-

Monday 8:30pm ET - Fed Gov. Bullard speaks

-

Monday 10:00am ET - ISM (Manufacturing)

-

Monday 4:15pm ET - Fed Gov. Cook speaks

-

Tuesday 6:00pm ET - Fed Gov. Mester speaks

-

Wednesday 8:15am ET - ADP

-

Wednesday 10:00am ET - ISM (Service)

-

Thursday 10:00am ET - Fed Gov. Bullard speaks

-

Friday 8:30am ET - NFP

*Edit: Previously didn’t note ISM manufacturing number

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math minded people here, pardon any typos.

THE BIG PICTURE THEMES:

This week we’ll have an important NFP release. Any sort of job softening will be a relief to Powell, proving his efforts have started to work.

Should NFP remain strong Powell and the Fed will remain in a tight situation.

BTC’s price action continues to look strong despite the recent consolidation.

The Banking runs, triggered by SVB, seem to have calmed down as VIX and VVIX head lower after a brief spike higher related to the to bank runs.

With this calm returning to both equity volatility and vol. of vol., we’re likely beyond the ST bank-run panic.

What remains however are the loosening effects of BTFP (the Fed’s emergency liquidity program), which is likely the reason for risk-assets being bid.

BTC: $28,153 +1.14%

ETH :$1,797 +1.67%

SOL: $20.57 -1.80%

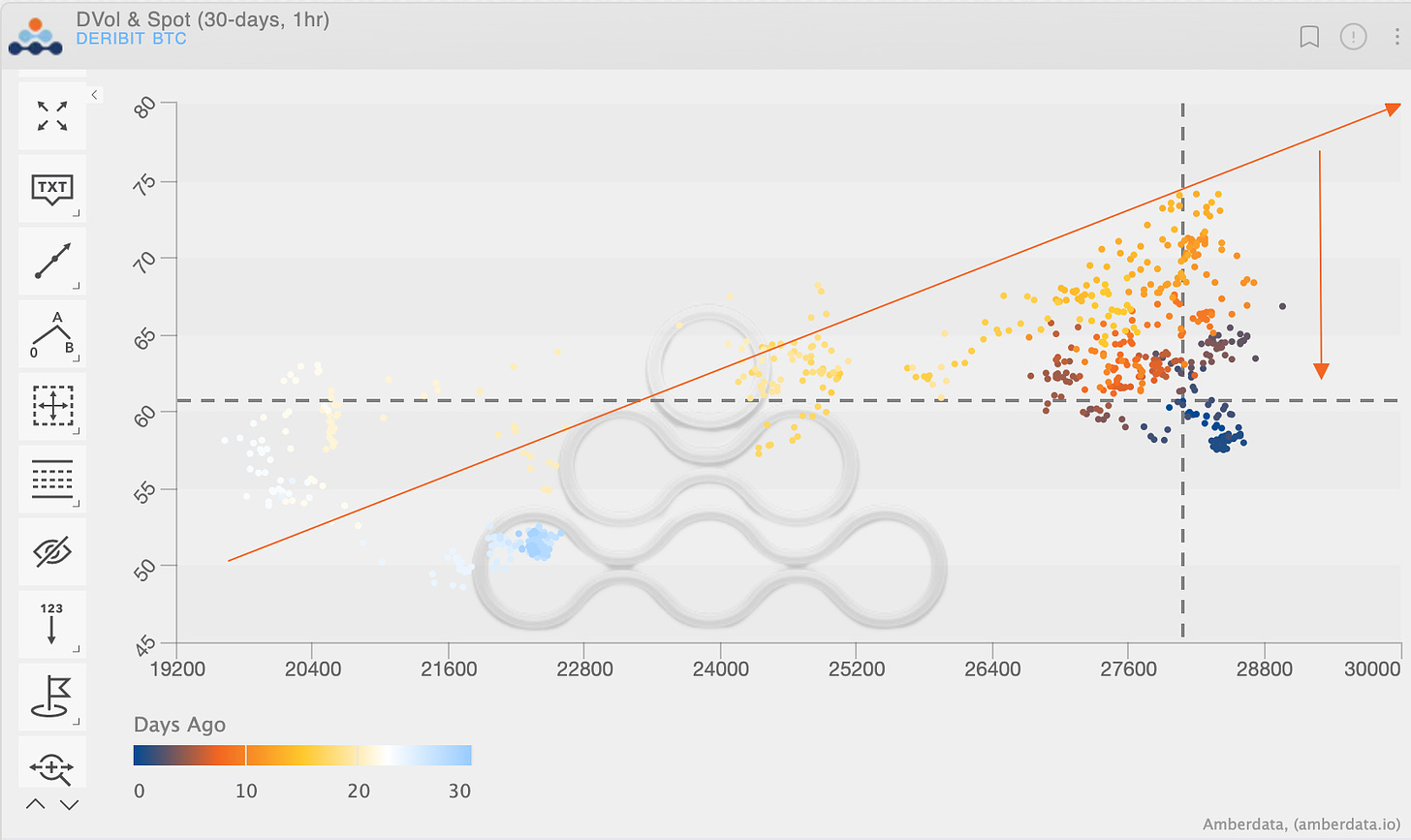

BTC Spot/Vol.

Looking at the past 30-days of DVol (VS) Spot price action we can see two clear themes.

-

Spot/Vol. correlation continues to be positive, a theme that’s been strong and robust YTD.

-

As BTC has consolidated, overall DVol level has dropped.

