-

Monday 10a - ISM Manufacturing

-

Wednesday 8:15a ET - ADP employment

-

⭐️ Wednesday 2p ET - FOMC

-

⭐️ Wednesday 2:30p ET - FOMC Press Conference

-

⭐️ Friday 8:30a - NFP

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math-minded people here, pardon any typos.

THE BIG PICTURE THEMES: [FOMC] and [NFP]

Is crypto still being run by macro themes or is a more sector-specific narrative emerging?

This is a question I’ve been asking myself throughout the year (especially post the ETH “Shapella” upgrade).

I like to view the BTC & ETH relationship as similar to the Gold & Silver relationship.

If BTC is gold, ETH and other altcoins are like silver.

Silver is a store of value, but silver is also driven by industrial demand in a booming economy. Therefore silver trades as both a risk asset (doing well in a growing economy) and an alternative currency.

During crypto bull runs we often see altcoins, such as ETH, outperform BTC. This signals an investment crowd viewing Web3 and the new “Crypto Economy” as part of a growing economy… a new TECH sector, so to speak.

In this sense, altcoins are “risk-on” assets.

YTD ETH has underperformed BTC.

Similarly, Gold is at all-time highs while silver needs to double to reach ATHs.

This makes me think that the current crypto rally is really driven by macro developments, making this week especially important as BTC hangs around $30k.

We have an FOMC rate decision this Wednesday (+25bps expected) and the employment report (NFP) this Friday.

These are key drivers of the current macro environment (along with CPI).

First Republic National Bank was also auctioned-off this weekend, highlighting the fact that pain remains post-SVB crisis.

Another potential influence on the Fed.

BTC: $29,416 (+5.60% / 7-day)

ETH :$1,893 (+0.80% / 7-day)

SOL: $23.12 (+5.80% / 7-day)

A key theme that seems to be emerging is a softening economy that will force the Fed to cut rates into end-of-year.

This would likely cause opposing flows between BTC and ETH.

Crypto options are currently priced with this Fed prediction in mind, but this pricing is far from the typical median relationships and could provide us with a good mean-reversion opportunity.

The current narrative reads like this to me:

Should the economy weaken further (risk-off) this would hurt ETH, causing ETH to underperform to the downside.

A recession would cause the Fed to pivot and cut rates later this year (good for Gold and BTC).

Therefore we’d expect BTC to continue to outperform and increase market share.

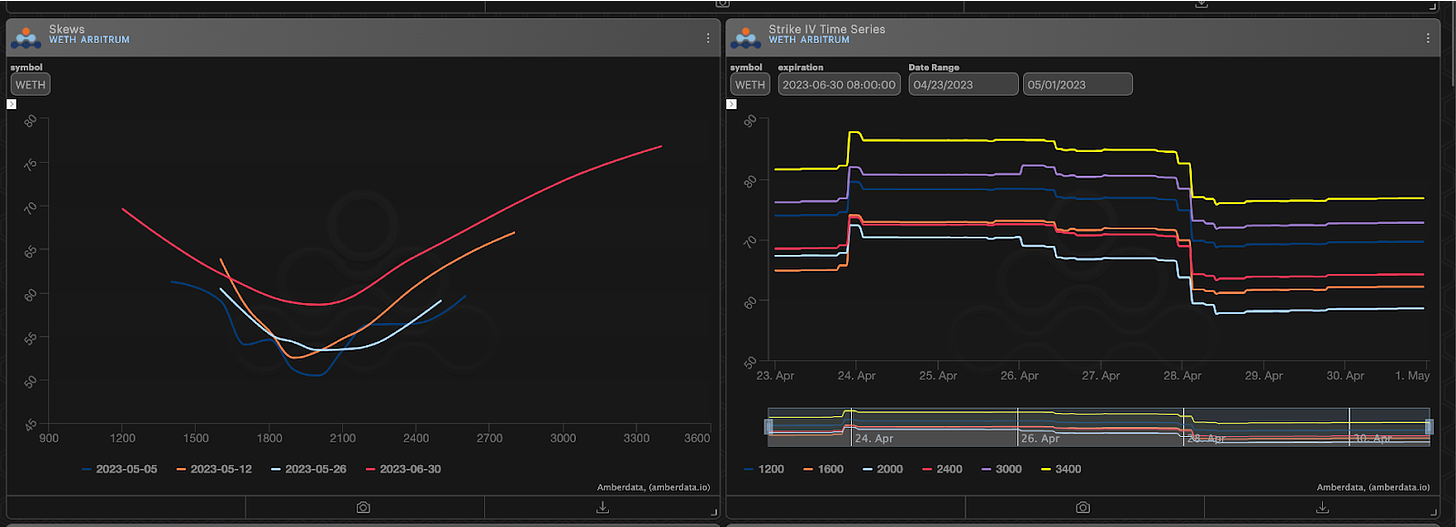

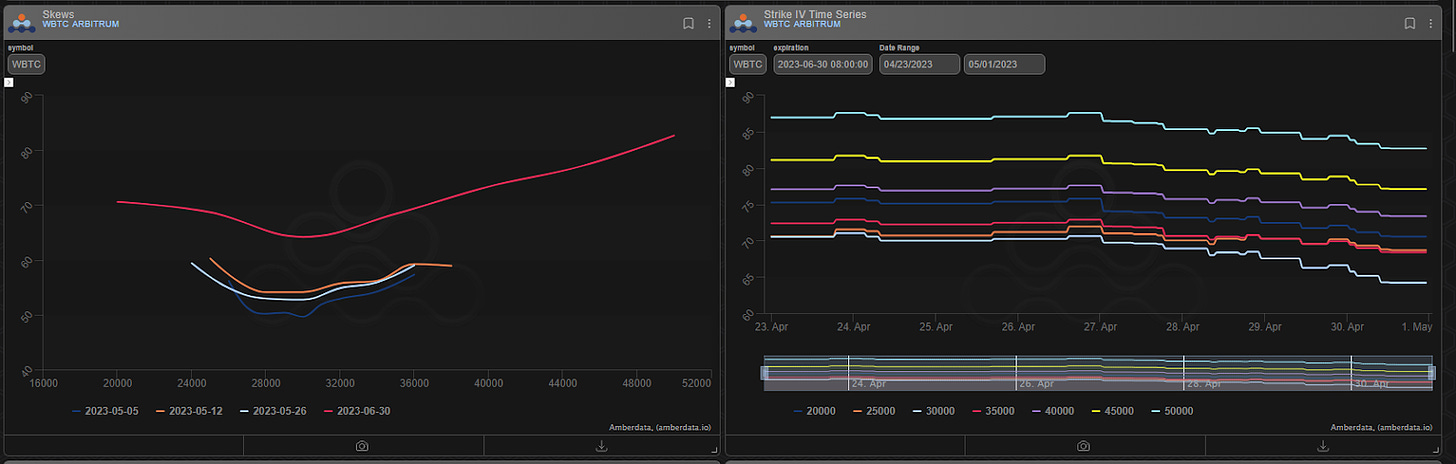

This seems to be how the vol surface is currently being priced.

