Crypto Options Analytics, Dec 17, 2023: FED Trends & ETF Anticipation

USA Week Ahead:

-

Monday 10pm ET - BoJ Interest Rate Decision

-

Thursday 8:30am ET - GDP (Revision)

-

Friday 8:30am ET - PCE

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH, and Lyra and may change their holdings anytime.

CRYPTO OPTIONS MACRO THEMES:

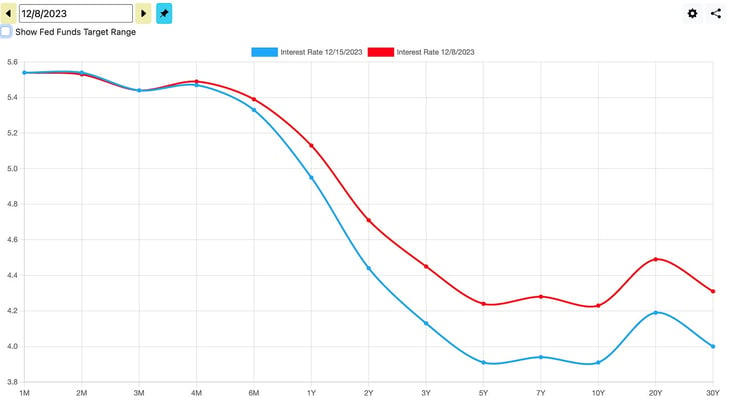

CPI readings on Tuesday were a bit higher than expected but the overall trend for lower inflation is intact.

Demand for duration remains strong, especially after last week’s FOMC meeting.

The Fed continued to hold rates steady but suggested that inflation is coming down nicely and that they will start to focus more on the employment side of the “dual-mandate” equation.

Most Fed members expect 2 or 3 rate cuts next year, likely to occur in H2.

Nevertheless, Goldman Sachs now expects 5 rate cuts next year, with a start sometime around March.

Next week is the last real trading week of the year and the economic news is relatively light.

We will have GDP revisions on Thursday, and PCE on Friday.

BTC: $41,871 (-4.4% / 7-day)

ETH :$2,235 (-5.3% / 7-day)

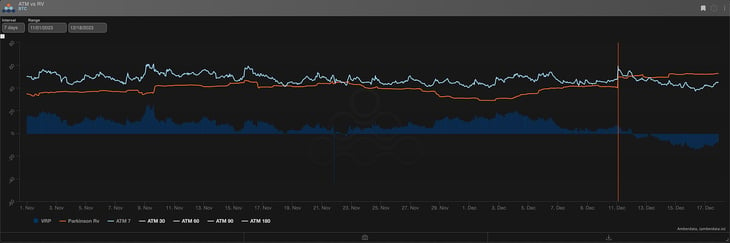

Last week we saw a sharp pullback lower in spot BTC. This helped justify the previously positive VRP as RV jumped higher on the back of this mini-crash.

Chart: (Finviz.com SPOT BTC)

Chart: (BTC 7-DTE VRP 11/1/23 to present)

We can see the large 20pts VRP seen in early December actually flip negative as the RV jumped higher.

Interestingly, the 7-day IV has trended lower since the BTC crash last Sunday… as the market anticipates some consolidation.

The big catalyst on everyone’s radar is the January Spot ETF news event.

Deribit has listed the Jan. 12th contract, earlier than normal, in order to help traders position themselves around this event.

DeFi Options Protocol LYRA has also launched their V2 with the Jan 12th expiration contract listed. They created a trading competition for around this contract as well.

Summon ye traders, the storm cloud brings;

— Lyra 🧙🧙🧙🧙 (@lyrafinance) December 14, 2023

A month-long quest, to return a king.

What is the BTC ETF PVP? 🧵👇 pic.twitter.com/xlr1rVZtHb

Trading this event is interesting; the best precedent to this “Crypto Vol Event” is the Sept’22 PoS Merge in Ethereum.

7-day ATM IV rallied from 92% → 134% in 10-days going into this event. That’s 40% of implied vol. but the actual merge had almost 0 impact on realized volatility.

Therefore, the thesis of implied volatility for BTC Jan 12th’s expiration rallying into the event has a strong precedent. Especially given the assumption that the Spot BTC ETF decision has a broader audience than the ETH POS merge.

On the “short-vol” side of the argument, after witnessing such a large discrepancy between IV and RV, option traders won’t be “fooled” again by a non-performing crypto “vol event”.

