.png)

-

Tuesday 8:30am - CPI

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math minded people here, pardon any typos.

THE BIG PICTURE THEMES:

Tuesday’s CPI release is going to be a big number. Should CPI come in higher than expected, given the massive NFP surprise recently seen, this could prove quite bearish for risk assets.

Something to consider on the better-side of the CPI debate is the large drop in energy prices recently.

Natural gas is back near pre-conflict levels and WTI has seen a nice pull-back.

As I said in my recent interview on “The Misfit Happy Hour”, the massive rally early in 2023 has personally caught me a bit by surprise.

In the medium-term, I’m still cautious, given the big picture themes of yield curve inversion, de-globalization and shift in monetary policy, being a completely new environment for crypto.

Sticky inflation issues could break a lot of things.

BTC: $21,714 -5.64%

ETH :$1,506 -7.75%

SOL: $20.79 -11.77%

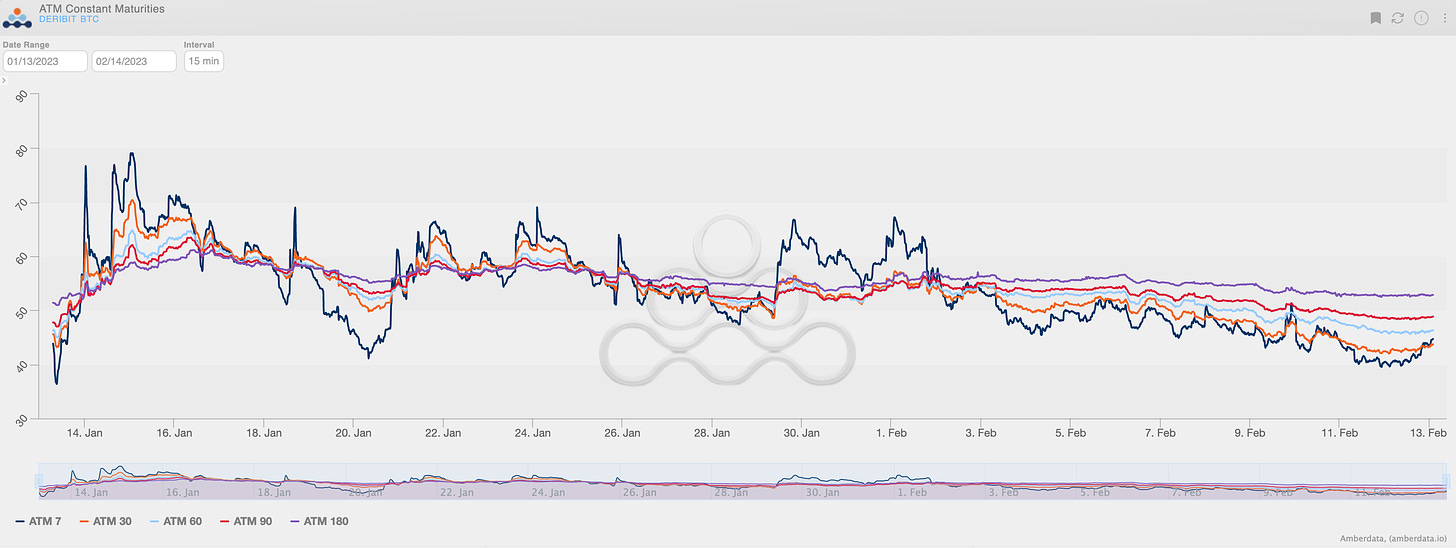

TERM STRUCTURE

(Feb. 12th, 2023 - BTC Term Structure - Deribit)

Implied volatility has come down significantly, given the pull-back in spot prices.

Jan 2023 has seen the FOMO environment of positive spot/vol. correlation.

Macro events could flip that relationship back into a negative spot/vol. trend - which proved strong in 2022 - so I can easily see vol. move higher from here, no matter what spot does.

Going into this week’s CPI: buying IV into the event - as these levels seem like an interesting buy.

