USA Week Ahead:

-

Throughout Week - Fed Presidents speak.

-

Tuesday 9:45a ET- PMI.

-

Wednesday 2p - Minutes of Fed's May FOMC meeting.

-

Thursday 8:30a ET - GDP.

-

Friday 8:30a ET - PCE.

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math-minded people here, pardon any typos.

MACRO THEMES: PCE & FOMC Minutes

This week, there are a couple of bigger numbers and a mix of Fed speakers making appearances.

That being said, overall crypto vol seems most likely to continue the “wait and see” pattern for the short term.

PCE is likely to be in line with the recent CPI trends and the FOMC May minutes will likely echo that the Fed is also in a “wait and see” pattern.

Both of those outcomes would be conducive to the quiet passage of time.

Negotiations over debt ceiling issues are a little less predictable in my opinion, despite most people thinking it will be a non-event.

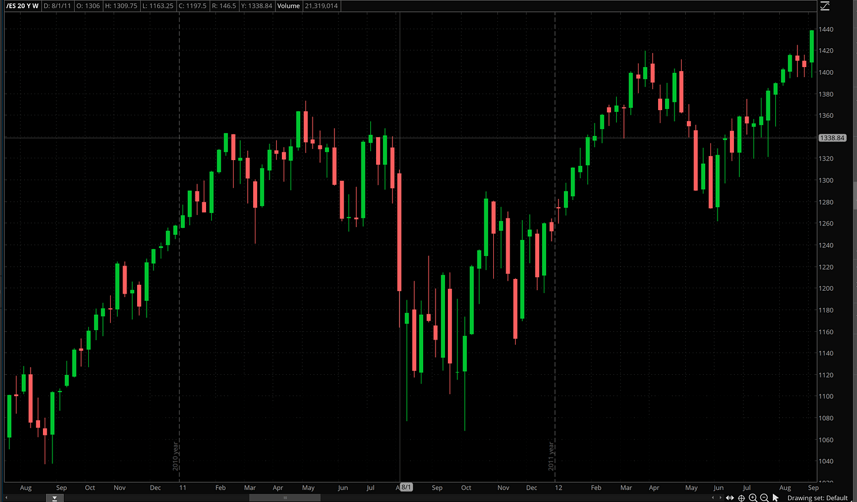

I remember trading equities at SMB Capital in the summer of 2011, when US treasury debt was downgraded due to debt ceiling issues and the markets reacted a lot then.

That being said, my base-case assumption is that RV continues to be quiet in the short-term and BTC vol selling in the front-end is interesting.

BTC: $26,867 (-0.3% / 7-day)

ETH :$1,808 (+0.1% / 7-day)

SOL: $19.96 (-5% / 7-day)

