-

Monday 11a ET- Fed Gov. Goolsbee TV interview

-

Tuesday 8:30a ET- Fed Gov. Jefferson Speaks

-

Tuesday 12:05a ET- Fed Gov. NY Williams Speaks

-

⭐️ Wednesday 8:30a ET - CPI

-

⭐️ Thursday 8:30a ET - PPI

-

Thursday 10:15a ET - Fed Gov. Waller Speaks

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math-minded people here, pardon any typos.

THE BIG PICTURE THEMES: [CPI] and [PPI]

The Fed raised rates by +25bps and added guidance to suggest that they are potentially done raising.

This guidance isn’t set in stone and is mostly going to be driven by employment, CPI, and the banking crisis.

We had a surprise beat in the employment report of +253k Jobs (vs +180k expected); we also saw the unemployment rate drop to 3.4% (vs 3.6% expected).

Overall, this is a surprise beat for NFP. Therefore, hawkish.

However, the banking crisis seems to have come back rather quickly. We had First Republic going under and being bought by JPM on Sunday, while it looks like other banks are still in hot water. This is dovish for the Fed.

These are two factors off-setting each other (from a policy perspective) and ultimately creating a consolidation zone for BTC spot prices.

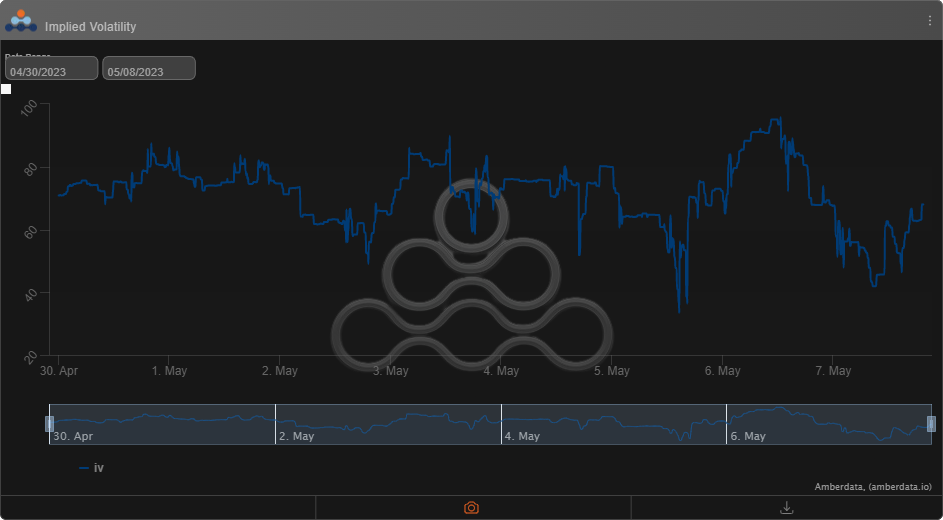

Overall, IV levels for BTC weekly options are back to pre-SVB crisis levels.

CPI and PPI this week are the main macro vol events, but outside any major surprises, the implications for Fed policy (aka pause) are likely stable.

BTC: $28,593 (-2.70% / 7-day)

ETH :$1,882 (-0.10% / 7-day)

SOL: $21.76 (-5.30% / 7-day)

Thinking through a trail of logic here…

I continue to think BTC will consolidate, but I want to ignore that random bias for a second.

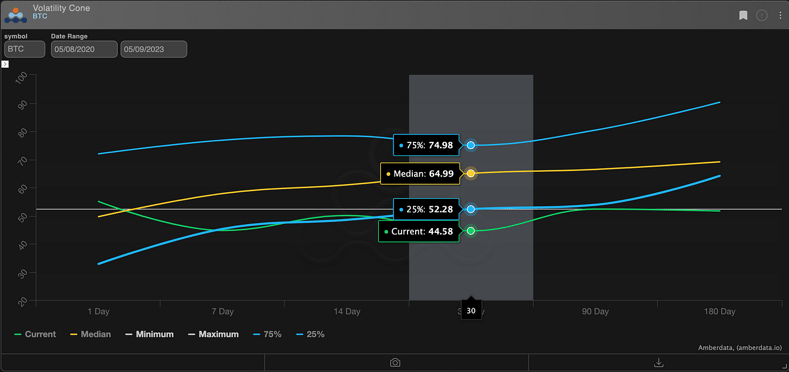

(May 7th, 2023 - 3-year BTC Realized Volatility Cone)

(May 7th, 2023 - 3-year BTC Realized Volatility Cone)

Current RV is below the 25% percentile for the past 3 years. There’s a clear argument to be made that RV levels are, well, pretty low.

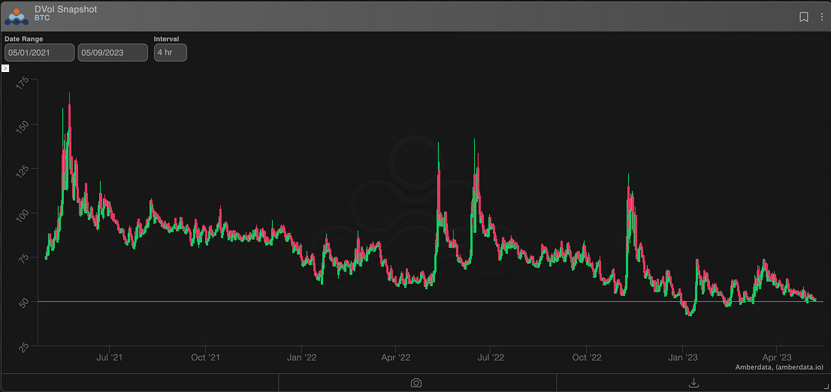

(May 7th, 2023 - DVOL BTC index since inception)

(May 7th, 2023 - DVOL BTC index since inception)

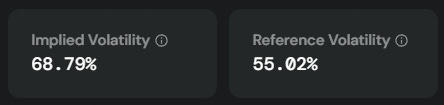

If we look at the implied space, BTC’s DVol index is basically near all-time lows since “inception”.