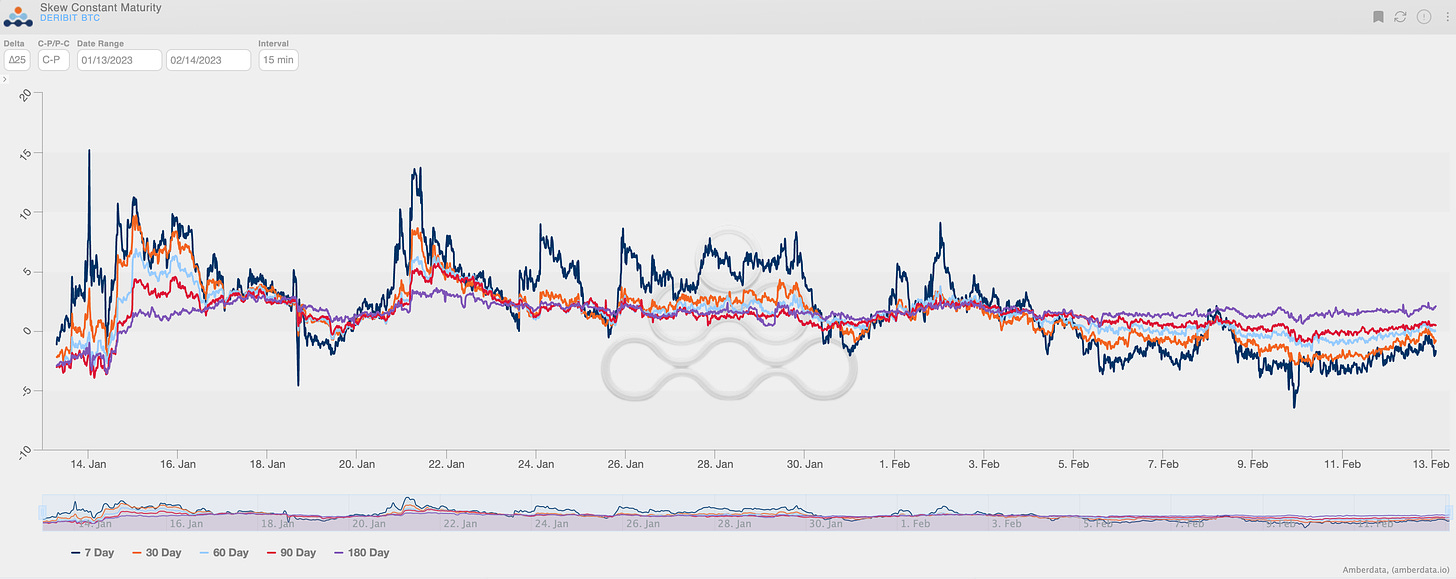

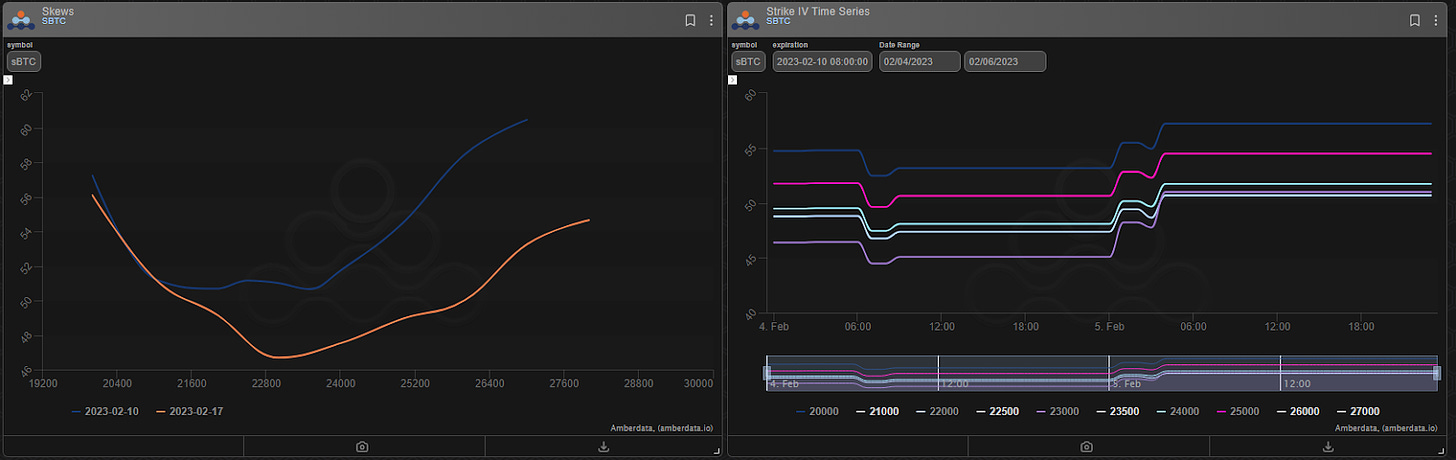

SKEWS

(Feb. 12th, 2023 - BTC RR SKEW (C-P) ∆25 - Deribit)

The current RR-skew term structure is split between positive and negative profiles.

To me, the obvious trade remains selling the long-term positive RR-Skew.

