.png)

USA Week Ahead:

-

Thurday 8:30am: Initial Jobless Claims

- Friday 8:30am: PCE

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math minded people here, pardon any typos.

THE BIG PICTURE THEMES:

VIX trading was interesting going into CPI.

VIX cash traded at a significant premium to VIX futures (which were in Contango). Traders were buying SPX vol. but VIX futures traders expected this valuation to be short-lived.

This did not happen for FOMC.

Risk-assets have been trading weak post FOMC release. The Fed does seem to accept a recession may be expected (hence “allowed” to occur).

PCE might move markets on Friday, but on balance I think holidays will keep markets rather quiet going into EOY.

Crypto:

Long story short, the most likely outcome from here until EOY (There will be no newsletter on Christmas) is likely a quiet holiday environment.

HOWEVER, there was a lot of Binance FUD this week and should there be any legitimacy to this, this could easily shake things up.

Here’s a brief twitter thread to recap:

What's going on with Binance?

— Genevieve Roch-Decter, CFA (@GRDecter) December 16, 2022

Here's what I know 🧵

The FUD play would be to trade Put 1X2 or 1X3, (short the 1x).

A structure with a credit could be the best of both worlds, given the binary thesis (FUD crash or zero holiday spot movement).

BTC: $16,792 -1.82%

ETH :$1,187 -5.8%

SOL: $12.50 -6.82%

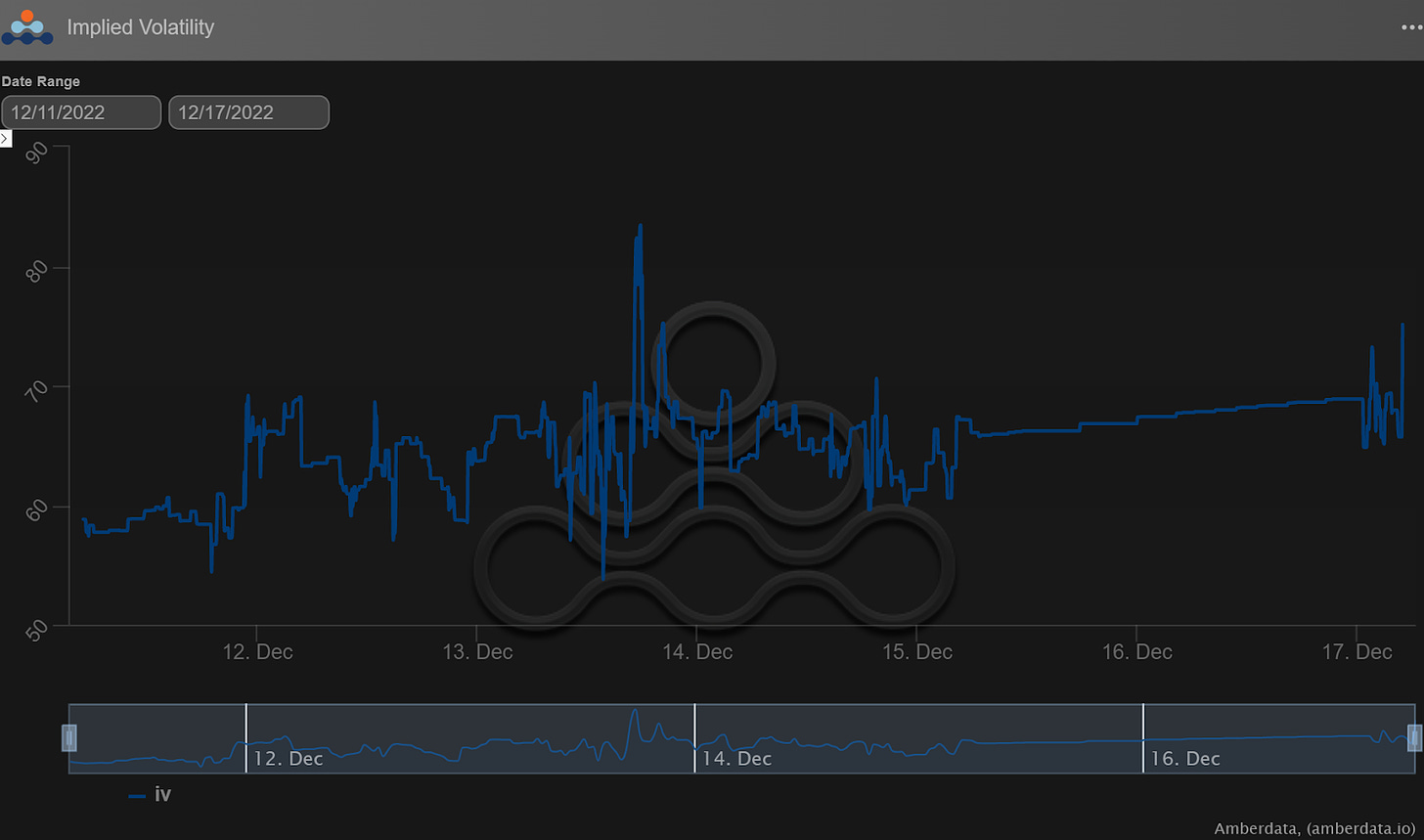

DVOL: Deribit’s volatility index

BTC - (365-days w/ spot line chart)

