Welcome to Amberdata's Crypto Snapshots, your one-stop source for in-depth insights into the dynamic world of cryptocurrencies. Our comprehensive coverage includes spot, futures, and swaps trading, as well as DeFi DEXs (decentralized exchanges) and DeFi borrow/lend platforms. We also provide detailed analysis of various blockchain networks, giving you a holistic view of the rapidly evolving crypto landscape. Stay ahead of the curve with Amberdata's Crypto Snapshots and unlock a deeper understanding of the crypto markets!

Nothing travels faster than the speed of light with the possible exception of bad news, which obeys its own special laws.

- The Hitchhiker's Guide to the Galaxy

The Hitchhiker’s Guide to the Galaxy is remarkably applicable to navigating DeFi. As Douglas Adams' novel of the same name describes, the “guide” looks “insanely complicated" to operate, and new DeFi users feel a similar complexity barrier keeping up with new terminology and concepts as well as constant changes happening virtually every second (pun intended). One such entity struggling to understand DeFi is the SEC, with Gary Gensler appearing at the U.S. House Committee on Financial Services to discuss oversight on April 18, 2023, demonstrating that few, even the de jure financial regulating body of the United States, genuinely understand DeFi and its concepts.

In the hearing, U.S. Congressman Warren Davidson called for a restructuring of the SEC and removal of the Chair during his interview, while GOP Majority Whip Tom Emmer pressed hard against the Chairman’s approach of regulation by enforcementrather than an industry wide regulation. With more countries paving the way for crypto adoption, such as Zimbabwe’s attempts at a digital currency backed by gold, Hong Kong’s ruling that crypto is property, and China paying some city employees in Changsu with digital yuan, the United States’ regulatory whirlwind may leave some companies (like Coinbase) to throw in the towel.

Almost, but not quite, entirely unlike an exploit, a new trend for scams is taking place – one that is not getting attention and one that everyone should be extremely panicked about: a “permit from” exploit. The exploit has stolen over $31m so far on Ethereum alone. Gasless transactions (known as gasless meta-transactions, from EIP-2771) leverage simple function signatures that approve the spending of a user’s tokens by a particular address off chain (very similar to connecting a wallet to a website and verifying yourself as the owner).To read more on meta-transactions here is a good starting point.

The problem is these signatures (off-chain messages), which are essentially delegations (which allow the spender to spend tokens on your behalf), look exactly the same as any other signature request, and the text is completely arbitrary and non-binding in any way. Users are accustomed to signature requests for various DeFi protocols, so with more of the same (but this time different), even the most hesitant of users are likely to fall victim. With gasless transactions being promised as the next wave of onboarding new users to crypto, especially on L2s, this will cause more people to say “So long, and thanks for all the fish.”

Spot Market

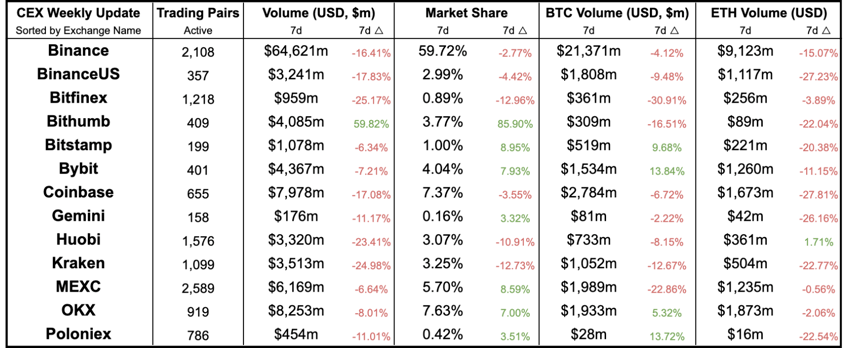

Centralized Exchange (CEX) comparisons between this and last week

A common mistake that people make when trying to design something completely foolproof is to underestimate the ingenuity of complete fools.

