-

Monday 8:30am ET - Empire State

-

Monday 12:45pm ET - Fed Gov. Barkin speaks

-

Tuesday 1pm ET - Fed Gov. Bowman speaks

-

Wednesday 2pm ET - Beige Book Release

-

Wednesday 7pm ET - Fed Gov. Williams speaks

-

Thursday 12p-5p - Fed Govs. Speak

-

Friday 9:45am ET - PMI

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math minded people here, pardon any typos.

THE BIG PICTURE THEMES:

Q1 2023 has been characterized as the big comeback for BTC volatility trading.

We’ve seen BTC option OI, volume and implied volatility surpass ETH on all three fronts (although briefly for IV).

This week we had the “Shapella” upgrade successfully executed for ETH. This led to a spot price rally, major block-flow, and a high VRP going into the event (similar to the Sept-2022 PoS merge).

This has been the first “signs-of-life” being breathed back into ETH vol. trading.

On the macro front, we’re still at an interesting cross-roads for the Fed’s next move.

On the one hand the banking crises seem to have subsided and equity volatility continues to drop.

(ThinkOrSwim)

This gives the Fed more room to combat inflation.

“I certainly think we are past peak on inflation, but we still have a ways to go,” Barkin said in a CNBC interview.

“Looking ahead, there are good reasons to think that policy may have to tighten more to bring inflation down,” Daly said.

Together this currently lands market expectations at a +25% hike in May (with a 75% probability).

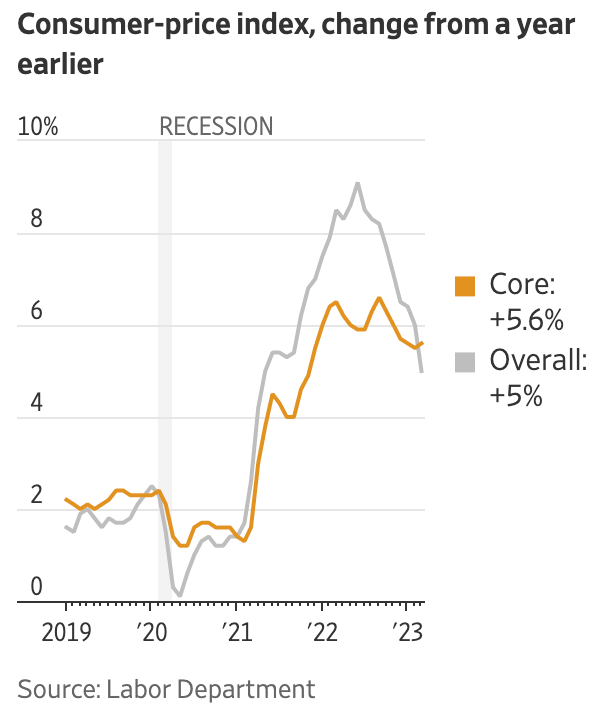

(WSJ.com)

On the flip side, U.S. inflation eased in March to its lowest level in nearly two years.

This gives the Fed the ability to move slowly with any future rate hikes being very modest and methodic.

This predictability is great for avoiding volatility and potentially this volatility crushing could bleed into crypto.

BTC: $29,544 +4.49%

ETH :$2,078 +12.13%

SOL: $25.39 +25.64%

ETH VRP

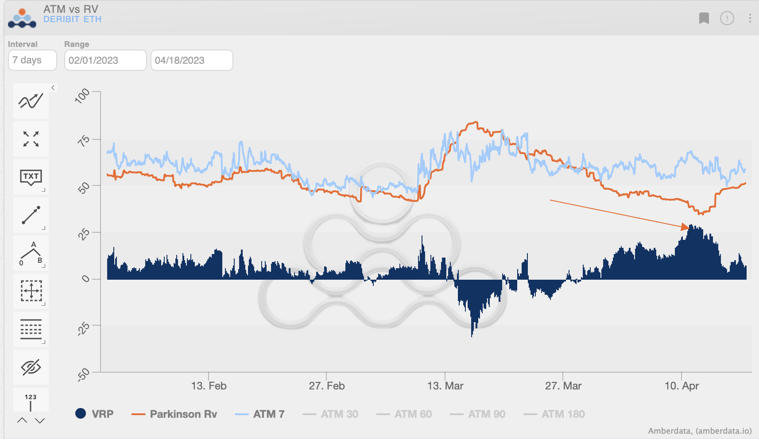

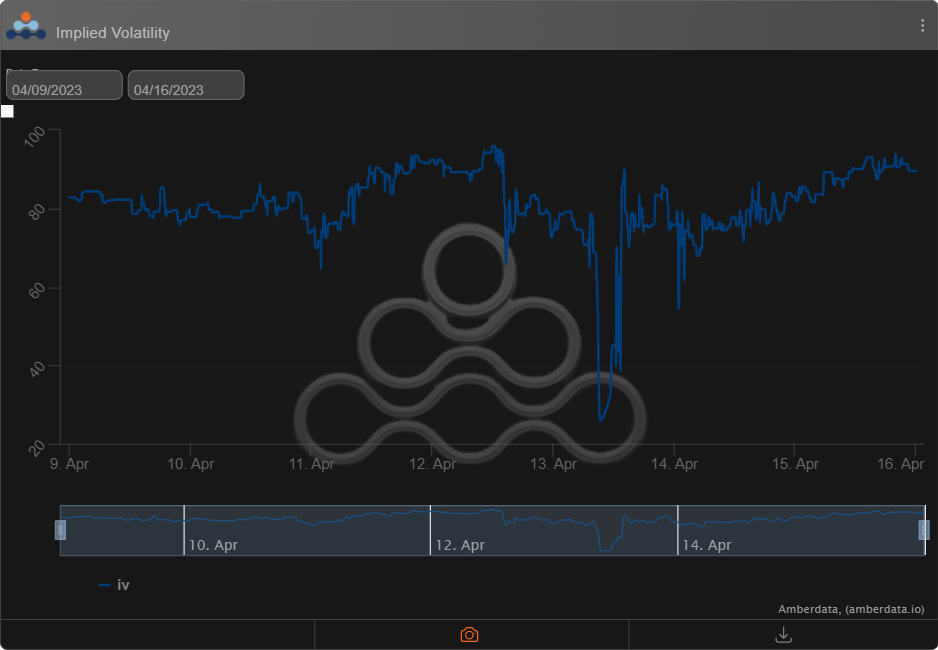

Going into the “Shapella” Ethereum upgrade, we saw a massive differential between RV and IV.

The spread reached about +25pts, even post ETH rally, the pickup in RV was unable to close the gap.

