Crypto Options Analytics, Sept 4th, 2023: BTC, ETH, and oSQTH Analysis

USA Week Ahead: ET Timezone

-

Wednesday 10:00am - ISM

-

Wednesday 2pm - Beige Book

-

Thursday - Fed Presidents Speak

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH and Lyra and may change their holdings anytime.

Math-minded people here, pardon any typos.

BTC: $25,775 (-1.5% / 7-day)

ETH :$1,629 (-1.8% / 7-day)

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

The bitcoin market continues to have the favor of traders, with another good week of volumes.

Ethereum post-merge 2022 is steadily declining and is now stable at about half of Bitcoin.

The gamma week incentivized participants to take multiple positions, often ahead of price action.

The first relevant trade was the buy of a put spread financed by calls at zero cost:

https://twitter.com/Gravity5ucks/status/1696802635217530925?s=20

Later in the week with the spot at around 28k and with exceptional timing the purchase of risk-reversal (puts bought) -$30k+$26k went quickly in profit:

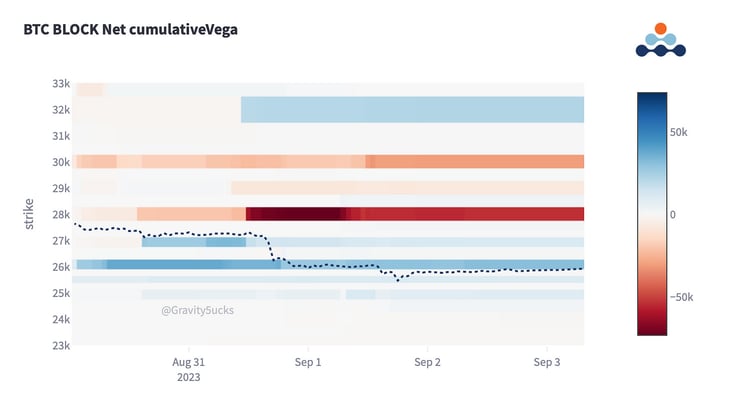

In vega terms instead, the fullest trade of the week was the sale of a DEC $28k straddle:

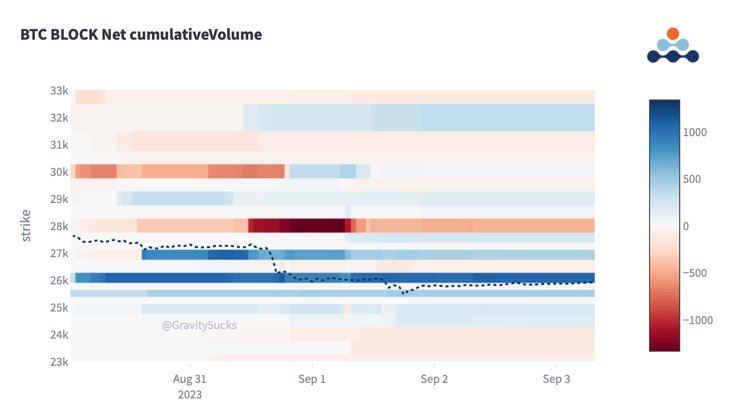

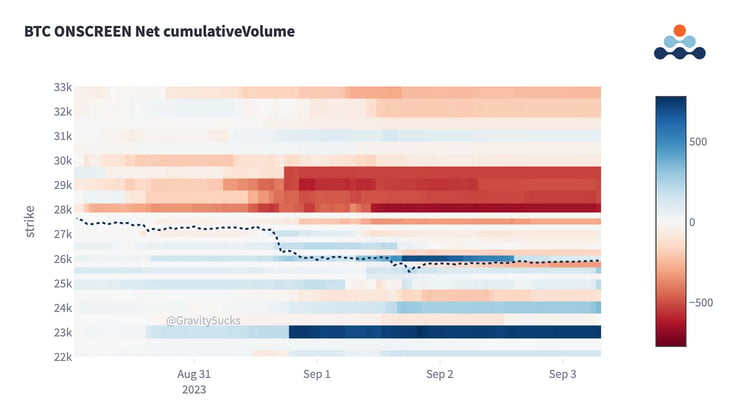

With the loss of $27k support, on-screen the flow was focused on selling calls in the $28k-$30k strike range on September.

