

Crypto markets had a relatively quiet week. ETH ended the week -0.28%, oSQTH ended the week -5.36%.

Volatility

oSQTH IV saw large declines to end the week in the high 60s.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $209.94k

January 18th saw the most volume, with a daily total of $90.10k traded.

Crab Strategy

Crab saw large gains throughout the week ending at +3.98% in USDC terms.

Opyn Twitter: https://twitter.com/opyn

Opyn Discord: discord.gg/opyn

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...