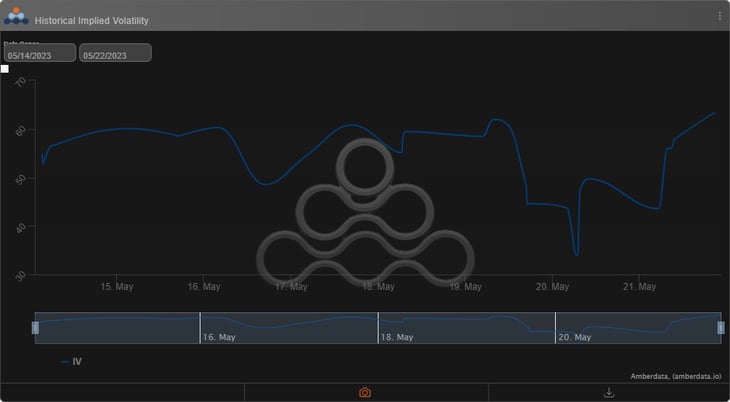

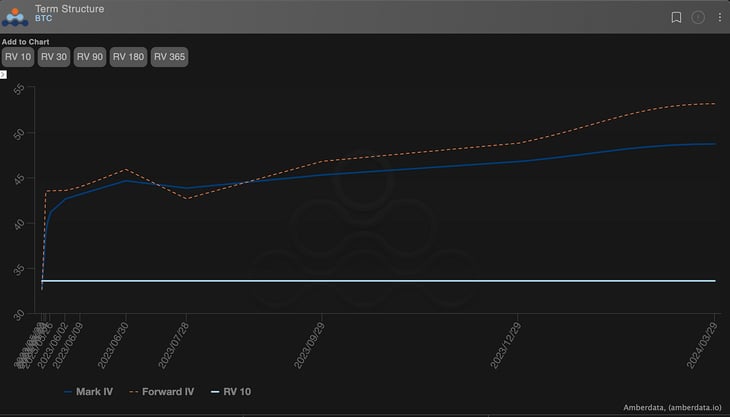

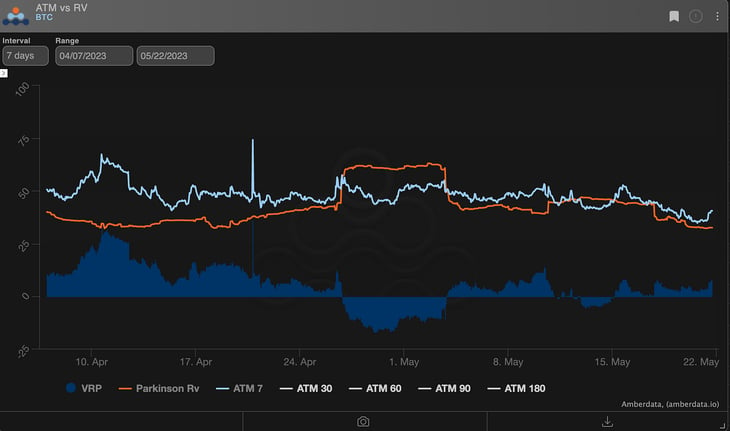

Last week, realized volatility was very low as spot prices ended the week nearly unchanged.

The very short-term options, 3 days and under, are currently in the 30-handle for BTC implied vols.

Assuming the low realized vol trend continues for BTC, there’s an interesting vol selling opportunity in the 7-day options and other short-term (but longer than daily) options.

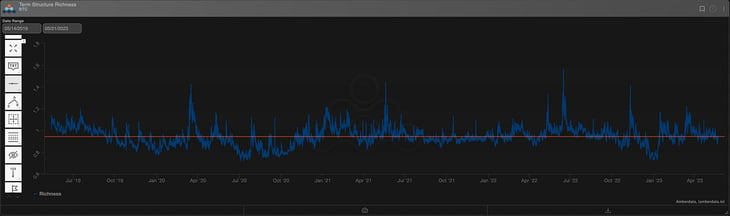

Notice the large 7-day VRP (above), while the 3-day VRP is nearly non-existent.

One thing that I recently noted is the attractiveness of ETH vol in the longer-term maturities.

I continue to think that!

To finance such a trade, I continue to believe short-term options are a decent sell.

Usually, when RV is at historic lows, the term structure shape is in steep “Contango”.

A steep “Contango” term structure signals that vol is “low right NOW” but should mean reverting later.

Well, 7-day “Right NOW” options are a bit high.

Maybe the “debt ceiling” issues are in part to blame, it’s hard to know with n=1 situations like this… PCE, on the other hand, is unlikely to surprise.

(ETH Dvol divided by BTC DVol)

Finally, looking to sell short-term BTC vol to finance ETH long-term IV (or either leg on its own), continues to have an interesting relative vol component present.

Please share and retweet if you like this kind of analysis. It helps a lot.

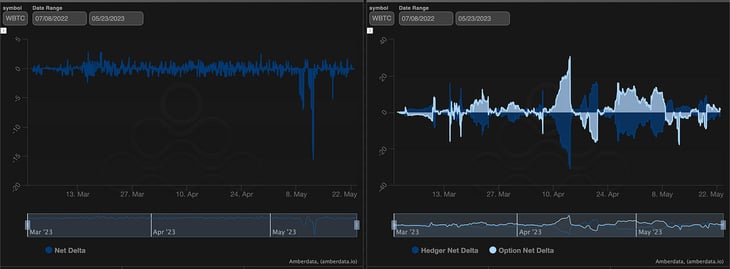

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

In weeks like these, there is a risk of being pedantic and wanting to comment at all costs when, in reality, there is little to say.