- The Hitchhiker's Guide to the Galaxy

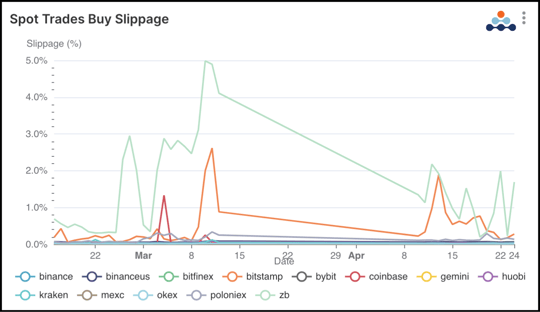

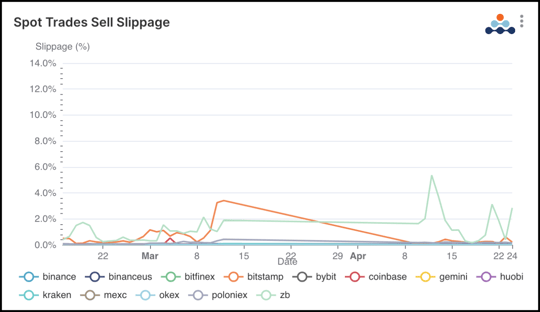

Buy and sell slippage on $100k+ trades for ETH / USDT on CEXes

Slippage has the potential to turn a large fortune into a small one, so paying attention to liquidity and calculating potential slippage is extremely important for large traders. In the last 30 days, Bitstamp and ZB trades above $100,000 on both sides of the ETH / USDT trade faced relatively high levels of slippage, going as high as 5% for buyers and sellers.

There are a few ways for savvy traders to mitigate slippage, though they often come at a trade-off between speed and capital efficiency. OTC trades are becoming more commonplace and several centralized exchanges are offering services to extremely well-capitalized entities, often sacrificing both speed and efficiency due to holding all funds on a single exchange or platform. Splitting funds across a number of exchanges can also be a beneficial strategy – allowing traders to take advantage of multiple liquidity pools and market makers to ensure lower slippage risk at the cost of speed and increased management costs (not to mention due diligence).