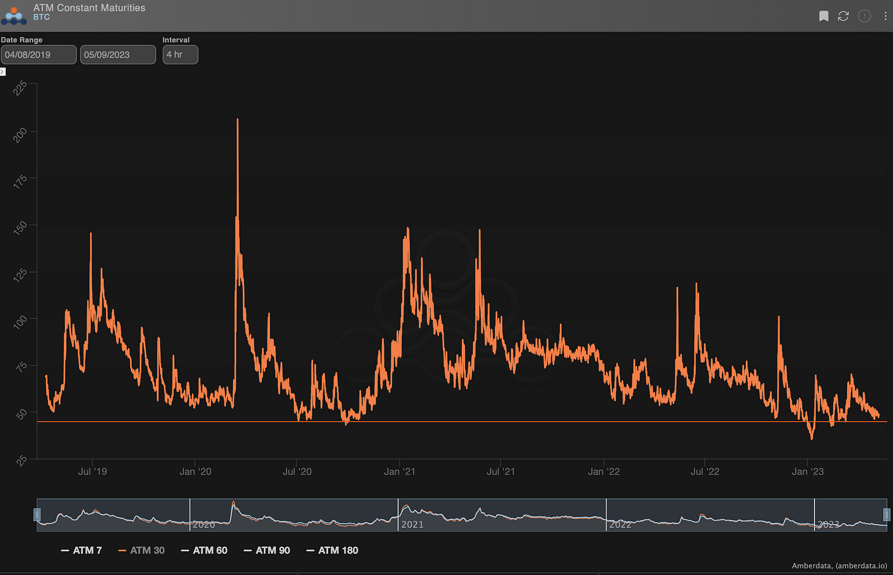

(May 7th, 2023 - 4-year ATM 30-day IV)

(May 7th, 2023 - 4-year ATM 30-day IV)

If we isolate the belly and look at how expensive ATM vol is for 30 days, over the past 4 years…

… well, we can clearly see that it’s pretty low. Again, this is NOT a reason for something to happen. There still needs to be a catalyst.

That said, the world seems full of unknown, unknowns, right now.

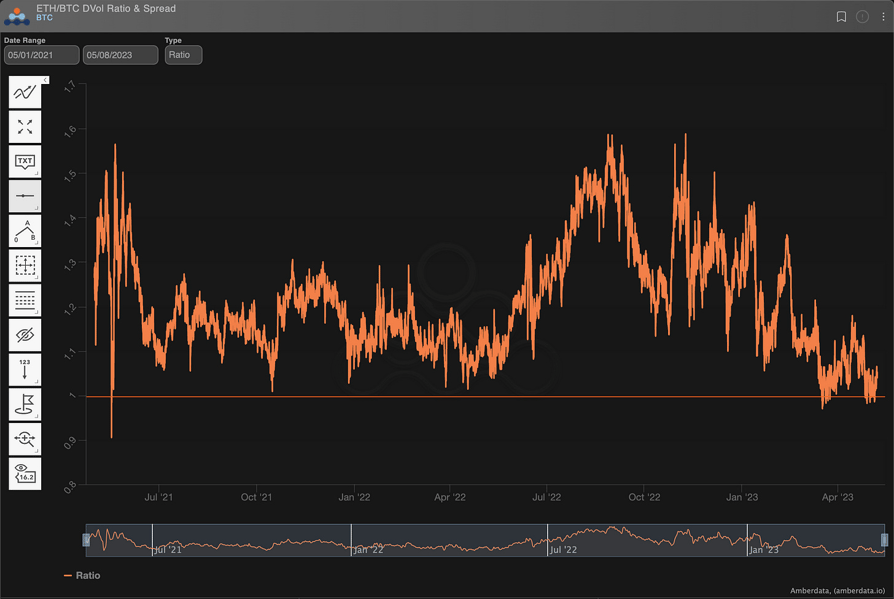

(May 7th, 2023 - ETH-DVOL divided by BTC-DVOL)

(May 7th, 2023 - ETH-DVOL divided by BTC-DVOL)

Now that the BTC vol picture seems clearly “rather cheap”, it’s interesting to extrapolate this into ETH vol.

Looking at the ratio of ETH-Dvol divided by BTC-DVol, relative vol. is basically near all-time lows… so that’s interesting.