Negative short-term RR-Skew makes a lot of sense to me here, given the potential for a macro surprise.

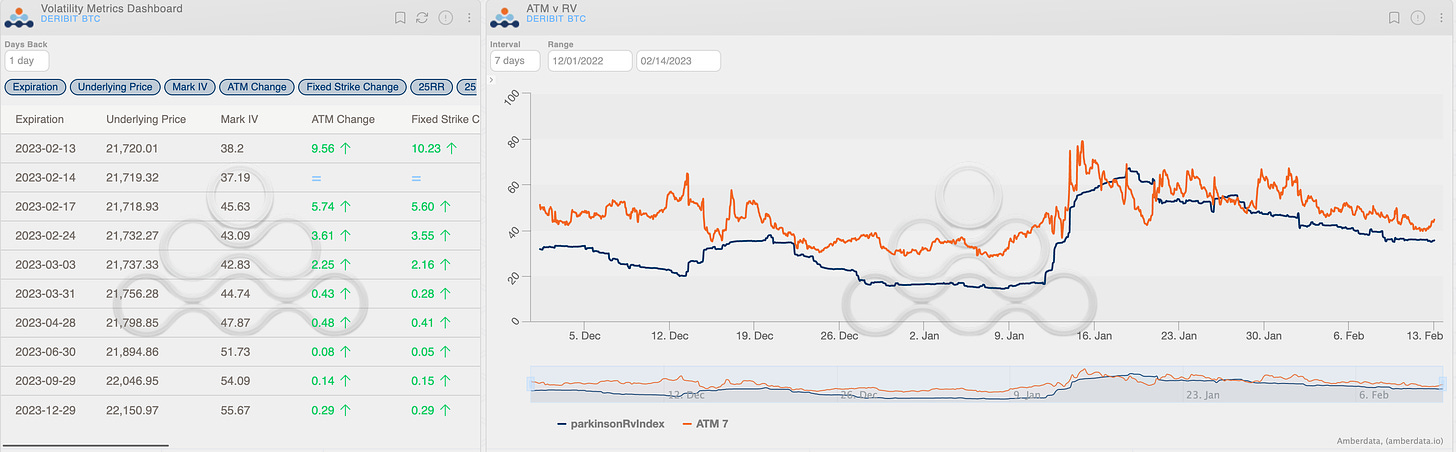

VOLATILITY PREMIUM

(Feb. 12th, 2023 - BTC IV-RV)

VRP is thin, if even in existence at all.

Again, there’s a massive potential catalyst for RV to jump higher this week; buying volatility here seems obvious.

There’s almost no premium to IV and RV will likely be higher week-over-week with CPI (this isn’t a guarantee but possible and asymmetric to the vol. buyer)

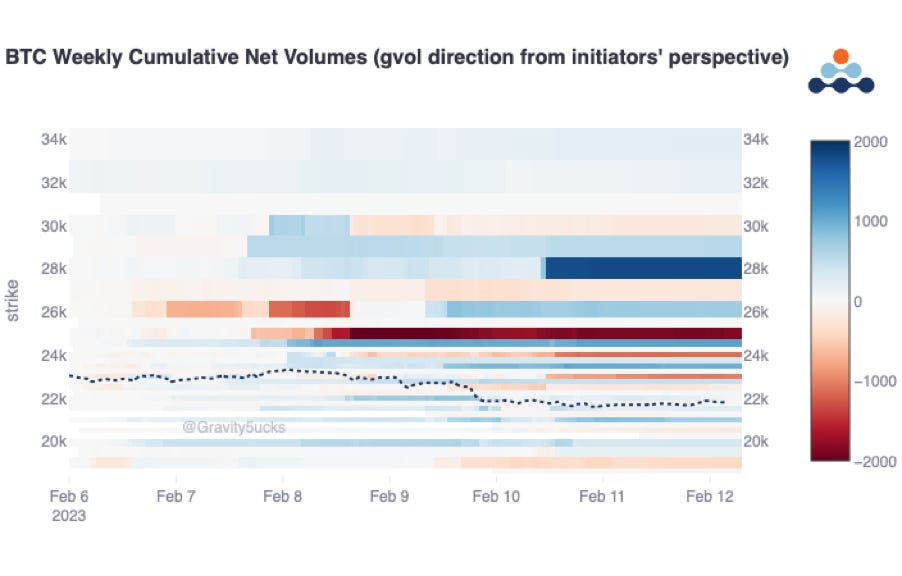

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

Volume down on Bitcoin after the excitement of the last few weeks.

Ethereum is confirmed on average. Notional: Bitcoin $2.6B vs Ethereum $2.3B.