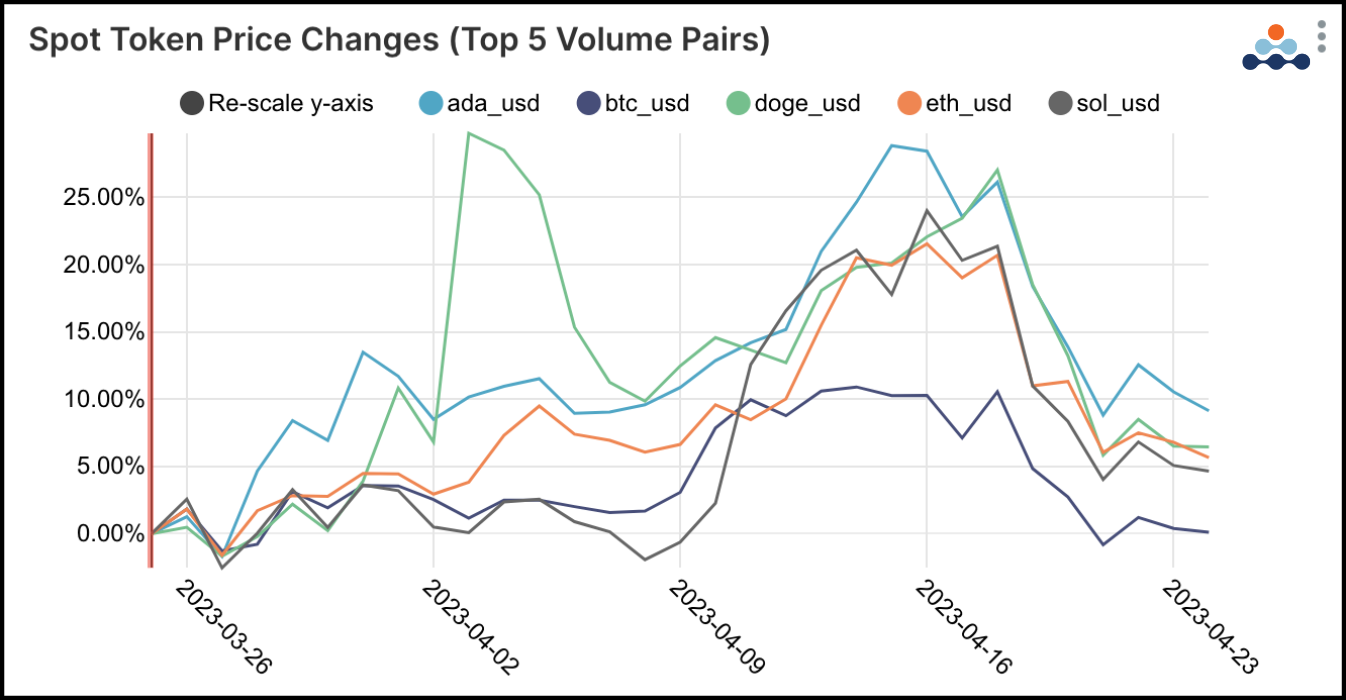

Price volatility in the last month has really lived up to its name. The price of DOGE spiked after Elon Musk’s Twitter logo change, causing DOGE to make a second run-up to near previous highs in the last 30 days, before swinging back to end the period up 6.5%. This second run-up period coincided with several other tokens seeing a temporary spike, likely due to the Ethereum Shapella upgrade (read Amberdata’s analysis here.) The upgrade was speculated to cause a wide token sell-off as Ethereum stakers were finally able to un-stake. Given the current bear market conditions, it seemed logical that traders would be looking for liquidity, but the actual event had the opposite effect with prices heating before cooling. All currencies, with the exception of BTC, ended the last 30 days up around 5%.

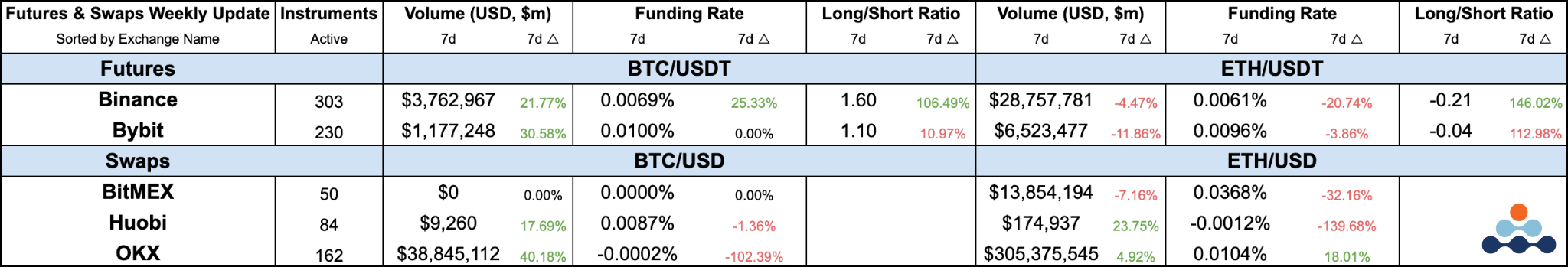

Futures & Swaps

All you really need to know for the moment is that

the universe is a lot more complicated than you might think, even if you start from a position of thinking it’s pretty damn complicated in the first place.

