.png)

-

Tuesday 10:00am ET - Fed Chairman Powell testifies to Senate

-

Wednesday 8:15am ET - ADP employment

-

Wednesday 2pm ET - Beige Book

-

Thursday 10:00am ET - Fed Gov Waller speaks

-

Friday 8:30am ET - NFP

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math minded people here, pardon any typos.

THE BIG PICTURE THEMES:

Last week we had multiple appearances by various Fed members speaking.

We have our next FOMC meeting on March 21 & 22.

The big theme running the markets this week will be whether we’re in line for another 25bps hike or 50bps hike. Friday’s NFP release will be a big clue into the direction.

In crypto-specific news, we’re seeing some regulatory scrutiny around Binance and Binance.us. It’s starting to look like Binance.Us wasn’t separated enough from Binance.com which could make the entire Binance ecosystem subject to US regulatory jurisdiction. This might not be a big deal and mean little more than a few settlement fines, but it’s hard to tell. Something to follow.

Lastly, this week we have the bank of Canada announcing their latest rates decision.

BTC: $22,422 -4.58%

ETH :$1,567 -3.95%

SOL: $21.14 -9.59%

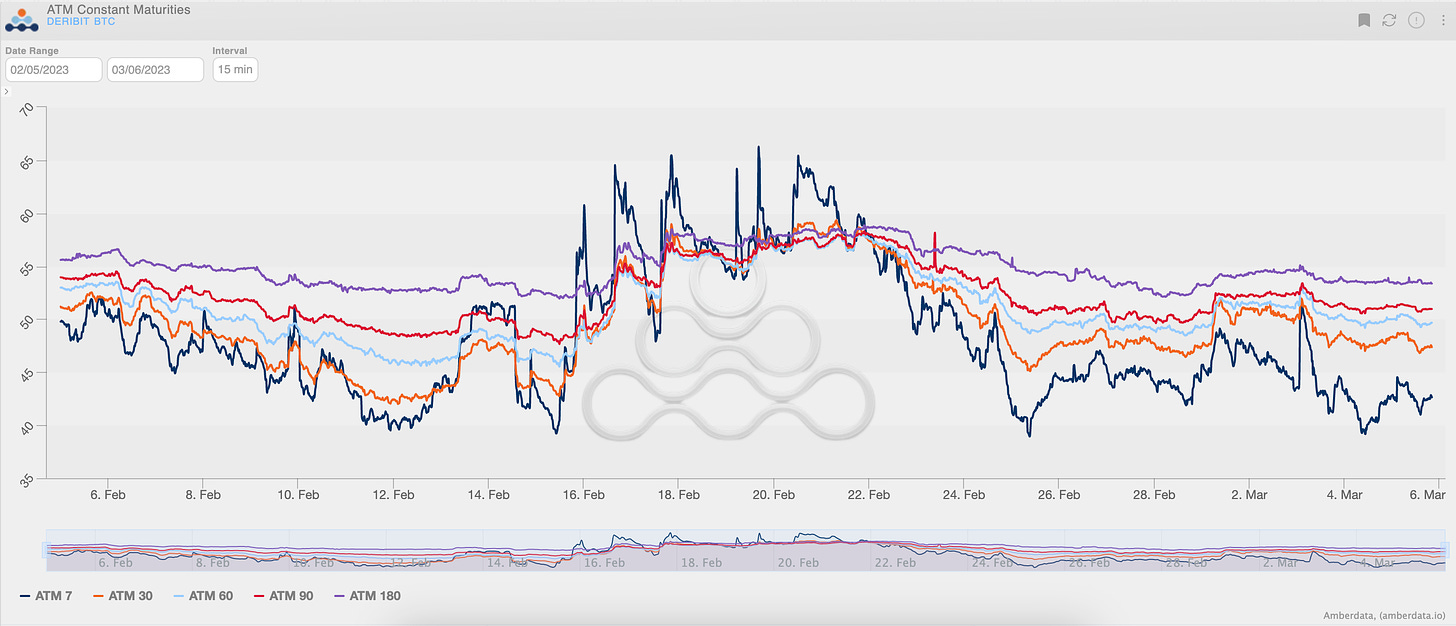

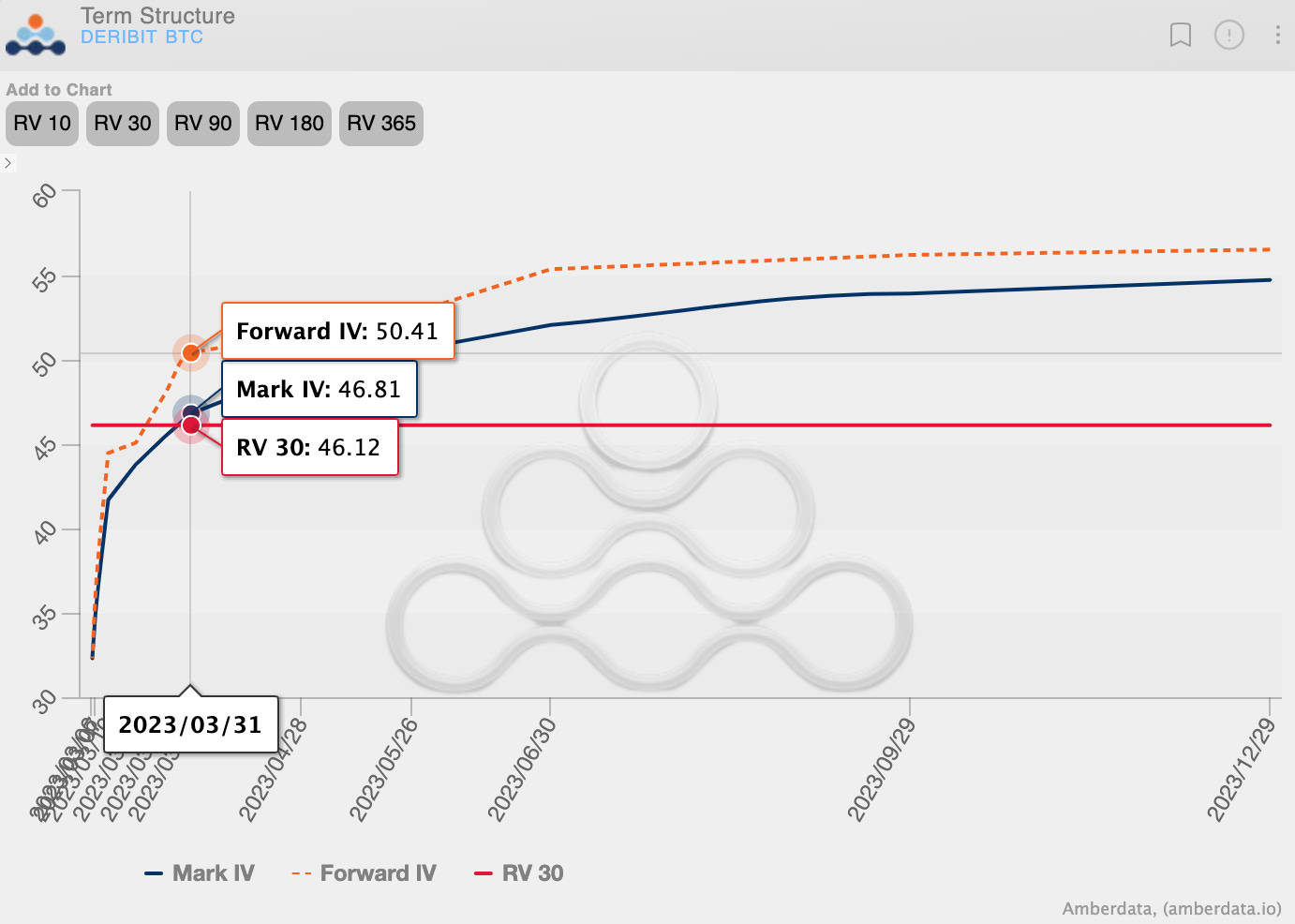

TERM STRUCTURE

(March 5th, 2023 - BTC Term Structure - Deribit)

Implied volatility continues to soften as spot prices decline.

We had a sharp decline in spot prices for BTC on Thursday from $23.5k → $22.5k, but this barely increased IV.

You can see a quick spike higher in 7-day IV during the drop but IV was quickly sold back down and the term structure remains in a strict Contango shape.

The term-structure “Roll-down” is greatest between 30days → 7-days (for fixed maturities) and most pronounced for the 3/31 actively traded expiration, as depicted by the forward volatility.

All in all, I continue to think that implied isn’t very expensive, and given the spot/vol. dynamics, slightly OTM calls could be a good buy.

