.png)

-

Monday - U.S. stock and bond markets are closed in observance of Presidents Day.

-

Wednesday 2pm (ET) - FOMC minutes from Jan 31-Feb 1 Meeting

-

Thursday 8:30am (ET) - Q4 GDP (1st revision) Previously 2.9% Annual

-

Friday 8:30am (ET) - PCE Index

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math minded people here, pardon any typos.

THE BIG PICTURE THEMES:

Crypto volatility paid-off and is likely still an interesting long.

There’s a big bifurcation between "retail assets” and “institutional assets” (my own categorization).

After the massive jobs report, reflecting January employment gains, we’ve seen commodities, bonds and precious metals all quickly nosedive. The USD has also rallied against other major pairs.

I’d call these “institutional assets”, considering the maturity of these markets.

Heavily shorted stocks and crypto are rallying higher and continue to show strength.

Gold and BTC have completely broken apart in their correlations, after trading higher together since November post-FTX.

And another compelling data point to this bifurcation theory is that while BTC has been on a tier higher, option dealers are net short gamma in the face of the rally.

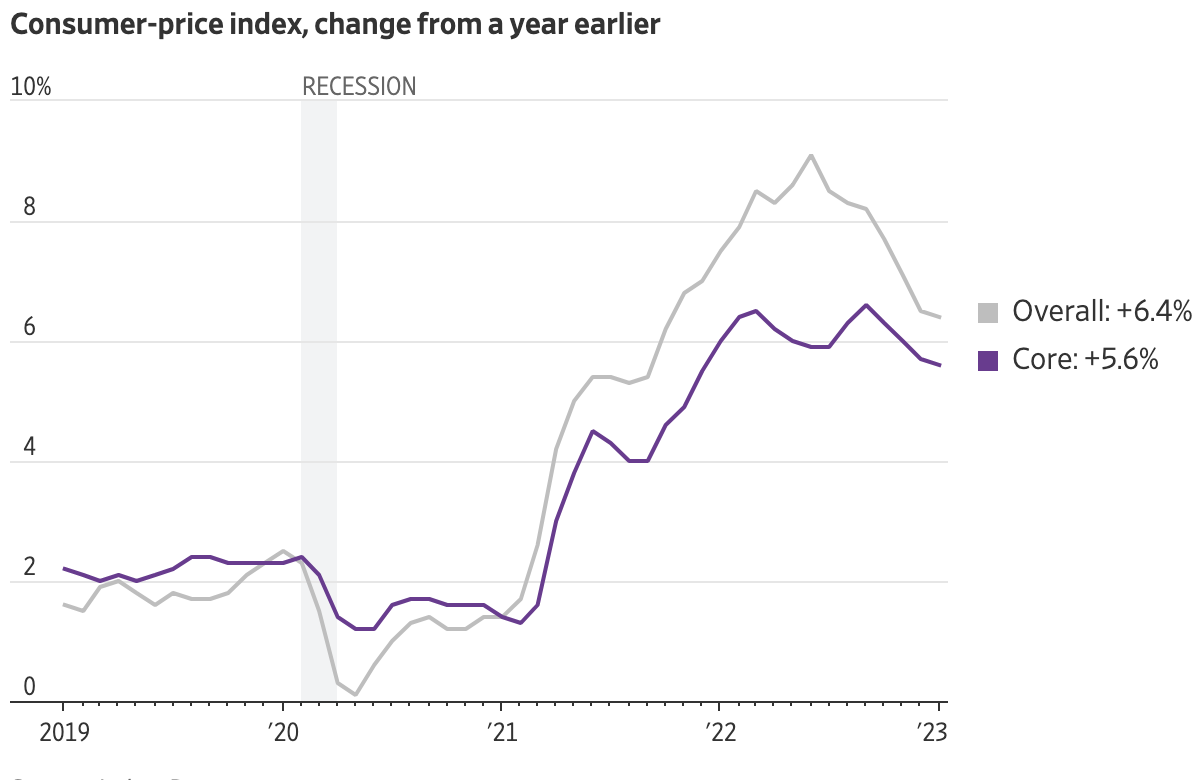

Last week’s CPI release has been interpreted differently, based on which assets.

This week is likely going to be moved by the FOMC minutes release on Wednesday, and the Friday PCE reading.

The Federal Reserve releases the minutes from its Jan. 31-Feb.1 meeting, when rates were hiked by 25bps. The minutes will provide more details on the decision.

The personal-consumption expenditures price index (PCE) is a gauge of inflation closely watched by the Fed.

Last week Powell said “Lowering inflation is likely to take quite a bit of time. It’s not going to be, we don’t think, smooth.”

I don’t think that this bifurcation in asset price action can continue indefinitely.

