.png)

USA Week Ahead:

-

Monday 10am ET: ISM Services Index

-

Friday 8:30am ET: Producer Price Index

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math minded people here, pardon any typos.

TALENT CORNER - Crypto Vol. is a small space! Given the FTX meltdown taking down companies, we’re highlighting vol. traders who could be a good fit at new company.

Mark Treinkman: https://www.linkedin.com/in/mark-t-4492735a/

THE BIG PICTURE THEMES:

The market is expecting a +50bps hike for this month’s FOMC rate decision.

Powell has signaled some slight softness around this next rate hike, which has sent markets substantially higher, giving legs to the “Santa Rally” this year.

On the flip side, NFP this week came in strong.

We have 3.7% unemployment and +282k jobs, along with strong wage growth (5.1% YoY).

Everything taken together suggests a mixed bag.

The Fed wants to see what happens to the economy, given that the effects from rate hikes have a lag, but as long as the job market remains strong and wage-growth high, we are going to see higher rates for longer.

Crypto:

The Crypto contagion situation is still unknown.

Vol. has completely retraced (I know, I know, I wasn’t willing to sell it) and spot prices are recovering slightly with other risk assets.

All in all, I expect DEC to be bullish, given the seasonality and the macro market tail-winds.

That’s my theme this week.

BTC → Heading back towards $20k.

BTC VOL → Remains soft.

Medium to long-term, there’s likely more pain coming in 2023.

Rates, Regulation and Recession.

BTC: $17,130 +4.17%

ETH :$1,280 +7.12%

SOL: $13.72 -2.82%

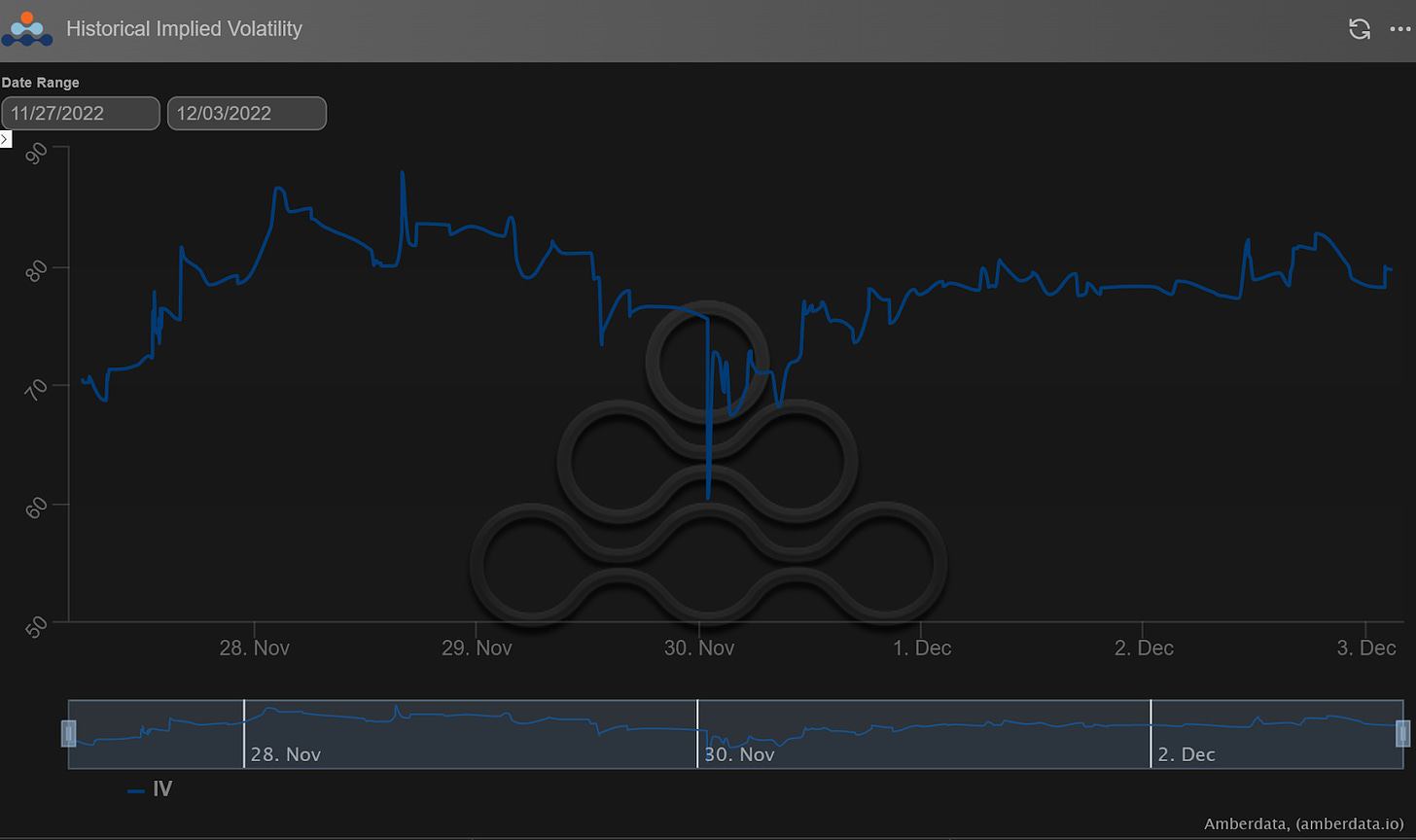

DVOL: Deribit’s volatility index

BTC - (365-days w/ spot line chart)

Notice that spot prices essentially consolidated near FTX lows.