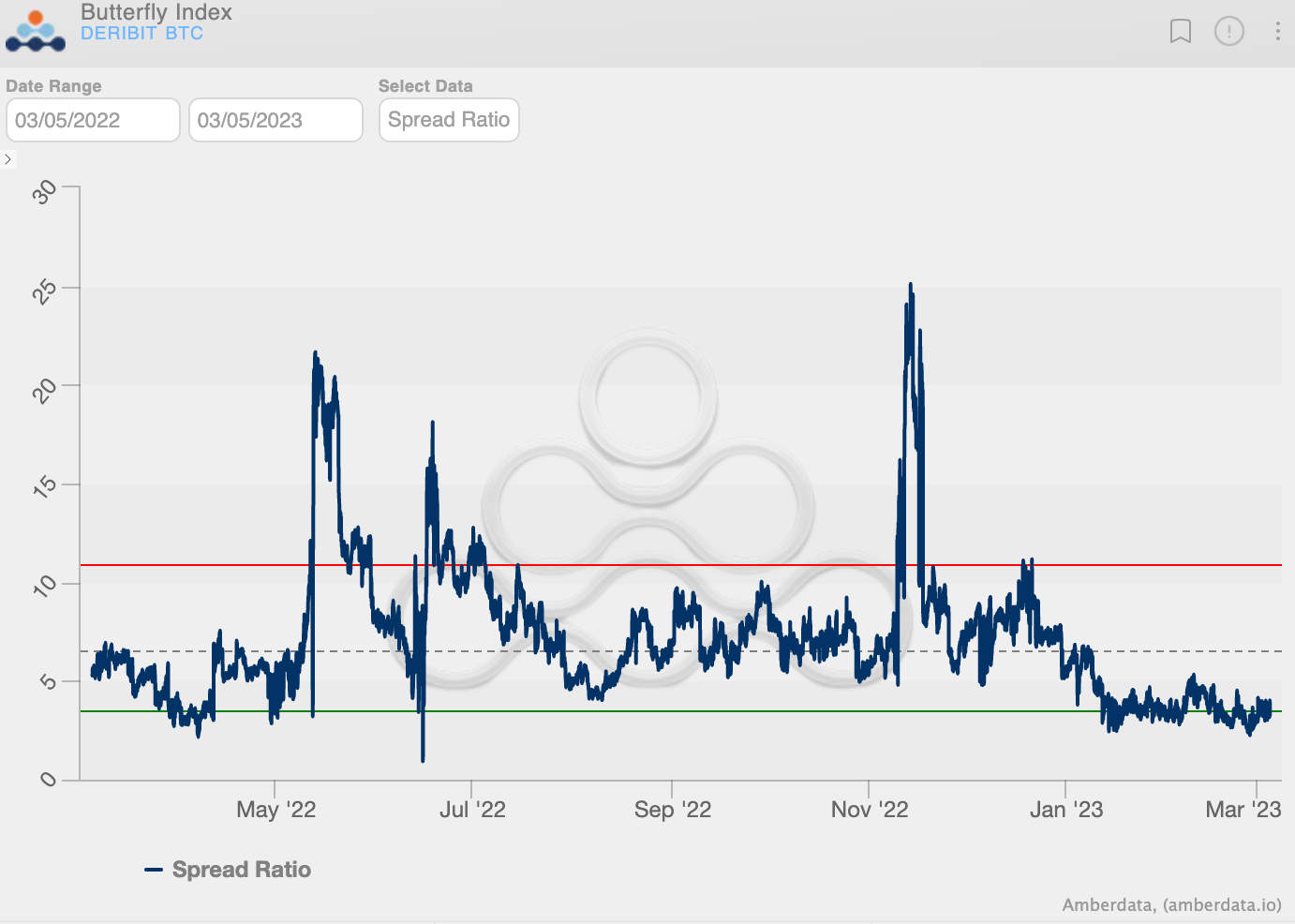

SKEWS

(March 5th, 2023 - BTC RR SKEW (C-P) ∆25 - Deribit)

Echoing my sentiment above with respect to interesting OTM call purchases, we can see the DVol/ATM30 ratio is showing cheap wings for 30-days out.

The current reading is in the lower 10% percentile for the entire dataset.

30-day and 7-day RR-Skew is now negative, but I’d think this could quickly rip higher should macro markets move higher, dragging BTC higher along with it.

I continue to think that 6-month RR-skew is a decent sale.

Traders could package both ideas together.

In the short-term, the downside momentum for BTC prices seems lackluster.