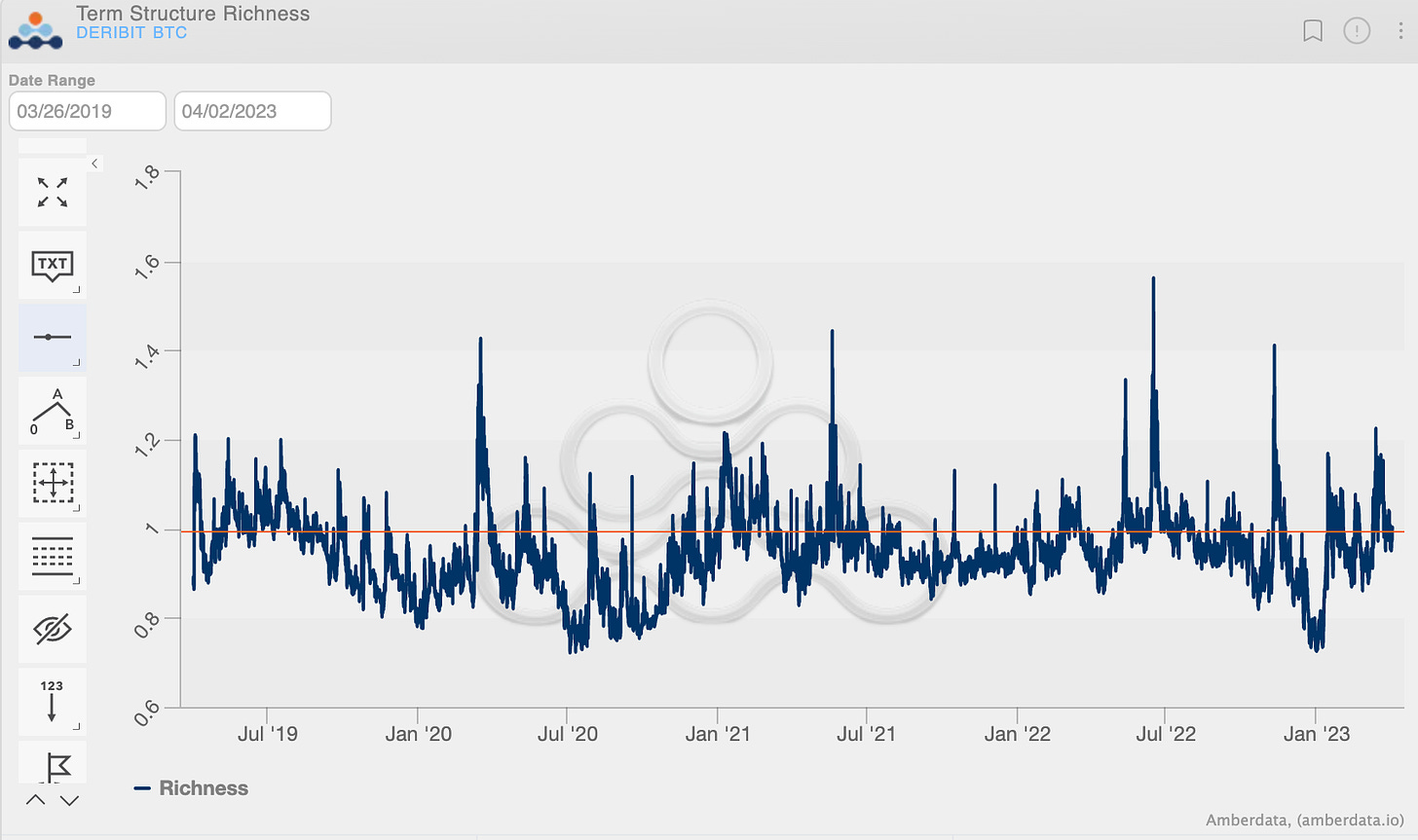

We can currently see the BTC term structure has been put into a “FLAT” state.

Vol. levels are also around the YTD highs, with the exception of ATM-7 which saw higher levels during “backwardation”.

(April 2nd, 2023 - TS Richness/Discount - Deribit)

Short-vol. structures seem the most interesting to me now.

The “FLAT” term structure is typically a transition shape and rarely hangs around too long.

Looking at the TS richness/discount chart above (and as seen in our January report) “Contango” is the normal state of the term structure.

77.5% of the time we’re in Contango.

Combine this with equity vol. already showing us a directional “preview” of where vol. is headed, I can’t help but conclude a short-vol bias.

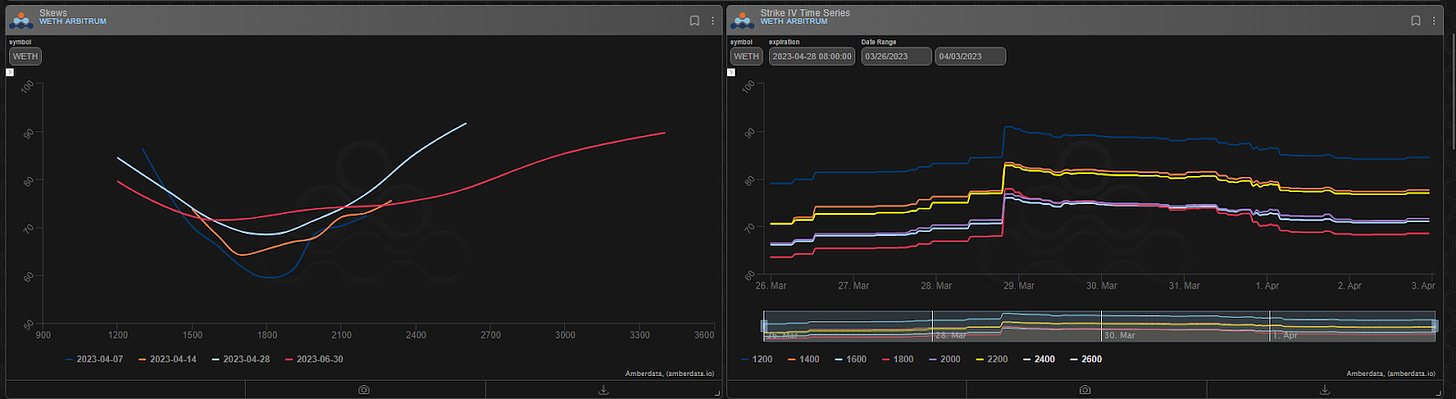

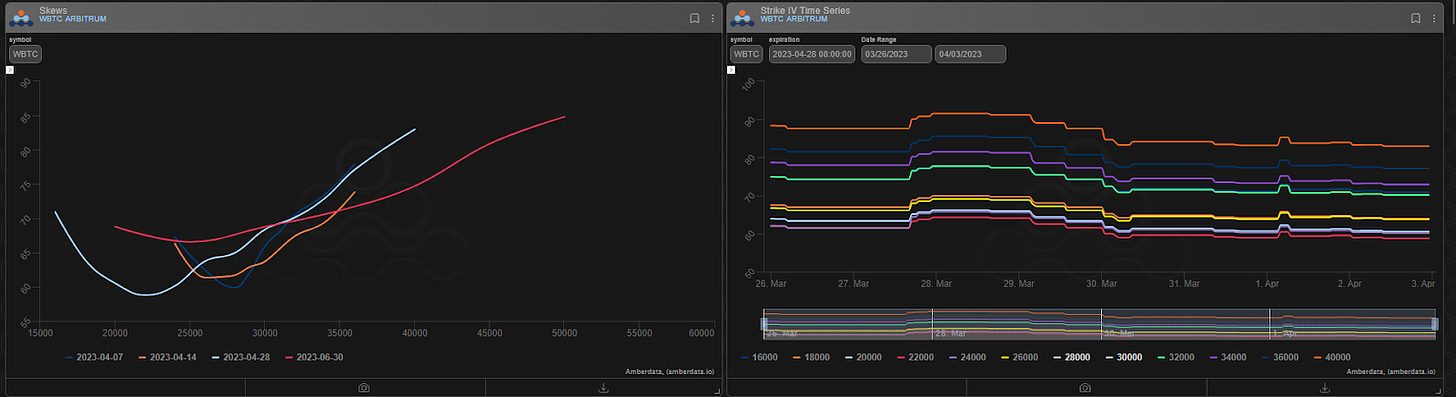

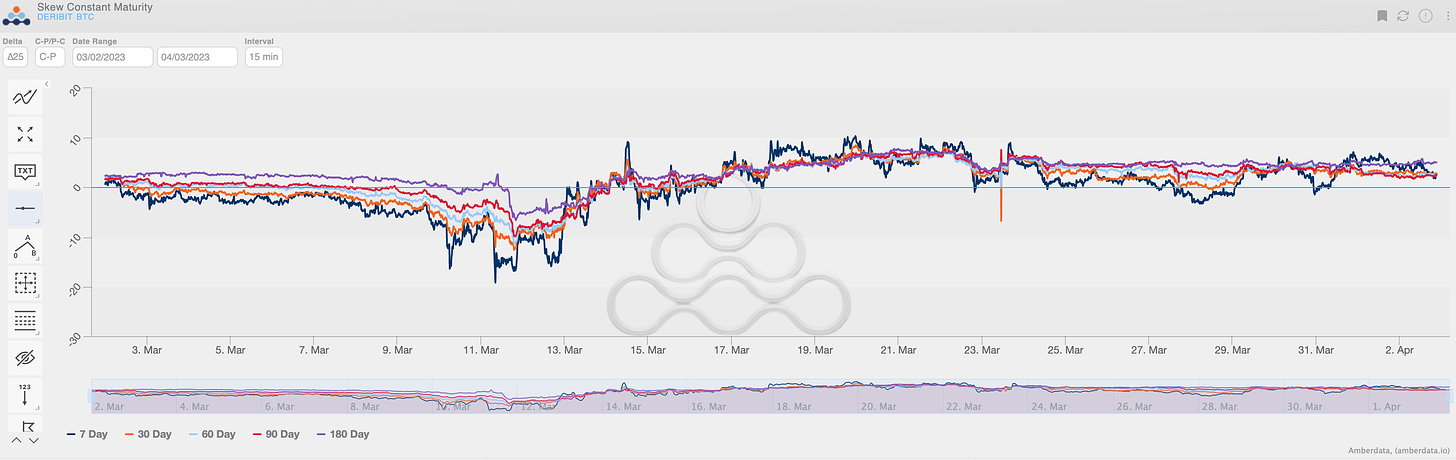

SKEWS

RR-Skew is positive across the board and essentially justified given the spot/vol. correlation and bullish price action.

