-

Tuesday 08:30am ET - CPI

-

Wednesday 8:30am ET - PPI

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math minded people here, pardon any typos.

THE BIG PICTURE THEMES:

The macro environment is currently ruling everything once again, given the current situation at SVB.

The story goes deeper however.

This week we have a CPI & PPI releases, which will be followed by FOMC next week.

All this on the back of a mostly strong NFP print last week , despite a slight softening in the unemployment rate and wage growth.

There’s a lot of mixed signals in the market right now, so there should absolutely be more volatility to be found.

We have strong jobs and a recently more hawkish Fed, with financial sector weakness… This leads to the question of +50bps or +25bps next week.

This weeks economic releases will set the tone into FOMC.

As far as the SVB situation goes, there’s likely to be more clarity this week. Banks have interesting term structures and calendar opportunities.

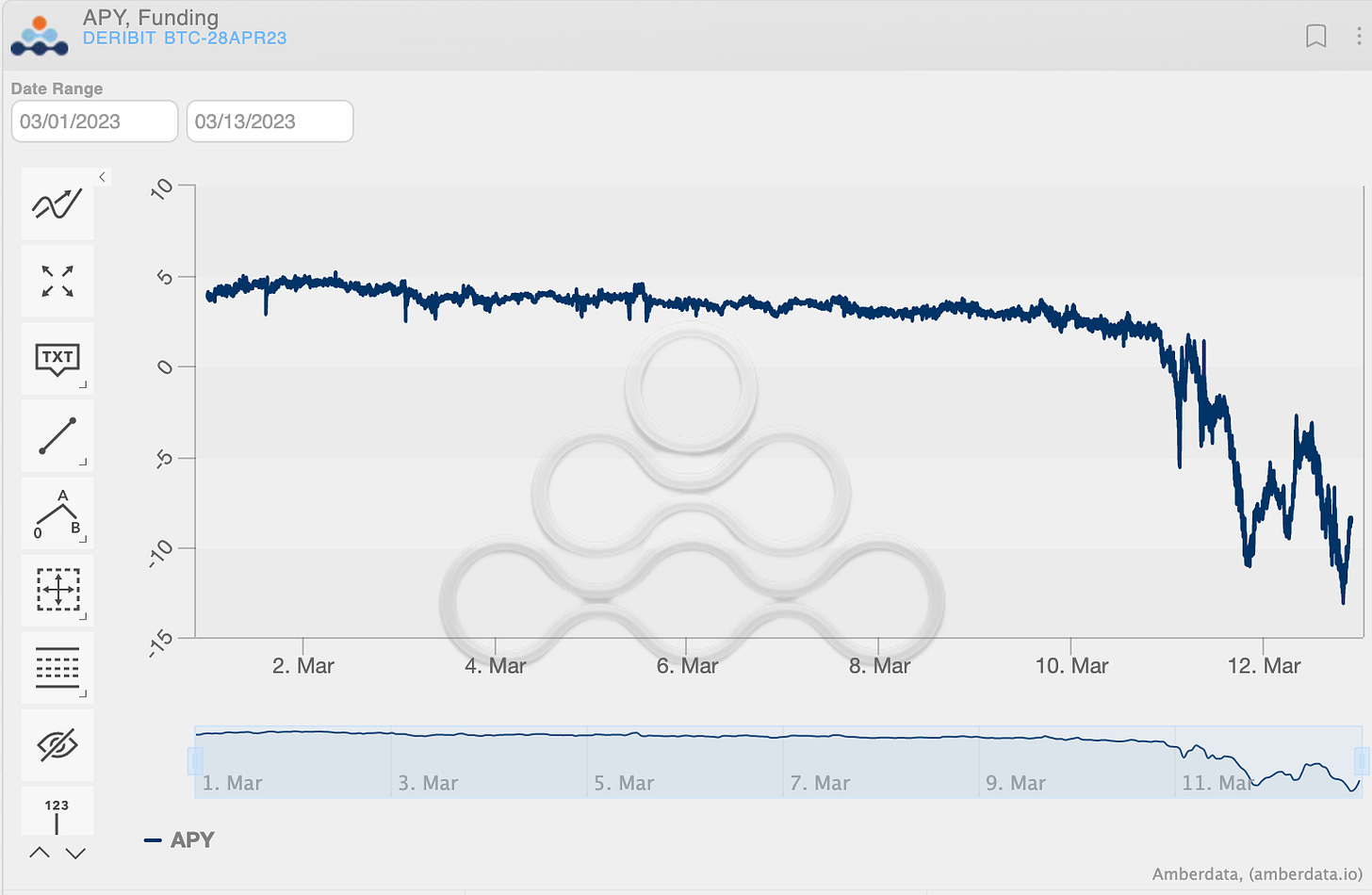

Calendars are also currently interesting in the crypto space, as well explore below.