- The Hitchhiker's Guide to the Galaxy

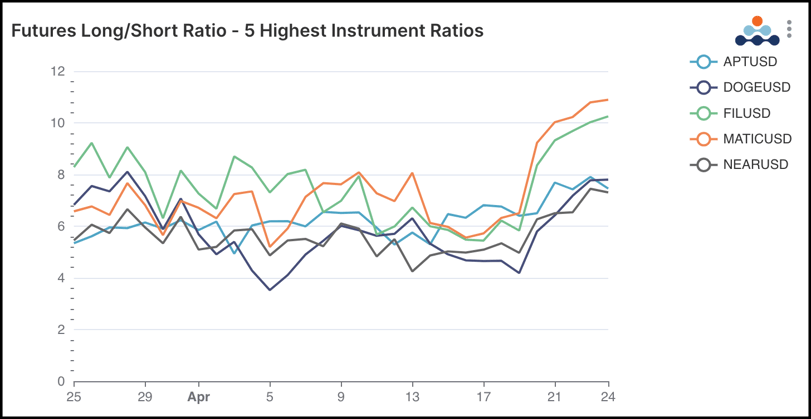

Futures long/short ratios for the 5 highest ratio instruments

Futures long/short ratios for the 5 highest ratio instruments

Bullish signals are on the horizon for Aptos (APT), which has been down around 44% against USD in the last 3 months, though (as mentioned in the last edition of Crypto Snapshot) MATIC continues to surge in the futures market. Aptos’ partnership with Pancake Swap appears to be bearing fruit for those looking to hedge bets onto L1’s, while Filecoin (FIL) has also been showing signs of life after announcing Filecoin Web Services (FWS) – a decentralized storage network. This essentially creates a decentralized alternative to AWS and Azure.