(BTC vs ETH Weekly Volumes Notional - Options Deribit Historical Section)

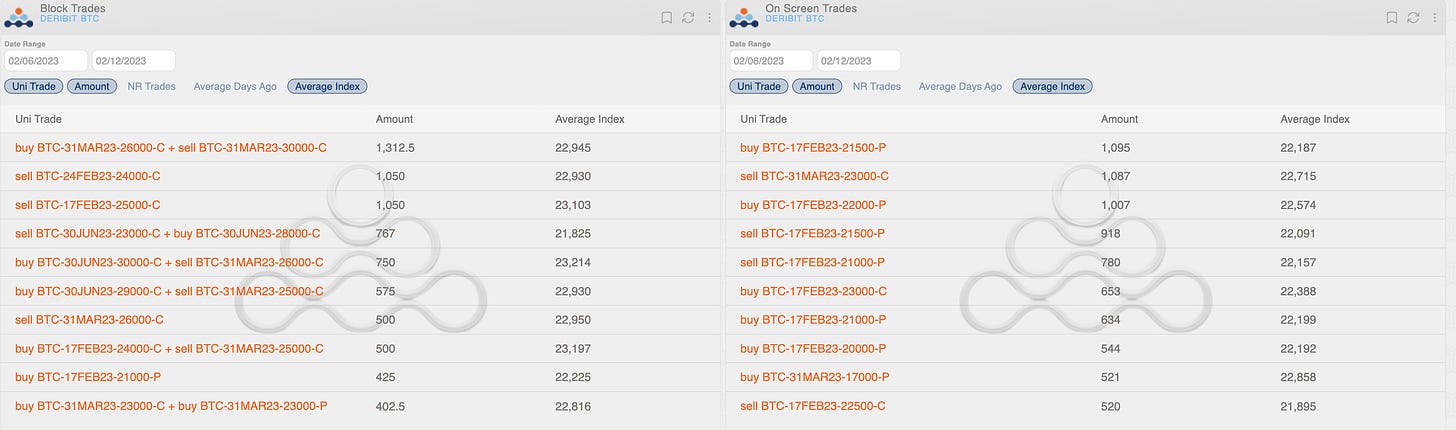

Interim week without trade of great evidence. Some previously opened positions have been unwinded (calls $23k-$26k). Worth noting: the on-screen activity on 17FEB, with puts $22k/$21.5k bought with spot > $22k.

With the spot dropped below 23k, sales were concentrated in the $25k strike, indicating a major short term resistance.

(BTC AD Direction tables with uni_trade - Options Scanner section)