We can see that the vol surface is priced as such (although only modestly)

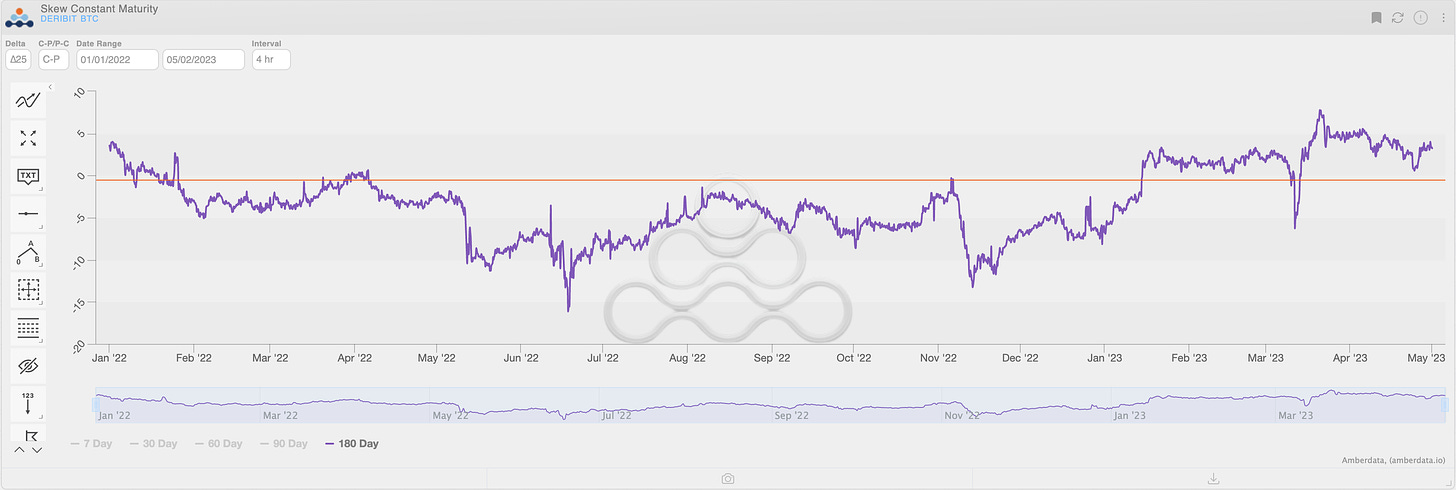

BTC OTM ∆25 calls trade at a premium to puts, while ETH is the opposite.

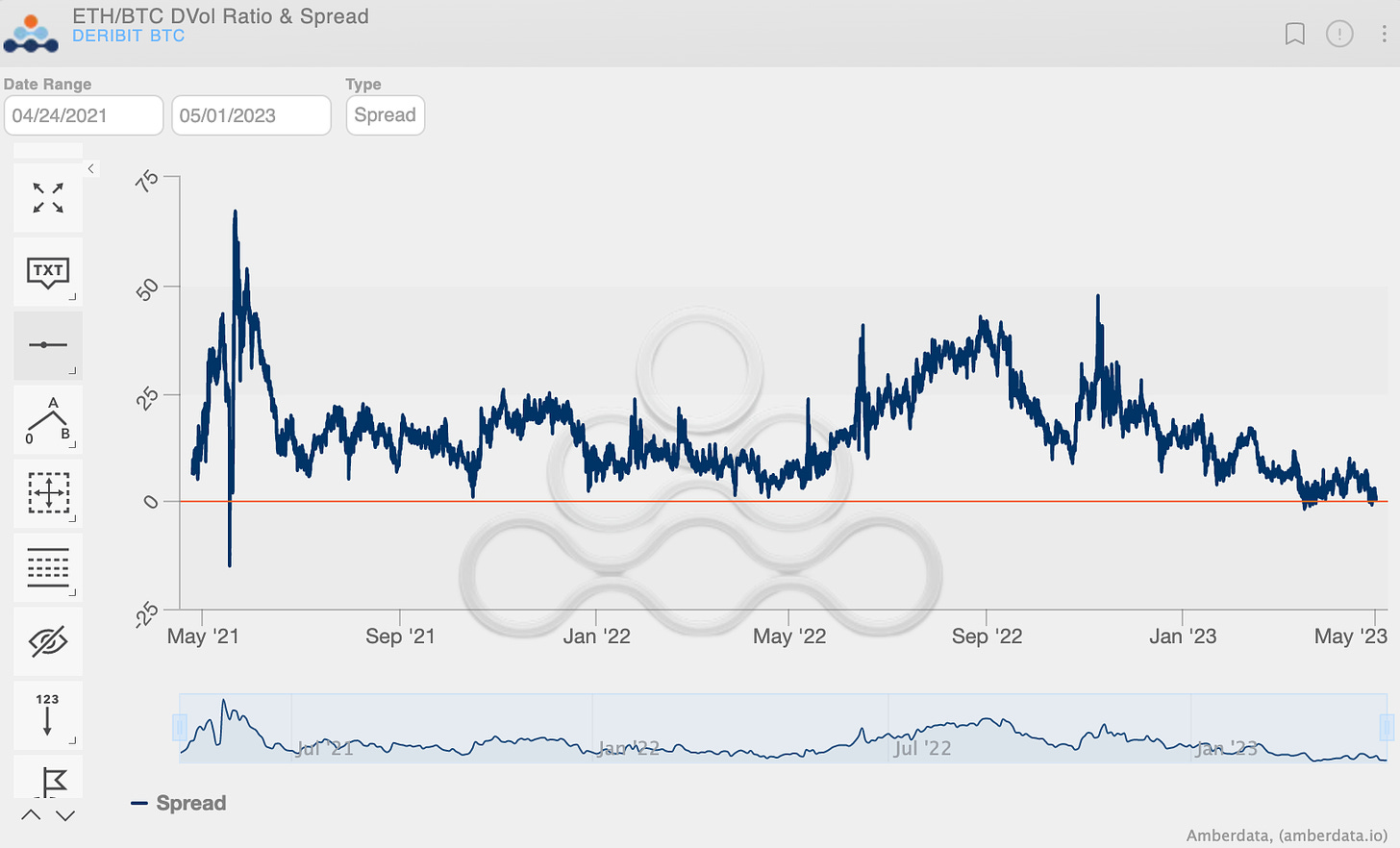

The BTC rally YTD has caused BTC IV to gain relative to ETH IV.

This macro-driven event means that BTC is the main crypto flavor given that BTC is a commodity pure-play for USD alternatives.

Should a recession occur, ETH IV could gain as ETH crashes harder than BTC, but when (or if) the Fed cuts rates BTC will gain more relative to ETH, enjoying a leg higher with more vol.