BTC: $24,457 +12.26%

ETH :$1,685 +11.27%

SOL: $25.11 +16.50%

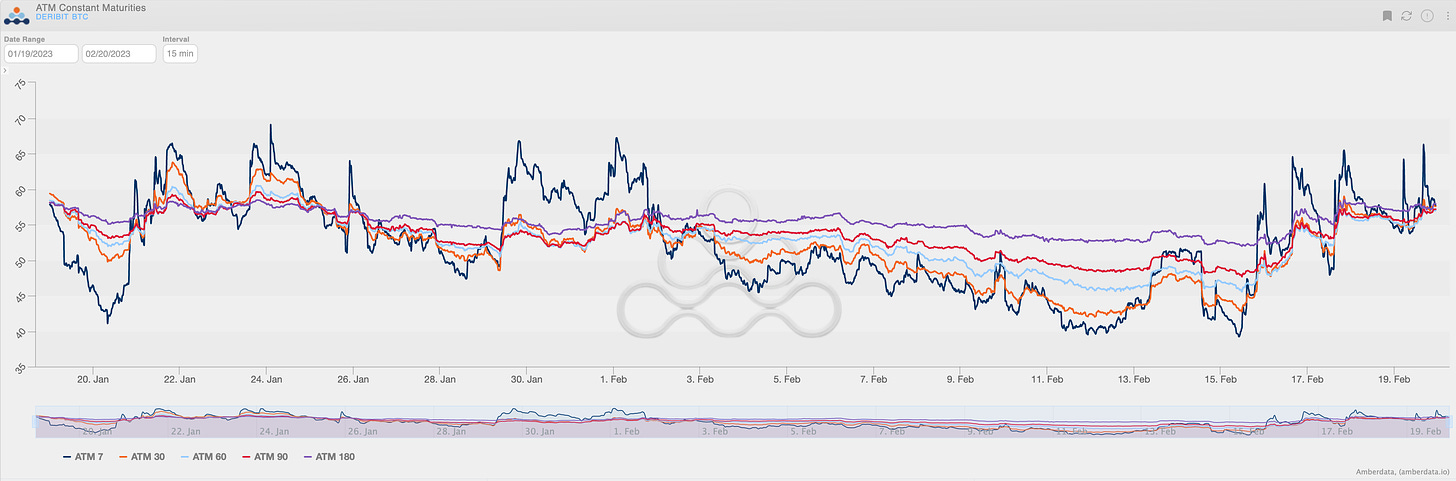

TERM STRUCTURE

(Feb. 12th, 2023 - BTC Term Structure - Deribit)

Short-term spot/vol. correlation proved to be VERY strong once again. We’re seeing BTC tear higher with a lot of momentum. We could easily see prices rise to $30k, given the current velocity.

This is causing the BTC term structure to flip into backwardation on these price rallies.

Long term 180-day ATM IV is anchored, however, and has only moved in a +5/-5 range throughout all this action.

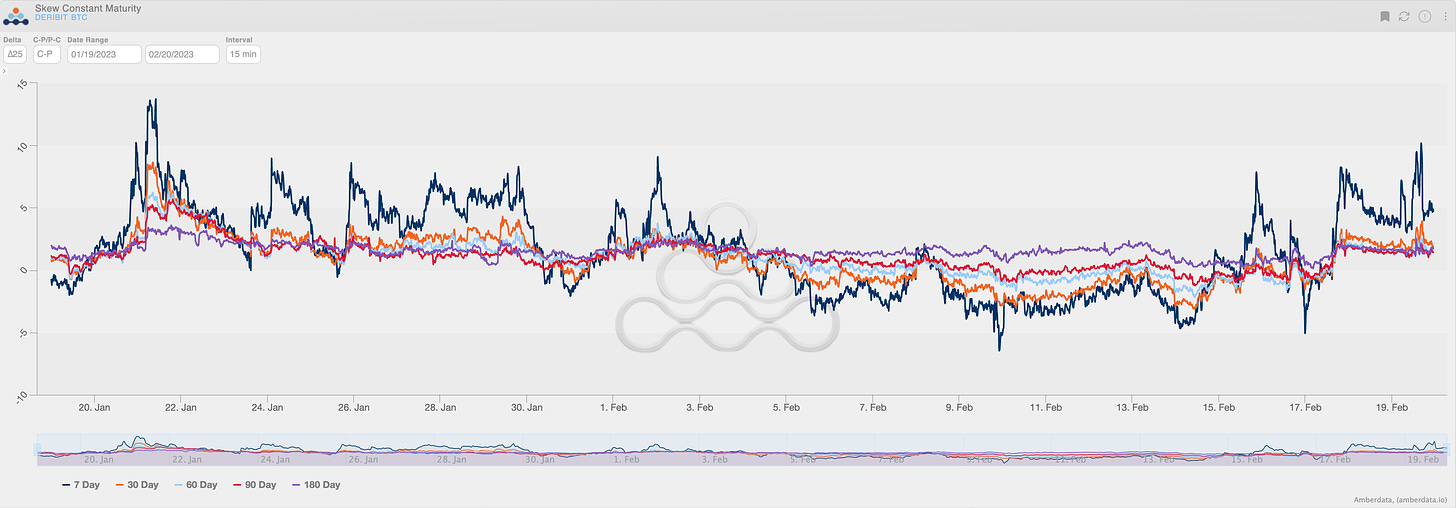

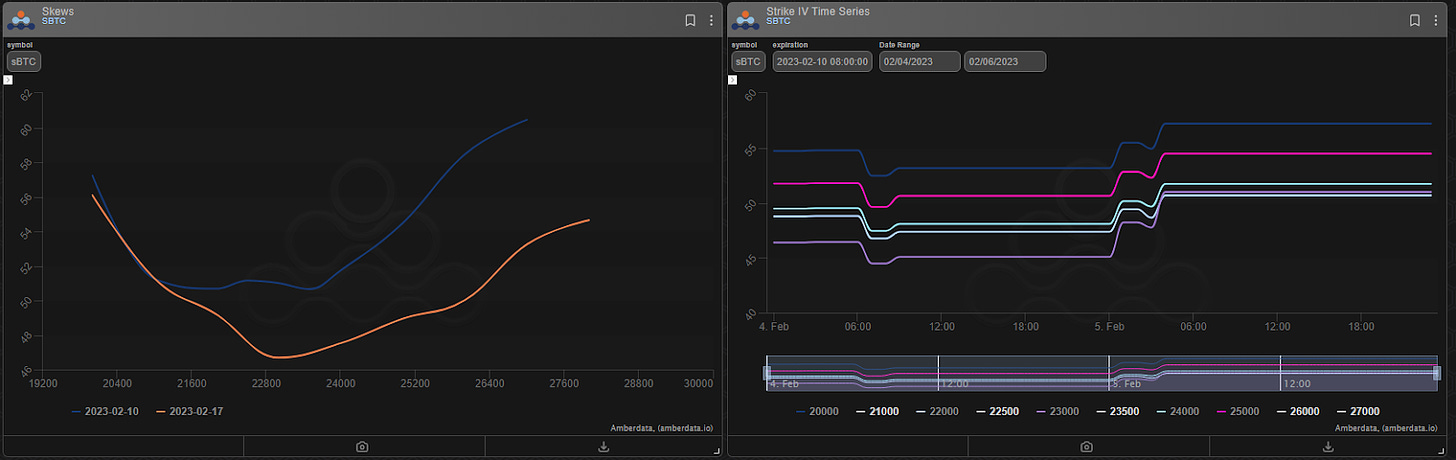

SKEWS

(Feb. 19th, 2023 - BTC RR SKEW (C-P) ∆25 - Deribit)

The RR-Skew proved worthy of another rally higher, especially in the short-term 7-day maturities.