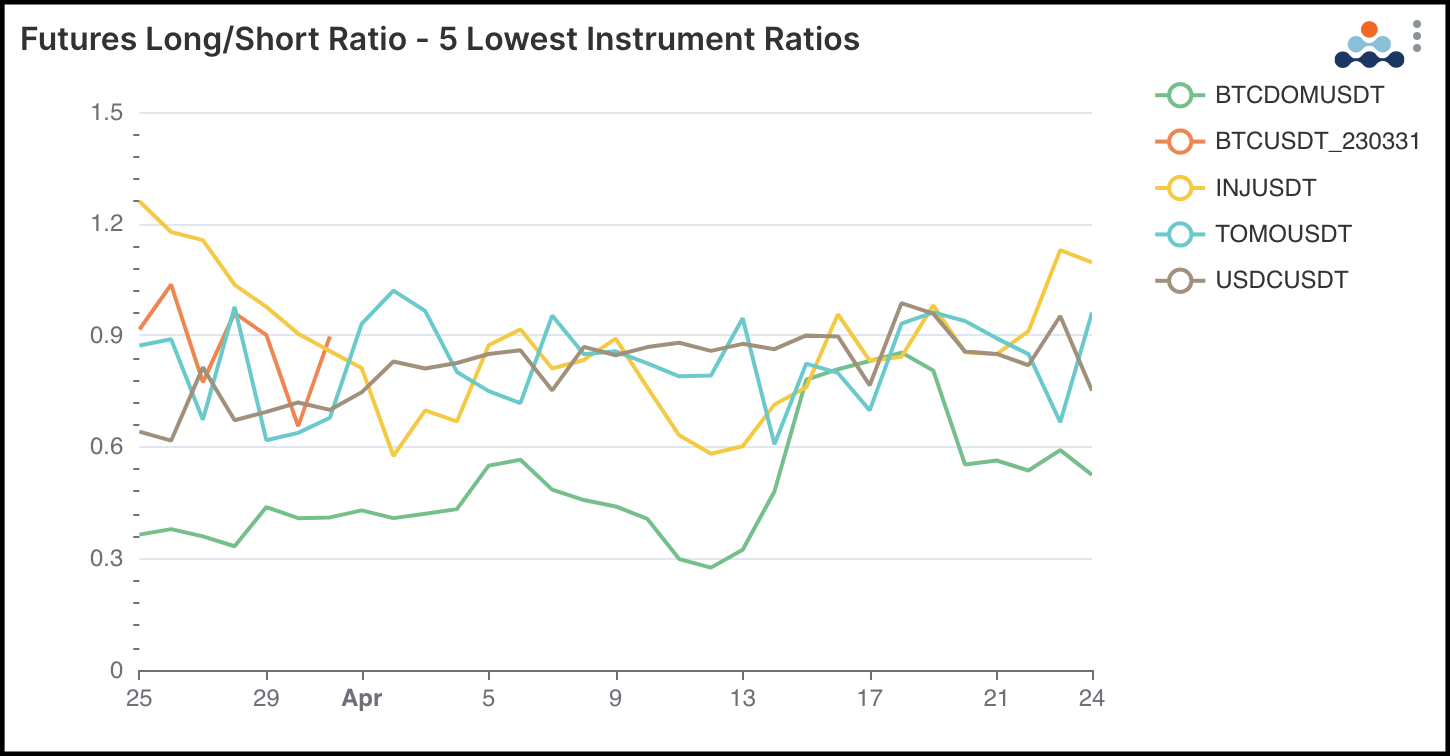

Futures long/short ratios for the 5 lowest ratio instruments

Futures long/short ratios for the 5 lowest ratio instruments

As for the biggest bear signals, USDC / USDT has dropped back into bearish territory (i.e., ratio less than 1, indicating more shorts than longs) after having suffered a depeg in recent months. The ratio is surprising given that the USDC peg returned to stable levels after the chaos of the recent banking failures, however it is likely due to the regulatory pressure by the SEC who continues to push enforcement actions against crypto generally, and stablecoins more specifically.

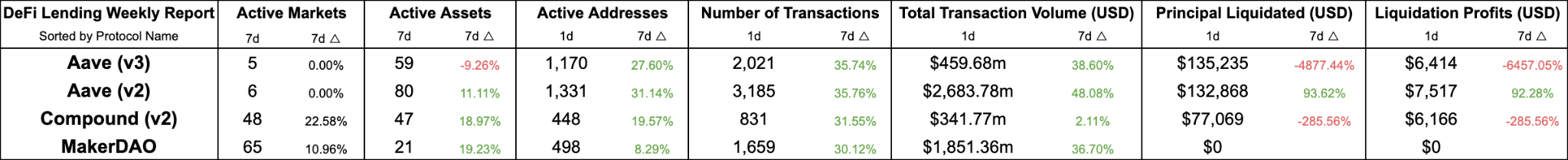

DeFi Borrow / Lend

DeFi Lending protocol comparisons between this and last week

There is an art, it says, or rather, a knack to flying. The knack lies in learning how to throw yourself at the ground and miss.

