.png)

-

Monday - MLK Day,TradFi markets closed

-

Wednesday 2pm ET - Beige Book

-

Thursday 1:15pm ET - Fed Speaker, speaks

-

Friday 1:00pm ET - Fed Speaker, speaks

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math minded people here, pardon any typos.

THE BIG PICTURE THEMES:

CPI release last week was followed by strong risk-asset performance, particularly apparent in crypto.

Inflation dropped -0.10% from November to December 2022 but the annual rate still remains high, at 6.5% after peaking at 9.1% in June.

This prompted a massive rally in crypto.

BTC 7-day RV increased too 55% after making near decade lows around 16%. Implied moved from 30% to 69%. Spot prices rose +22% for BTC.

Equity volatility continues to drop as the VIX broke below to 18 last week, settling around 18.35

This quick drop in VIX prompted a rally in VVIX from 72 → 80.

BTC: $20,894 +22.02%

ETH :$1,555 +20.74%

SOL: $22.96 +58.88%

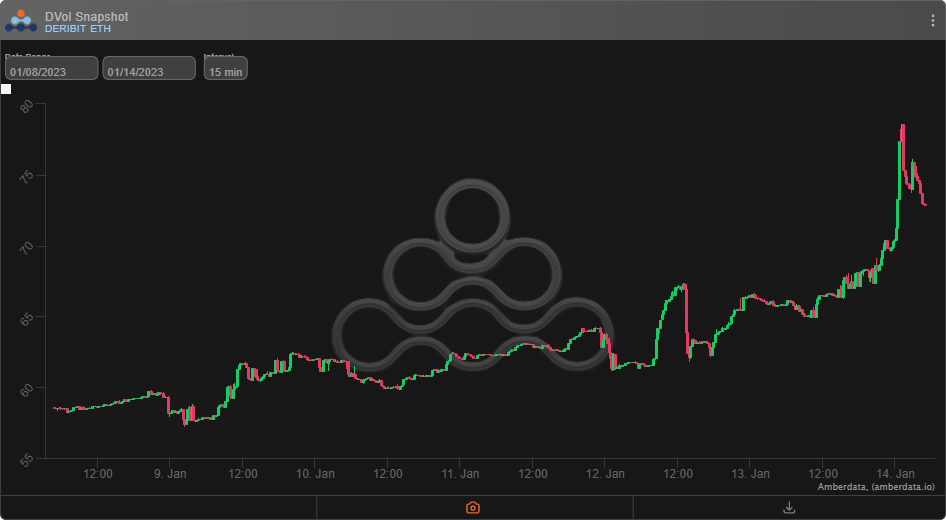

DVOL: Deribit’s volatility index

BTC - (365-days w/ spot line chart)

DVOL is back around 70%, bringing the DVOL/VIX ratio to 3.80. In the crypto panic environment we saw this ratio below 2.00. Option RR-Skew is now being priced into DVOL from call options.