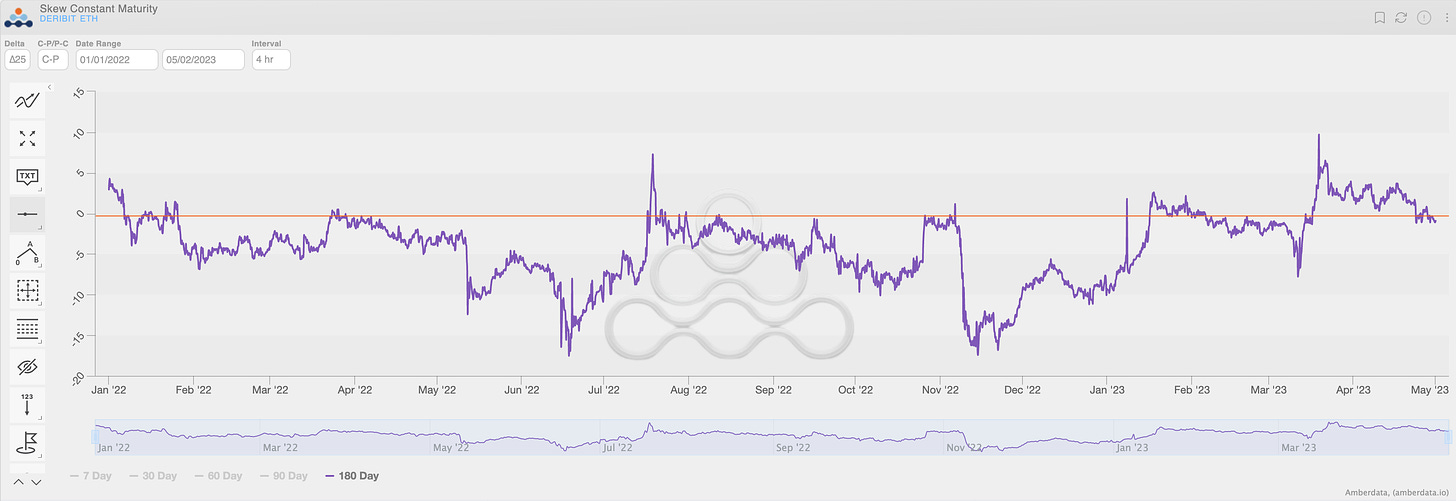

Assuming mean reversion, selling BTC IV is interesting and selling the BTC RR-Skew 180-days out is interesting.

Buying ETH puts due to relatively low ETH IV and only slightly negative ETH RR-Skew looks attractive here as well.

Doing both these trades on a delta hedged basis given the context of 2022 seems interesting (see below).

Again, this is priced accordingly for a reason but can this reason truly fend off the forces of mean reversion?

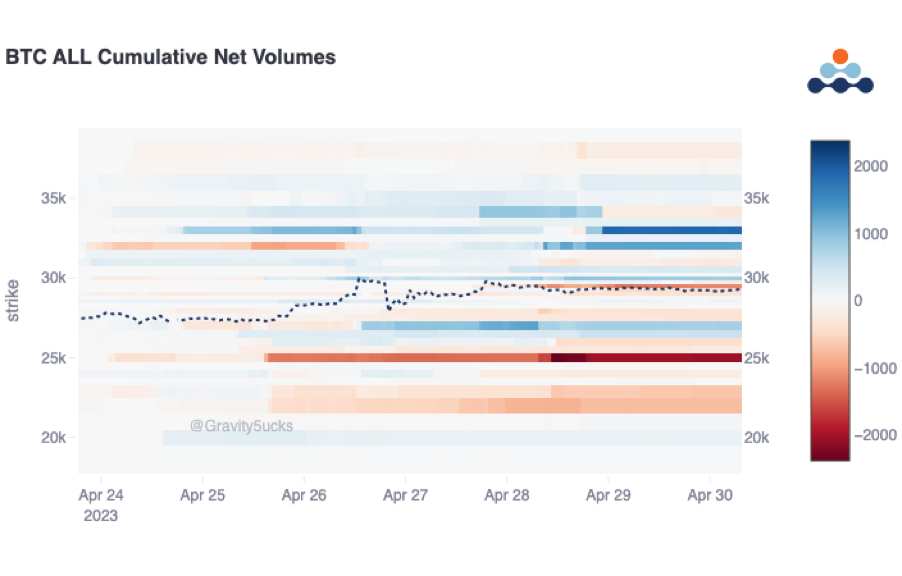

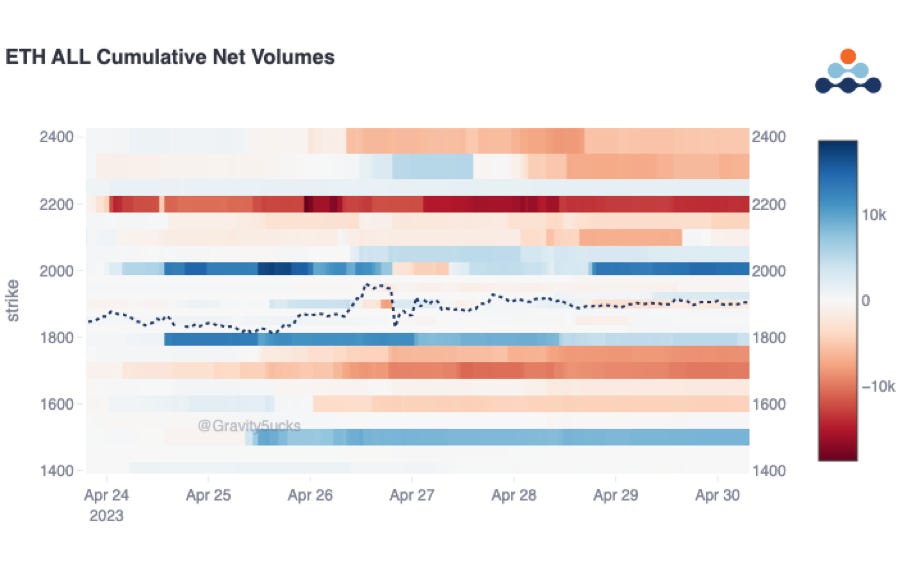

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

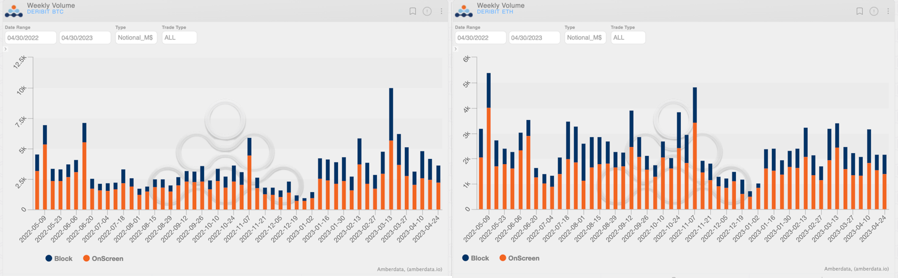

This week, market continued to show a similar trend to the previous week, with relatively low trading volumes compared to recent averages.

With the upcoming FOMC meeting we could see a pickup in trading activity.

Overall, the trading week has been lackluster compared to the good performance of realized volatility. The market in general is evaluating the $29k level with extreme attention.

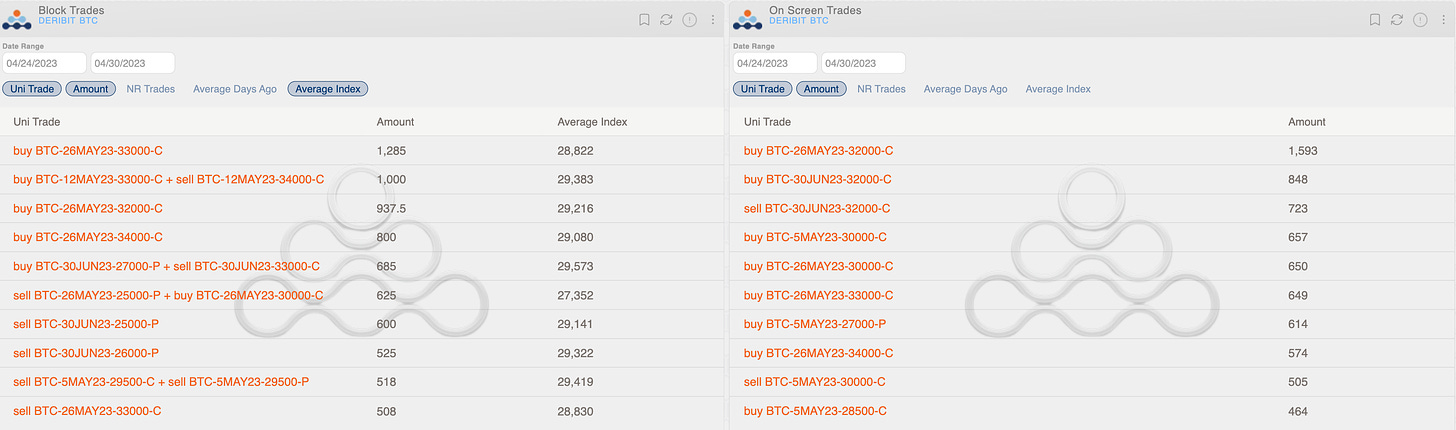

Notable trades include the sale of $25k puts for June, as well as activity on the $32k/$33k strikes when the spot regained the $29k threshold.