This consolidation was enough to crush HV and bring the DVOL back near annual lows.

The macro vol. environment is also very soft, with VIX at 19 and GOLD vol. (GVZ) around 15pts.

Across the board, DEC seems to be a vol. crush for all assets classes and an outlier in Crypto.

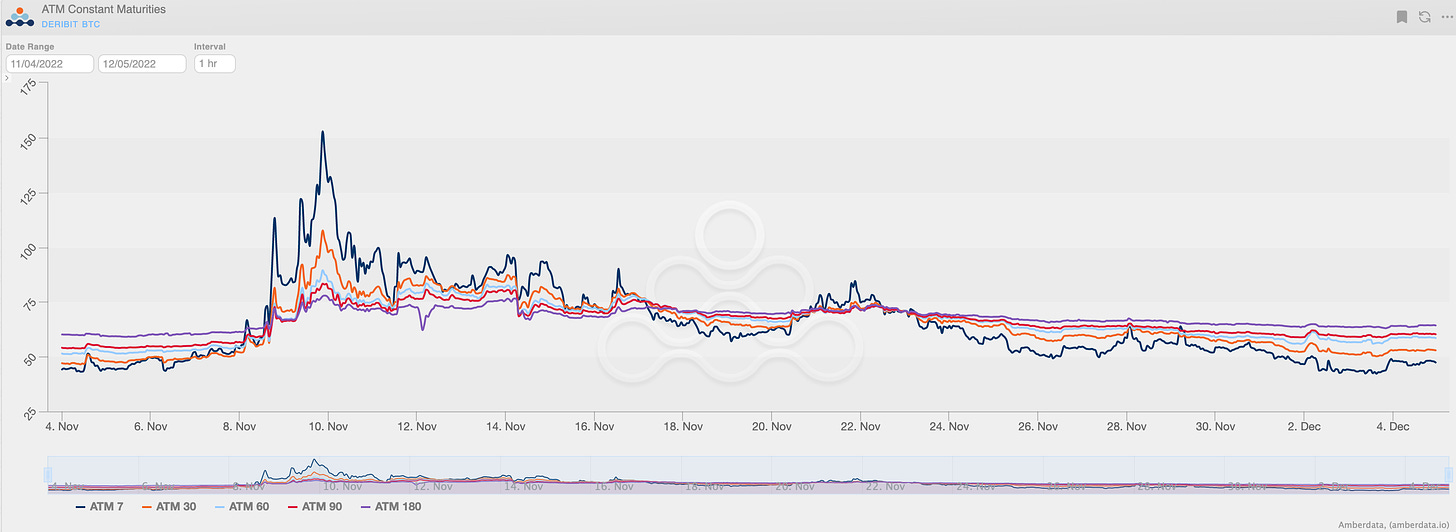

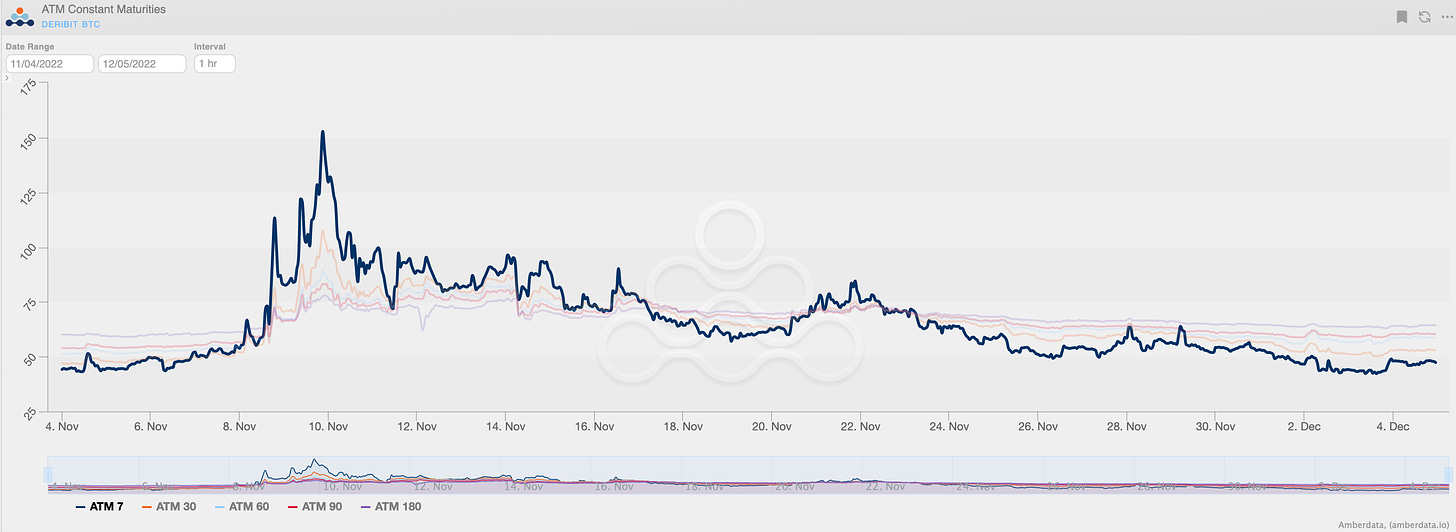

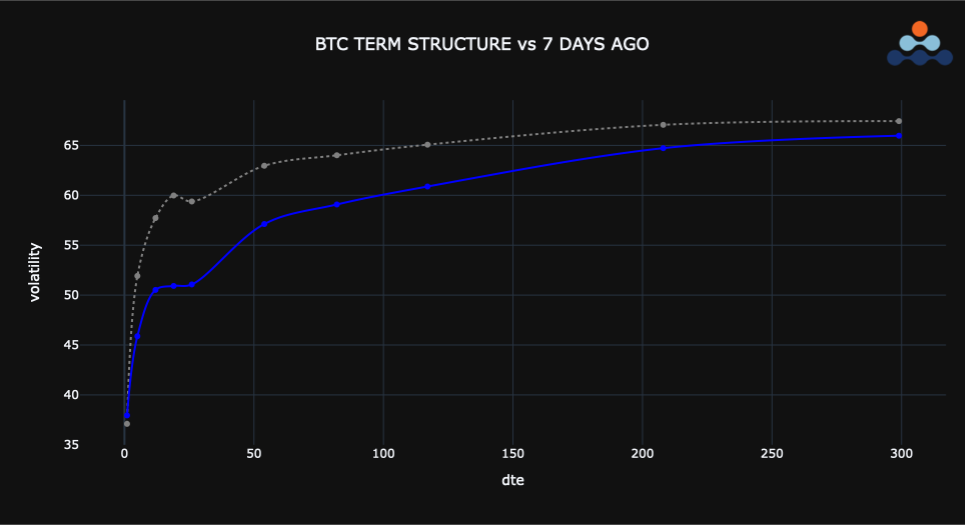

TERM STRUCTURE

(Dec. 4th, 2022 - BTC Term Structure - Deribit)

(7-day highlight)

