Crypto Options Analytics, Nov 12th, 2023: Powell's Hawkish Tone

-

Monday through Friday - Various Fed Governors speak

-

Tuesday 8:30am ET - CPI

-

Wednesday - 8:30am ET - PPI

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH, and Lyra and may change their holdings anytime.

CRYPTO OPTIONS MACRO THEMES:

Risk assets remain strong and closed the week higher (both crypto and stocks). That said, Powell’s speech to the IMF last Thursday leaned Hawkish, as Powell said that he’s “not confident rates are high enough to meet their 2% inflation target”.

30-year bond futures moved lower on the speech, see below.

Chart: (ThinkOrSwim /ZB 30-yr bond futures)

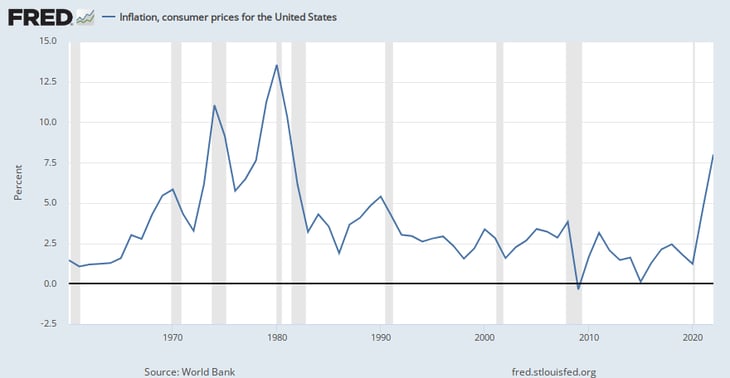

Another interesting note in Powell’s speech is that he said, he was weary of data “head fakes”. That historically, inflation data can improve briefly, before worsening again.

(That information is important to take with us going into this week’s CPI and PPI economic releases).

Notice the periodic “down ticks” in inflation during the 1970’s.

I’m starting to think that it’s best to assume Powell is going to lean Hawkish throughout all his appearances, as a “base case” assumption.

Chart: (ThinkOrSwim VIX)

The Vix index moved higher with Powell’s speech, but that was very short-lived. The market seems to have decided risk is behind us and positioning for an EOY rally makes the most sense.

This coincides well for crypto as a “risk-asset” narrative, although BTC as a “safe-haven asset” has proven itself in 2023.

I think BTC is likely invincible going into EOY and will march higher regardless of the environment. More on BTC below.

BTC: $37,096 (+5.8% / 7-day)

ETH :$2,049 (+7.9% / 7-day)

BTC

BTC had a nice “pop” higher last week as spot moved from $35k→$37k.

