Crypto Options Analytics, Dec 3rd, 2023: US Rates & Crypto Trends

USA Week Ahead:

-

Tuesday 10am ET - ISM Services

-

Wednesday 8:15am ET - ADP Employment

-

CAD Wednesday 10am ET - BoC Rate Decision (5% expected, unch)

-

Thursday 8:30am - Jobless Claims

-

Friday 8:30am - NFP

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH, and Lyra and may change their holdings anytime.

CRYPTO OPTIONS MACRO THEMES:

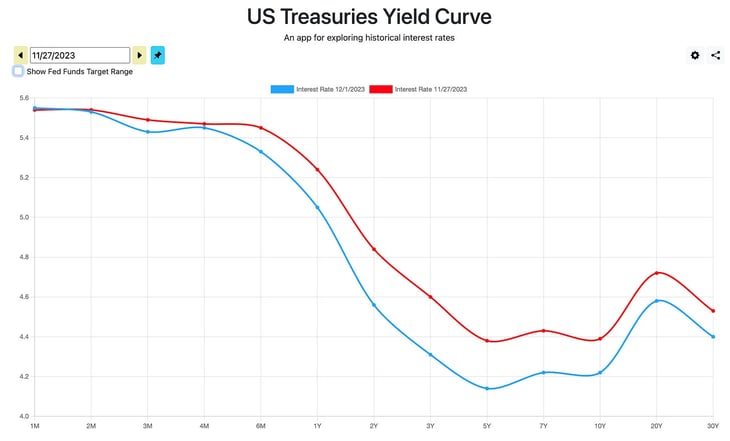

Last week the macro markets saw a lot of action in US rates, as Fed speaker Waller, traditionally a hawk, said the Fed could cut rates if the current run of mild inflation readings continues into the spring.

Powell also echoed a similar sentiment when he said, interest rates are “well into restrictive territory”.

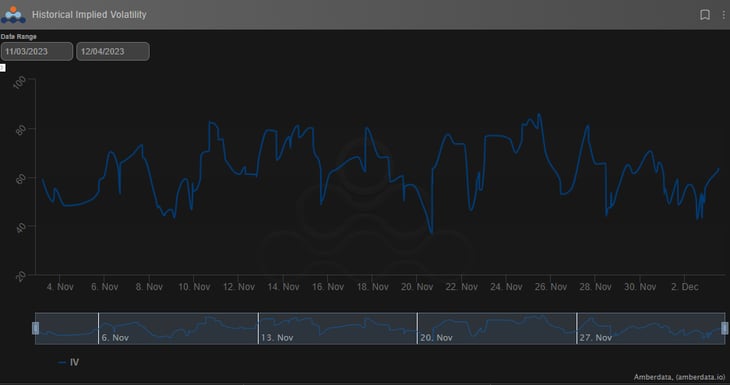

Chart: (https://www.ustreasuryyieldcurve.com/)

This caused duration to rally w/w as interest rates fell across the board and notably in the backend of the yield curve.

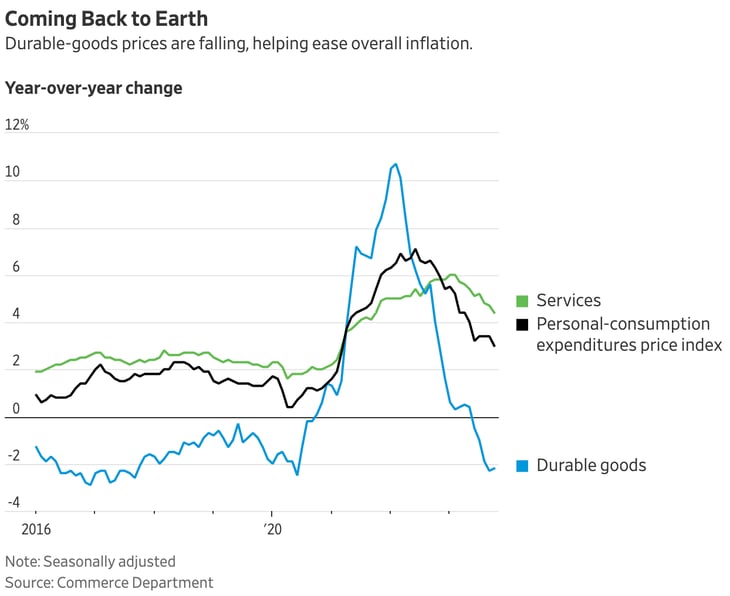

To help backup this sentiment we also have the PCE numbers released last week (along with GDP) that helped support the view that a soft-landing is possible.