However, given the short-vol. bias above, I like the idea of taking the other side of an extended call wings.

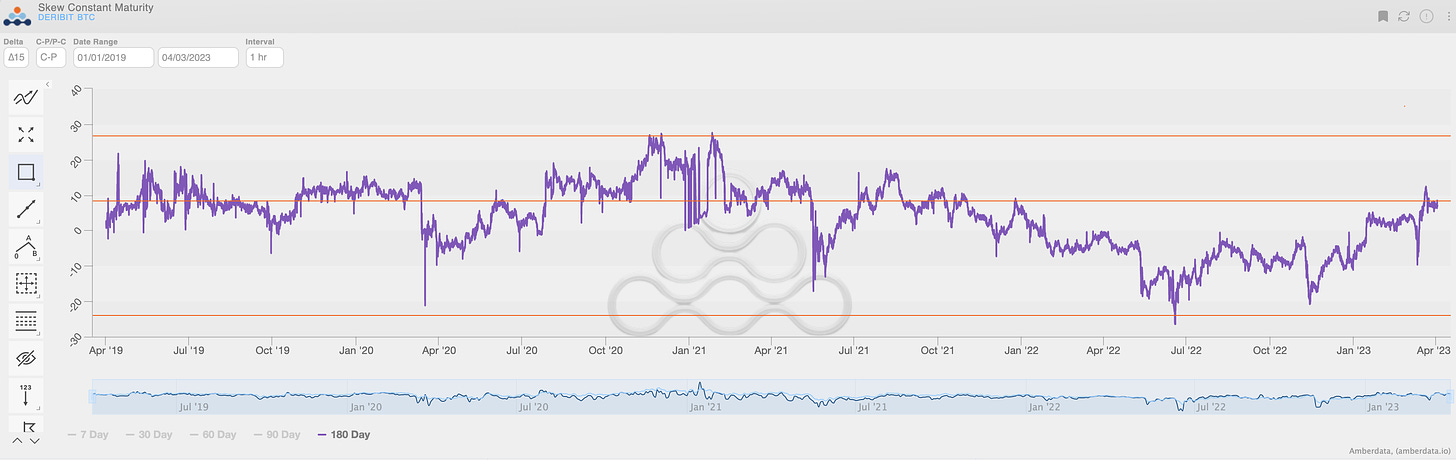

We can see that 180-DTE ∆15 RR-Skew is at the higher end of the past 4-years of data.

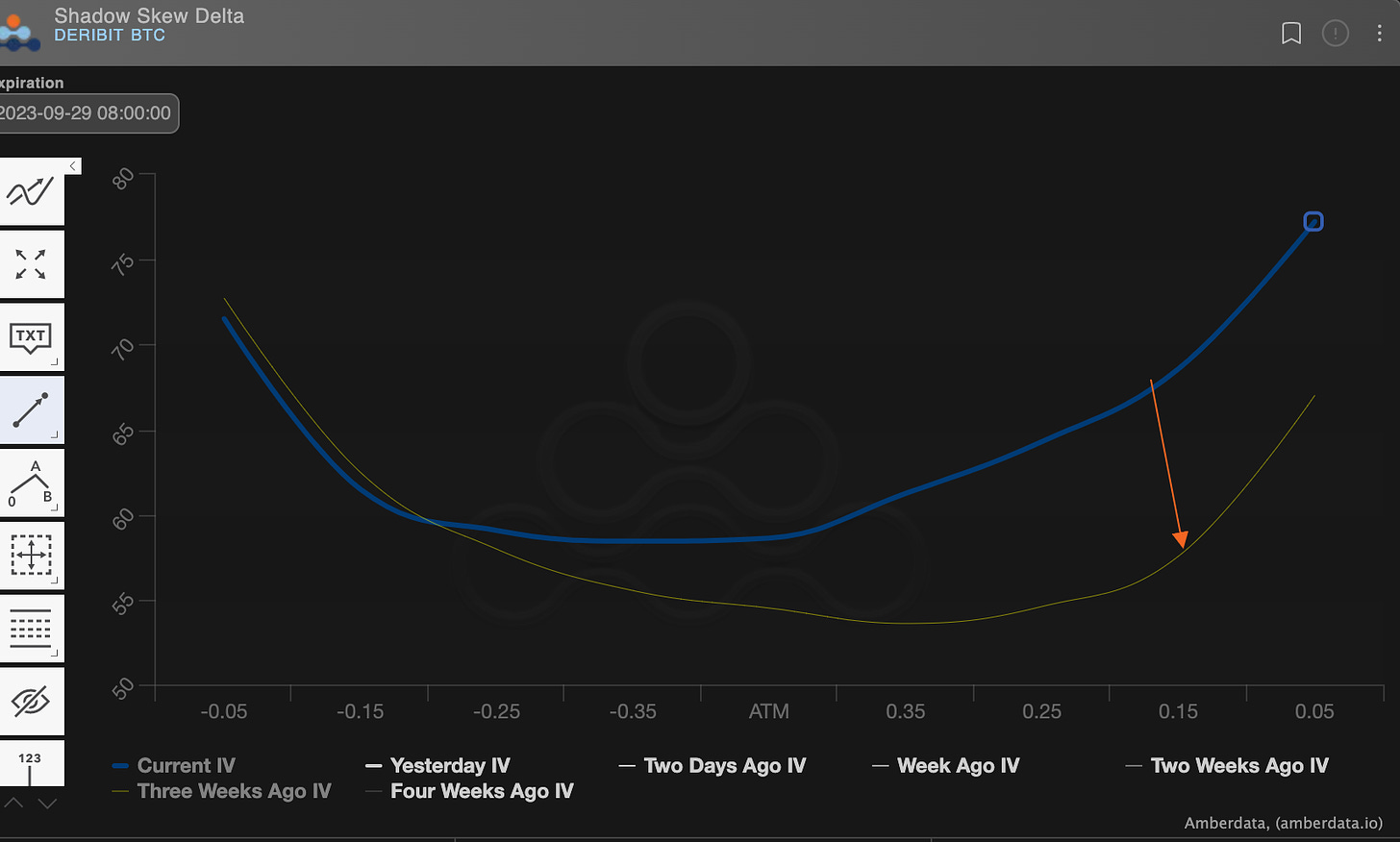

Looking at this Sept. expiration smile versus 3-weeks ago also shows the level of extension in the call wing.

Something like the below structure is the type of trade style that resonates nicely with me. (Again for information purposes).

Sept. (+1)45k/(-2x)55k =[$225 Credit/-∆4] & (+1)June(60k)=[$141 Deibit/+∆4]

This type of trade will benefit from a reduction in the call wing vol. and “Pick-up” deltas as IV drops (or time decays).

Adding the $60k June “throw-away” call is merely insurance against a spot explosion higher.