BTC: $21,422 -4.50%

ETH :$1,553 -1.00%

SOL: $19.01 -10.36%

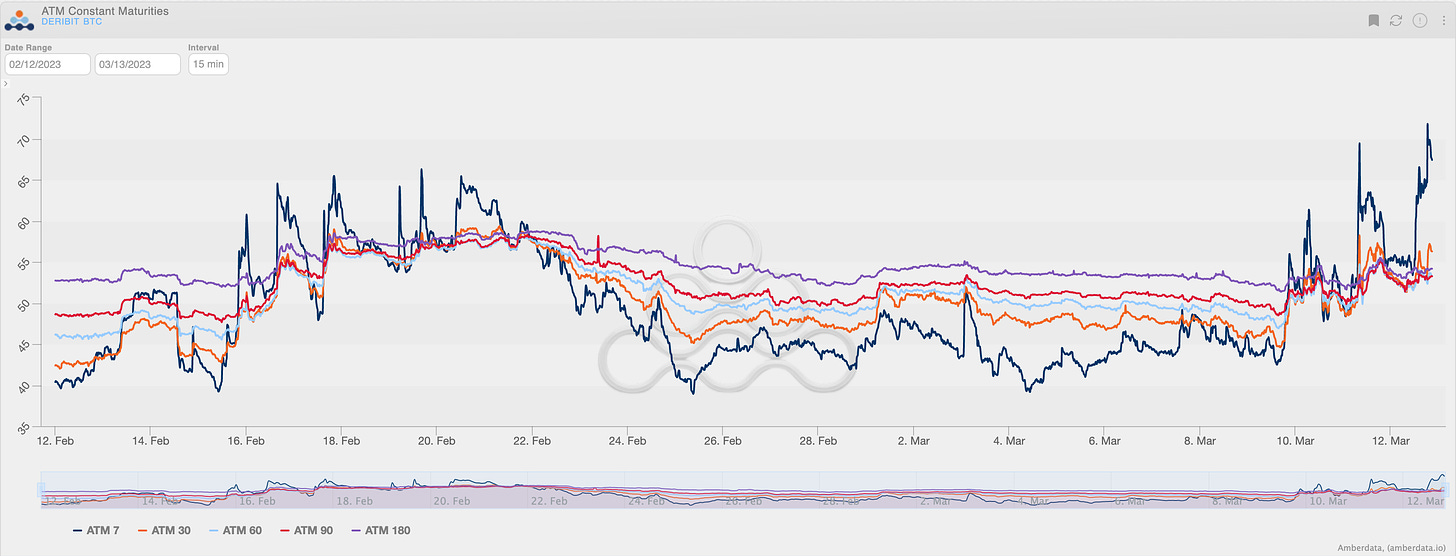

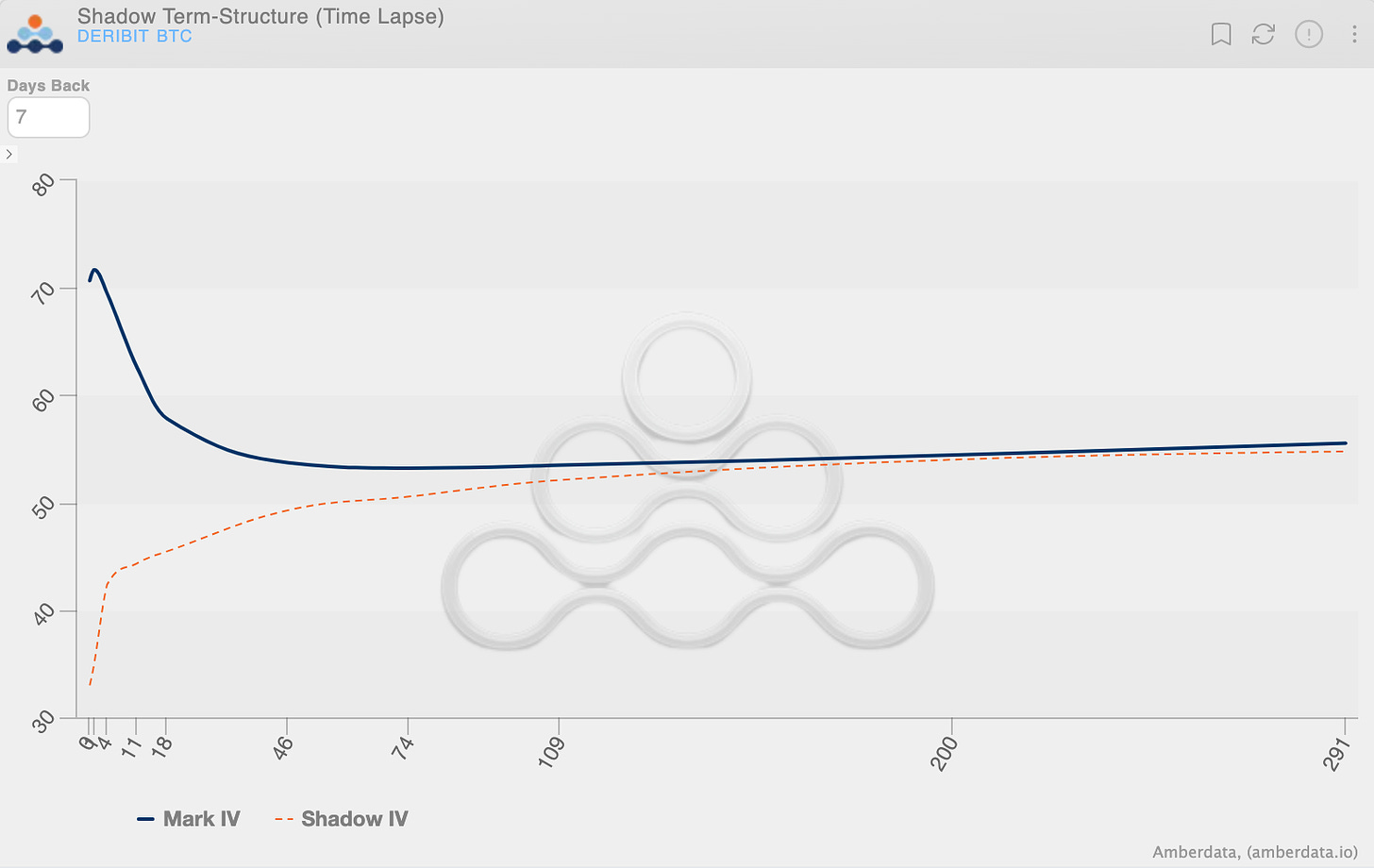

TERM STRUCTURE

(March 12th, 2023 - BTC Term Structure - Deribit)

Given the macro environment last week, it’s no surprise the see the term structure back into Backwardation.

However there’s a lot of interesting term structure opportunity right now, given that next week is FOMC and 7-day IV is extremely expensive versus +30-day.

We can see short-term IV has see an enormous pump higher in the very short-term options week-over-week.