This was accompanied by the covering of May's $32k shorts and later in the week with purchases of $32k/$33k strikes.

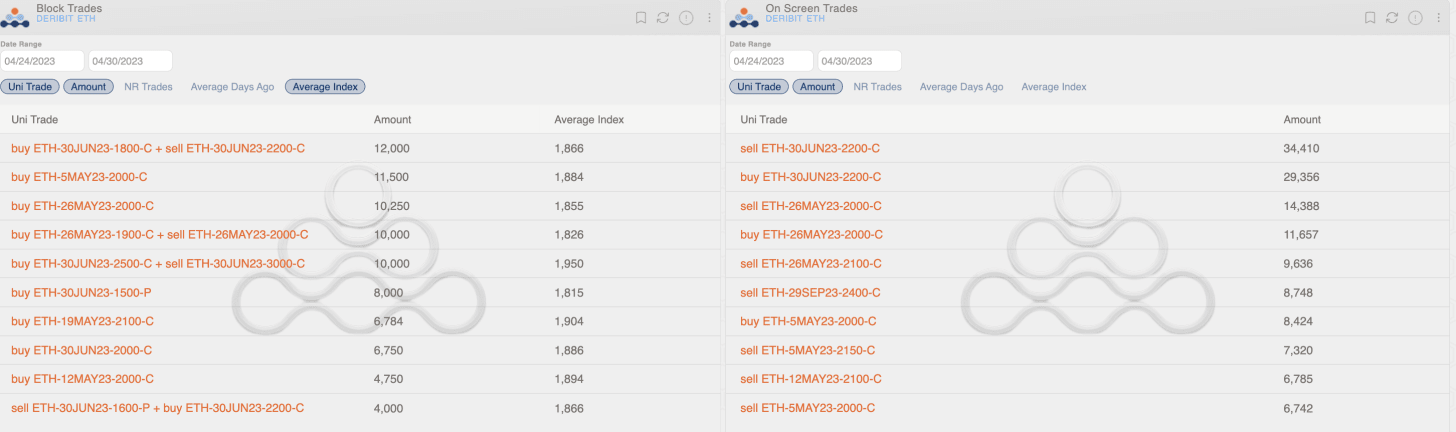

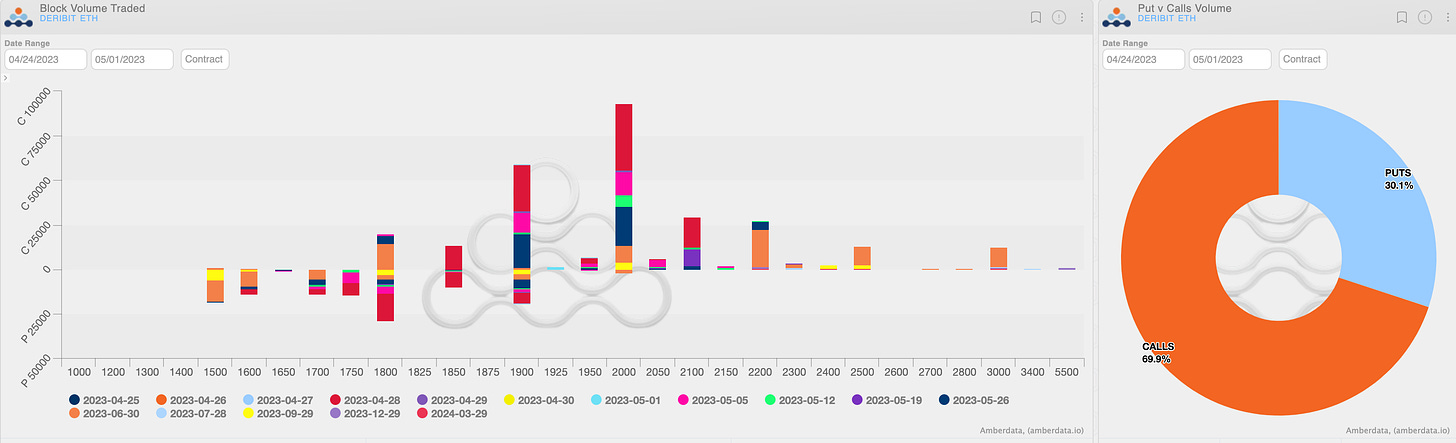

We also observe for Ethereum the sale of OTM puts and profit taking of $2k contracts when the spot regained ground. All in all, the week's closing was constructive with the establishment of new long positions at the $2k strike.

Paradigm Block Insights

Strong week for crypto majors as BTC rallies back to top of spot range towards 30k. Significant vol selling of downside strikes at the beginning of the week, then BTC upside buying as implieds retrace back into the mid 40s..

BTC +6.5% / ETH +3% / NDX +1.9%

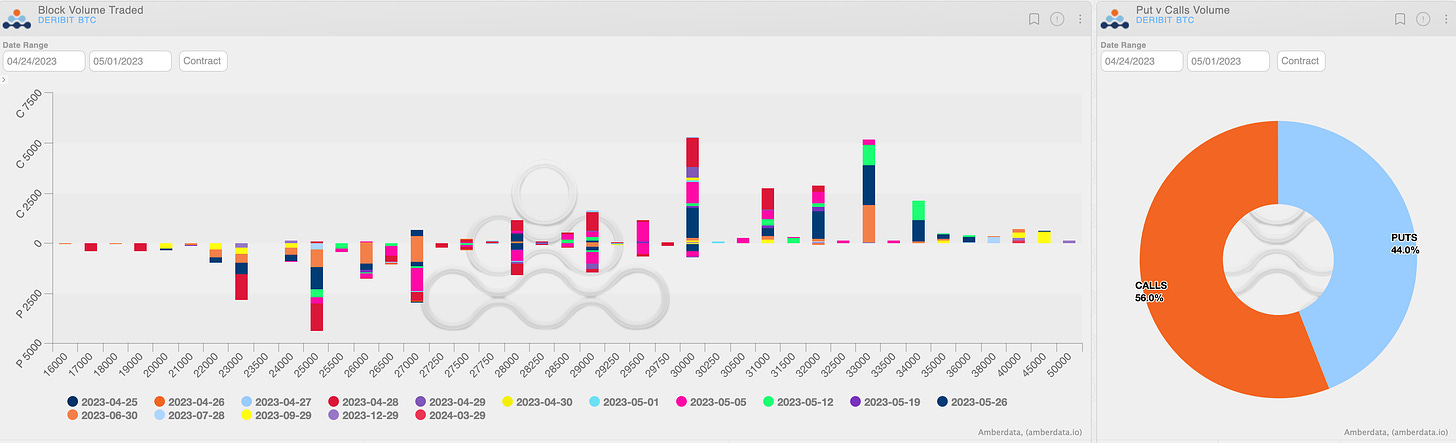

BTC 🌊

BTC downside vols heavily for sale throughout the week in outright and risk reversal formats. We hear dealers are generally long downside strikes from Paradigm and OTC flows…these have been brutal to carry.