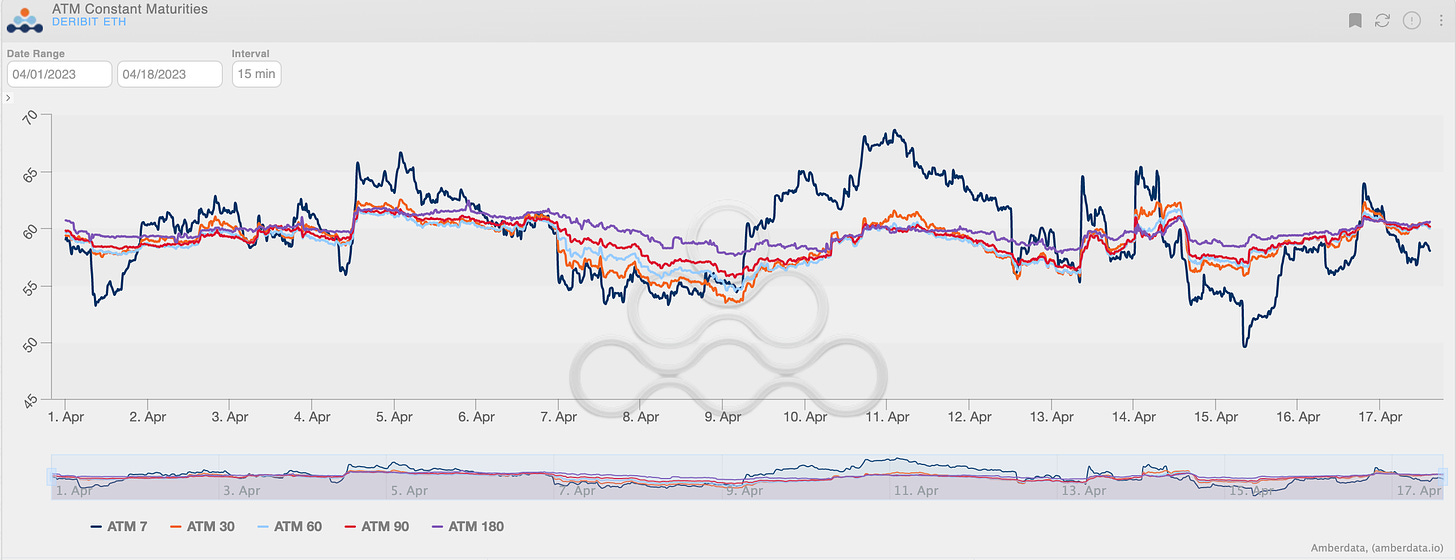

We can see the term structure was well anchored for longer maturities but the 7-ATM vol swung the term structure back and forth between Backwardation and Contago around the “Shapella” event.

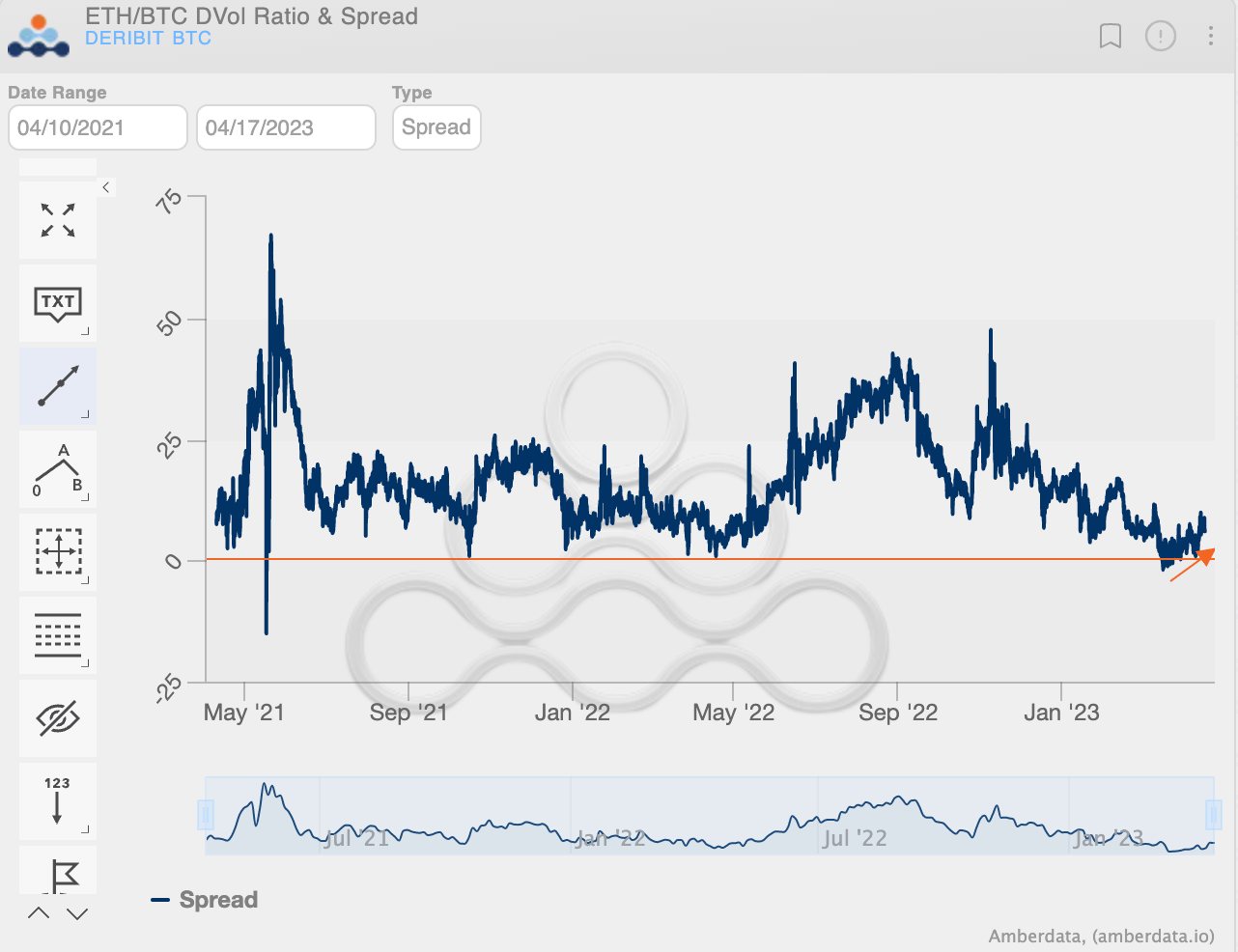

We can see that ETH DVol is bouncing higher, after making new “inception” lows.

This can be read one of two ways

1: ETH DVol is cheap or 2: BTC Dvol is expensive.