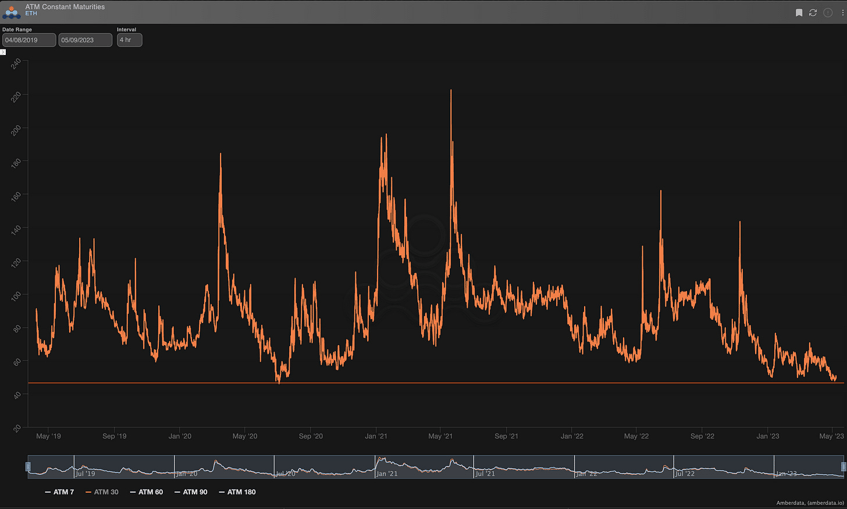

(May 7th, 2023 - 4-year ATM 30-day IV)

(May 7th, 2023 - 4-year ATM 30-day IV)

Doing a similar ATM 30-day analysis, we can see that ETH vol, is at all-time lows. Period. And that, since inception of ETH options trading, which was pioneered by Deribit.

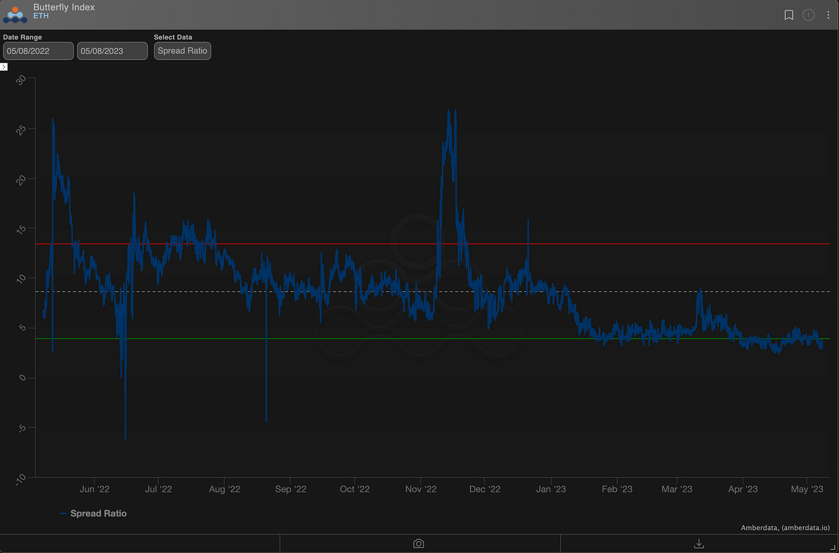

(May 7th, 2023 - ETH-DVOL / ATM 30-day)

(May 7th, 2023 - ETH-DVOL / ATM 30-day)

Now, given that ETH vol is low, where do we place bets? Well, if we divide DVol by ATM30, we can get a good gauge of the relative costs of wings vs belly…

This green line is the lower 10% percentile since inception.

DVol has more “OTM puts” (due to constant vega exposure) than “OTM calls”.

Taken together, the OTM put wing is currently relatively cheap.

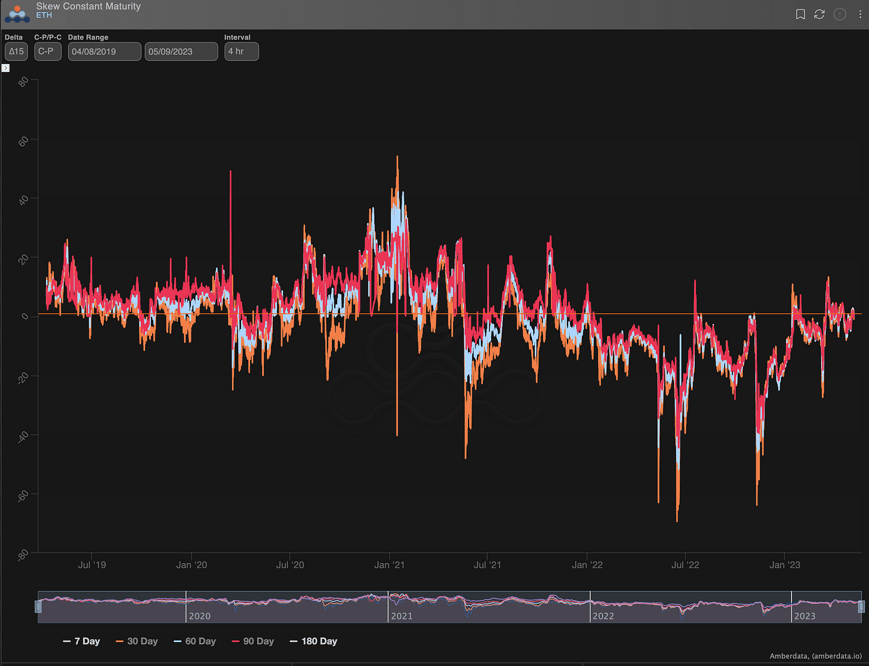

(May 7th, 2023 - 4-year ∆15 RR-Skew IV)

(May 7th, 2023 - 4-year ∆15 RR-Skew IV)

Lastly, looking at the ∆15 RR-skew, we can see clear symmetry currently, but MASSIVE spikes low on negative spot/vol. events.

As I mentioned last week, a risk-off CRASH would likely hurt ETH spot prices a lot… due to its “Altcoin” nature.

But on the flip side… IF we’re really, truly resuming a crypto bull-market… “Altcoins” should outperfom.