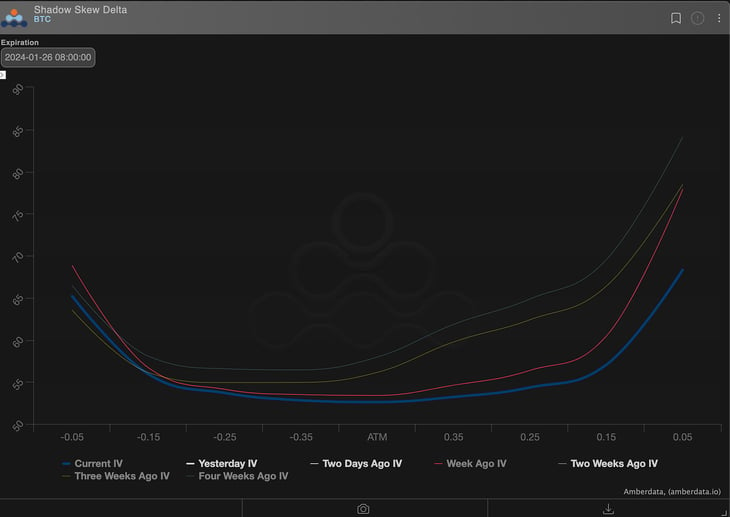

Chart: (Jan 26 2024, BTC option)

In my opinion, the asymmetric trade lies in buying ∆25 and ∆15 call wings, in either Jan 12 or Jan 26 expirations, given the following assumptions:

-

The recent spot price “pullback” is good delta value.

-

Call wing pricing has dropped back down a lot and bottomed out.

-

I expect IV to firm into the decision day.

-

Spot prices likely “creep higher” into decision day as well.

-

Demand for duration (lower rates) is a good macro tailwind for BTC.

The $44k resistance exhausted aggressive buyers at the beginning of the week. The loss of contact with the level hasn't overly spurred the downward momentum and delineating the range $40k-$44k as the current supports and resistances. Potential range breakouts could accelerate the increase in volatility.

Chart: (Binance BTCUSDT Price)

The liquidation heat map confirms the above, with surges in forced sellers/buyers at the extremes of the range. The overall low leverage suggests uncertainty in traders' expectations, and with the ETF approval window now imminent, many are wondering whether the event will be a “sell the news’” event or a continuation of the bullish movement.

Chart: (BTC Liquidation Heatmap)

In line with this scenario, the options market is also experiencing a pause, with decreasing volumes and generally without marked positions both for direction and volatility.

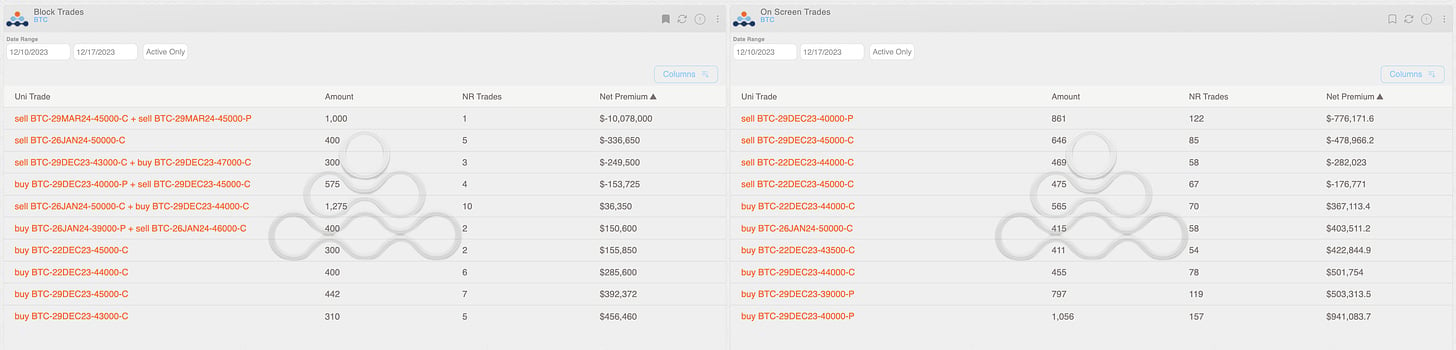

Chart: (BTC Weekly Trades)

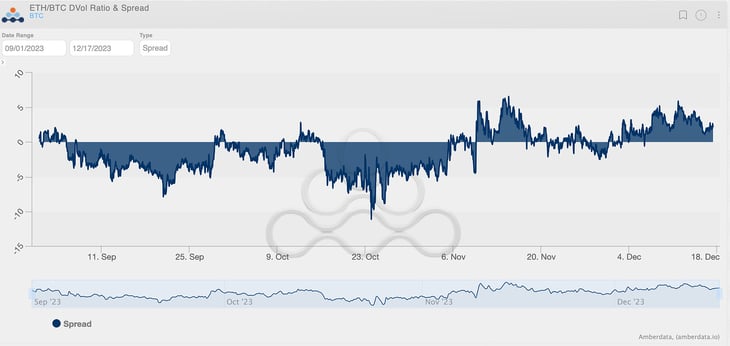

The trade of the week has been the relative volatility play between BTC and ETH, with the trade initiator betting that the volatility differential between the two coins will favor ETH. Each percentage point of the spread is worth approximately $160k.