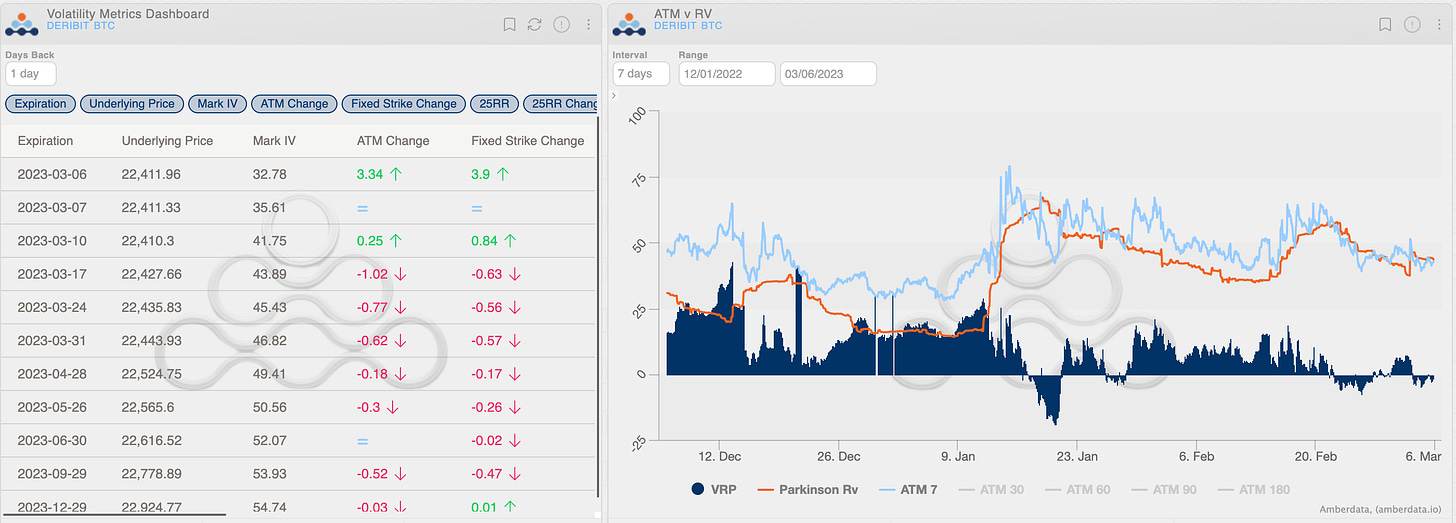

VOLATILITY PREMIUM

(March 5th, 2023 - BTC IV-RV)

We’ve updated the above VRP chart to display the richness/discount of VRP, using dark blue histogram bars to highlight the net difference.

All in all, the VRP looks to be at a 90-day minimum and therefore, provides fair value convexity to long vol. traders.

This continues to be the logical play.

TLDR: Long vol, using slightly OTM options on the call side.

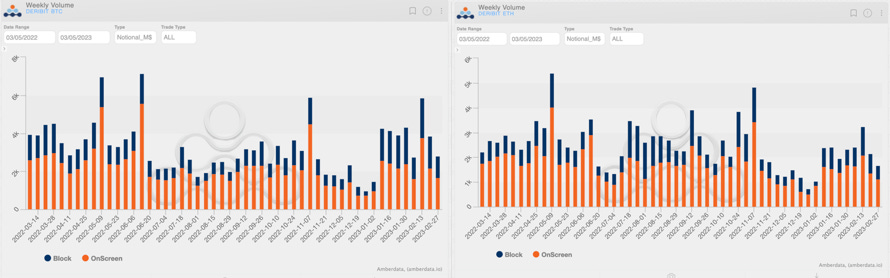

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

The declining volumes this week reflect the lack of clear price directionality.

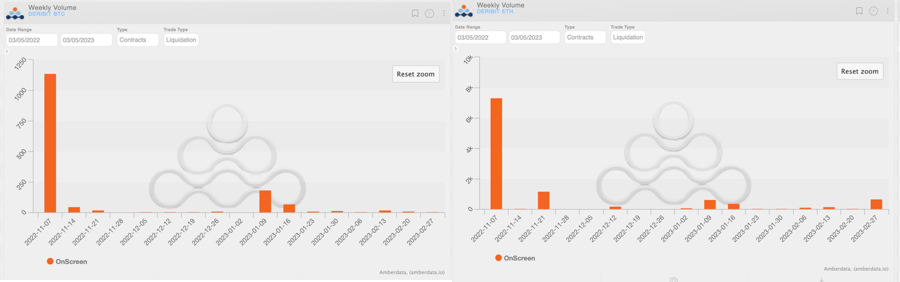

The sell-off on Friday caught ETH traders unprepared, with not negligible liquidations. Phenomenon completely absent on BTC. This says a lot about the different leverage and approach between the two.