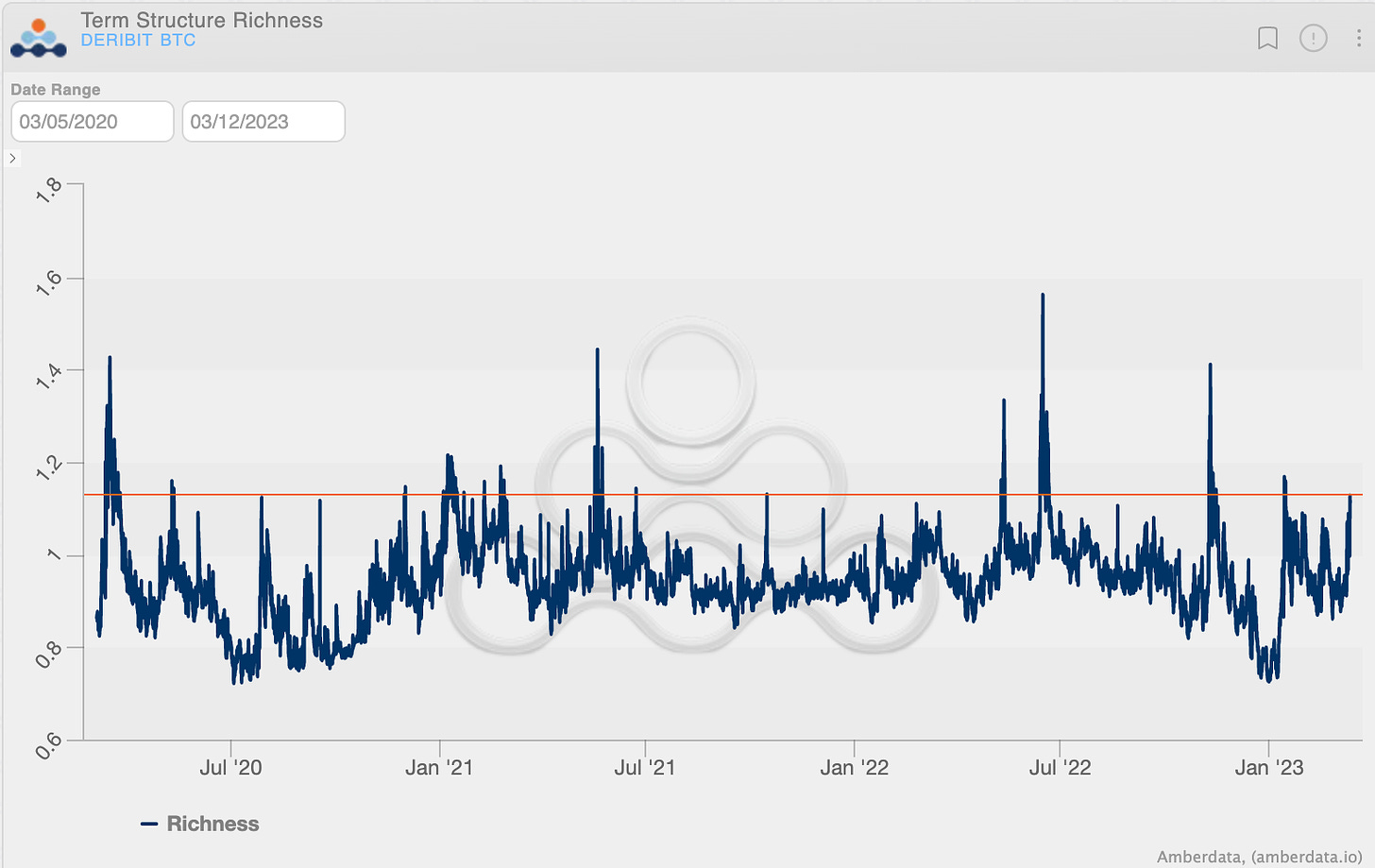

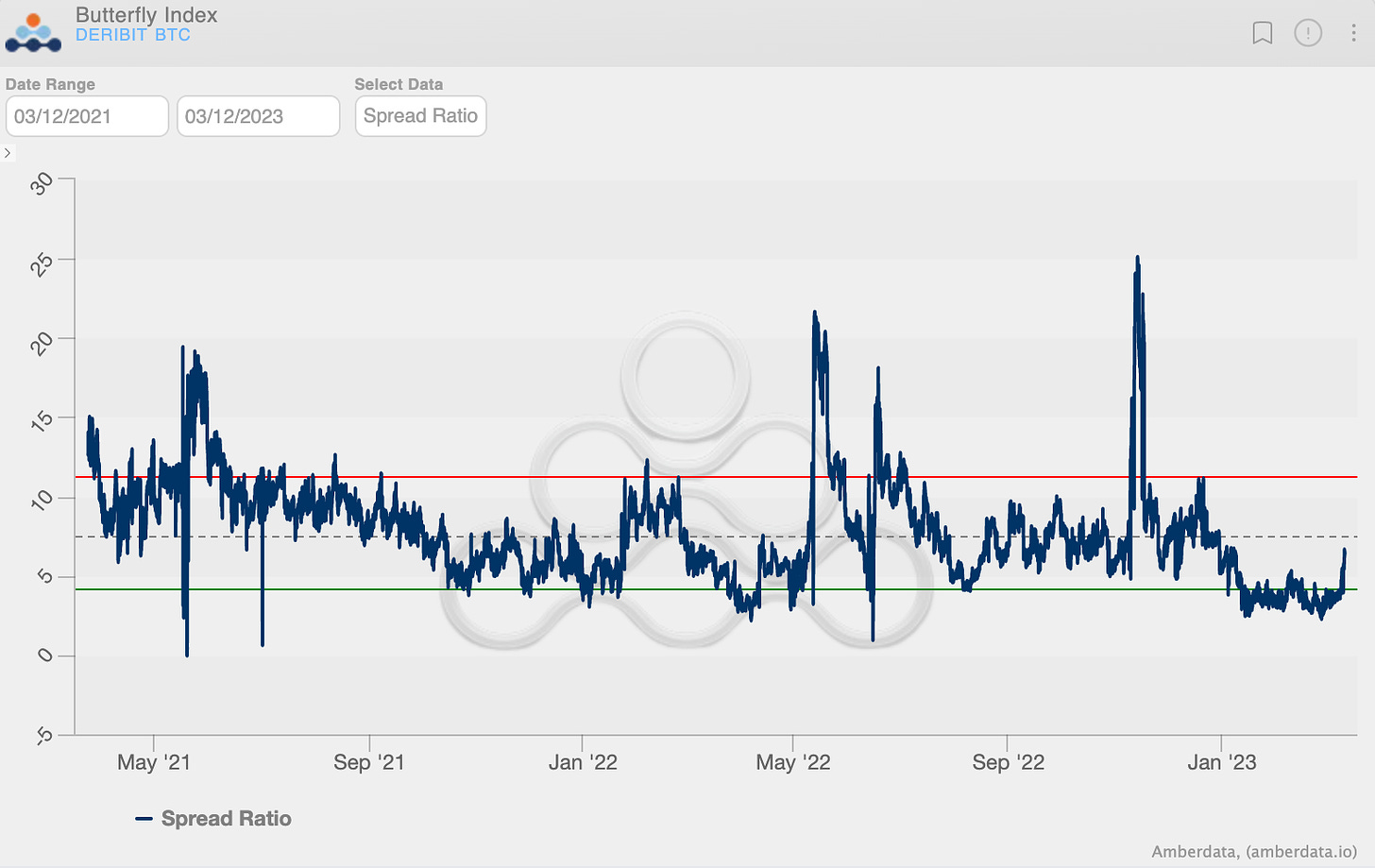

This has sent the term structure at a very elevated range over the past 3-years.

Doing some sort of calendar or diagonal structure can be very interesting here.

Especially since next week we have FOMC, which can keep IV pumped higher, despite any SVB resolution seen this week in the markets.

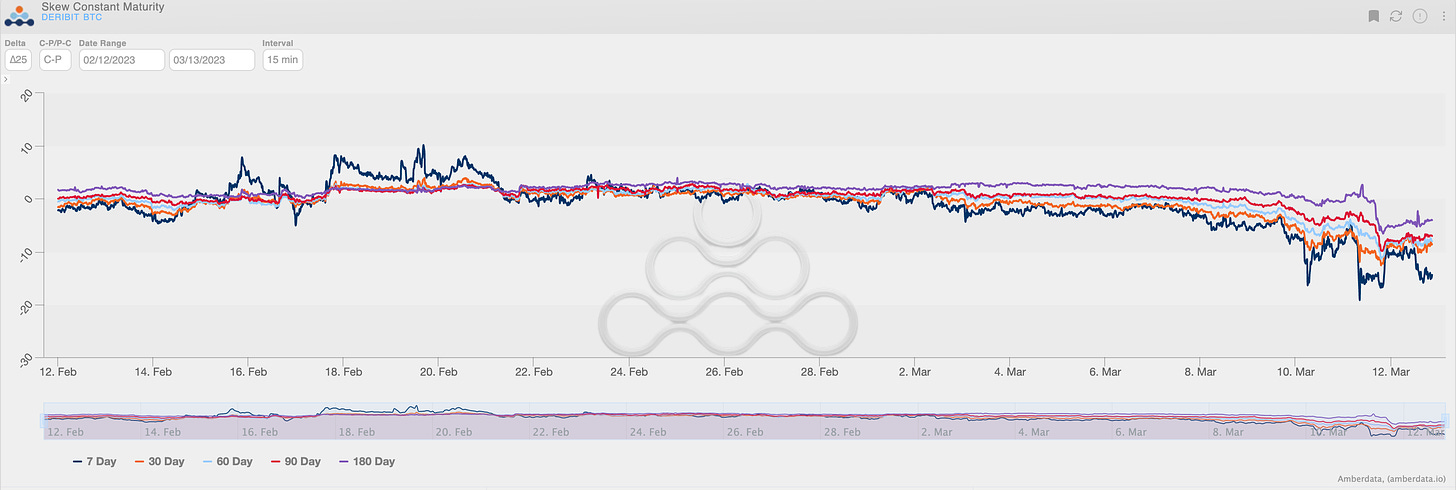

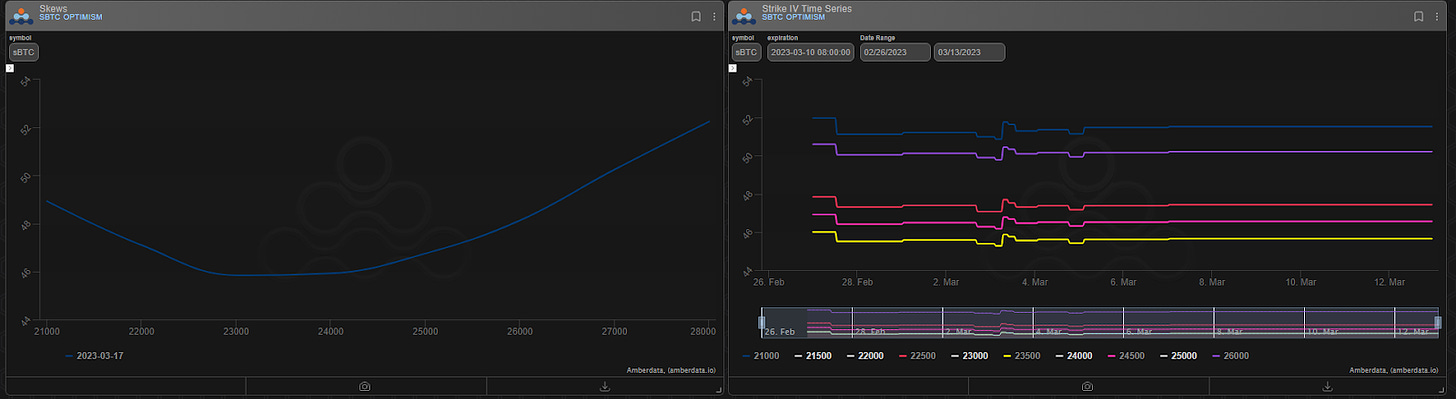

SKEWS

(March 12th, 2023 - BTC RR SKEW (C-P) ∆25 - Deribit)

We’ve written relentlessly about the positive 6-month RR-Skew.

Finally that 6-month RR-skew broke into negative territory thanks to a macro risk-off environment.

BTC remains a “risk-on” asset for now and pricing 6-month RR-skew in the positive seemed to contradict other risk asset vol. surfaces.

Keep in mind, this analysis was specifically for longterm RR-skew. In the short-term, vol. curves can do just about anything due to the potential for spot/vol. dynamics to assumed a wide array of behaviors, in the short-term.

∆25 OTM wings have also repriced higher this week.

Moving from below the 10% percentile back to the historical mean.

Taken together, what does this look like?