We can see that the BTC term structure continues to drop as BTC prices hold steady.

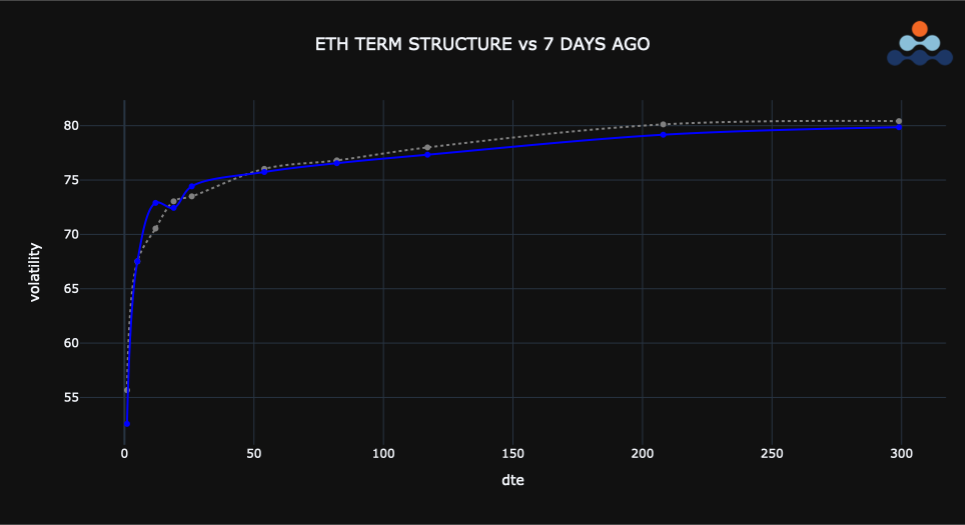

The ETH term structure hasn’t moved much WoW, but starting around 30-days until EXP. the term structure quickly drops… This is a very steep Contango shape.

Combining the steep term structure with the potential “spot-bullish” December month, buying EOY call flies, using 12/30/2022 expiration, which could provide decent upside spot exposure and gain from the IV term structure shape.