I thought this trend would be over but it’s proving extremely resilient so far in Q1 2023.

If this RR-skew rally momentum can bleed into longer maturities, I’d love the fade, given the 2022 relationships we witnessed last year.

For short-term RR-skew, there’s a great argument for a fade here too.

“Easy come, easy go” can easily happen with violent rallies higher like this, if spot prices erase gains, having sold a very expensive RR-Skew is $money.

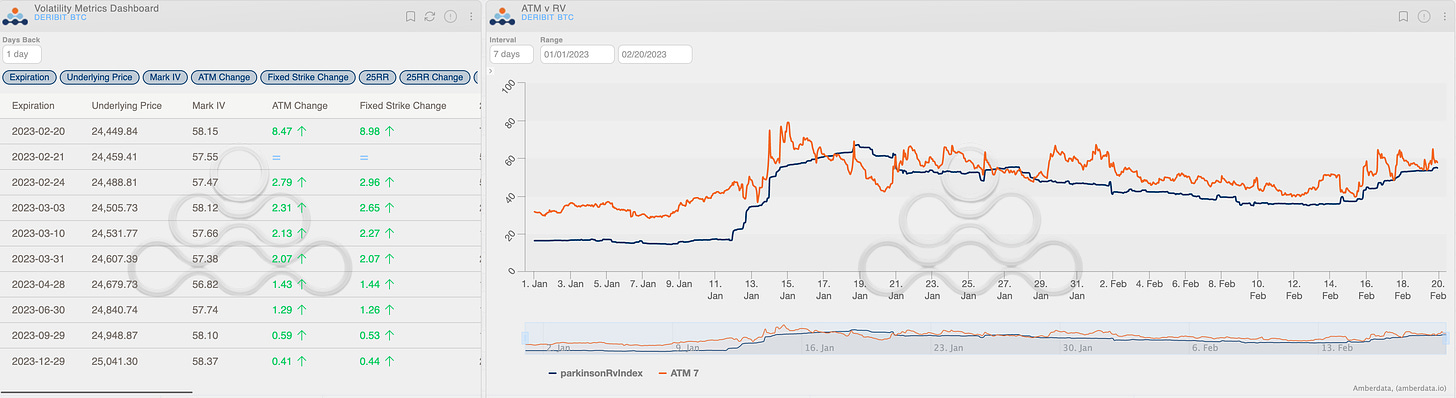

VOLATILITY PREMIUM

(Feb. 19th, 2023 - BTC IV-RV)

IV is still a good long by my estimation.

RV is trading right around this historical median and IV isn’t pricing much of a VRP at all.

Given the explosive price action - which could easily reverse gains - there’s potential for continued RV, whichever direction spot prices go.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

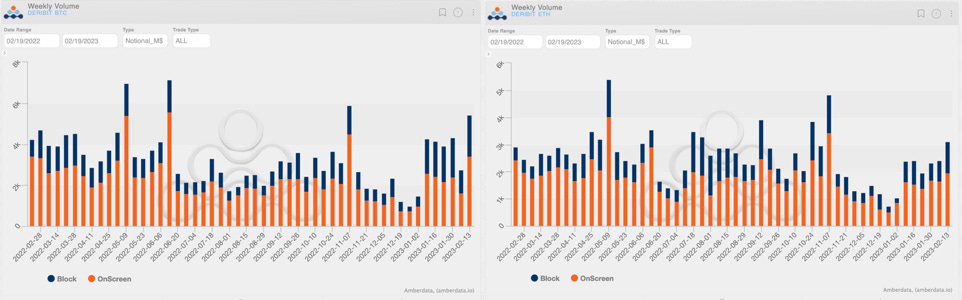

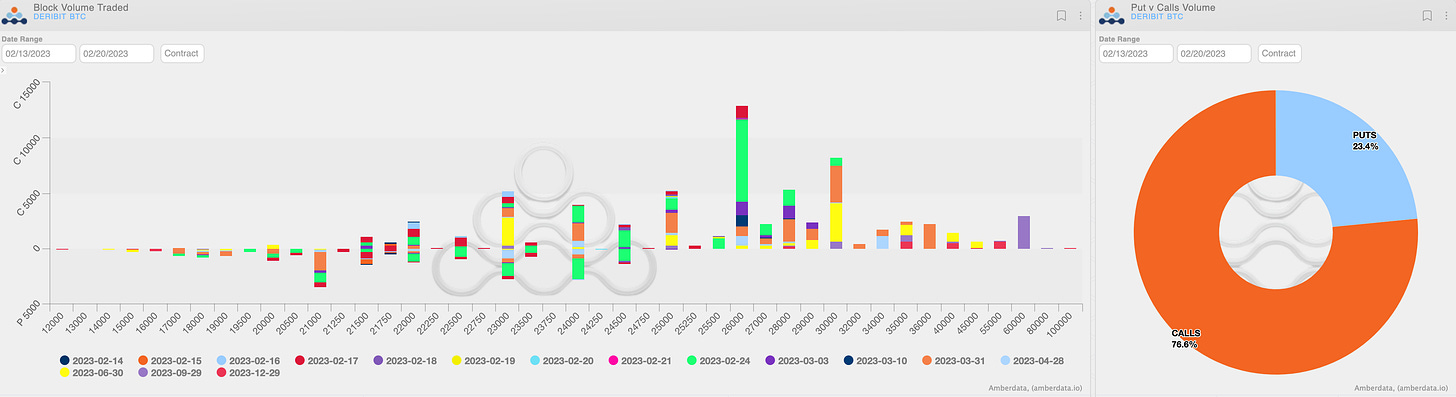

What a week for volumes on Deribit! Strong on-screen activity.