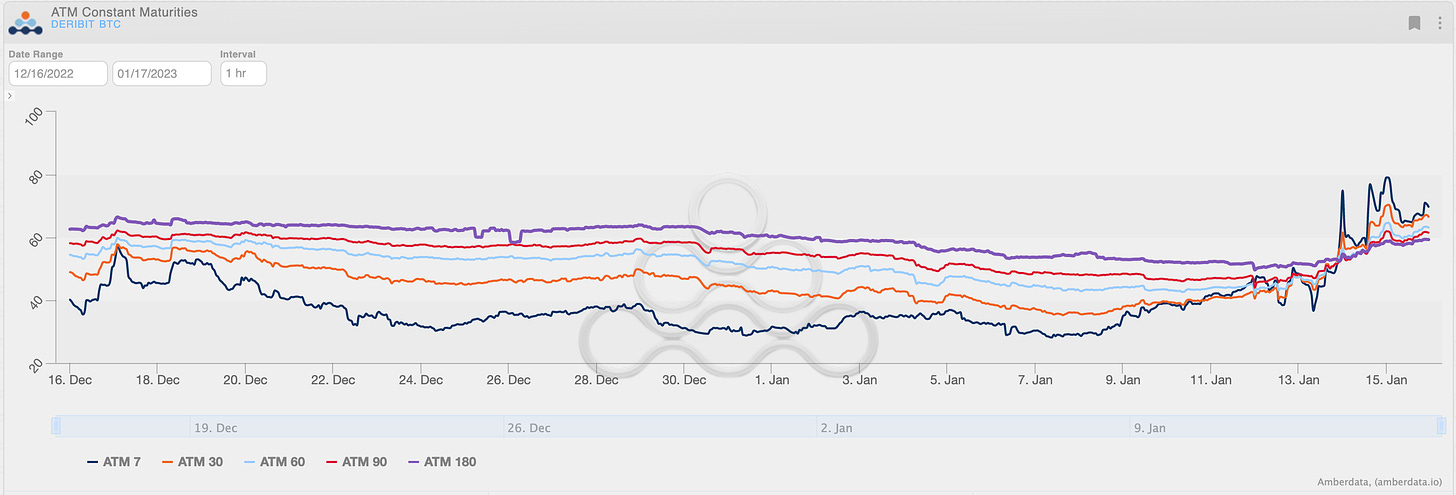

TERM STRUCTURE

(Jan. 15th, 2023 - BTC Term Structure - Deribit)

The term structure is now in Backwardation on an upside spot move, this is like Jan 2021 when BTC recently broke into fresh ATH’s.

Option traders are pricing in a lot of momentum in the short-term for continued volatility, I could see this and spot traders should take heed for “breakout” set-ups.

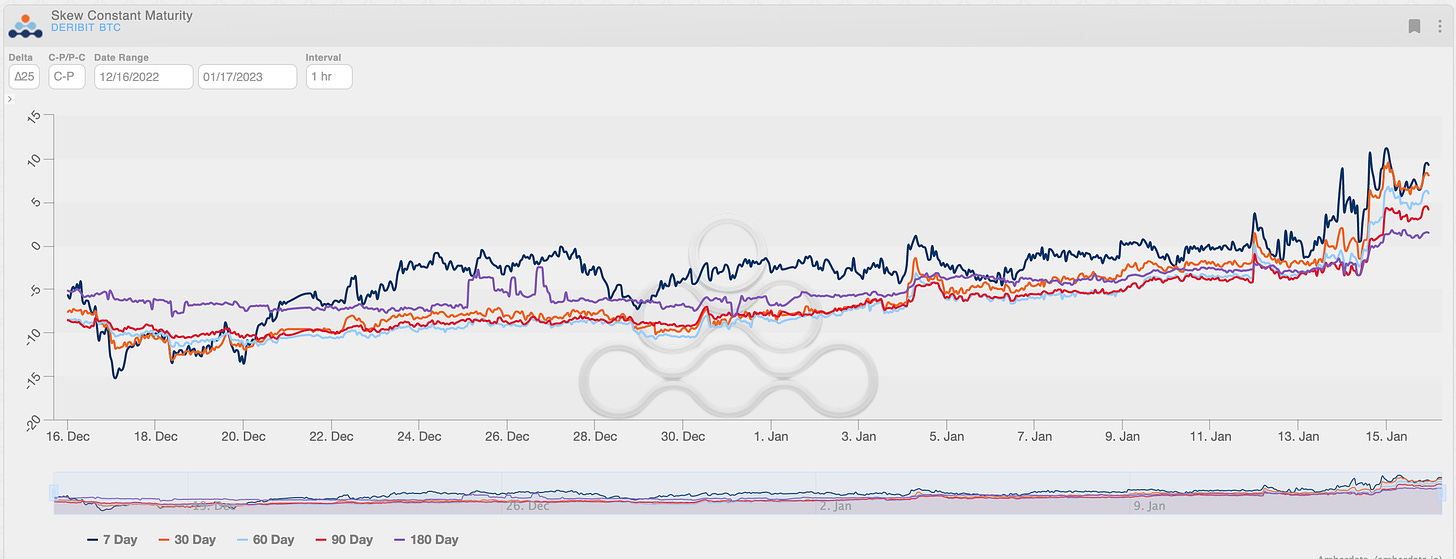

SKEWS

(Jan. 15th, 2023 - BTC RR SKEW (C-P) ∆25 - Deribit)

This is the first time since 2021 to see the RR-Skew positive across the board.