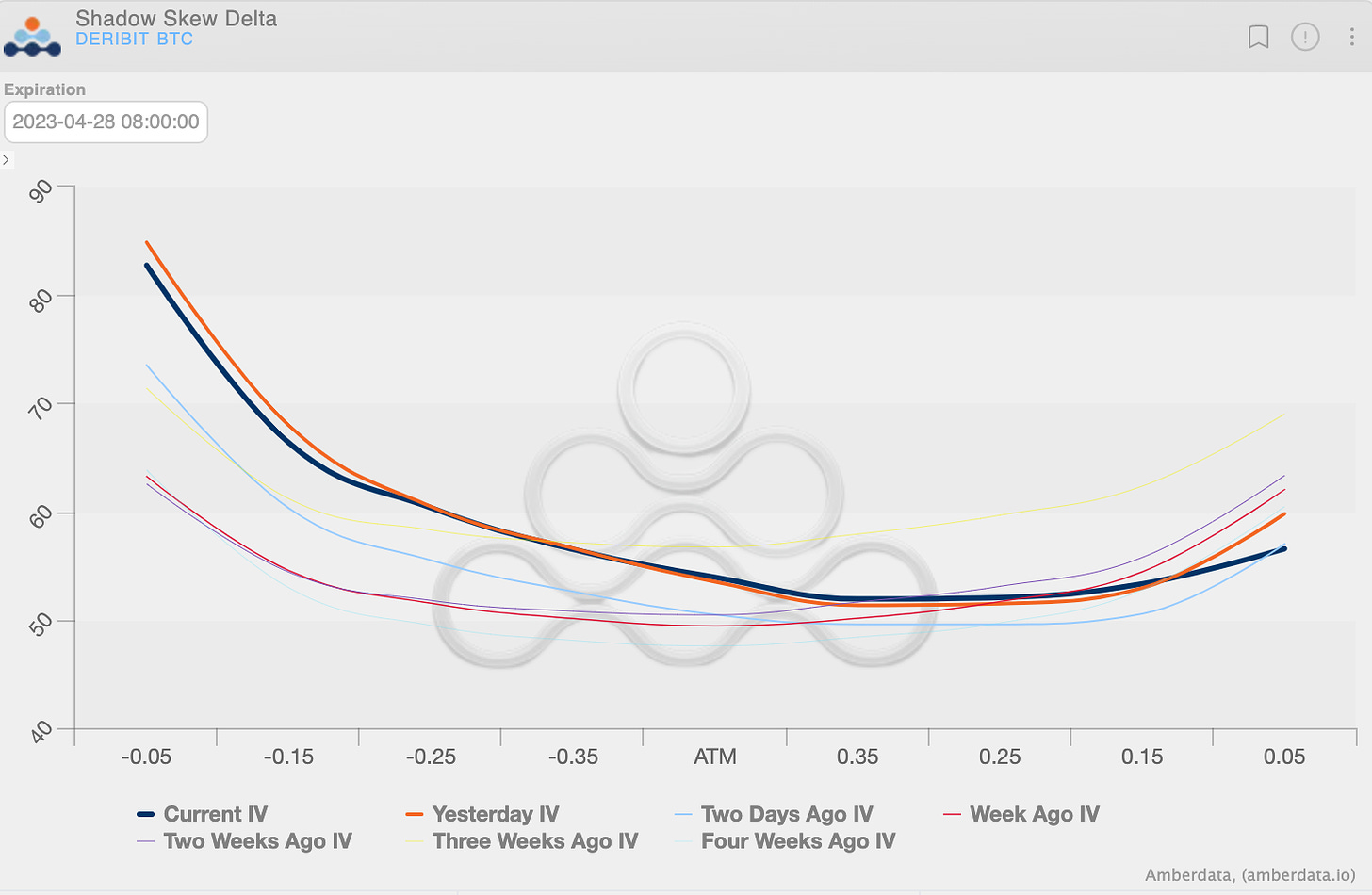

You can see the put skew, especially in the low delta range, is current at the highs, while low delta calls are in the mid-range IV zone.

Traders are expecting any relief rally to be accompanied with a vol. collapse.

That said, there’s likely a decent opportunity here, in the call wing.

As pointed out by my friend Ryan, not only is the call wing flattened down, the Futures basis is at a substantial discount.

Should we get a relief rally, the combined effects of a cheaper call wing AND a negative basis potentially flipping back into positive territory can quickly justify this OTM call premium.

A 25bps hike for FOMC could be a rally catalyst.

Financing this position via a calendar or diagonal structure.

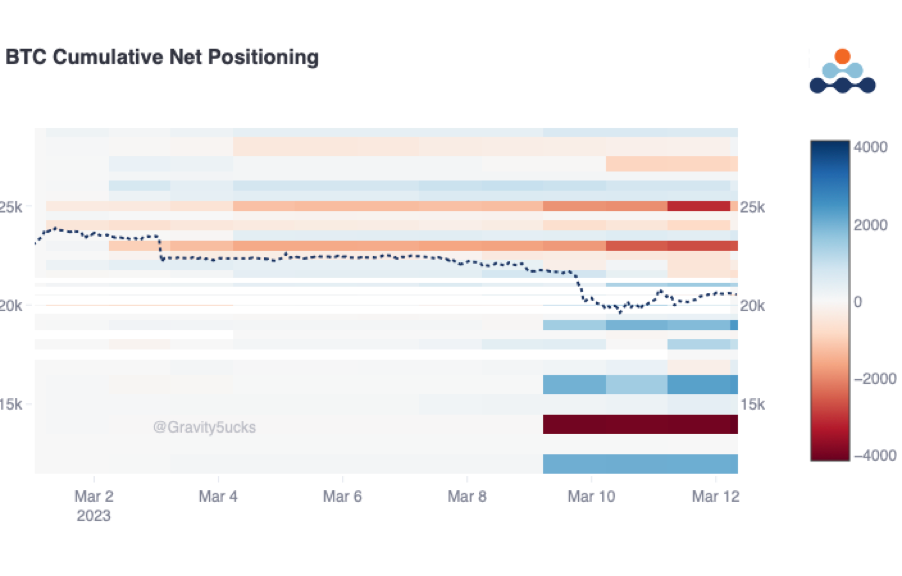

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

Incredible week from all points of view. The interconnection of events and the cross-correlation between assets, gave impetus to the positioning of traders with volumes up sharply from the previous week.

As is often the case, evaluating trades on these occasions of large price swings is more of an art than a science, but the recent tools developed at Amberdata help to make the picture clearer.

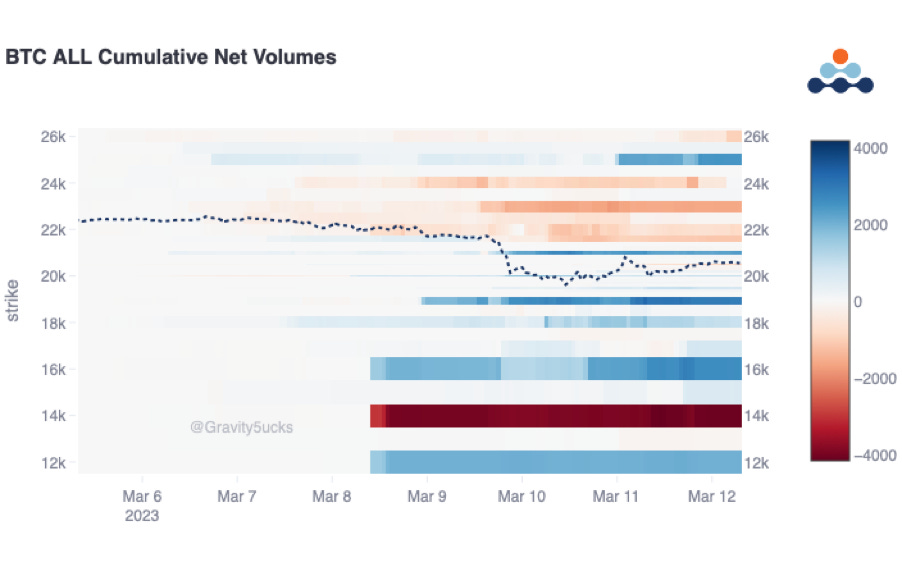

Volume heat map highlights a first part of the week in continuity with the previous one, with light volumes.