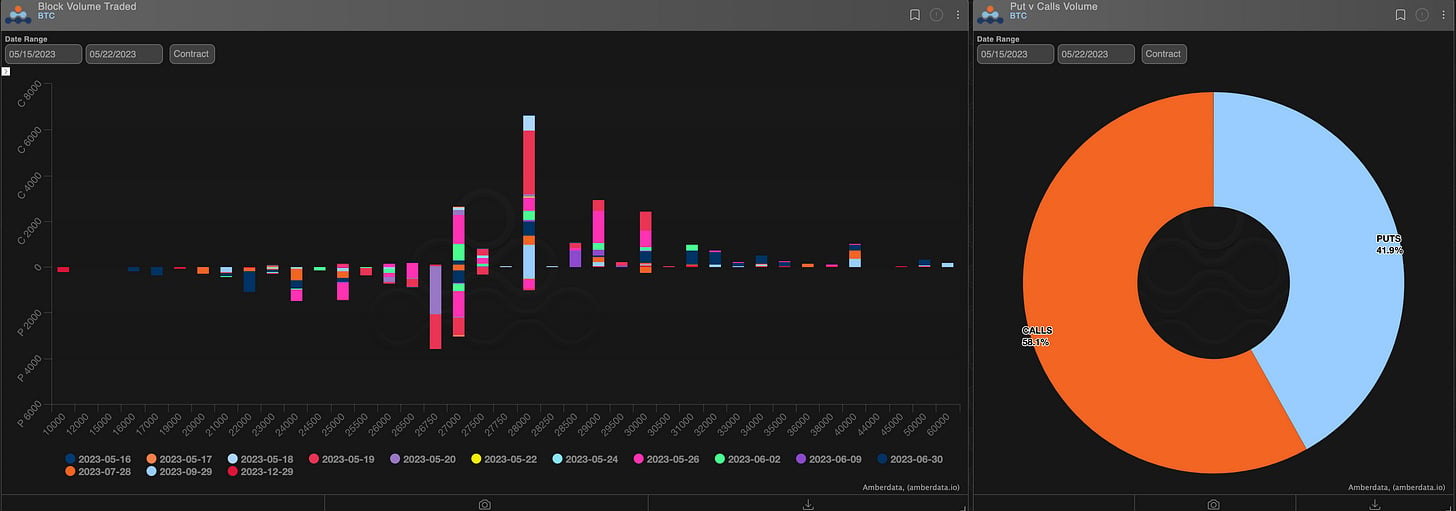

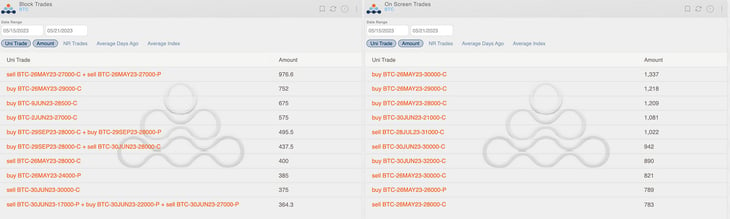

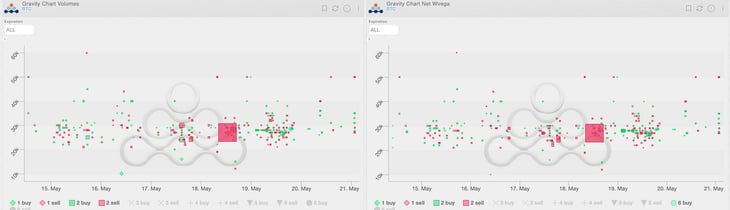

At the beginning of the week, with the price bouncing back above the $27k and unprecedented levels of (almost) unseen volatility, we can observe confident purchases of 26th May calls.