ETH should out-rally BTC, in that “traditional” crypto bull scenario.

So, by my thinking, long ∆15 puts with long ETH positions (delta neutral, or slightly long delta)… seem pretty interesting.

Please share and retweet if you like this kind of analysis. It helps a lot.

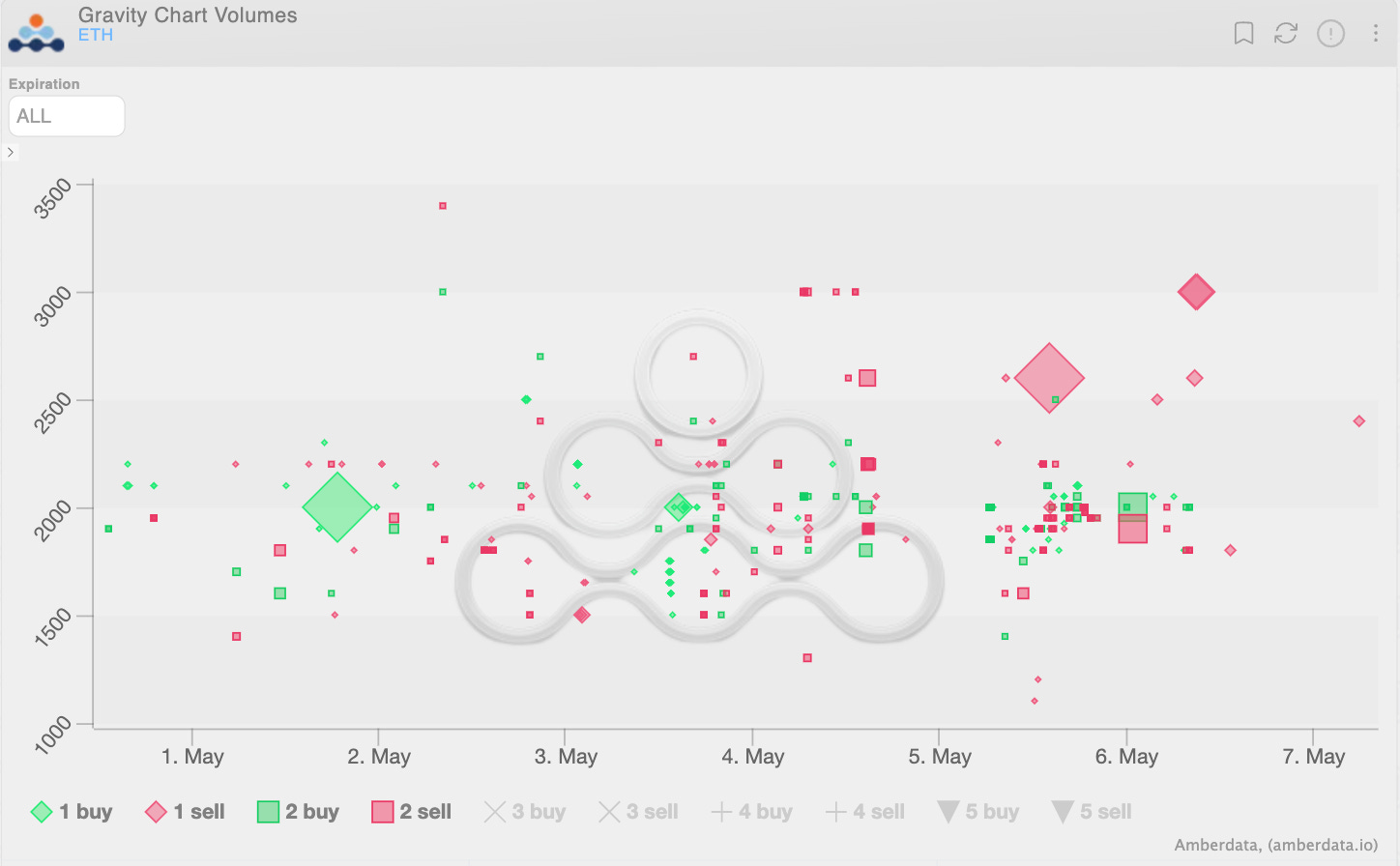

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

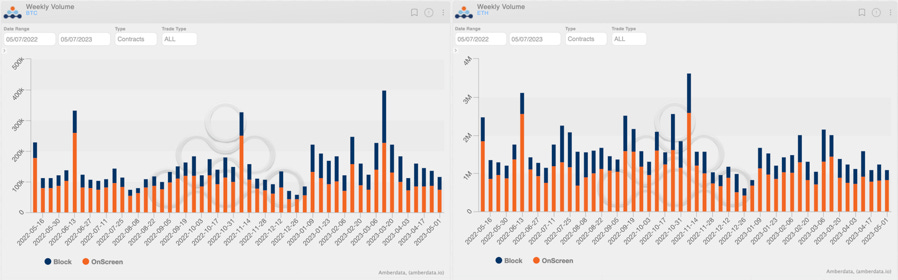

The crypto options market remains apathetic, with volumes showing no reaction to the FOMC week.

The consistent decline over the past few weeks is the flip side of historically low IV levels across the entire term structure, particularly for Ethereum.

It's a tricky regime for taking a clear volatility stance.

— GravitySucks (@Gravity5ucks) May 7, 2023

Minimum VRP and term structure percentiles distribution since 2019 don't favor being short.