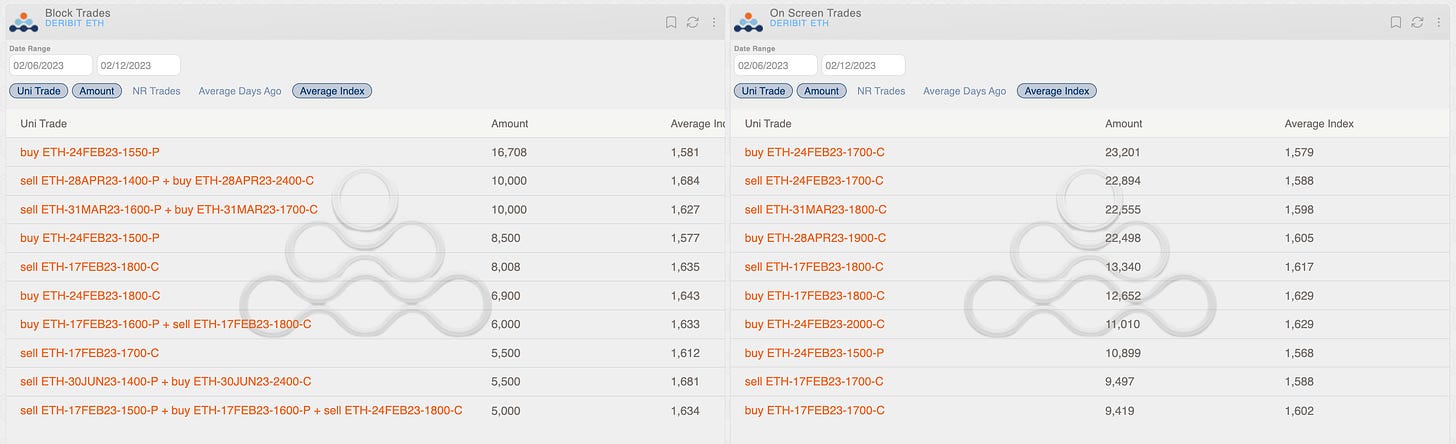

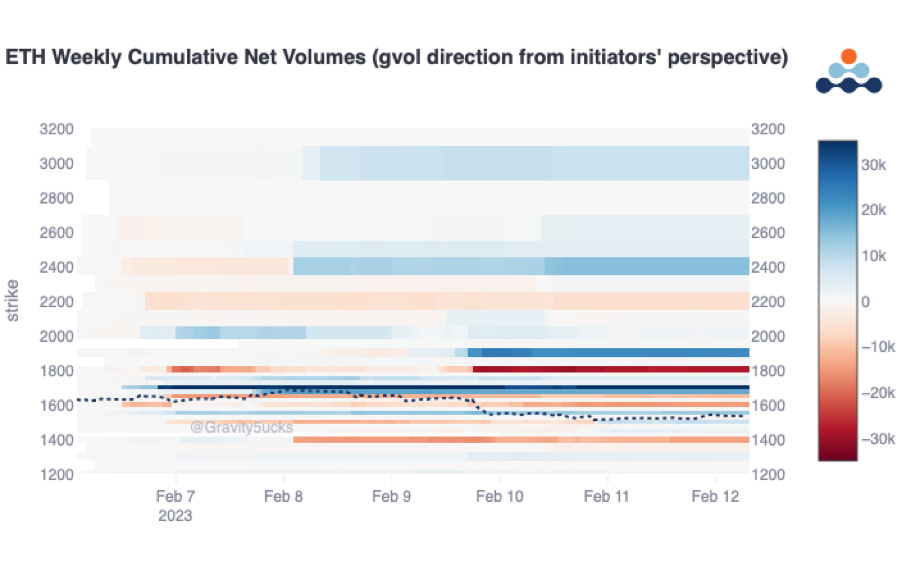

Interestingly also, heatmap for Ethereum highlights quite similar behavior of traders, with $1.8k sold as short term resistance (even if supposedly calendarized on screen, with $1.9k bought on April).

(ETH AD Direction tables with uni_trade - Options Scanner section)

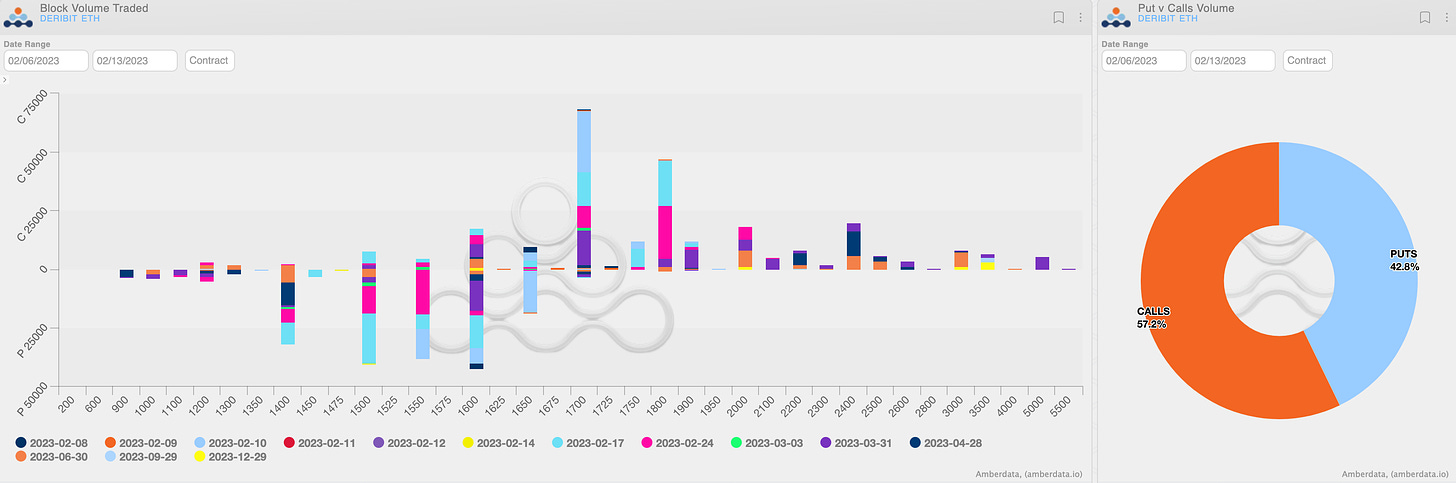

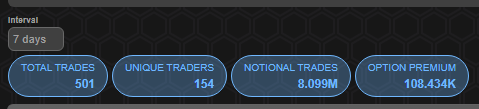

Paradigm Block Insights (Feb 6th, 2023 - Feb 12th, 2023)

Crypto majors grind lower at the beginning of week - with downward momentum picking up on Thursday, as Kraken suspended staking services in response to SEC pressure.