There could be great trades in fading long-term BTC RR-Skew, since judging by 2022 the negative RR-Skew proved to be very persistent, and we could easily return to such an environment.

Short-term options are likely well priced, since short-term spot/vol dynamics are clearly to the upside today, but to extrapolate that relationship into the long-term seems ambitious.

VOLATILITY PREMIUM

(Jan. 15th, 2023 - BTC IV-RV)

The VRP Gap briefly closed as spot prices were breaking higher in BTC but IV quickly followed higher and as again priced in a small VRP.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

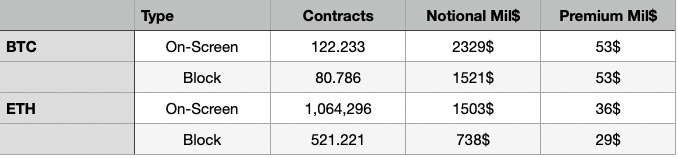

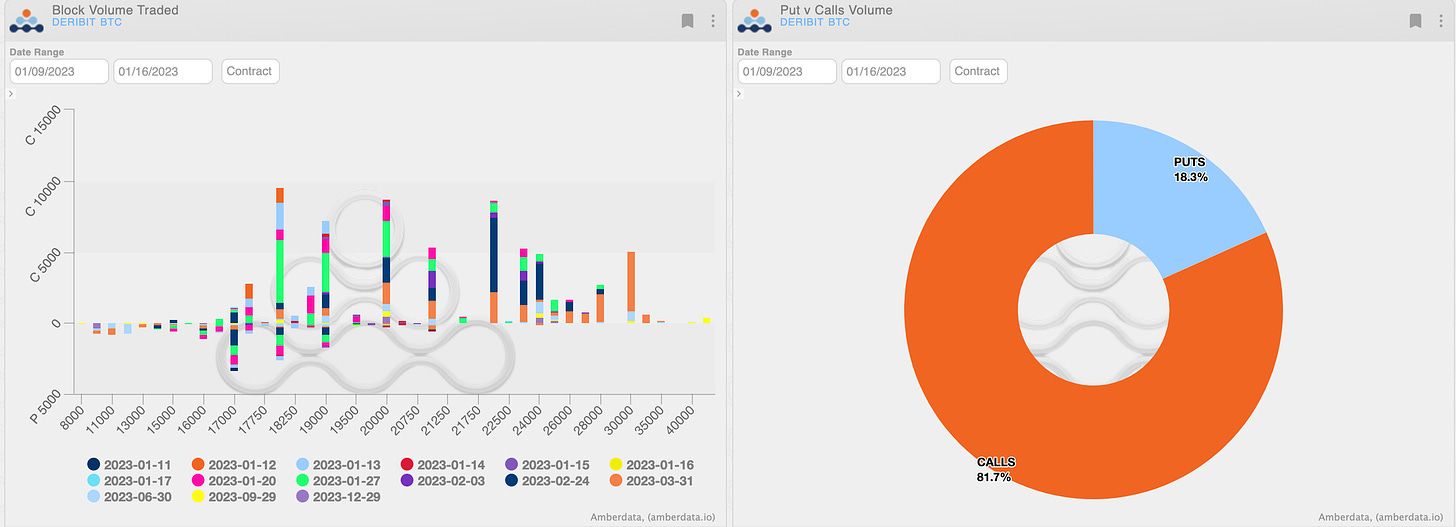

Bitcoin weekly volumes sharply increasing. The spot move has revived the options market after its recent weeks of apathy.

