-

Tuesday 10:00 am - ISM Manufacturing

-

Wednesday 8:15 am - ADP

-

Thursday 10:00 am - ISM Services

-

Friday 8:30 am - NFP

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH, and Lyra and may change their holdings anytime.

Math-minded people here, pardon any typos.

MACRO THEMES:

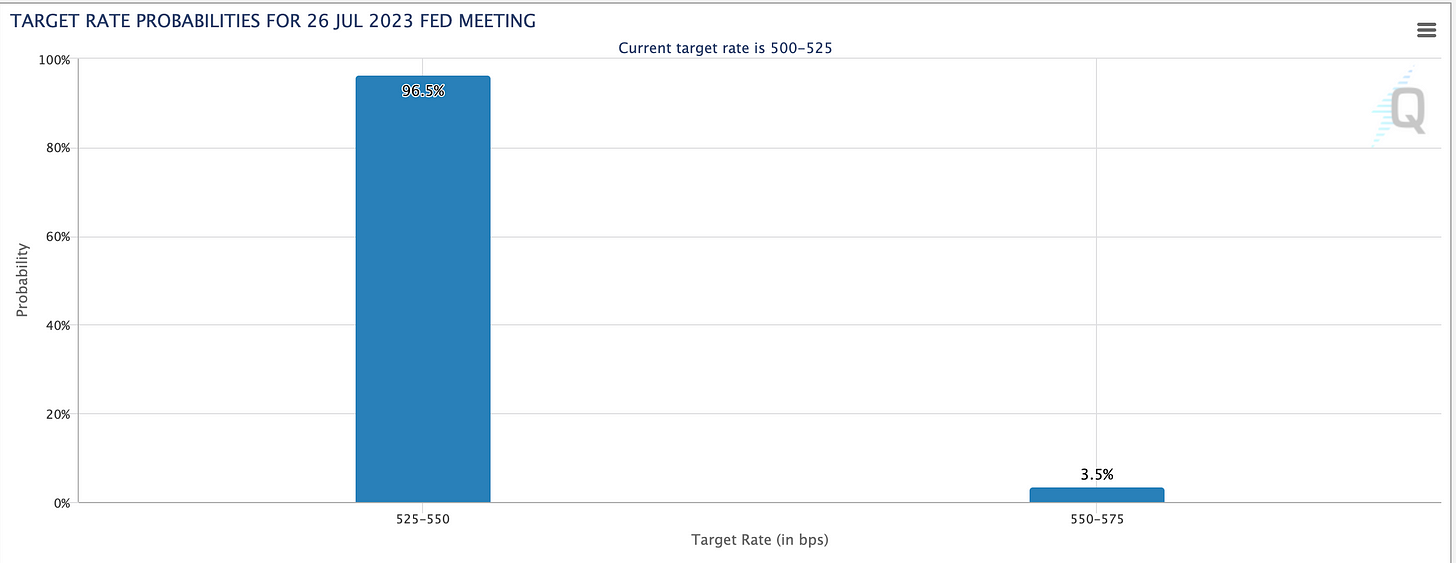

The Fed raised rates +25bps on Wednesday. This outcome was highly expected. Going into FOMC, the “CME Fed-Watch Tool” showed the market pricing in a 96.5% chance of this outcome.

The Fed also said it would be very “data dependent” when considering another rate hike going into the September FOMC meeting; because of this, the +2.4% GDP print on Thursday moved markets, as the economy grew more than expected (2.0% expected).

The soft landing narrative revolves around CPI coming down, while the unemployment rate remains historically low, at 3.6%.

Data dependence means this week’s NFP number will once again be a big driver of any potential realized volatility.

That said, the current market environment continues to price markets as stable and calm.

S&P straddles going into last week’s FOMC were the cheapest in recent history and the VIX continues to hover at post-pandemic lows.

Crypto continues to have historically low volatility and any jump in implied vol. due to the “macro picture” seems more like a fade, given that crypto has been trading on industry-specific news lately.