Chart: (BTC/ETH Dvol Spread)

The early introduction by Deribit of the “ETF expiration” of January 12th will be indicative of the general sentiment in the coming days. Although traded volumes have been modest to date, the initial effect has been to absorb the volatility premium that was previously assigned to the January monthly expiration.

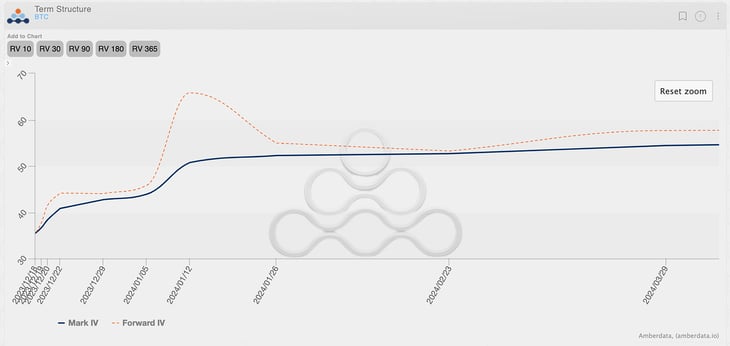

Chart: (BTC Term Structure)

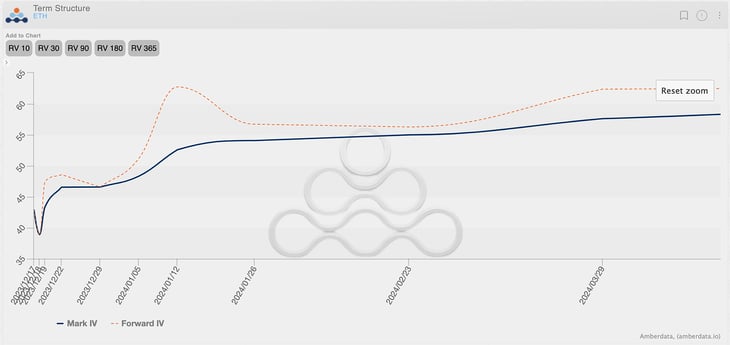

Anomalously, even the term structure of ETH exhibits the same kink, certainly more due to market symbiosis than fundamental reasons. Something that I believe will dissolve in the next two weeks.

Chart: (ETH Term Structure)