The loss of the $22k in the middle of the week, was the watershed: volumes accelerating seeking for protection, all accompanied by a Dvol/Dspot reversal.

Butterfly $16k/$14k/$12k on April, buying puts and selling calls, are the most obvious elements.

A less defined theme is the activity seen on the $25k strike but the analysis of open interest suggests a roll-forward of short-calls from March → April and from April → June.

Also interesting is the activity on the $21k strike with covering of short positions and calls bought with index around $20k.

(BTC AD Volume Heatmaps)

(BTC DvolDSpot)

The resulting positioning highlights short term resistances of $23k and $25k, and a negative GEX downward of up to $14k

(BTC AD Positioning Heatmaps)

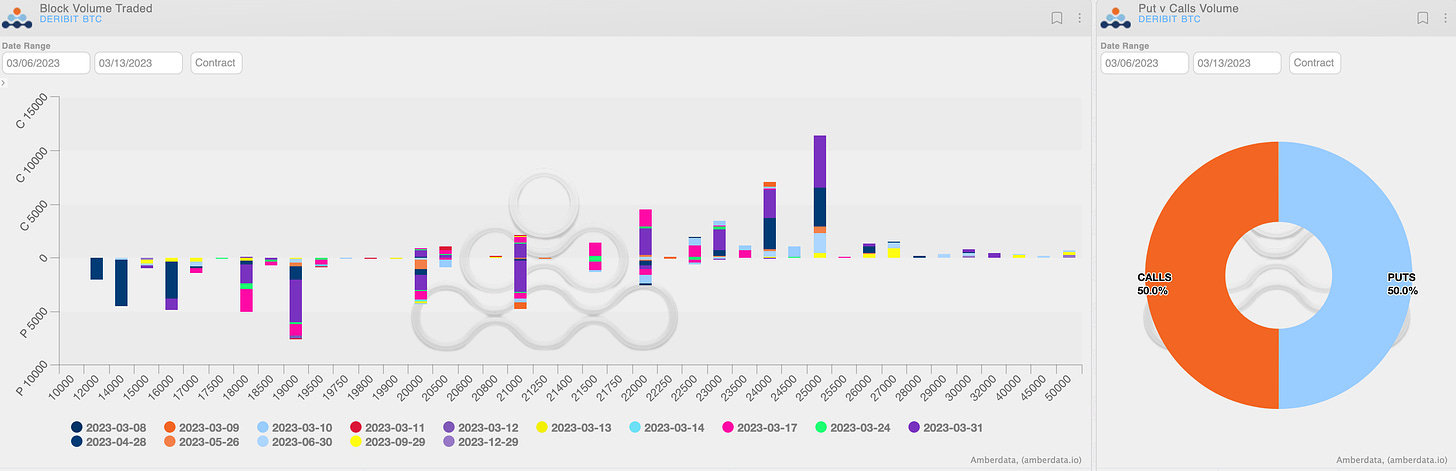

Paradigm Block Insights (06Mar - 12Mar) @GenesisVol 🧵

What a week… high options volumes amidst the turbulence in markets. Heavy downside buying amidst a bid for protection drove strong moves in skew. Realized vol performs.

BTC -6% / ETH unch. / NDX -4.3%

🌊 Paradigm saw takers primarily bid for downside, kicked off by notable protection scooped early in the week, pre-selloff:

2000x Apr 16k/14k/12k Put Fly bought

1000x Mar 19k Put bought

As the SVB news hit the tape and risk sold off, takers bought puts… Skew has seen a big move across the surface.

2400x Mar 19000 Put bot

1485x 17Mar 18000 Put bot

1000x Mar 21000/19000 Put Spread bought

27k Mar 1200 Put bought

25k Mar 1300 Put bought

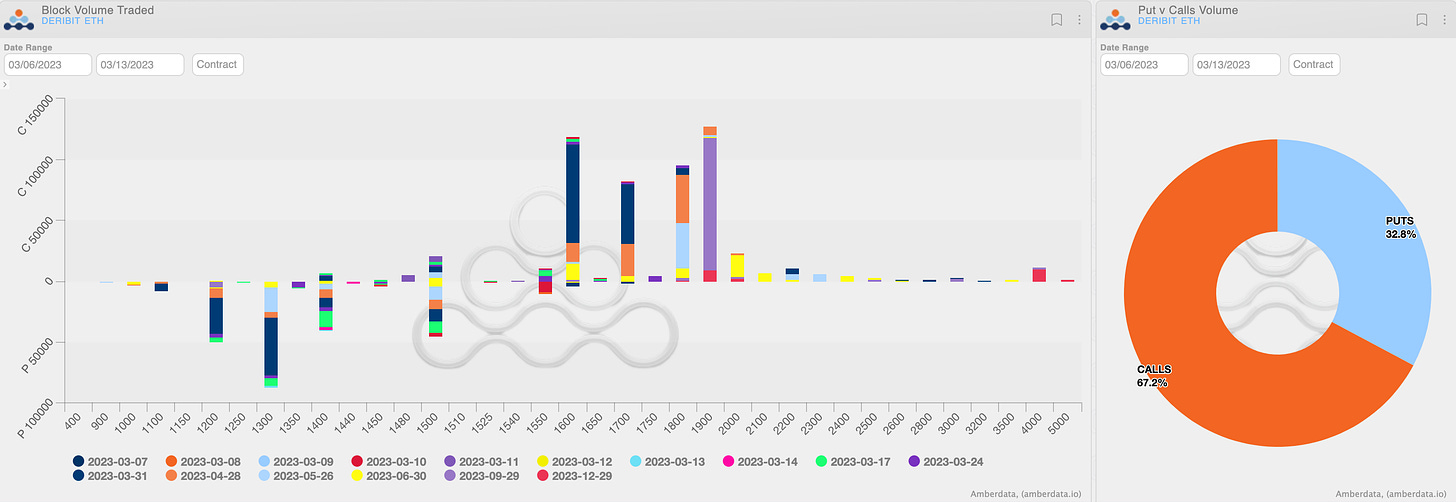

🌊 ETH Flows

ETH optionality came alive this week with some massive flows. Natural taker flows were mixed.

27k Mar 1200 Put bought

25k Mar 1300 Put bought

23k Apr 1700 Call bought

15k Apr 1600 Call bought

Worth mentioning this outsized yield play in Dec mid week too:

live feed of trading desk selling 25k of vega at all-time lows in long-dated ETH IV...

— Joshua Lim (@joshua_j_lim) March 9, 2023

Trade: ETH 29 Dec 23 4000 Call 10,000x (10,000 ETH) @ 0.0235 ETH, Vol 66.5%, Ref 1543.37, Blocked on DBT (via Paradigm) pic.twitter.com/Lv4qQR0f7y

🧵4/9

Overwriter flows

Two-way flow on the upside, with $120k vega sold via Sep 1900 calls (c/p trades ~30k contracts)...quite sizeable. These calls were sold by the large overwriter we mentioned earlier this week, mostly via the below calendar roll in multiple clips.

26k ETH Jun 1700 / Sep 1900 Call Calendar sold

58.5v vs. 59.3v

$51k net vega sold

Nice to see realized vol perform this week on the downturn in spot. 1m RV trading at 48v and 53v in BTC and ETH respectively.

Vols performed nicely throughout the weekend as market braces for a surely turbulent week ahead. Wings below lifted in chunky size.

2500x Mar 25k Call bought

2000x Apr 24k Call bought

New episode of TBP is out! 🔊

The rumors of a "flight to quality in crypto options" have been greatly exaggerated...so far!

Kyle Song from Albatross Labs joins us on #TBP this week! 🔥

We discussed recent flows and vol dynamics and how they tie into the macro picture. CME Options, and Bitcoin as Gold 2.0!

Please like and subscribe to our channel if you find these helpful!