BTC: $29,185 (-2.9% / 7-day)

ETH :$1,860 (-1.4% / 7-day)

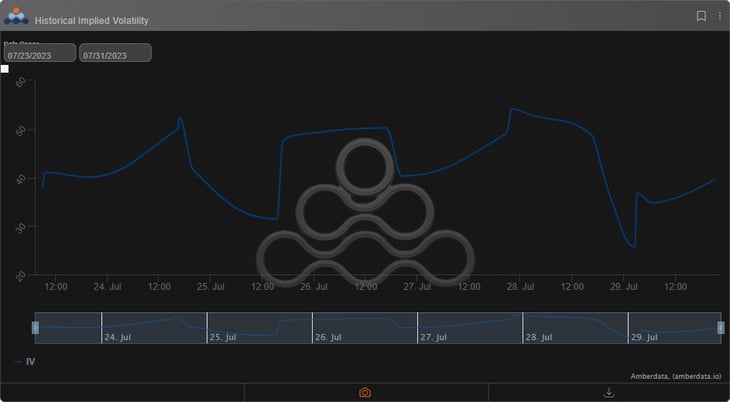

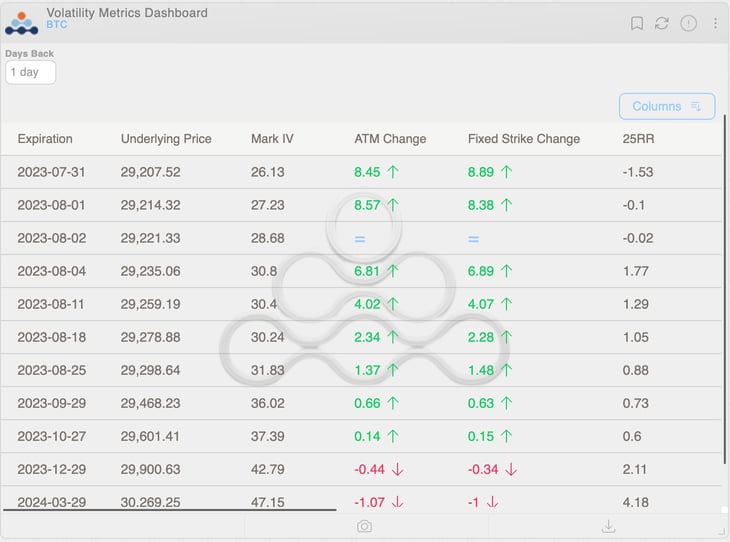

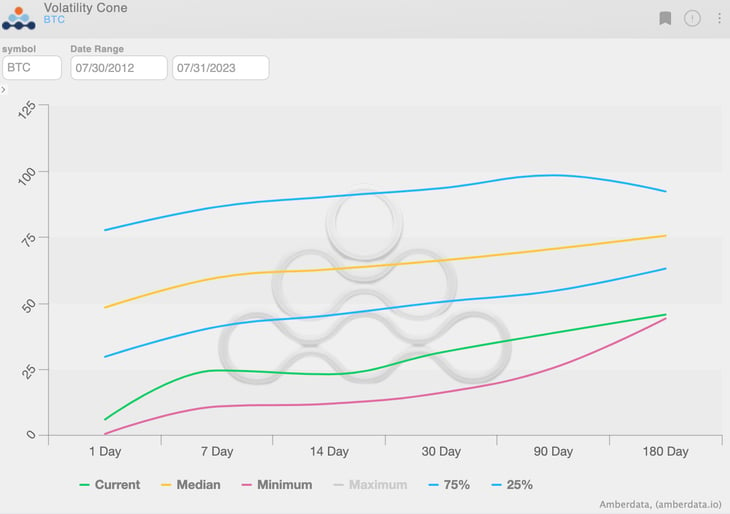

We’re finally seeing some steep Contango, given the currently low realized volatility environment.

Daily options are hovering around 26%, an INSANELY low level of implied volatility, but NOT cheap.