Paradigm's Week In Review

BTC +0.7% / ETH +0.3% / NDX +3.3%

Paradigm Top Trades this Week 👇

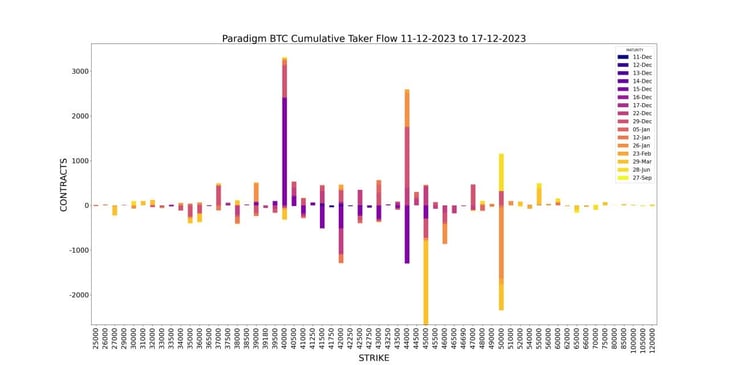

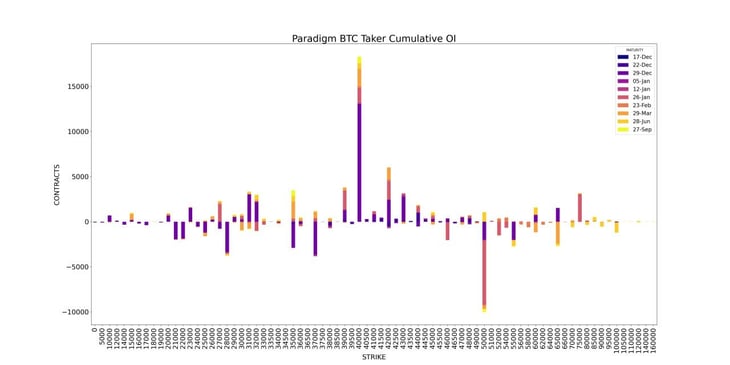

Weekly BTC Cumulative Taker Flow 🌊

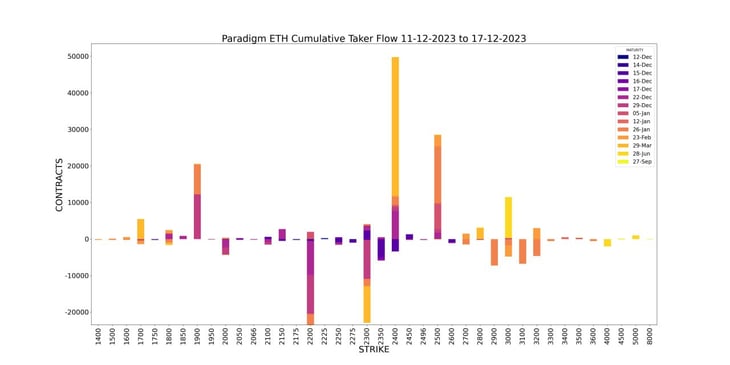

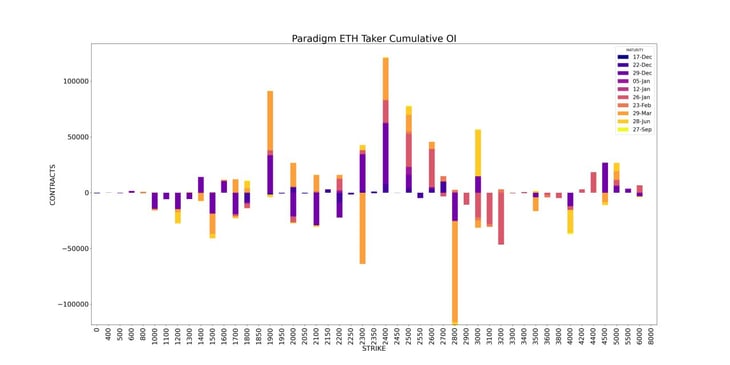

Weekly ETH Cumulative Taker Flow 🌊

BTC Cumulative OI

ETH Cumulative OI

TBP | BTC Options Pricing in ETF Fireworks 💥 w/ Jerry Li from Bybit - Ep. 42

📊 BTC term structure and skew dynamics ahead of ETF decisions

💰 Bybit's new structured product offering

📉 Paradigm's proprietary Interdealer data

📣 New Listings to Ape on @tradeparadex! 🦍

$AVAX

$XRP

As always, you can hit us up from the below

Hit us up on Telegram! 🙏

Paradigm Edge: Daily Commentary✍️ http://pdgm.co/edge

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

BTC

ETH

The Squeethcosystem Report

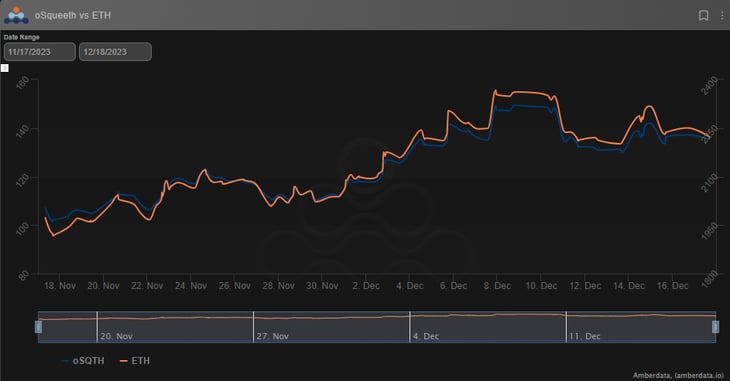

Crypto markets found their way higher throughout the week. ETH ended the week -5.44%, oSQTH ended the week -8.87%.

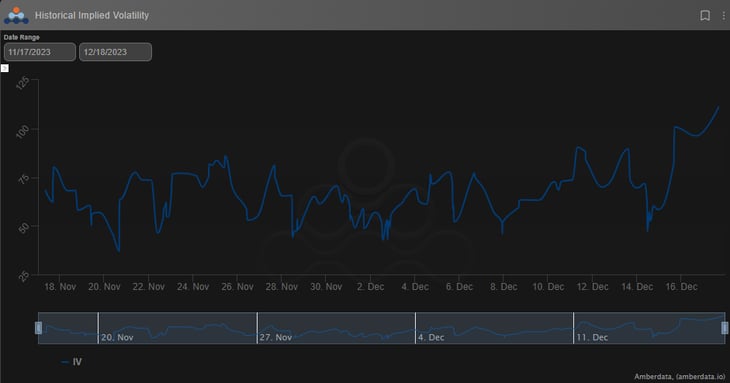

Volatility

oSQTH IV continued to trade higher throughout the week ending in the 100s.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $510.54k

December 11th saw the most volume, with a daily total of $284.12k traded.

Crab Strategy

Crab saw declines during the week, ending at -1.53% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...