BTC -5% / ETH -7% / NDX -2%

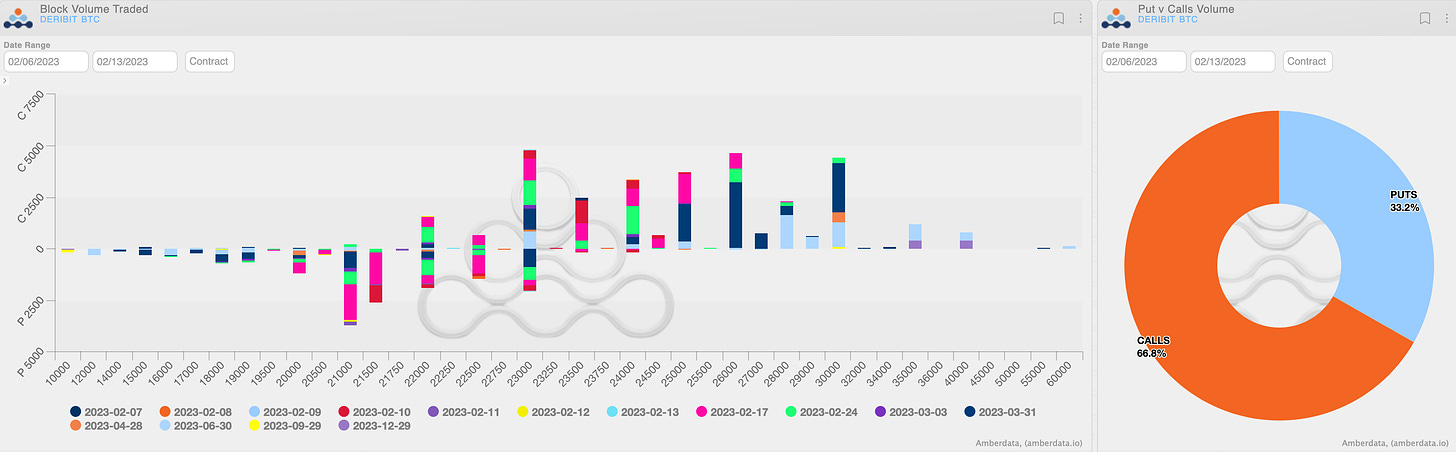

🌊BTC Flows

Flows mixed in BTC, as skew moved more in favor of puts this week. Decent bit of topside closed out early in the week:

1075x 24-Feb-23 24000 Call Sold

1000x 31-Mar-23 26000/30000 Call Spread bot

525x 31-Mar-23 26000 Call Sold

🌊BTC cont.

Large BTC calendars printed on Paradigm, open interest decreased in front month:

750x 31-Mar-23 26000 / 30-Jun-23 30000 Call Calendar bot

575x 31-Mar-23 25000 / 30-Jun-23 29000 Call Calendar bot

🌊ETH

ETH flows quite bullish early in the week, with a large buyer of Friday 1700 calls in clips of 4-6k, and buyer of ETH Mar bullish risk reversals. A welcome change, given that most of the upside flow has been concentrated in BTC.

18000x 10-Feb-23 1700 Call Bought

10000x 31-Mar-23 1600/1700 Bull Risk Reversal Bought

9250x 10-Feb-23 1650 Put Sold

On Thursday, BTC vol selling picked up in Feb-Apr buckets, as spot broke the lows on the Kraken staking news.

Long dates also starting to see some focus, with Dec 40k calls sold at ~58.5v in clips of 3k vega.

Sold 425x 17-Feb-23 21500 Put

Sold 350x 17-Feb-23 22500/23000 Strangle

Sold 3750x 24-Feb-23 1800 Call

On Friday, finally some protection interest in ETH as spot started rolling over in the afternoon.

Interestingly, not much vol premium baked-in with 17Feb ATMs trading _v.

Bought 7500x 24-Feb-23 1500 Put

Bought 4500x 17-Feb-23 1400 Put

Bought 2500x 17-Feb-23 1500 Straddle

🔊 The Big Picture

New Episode of #TBP- with Sean from @coinhako -just dropped!

Massive upside potential

Pricing Options correctly

Macro effects on $BTC

https://t.co/fodJewm2dG

Market Share Dominance!! 💪

Paradigm was 40% of @DeribitExchange BTC Options volumes in Jan, and is 44% so far in February.