However, it may take some "time" for the situation to return to a more median range.#BTC vs #ETH pic.twitter.com/OayxPgxH2K

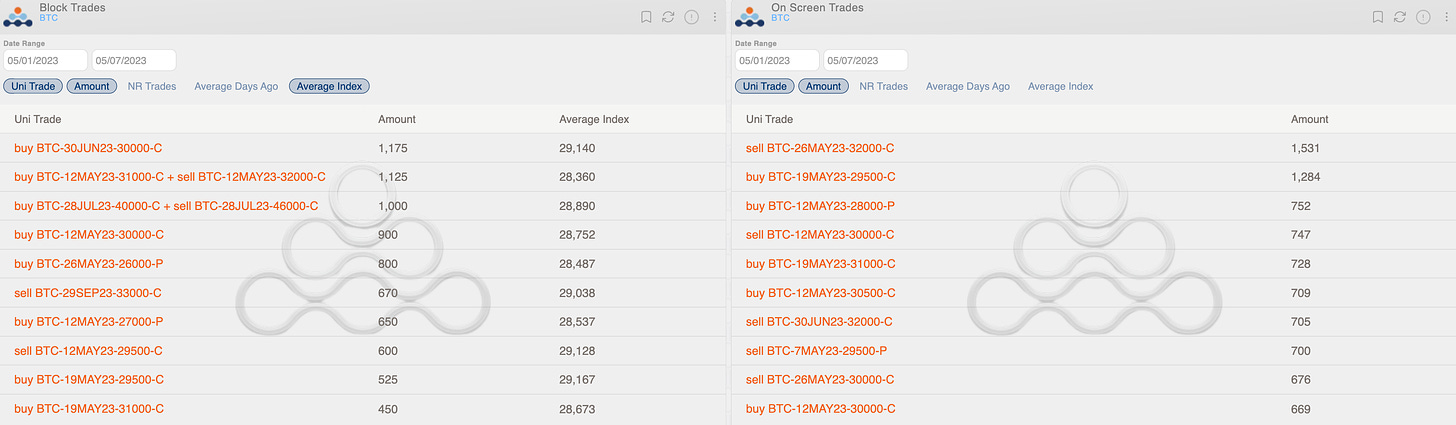

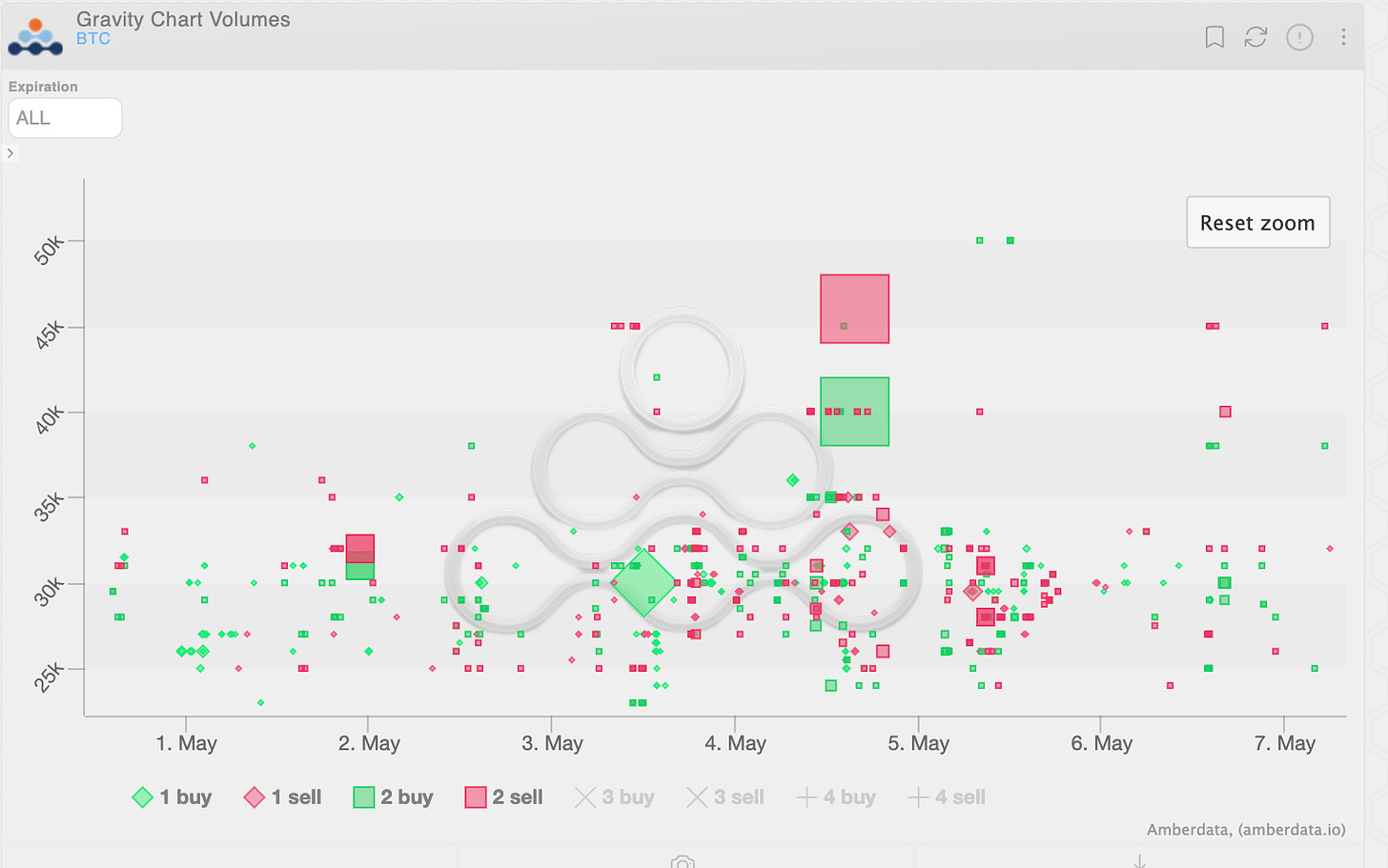

Low IV levels and lack of clear directionality must have influenced the preference for delta-hedged trades. Approximately $45k vega purchased on June and a $40k-$46k call spread on July were the two most interesting trades of the week. The predominantly sold $32k strike suggests the short-term resistance.

