USA Week Ahead:

-

Tuesday 8:30a - Retail Sales

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math-minded people here, pardon any typos.

MACRO THEMES:

This upcoming week is rather light on market-moving economic releases. Tuesday we have retail sales but nothing of interest beyond that.

CPI last week was a good reading for risk assets. The y/y June rise in CPI was the slowest pace in more than 2 years, coming in at 3%.

Wholesale prices rose at the slowest pace since August 2020.

Inflation expectations are also falling as investors begin to think the Fed can pull off a “soft landing”.

This is moving stocks higher while the VIX index hangs around YTD lows, in the 13-handle.

The big news this week was Judge Torres’s decision around XRP.

Saying that retail traders trading XRP amongst themselves doesn’t constitute a security (while selling an offering to Institutional investors is a security) has a lot of implications for the entire industry. Spot moved higher on the news for XRP and major pairs.

Coinbase stock also moved higher as the CBOE amended its spot ETF application to make COIN its surveillance partner.

All these news events are likely a source of volatility for crypto, despite the quiet macro lineup.

BTC: $30,290 (+.3% / 7-day)

ETH :$1,935 (+3.5% / 7-day)

SOL: $27.72 (+28.8% / 7-day)

Spot prices this week had a decent amount of intra-day gamma, but overall, w/w we remain nearly unchanged.

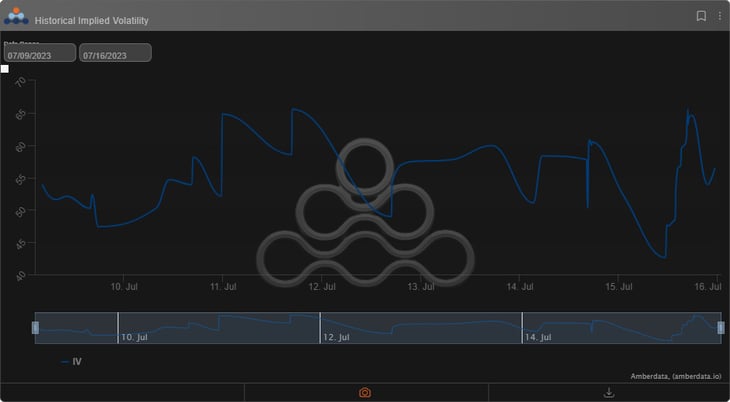

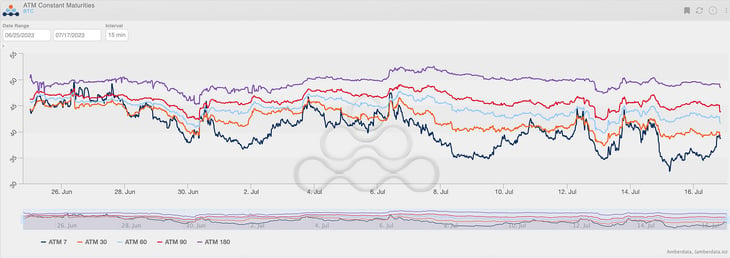

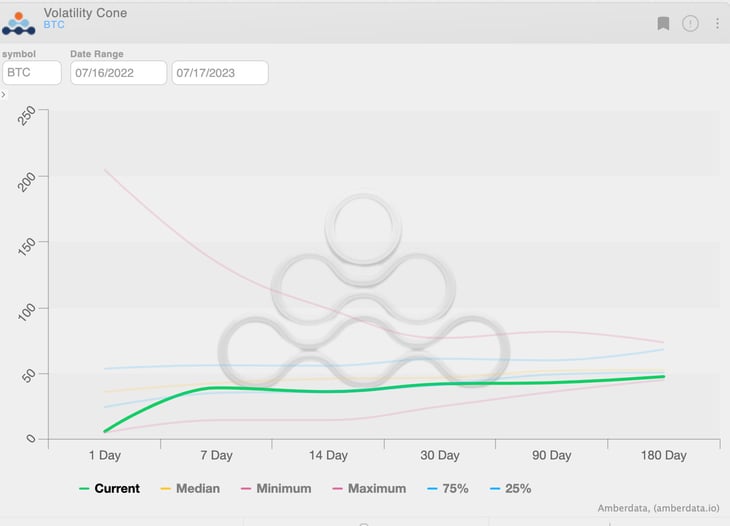

The reaction in IV to the news was isolated to the front-end of the term structure. 7-day IV moved higher but quickly gave back all flattening movement.