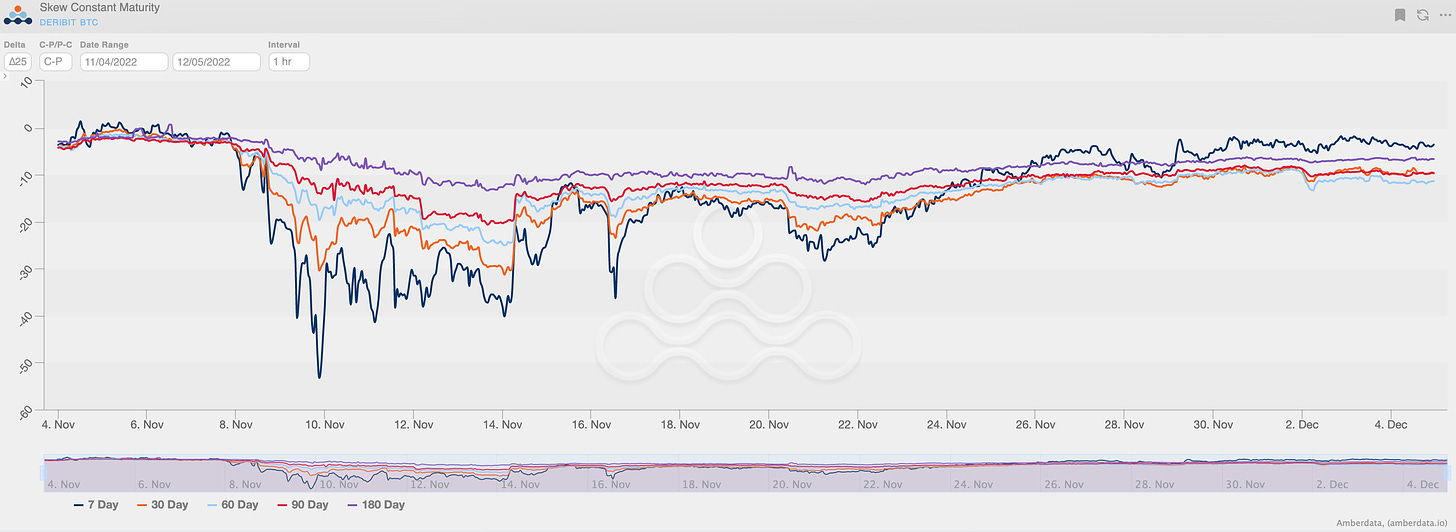

SKEWS

(Dec. 4th, 2022 - BTC RR SKEW (C-P) ∆25 - Deribit)

(7-day highlight)

BTC RR-SKEW is being led higher by short-term options.

7-day weekly expiration has had a massive reversal since the FTX meltdown.

We’re seeing traders price-in symmetry between the upside/downside spot/vol relationship.

However, I expect $20k to provide substantial spot resistance as previous support become future resistance, if BTC prices can get there this month.

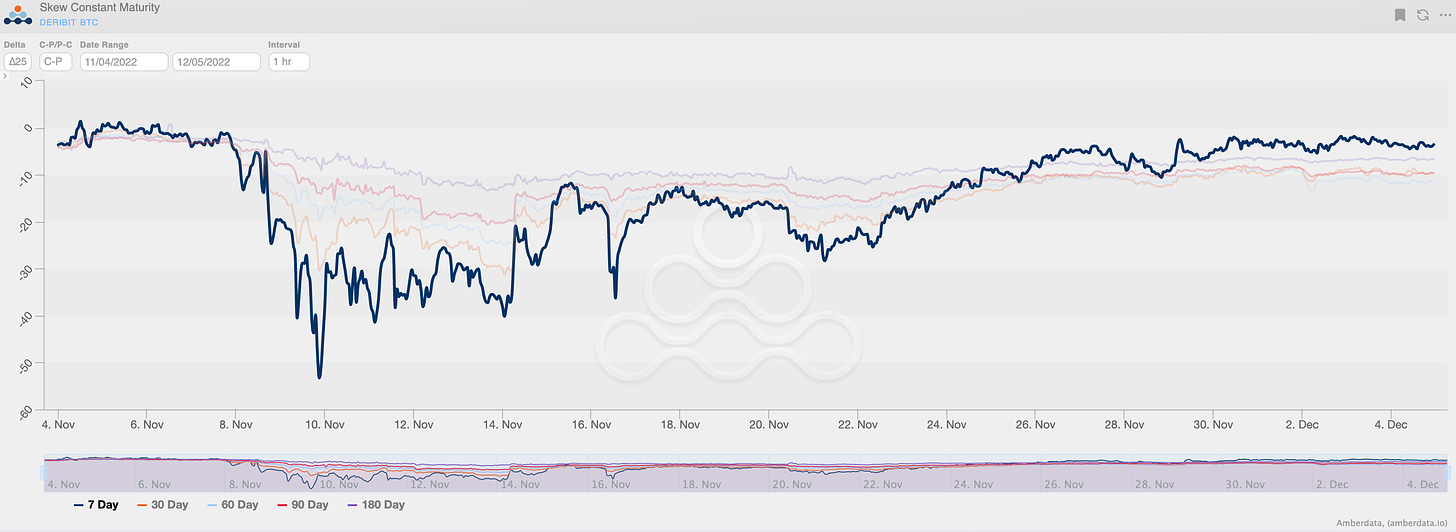

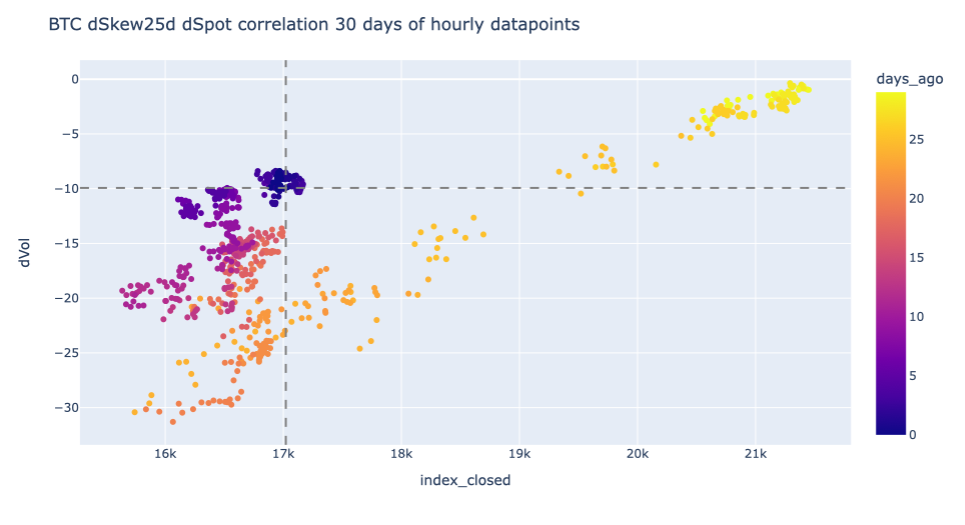

(30-day, 25∆ BTC RR-Skew)