Full Episode: 👉

Rates: The Missing Piece of the Puzzle

Latest The Macro Pulse is out ahead of a HUGE data week👇

TLDR: Broad risk conditions look supportive. If rates reverse, risk and crypto can 🚀

BTC

ETH

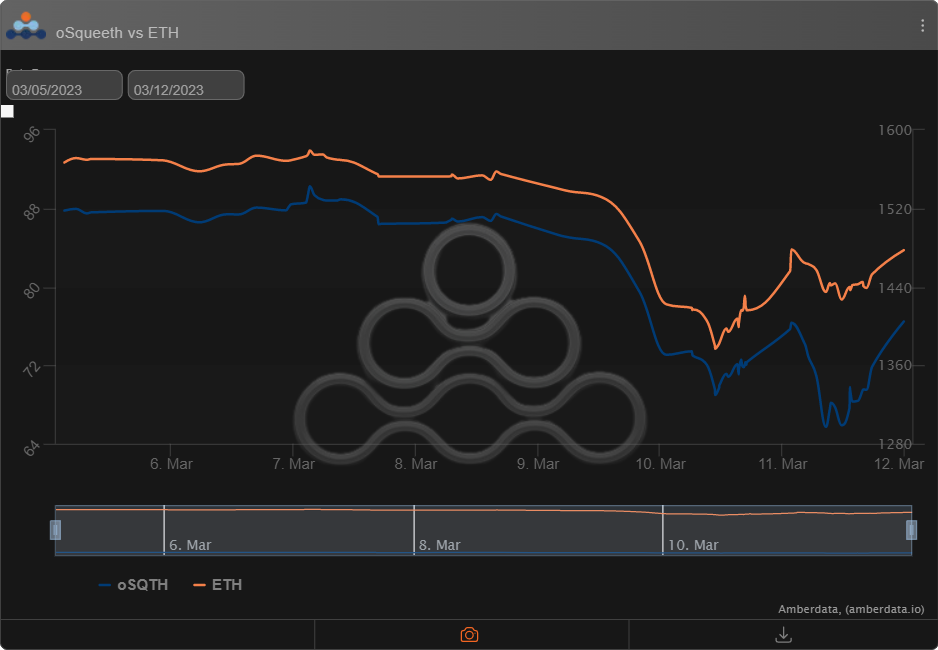

The Squeethcosystem Report (3/05/23 - 3/12/23)

What a week it was, with the fallout of Silvergate spilling into the fallout of Silicon Valley Bank markets remain active, as traders continue to monitor the USDC de-peg. ETH ended the week -5.67% and oSQTH ended the week -12.88%.

Volatility

Squeeth IV remains incredibly active trading with a theoretical value below 0 this week.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $7.17m. March 11th saw the highest volume, with a daily total of $2.04m traded. An additional $677,031 traded via OTC auctions this week.

Crab Strategy

Crab saw volatility this week due to the USDC de-peg ending the week +4.6%.

Zen-Bull Strategy

Zen-Bull also found volatility this week with the USDC de-peg ending the week +2.35%.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