Bitcoin notional of $5.4B almost reached the peaks of FTX week, and it’s one of the higher in the last year.

Ethereum notional of $3.1B.

Market participants continue showing preference over Bitcoin.

(BTC vs ETH Weekly Volumes Notional - Options Deribit Historical Section)

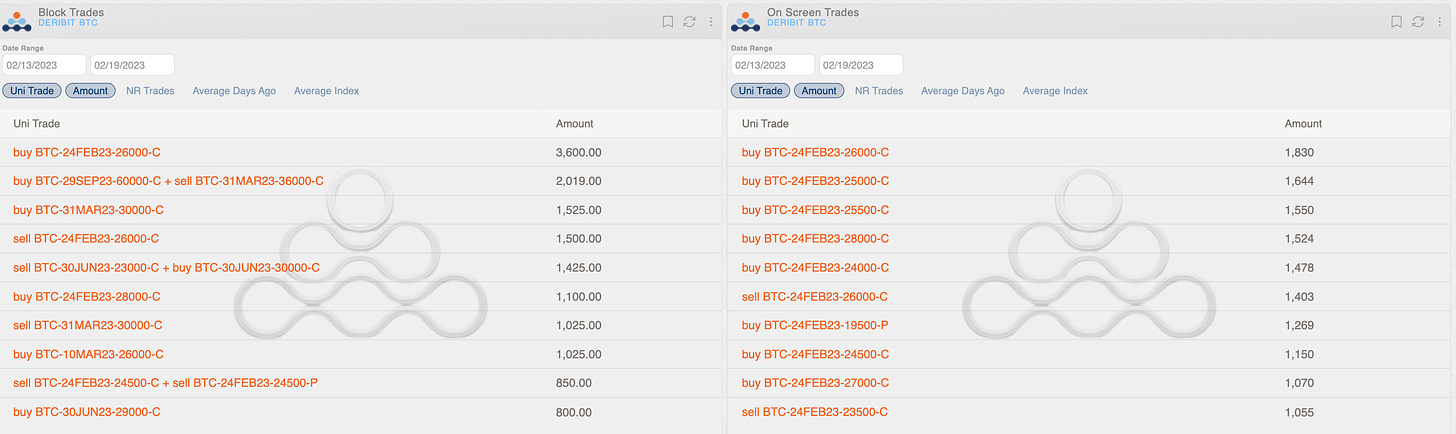

Difficult to assert with certainty the intentions of the long calendar $36k/$60k Mar/Sep; the first leg seems to be a closing position.

In the second part of the week, instead, the flow was sharper and well aligned between blocks and on-screen, with long positions on $26k/$28k/$30k calls opened with conviction.

(BTC AD Direction tables with uni_trade - Options Scanner section)

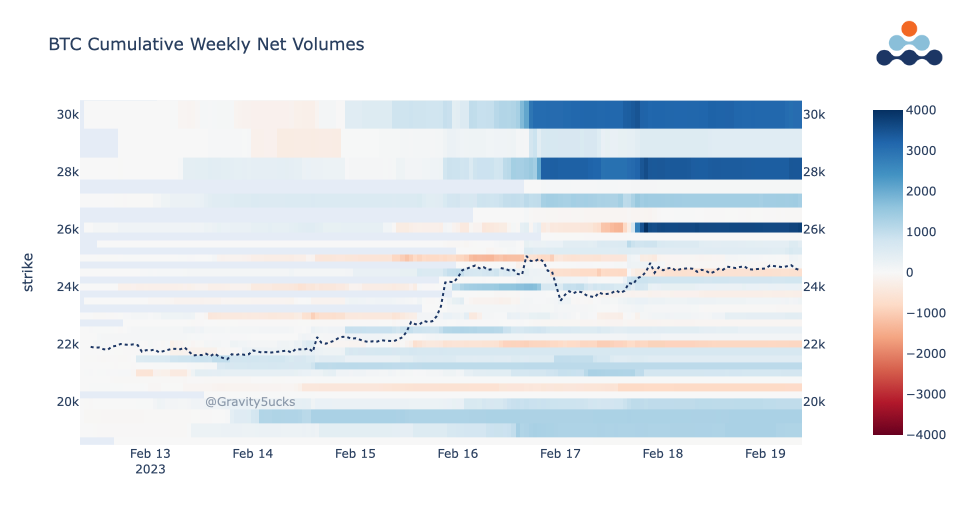

Positioning of market participants into 2023 seems to show a clear conviction of a bull rally to the $30k. Above the current spot price, dealers are carrying negative gamma that could help to self-reinforce the view.

This is how #BTC total options market positioned itself since 1st January 2023.

— GravitySucks (@Gravity5ucks) February 17, 2023

Blue: market is long the strike

Red: market is short the strike

30k is a major short/mid term resistance.