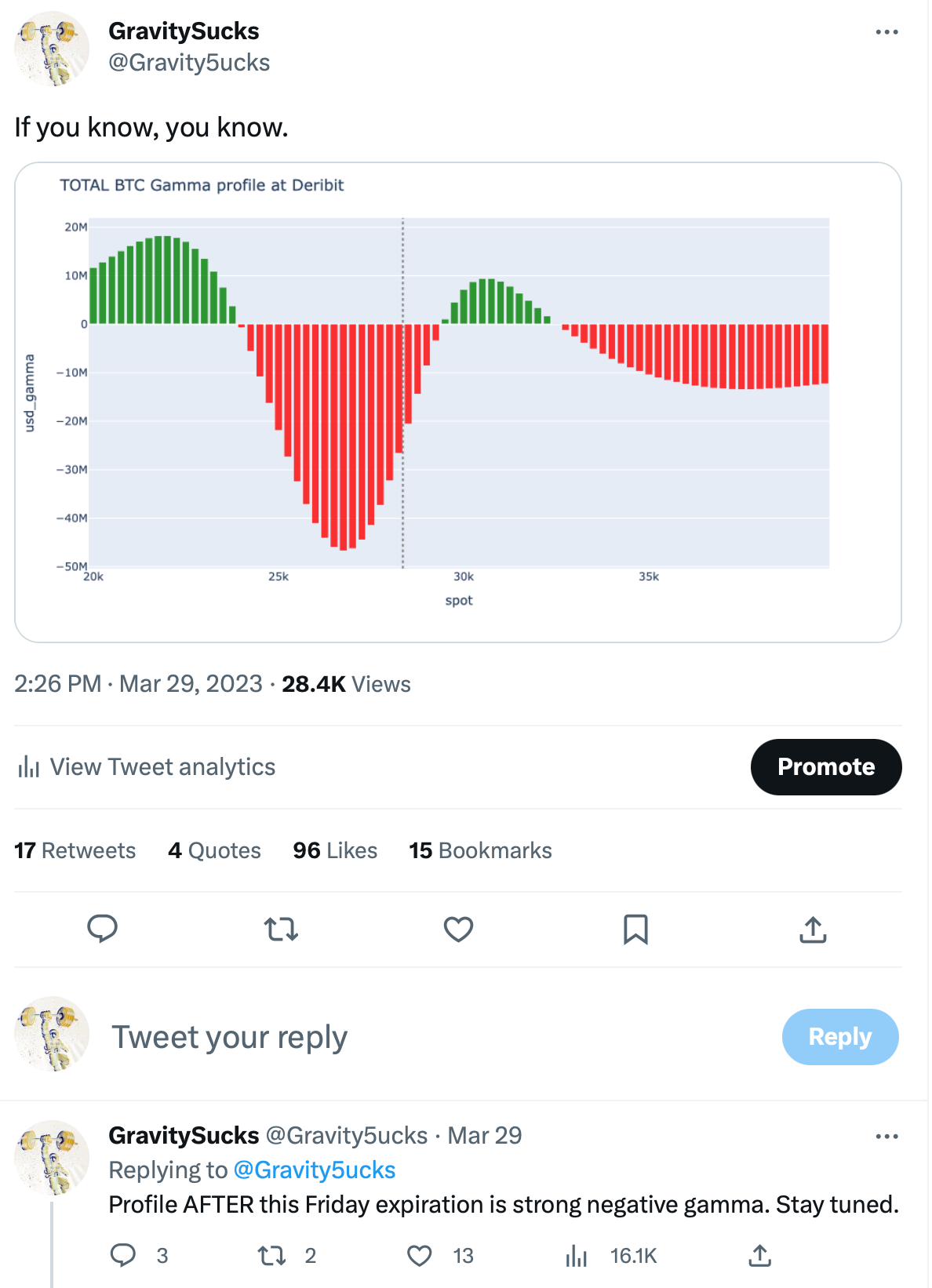

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

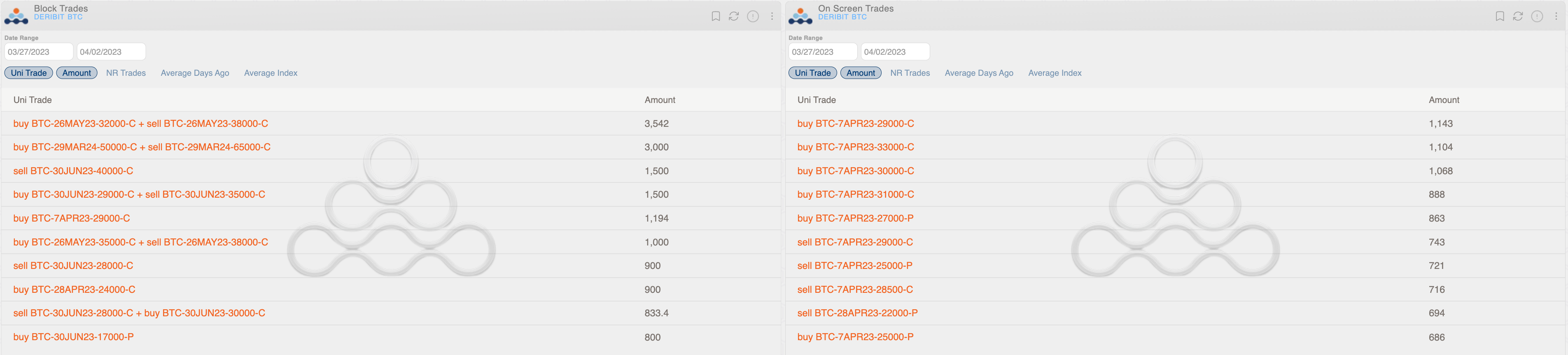

A week of consolidation, with volumes more in line with average values.

The quarter’s big deadline captured attention, but displeased those who believed in an immediate resumption of spot rally after Friday’s huge gamma being flushed away.

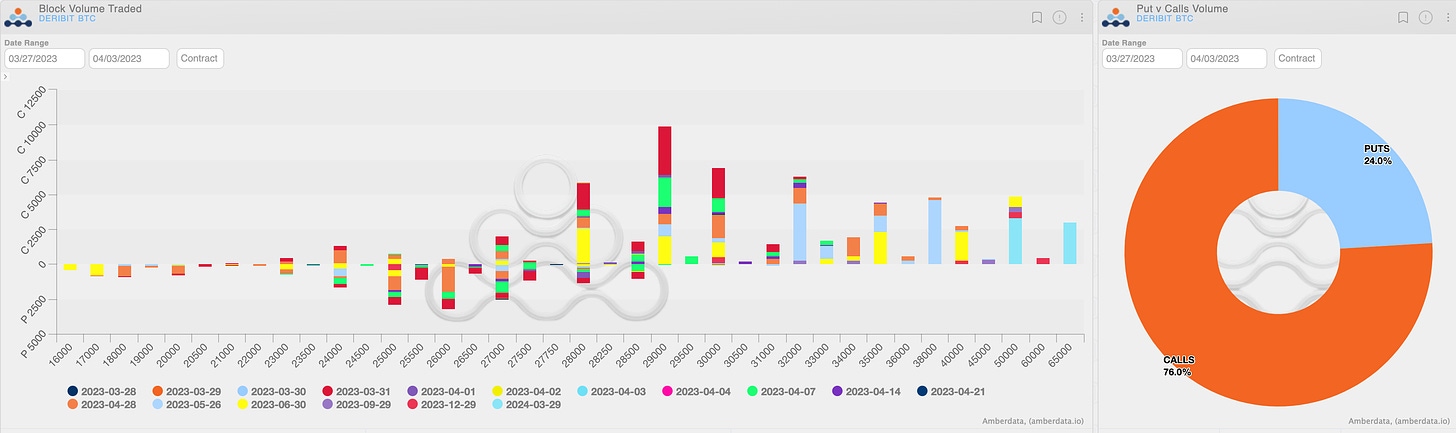

The blocked call spread activity continues non-stop, while on screen the flow was one-way on the front week with long calls.