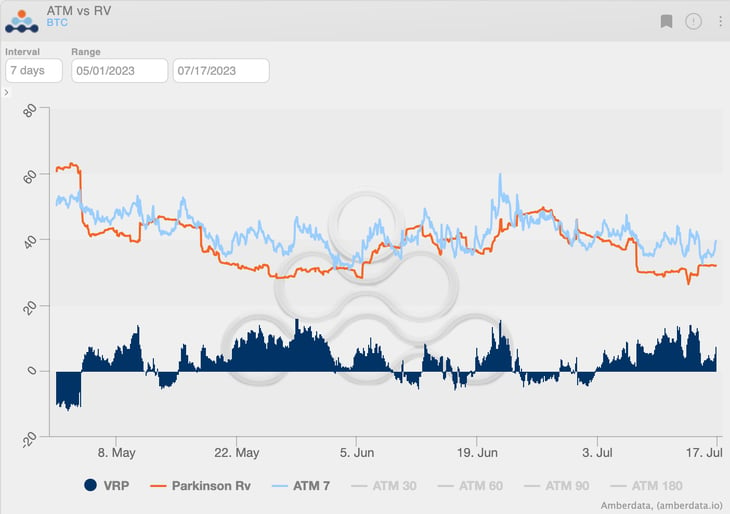

The VRP has held its premium and is likely going to continue to do so, as crypto specific headlines currently dominate the tape and it’s nearly impossible to predict them.

Meanwhile, 12-month RV is aligned on the lower 25% percentile for all measurements (> 1-day).

This is in line with a positive VRP, as traders price-in a bit of mean-reversion into option prices.

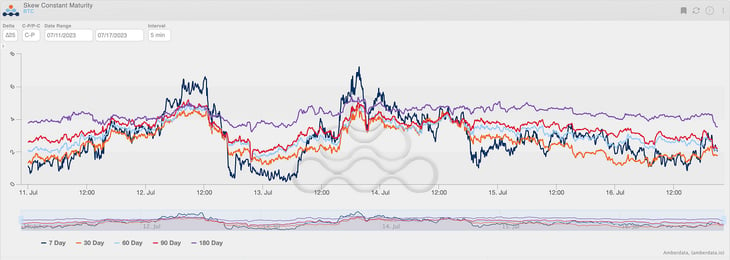

(BTC ∆25 RR-Skew)

The ∆25 RR reacted a lot to the XRP news, in the 7-day maturity.

Upside structures make sense as the headline risk has fallen to the bullish side of the equation lately, and we could see bullish news catalysts in the near future.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