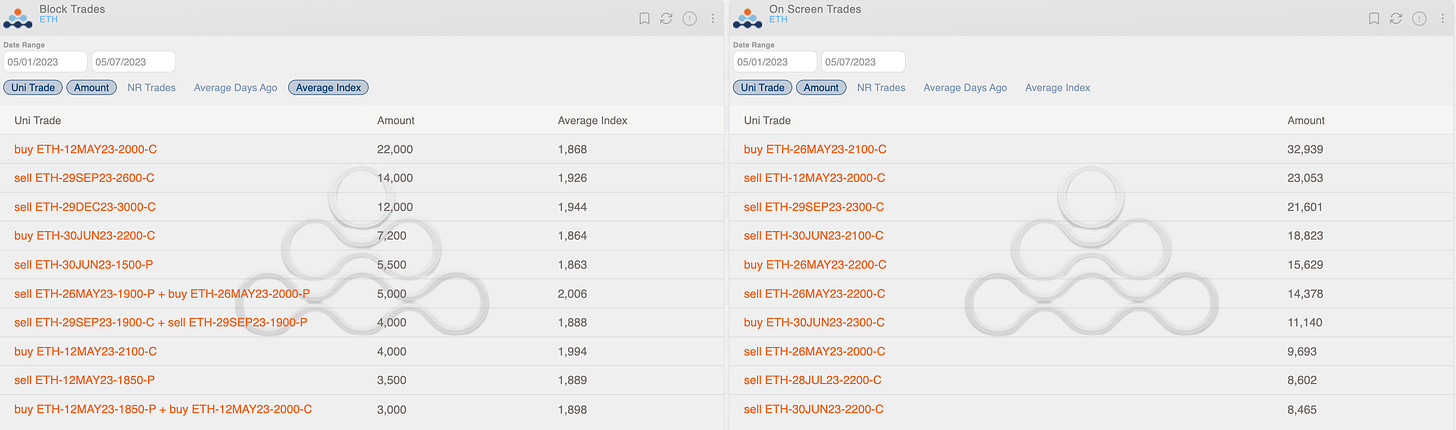

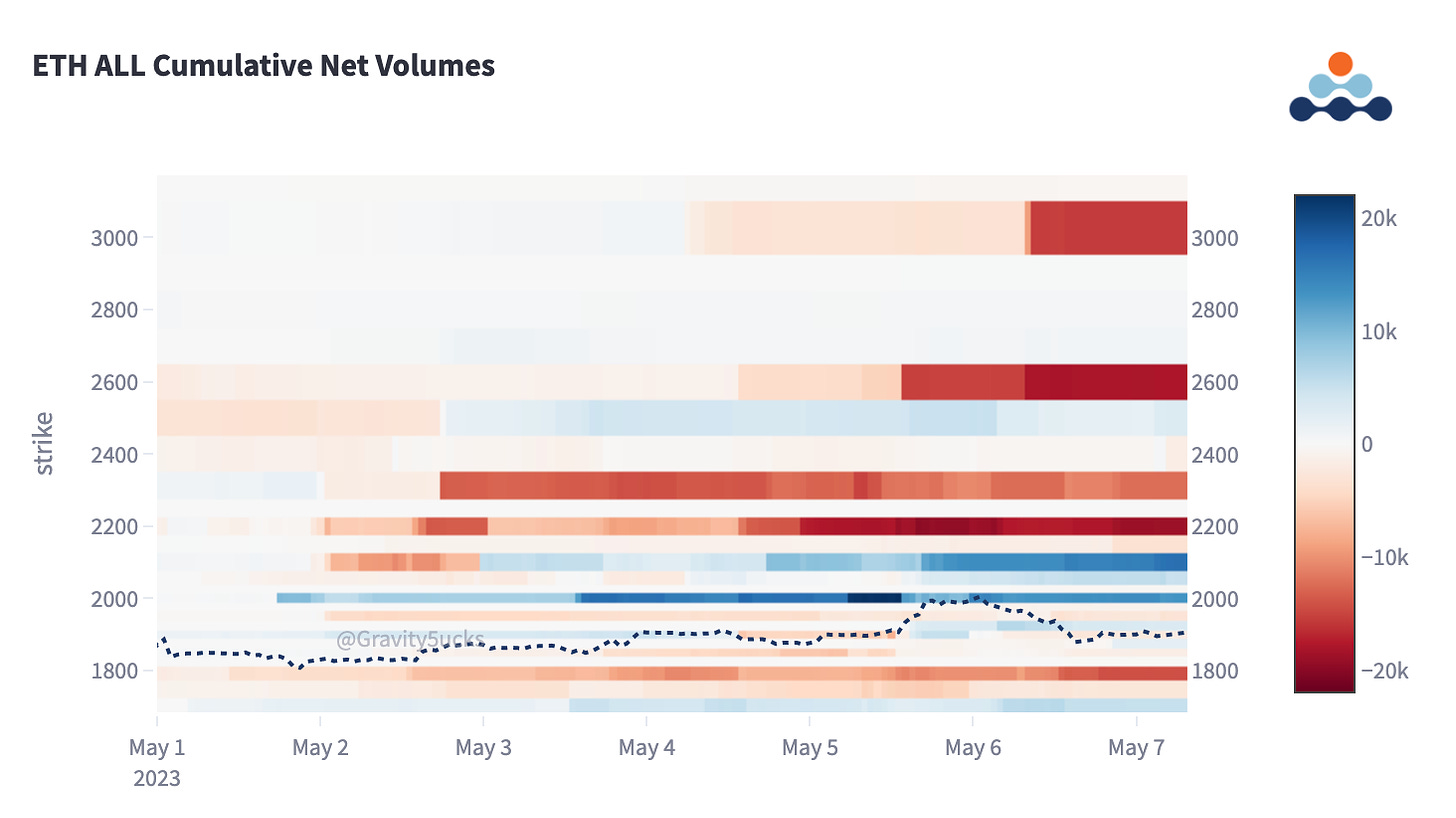

General sales for Ethereum are more pronounced and clearly highlighted both by the gravity chart and the heat map. On-screen and OTC, all strikes from $2.2k were sold for almost the entire week.

Finally and noteworthy: the pre-FOMC trade with the long position in the 12 MAY $2k call.

Paradigm Block Insights (01 May - 07 May)

Muted price action through Wednesday’s FOMC data, followed by swift risk-on move on the back of Friday’s strong jobs report. ETH vols melt lower.