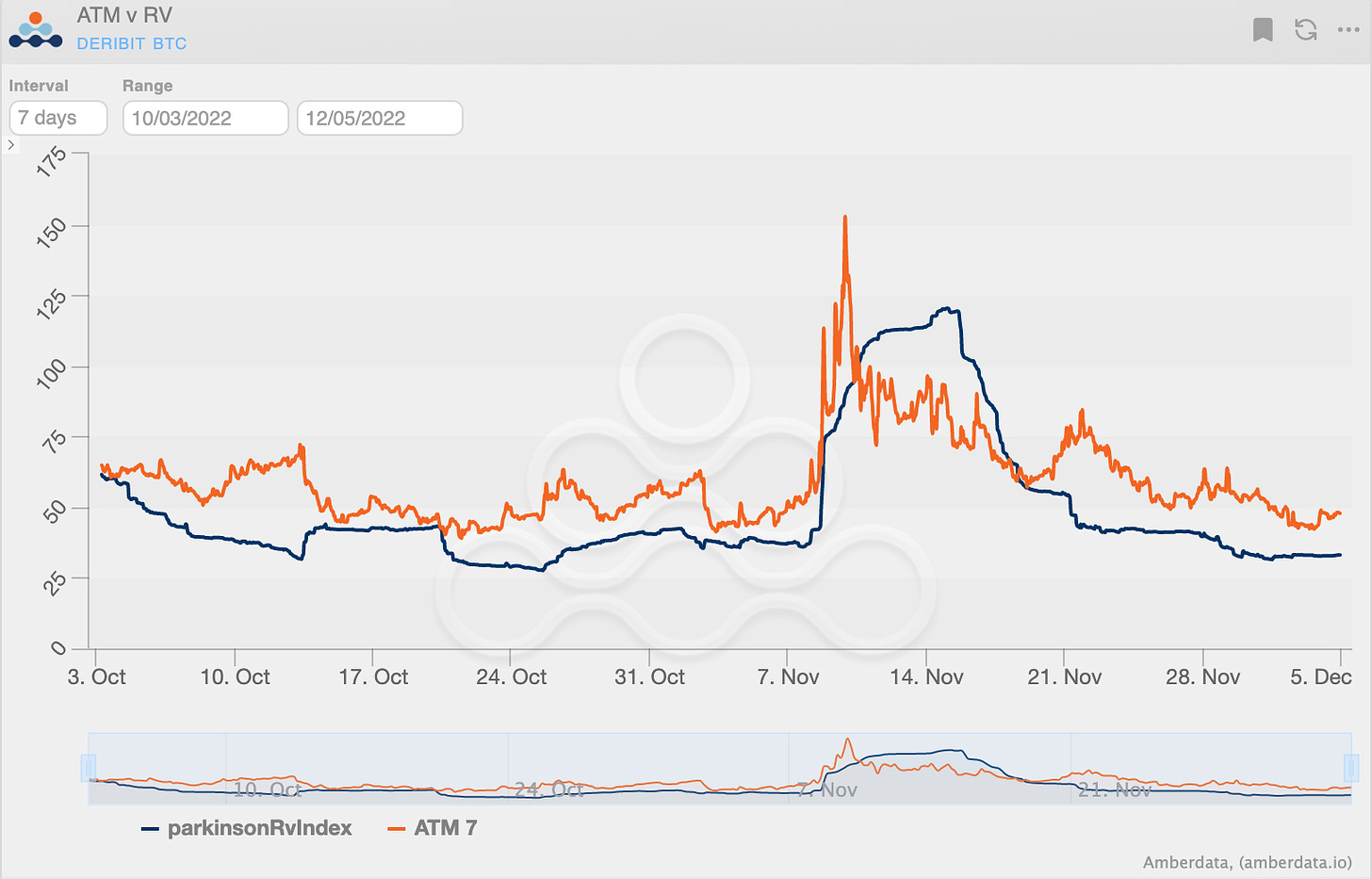

VOLATILITY PREMIUM

(Dec. 4th, 2022 - BTC IV-RV)

VRP is back.

HV has completely fallen off a cliff, unaffected by BlockFi’s bankruptcy or Genesis Trading issues, as BTC spot prices have consolidated.

As scary as the fundamental situation for crypto seems, options are officially “expensive”, given the lack of HV.

The only non-degen trade that makes sense to me right now, is EOY call flies. Should Vol. come back or prices crash, there wouldn’t be too much damage done from flies.