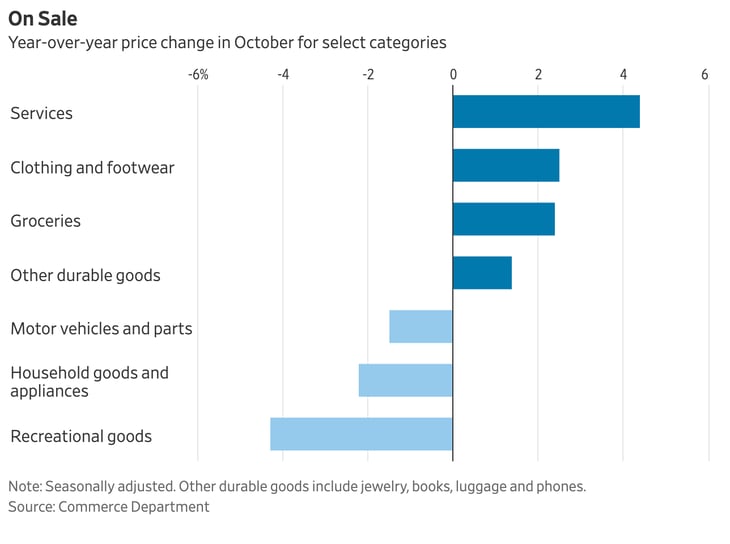

The services sector is the main point of consistent inflation while durable good and used cars have finally come back down as supply chain bottle necks (and higher financing rates) are helping ease overall inflation.

This upcoming week we have the employment situation (NFP) on Friday along with a Bank of Canada rate decision (that’s expected to be a non-event, but hopefully insightful for US traders).

Crypto on the other hand has been moving nicely higher, along with Gold, on the back of lower yields.

BTC: $39,615 (+5.5% / 7-day)

ETH :$2,175 (+4.7% / 7-day)

Bitcoin has been eager to jump higher, even without the Spot ETF catalysts headline hitting the wires, the market is looking to get long.