625x 26-May-23 25000/30000 Bull Risk Reversal bought

550x 30-Jun-23 25000 Put sold

500x 26-May-23 25000 Put sold

500x 26-Jun-23 26000 Put sold

A renewal of BTC topside bids on Friday as spot chops around 29.5k. A grind lower in realized as spot approached the 30k resistance, coupled with strong selling flows, brought ATM implieds back into the 40s.

Bought 1183.0x BTC 26-May-23 33000 call

Bought 1000x BTC 26-May-23 32000 call

Strong risk-reward to own upside with spot flirting with local highs once again. 30k has proven quite a tough ceiling to break through, but with 7d realized =61.1v and 30d realized = 45.4v, not surprising to see the above 👆 trades.

Especially given the latest FRC fireworks, which are a potential catalyst for spot to break out of the range.

ETH: 🌊

ETH flows were quieter this week, with a bias towards upside buying for the largest blocks. Owning upside at these levels seems like strong risk-reward to play for a spot breakout.

Bought 6500.0x ETH 30-Jun-23 2000 call

Bought 6100x 28-Apr-23 1750/1900 Bull Risk Reversal

Bought 2000.0x ETH 12-May-23 2000 call

Bybit Futures Spreads on @tradeparadigm are heating up 🔥👇

https://twitter.com/tradeparadigm/status/1651223090402152450

Bybit x Paradigm Futures Spread Trade Tape and Sign-Up link below 💥👇

TBP | How Crypto Affects the Macro with Former Coindesk Head of Research Noelle Acheson - Ep. 22

In this episode, we dive deep into how Crypto is impacting macro markets with the previous Head of Research at CoinDesk and Genesis Trading and the current author of the Crypto is Macro Now newsletter, Noelle Acheson.

We also explore the current vol regime and which types of traders are coming out on top in this market.

AD Derivatives Podcast (ft. Joe Kruy of Paradigm)

Paradigm's Joe Kruy (head of institutional coverage - Americas) speaks with Greg Magadini of Amberdata around the current state of the digital asset derivatives market.

BTC

ETH

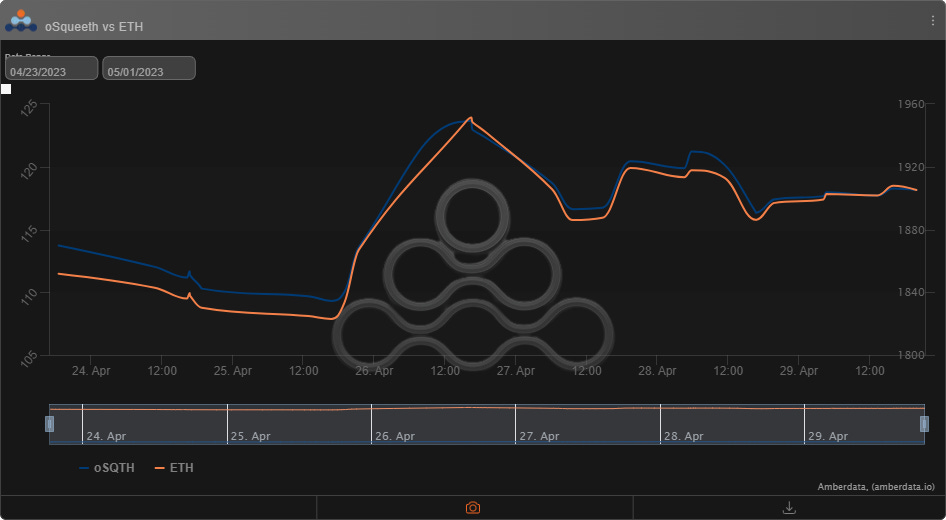

The Squeethcosystem Report (4/23/23 - 4/30/23)

After last weeks declines the majors found a bid to start the week and ended positive . ETH ended the week +2.88%, and oSQTH ended the week roughly +3.88%

Volatility

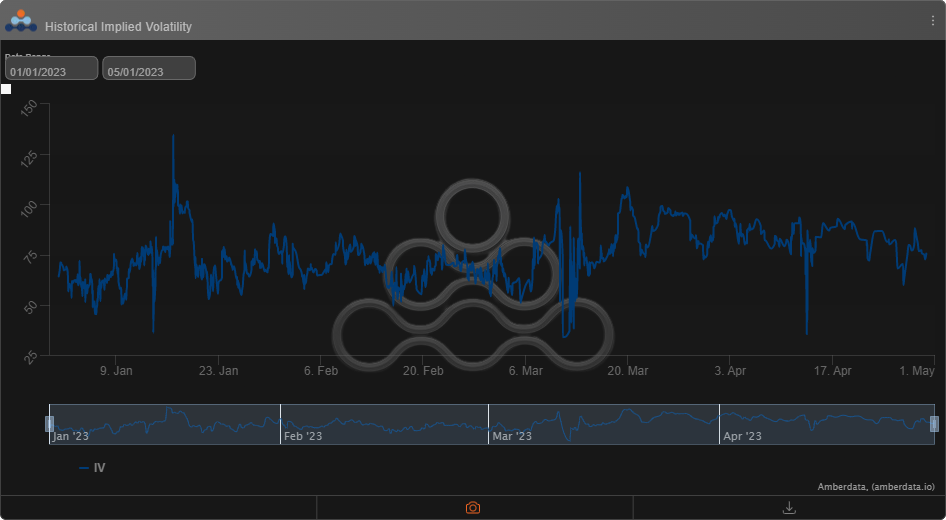

Implied vol has been the talk of CT this week with ETH 30-day printing all time lows. oSQTH implied remains in the 70s vs. a ref vol of 54.14% at the time of writing.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $1.28m. April 26th saw the most volume, with a daily total of $382k traded. An additional $460,488k traded via OTC auctions this week.

Crab Strategy

Crab ended the week at +0.16% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