This week had a decent amount of movement “intra-week” with Tuesday’s CPI and Wednesday’s rate decision.

Spot prices rallied above 18,250 going into FOMC, only to close around 16,750 on the week.

Week over week, RV was zilch despite the intraday movement.

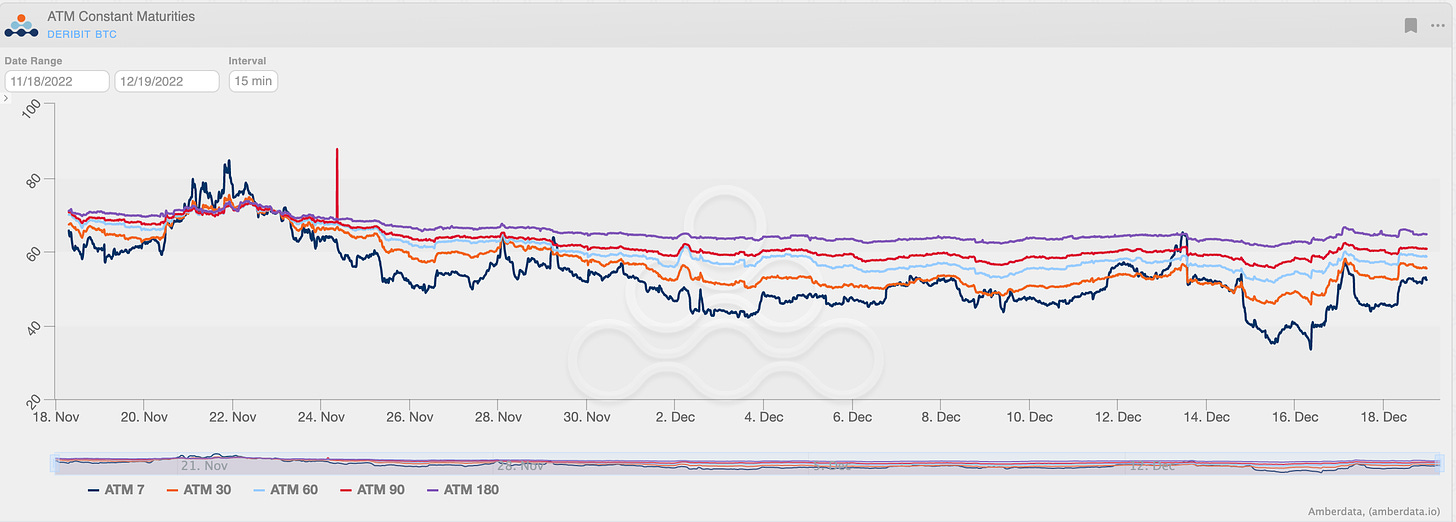

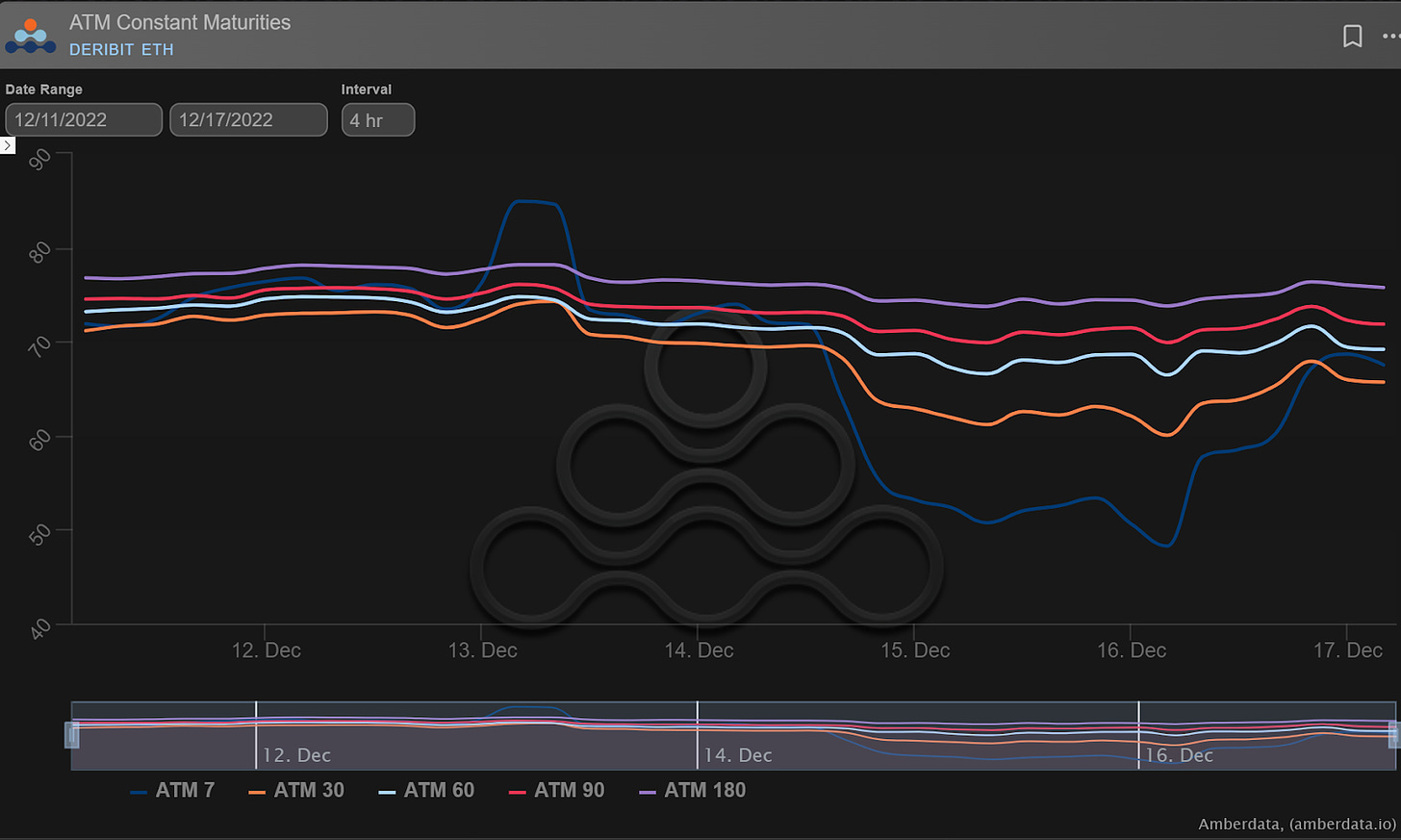

TERM STRUCTURE

(Dec. 18th, 2022 - BTC Term Structure - Deribit)

There was good movement this week in the term-structure.

Going into CPI the 7-day IV matched the highest level (the 180-day) only to quickly give it back post CPI.

This type of activity is indicative that traders are “paying attention” to the macro.

Given that CPI was less certain than FOMC, the term structure was unable to move at all pre-release.

Post FOMC we term structure melted much further.

(7-day highlight)

7-day IV was responsible for most of the action this week.

Hitting new lows post-FOMC but ended the week nearly unchanged as spot prices triggered Vol. buying from hedgers.

Weekly lows for the 7-day IV will likely be revisited from now until EOY as I expect holidays to be quiet.