(BTC AD Direction tables with uni_trade - Options Scanner section)

(BTC AD Direction tables with uni_trade - Options Scanner section)

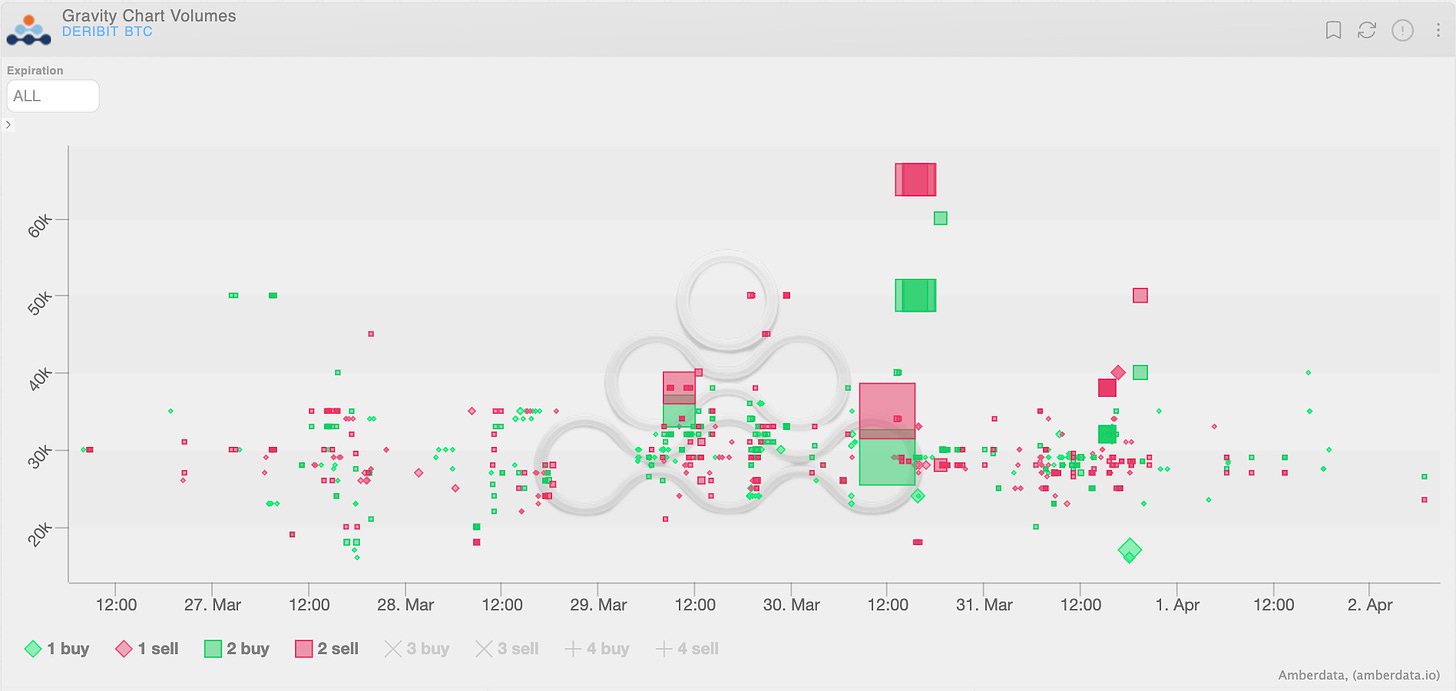

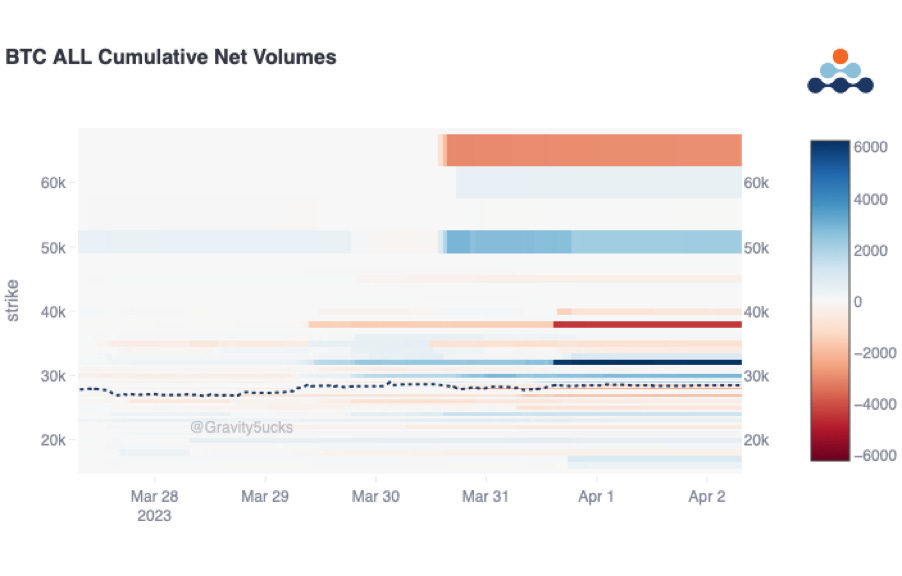

Both the “gravity chart” and the “heat map” well highlight the dominance of call-spreads.

(BTC Gravity Charts Volumes - Options Deribit Historic section)

Spread $32k-$38k was much discussed but a consensus on what happened is still debated; Joshua Lim wrote about it here:

1/ today's massive BTC options print on CME demonstrates a larger trend happening in crypto options pic.twitter.com/wkP78fzE0f

— Joshua Lim (@joshua_j_lim) March 31, 2023

Paradigm Block Insights (27Mar - 02Apr)

ATH Monthly Volumes on Paradigm! Large options expiry rolling off, thin liquidity, gappy price action and tactical directional flows traded. Massive downside bid came in Friday night.

BTC +2% / ETH +3.5% / NDX +3%

Early in the week we noted a change in sentiment with downside flows in focus as takers sought tactical protection:

Sold 600x 28-Apr-23 26000 Put

Bought 390x 31-Mar-23 25500 Put

Bought 250x 31-Mar-23 25000/26000 Put Spread

Bought 240x 31-Mar-23 26000 Put

While flows were relatively light, we did note BTC 1w 25d skew trading puts over calls.

We spoke a lot about liquidity in our daily notes this week.. Important to reiterate the deep gamma pockets that formed ahead of the 31Mar expiry.

Given all of the upside buying from lower spot levels, as we rallied dealers have had to cover their short gamma positions, sending spot higher via gappy price action.

Wednesday’s rally coupled with the high vol-of-vol led fixed-strike vols to rally 6 vols.

Large upside buying chased the rally:

1000x 26-May-23 35000/38000 Call Spread bot

542x 26-May-23 32000/38000 Call Spread bot

537.5x 31-Mar-23 29000/31000 Call Spread bot

480x 28-Apr-23 26000/30000 Bull Risk Reversal bought

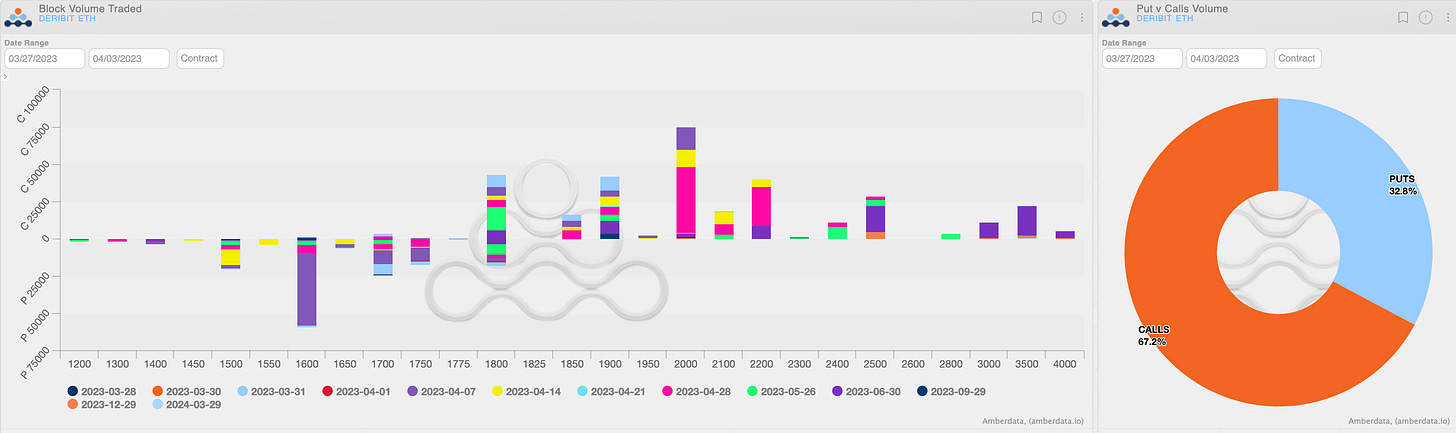

Chunky ETH upside:

10000x 30-Jun-23 2500/3500 1x2 Call Ratio bought

Thursday was Paradigm's 5th largest day ever! $1.1b of volume! 59% Deribit Market Share and huge bullish flows were blocked 👇

The freshly listed Mar 24' expiry was in focus. Taker bought 3000x BTC 29-Mar-24 50000 / 65000 Call Spreads...

