Amberdata Derivatives Newsletter: Inflation Jitters, Fed Drama, & Crypto Breakout

Mixed macro signals, market jitters, and political drama set the tone last week — with inflation data sending conflicting messages and Trump stirring speculation around Fed leadership. While Gold and bond markets reacted swiftly, the Fed's course remains steady for now. But the crypto market? That’s where things really lit up… Learn more in this week's Amberdata Derivatives Newsletter:

- Monday 10am - Leading Indicators

- Tuesday 8:30am - Fed Chair Powell opening remarks at banking conference

- Wednesday 10am - Existing Home Sales

- Thursday 9:45am - Flash PMI

- Thursday 10am - New Home Sales

- Friday 8:30am - Durable Goods

Visit Amberdata.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH, and Derive and may change their holdings anytime.

MACRO Market Overview

There was a ton of action last week on the macro front.

Starting with the regularly scheduled activity, we had the release of both the CPI and PPI numbers.

The producer price index (PPI) came in flat for June vs May at +0.0%, while most economists expected an increase of +0.2%. This was a good inflation reading. On year-over-year terms, the June PPI reading was +2.5%, compared to +2.8% in May.

Even though PPI inflation is trending towards the Fed target of +2.0% annualized inflation, the Fed (and many economists) still expects tariff-related inflationary forces to appear in the next few months.

(WSJ.com)

The CPI release on the other-hand was a bit less rosy. Inflation came in-line with expectations at +2.7%, but this is higher than the reading of +2.4% in May and +2.3% in April. Economists also expect this inflation rate to increase to +3.0% by December due to tariff impacts.

Taken together, this data does nothing to change the Fed’s current stance on interest rates in my opinion. “Wait-and-see” is the natural reaction to this mixed data. The resilient jobs market also removes the pressure from the Fed to take imminent action to support the economy.

Speaking of pressure however, last week also displayed increasing sentiment from Trump to remove chairman Powell and replace him with someone more dovish.

Trump’s main concern is the desire to finance government deficits and debt at a lower rate. His plan is to get a dovish Fed to reduce short-term rates and refinance maturing debt at the front of the yield curve. In theory creating lower financing.

(ustreasuryyieldcurve.com/)

This spooked the markets a lot during the week and spiked Gold higher on the initial reaction. A Bloomberg article was published with rumors that Powell was going to be fired soon, until Trump and the administration denied these claims.

Treasury Secretary Scott Bessent is against the idea and apparently talked Trump away from the idea.

Bessent believes that there’s no need to do this since the Fed has already signaled two potential rate cuts this year and he also believes that it will negatively affect markets (and inflation expectations) should the Fed lose its perceived independence.

Although legally Trump cannot fire Powell without cause, it seems that Trump is gearing towards pointing to over-budget renovation costs at the DC Fed building as an excuse for “cause”.

In my opinion, this would be a very big deal should it happen. Already the idea of fiat money is theoretically unsound in my opinion, but with no-one ensuring that inflation isn’t out-of-control makes me think the last guardrail would be gone. Great for Bitcoin prices but not great for bonds, the economy and anyone who has prudently saved their money.

Like Gold, Bond futures were instantly reactive to the rumors too.

Next week’s economic data will be pretty tame on the US macro front; the most interesting will be Powell’s speech on Tuesday during a banking conference.

Outside of that, there is a Japanese election going on today with results likely to be finalized Monday morning. Japan is also dealing with inflation and higher bond yields (and a historically weak currency). The current party in power would like to give direct cash distributions to spur growth, while the challengers would like to cut the VAT. Neither promise seems good for the current Japanese debt situation and growing social security burden.

I continue to see Japanese ¥ has downside from here.

BTC: $118,175 (-0.2% / 7-day)

ETH :$3,755 (+25.3% / 7-day)

SOL :$182.12 (+12.0% / 7-day)

Crypto Options Overview

The crypto markets were extremely exciting this week.

Not only is crypto a beneficiary of the current macro landscape, but the regulatory environment continues to get better under the Trump administration.

This week Trump signed the GENIUS act into law, while also removing the possibility of a US based CBDC. The administration clearly signaled that the digital economy should remain in the private sector, with the US as a leader.

This week was especially bullish for web3 crypto and crypto-related equities.

The GENIUS act makes Circle a direct beneficiary of the law, since Circle has been at the forefront of transparency with their reserves, monthly attestations, and holdings of US short-term treasury bills.