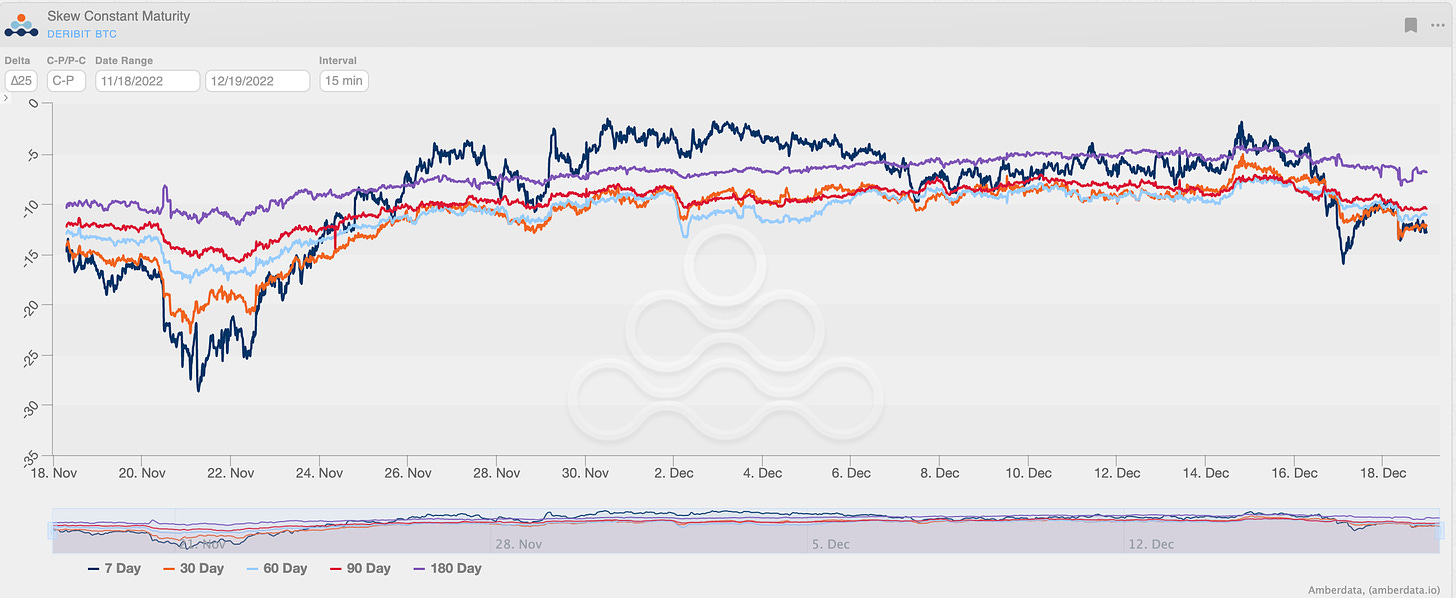

SKEWS

(Dec. 18th, 2022 - BTC RR SKEW (C-P) ∆25 - Deribit)

Option RR-skew has dropped along with spot prices.

This is no surprise and could absolutely drop further if something happens in the near future.

I think all the vol. risk comes from lower spot prices, given the macro environment and the industry contagion risk.

Think Binance Fud? Tether?

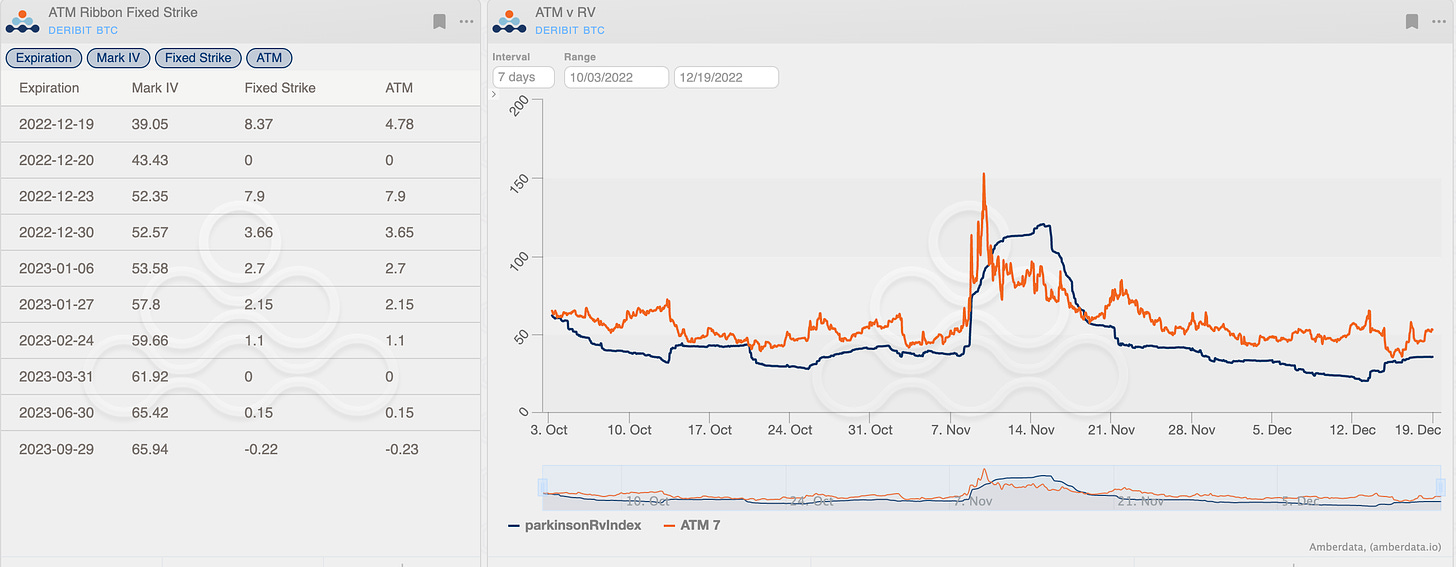

VOLATILITY PREMIUM

(Dec. 18th, 2022 - BTC IV-RV)

Weakness in risk assets, post FOMC, has brought BTC spot prices down and RV higher.