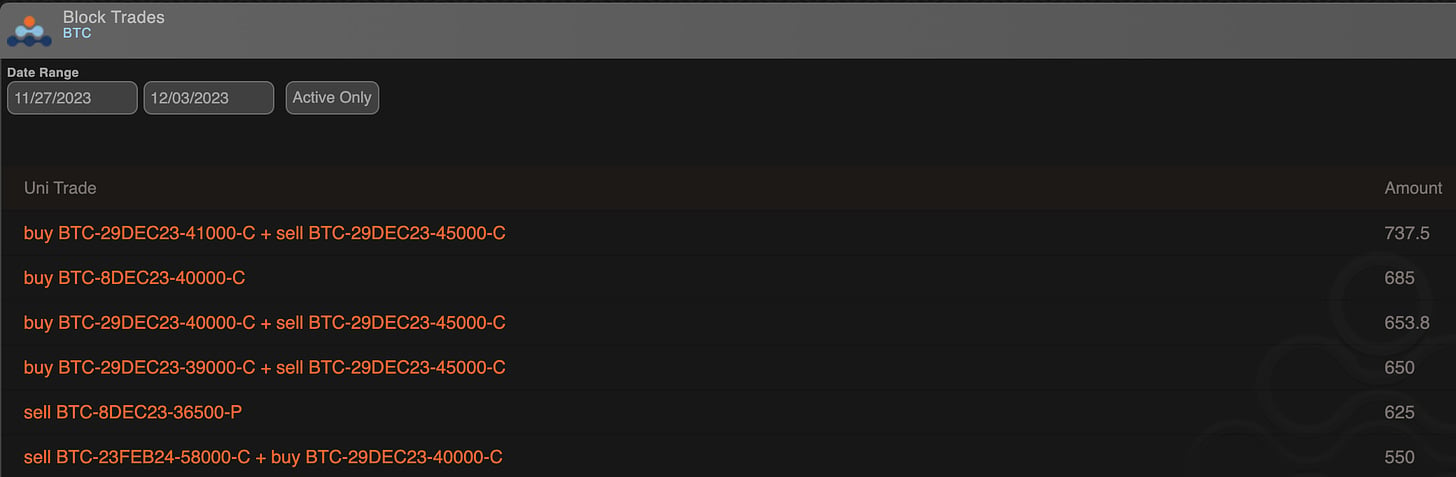

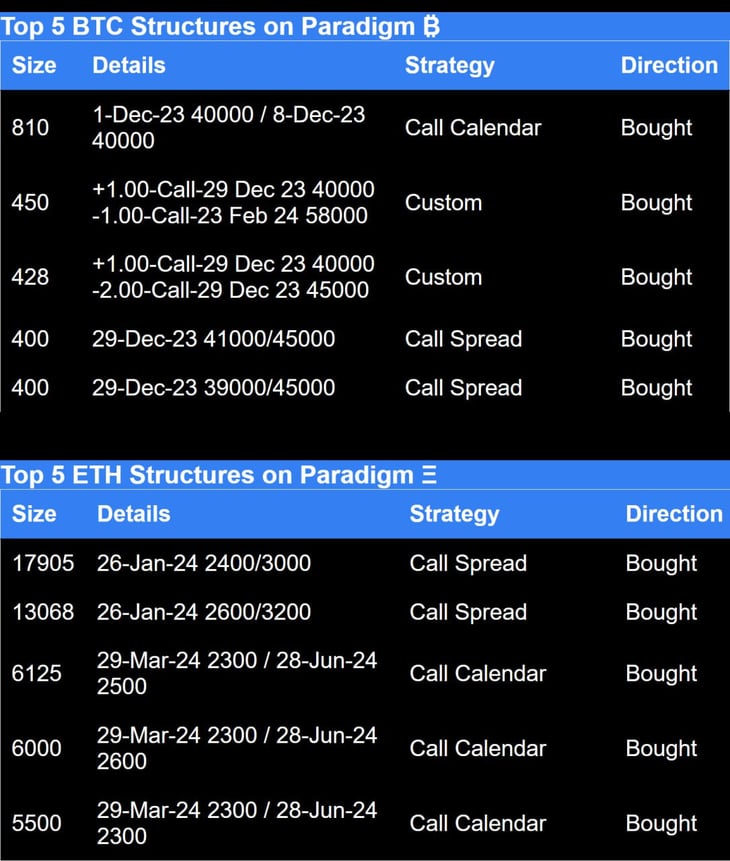

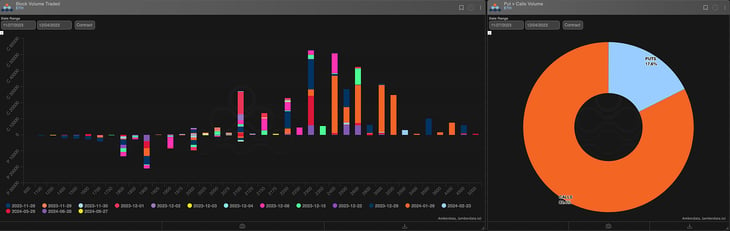

Chart: (Top Block-trades last week)