(BTC vs ETH Weekly Volumes Notional - Options Deribit Historical Section)

(BTC vs ETH Weekly Volumes Liquidations Contracts - Options Deribit Historical Section)

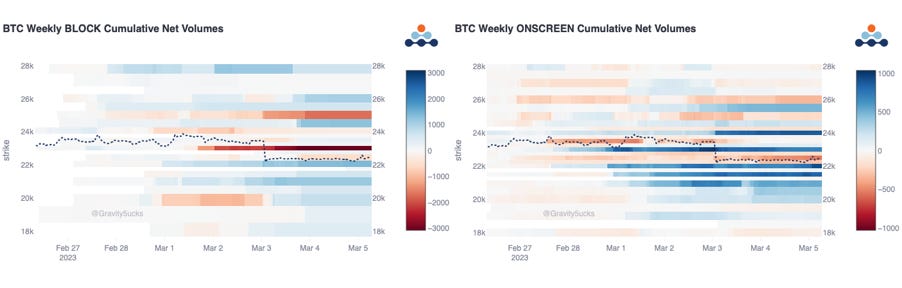

Heat maps highlight the search for protection in strikes $22k-$20k, anyway, it is difficult to find top trades in this pale week.

The reaction for the loss of $23k support was rather contained, both for the impact on volatility and for the opening of new positions.

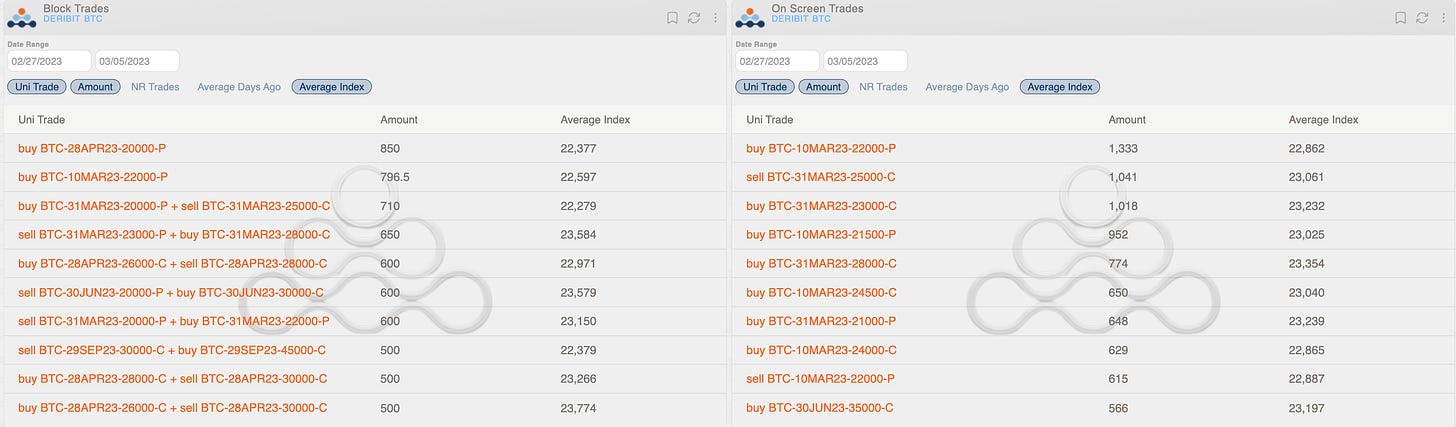

(BTC AD Direction tables with uni_trade - Options Scanner section)

(BTC AD Heatmaps)