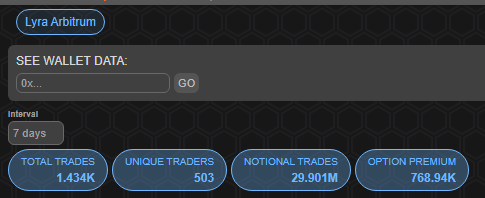

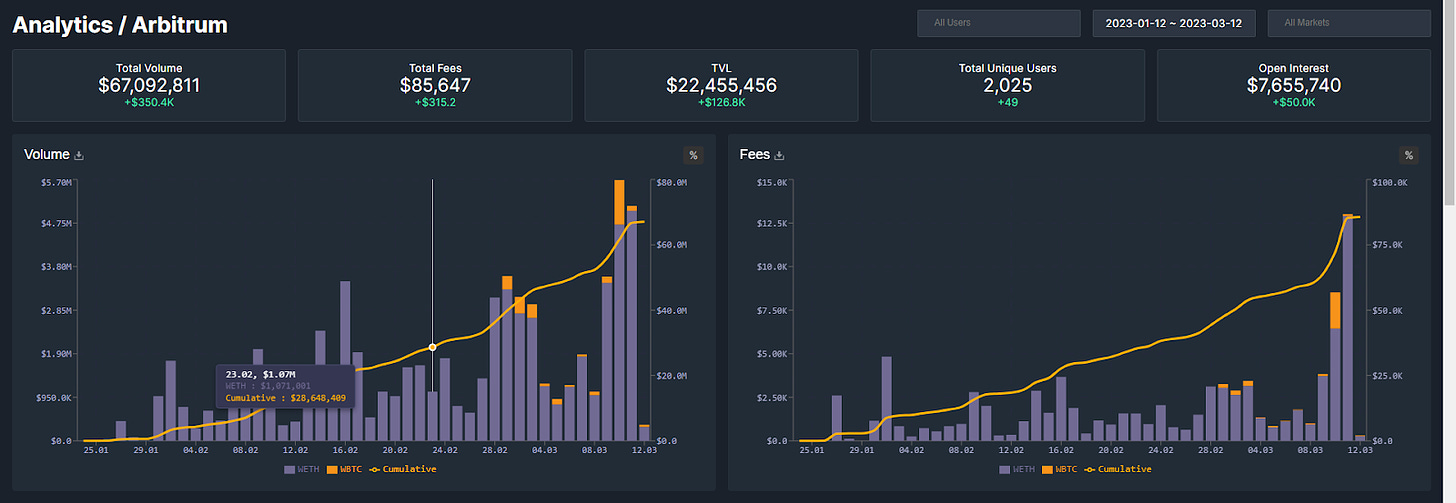

Lyra Weekly Review

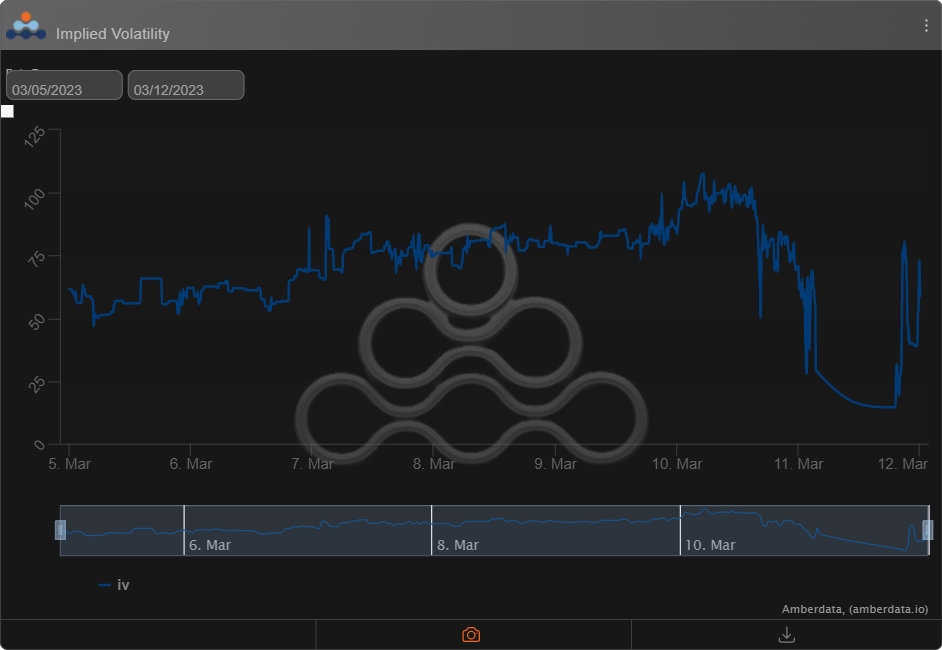

Volatility

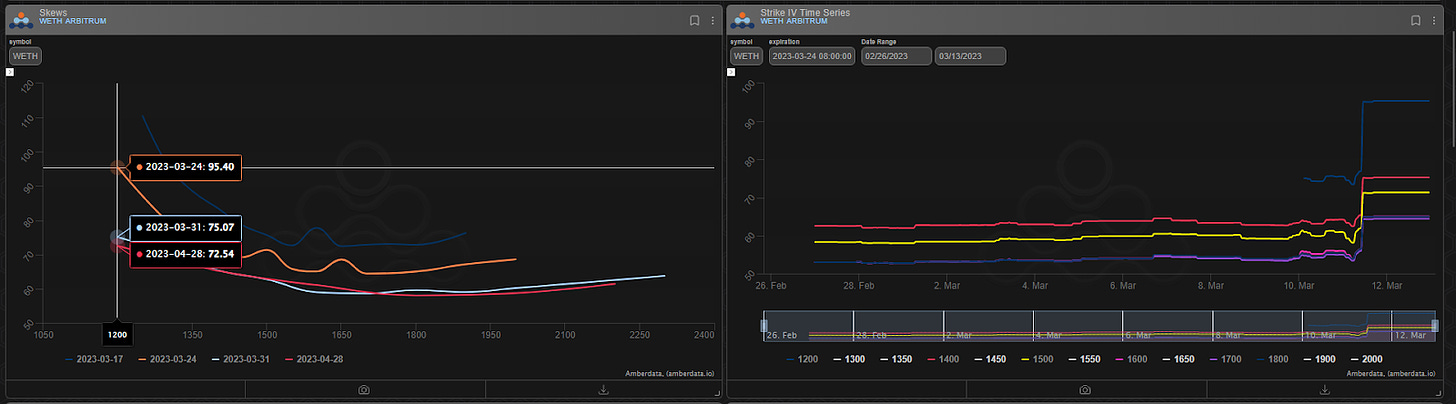

Current ATM IV is ~75% in ETH, up around 15 points on the week. Fear of the Silicon Valley Bank fallout and USDC depeg has led to heightened IVs across markets. The increase may be short-lived if realized vol fails to materialize. Markets are in backwardation with a slight discount to the call skew.

Trading

Despite market turmoil, Lyra continues to offer trading on ETH and BTC options.

Word is getting out that there's 24/7, deep, two-sided options liquidity on @arbitrum with @lyrafinance pic.twitter.com/bPCUXvHLIf

— Nick (@itseneff) March 10, 2023

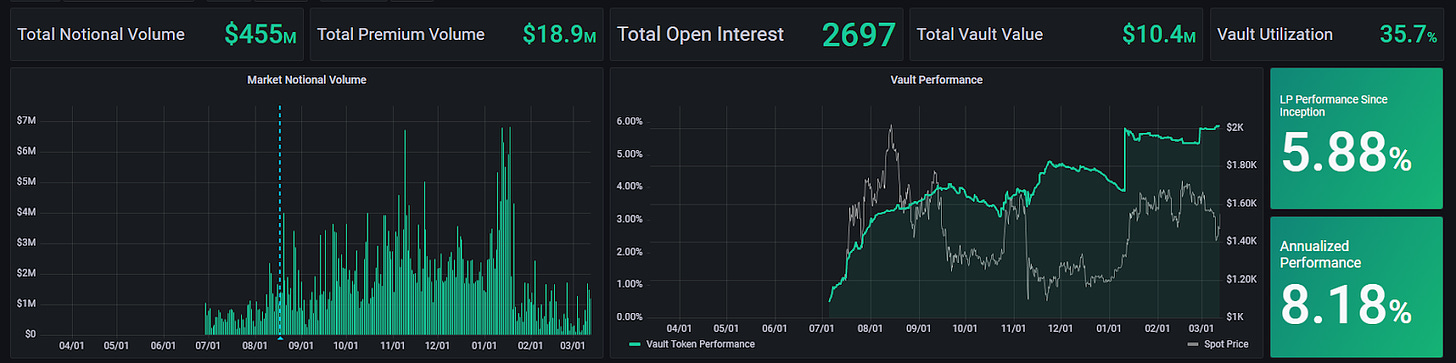

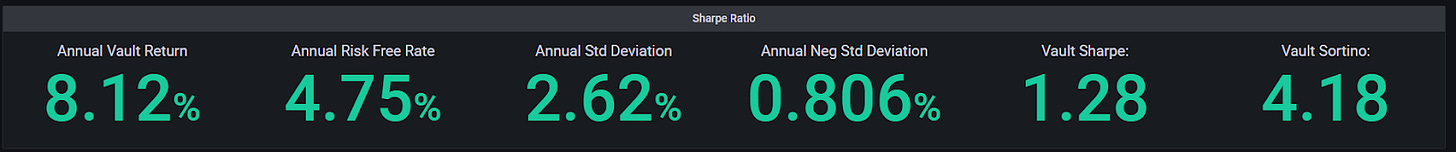

ETH Market-Making Vault

The ETH MMV on Optimism has returned +5.88% since its inception(June 28th, 2022) representing a weekly change of +.10%. Annualized performance since inception is +8.18%.

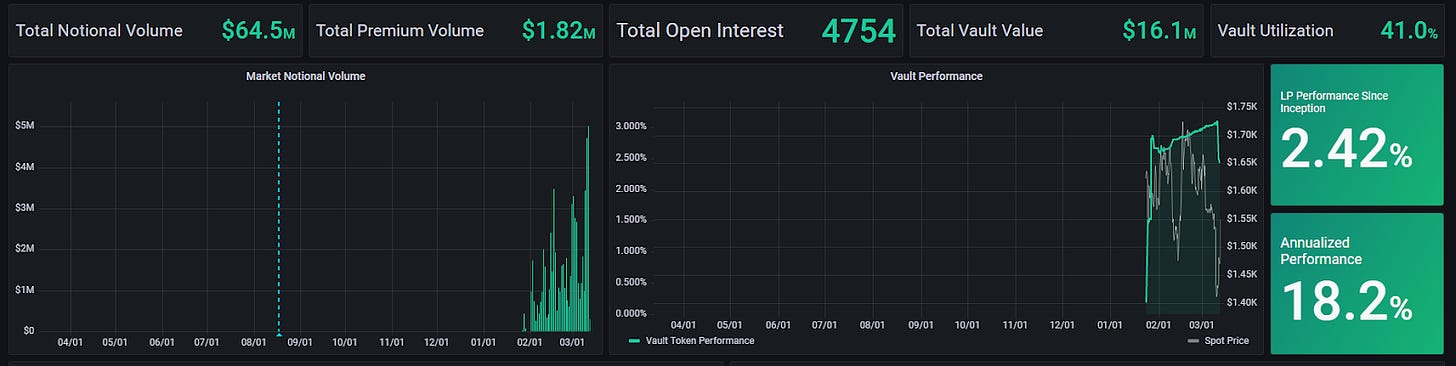

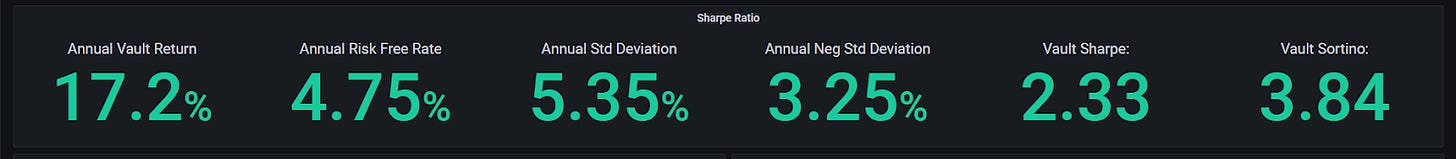

The ETH MMV on Arbitrum has returned +2.42% since its inception representing a weekly change of -.50%. The drawdown was a result of hedger fees charged by GMX for USDC-based hedges during the depeg event. Annualized performance since inception is +18.2%

Depositors earn an additional 9.09% rewards APY, boosted up to 18.18% for LYRA Stakers on Optimism or 16.07% boosted up to 32.14% for LYRA Stakers on Arbitrum (new).