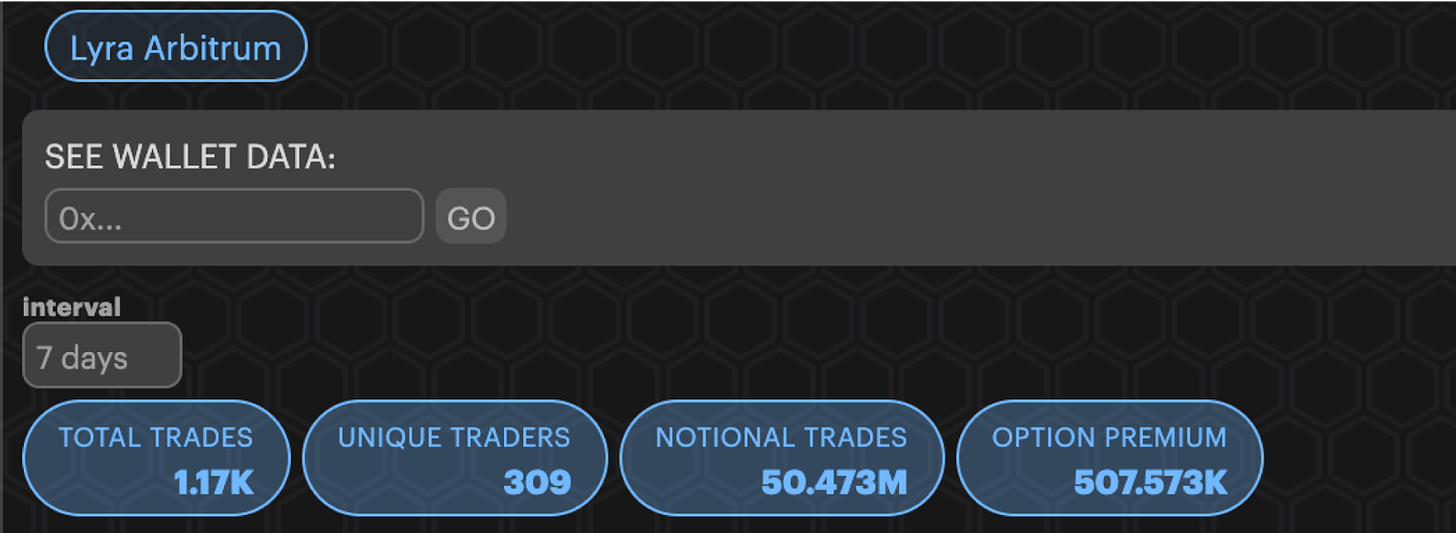

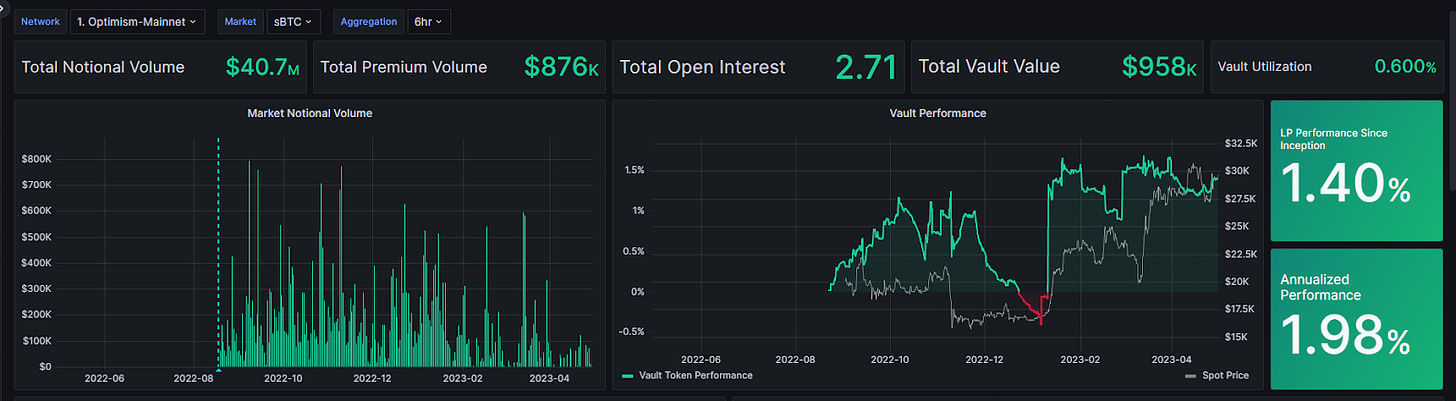

Lyra Weekly Review

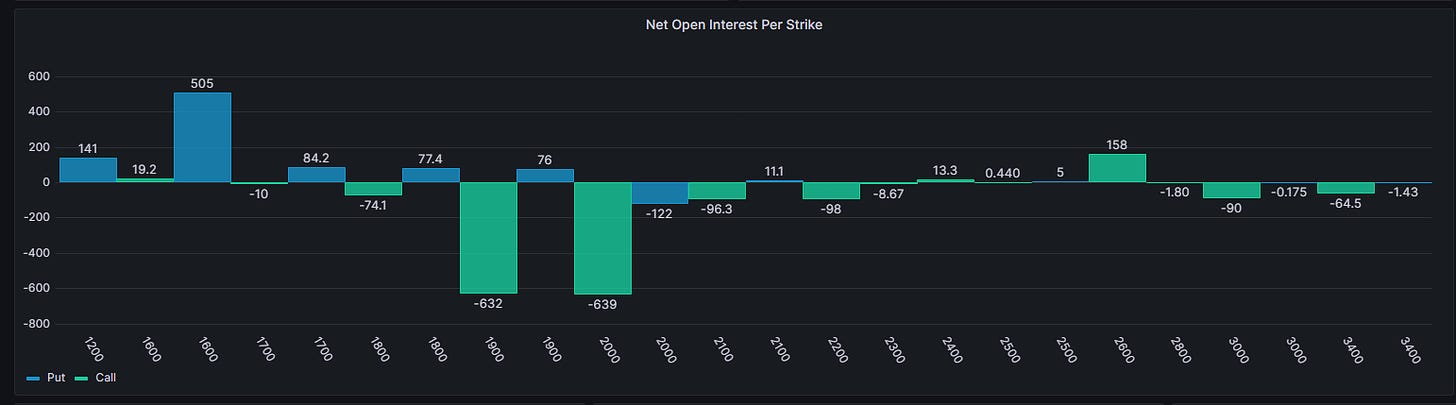

Arbitrum:

Optimism:

Volatility

Current ATM IV is ~50% in ETH, off nearly 10 points on the week. Term structure is sitting in contango with a slight call premium. Longer-dated IVs have remained firm at ~65%.

Check out Amber Data’s in-depth analysis of Lyra’s volatility!

https://twitter.com/Amberdataio/status/1648810555182923778?s=20

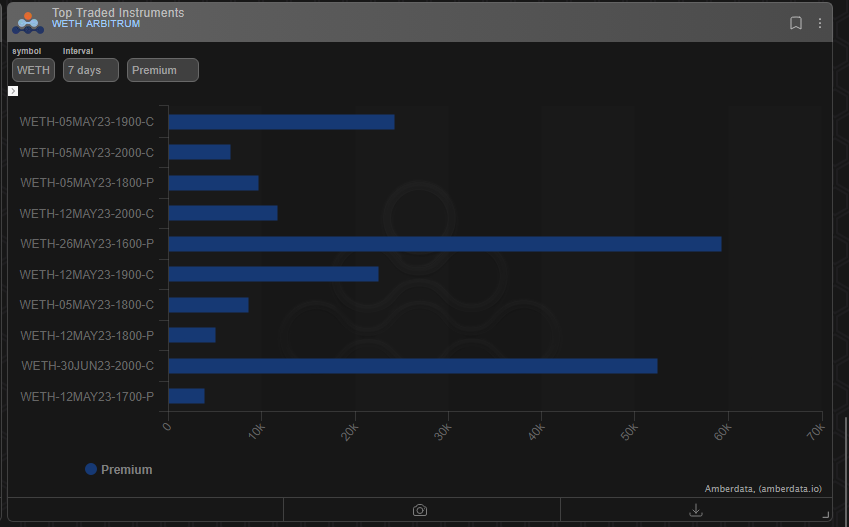

Trading

Lyra options continue to see increased adoption, hitting another all-time high in Open Interest of over $30 million!

https://twitter.com/ksett13/status/1651963907316101126?s=20

Lyra also launched their referral program enabling traders and integrators to earn ups to 60% rewards on trading fees!

https://twitter.com/lyrafinance/status/1651389037322833922

Traders look to hedge their downside with the May 26th 1600P being the most actively traded option.