When new expiries are listed it typically takes a while for activity and notable size to pick up. In this case, $60k of vega was scooped at a tight level on day one.

Thurs flows cont.

Chunky June call spreads bought:

1500x 30-Jun-23 35000/40000 CS

1500x 30-Jun-23 29000/35000 CS

It's worth re-noting the large 10k ETH Call Calendar that went up in EU's session today, spreading of risk to capture Shanghai 👀

10000x 7-Apr-23 2000 / 28-Apr-23 2000 Call Calendar bought

Late Friday evening, a downside buyer came in RFQ’ing 10k lots of 1-week ~5-7 delta puts… they bought 45000x 7-Apr-23 1600 Puts.

Front-end ETH skew reflecting recent downside flows, coupled with Shanghai uncertainty.

All in all, it is refreshing to see large directional bets put on and takers having strong conviction.

Leveraging Crypto Derivatives for BTC Miner Longevity | #TBP Ep. 19

Featuring: Nathan Cox, Adam Richard of Two Prime

Two Prime sits down to talk about BTC Miners and Crypto Derivatives. This unique episode highlights topics such as miner's needs, Luxor's Hashprice Derivative, the Shanghai Upgrade and potential flows / price action around it!

CME / Deribit May Call Spreads:

It is important to note the outsized action that went up on CME and Deribit on Friday… 3000x 26-May-23 32000/38000 Call Spreads were bought to open on CME.. and moments later the the same structure and sizing was sold to close on Deribit via Paradigm.

Twitter - @joshua_j_lim with context:

1/ today's massive BTC options print on CME demonstrates a larger trend happening in crypto options pic.twitter.com/wkP78fzE0f

— Joshua Lim (@joshua_j_lim) March 31, 2023

BTC

ETH

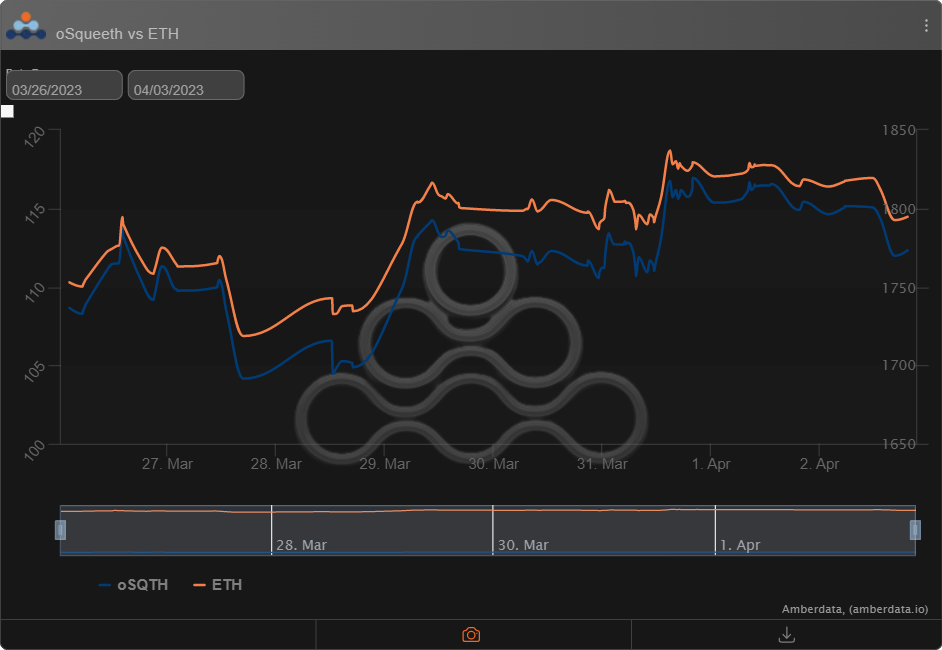

The Squeethcosystem Report (3/26/23 - 4/02/23)

With most of the headline risk out of the way this week, markets remained quiet. As the market now looks forward to the month of April, things could get interesting. ETH ended the week +2.39% and oSQTH ended the week +3.38%

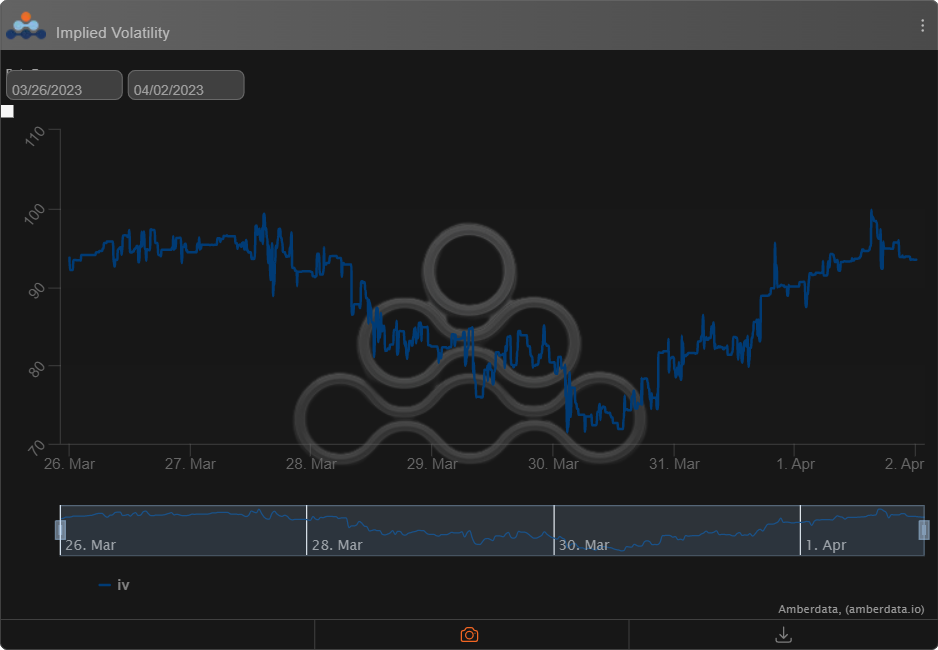

Volatility

Squeeth IV remained active this week, starting the week around 100% and quickly getting sold to 80% before finding its way back to the mid-90s.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $2.23m. March 27th saw the highest volume, with a daily total of $447k traded. An additional $329k traded via OTC auctions this week.