Scott Bessent has said he believes that stablecoin issuance could be in the trillions of dollars by 2028.

Circle also stands to gain substantial market share from USDT, which continues to remain non-compliant with many of the requirements in the GENIUS Act. USDT is not as transparent in their reserve holding compared to Circle (which has clean reserve holdings with monthly attestations performed by Big-4 accounting firm Deloitte).

Since the IPO, CRCL has had a positive spot/vol correlation relationship.

We can see the ∆20 RR-skew expanded more this week as volatility increased along with the spot price rally.

5-dte and 10-dte implied volatility moved +25pts from the start of the week to finish the week around 115% implied volatility.

The current term-structure is in backwardation with long-term volatility around 80%, closer to ETH and altcoin levels. Today however CRCL provides one of the highest beta exposures to the crypto sector beyond major pairs and most alts.

Ethereum is the natural web3 play and likely has a lot more upside in the immediate future. After years of underperformance, ETH is likely underowned as most players are on the sidelines.

The current term structure reflects this melt-up rally, but the current volatility of ETH underestimates how quickly ETH could rally to ATHs from here.

From a historical perspective, ETH implied volatility is only measuring around it’s median at the moment. Yes, the nature of crypto today is different from 2020/2021, but ETH still have ⅕ of the BTC market cap and the combination of smaller float (due to staking), ETF inflows continuing to grow, corporate treasury purchases of ETH and an investor community realizing that they’re under-exposed to ETH… could create massive cyclical upside volatility.

This is especially true as Web3 and stablecoin legislation currently benefit EVM infrastructure.

This leads me to COIN.

Coinbase stock is now right back to the IPO all-time-high. There’s no reason to sell COIN stock at these prices. Breaking ATH’s is nothing but a signal to bet on more COIN upside.

As a result of the GENIUS act passing, the future for Coinbase looks very bright.

Coinbase has a lucrative partnership with CRCL, which allows it to receive a revenue share of Circle's reserve asset income. As stablecoins are adopted this revenue is likely to increase even if Circle renegotiates more favorable margins with Coinbase. Think of this as stablecoin exposure for COIN

The IBIT and other crypto ETFs are also seeing continued inflows, allowing Coinbase to continue to successfully scale out its custody business as the exchange remains the main custodian.

The prospect of staking ETFs being launched for ETH is another win for the exchange in this regard as ETF inflows are expected to continue as a result. Think of this as ETF adoption exposure for COIN.

The most significant product win, often overlooked, is the BASE chain built by Coinbase. The passage of the GENIUS Act and Clarity Act will likely enable more DeFi development in the crypto sector and notably on EVM chains. BASE has gained significant adoption due to its quick transactions and cheap fees, allowing Coinbase to continue to benefit from wider adoption. Think of this as the web3 EVM exposure for COIN.

Altogether, Coinbase stands to benefit from the regulatory shifts seen this week.

Current COIN 21-day RV is about 80%, but the Implied volatility term structure is around 60%, despite the backwardation.

Gamma for COIN seems like a good buy here, especially for Call side delta as prices test (and hopefully break) all-time-highs.

COIN has ¼ the marketcap size of Ethereum. It also has a smaller market cap then XRP (two crypto currencies with higher implied volatility).

This makes me think upside call exposure to COIN is a decent bet.

Paradigm – Institutional Grade Liquidity for Crypto Derivatives

Paradigm Top Trades this Week

BTC Cumulative Taker Flow

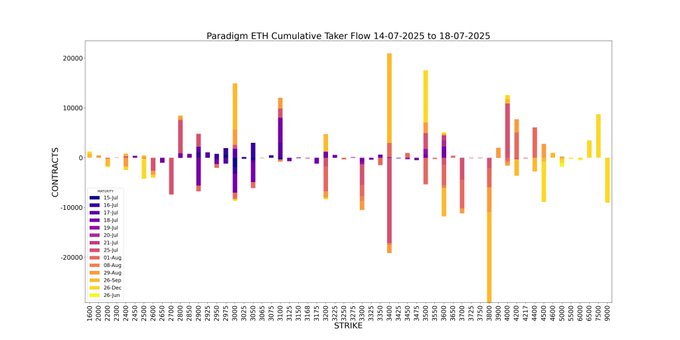

ETH Cumulative Taker Flow

BTC Cumulative OI

ETH Cumulative OI

BTC

.png?width=3064&height=1048&name=image%20(45).png)

ETH

.png?width=810&height=277&name=image%20(46).png)

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...