I could see prices slowly climb higher throughout the month until EOY expiration.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @fb_gravitysucks

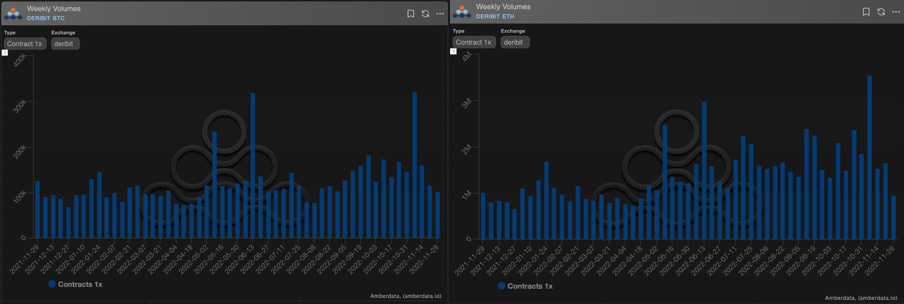

Weekly volumes down since September (if we exclude the weeks of FTX chaos), just below the average annual value. After the merge, Bitcoin continues to outperform, with +50% premium/notional vs Ethereum.

(Deribit Historical - Historical contracts volume- BTC vs ETH)

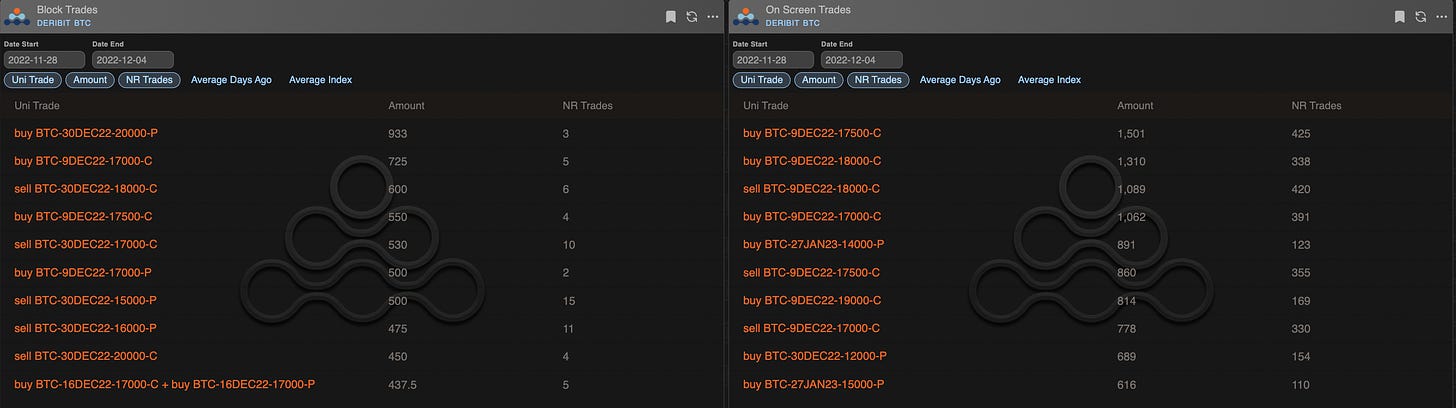

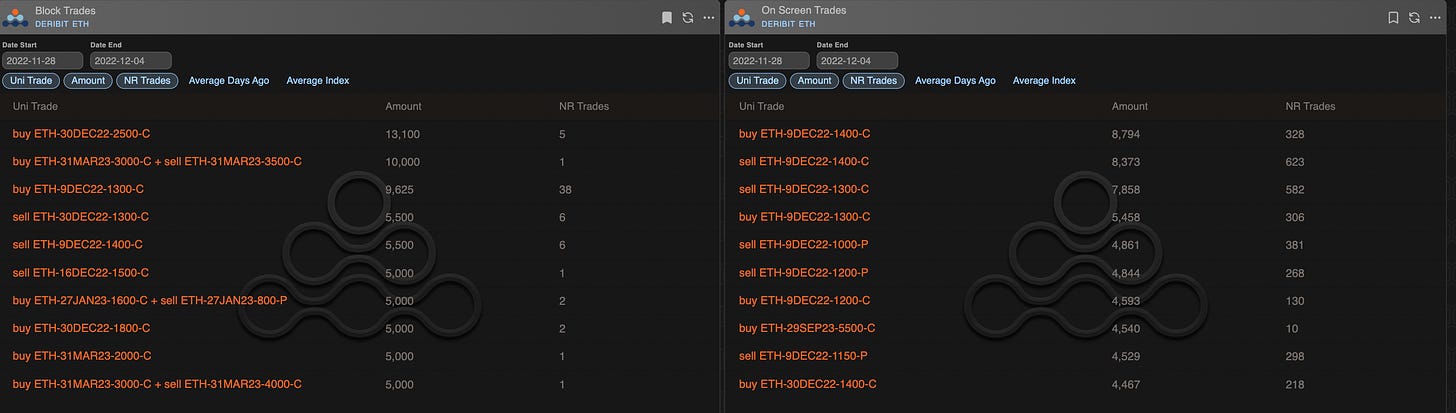

In recent newsletters we have talked about the difficulty of reading the flow correctly, but this week it is as if some of the fog has cleared and now the trades have gained more consistency.

The dominant flow was buying calls (even if with many strikes with a two-way interest) predominantly on December. However, the rather limited concentrations show that the "business is not back to normal".