Crab Strategy

Crab benefited from the lack of direction this week, ending the week +0.98% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

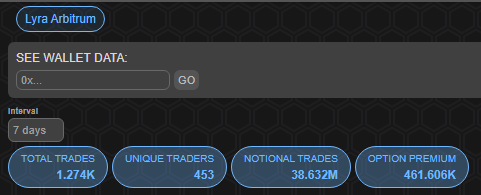

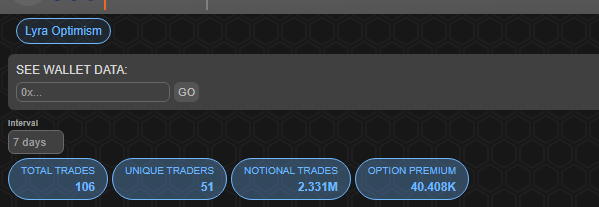

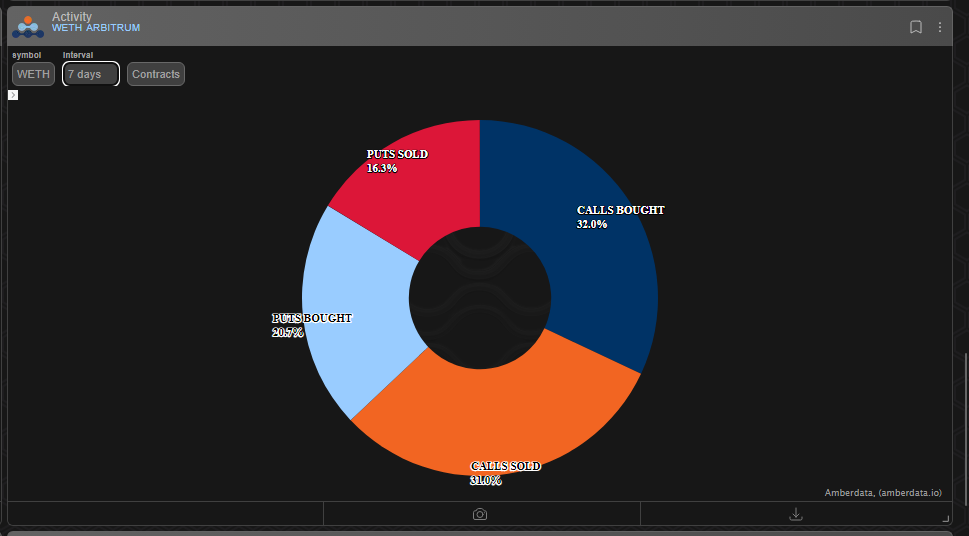

Lyra Weekly Review

Volatility

Current ATM IV is ~60% in ETH, down ~3 points on the week and down ~20% over the last couple. Markets have fallen back into contango while realized vol has failed to materialize and ETH remains range bound.

Trading

Lyra call skew is sitting at a premium with calls making up 63% of the volume traded over the last week.

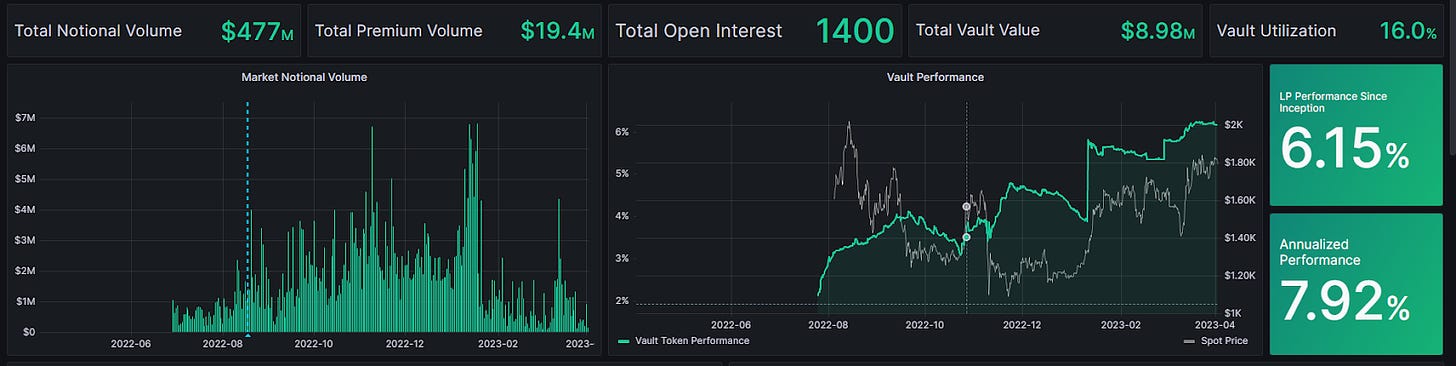

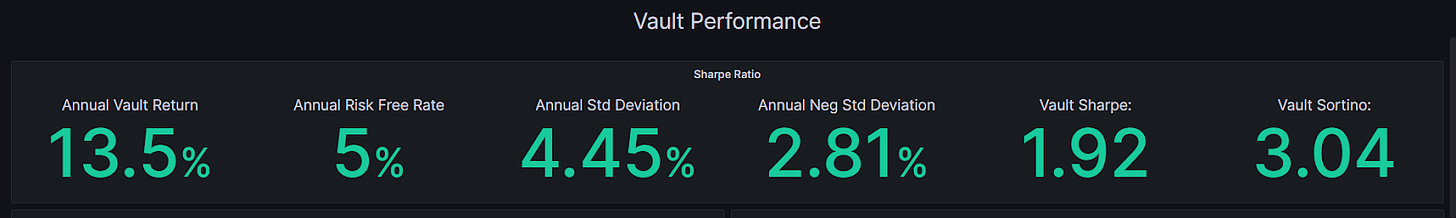

ETH Market-Making Vault

The ETH MMV on Optimism has returned +6.15% since its inception(June 28th, 2022) representing a weekly change of -.02%. Annualized performance since inception is +7.92%.

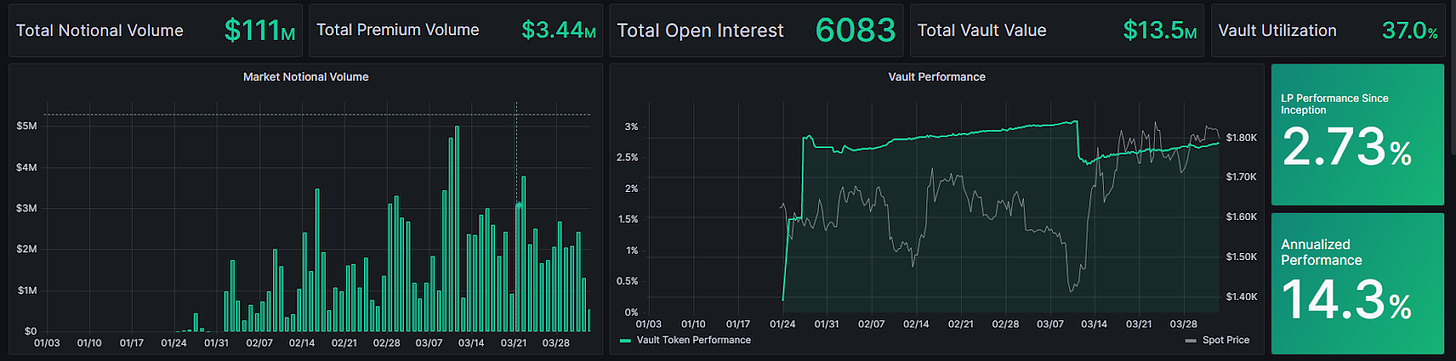

The ETH MMV on Arbitrum has returned +2.73% since its inception representing a weekly change of +.12%.

Depositors earn an additional 13.64% rewards APY, boosted up to 27.3% for LYRA Stakers on Arbitrum (new) or 9.04% boosted up to 18.07% for LYRA Stakers on Optimism.