That said, 7-day RV remains around 35% with no big obvious catalysts until EOY, that could close the gap.

EOY ATM vol. is currently pricing 52% with a steep “roll-down” to 39% into the daily’s.

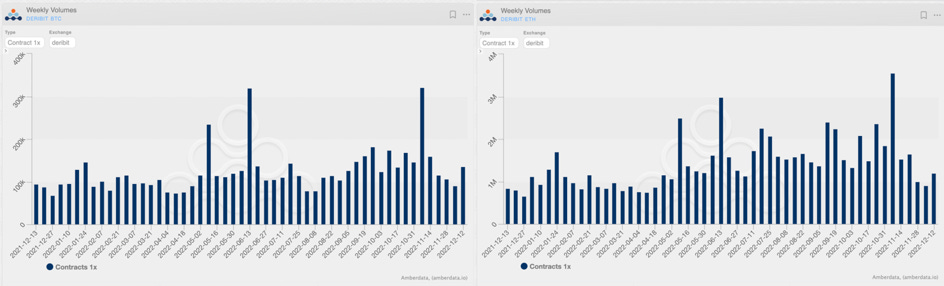

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

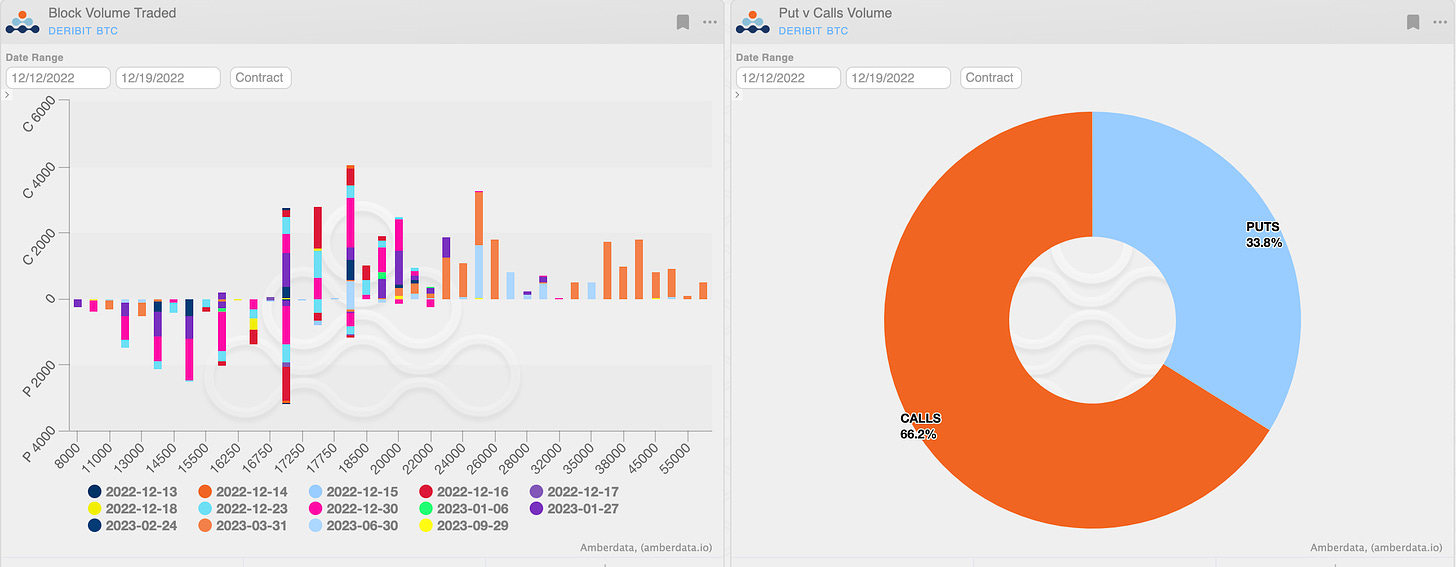

The increasing volumes from previous weeks is a good sign of optimism for a return to a normality or at least a “new normality”. The focus on bitcoin continues with +56% notional compared to ethereum.