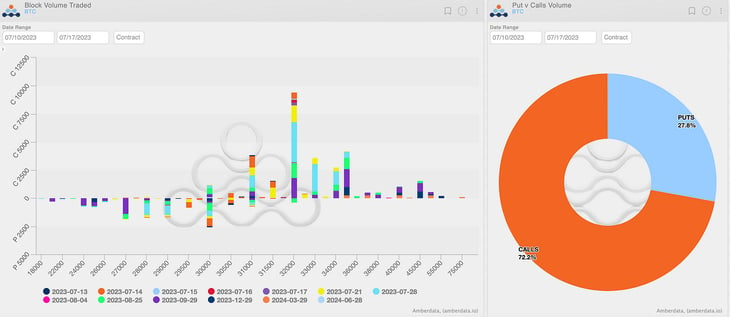

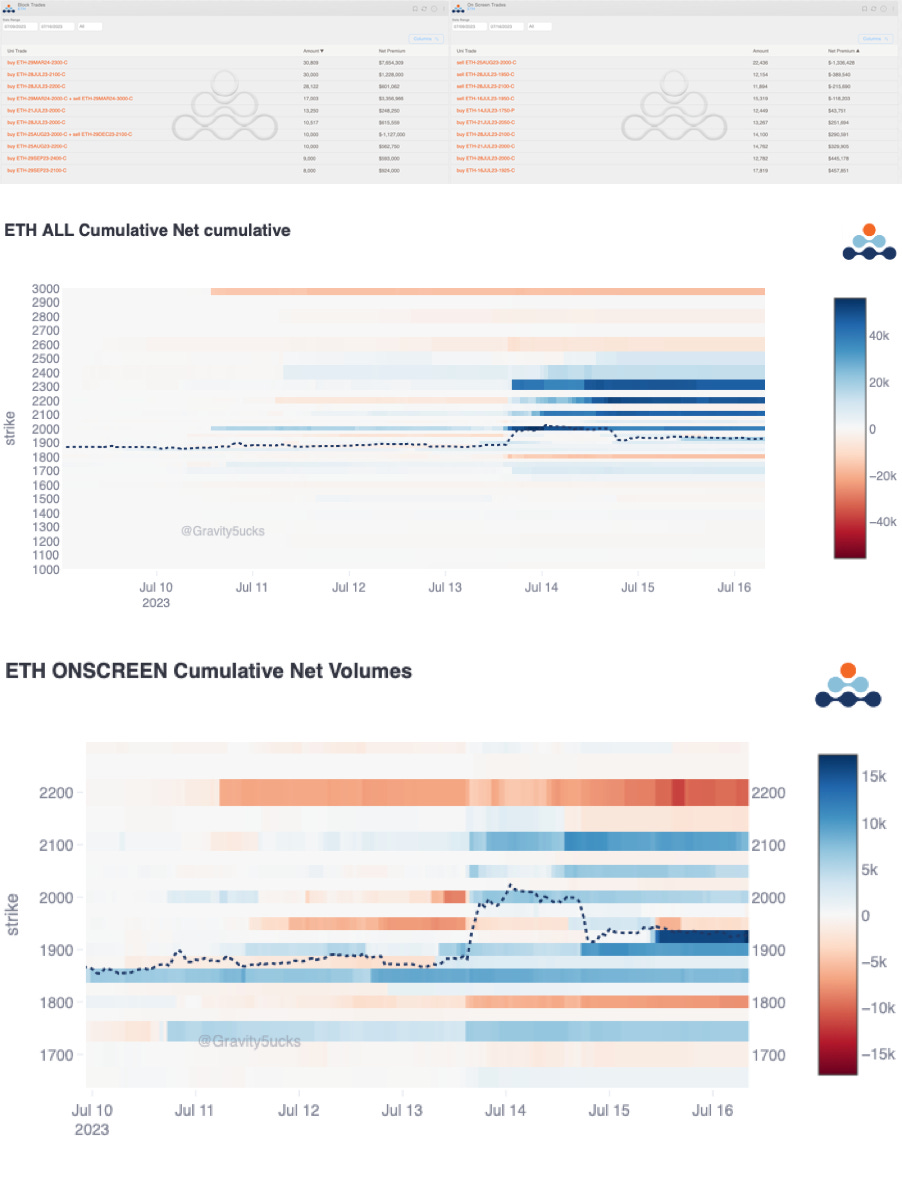

We have been discussing the divergent positioning of traders between BTC and ETH for months, with the latter actively pursuing yield generation through a consistent short-call flow.

The +7% spot movement on Thursday served as confirmation of our observations, since notably ETH traders on Deribit witnessed some of the highest liquidations in recent months, whereas BTC liquidations remained significantly subdued.