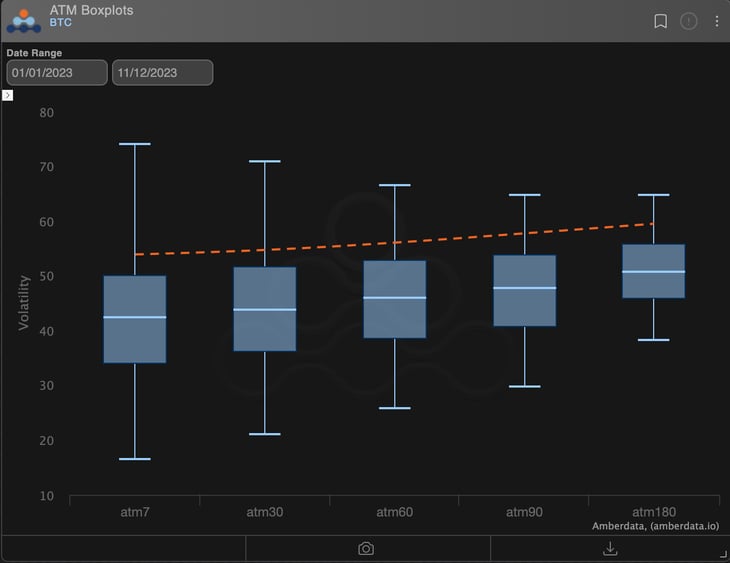

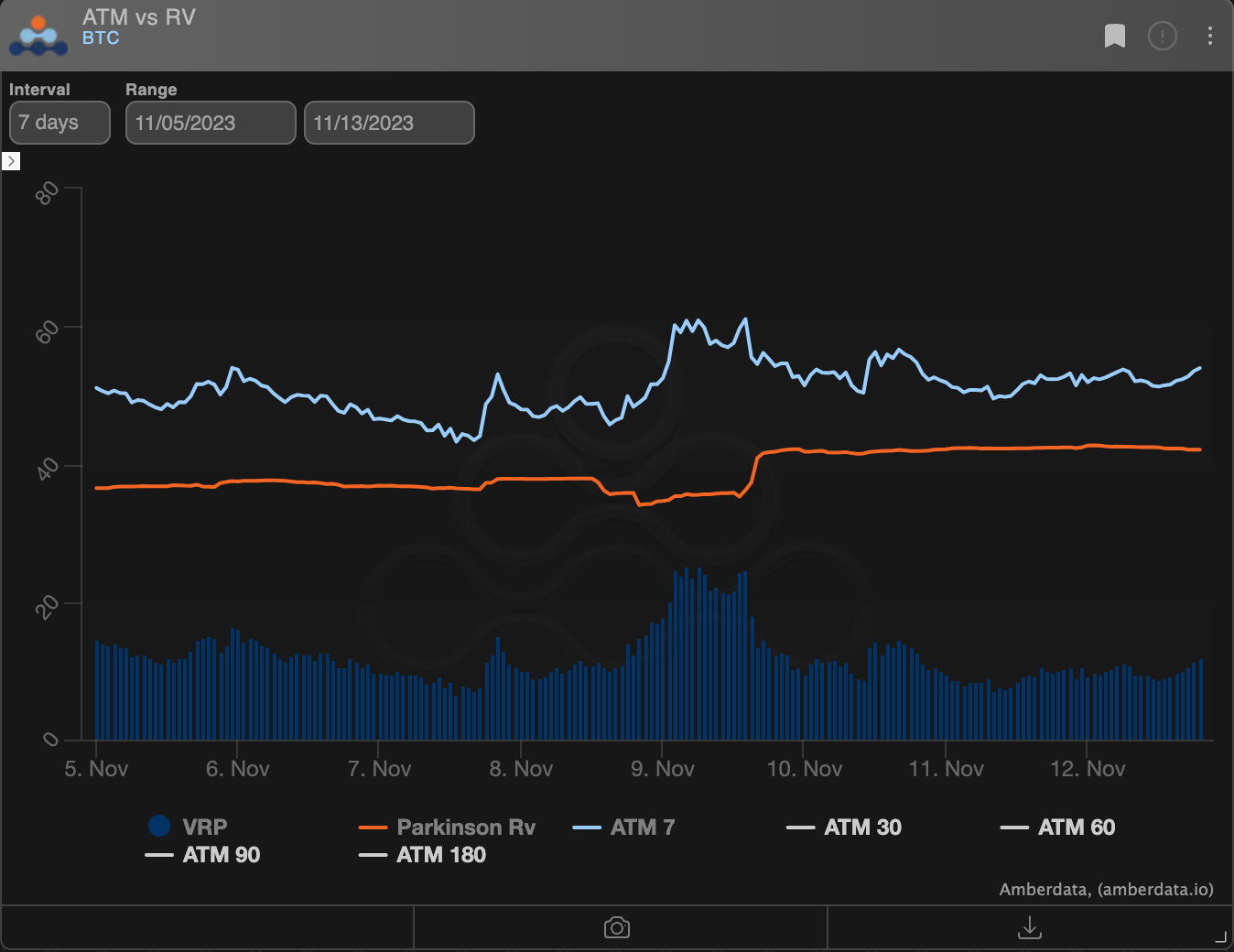

The term structure remains flat and the VRP remains high. Traders are willing to pay a premium for volatility as we expect spot prices to move in reaction to ETF news.

Chart: (BTC Current ATM term structure vs the YTD range)

Chart: (BTC 7-day VRP currently about +17pts)

This week, I’m very neutral on the delta direction in the short-term.