(Deribit Historical - Historical contracts volume- BTC vs ETH)

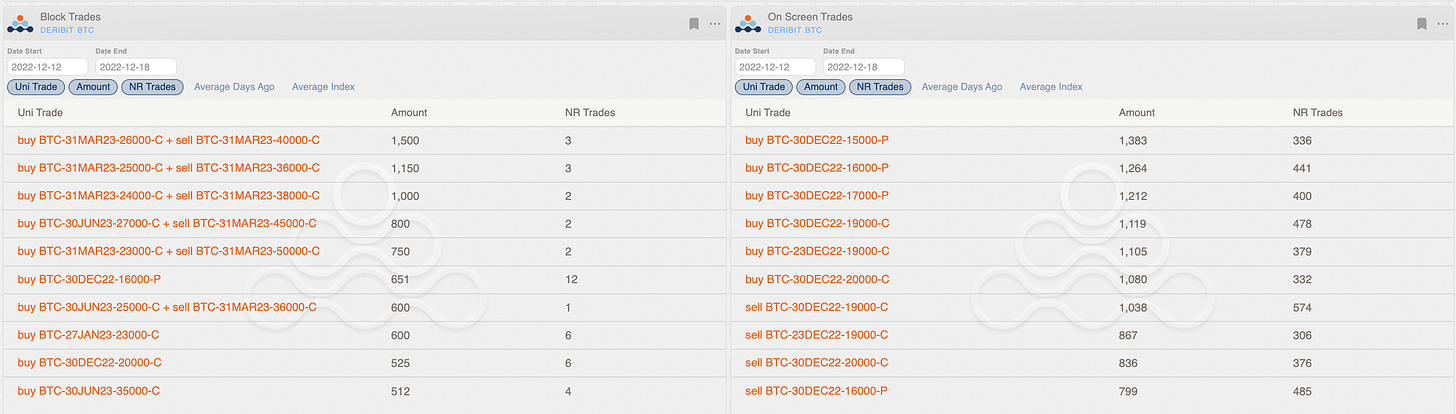

On bitcoin the flow was dominated by call spreads, specifically on March 2023. All the block trades in question were delta-hedged, with impacts on open interest often unclear. These and other elements could suggest movements beyond normal trades but if we assumed them as such, being long 3-months volatility with iv <60% with a very interesting gamma/theta ratio, it would seem like a bet with edge.

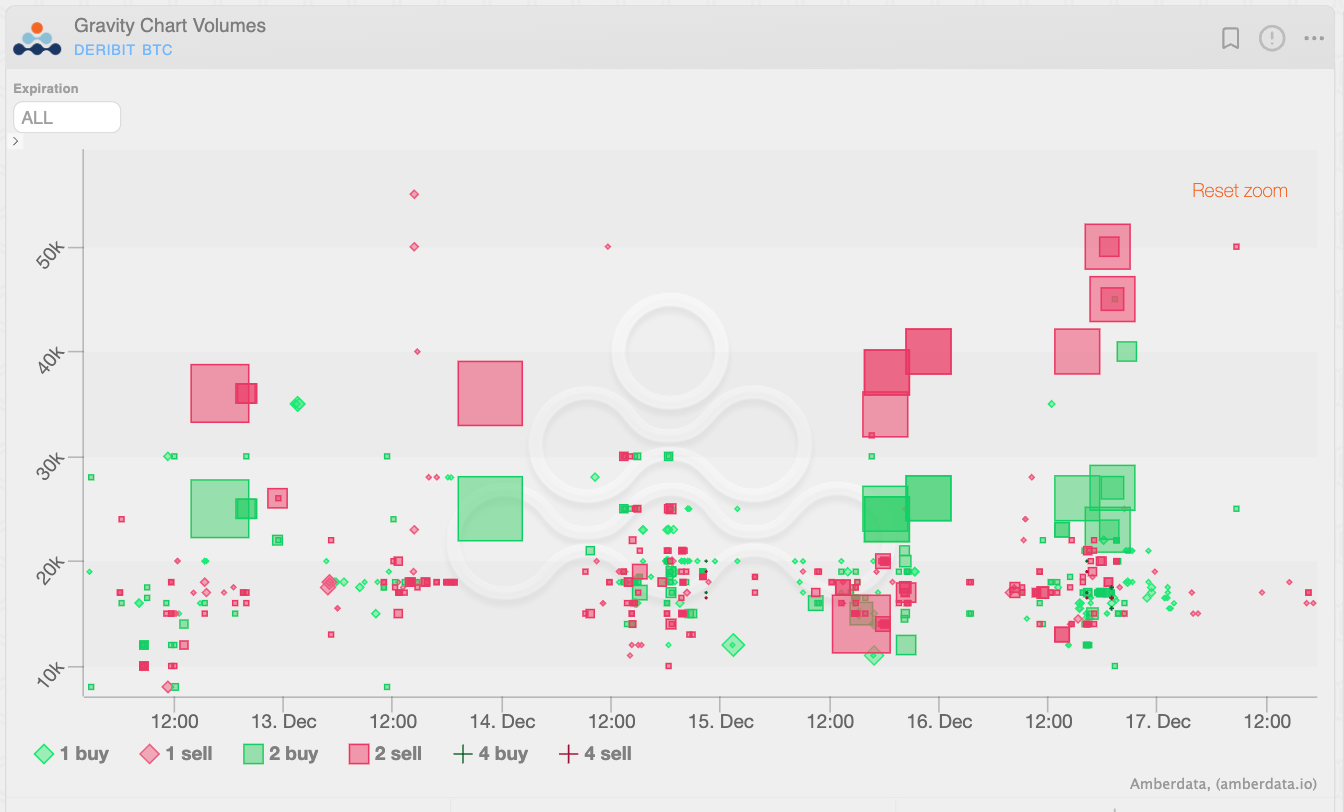

(BTC Gravity Chart Volumes - Deribit Historical section)

On screen trades have focused on the 30DEC with puts bought and calls with a more mixed flow, but always predominantly long.