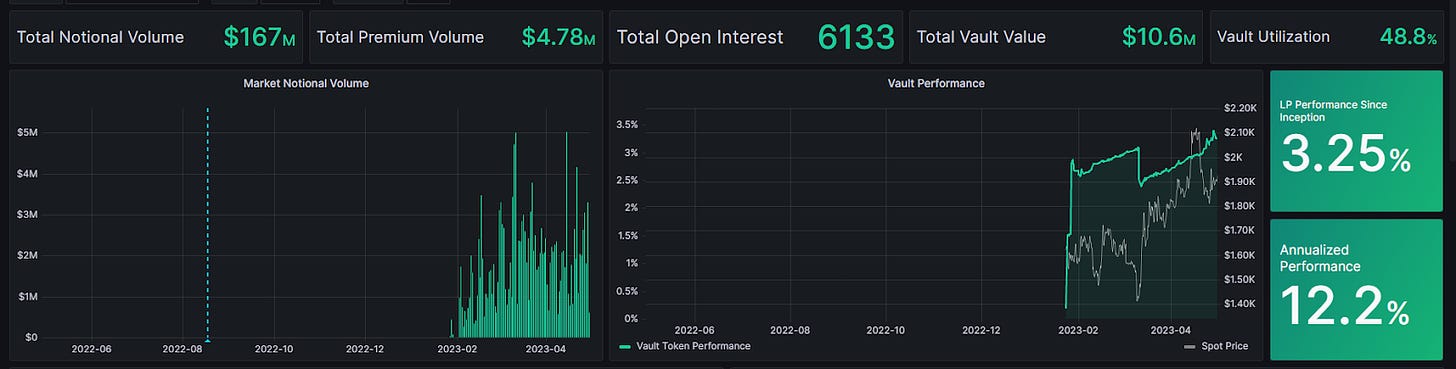

ETH Market-Making Vault

The ETH MMV on Arbitrum has returned +3.25% since its inceptionrepresenting a weekly change of +.18%. Annualized performance since inception is +12.2%.

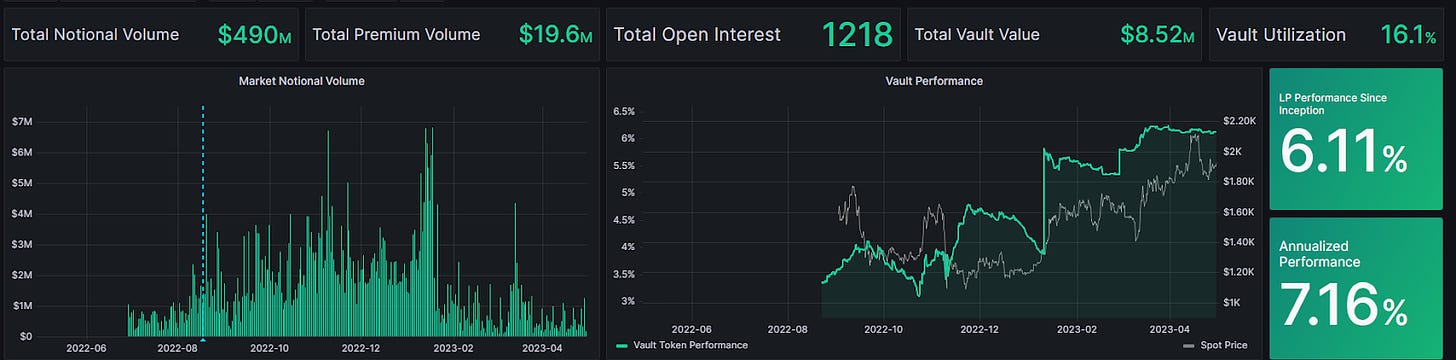

The ETH MMV on Optimism has returned +6.11% since its inception representing a weekly change of -.01%. Annualized performance since inception is +7.16%.

Depositors earn an additional 15.24% rewards APY, boosted up to 30.5% for LYRA Stakers on Arbitrum or 7.2% boosted up to 14.4% for LYRA Stakers on Optimism.

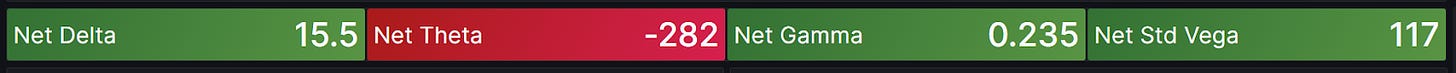

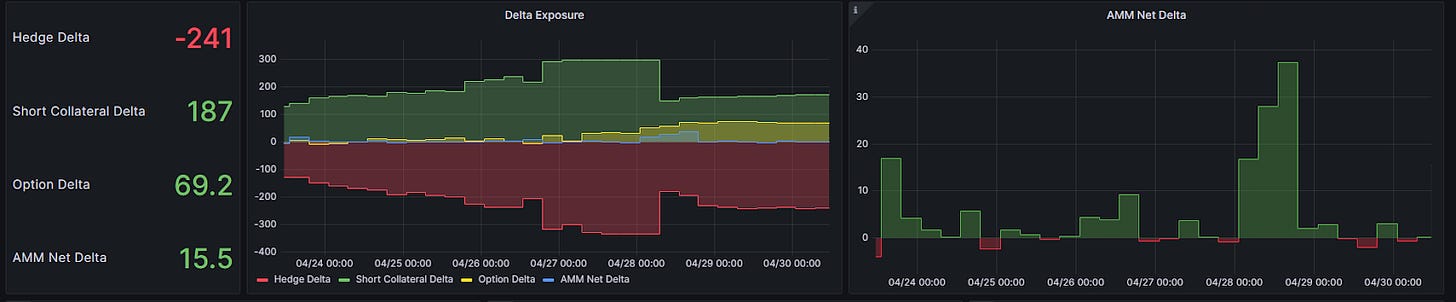

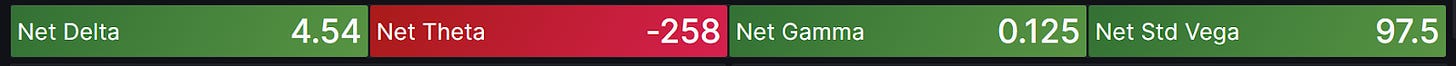

Net MMV Exposure:

Both ETH vaults are long Gamma and Vega as it seems traders are betting against volatility. The Arbitrum MMV is long at the money options and short puts across multiple expiries, LPs will need some price movement in the coming weeks to maintain profitability.