I could easily see a scenario where BTC retraces back to the $35k level to “flush” longs, before resuming a run to +$40k into EOY optimism or ETF news.

I’m not convinced of that scenario, but I could see it.

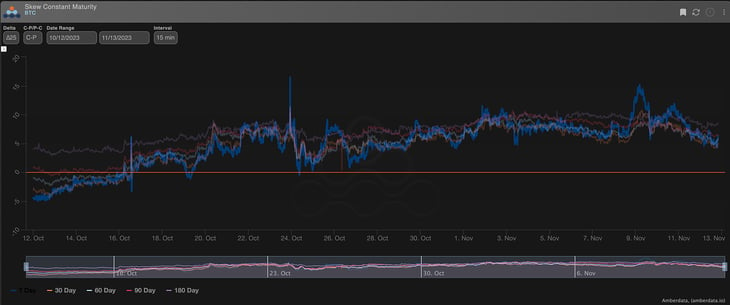

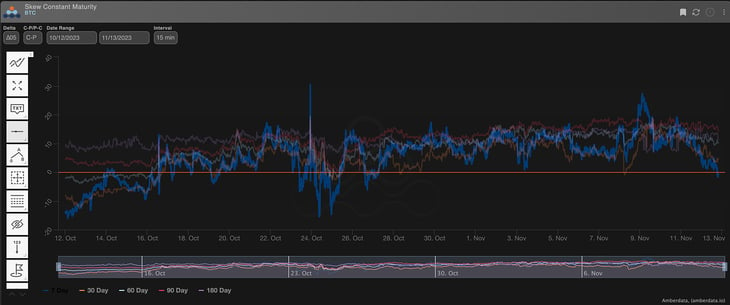

Chart: (BTC ∆25 Delta RR w/ blue=7day)

Chart: (BTC ∆05 Delta RR w/ blue=7day)

The divergence between the weekly ∆25-RR and the ∆05-RR is interesting to me and a bit telling for the potential pull-back “flush” narrative.

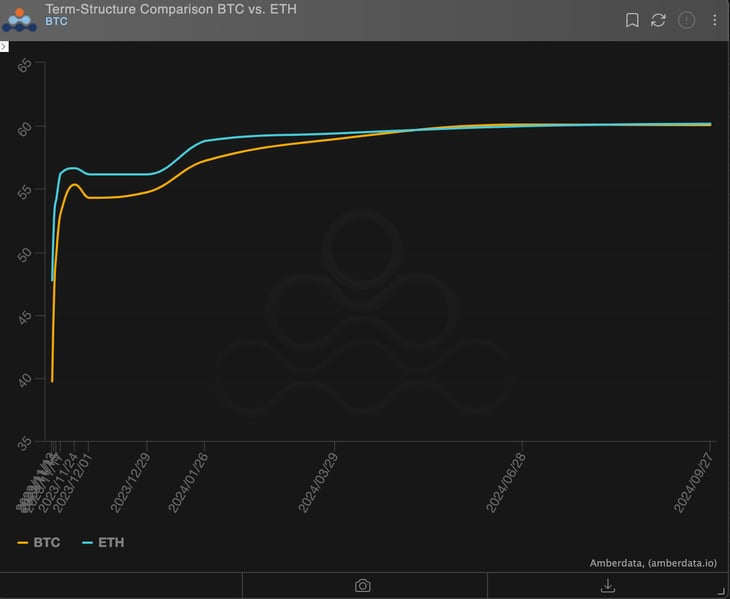

Another fascinating pricing in the current term structure is the “throw-away” waterfall in ATM IV.

Chart: (BTC & ETH ATM Term Structure)

As options approach expiration and it becomes clear that an event isn’t likely to occur during the options life cycle… traders are quick to throw them away and sell them right down to RV.

This is likely due to some sort of rolling activity as opposed to outright selling, but it’s something to be aware of for short-term options and could provide opportunity for those willing to trade 0DTEs short-side.

ETH

Chart: (ETH Dealer Gamma profile 11/12 00:00)

ETH had an interesting turn of events this week as BlackRock also filed an application for an ETH ETF.