(BTC Weekly Volumes Contracts/Notional - Options Global section)

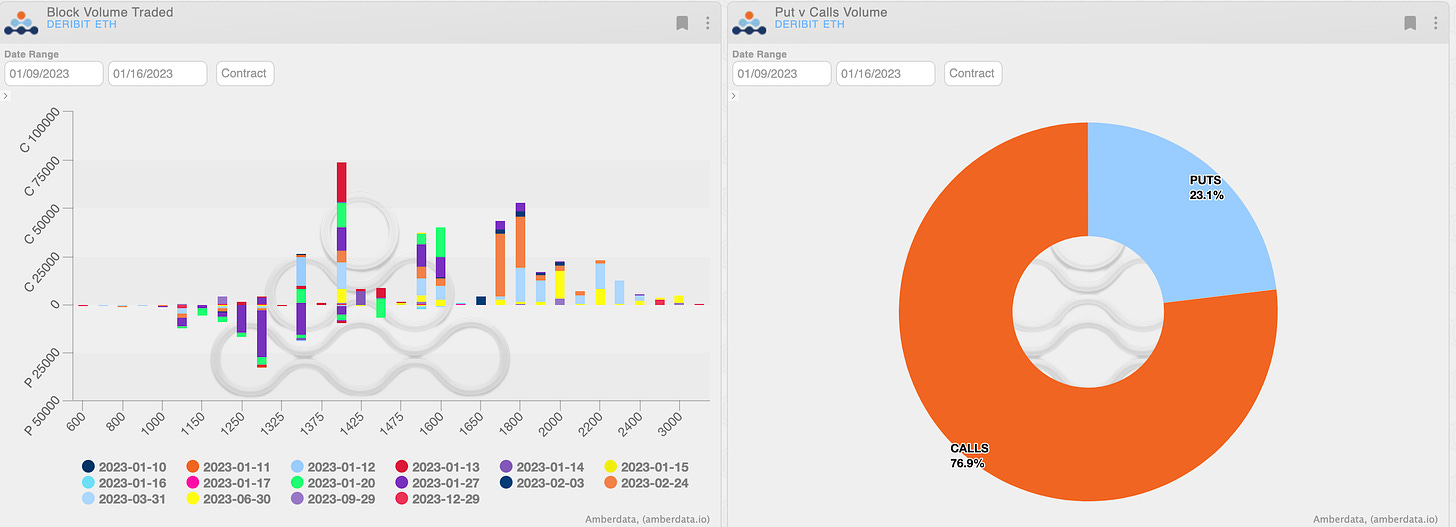

On the other hand, the underperformance of ethereum continues with notional 80% lower than btc, and volumes that have no longer reached the hype of the pre-merge.