Hit us up on Telegram! 🙏

Daily Commentary✍️ http://pdgm.co/cmmntry

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

https://t.co/fodJewm2dG

BTC

ETH

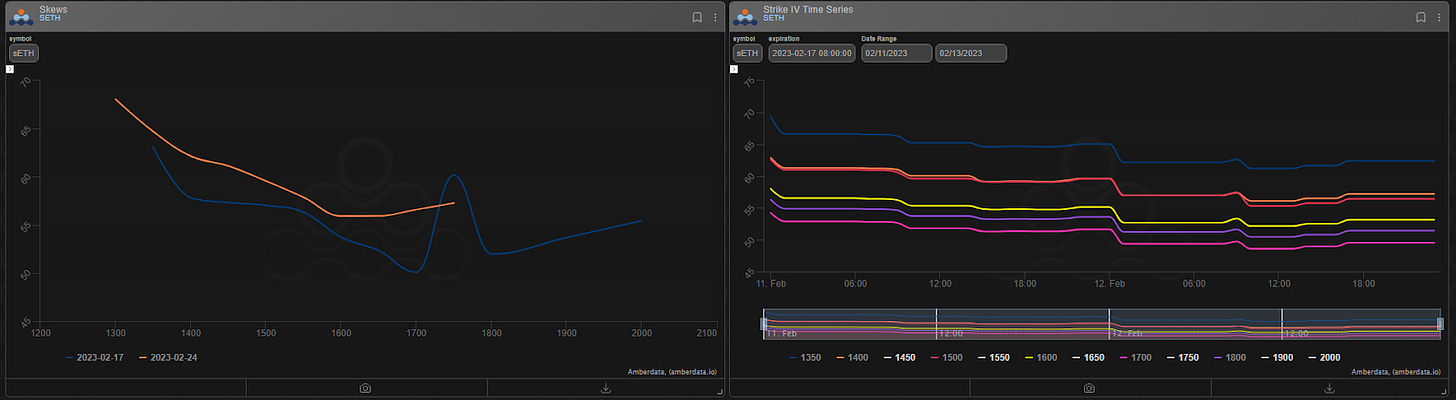

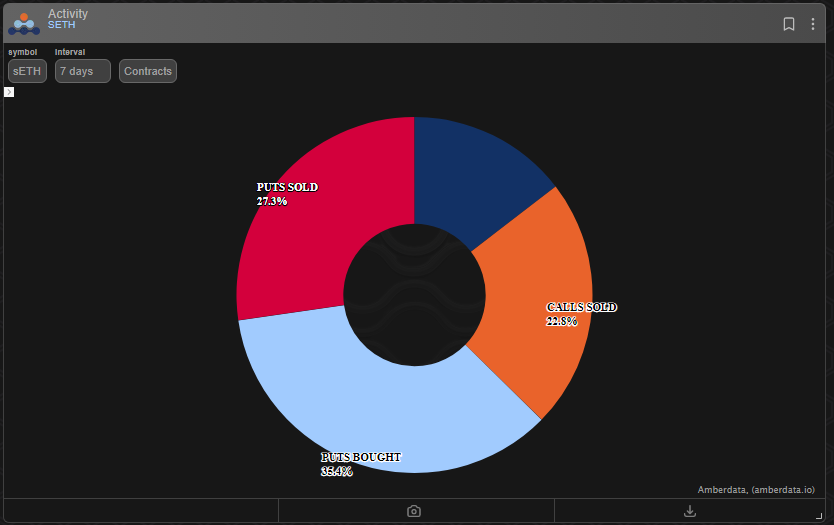

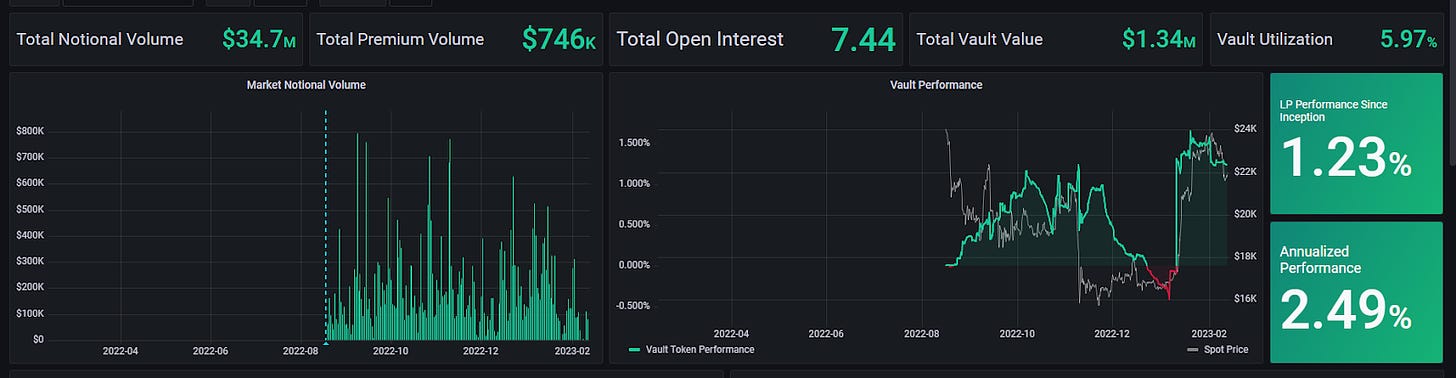

Lyra Weekly Review

Volatility

Current ATM IV is ~55% in ETH, normalizing as upside momentum has stalled. Term structure is back in contango, with put skew trading at a premium.

Trading

Trading on Arbitrum and Optimism creates a new opportunity for arbitragers to balance skew and IV cross-chain. Puts continue to be more popular this week, with over 60% of the trading activity in puts.

TVL and Open Interest on Arbitrum have quickly overtaken those on Optimism.

Trading activity on Lyra has hit a massive milestone of $1 Billion in notional volume traded since inception!

Congratulations to the Lyra community for passing this milestone, we're just getting started 💚 pic.twitter.com/TOC7IrvhpB