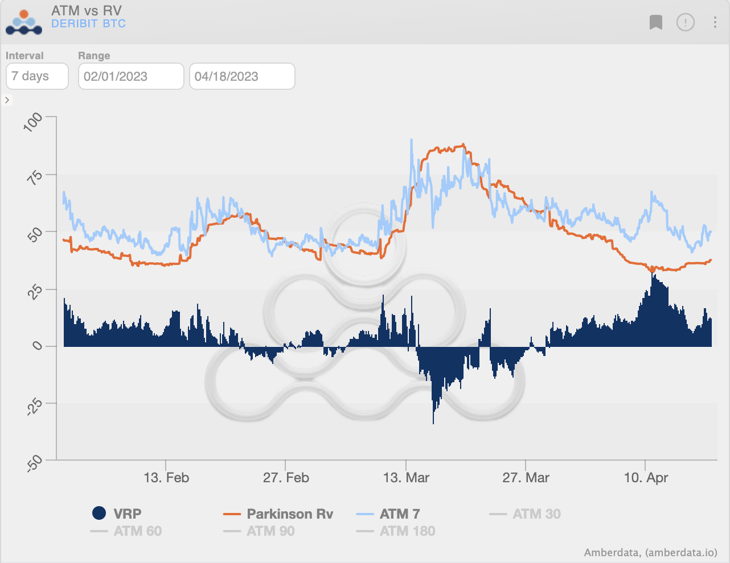

We can see the BTC RV gradually come down and stabilize lower as spot prices put in work around the $30k price level.

This has translated into a wide VRP spread as well.

Given the macro context of lower vol, banking crisis calm, and slowing CPI, plus the argument of a relatively expensive BTC Dvol level, betting against IV looks appealing.

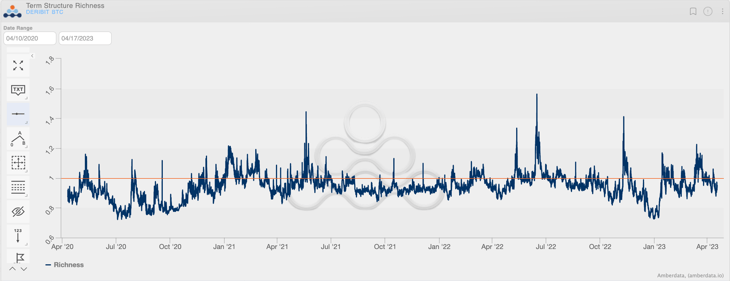

The current term structure is transitioning back into Contango, after flirting with a flat reading for the past couple of weeks.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

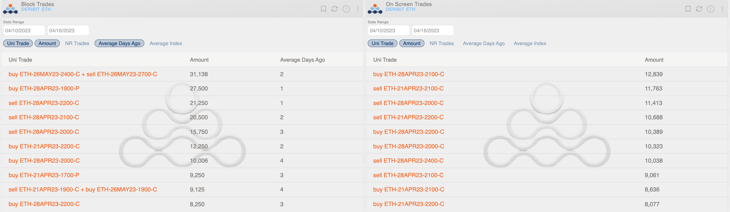

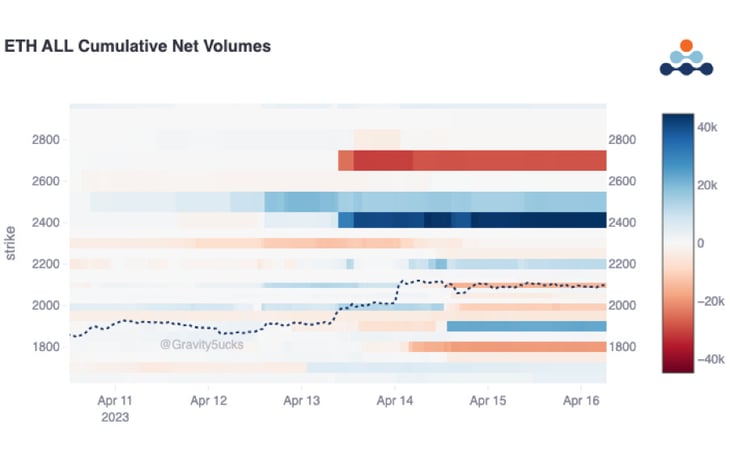

Intense trading activity on Ethereum, which has had one of its best weeks of the year. The successful completion of Shanghai hard fork must have revitalized risk-taking behavior.