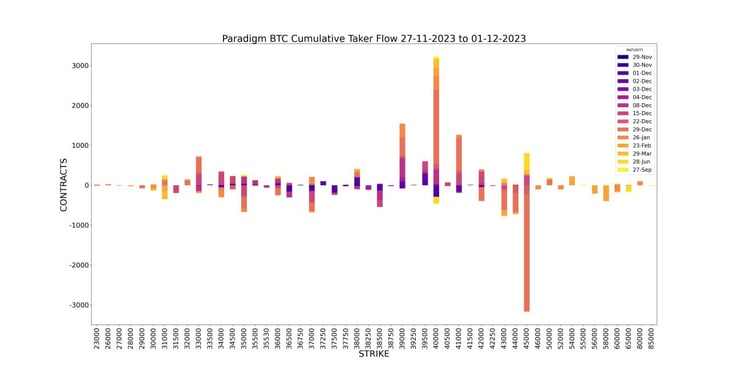

Chart: (Block Trades by strike & expiration)

We can see that block traders (typically professionals) are eyeing the $40k strike. Both outright calls being bought and as part of $40k-$45k call spread structures.

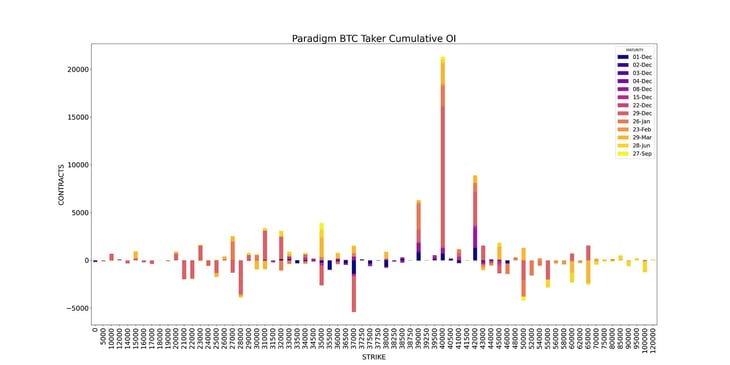

Chart: (Dealer Gamma Profile)

This has lead the gamma profile of dealers to be short between $39k-$43k.

Traders clearly expect the $40k level to be pivotal with momentum carrying prices into the low $40k-$43k range as early as next Friday, but certainly into EOY.

Chart: (30-day ∆25 wing as % of ATM IV)

Traders are also willing to sell $36k puts in size (the 5th biggest block seen last week).

This has created a “negative Put skew” for BTC options, while the call wing is exceptionally expensive.

I would view this pricing as borderline reckless, as traders could find opportunity getting long spot BTC and buying the $36k put as part of a protection package.

A collar type of structure would maintain the long detail bias without over-paying for vol.