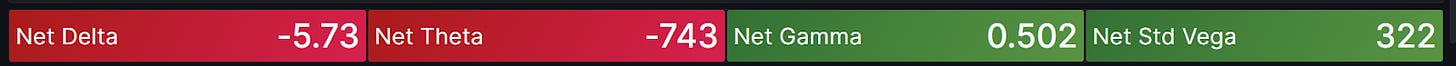

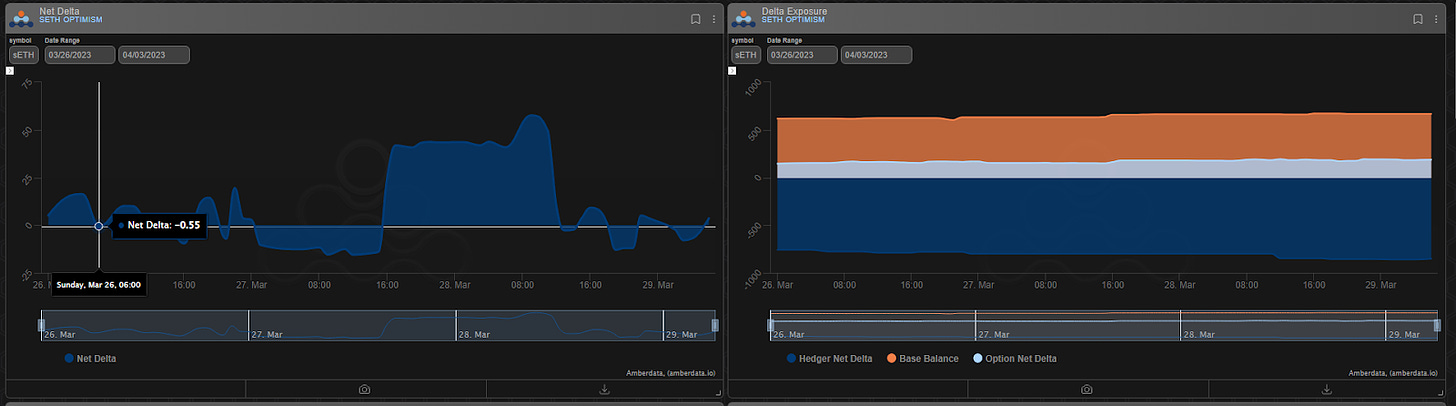

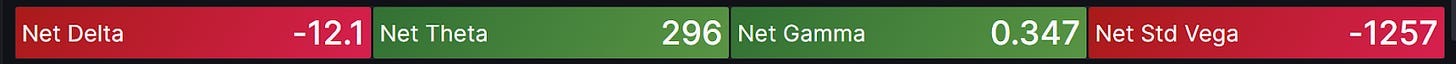

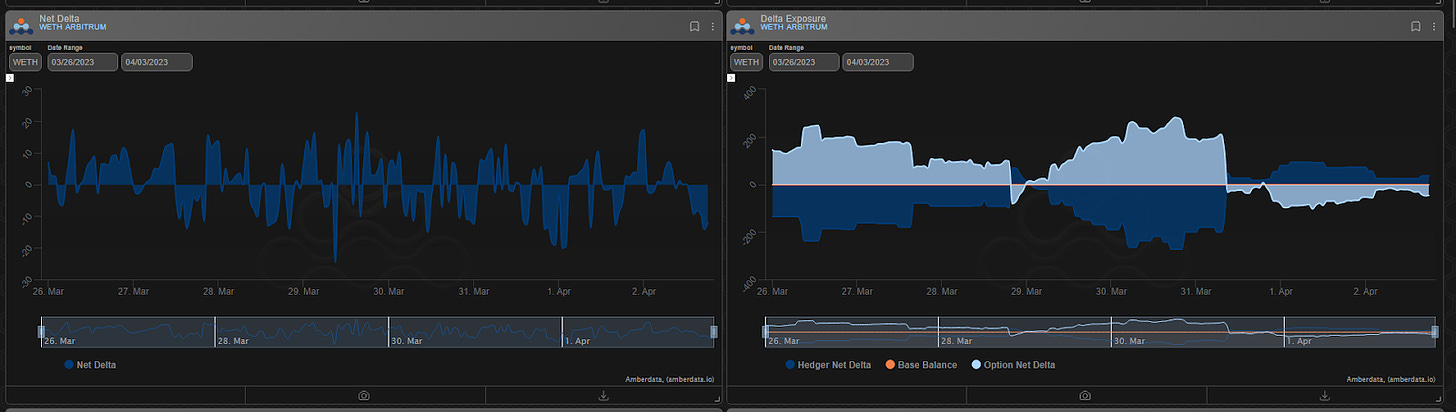

Net MMV Exposure:

Optimism Vault remains slightly long vega with consistent sellers in that market. The Arbitrum MMVs have tended to stay a bit short vega.

Optimism:

Arbitrum:

BTC Volatility

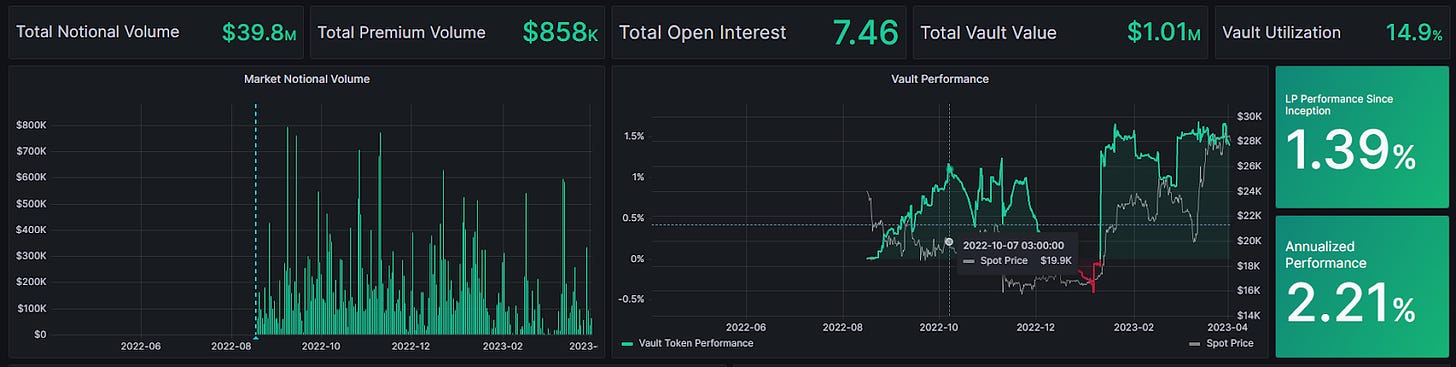

BTC Market-Making Vault

Lyra’s BTC MMV has returned +1.39% since its inception (August 16th, 2022). This represents a weekly change of -0.09%. Annualized performance since inception is +2.21%.

Depositors earn an additional 13.95% rewards APY (boosted up to 27.9% for LYRA Stakers)on Arbitrum and 10.72%(boosted up to 21.45% for LYRA Stakers)on Optimism.

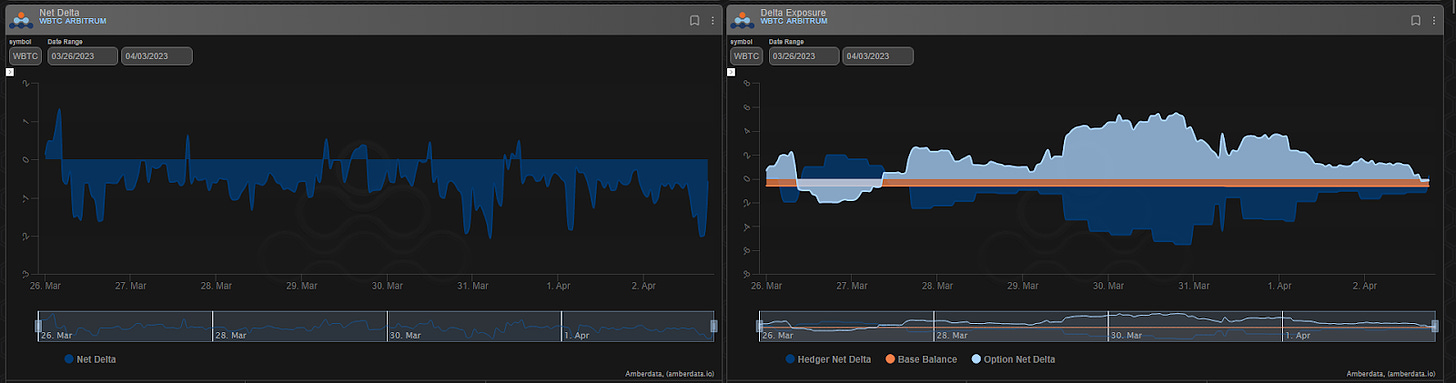

Net BTC MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...