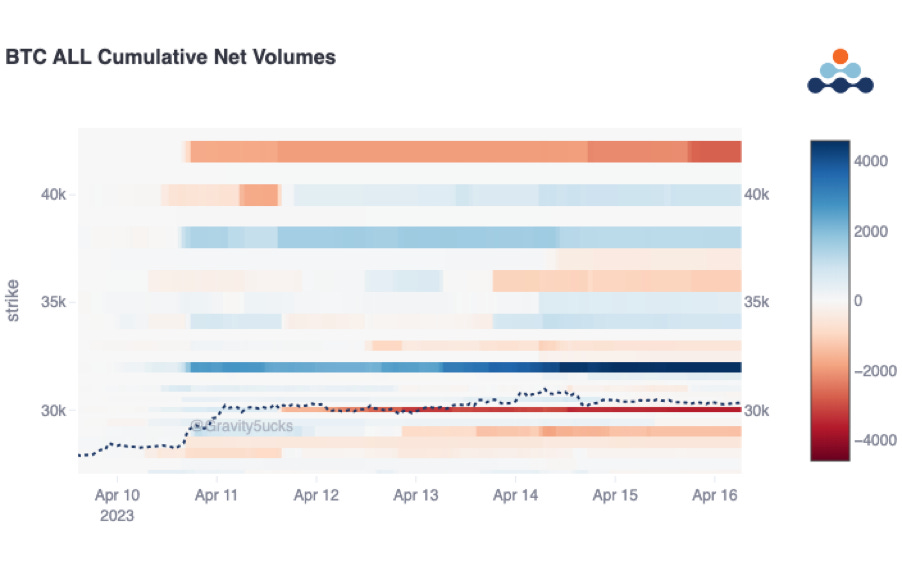

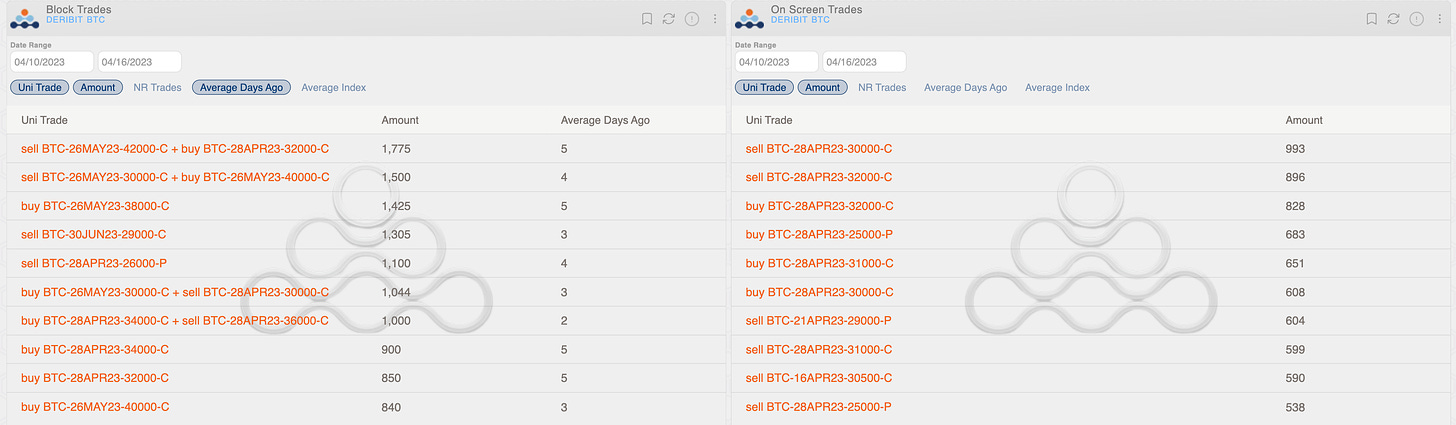

Bitcoin continues to dominate the flow.

The breaking of the $30k resistance (which was the most sold strike of 2023) has caused some traders to profit taking on the 28APR $30k contract.

It is also worth noting the diagonal purchased 28APR/26MAY +$32k/-$42k.

The most talked-about trade of the week was the massive delta-hedged call spread purchased on May $2.4k/$2.7k, which expresses a view on volatility rather than directionality.

Ethereum experienced comparable profit-taking dynamics with Bitcoin, with spot prices above $2k prompting the closing of call contracts within the $1.8k-$2.2k strike range.

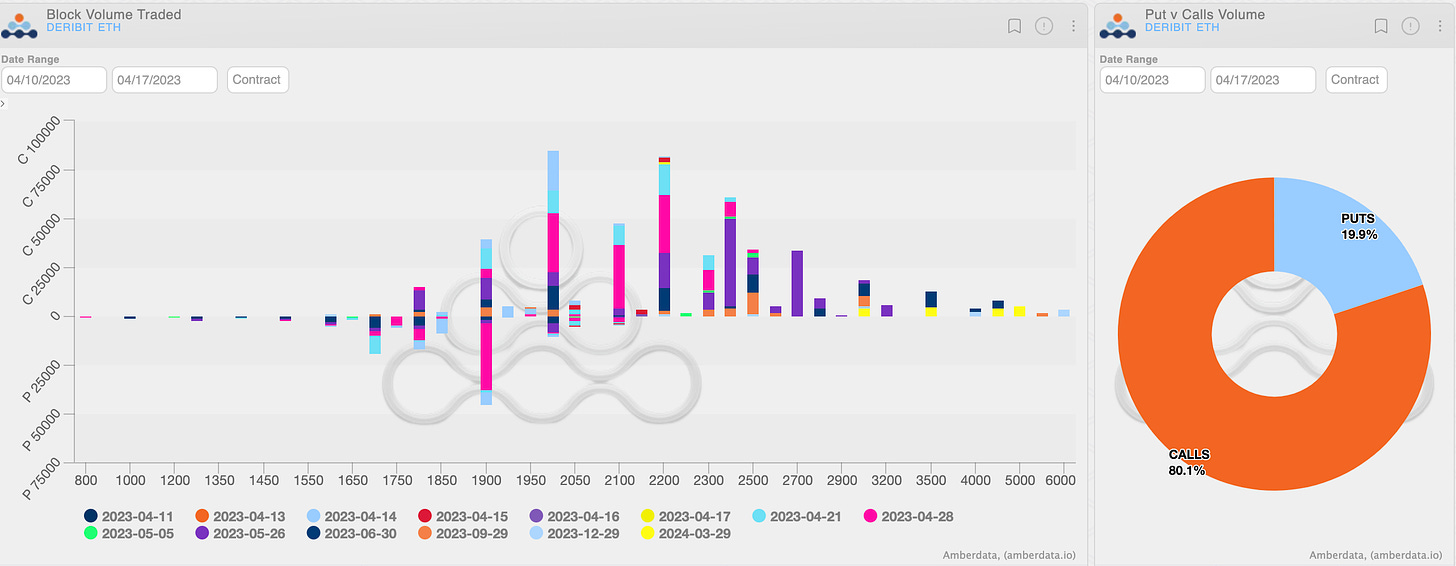

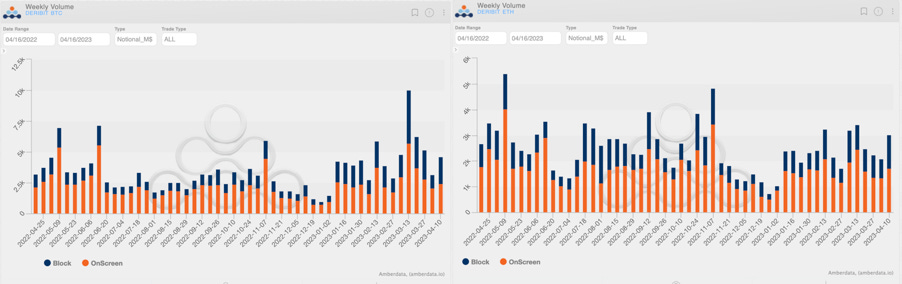

Paradigm Block Insights (9Apr - 16Apr)

Crypto outperformance vs equities continues in 2023, with BTC spiking through 30k earlier in the week, while ETH plays catch-up post-Shapella upgrade.

BTC +7% / ETH + 12.4% / SPX 1%

YTD: BTC +82% vs. SPX +8.5%

BTC 🌊

Upside buying and put selling alongside the spot rally, helping drive 25d skews further in favor of calls. These flows were relatively muted in comparison to previous BTC rallies.

1400x 26-May-23 38000 Call bought

700x 28-Apr-23 34000 Call bought

550x 28-Apr-23 32000 Call bought

BTC vols cratered later in the week as spot chopped around 30k. Implieds back at local lows and expect to see strong vol demand next week, especially from directional takers via outright calls.

The stepwise price action without significant spot retracement is encouraging, and takers likely comfortable bleeding gamma at these levels despite lower trailing realized.

Seeing some BTC vega demand over the weekend in higher strikes given the vol reset. Dec 15-delta calls bot 300x total for 63.9v. This line traded 4v higher at the beginning of the week and feels like good value here.

🌊ETH

What a week for ETH! ETH Options Volumes post-Shapella surpassed BTC for the first daily period in 2023.

ETH/BTC trades ~0.0693… rallying 11% this week! Strong spot performance post-shapella has increased taker optionality demand.

🌊ETH

Main flows after the event were topside buying alongside the rally.