This cause traders to buy volatility en-mass and finally flipped dealer inventory from long gamma to short-gamma… a trend that had previously been persistent since the Shanghai upgrade back in April.

Chart: (ETH Dealer Gamma profile 11/5 00:00)

Chart: (ETH gamma inventory time series with 0-line in orange)

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

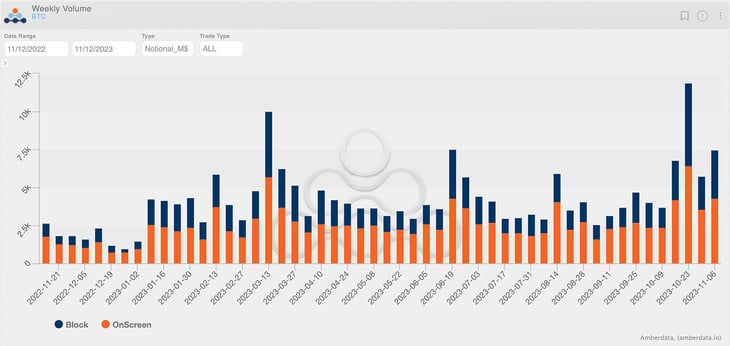

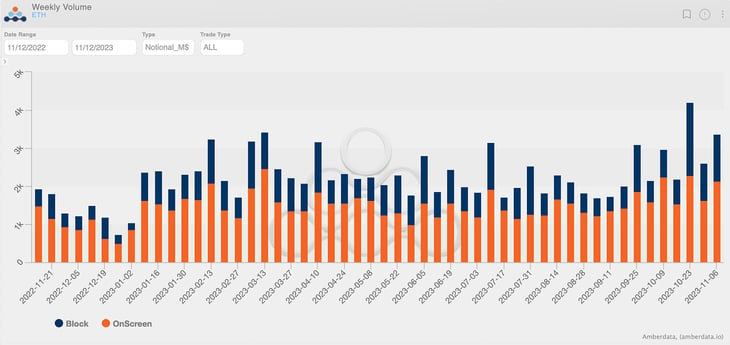

A constructive week in terms of volumes for both Bitcoin and Ethereum. Although to a lesser extent, we witnessed some profit-taking again.

The elevated skew favored call spreads and diagonals.

Chart: (BTC Weekly volumes)

Chart: (ETH Weekly volumes)

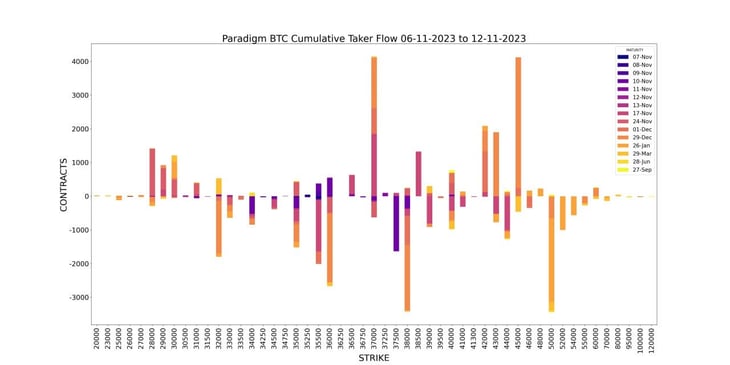

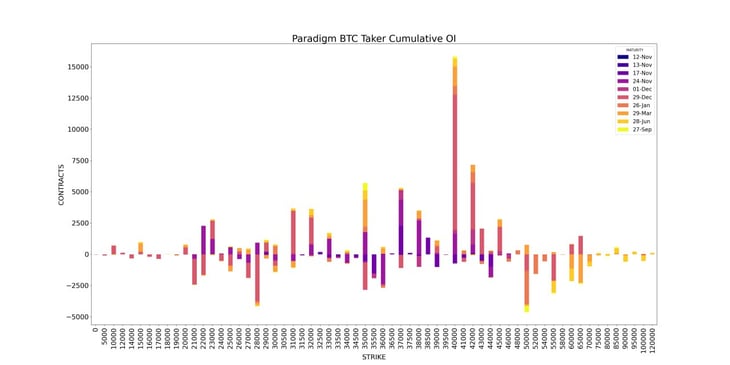

Significant profit-taking on December for Bitcoin with the sale of contracts at strikes $32k-$36k-$38k-$40k. Some of these were rolled into $37k and $45k.