Between here and there, only longs... pic.twitter.com/7KPOpg7wsE

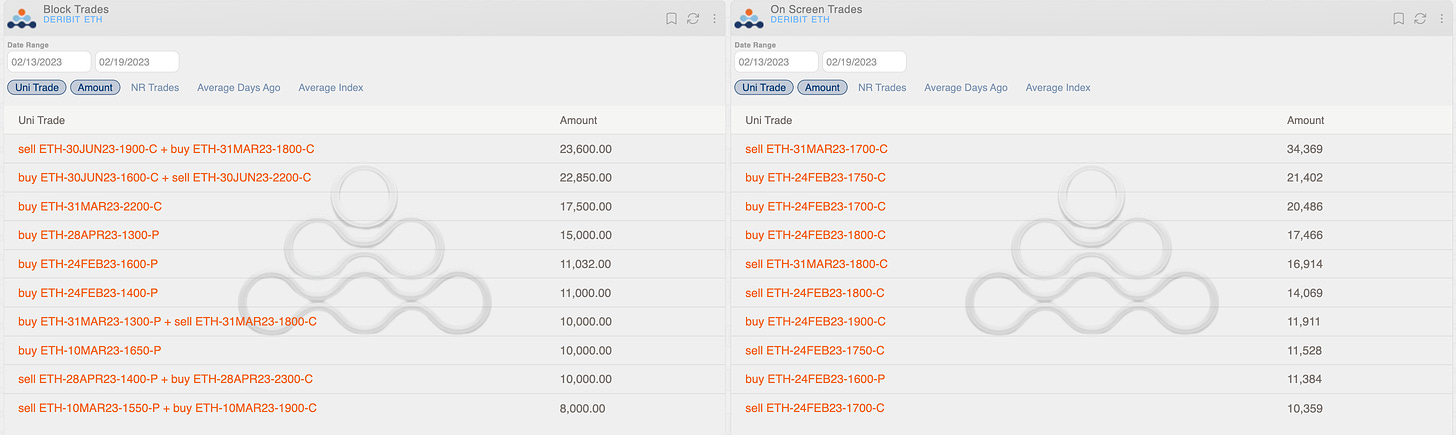

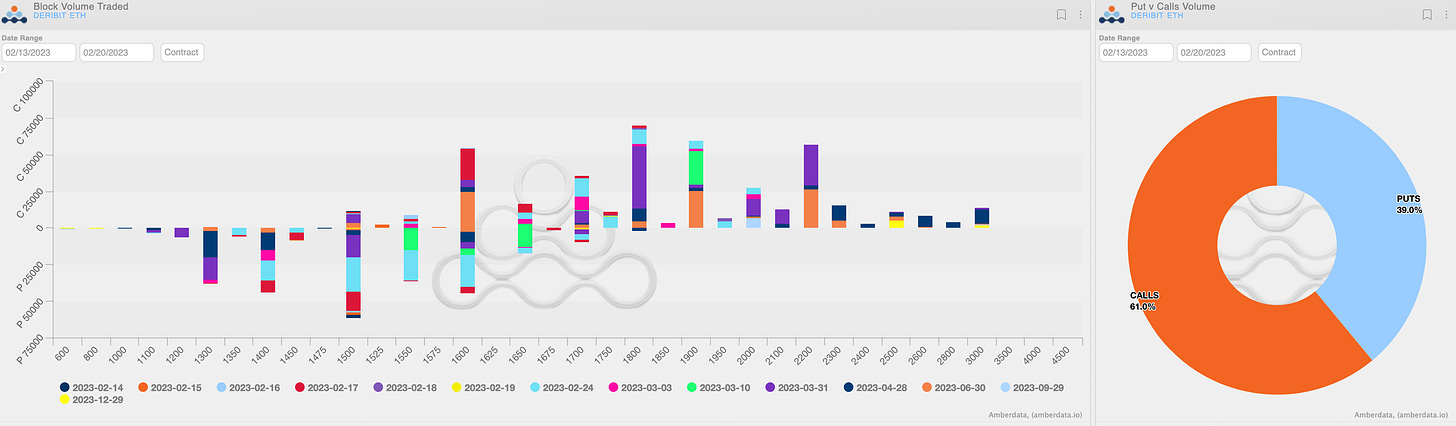

Tape on Ethereum reflected the overall sentiment, with less bullish action. Noteworthy puts interest.

(ETH AD Direction tables with uni_trade - Options Scanner section)

Paradigm Block Insights (13Feb - 19Feb)

Strong outperformance of crypto vs. equities, with rally gathering steam following HKMA rumors around retail access.

Flow themes included call buying / put selling across majors.

BTC +13% / ETH +12% / NDX +0.2%

🌊BTC

Takers quite axed for outright calls on the rally, given low implieds vs the extent of upside realized. This topside activity had been more subdued since the January rally. BTC 7D IV-RV = 3v.

5075x 24Feb 26000 Call bot

2550x 31Mar 30000 Call bot

1M 25d skew ~2v calls over after the spot rally and topside buying this week. Interesting divergence vs. ETH that has remained persistently in favor of puts across most of the curve.

🌊ETH

ETH flows more bullish. According to GEX, dealer gamma positioning has shifted significantly from being heavily short gamma, to tilting net long $ gamma exposure.

22350x 30Jun 1600/2200 Call Spread bot

17500x 31Mar 2200 Call bot

IVs ticked higher last week on a fixed strike basis (alongside spot moving higher).

More flows:

11532x 24Feb 1600 Put sold

10250x 31Mar 1300/1800 Bull Risk Reversal bot

10250x 28Apr 1300 Put bot

🔊 The Big Picture

Check out our latest TBP episode focused on the emergence of crypto exotic derivatives. 🧠

Link to full episode:

BTC

ETH

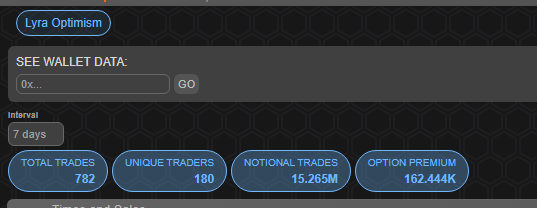

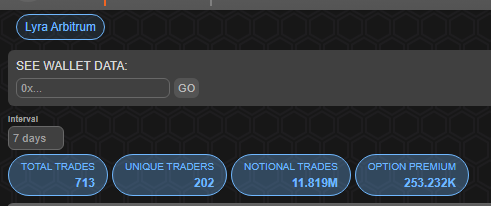

We NOW support @lyrafinance's latest V2 release on Arbitrum along with a full suite of features on the AD Derivatives App.