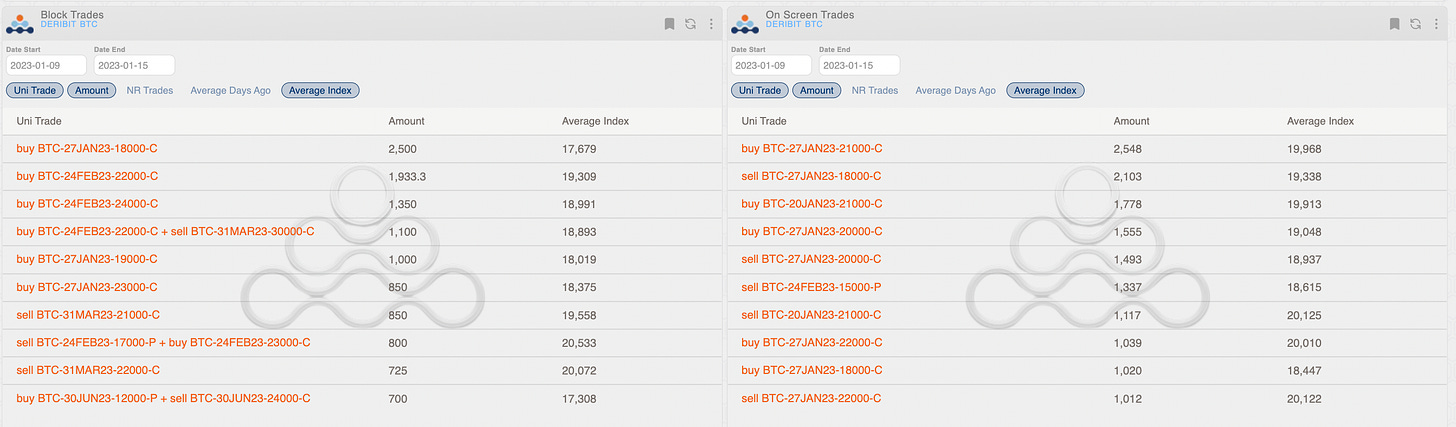

A week of trading like we haven't seen in a while, with some trades of excellent timing.

Calls $18k/$19k bought with the spot at $17k were the main trade, with subsequent on screen profit taking with >$19k spot.

Interesting how the flow of options can give insight on the technical levels of support and resistance observed by market participants. In this regard, note the February purchases of $22k/$24k calls at the break of $19k.

(BTC AD direction table with uni_trade - Options Scanner section)

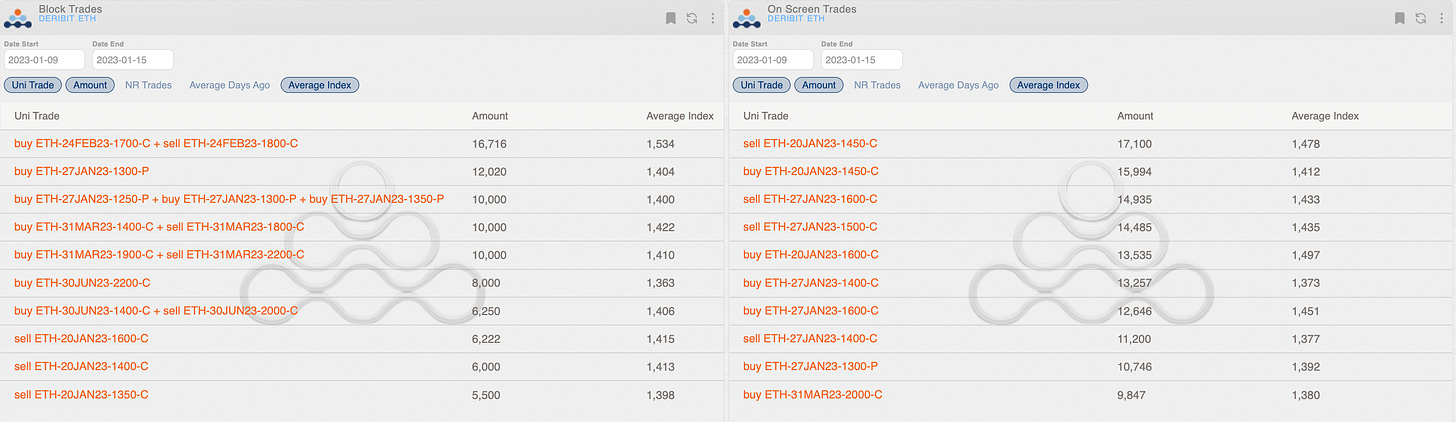

Although smaller, even on ethereum there have been some interesting movements. To report call spreads on March and a put-strip (see detail in the tweet from Deribit).

(ETH AD direction table with uni_trade - Options Scanner section)

(ETH 27JAN PUT STRIP)

4) In ETH, a large Put strategy dominated pre-CPI.