In the middle of the week, however, the dominant vega-weighted trade is the sale of the $27k straddle.

It seems that the low levels of implied volatility are never low enough to discourage sellers. Bold moves.

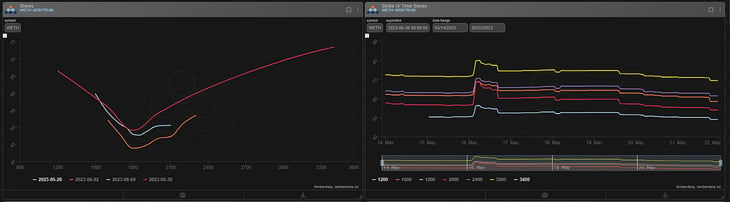

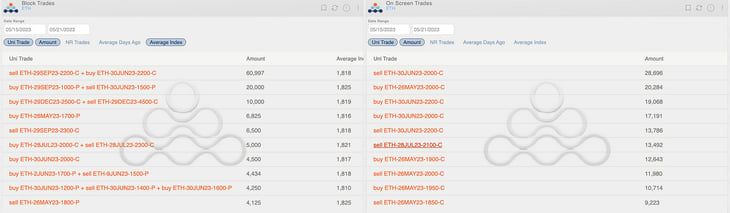

The most talked-about trade of the week was certainly the massive "apparent" short calendar June/September position of over 60k contracts. However, the more accurate interpretation is that it is a short call roll.

This is a dynamic that we have observed a few times in recent months.

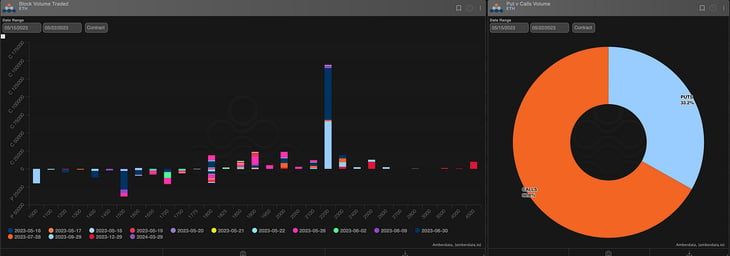

😲 ETH options "calendar spread" purchase of 57,000+ contracts of ETH June expiry call option at the $2,200 strike price and sale of an equal amount of contracts of September expiry call at $2,200 has sparked conversation in the options world!

— Amberdata (@Amberdataio) May 18, 2023

Read more:https://t.co/30UApK9EWH pic.twitter.com/j8Z9ATI9z0

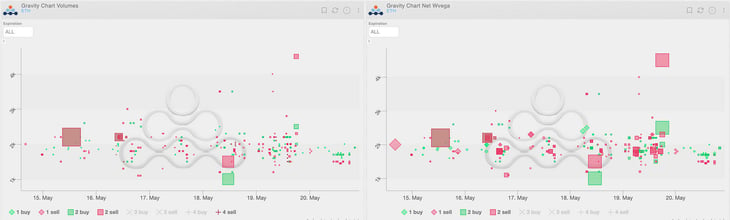

(ETH Gravity Charts Volumes and Vega Weighted)

Paradigm Block Insights

Crypto majors are roughly unchanged this week as vols move sharply lower across BTC and ETH curves. ETH 1M vols trade <40v, under BTC, as curves move into steeper contango, driven by the front-end drip lower.

BTC -1.5% / ETH -1% / NDX +3.5%

We are proud to launch Paradigm Institutional Insights! 🧠 A proprietary analysis on the state of the Crypto Option Block Markets. 🚀 This periodic report unveils key themes in the institutional crypto derivatives block market!

Take a look 👉 https://pdgm.co/41JLkbk

The biggest BTC trade of the week was a 19mar/20may put calendar traded on Wednesday, with the 20may leg being unwound after expiration. Potentially some pin mgmt ahead of the Friday settlement.

950x 19-May-23 / 20-May-23 26750 Put Calendar bought.

In ETH, the infamous call overwriter returned, and rolled Jun exposure to Sep and delivered ~200k net vega between this rolls and screen activity.