— Lyra (@lyrafinance) February 7, 2023

ETH Market-Making Vault

The ETH MMV has returned +5.44% since its inception (June 28th, 2022), representing a weekly change of -0.05.

Annualized performance since inception is +8.47%

Depositors earn an additional 15.84% rewards APY, boosted up to 31.7% for LYRA Stakers on Optimism or 44.8% boosted up to 89.6% for LYRA Stakers on Arbitrum (new).

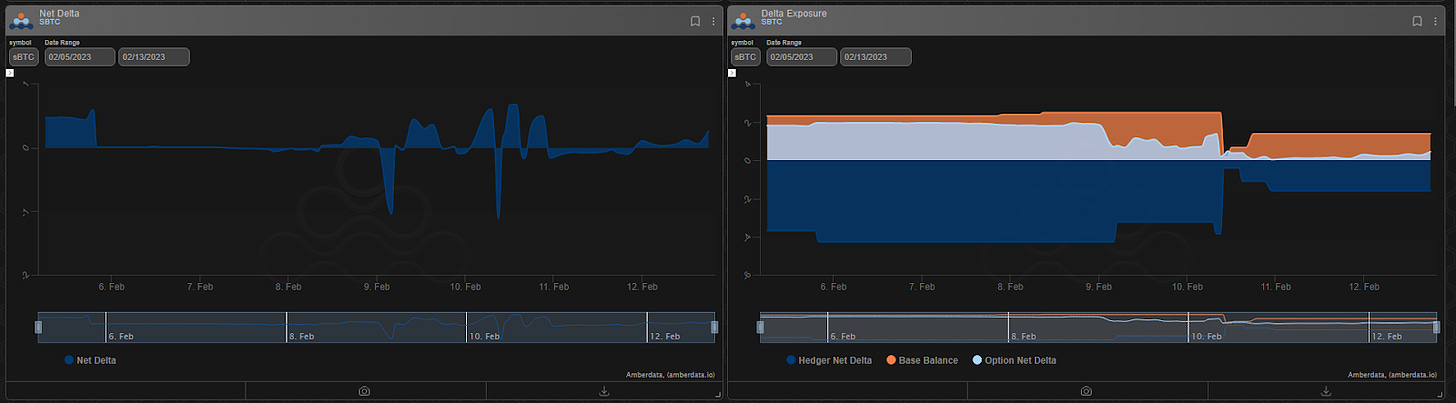

Net MMV Exposure:

Both ETH vaults return to long gamma, as seller activity picks up in the weeklies.

Optimism:

Arbitrum:

BTC Volatility

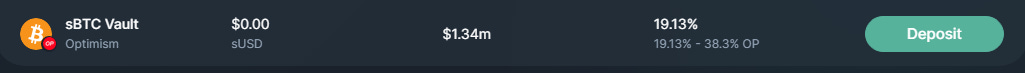

BTC Market-Making Vault

Lyra’s BTC MMV has returned +1.23% since its inception (August 16th, 2022). This represents a weekly change of -.05%. Annualized performance since inception is +2.49%

Depositors earn an additional 19.13% rewards APY (boosted up to 38.3% for LYRA Stakers)

Net BTC MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...