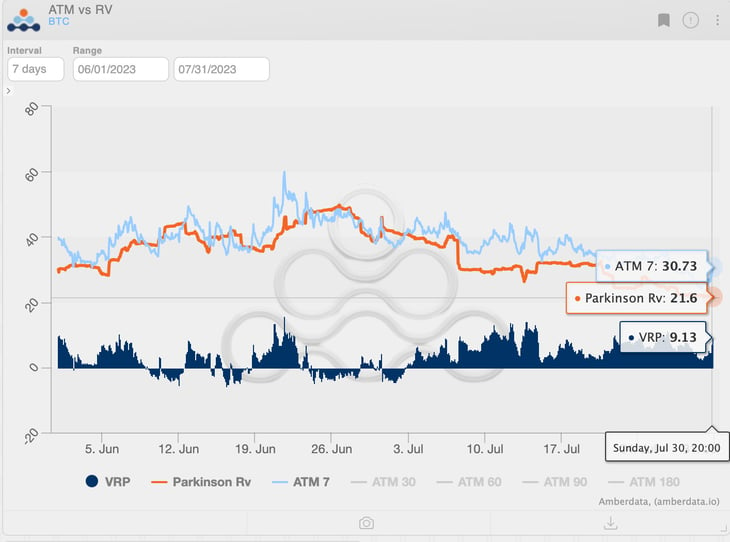

The 7-DTE “Variance Risk Premium” is currently 9 points, as the 7-day RV is hovering around 21.6% and the 7-DTE IV is currently around 30.73%.

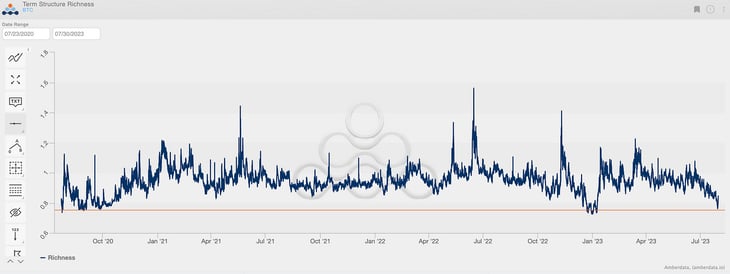

Buying volatility here because “it’s low” is extremely expensive to carry. You’re not only buying a high VRP but the term structure quickly collapses lower. Averaging a -0.6% vol points “roll-down” per day, for weekly options.

This makes a lot of sense given that historically speaking, RV is near an 11-year of minimum.

RV can remain low for a while, especially as we wait months for Spot ETF news, or any other catalysts.

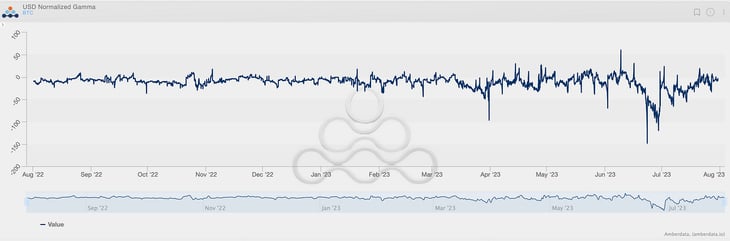

Lastly, market makers aren’t currently saddled with big gamma positions.

Since the June quarterly expiration, extreme positioning has cleared from the books.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

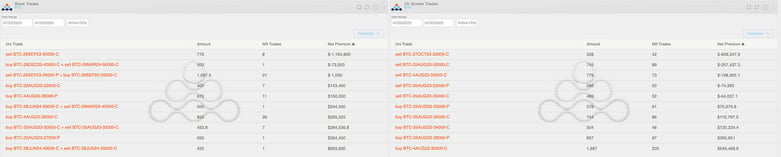

This view is currently my favorite for summarizing the flow of the week. Sorting the trades by net premium is helpful in highlighting the impact of sales/buys. Here, for instance, the sales, especially on blocks, have been more substantial compared to the buys.

A more balanced scenario was on-screen.