31k 26-May-23 2400/2700 Call Spread bought

8000x 26-May 1800/2200 Call Spread sold (rolling strike up)

6500x 21-Apr 2200 Call bought

🌊ETH

Large bearish flows blocked to finish the week… takers bought downside and sold to close outright calls positions.

22500x 28-Apr 1900 Put bought

20000x 28-Apr 2200 Call sold

15000x 28-Apr 2100 Call sold

10000x 28-Apr 2000 Call sold

TBP | Is #ETH About to Catch Up to #Bitcoin? - Ep. 20

In this episode, everyone's favorite erudite option trader Gordon Grant from Genesis is back with his views on ETH vol flows pre and post-Shanghai, how options traders are positioned, and what is driving this leg of the spot rally.

BTC

ETH

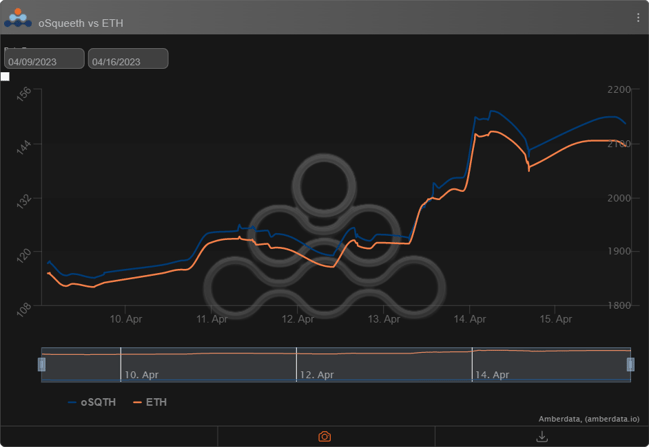

The Squeethcosystem Report (4/09/23 - 4/16/23)

With the much anticipated Shapella upgrade going smoothly, ETH found a bid and didn’t look back. ETH ended the week +12.7%, and oSQTH ended the week +26.52%

Volatility

Squeeth IV remained active on the back of the Shapella upgrade.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $4.55m. April 13th saw the highest volume, with a daily total of $1.64m traded. An additional $82.88k traded via OTC auctions this week.

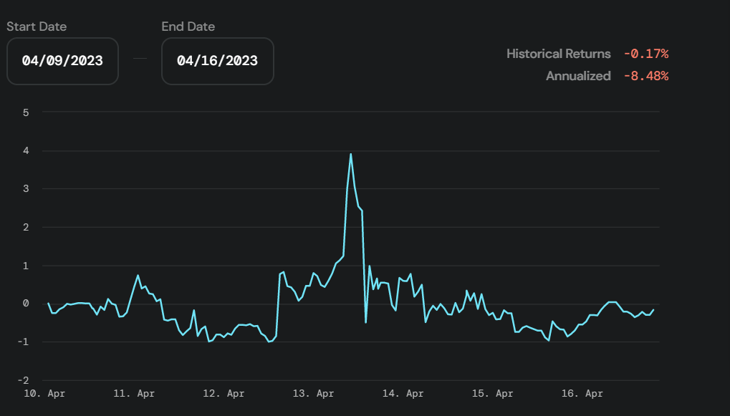

Crab Strategy

Crab saw slight declines, ending the week at -0.17% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opy

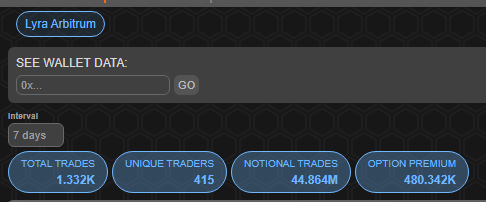

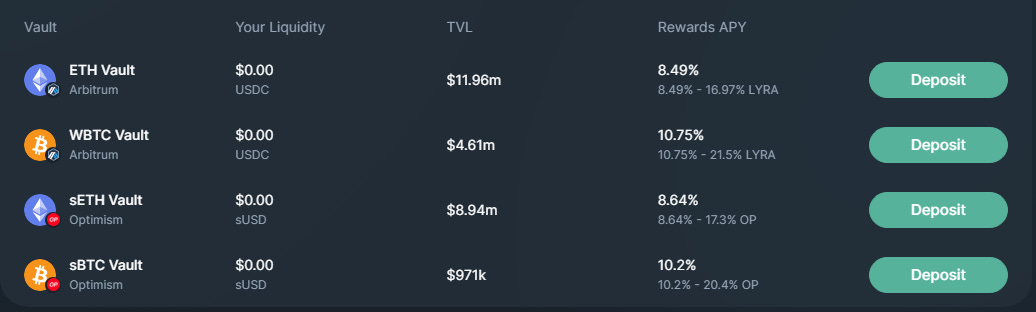

Lyra Weekly Review

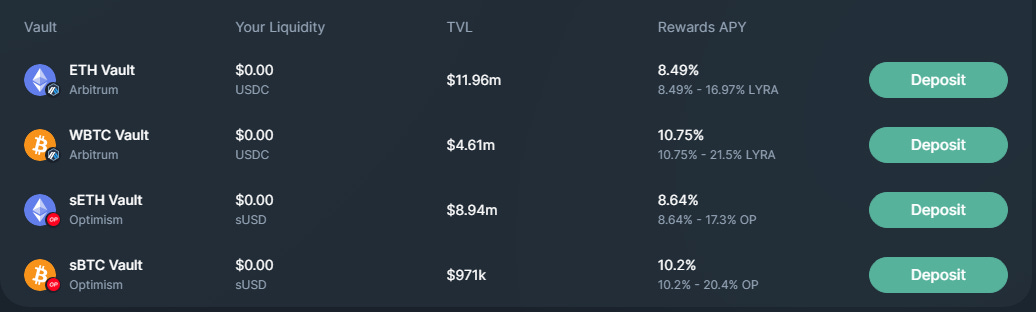

Arbitrum:

Optimism:

