Latest in a busy week: the return of a bull.

Grayscale Bitcoin Trust (GBTC) is about to have some company after BlackRock filed for a spot Bitcoin ETF this week. Just a few days later, ETF manager Invesco reactivated its Bitcoin ETF Filing, along with WisdomTree. Bitwise has also filed for a Bitcoin ETF.

Centralized exchanges should also expect some company as traditional finance enters the fray with plans to launch EDX – a new cryptocurrency exchange backed by Citadel Securities, Fidelity Investments, and Charles Schwab – that will offer trading for BTC, ETH, LTC, and BCH. Deutsche Bank revealed that they, too, have applied to operate a cryptocurrency custody service, though with the German regulatory bodies.

The timing of these events is extremely interesting as the industry is still reeling from a series of charges from the SEC. Traditional Finance (TradFi) appears to be taking advantage of this opportunity and jumping in head-first, while native cryptocurrency companies are pushing the US Securities regulator for clarity (and seemingly finding support). Coinbase also received positive news from the courts.

Last week, Uniswap Labs released plans for Uniswap v4 that introduce “hooks” and custom liquidity pools. CEO Hayden Adams described them as “plug-ins to customize how pools, swaps, fees, and LP positions interact.” It is likely that v4 will also introduce dynamic fees and limit orders, as well as performance improvements and fee reductions. These improvements are expected to make it cheaper to create new pools, which anyone can do due to the DEX’s permissionless nature. However, Uniswap Labs is also facing criticism from the development community after filing a business source license (BSL), which may catch developers of other projects under a copyright claim.

Spot Market

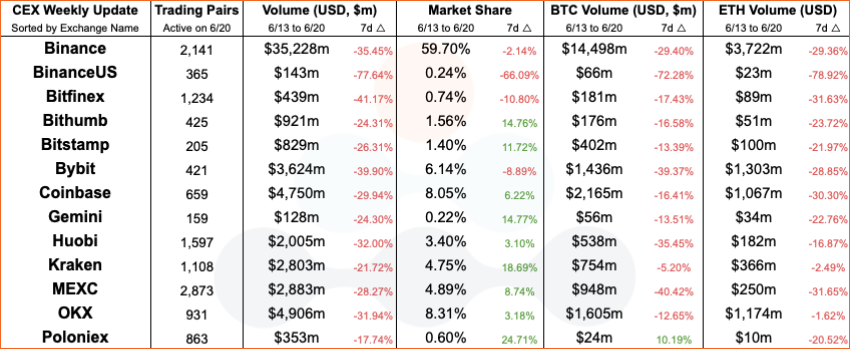

Centralized Exchange (CEX) comparisons between the weeks of 6/13 and 6/20.

Centralized Exchange (CEX) volumes for the last 90 days.

CeFi continues to reel from the SEC charges over the last few weeks, where trading volumes appear to be in steep decline. Keep in mind that total trading volume (displayed above) includes sells, so the trading volume’s week-over-week change is a biased metric. The biggest sticking point appears to be Binance US’s shift announced last week: they announced layoffs and (more importantly) have dropped fiat payment rails – a move that will see them become a crypto-only exchange. This change has dramatically impacted the exchanges’ volume with a 66% drop in market share from the last two weeks.

Centralized Exchange (CEX) buy and sell slippage for the last 31 days for BTC/USDT and ETH/USDT trading pairs.

Perhaps the most potent example of impact was the sell-side slippage for BTC/USDT and ETH/USDT across centralized exchanges as users looked to de-risk their cryptocurrency holdings into stablecoins such as USDT. Buy-side volumes were much more stable in the same period and increased in the last day as TradFi announcements begin to bring back both investors who see positive signs for Bitcoin and Ethereum and a new wave of investors flooding into the gates.

DeFi DEXs

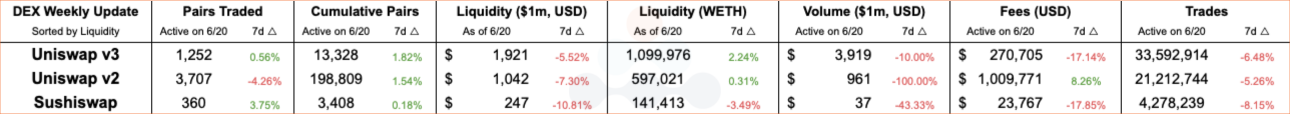

Decentralized Exchange (DEX) protocol comparisons between this and last week.

DEX Pool 7-day Trading volumes, sorted by trading volume over the last week (6/13 - 6/20).

Stablecoin pools dominated in trading volume over the last 7 days, with USDC/WETH transacting over $1b in swaps on DEXs. Interestingly, USDC/USDT was the next highest traded pair, followed by WETH/USDT. As we saw in previous weeks, traders were moving away from tokens listed on the Binance and Coinbase SEC charges and moving into WETH and stablecoins. It appears that traders have been waiting for the moment we see now: a return of bull markets and key opportunities. Last week, traders appeared to be holding a bag consisting of USDC, USDT, and WETH and moved between these currencies to find the best opportunity for yield.

Number of “Liquidity Add” events (mints/deposits) and “Liquidity Removal” events (burns/withdrawals).