- The Hitchhiker's Guide to the Galaxy

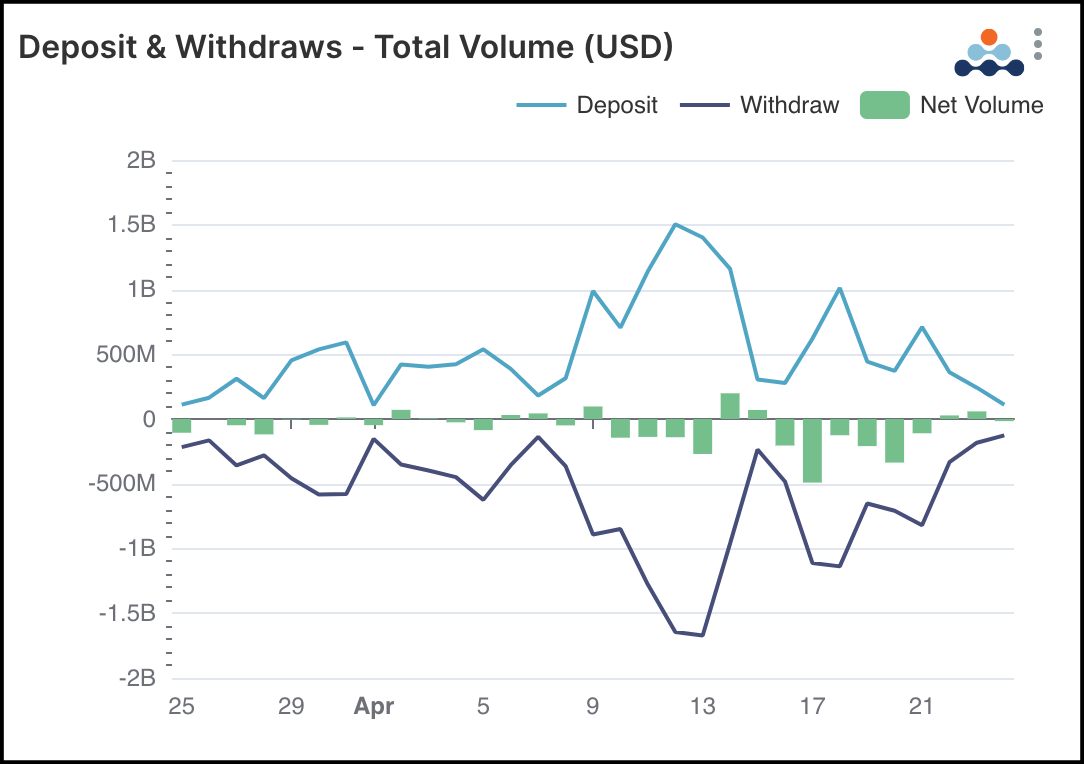

DeFi Lending deposits and withdraws from the last 30 days

Net deposit and withdraw volumes have overall been largely negative with more volume being withdrawn in the last thirty days than deposits. With the (generally surprising) lack of market selling after the Shapella upgrades, the market appears to have valued liquidity over passive yield in lending protocols.

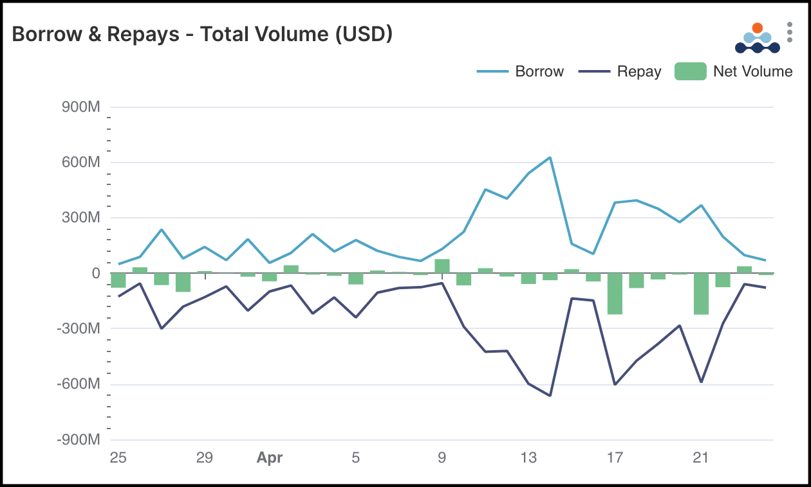

DeFi Lending borrow and repayments from the last 30 days

The preference liquidity can also be attributed to the repayment of loans, as for the last two weeks the trend has been the volume of repayments far exceeding the borrows. With token prices ending the last 30 days fairly flat (top CEX tokens up ~5% with BTC ending neutral) and the amount LP’d in lending pools decreasing (deposit volume minus withdraw volume), activity in lending pools appears to be signaling a period of uncertainty. This could be a good time to make long-term bets (as seen in the futures market) or hedge current positions, as the market waits for the next opportunity to present itself.

Networks

Network comparisons between this and last week

It is a mistake to think you can solve any major problems just with potatoes.