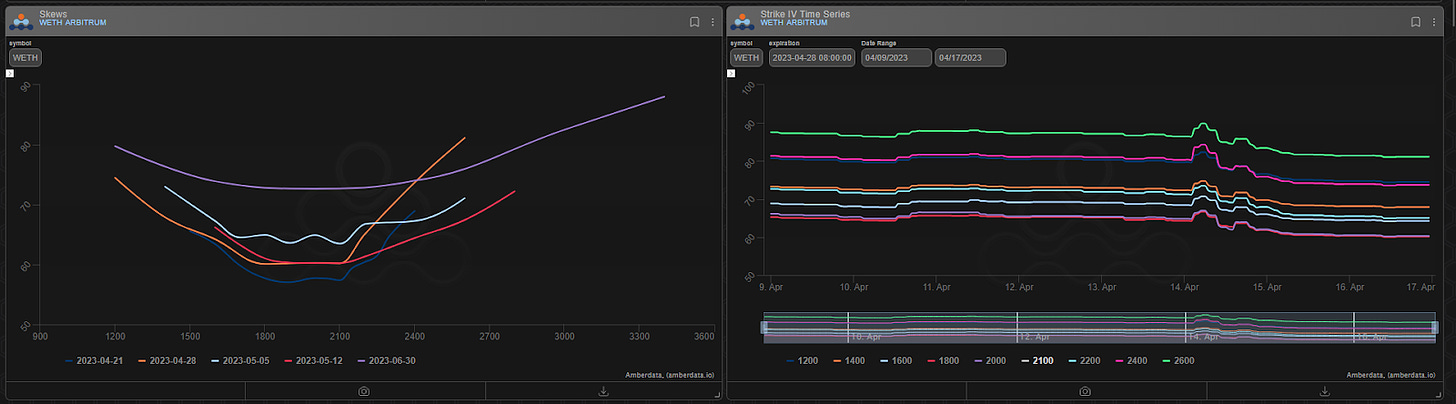

Volatility

Current ATM IV is ~60% in ETH, unchanged on the week after Shapella rally. Markets are sitting in contango with a slight call premium.

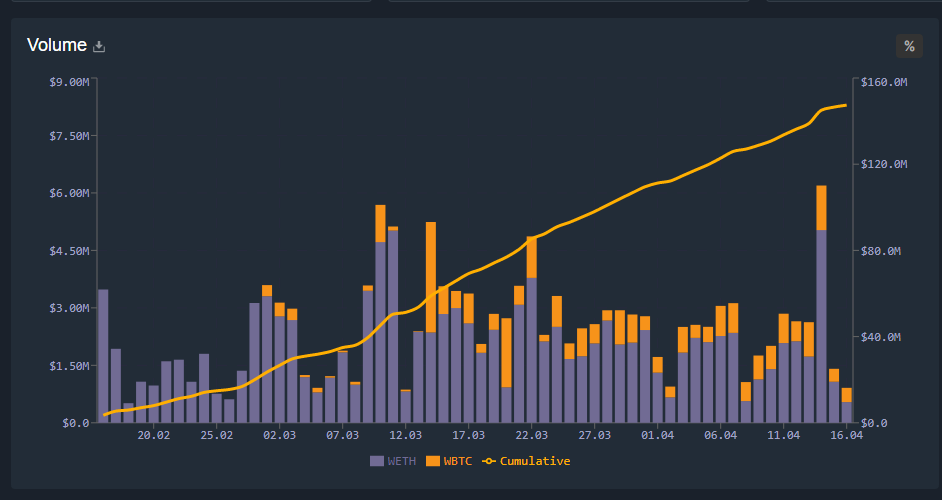

Trading

Lyra trading volume hit new highs this week, seeing over $6M in notional options traded in one day. The record day comes just after the launch of Lyra’s new trading rewards and referrals program.