63k 30Jun 2200 / 29Sep 2200 Call Cal.

They’re the largest listed ETH player and have changed the asset’s vol dynamics in 2023.

Given this large Sep vega sale, it’s no surprise to see this bucket heavily sold this week… especially as spot creeps to the large Jun 1800 call position; dealers are long from a previous overwrite.

6500x 29-Sep-23 2300 Call sold.

1000x 29-Sep-23 2200 Call sold.

TBP | Diving into On-Chain Options and the Death of $ETH Volatility. - Ep: 23

Greg Magadini from Amberdata joins us as we explore the fascinating realm of ETH volatility, on-chain options in DeFi, and macro insights.

BTC

ETH

The Squeethcosystem Report

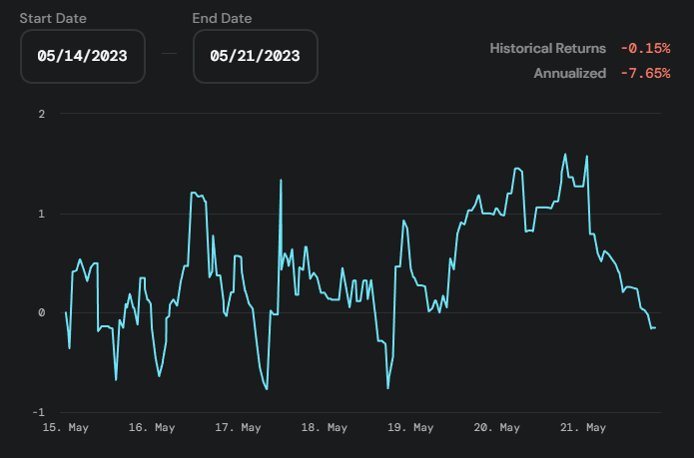

Majors continue to lack direction this week. ETH ended the week +.43%, and oSQTH ended the week roughly +0.7%

Volatility

ETH implied volatility is front and center, with 30-day hitting another all-time low in the vanilla market. Squeeth continues to trade rich to its reference volatility.

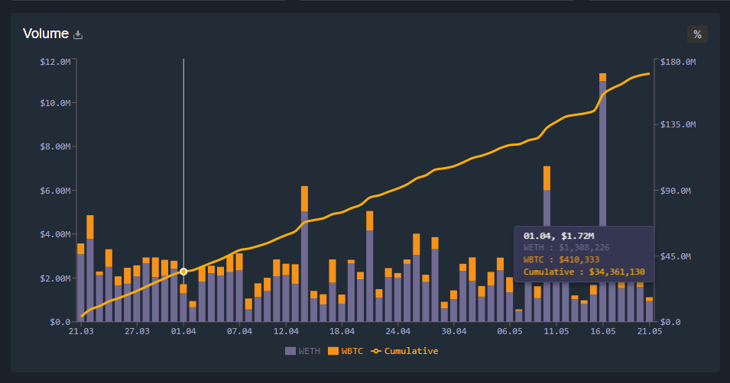

Volume

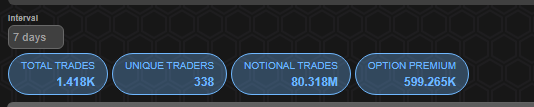

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $622.09k

May 17th saw the most volume, with a daily total of $226.75k traded.

Crab Strategy

Crab ended the week at -.15% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

Lyra Weekly Review

Arbitrum:

Optimism:

Vaults on Optimism are under migration to a more capital-efficient version of the AMM:

A proposal to deploy a new version of Lyra, integrating with @Synthetix_io Perps V2 for hedging and cash collateralization on @OptimismFND, is now live for voting.

— Lyra (@lyrafinance) May 19, 2023

Vote now 👇https://t.co/12nt3Q5jIs

Volatility

Current ATM IV is ~45% in ETH, with spot stuck rangebound. Term structure is sitting in contango with a slight call premium. Longer-dated IVs have also seen a decline over the last week.