— Amberdata.io 📊📈 (@Amberdataio) February 17, 2023

Read more about Lyra's latest V2 release here 👇 https://t.co/d2XiWPfaQn

Access on our app, go to DeFi ➡ Lyra ➡ Arbitrum👇 https://t.co/DHF5xQu8l1 pic.twitter.com/Y2NCCm2UKM

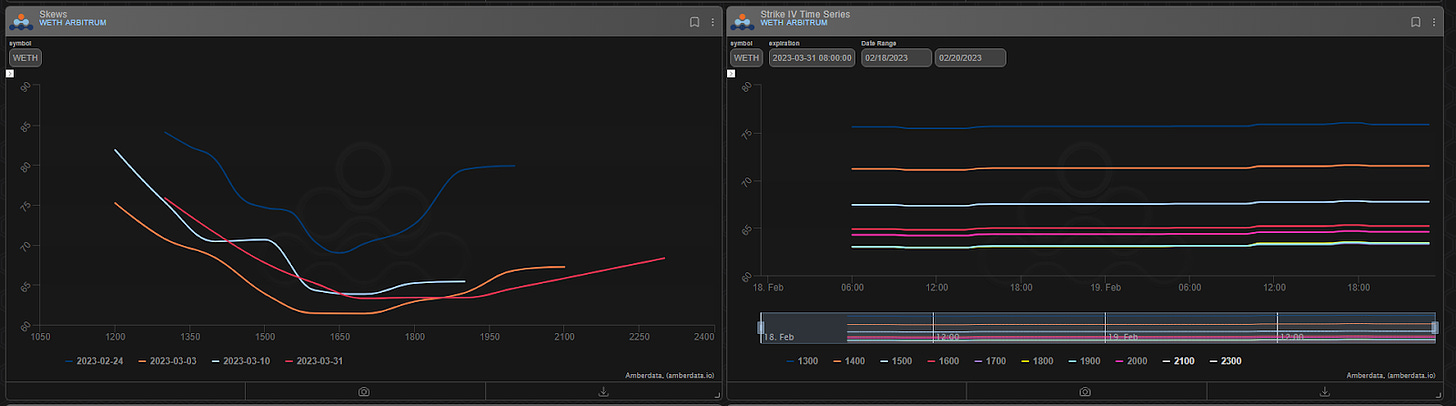

Volatility

Current ATM IV is ~65% in ETH, bouncing 10 points off last week's lows on the recent price run-up. Term structure is mixed and fairly flat across Arbitrum and Optimism deployments.

Trading

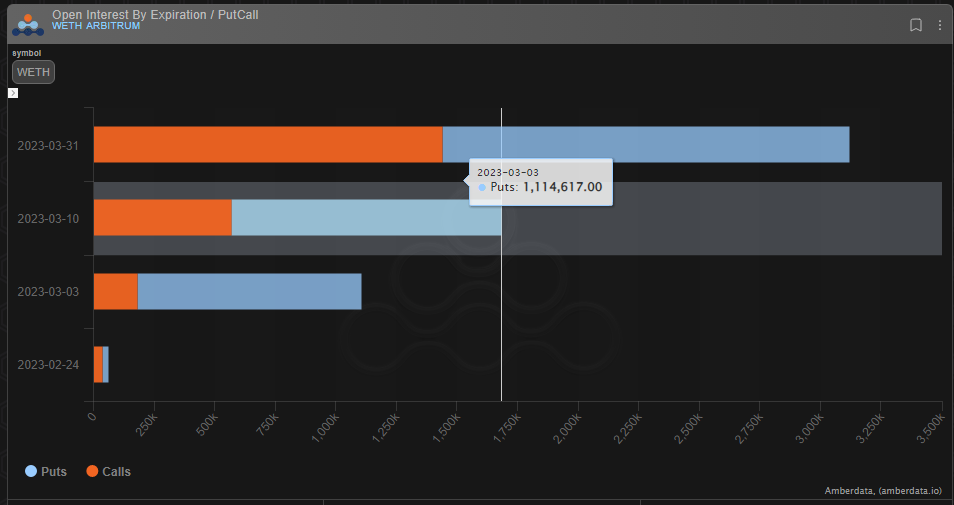

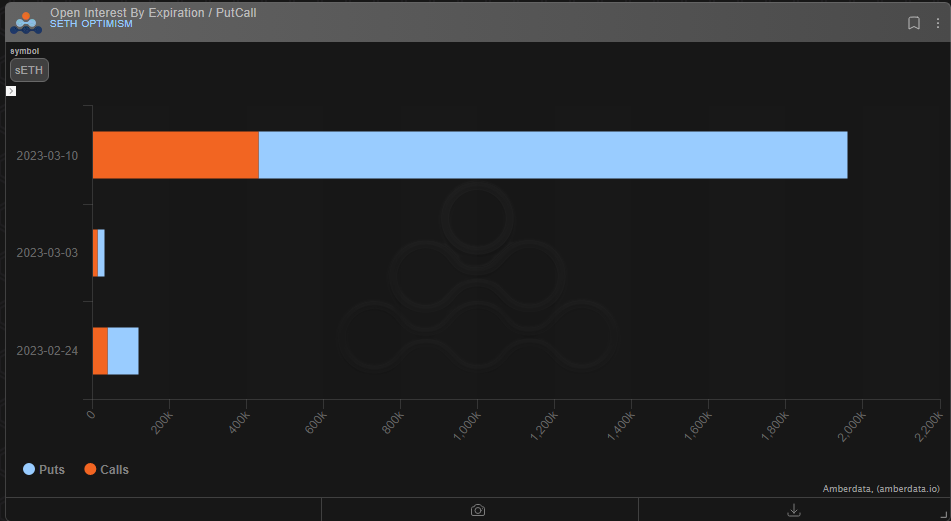

Trading on Arbitrum and Optimism creates a new opportunity for arbitragers to balance skew and IV cross-chain. Arbitrum options are currently sitting at a premium to CEXs. Put OI is dominating across all expiries. Traders are still eligible for short collateral rewards and a reduction in the bid/ask spread up to 60% via trading rebates on Lyra! https://docs.lyra.finance/governance/incentives#trading-rebates-and-boosting