(BTC AD direction table with uni_trade - Options Scanner section)

(ETH AD direction table with uni_trade - Options Scanner section)

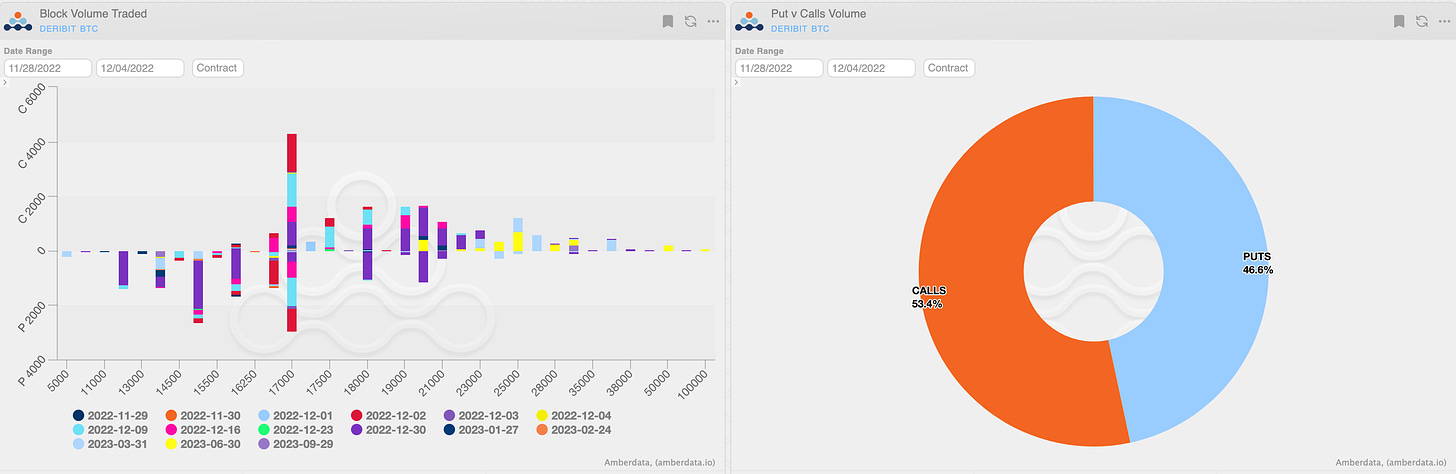

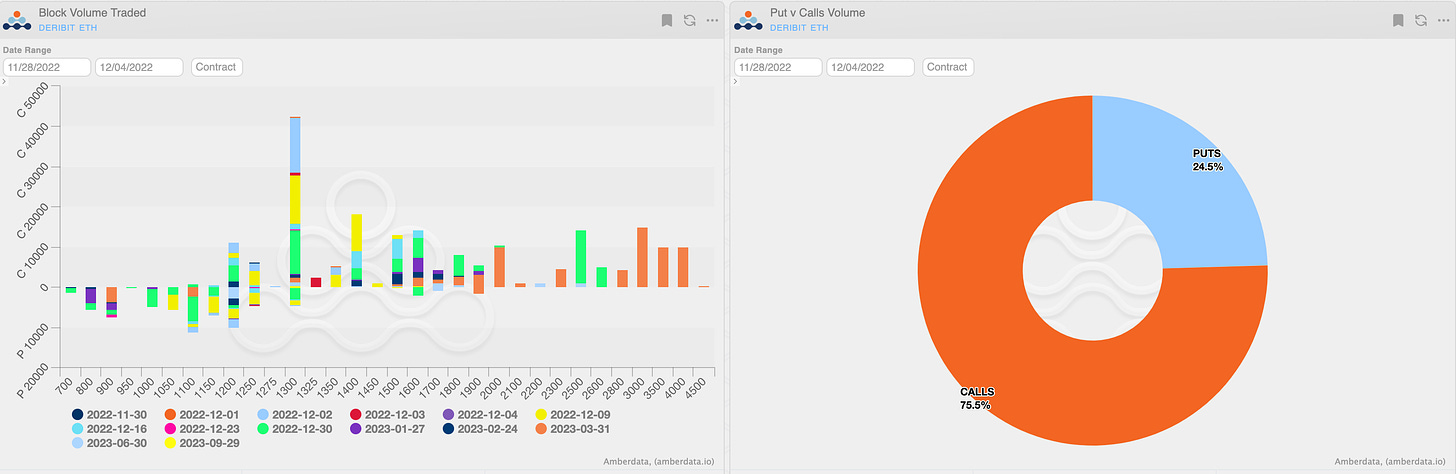

Paradigm Block Insights (28 Nov - 04 DEC)

Crypto majors grinded higher this week. Takers reduced risk on Paradigm. Realized vol continues to melt lower, completing a roundtrip from early November.

BTC +6% / ETH +8% / NDX +2%

🌊 BTC Flows

Notable BTC risk closed on Paradigm this week:

700x 2-Dec-22 16500 Put bot

450x 30-Dec-22 15000 Put sold

300x 31-Mar-23 15000/14000 Put Spread sold (puts rolled down to 14k strike)

Truly shocking, given contagion concerns that realized vol has managed to complete a full round trip from before the FTX implosion. We saw some interest to scoop vol at these levels (despite the awful realized) via Dec strangles in both BTC and ETH.

BTC 405x Dec 12k/21k Strangle bot

ETH 2500x Dec 1100/1300 Strangle bot

🌊ETH Flows

Open interest added in Mar 4000s via 1x2 call ratio...this is a call fly belly strike and the highest OI strike in the expiry with over 200k cts.

5000x Mar 3000 / 4000 1x2 Call Ratio bot

5k 16Dec 1500 calls bot for 0078 last week monetized today at 0121.