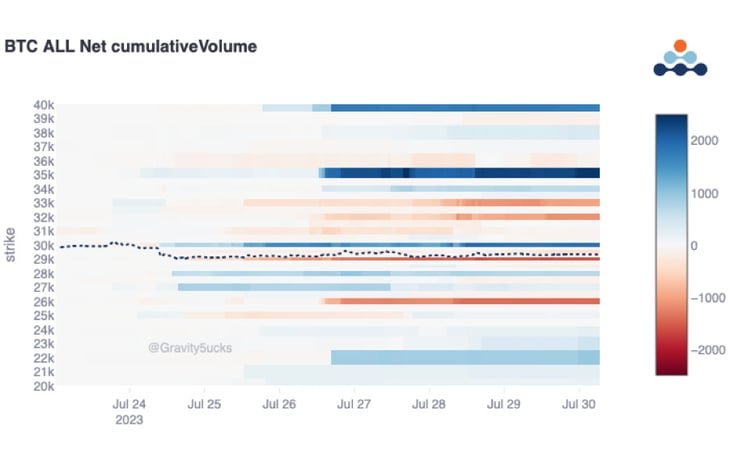

The trading week heated up, starting from Wednesday's session. Of particular note is the long risk reversal at zero cost: purchasing September $35k calls financed by selling $26k puts (replicated the following day with smaller quantities and strikes of -$27k/+$34k).

The sale of September $30k calls during the APAC session did not dent a profile dominated by purchases for the key level of the past months. The overall net flow for the $30k strike remains positive.

Additionally, the on-screen flow with sales of $32k-$33k calls is highly intriguing. The chosen monthly expirations for August and October suggest execution by "smart money" (typically, on-screen, we observe a prevalence of gamma trades with much closer expirations).

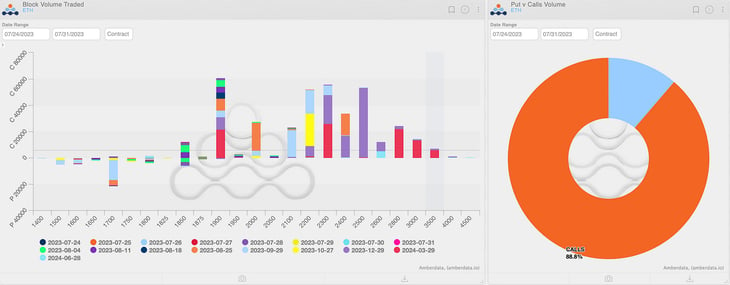

The week was more substantial in terms of trading activity on ETH, with a prevalence of block trades.

Notable highlights include the long call spread on March $1.9k/$2.8k and the call purchases within the range of $2k-$2.5k spanning from August to December.

Particular attention is warranted for the $2.3k strike, as it was initially purchased for December and later sold for March (different participants), resulting in a relatively neutral volume profile in the heat map.

Paradigm Block Insights

Barbie's mention was the highlight of this week’s FOMC meeting for me and Deribit’s DVOL hitting new lows agree 💤.

Let’s dive into this week’s option flows!

BTC -1.4% / NDX -2% / ETH -.5%

🌊BTC

Upside bullish risk reversals, rolls and call purchases. Risk is on the back of call skew flattening to the end the month.

1025x 29-Sep-23 26000/35000 Bull Risk Reversal bought.

875x 4-Aug-23 30000 Call bought.

500x Dec 40k / Mar 50k Call Calendar bought.

500x 29-Mar-24 45000 / 28-Jun-24 50000 Call Calendar bought.

🌊BTC (continued)

30-day implied is down to 31v! We saw clients take advantage of this via a custom structure buying wings (lower delta option) and selling options near the current spot level.

900x Aug-23 Custom Bought 22k Put / 40k Call | Sold Aug-23 300x 29k Put / Call

🧵4/

ETH 🌊

Remember the large quantity of Mar 2300 Calls bought to close last week. Interesting to see this print.

Mixed ETH flows on Paradigm, continuation of Deribit-direct Mar vega buying blocks printed..

— Paradigm (@tradeparadigm) July 23, 2023

Total flows noted below. We discuss these flows on the new #TBP coming tomorrow 🙏

6k Dec 1600/2400 Strangle bought

5k Aug 1900/2200 Call Spread sold

4k Sep 2200 Call bought

🧵4/7 pic.twitter.com/N1ulZ1fY5U

25000x 29-Mar-24 (with delta hedge) Call sold.