BTC ~Unch. / ETH +3% / NDX +0.25%

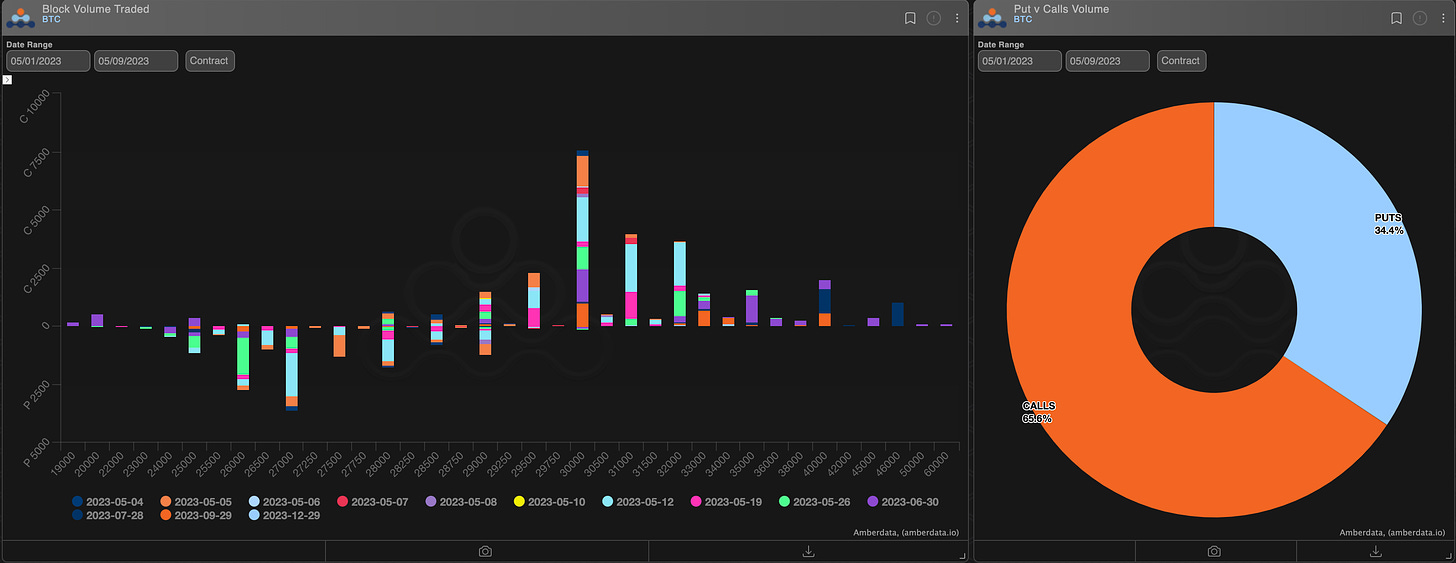

🌊BTC

Front-end BTC topside scooped on lower absolute implieds. BTC 1m 25d call offered @ 52v.

1000x 12-May-23 31000/32000 Call Spread bought

1000x 30-Jun-23 30000 Call bought

1000x 28-Jul-23 40000/46000 Call Spread bought

825x 12-May-23 30000 Call bought

Market was well offered for vega on Thursday; notable clips were sold in BTC and ETH:

BTC

250x 29-Sep-23 26000/34000 Strangle ($34k vega)

250x 29-Sep-23 33000 Call ($18k vega)

ETH

4000x 29-Sep-23 1900 Straddle ($40k vega)