(BTC AD direction table with uni_trade - Options Scanner section)

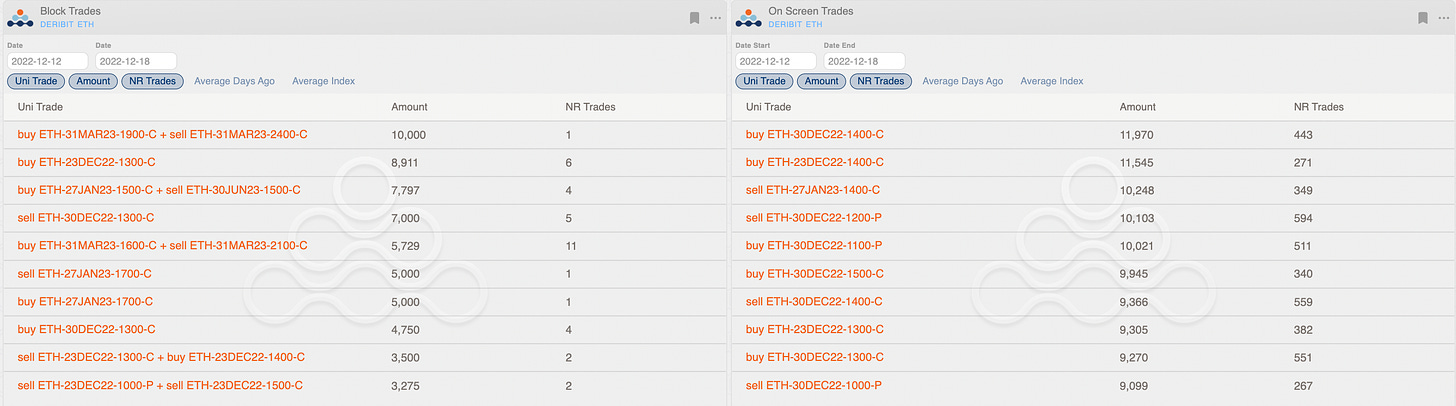

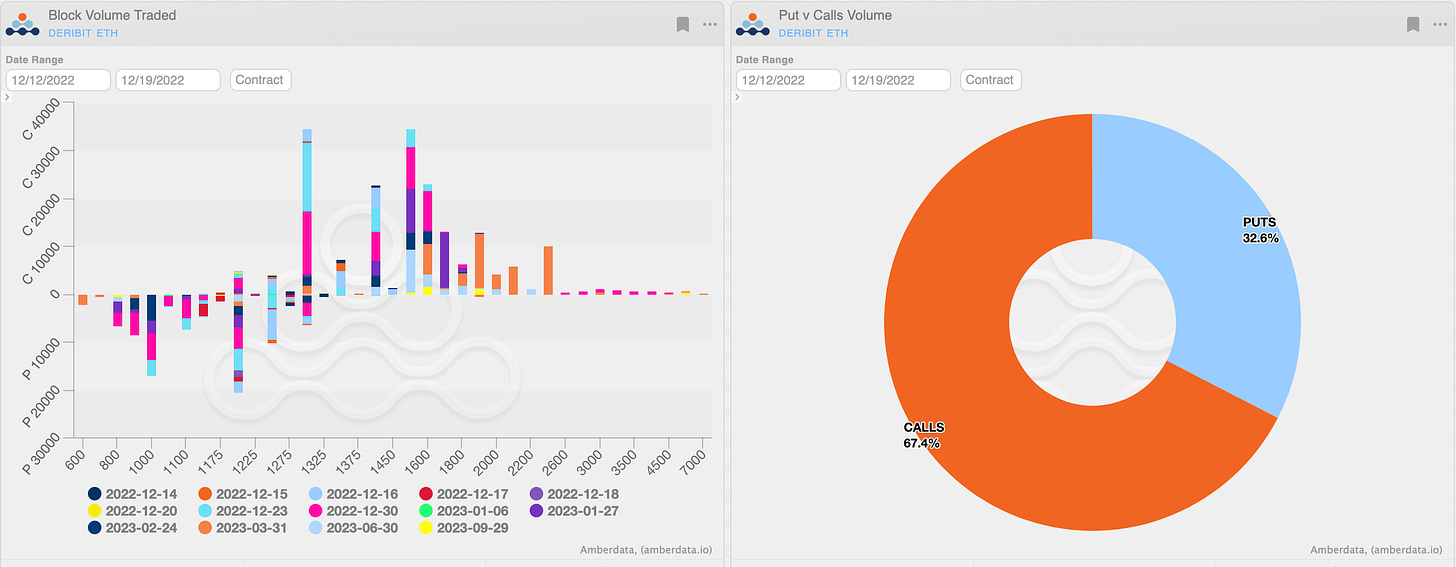

On ethereum here too we notice an important call spread on March2023. However after the merge and collapse of FTX the flow remained relatively muted.

(ETH AD direction table with uni_trade - Options Scanner section)

Paradigm Block Insights (12 Dec - 18 Dec)

Busy week of macro data. Majors closed lower on the week. Large taker flows blocked on Paradigm. Crypto Derivatives volumes update 🔊. Exotic options in Crypto.

BTC -2% / ETH -6% / NDX -3%

BTC frontend vols get hammered post-FOMC, with 7D ATMs trading lower from a high of 65v down to a low to 35v on Thursday. BTC vols rallied on Friday’s selloff, but Dec vols <50v with spot selling off 10% in 24 hours seems like decent value to own.

🌊 BTC Flows

Large strike rolling flows in BTC this week on Paradigm. Taker rolled down wingy Mar strikes.

1500x 31-Mar-23 26000/40000 Call Spread bot

1150x 31-Mar-23 25000/36000 Call Spread bot

1000x 31-Mar-23 24000/38000 Call Spread bot

800x 31-Mar-23 45000 / 30-Jun-23 27000 Call Calendar bot

🌊 ETH Flows

Notable topside buying interests this week in ETH!

We saw risk being recycled, bot and then sold throughout the week below.

4500x 30Dec 1300 Call bot

2500x 30Dec 1400 Call bot

A size buyer scooped front-end vol post-FOMC at the tail end of the week the lower reset implieds.

6k 23Dec 1300 Call bot

Crypto Derivatives Volumes Update 🔊

Through roughly first half of Dec, “interdealer” flow as % of Paradigm volume is the highest of 2022 (43.53%).

This can chalk up to buyside clients closing books for the year, and still only halfway through the month, but a jump this high suggests a structural change. Check thread below if missed!

Paradigm Interdealer Flow in FTX Aftermath🧵

— Paradigm (@tradeparadigm) December 13, 2022

On last week's "The Big Picture", @jkruy26 discussed lower buyside taker interest since FTX, and the crypto option market feeling more "interdealer" than before.