— Deribit Insights (@DeribitInsights) January 13, 2023

As Spot traded 1400, 10k of the 1.3k Put and 10k 1.25,1.3,1.35 Put Strip was purchased (buying 10k of each Strike). Total premium spent ~$1.4m.

This trade was executed as a protective Hedge vs a Fund's long underlying position. pic.twitter.com/bWxxzIuFXr

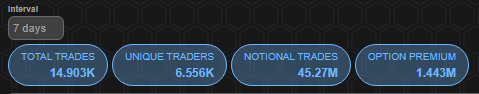

Paradigm Block Insights (09 Jan - 15 Jan)

What a week! Major themes include a relentless topside bid, beginning pre-CPI. Followed by chasing upside, a gamma squeeze fueled by the heavy calling buying.

🌊BTC

Topside bid began Tuesday with large BTC 27Jan 18k and 19k call prints (~40v) representing ~$17.5M of delta easily absorbed by market.

Bought 2425x 27-Jan-23 18000 Call

Bought 825x 27-Jan-23 19000 Call

🌊Weds. 1/11 flows (EU session)

Massive 2-day calendar trade went up Pre-CPI in BTC and ETH during Europe session:

1000x 12Jan 17.5k/13Jan 18k Diagonal Cspd bot

14500x 12Jan 1350/13Jan 1400 Diagonal Cspd bot

🌊Weds. 1/11 flows (US session)

A super interesting day for short-dated optionality ahead of CPIs.

1080x BTC 12Jan 18000 calls bought in clips for 7-8bps (5-7delta and not capturing CPI).

Rally into CPI resulted in these calls expiring well in the money for a ~20x realized profit.

🌊CPI flows BTC

The post-CPI rally drove a busy day of upside buying with call spreads being most notable prints. We like these trades given short-dated skews that continue to reset lower in favor of calls.

700x 24Feb 17k/20k CSpd bot

500x 24Feb 20k Call bot

400x 20Jan 18k / 27Jan 18k CCal sold

200x 27Jan 23k Call bot

🌊CPI flows ETH

The most notable ETH print today dwarfed the 50k Jun 400 puts from last week. 40k contracts of 27Jan 20-30 delta puts were bought before CPI for $1.4MM total premium.

Long 27Jan Put Strip: 10k 1300P, 10k 1350P, 10k 1250P

Long 27Jan Put: 10k 1300-P

Addl flow:

10k 31Mar 1400/1800 CSpd bot

h/t @ laevita

🌊CPI pt. 2

The most notable ETH print today dwarfed the 50k Jun 400 puts from last week. 40k contracts of 27Jan 20-30 delta puts were bought before CPI for $1.4MM total premium.

27Jan Put Strip: 10k 1300P, 10k 1350P, 10k 1250P bot

27Jan Put: 10k 1300P bot

10k 31Mar 1400/1800 CSpd bot

What an end to the week! Gamma rolling off post-expiry turned dealers short in the 18-19k strikes from large call buying earlier in the week.

Spot up / vol up quickly ensued as takers FOMO'd to buy the dip and maker hedging manifested a feedback loop that propelled the market higher.

Bought 2184x 24Feb 22k Call

Not surprisingly, BTC garnered most of the attention given the outperformance, but also saw new ETH call spread positions taking advantage of expensive upper wings. We expect increasing upside activity like this as the Shanghai fork approaches.

Bought 10000x 31-Mar-23 1900/2200 Call Spread

Bought 6250x 30-Jun-23 1400/2000 Call Spread

🌊Friday flows cont.