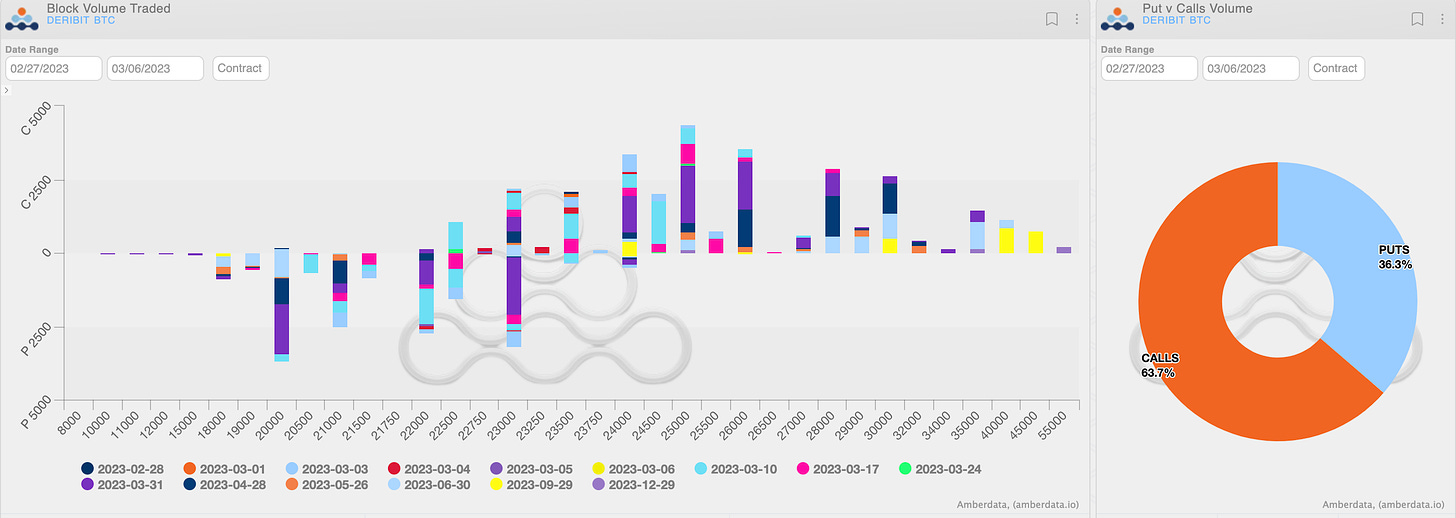

Paradigm Block Insights (27Feb - 05Mar)

Crypto majors underperform equities following the Silvergate 10k delay. Buyers of downside on the sharp move lower and topside convexity were the two main flow themes.

BTC -4.5% / ETH -4.5% / NDX +1.5%

Some takers buying call wings against near the money options (roughly vega neutral). We like owning upside convexity, given elevated spot/vol correlation and dealer short gamma if spot can break out.

Some of the aforementioned convexity flows expressed via call ratios last week (bought wing).