https://twitter.com/lyrafinance/status/1646348828889731072?s=2

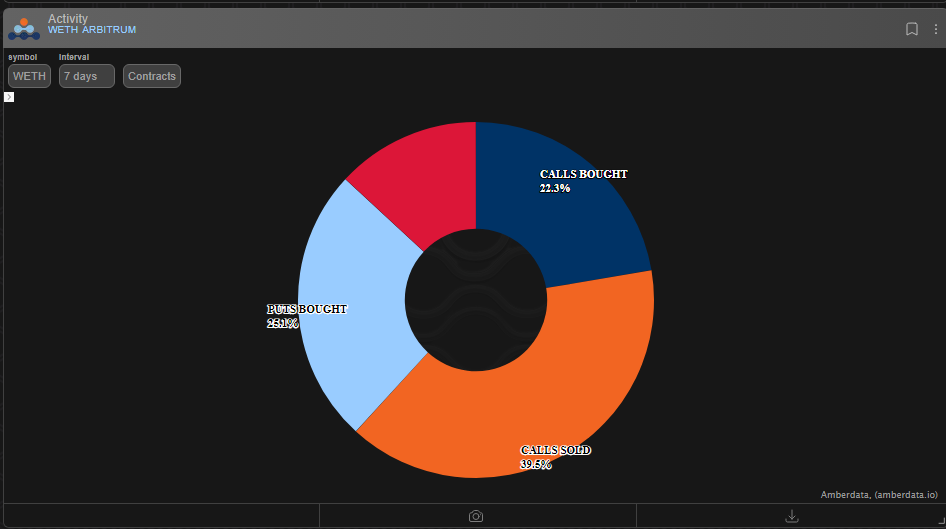

~ 62% of all volume over the last week was in calls

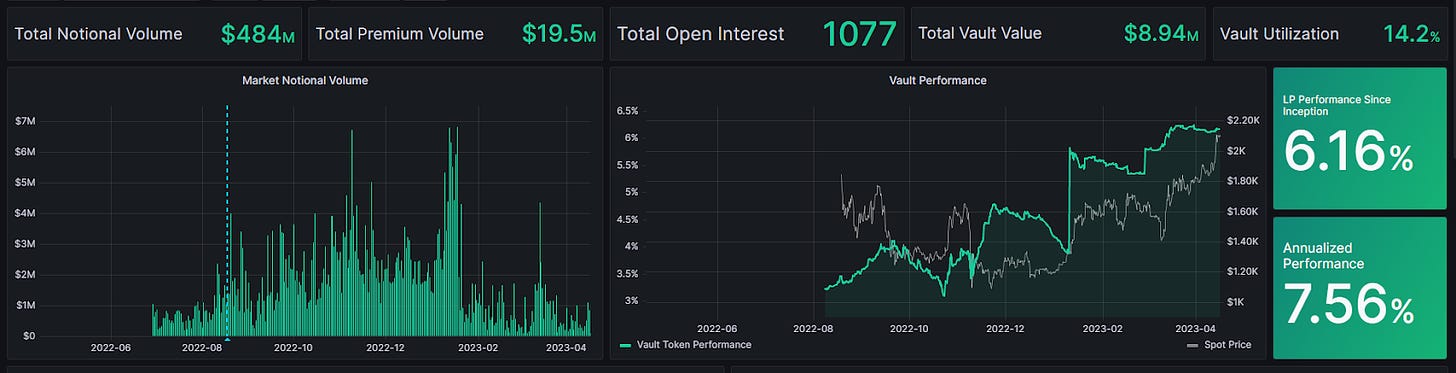

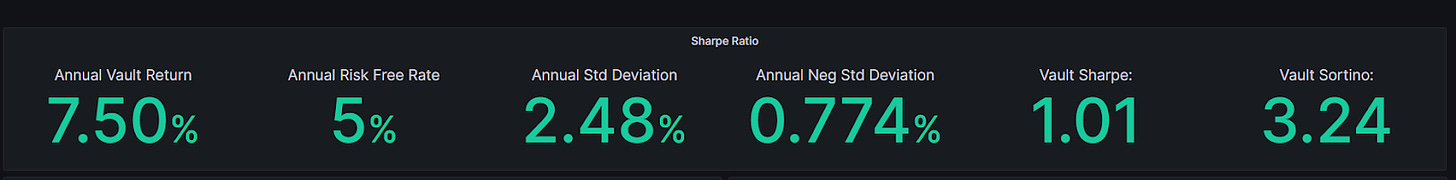

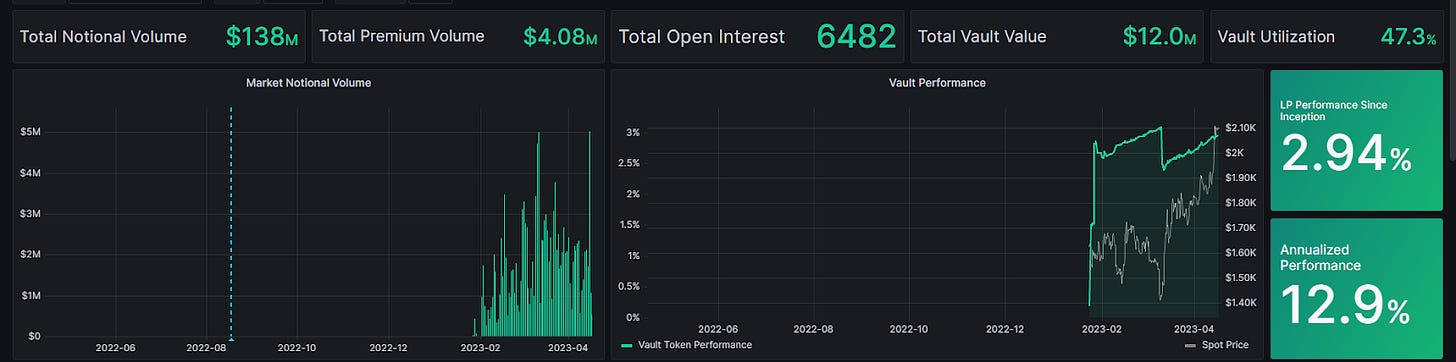

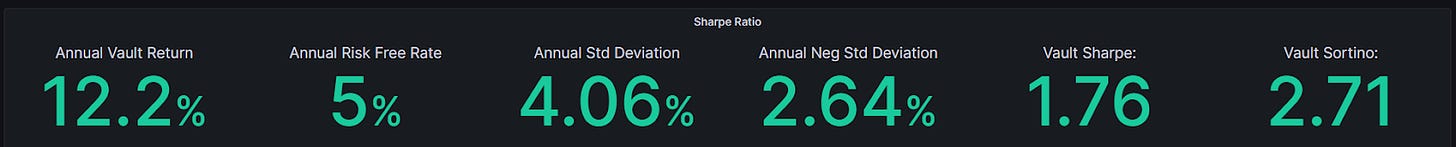

ETH Market-Making Vault

The ETH MMV on Optimism has returned +6.16% since its inception(June 28th, 2022) representing a weekly change of +.05%. Annualized performance since inception is +7.56%.

The ETH MMV on Arbitrum has returned +2.94% since its inception representing a weekly change of +.10%. Annualized performance since inception is +12.9%.

Depositors earn an additional 8.49% rewards APY, boosted up to 16.97% for LYRA Stakers on Arbitrum (new) or 8.64% boosted up to 17.3% for LYRA Stakers on Optimism.