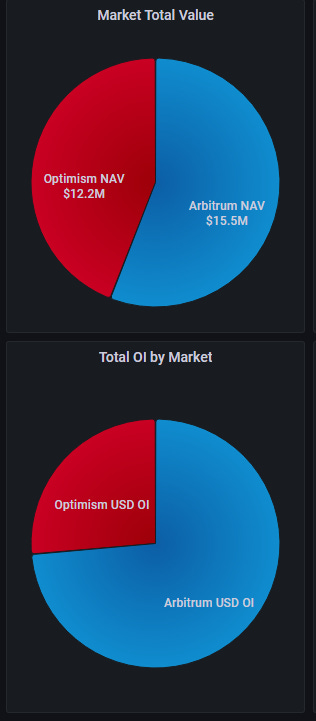

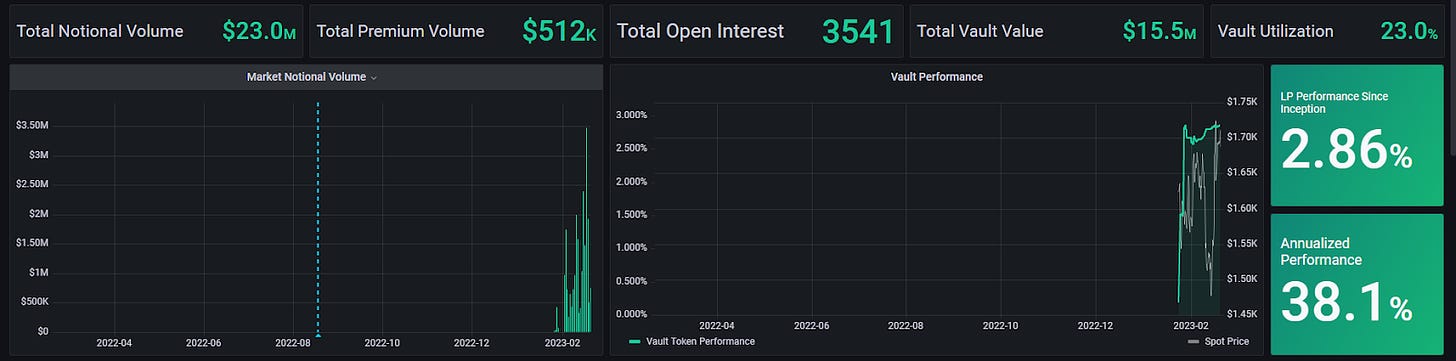

TVL and Open Interest on Arbitrum have quickly overtaken those on Optimism.

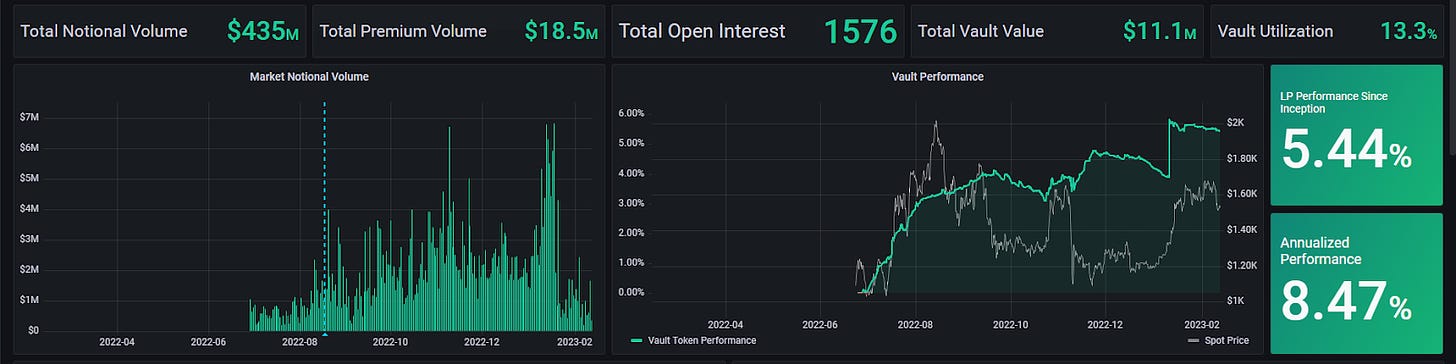

ETH Market-Making Vault

The ETH MMV on Optimism has returned +5.34% since its inception(June 28th, 2022), representing a weekly change of -0.10. Annualized performance since inception is +8.08%

The ETH MMV on Arbitrum has returned +2.86% since its inception, representing a weekly change of +.06. Annualized performance since inception is +38.1% (since the pool is relatively new, annualized performance may be misleading)

Depositors earn an additional 13.36% rewards APY, boosted up to 28.7% for LYRA Stakers on Optimism or 29% boosted up to 58% for LYRA Stakers on Arbitrum (new).