- The Hitchhiker's Guide to the Galaxy

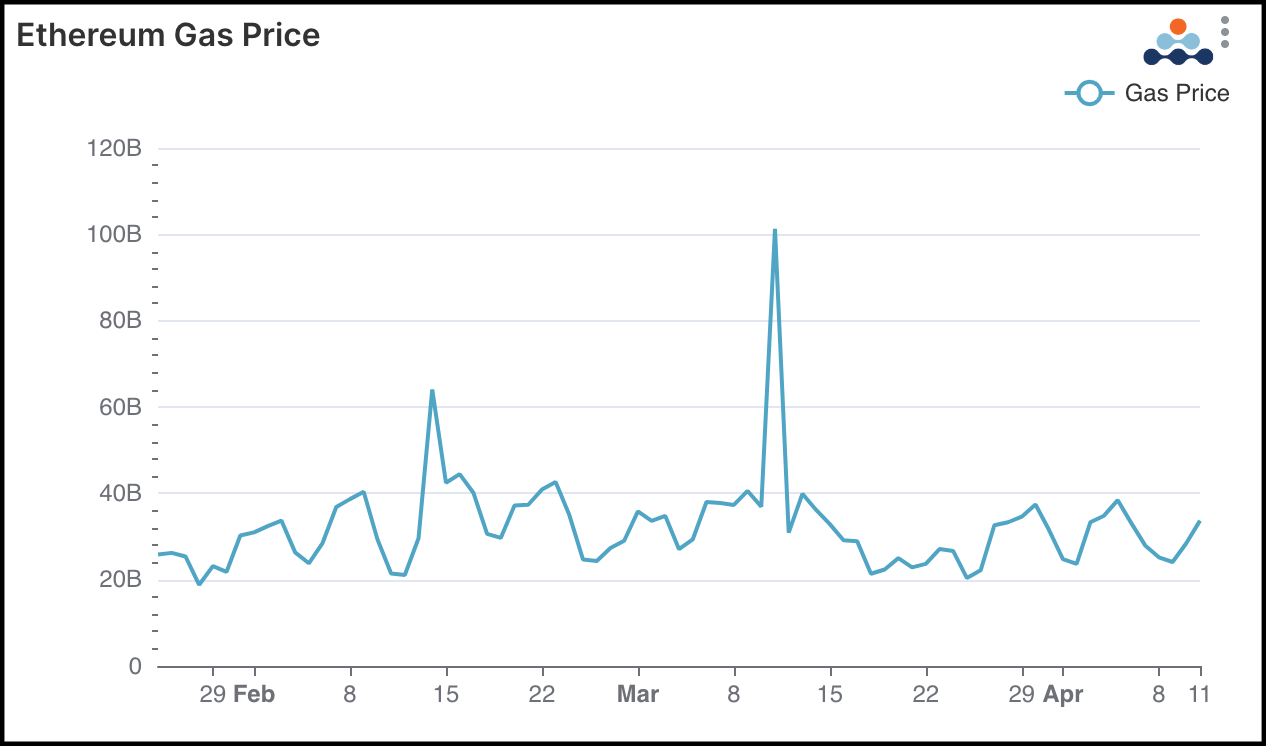

Ethereum gas prices from the last 3 months

Gas on Ethereum has somewhat steadied itself since the Shapella upgrades. However, these values have been consistently higher in the last few weeks than a month prior. Gas has been a real sticking point for the network as L2s increase in not only number but also volume, with users preferring to use L2s such as Optimism or Arbitrum to transact with far lower fees for remittances as well as potentially earn higher yields. L2s will play a significant role in the near future, likely driven more by gas prices on L1s than efficiency.

“Don’t Panic.”

- The Hitchhiker's Guide to the Galaxy

Meanwhile, the House has passed a bill for another 1.5 trillion to be added to the U.S. debt ceiling budget.

Click here to download this report.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...