Trading

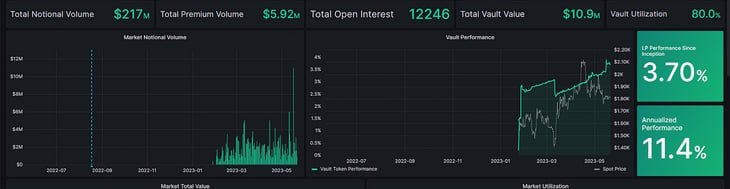

Lyra saw its largest volume day ever on Arbitrum this week.

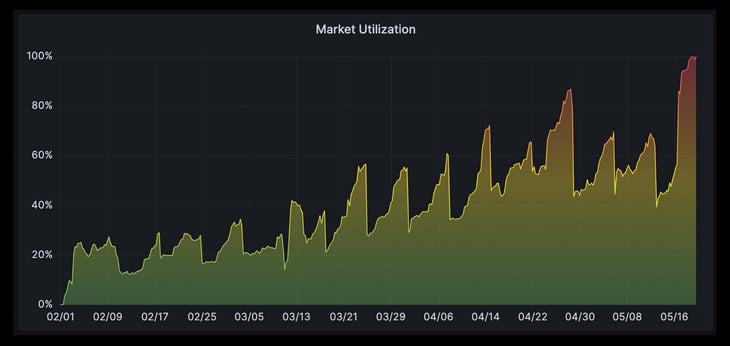

Demand for Lyra options continues to grow with vault utilizations steadily increasing since launching in February.

ETH Market-Making Vault

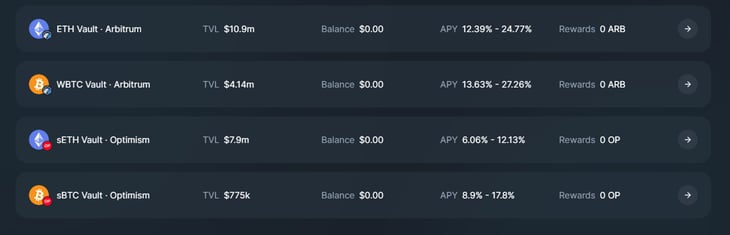

The ETH MMV on Arbitrum has returned +3.70% since its inception, representing a weekly change of +.10%. Annualized performance since inception is +11.4%.

Depositors earn an additional 12.39% rewards APY, boosted up to 24.77% for LYRA Stakers on Arbitrum.

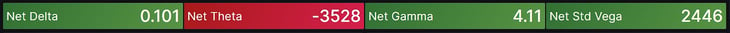

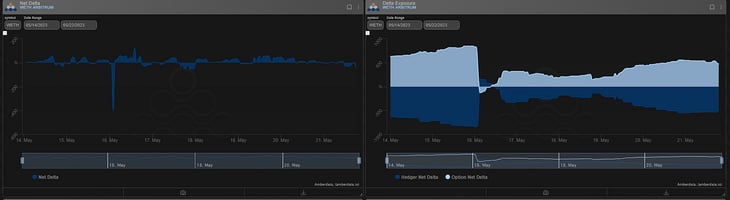

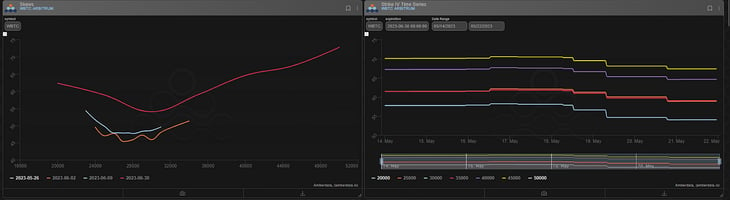

Net MMV Exposure:

ETH vault is long Gamma and Vega, as traders believe volatility will not be realized any time soon. The MMV is long at the money options concentrated around the 1800 strike.

ETH Arbitrum:

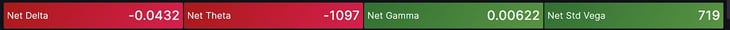

BTC Volatility

Net BTC MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here.

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...