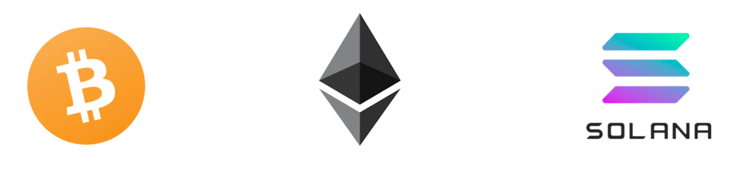

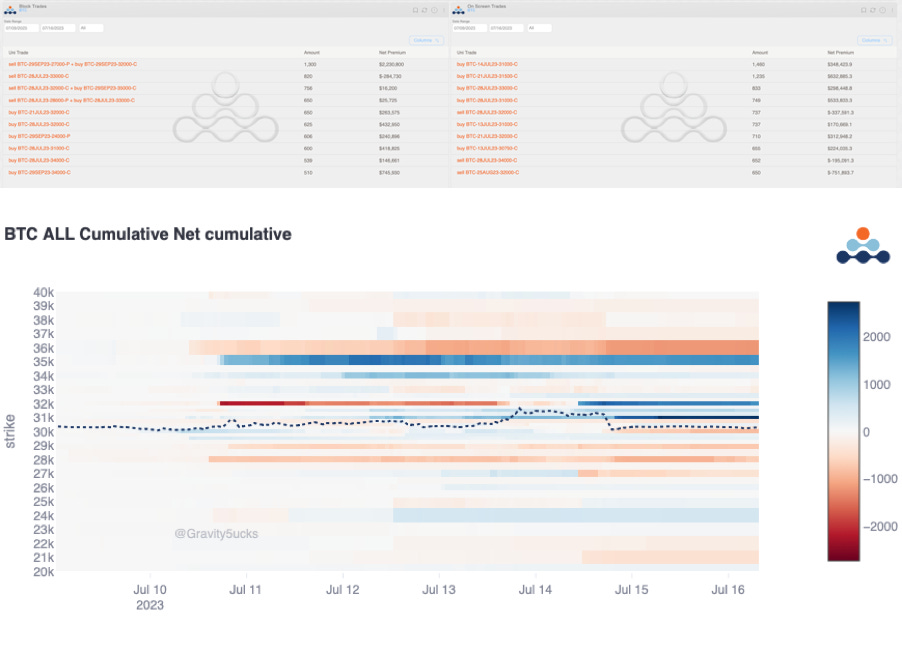

Bullish bitcoin blocks flow.

Main long risk-reversals in September and July: short $27k/$28k + long $32k/$33k.

A previous long calendar spread in July/September with -$32k/+$35k strikes created a two-way flow at the $32k strike on the heat map, resulting in a short gamma / long vega net positioning from traders.

Meanwhile, short positions were taken on screen with $36k strike in maturities August-December, counterbalanced by long $31K gamma.

For Ethereum a highly bullish scenario emerged, with blocks calls being purchased across various strike ranges and maturities, resulting in accumulation of delta, gamma, and vega.

On the other hand, the on-screen activity exhibited a more mixed flow, characterized by a long gamma position at near-atm strikes, and a short vega positioning in the $2.2k September strike.

Paradigm Block Insights

Strong outperformance by ETH (+4%) on the XRP (+55%) ruling, BTC (+.8%)

Up only options flow and resurgence of ETH options!

Large ETH overwriter shorts are being covered.

Giddy up!

XRP had been accused of selling unregistered securities and this week the SEC ruled partially in Ripple’s favor on programmatic sales on exchanges but against them for institutional sales. XRP and crypto stonks performed strongly on the back of this.

XRP +60% | COIN +34% | RIOT +22%

🌊BTC

Bullish flow expressed in outrights and risk reversals in July and September. The risk reversals (sell put and buy call) were purchased midweek during the slight pullback from 31k to 30k, where traders financed their risk reversals on elevated put skew.