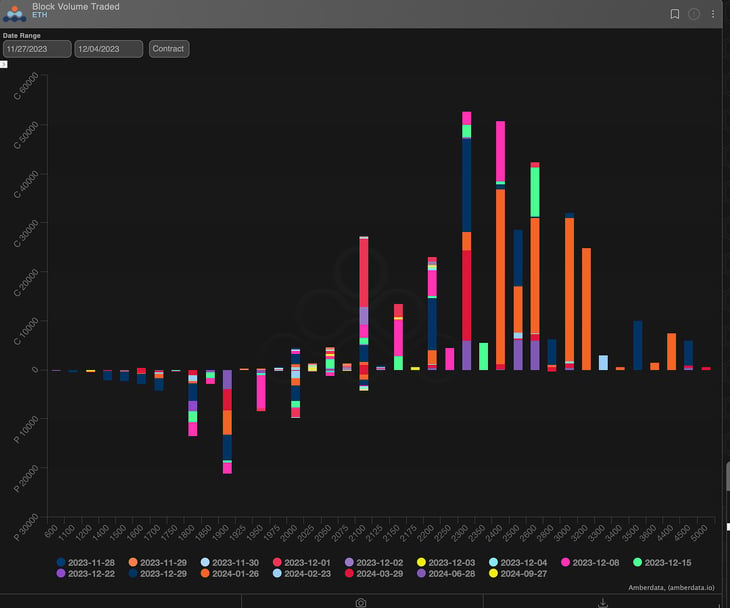

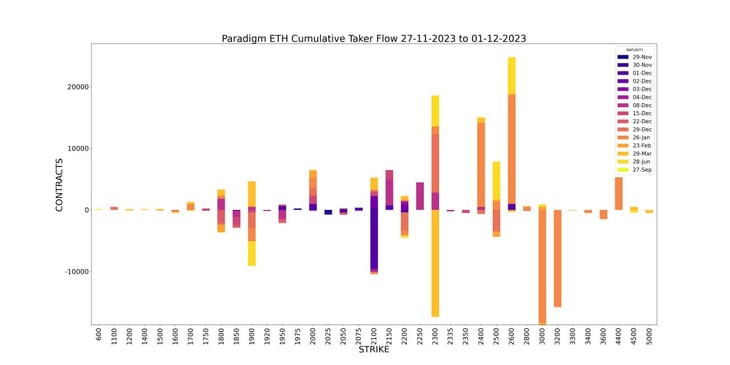

Chart: (Block Trades by strike & expiration)

ETH has also gained a lot of favor last week, with block trades clearly favoring the upside calls, but with a wider opinion on strike selection, $2,200 - $3,200.

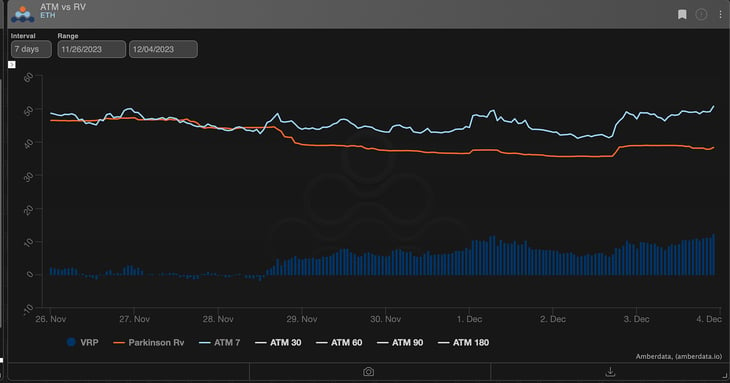

Chart: (ETH 7-day VRP)

That said, there’s still a wide VRP for ETH, so getting delta exposure in ETH needs to be done in a sophisticated way, outside of merely buying vol.

Especially given the persistent trend of ETH vol being historically cheaper in 2023.

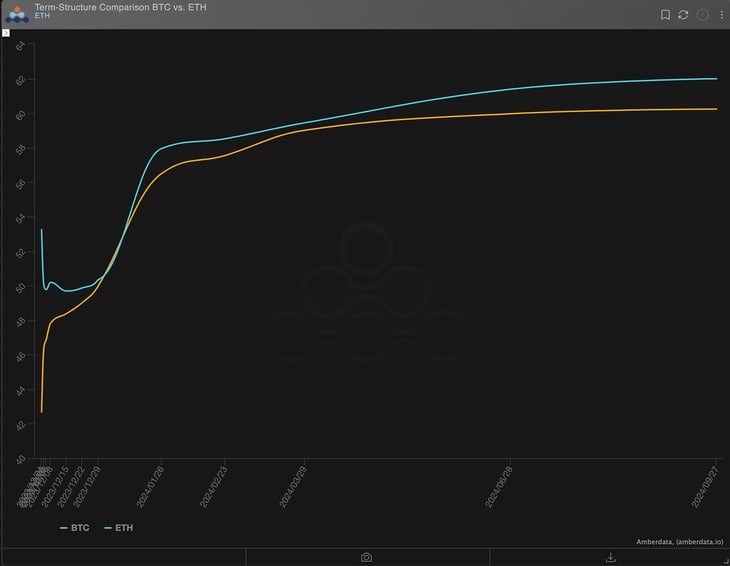

Chart: (BTC & ETH ATM Term Structure)

@Gravity5ucks, our favourite Italian, will be back next week!