What does this mean?

1/7 🧵 pic.twitter.com/y5zSKaVOFV

Exotic Options are a staple in Tradfi but are only now making their way into crypto.

Our latest piece written by @laevitas1 explains what a powerful tool these can be if you understand them.

Learn how you can use Exotics properly by starting here.

https://www.paradigm.co/blog/exotic-options-introduction-part-1?utm_campaign=Exotic_Options_pt_1&utm_source=twitter&utm_medium=social&utm_content=tradeparadigm

🎀 Another 🔥🔥🔥 @ribbonfinance auction on

@tradeparadigm 🥳

🎉 All vaults expiring OTM and comparable beats to screen this week of over 15% 🔥 helping boost those vault yields 💪

Winners 🏆

🥇 @BastionTrading

🥇 @MoonvaultCap

🥇 Various ANON 🤫

Same time next week 🫡

Hit us up on Telegram! 🙏

Daily Commentary✍️ http://pdgm.co/cmmntry

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

BTC

ETH

Squeeth Weekly Review (12/11/22 - 12/17/22)

Now that the CPI and FOMC are out of the way, market participants can look into 2023 for opportunities. With the recent dot plot showing the terminal rate expectations over 5%, ETH spot markets lost the bid quickly ending the week -8.11%. oSQTH ended the week -15.69%.

Volatility

Vol markets provided unique opportunities for traders this week. While IV found a bid early in short dated ETH options, oSQTH took a bit longer providing ample time for a vol spread.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $5.56m. December 13th saw the highest single day volume, with a daily total of $1.77m traded.

Crab Strategy

Crab strategy saw slight declines this week, ending the week -1.32% in USD.

Opyn is happy to announce Jumbo Crab, allowing larger deposits and less slippage!

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

If you would like more in-depth analysis, subscribe to AD Derivatives Newsletter & launch our app to utilize our tools for your trading strategies!

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...