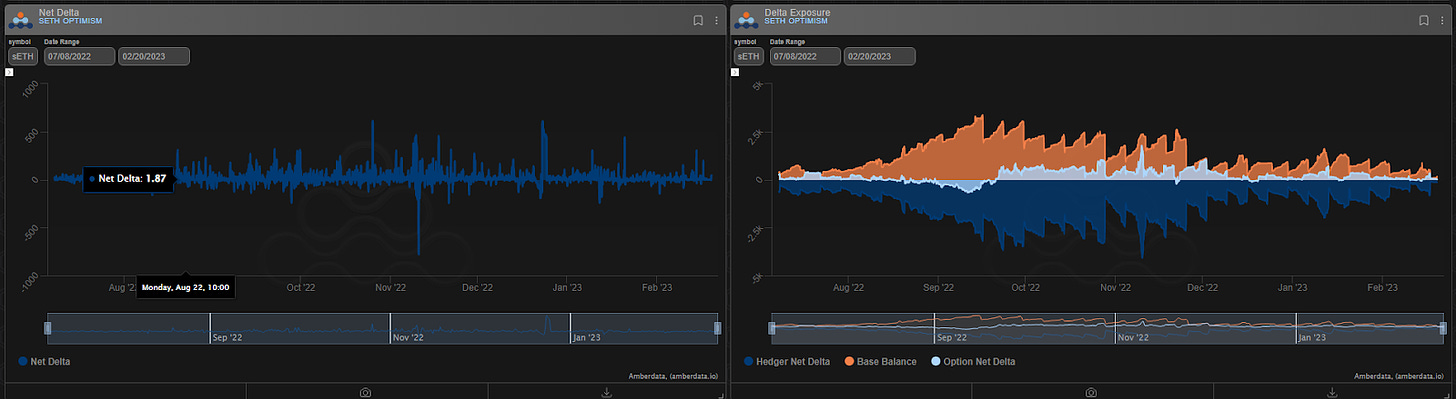

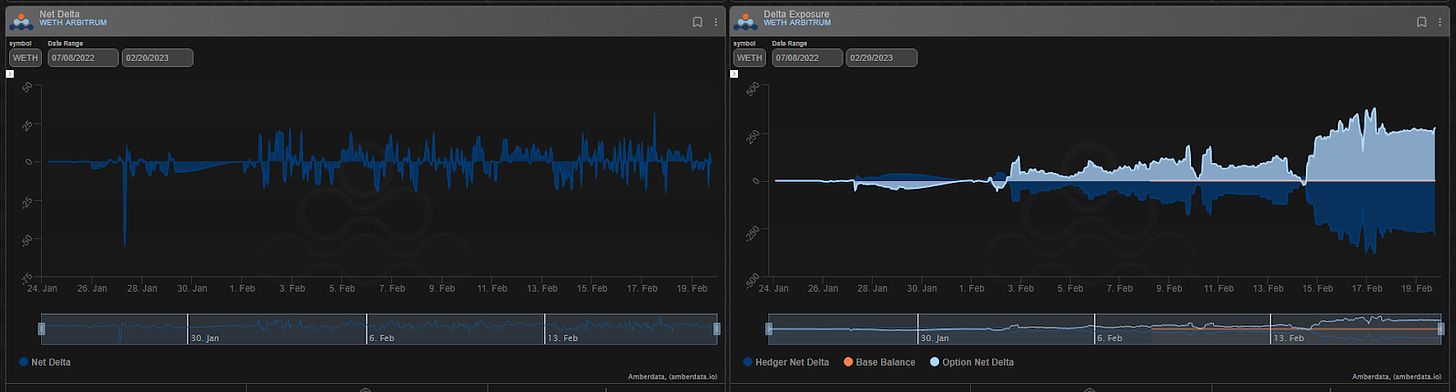

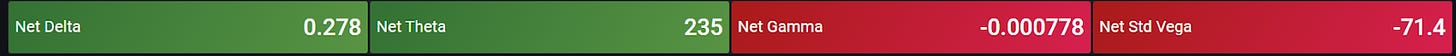

Net MMV Exposure:

Both ETH vaults are short gamma/vega, with Arbitrum taking on a bit more risk in the absence of a short-selling DOV deployed there.

Optimism:

Arbitrum:

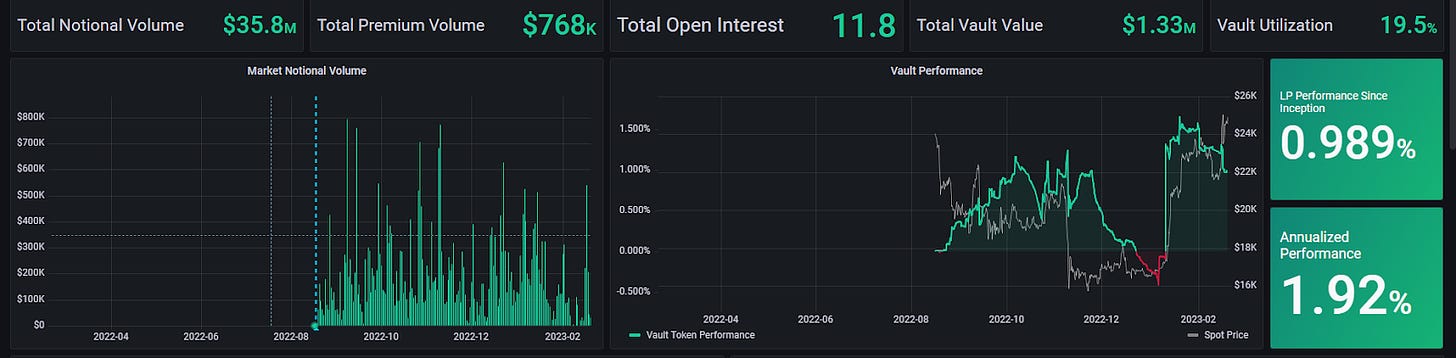

BTC Volatility

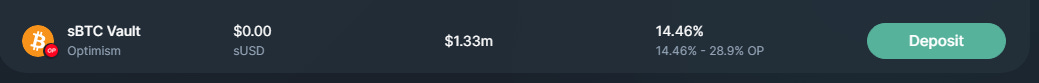

BTC Market-Making Vault

Lyra’s BTC MMV has returned +.989% since its inception (August 16th, 2022). This represents a weekly change of -.21%. Annualized performance since inception is +1.92%

Depositors earn an additional 14.46% rewards APY (boosted up to 28.9% for LYRA Stakers)

Net BTC MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...