5000x 16-Dec-22 1500 Call sold

🌊ETH Flows Cont.

Additional Notable Blocks:

13.1k 30-Dec-22 2500 Call bot

10k CSpd 31 Mar 23 3000/3500 bot

9500 9-Dec-22 1300 Call bot

🎀 Another successful @ribbonfinance auction on @tradeparadigm💥

⚡️The auctions continue to be 🔥🔥🔥, with average price beat to CeFi screen of over 5% 🙌

📢 Winners:

🥇 @GenesisTrading

🥇 @MoonvaultCap

🥇 Various ANON

Hit us up on Telegram! 🙏

Daily Commentary✍️ http://pdgm.co/cmmntry

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

BTC

ETH

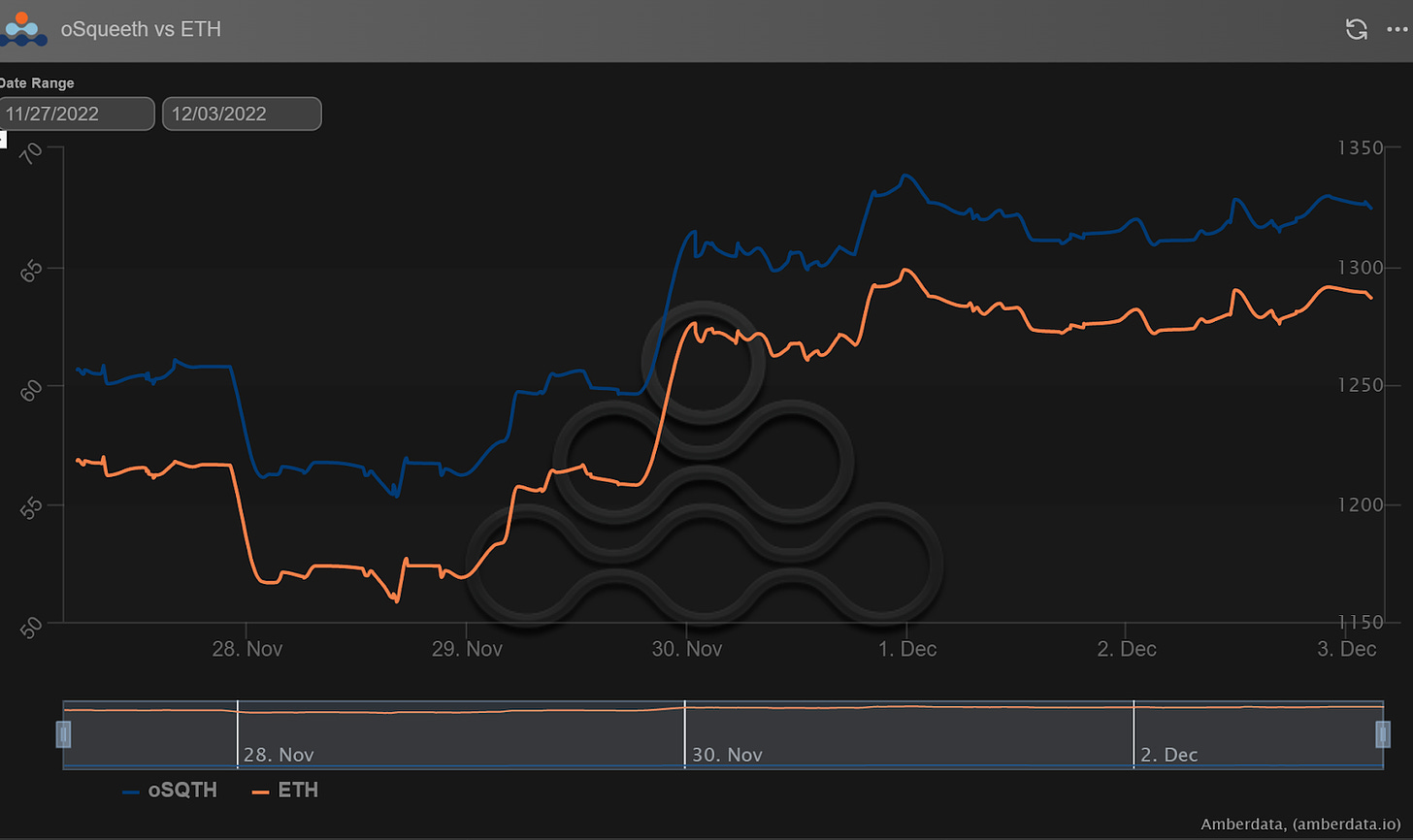

Squeeth: a Week in Review

With November ending, markets have started to lean on the seasonality narrative. In combination with a weakening dollar and dovish tones out of the Fed, crypto markets have found a long overdue bid. ETH ended the week +5.6% and oSQTH ended the week +11.2%.

Volatility

Squeeth vol saw slight upticks to start the week and saw little change to end the week. Vol markets remain fairly priced, relative to Squeeth’s reference vol.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $5.58m. November 30th saw the highest single day volume, with a daily total of $1.68m traded.

Crab Strategy

Crab found a way to make a positive return this week in USD terms, finishing the week +.11%

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

If you would like more in-depth analysis, subscribe to AD Derivatives Newsletter & launch our app to utilize our tools for your trading strategies!

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...