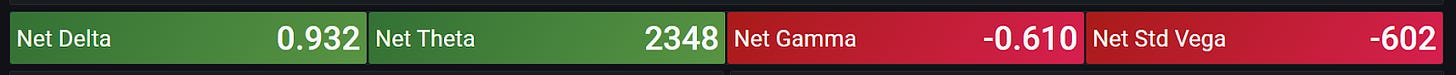

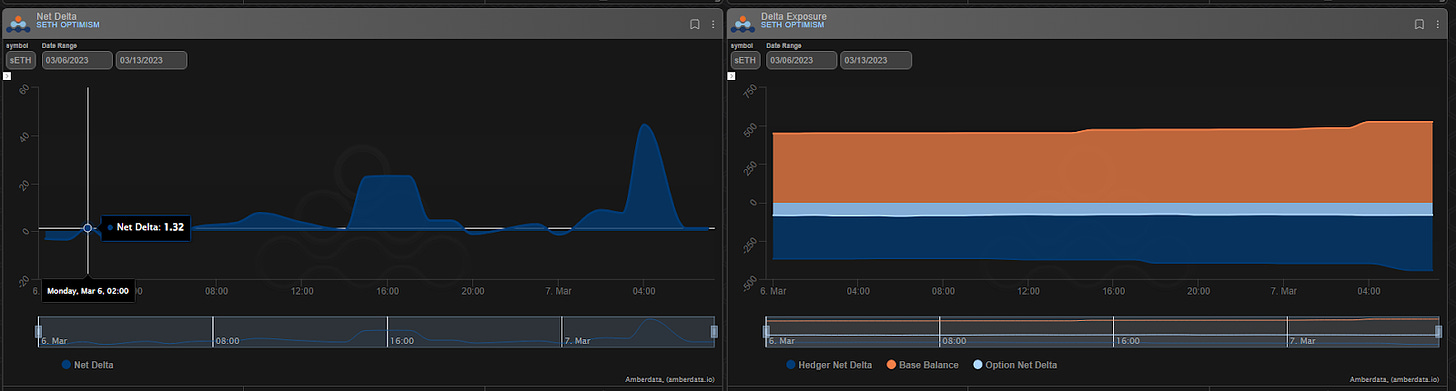

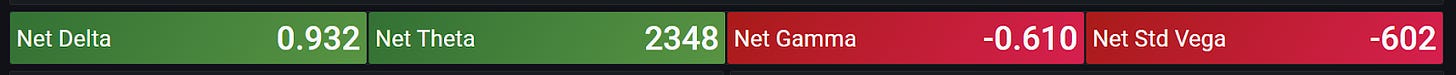

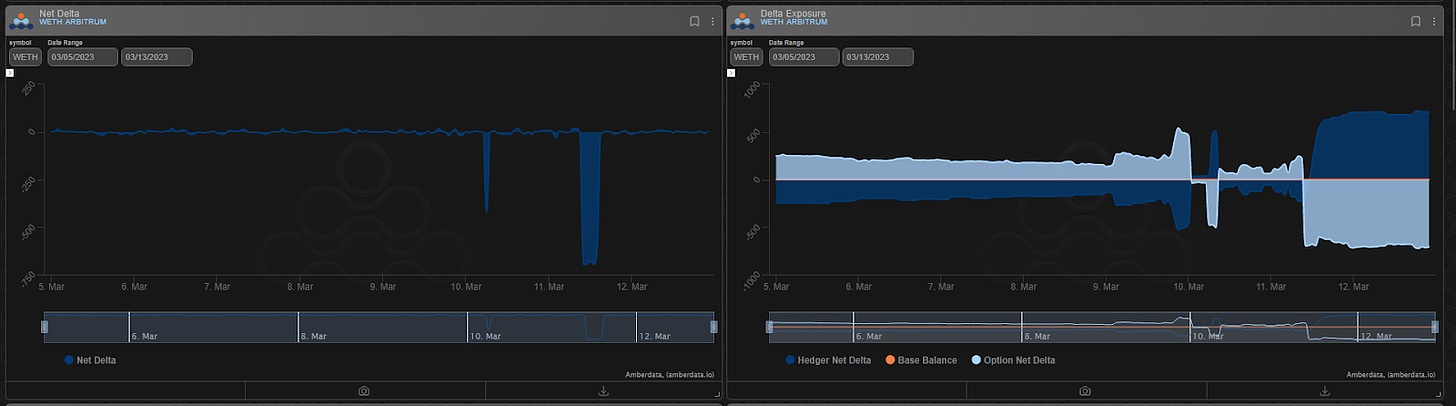

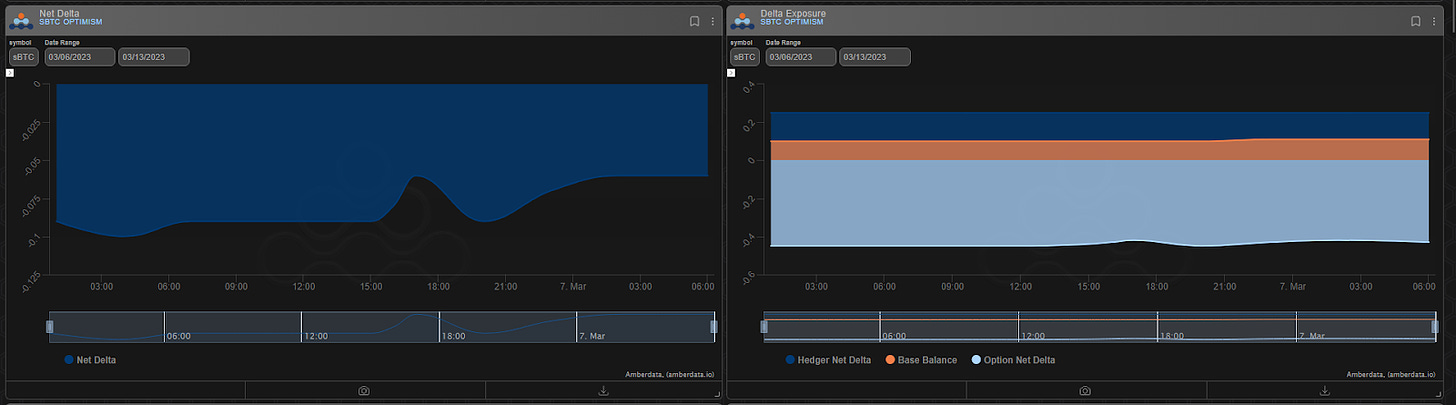

Net MMV Exposure:

Both ETH vaults are short gamma/vega with Optimism holding more long units. The Arbitrum ETH MMV was briefly blocked from hedging during high volatility but has since been able to hedge to delta neutral.

Optimism:

Arbitrum:

BTC Volatility

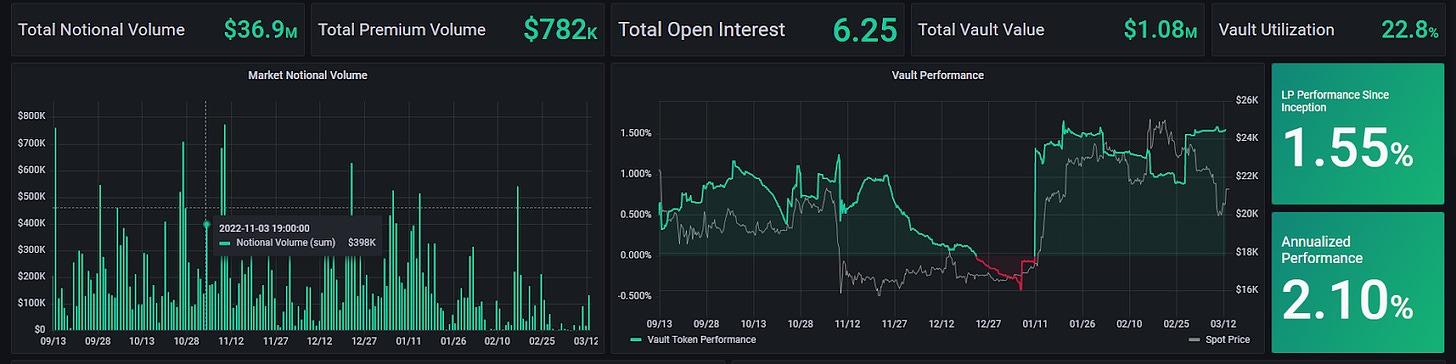

BTC Market-Making Vault

Lyra’s BTC MMV has returned +1.55% since its inception (August 16th, 2022). This represents a weekly change of +0.02%. Annualized performance since inception is +2.1%.

Depositors earn an additional 11.1% rewards APY (boosted up to 22.2% for LYRA Stakers)

Net BTC MMV Exposure:

🟠 WBTC-USDC Option Market Now Live 🟠

— Lyra (@lyrafinance) March 1, 2023

Access 24/7 option liquidity on @Arbitrum directly from your wallet.

➡️ https://t.co/wx07LdLe40 pic.twitter.com/xBUXDpoPYj

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...