Following liquidity additions and removals, one thing is for sure: traders believe the best course for yield is not as a liquidity provider (LP). Last week, there was a sharp decline in Uniswap v3 liquidity additions and liquidity withdrawals within the same time period. These inactivity metrics are a signal that yield is being found outside of DEX pools, which generate revenue from liquidity incentives and trading volume.

DeFi Lending and Borrowing

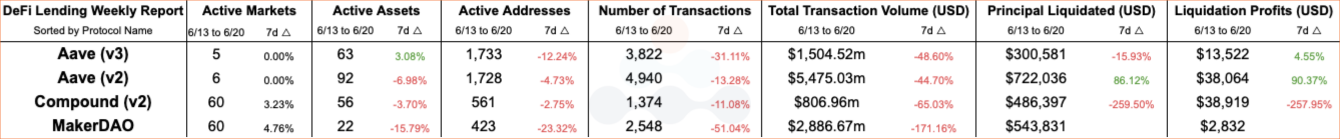

DeFi Lending protocol comparisons between this and last week.

DeFi Lending protocol deposit, withdraw, borrow, and repay volumes over the last 30 days.

At the same time that new DEX liquidity activity started to dry, DeFi Lending protocols saw a major spike across multiple events: deposits, withdrawals, borrows, and lends. The boilerplate discovery here is that money on-chain flows quickly and goes to the highest bidder – that is, the opportunity with the highest (and “safest”) yields. These protocols have all solidified their places as reliable over the course of years.

DeFi Lending protocol deposit and withdraw volumes for the Top 5 tokens by volume over the last 30 days.

Unsurprisingly, WETH and stablecoins dominate the DeFi landscape. As we saw when looking at DEX volumes, these have been the most swapped tokens, and with fewer events on DEXs the liquidity must move to other yield-providing opportunities. When tokens are not being traded, they are most effectively utilized in a pool – and if they’re not in a DEX pool, we could expect them in a DeFi Lending pool next. It will also be exciting to see how cross-chain lending protocols change the DeFi landscape, as we will not only need to look at a protocol or asset, but how these pools differ across networks. Will any L2 dominate in liquidity over the others? Will Ethereum be the main source of liquidity for side-chains, or will it be the network for opportunities to develop before they grow across new landscapes?

Networks

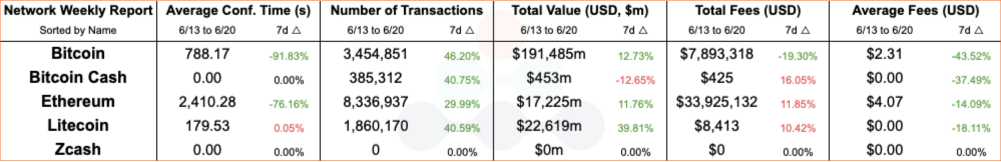

Network comparisons between this and last week.

Bitcoin and Ethereum daily average transaction fees over the last 90 days.

It hasn’t been said often this year, but on-chain transaction fees are way down. The sell-offs in the last few weeks mainly hit the centralized exchange order books, but the wider market (i.e., non-trader crypto users and retail users) has been sitting on the sidelines for some time now. NFT activity seems to have slowed and news from that front has been waning on “non-existent.” Now seems like a great time to unravel those positions that have been tied up due to high on-chain transaction fees.

Number of transactions over the last year.

An interesting and exciting perspective is a wave of transactions on Litecoin since May 2023. It’s unclear what has been triggering this, but the announcement of Litecoin (LTC) trading from EDX along with an upcoming (and much anticipated) halving in a few weeks (expected on August 2nd, 2023) appears to be moving the needle in terms of network usage.

Links

Recent Coverage

https://www.nftgators.com/edx-markets-launches-with-support-for-btc-eth-ltc-and-bch-spot-trading/

Spot Market

Spot market charts were built using the following endpoints:

- https://docs.amberdata.io/reference/market-metrics-exchanges-volumes-historical

- https://docs.amberdata.io/reference/market-metrics-exchanges-assets-volumes-historical

- https://docs.amberdata.io/reference/get-market-pairs

- https://docs.amberdata.io/reference/get-historical-ohlc

Futures

Futures / Swaps charts were built using the following endpoints:

- https://docs.amberdata.io/reference/futures-exchanges-pairs

- https://docs.amberdata.io/reference/futures-ohlcv-historical

- https://docs.amberdata.io/reference/futures-funding-rates-historical

- https://docs.amberdata.io/reference/futures-long-short-ratio-historical

- https://docs.amberdata.io/reference/swaps-exchanges-reference

- https://docs.amberdata.io/reference/swaps-ohlcv-historical

- https://docs.amberdata.io/reference/swaps-funding-rates-historical

DeFi DEXes

DEX charts were built using the following endpoints:

- https://docs.amberdata.io/reference/defi-metrics-exchanges-historical

- https://docs.amberdata.io/reference/defi-liquidity-historical

DeFi Borrow / Lend

DeFi lending charts were built using the following endpoints:

- https://docs.amberdata.io/reference/defi-lending-protocol-lens

- https://docs.amberdata.io/reference/lens-protocol-makerdao

- https://docs.amberdata.io/reference/lens-protocol-compound

To download the Crypto Snapshot, click here.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...