Optimism:

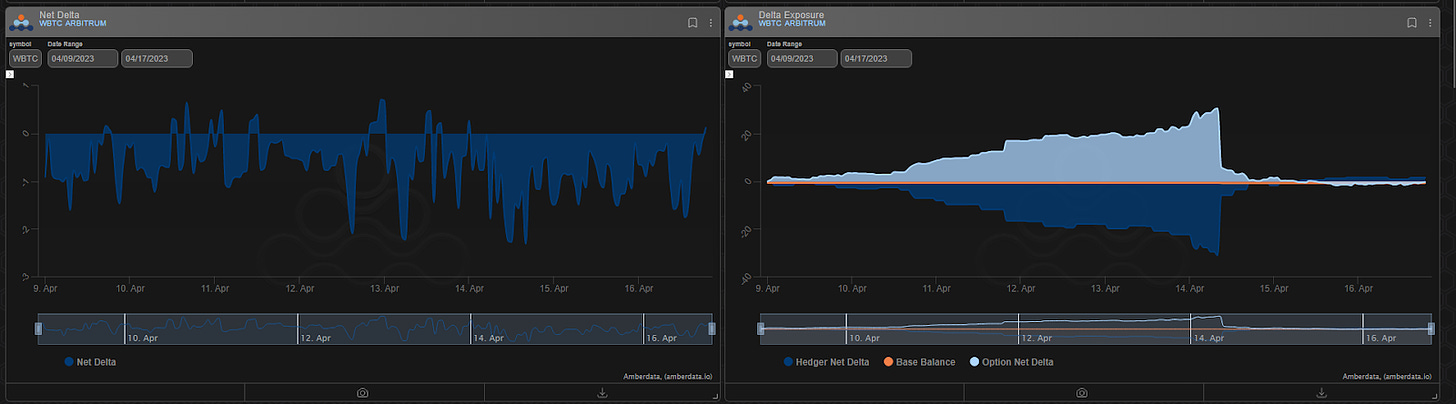

Arbitrum:

BTC Volatility

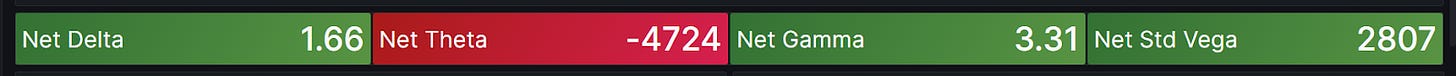

BTC Market-Making Vault

Lyra’s BTC MMV has returned +1.40% since its inception (August 16th, 2022). This represents a weekly change of +.17%. Annualized performance since inception is +1.98%.

Depositors earn an additional 19.54% rewards APY, boosted up to 39.1% for LYRA Stakerson Arbitrum and 8.48%, boosted up to 16.96% for LYRA Stakerson Optimism.

Net BTC MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...

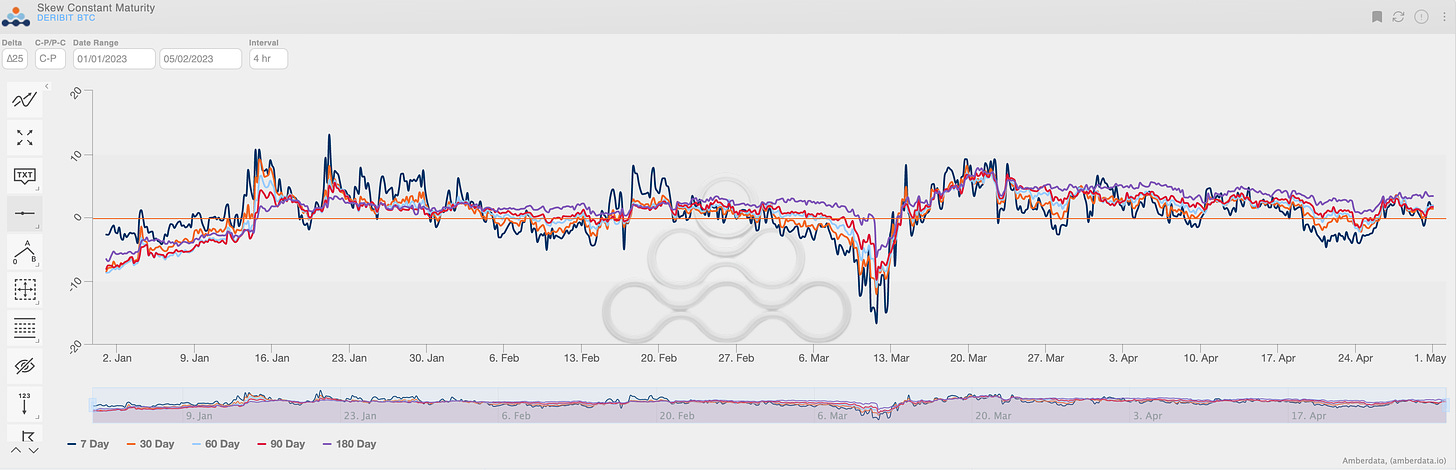

(April 30th, 2023 - BTC ∆25 RR-Skew - Deribit)

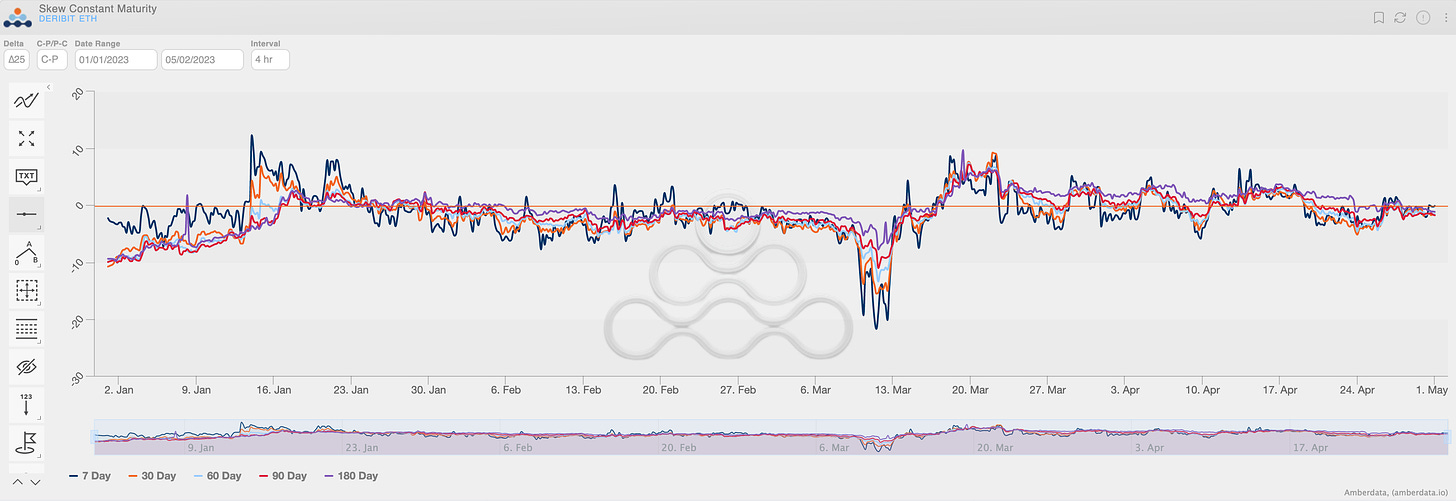

(April 30th, 2023 - BTC ∆25 RR-Skew - Deribit) (April 30th, 2023 - ETH ∆25 RR-Skew - Deribit)

(April 30th, 2023 - ETH ∆25 RR-Skew - Deribit) (April 30th, 2023 - ETH Dvol (minus) BTC Dvol - Deribit)

(April 30th, 2023 - ETH Dvol (minus) BTC Dvol - Deribit) (ETH 180-day ∆25 RR-Skew) → Put is relatively cheap.

(ETH 180-day ∆25 RR-Skew) → Put is relatively cheap. (BTC 180-day ∆25 RR-Skew) → Call is relatively expensive.

(BTC 180-day ∆25 RR-Skew) → Call is relatively expensive.