BTC

500x Sep 30k/45k 1x1.5 CR sold

400x Sep 24k/40k 1x2 CR sold

200x Jun 25k/35 1x2 CR sold

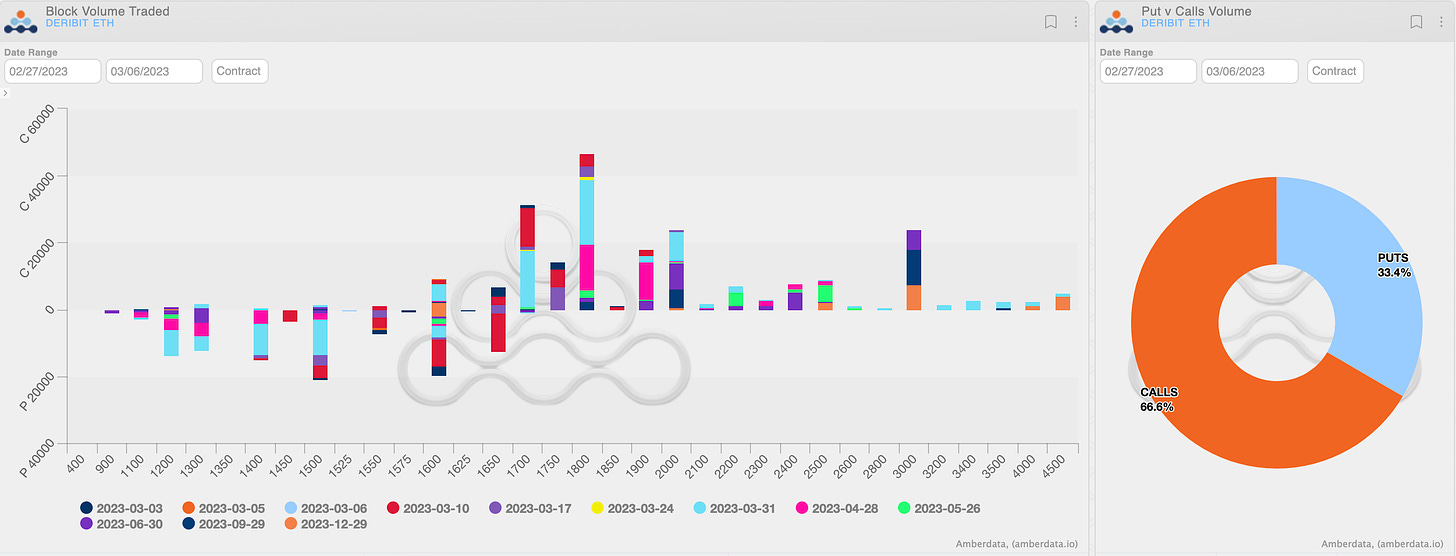

ETH

10k Jun 2500/3500 1x3 CR sold

5k Sep 2000/3000 1x2 CR sold

Buyers of downside on the sharp move lower following the Silvergate 10k delay.

850x 28-Apr-23 20000 Put bot

500x 31-Mar-23 20000/25000 Bear Risk Reversal bot

With spot and implied vols depressed after the selloff, takers took advantage, tactically buying short-dated vol and upside:

500x 28-Apr-23 26000/28000 Call Spread bought

300x 17-Mar-23 21500/23500 Strangle bought

Profit taking:

10000x 10-Mar-23 1650 Put sold

New TBP is out! Our #1 most-viewed guest is back on #TBP, and he did not disappoint! Gordon Grant from Genesis Trading walks us through the Bull Regime we find ourselves in and so much more! Please like and subscribe to our channel!

https://t.co/xP2bXi5O2Y

Latest thoughts in The Macro Pulse👇. TLDR: Cautious short term with cross-asset macro at pivotal lvls. No change to positive medium term outlook on peak inflation, peak Fed 🚀.

https://paradigm.co/blog/the-macro-pulse-watching-and-waiting

BTC

ETH

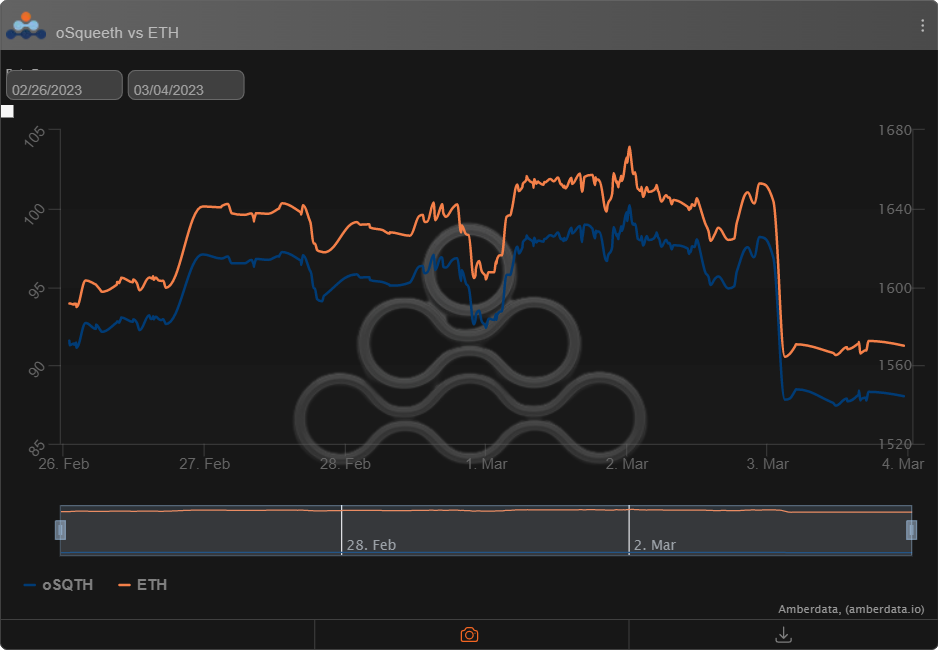

The Squeethcosystem Report (2/26/23 - 3/04/23)

With what was supposed to be a relatively quiet week, markets ended in fireworks without warning. Most of the market action came in hours on Thursday night as liquidations piled up. ETH ended the week -1.35%, and oSQTH ended the week -3.87%.