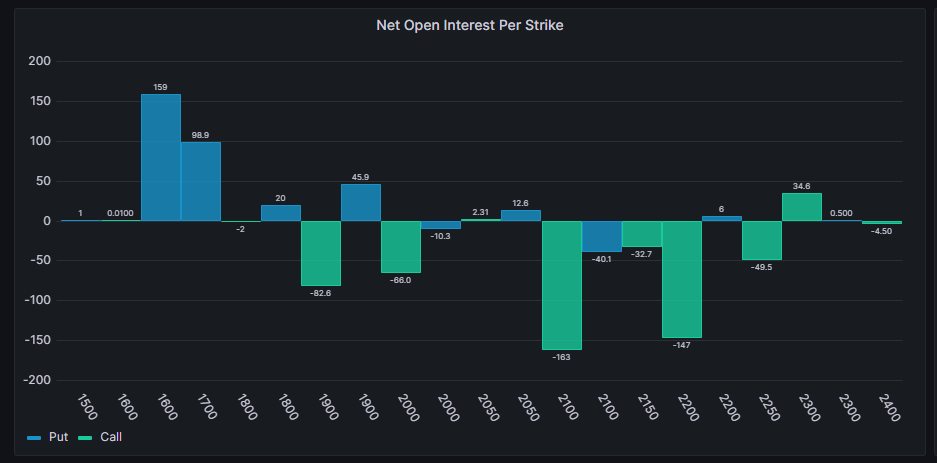

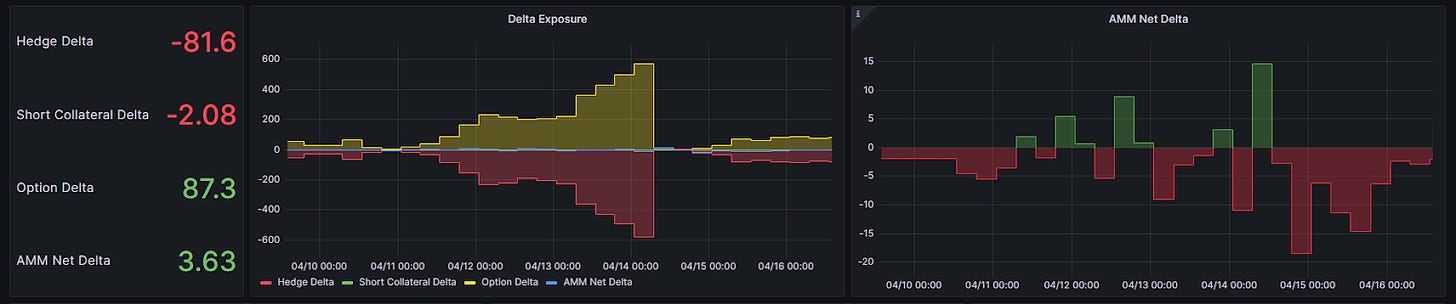

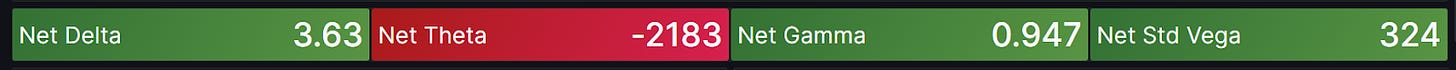

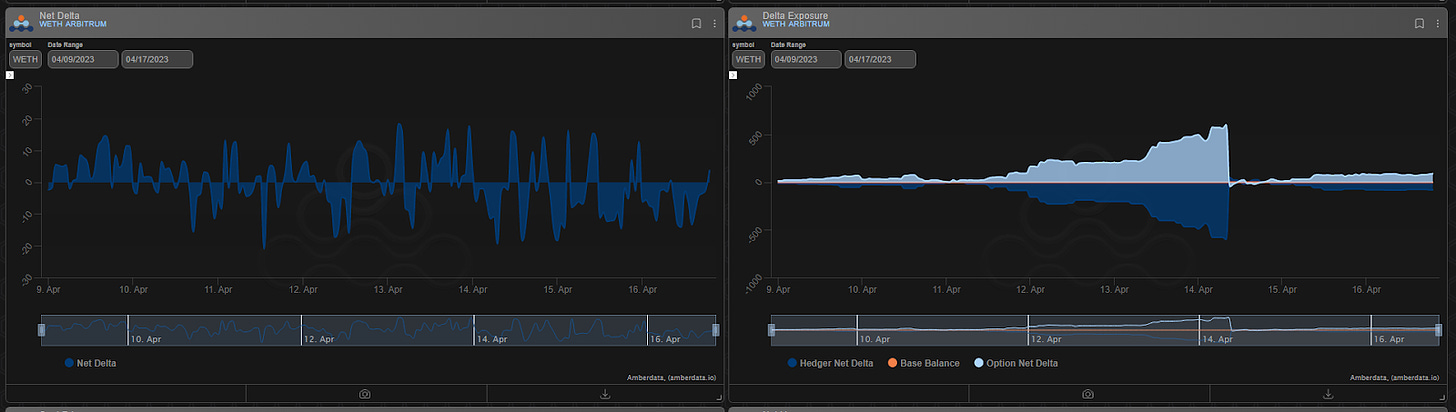

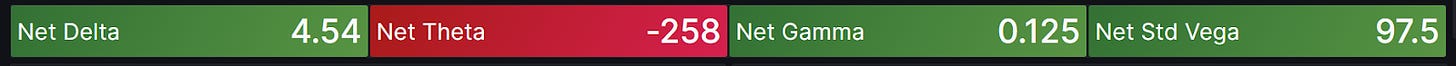

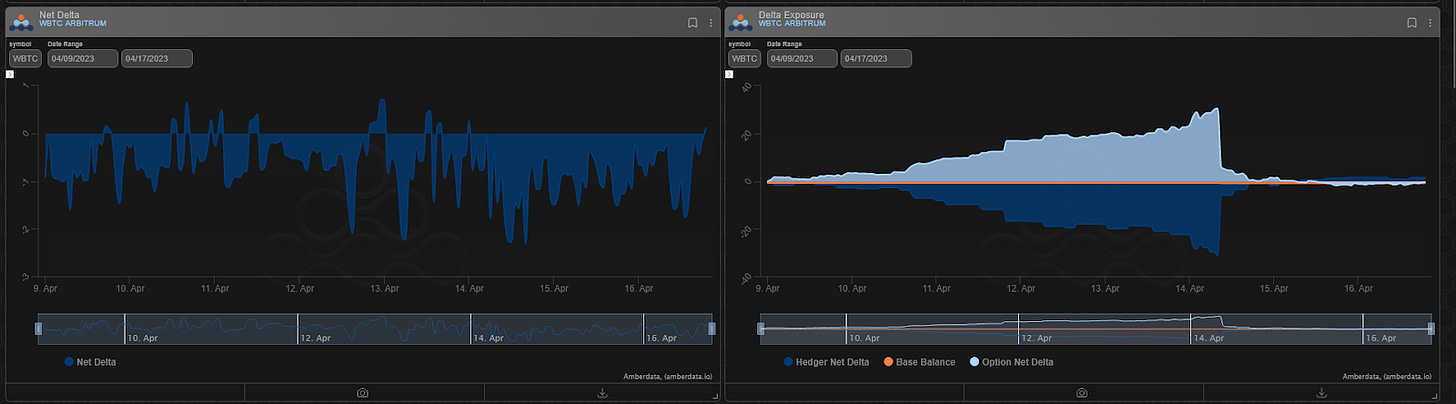

Net MMV Exposure:

Both vaults are long Gamma and Vega as it seems traders are betting against volatility in the coming weeks. The MMVs are long at-the-money options and calls and could capitalize if we see some short-term movement.

Optimism:

Arbitrum:

BTC Volatility

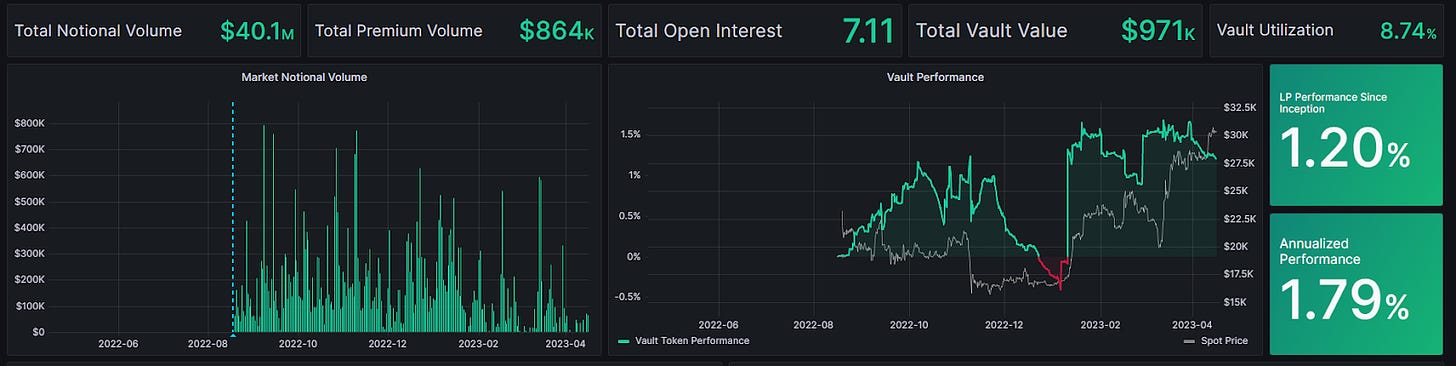

BTC Market-Making Vault

Lyra’s BTC MMV has returned +1.20% since its inception (August 16th, 2022). This represents a weekly change of -0.03%. Annualized performance since inception is +1.79%.

Depositors earn an additional 10.75% rewards APY (boosted up to 21.5% for LYRA Stakers)on Arbitrum and 10.2%(boosted up to 20.4% for LYRA Stakers)on Optimism.

Net BTC MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...