Moody's Investors Service Interactive Stablecoin Data Story Powered By Amberdata

New Moody’s Investors Service interactive data story driven by data from Amberdata looks at stablecoin depegs.

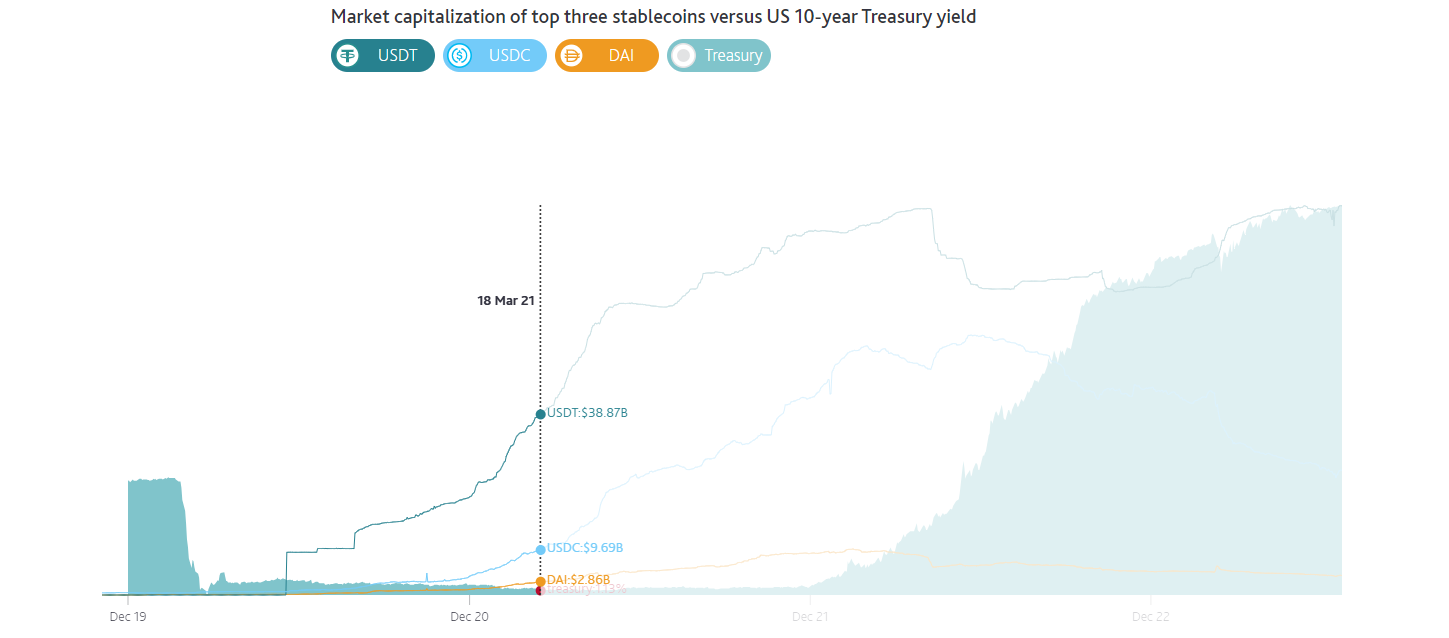

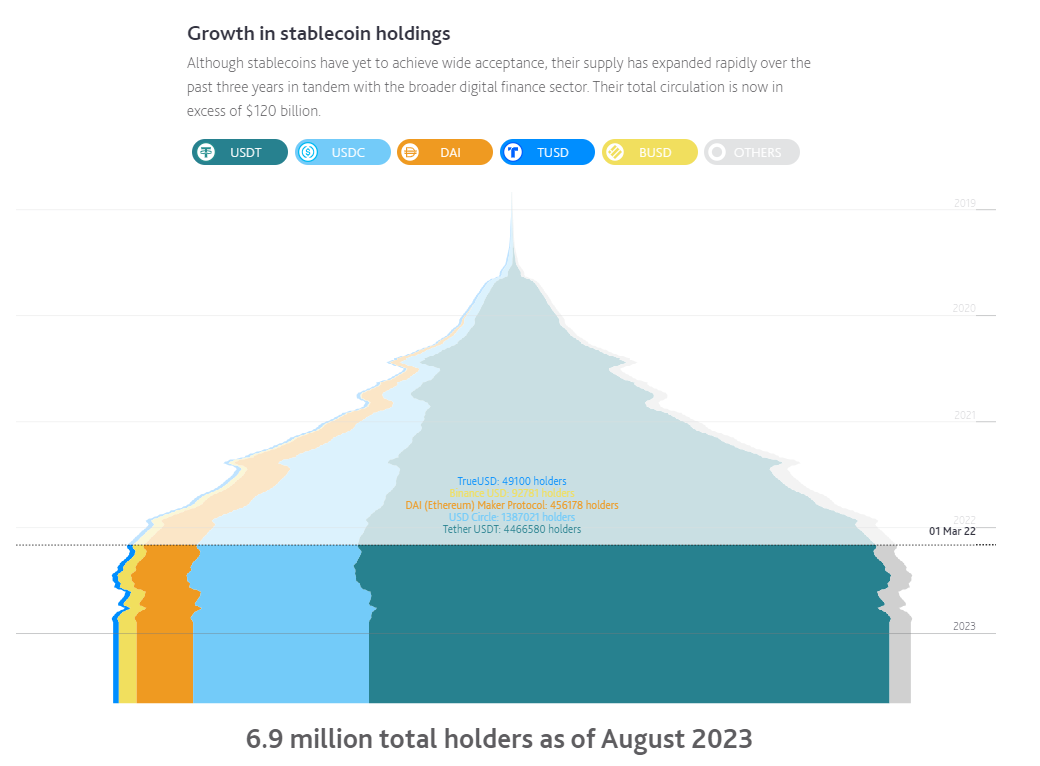

A new Moody’s Investors Service interactive data story entitled Stablecoins have been unstable. Why? looks at several high-profile instances of stablecoin depegs over the last year and explains why these happened, through 9 dynamic charts. Powered by Amberdata, a digital asset data and analytics provider, the report explains that such depeg events had impact on stablecoin adoption. Although there are signs their use could expand, including the announcement of new initiatives involving stablecoins from PayPal and Visa, price volatility remains a significant hurdle to overcome.

“There have been multiple drivers of stablecoin depegs in recent years. Major factors included lack of regulation, governance and risk management issues at a large crypto exchange, stress within traditional finance, and imbalances in digital asset pools that supply liquidity to decentralized exchanges,” said Rajeev Bamra, SVP – DeFI & Digital Analytics, Moody’s Investors Service.

Notable episodes investigated include:

- Why Terra’s Stablecoin collapse Terra’s collapse highlights risks associated with unregulated stablecoins

- How FTX collapse drove USDT depeg

- TradFi stress led to loss of USDC’s peg

- Liquidity imbalance triggers USDT depeg

- How US Treasury yields have an indirect impact on stablecoins

Check out the screenshots of two of the charts below. Engage with the rest of the dynamic charts to explore the reasons and key data points that drove volatility in major stablecoins.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...