1. 1000x 29-Sep-23 27000/32000 Bull RR bought.

2. 649x 28-Jul-23 28000/33000 Bull RR bought.

3. 625x 21-Jul-23 32000 Call bought.

4. 525x 28-Jul-23 32000 Call bought.

On 7/13, ETH options volumes outdone BTC for the first time in 2 months. This was due to the $300,000 of short vega covered this week as ETH rallied. This underwriting flow has historically kept volatility well supplied.

As the possibility of the “elusive” flow was no longer weighing down the curve, we saw significant outright topside vega and gamma being lifted this week.

1. 29000x 28-Jul-23 2100 Call bought.

2. 26872x 28-Jul-23 2200 Call bought.

3. 13250x 21-Jul-23 2000 Call bought.

4. 9000x 28-Jul-23 2000 Call bought.

🚨The Macro Man @davidbrickell80 and Vol Whisperer @jkruy26 dropped a HOT new #TBP.

Discussion on the decline in CPI.

Insights on DXY.

Deep dive into the current situation in China.

Live reaction to XRP news!

Tune in to stay informed 🤝

Hit us up on Telegram! 🙏

Daily Commentary✍️ http://pdgm.co/edge

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

Bybit x Paradigm Futures Spread Trade Tape: https://t.me/paradigm_bybit_fspd

BTC

ETH

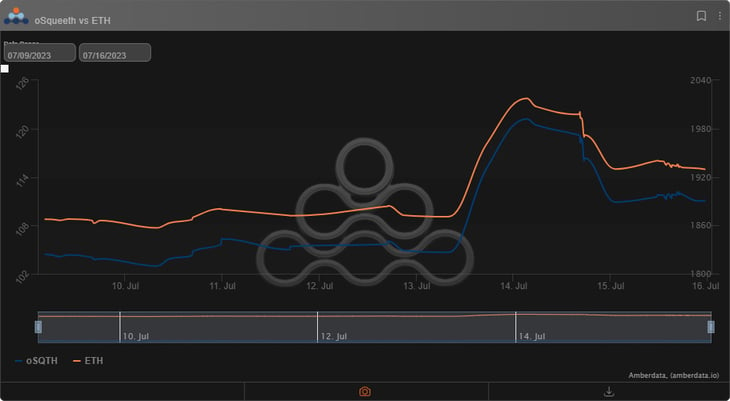

The Squeethcosystem Report

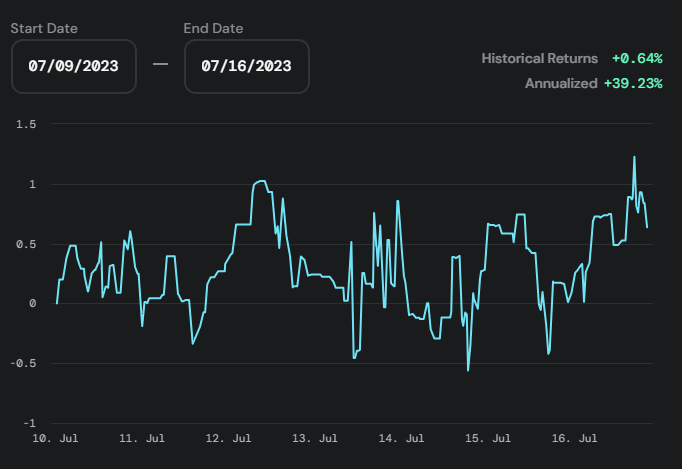

Markets found their way higher on the back of positive news out of the Ripple case. ETH ended the week 3.32%, oSQTH ended the week 6.33%.

Volatility

oSQTH IV remained range-bound this week, trading from the mid-60s to the low-40s.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $580.38k.

July 13th saw the most volume, with a daily total of $257.63k traded.

Crab Strategy

Crab ended the week strong to post a +0.64% gain in USDC terms for depositors.

View Opyn's Twitter and Discord

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...