DeFi legend, Curve.fi, is now available in Amberdata APIs 🎉👏

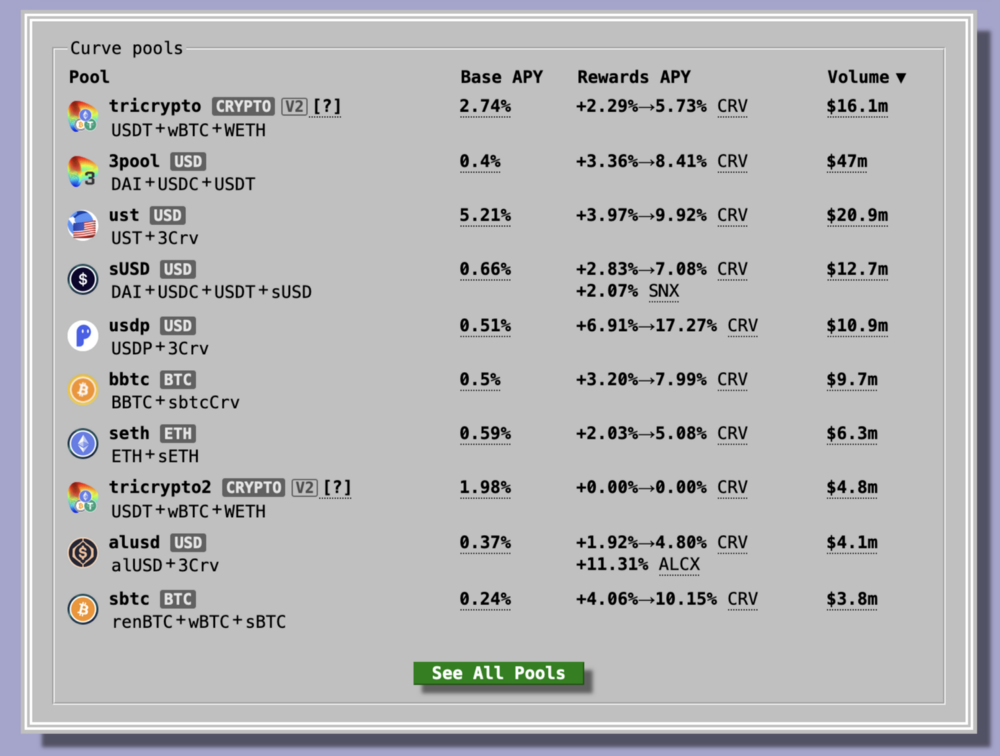

Curve provides a unique, efficient AMM and lending protocol on Ethereum as well as other layer 2 chains. It differentiates its liquidity pools by setting up multi-token support, including backing tokens with underlying ERC20 collateral.

From the Curve docs, a quick snapshot:

Curve achieves extremely efficient stablecoin trades by implementing the StableSwap invariant, which has significantly lower slippage for stablecoin trades than many other prominent invariants (e.g., constant-product)

The Curve pools provide a couple ways that trade can occur with higher capital efficiency.

First: Pools can contain multiple tokens, which allow for less “hops” between traded liquidity.

Second: The “Stable Swap” price formula uses a constant-product function that keeps slippage lower than other AMM protocols. Read more here →

Curve.fi Supported Features

Here’s the line-up of great data sets supported on Amberdata.io:

- Total Value Locked: Digital Asset & USD Amounts

- Reference Price

- OHLCV

- Liquidity

- Trades

How do I start using it today?

Quick and easy sign up process, follow these steps:

- Sign up on amberdata.io

- Create a Free API Key

- Start using the APIs, with comprehensive documentation

- Send us feedback, we’d love to help you be successful!

Got questions about today’s post?

- Leave a comment below

- Email us at support [ at ] amberdata.io