ETH 🌊 (cont)

Other notable flows were outright calls and various calendar spreads.

2. 21750x 29-Mar-24 1900/2800 Call Spread bought.

3. 12375x 27-Oct-23 2200 / 29-Dec-23 2500 Call Calendar sold.

4. 12000x Custom Strategy: +1.00 Call 27-Oct-23 2200 -2.00 Call 29-Dec-23 2500 +1.00 Call 29-Mar-24 3000 bought.

5. 10500x 29-Dec-23 2500 Call bought.

Macro Pulse drop!

Low vol and range bound markets have been dampened by China interventions. Yet, macro regime change is upon us and option traders are positioning for it.

Check it out 👇

With spot trading in an uninspiring range, vols continue to drift lower.

— Paradigm (@tradeparadigm) July 26, 2023

Flows, however continue to be bullish on @tradeparadigm, with upside $BTC positions being rolled further out and fresh upside positions initiated.

840x $BTC of 29 Dec 34k/45k Call Spreads recently bought.… pic.twitter.com/9XlYfvBk8t

Hit us up on Telegram! 🙏

Daily Commentary✍️ http://pdgm.co/edge

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

Bybit x Paradigm Futures Spread Trade Tape: https://t.me/paradigm_bybit_fspd

BTC

ETH

The Squeethcosystem Report (7/23/23 - 7/29/23)

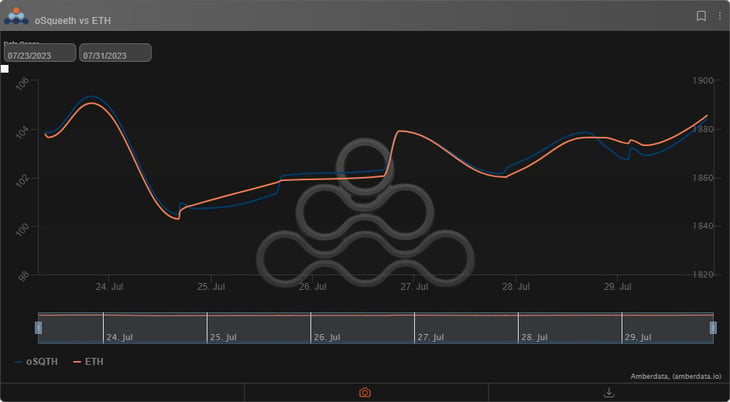

Markets lacked direction this week on the back of the FOMC. ETH ended the week +0.4%, oSQTH ended the week +0.53%.

Volatility

oSQTH IV remained range bound this week trading, from the mid-50s to the mid-30s.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $238.28k.

July 27th saw the most volume, with a daily total of $74.38k traded.

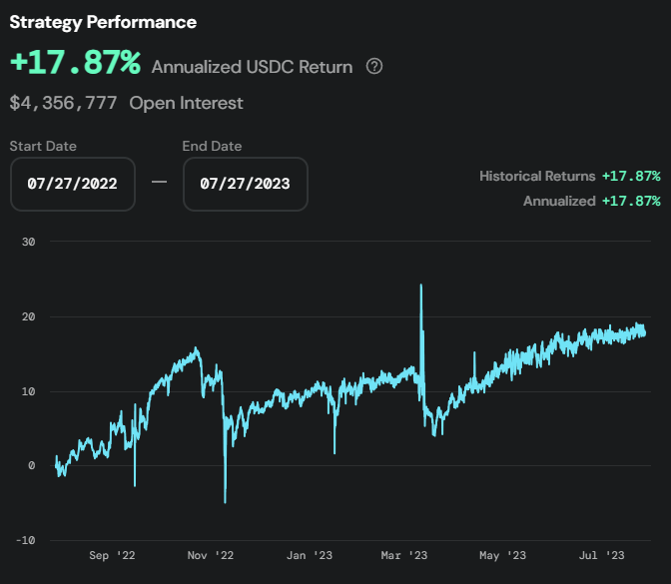

Crab Strategy

Crab has officially ended its first year as a live vault. During the year, the Crab returned +17.87% in USDC terms for depositors.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...