As well as long puts positions $23k October-November-December.

The Squeethcosystem Report (8/27/23 - 9/3/23)

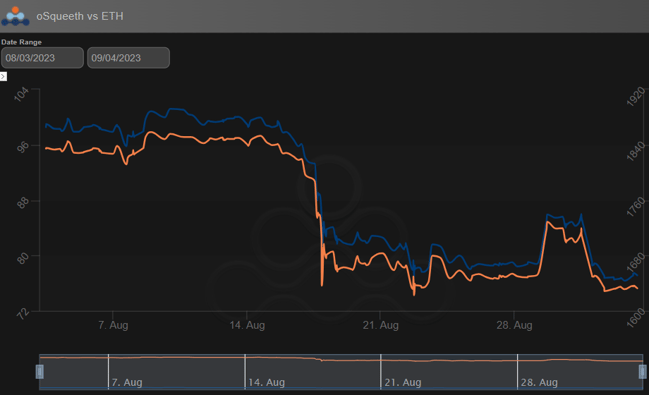

Crypto markets remained active this week with very little to show for it. ETH ended the week -1.21%, oSQTH ended the week -1.99%.

Crypto Volatility

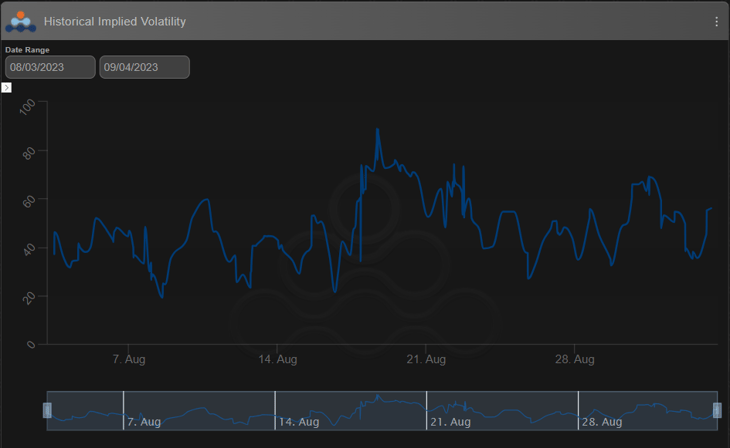

oSQTH IV found a low this week trading in the 40s and quickly bouncing back to the mid 50s.

Trading Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $323.28k

August 31st saw the most volume, with a daily total of $149.70k traded.

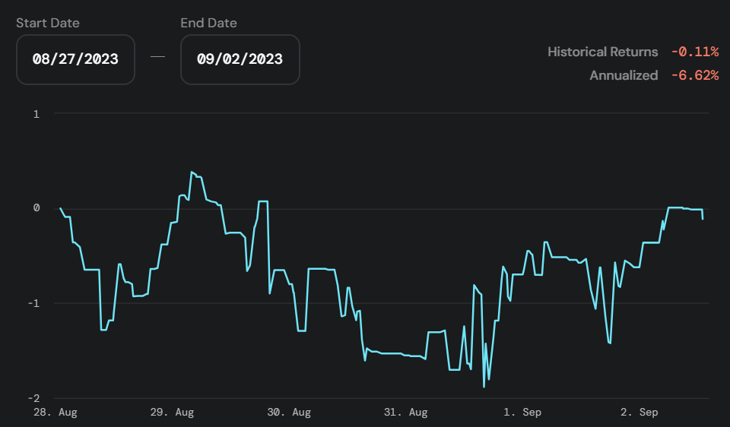

Crab Strategy

Crab saw slight declines during the week ending at -0.11% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes or should be relied on as a suggestion, offer, or other solicitation to engage in or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high-risk in nature. Don't invest more than what you can afford to lose.

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...