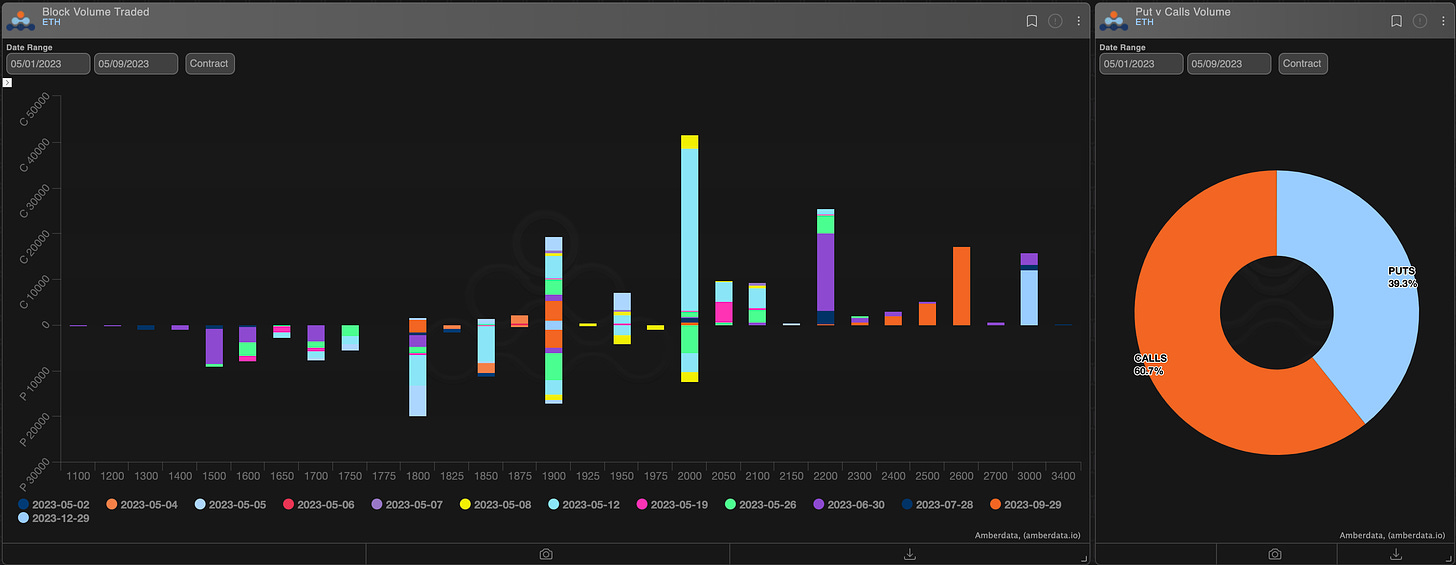

🌊ETH

Similar to BTC’s case, takers took advantage of cheaper optionality as implieds sank lower, scooping 12May expiry to capture busy macro schedule.

21750x Call 12 May 23 2000 bot

7200x Call 30 Jun 23 2200 bot

ETH vols compressing relative to BTC is not unexpected. A narrow implied spread feels justified in light of the banking crisis and absence of ETH catalysts, all of which contribute to a higher RV potential for BTC.

H/t @jsterz

https://twitter.com/JSterz/status/1654511104708562945

Our Head of Sales @davidbrickell80 was on @business this week to give his views on the Macro and what it means for our industry! 🚀

Get David's thoughts weekly here: https://paradigm.co/the-macro-pulse

https://twitter.com/tradeparadigm/status/1653814714785472512

Hit us up on Telegram! 🙏

Daily Commentary✍️ http://pdgm.co/cmmntry

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

Bybit x Paradigm Futures Spread Trade Tape: https://t.me/paradigm_bybit_fspd

BTC

ETH

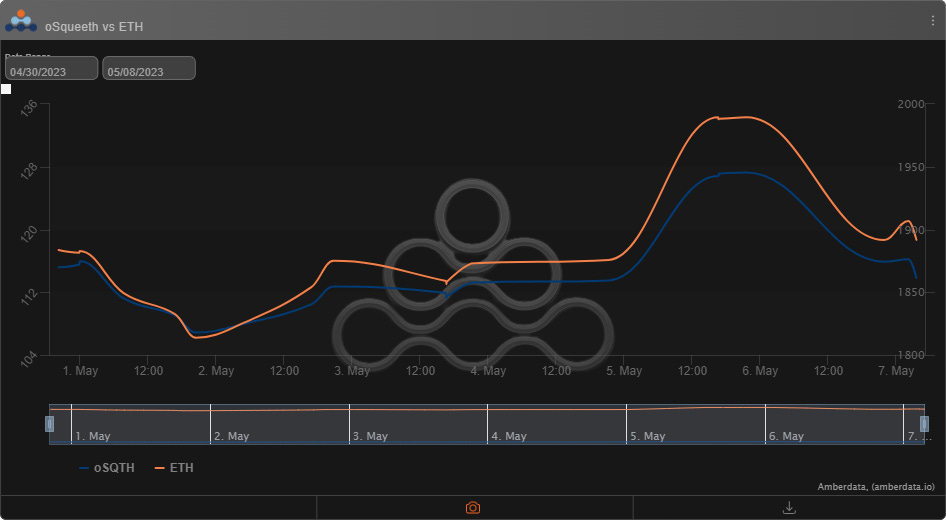

The Squeethcosystem Report (4/30/23 - 5/07/23)

This week was filled with headlines and yet markets remained calm to bring in May. ETH ended the week +0.43%, and oSQTH ended the week roughly -1.17%

Volatility

Implied vol was quite active this week, especially in the back half of the week.

Squeeth continues to trade rich to its reference volatility.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $874.59k

May 6th saw the most volume, with a daily total of $188.75k traded. An additional $514,906 traded via OTC auctions this week.

Crab Strategy

Crab ended the week at +1.07% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...