Paradigm's Week In Review

Bullish flows continue on Paradigm entering December 📈

Spot/vol correlation is down 📉

Santa Rally to 40k? 🎅

BTC +3.4% / ETH +1.2% / NDX +0.3%

Paradigm Top Trades this Week 👇

Weekly BTC Cumulative Taker Flow 🌊

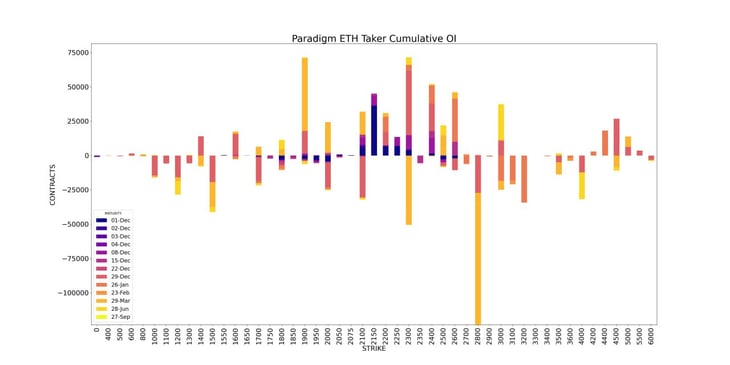

Weekly ETH Cumulative Taker Flow 🌊

BTC Cumulative OI

ETH Cumulative OI

Crypto Volatility Review: October 2023

Check out our newest piece authored by @BlockScholes 👇

Crypto Volatility Review: October 2023

— Paradigm (@tradeparadigm) December 1, 2023

October has again brought implied volatility back into the mid-50s and a big demand for upside.

But why?

Check out our newest piece authored by @BlockScholes to find out! 👇 pic.twitter.com/RLW3PbRMUg

As always you can hit us up from the below

Hit us up on Telegram! 🙏

Paradigm Edge: Daily Commentary✍️ http://pdgm.co/edge

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

BTC

ETH

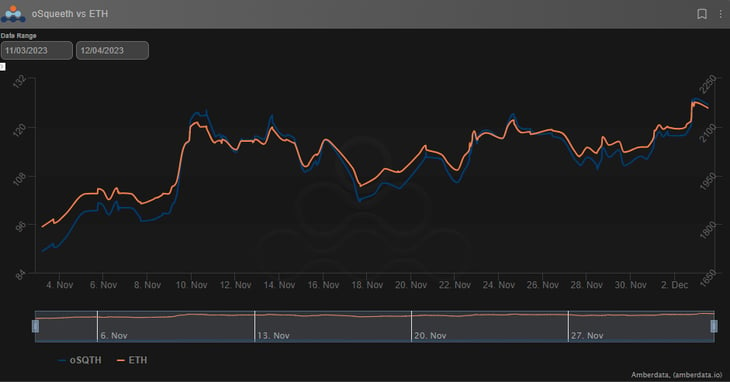

The Squeethcosystem Report

Crypto markets found their way higher throughout the week. ETH ended the week +3.18%, oSQTH ended the week +5.98%.

Volatility

oSQTH IV continued to remain volatile trading in the mid 40s to the high 60s most of the week.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $388.63k

December 3rd saw the most volume, with a daily total of $110.72k traded.

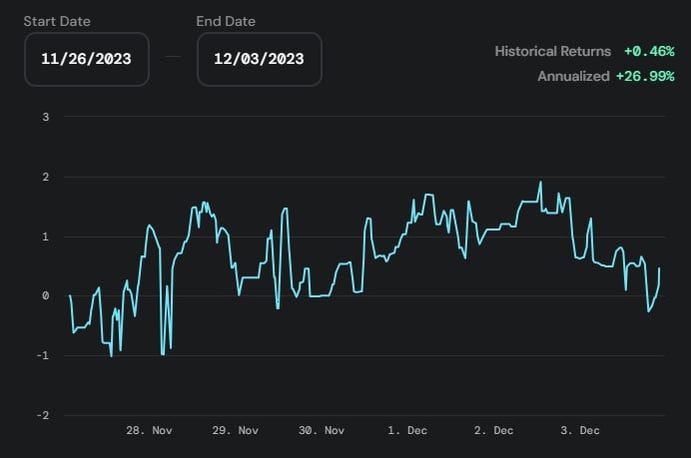

Crab Strategy

Crab saw declines during the week ending at +0.46% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high-risk in nature. Don't invest more than what you can afford to lose.

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...