The week of new positions, on the other hand, was dominated by spreads and diagonals:

-

November 17-24 call spread $37k-$40k

-

Diagonals December/January +$43k/-$50k +$45k/-$52k

Given the caution in profit-taking and the sale of November $40k, we can infer that market participants are weighing a “pause" scenario until the monthly expiration, with the likelihood of an early ETF approval being very limited.

On December and January, the outlook appears more optimistic with a bet range between $40k and $50k spot, although the flat term structure suggests absolute uncertainty around the theme.

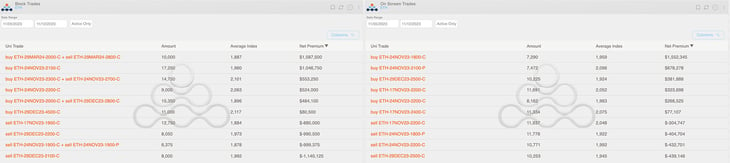

Chart: (BTC Top Trades)

Chart: (BTC Top Volume Oi)

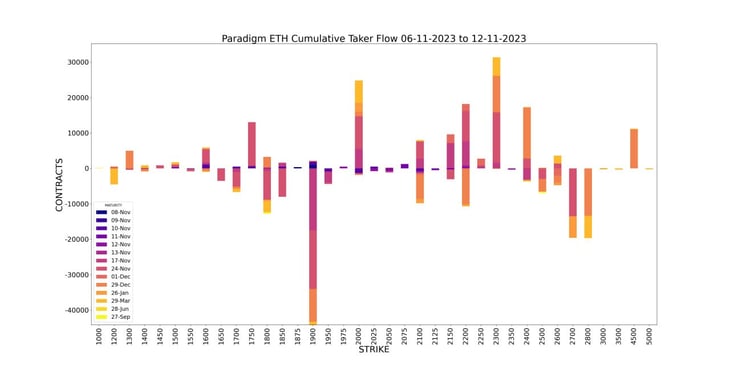

The tone for Ethereum mimics Bitcoin with some profit-taking at $1.9k-$2.1k and call spreads (November and March) and diagonals (November/December).

The ETH ETF narrative, despite playing a primary role in the ETH/BTC spot recovery, remains uncertain and certainly with longer timelines. This consideration is evident in traders' choices of expiration, where sentiment appears more dictated by betting on market rotation than a true catalyzing event.

Chart: (ETH Top Trades)