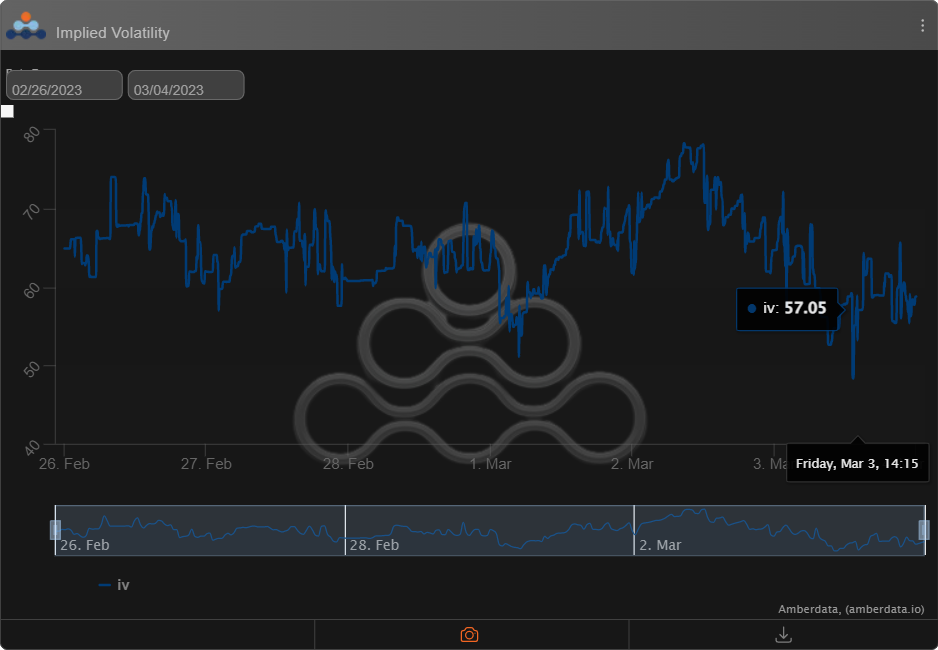

Volatility

Squeeth IV remains range bound between the mid-50s and upper-60s, creating an excellent environment for both the Crab and Zen-Bull. Squeeth continues to be a great opportunity for vol traders looking to sell some expensive IV relatives to its replication (reference vol).

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $2.06m. March 3rd saw the highest volume, with a daily total of $578.29k traded. An additional $551,746k traded via OTC auctions this week.

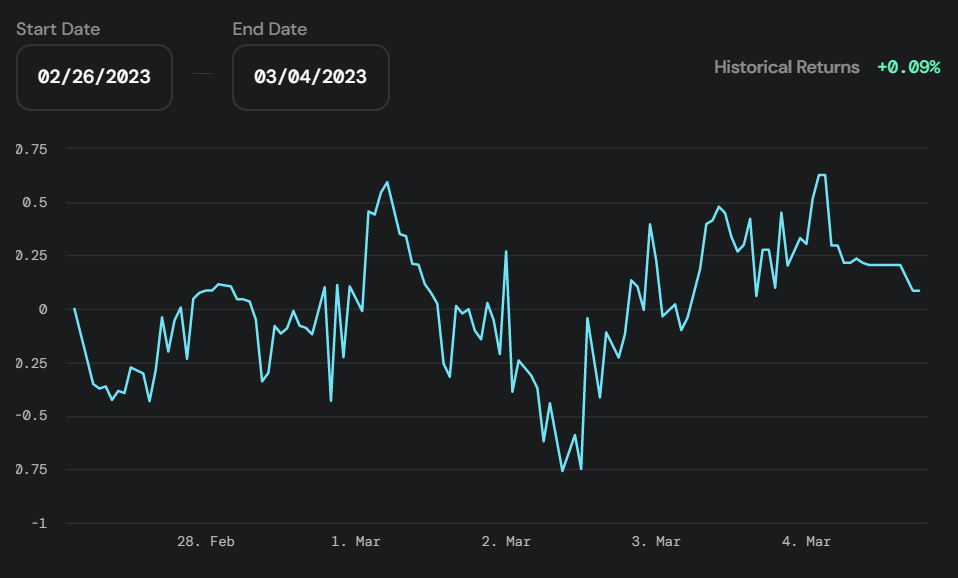

Crab Strategy

Crab continues to benefit from the lack of volatility in markets, returning +0.09% more USDC to depositors.

Zen-Bull Strategy

Zen-Bull also benefited from a lack of market volatility, stacking +0.10% more ETH for depositors.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...