Paradigm's Week In Review

Another strong week for risk assets 📈

ETH catches up with IVs sitting over BTC out to March ♻️

Strong volume with upside in focus at the near end of the curve 🎢

BTC +6.3% / ETH +8.8% / NDX +2.6%

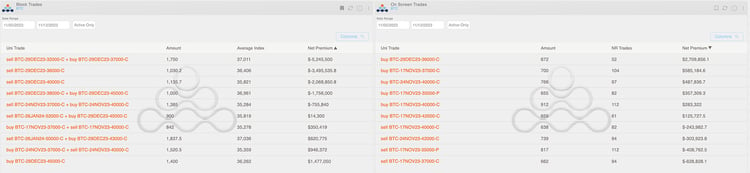

Paradigm Top Trades this Week 👇

Bullish flows into year end

Weekly BTC Cumulative Taker Flow 🌊

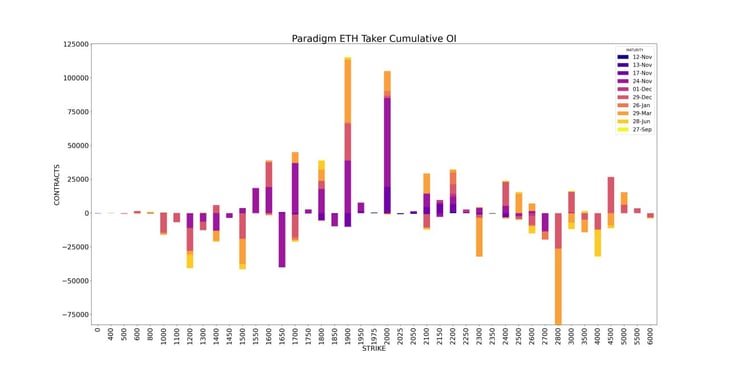

Weekly ETH Cumulative Taker Flow 🌊

BTC Cumulative OI

ETH Cumulative OI

As always you can hit us up from the below

Hit us up on Telegram! 🙏

Paradigm Edge: Daily Commentary✍️ http://pdgm.co/edge

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

BTC

ETH

The Squeethcosystem Report

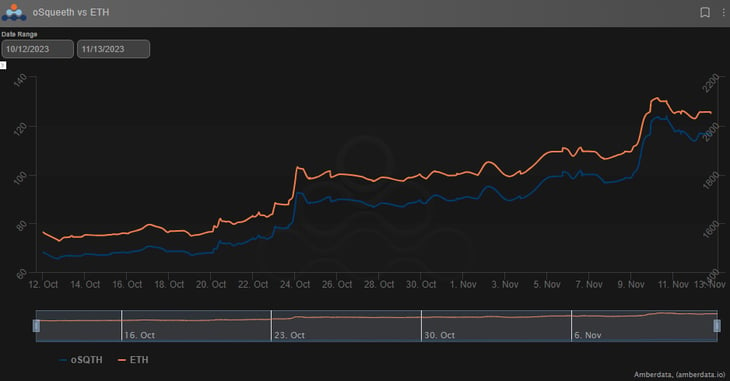

Crypto markets found their way higher throughout the week. ETH ended the week +8.06%, oSQTH ended the week +17.1%.

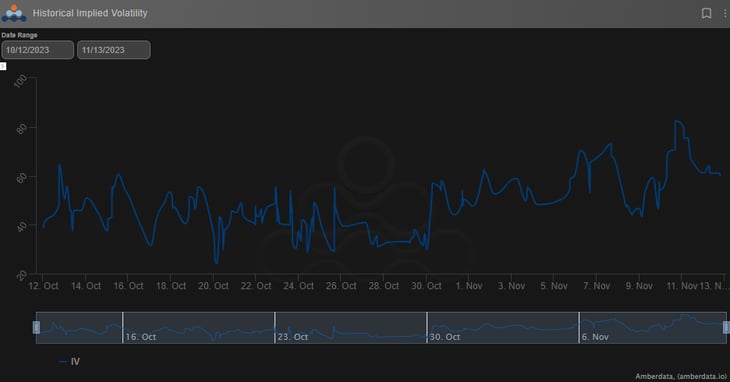

Volatility

oSQTH IV rose throughout the week from the mid-50s to the low 80s, before quickly reverting back to the low 60s.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $409.88k

October 31st saw the most volume, with a daily total of $165.05k traded.

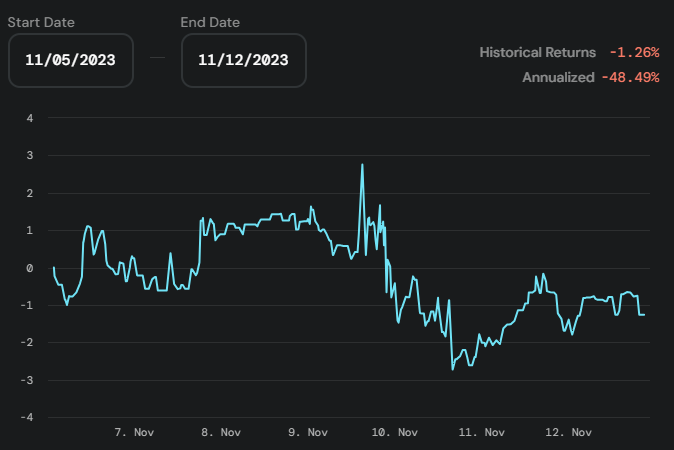

Crab Strategy

Crab saw declines during the week ending at -1.26% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...