Bought 1250x 24-Feb-23 24000 Call

Sold 800x 31-Mar-23 21000 Call

Bought 500x 3-Feb-23 21000/23000 Call Spread

Sold 450x 27-Jan-23 19000 / 31-Mar-23 20000 Call Calendar

In short, upside positioning ahead of CPI and spot moves have significantly brought back option volumes and renewed interest from a good mix of our clients. Paradigm weekly option volumes are in the 85th percentile over the past 12M! 🙏

Paradigm's "The Big Picture" podcast new episode is now out, it delves deeper into this dynamic with GSR (filmed pre-CPI). Check it out! 👇

BTC

ETH

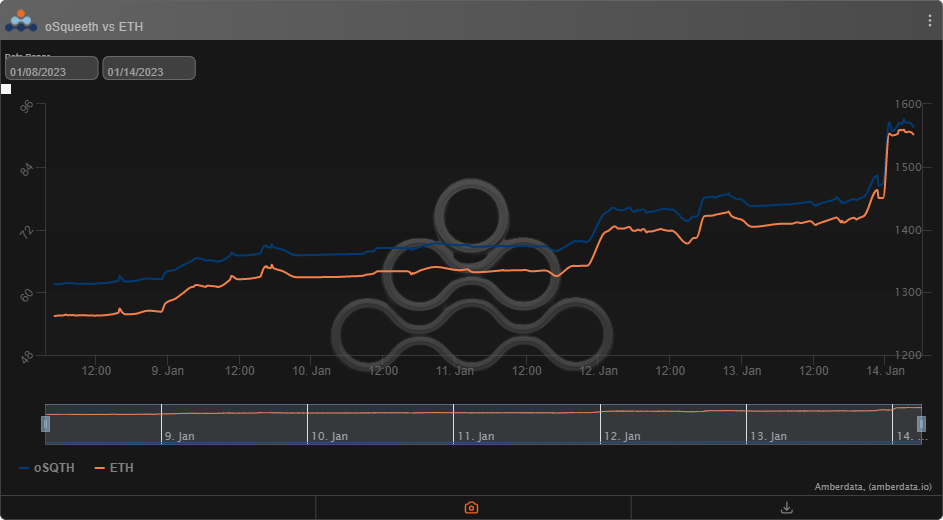

The Squeecosystem Report (1/08/23 - 1/14/23)

With a calm start to the year, many were left waiting for the first “bet” to be made. Flows remained quiet to begin the week but finally picked up to officially bring some excitement back to the broader market. ETH ended the week +22.93% and oSQTH ended the week +48.94%.

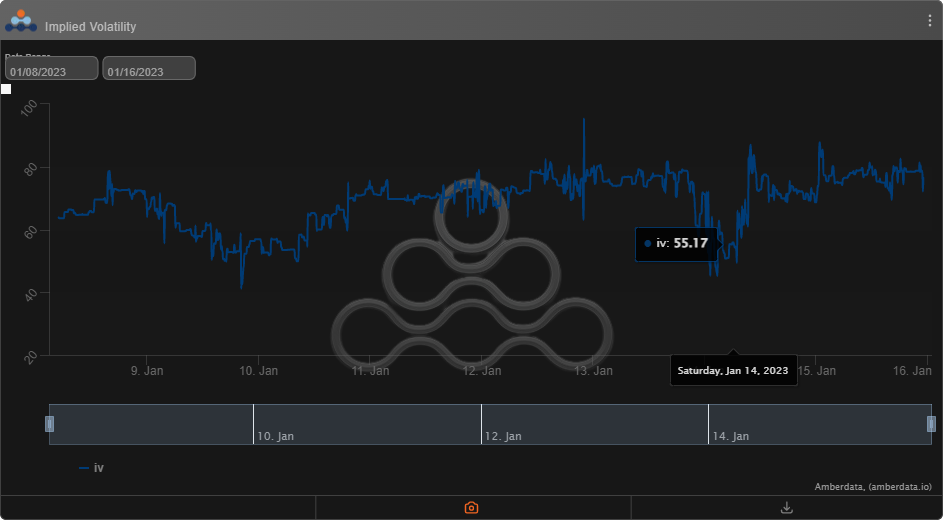

Volatility

This week Squeeth IV provided unique opportunities to trade against Deribit’s DVOL. Going forward Squeeth should provide great setups for traders, with the return of vol.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $5.27m. January 14th saw the highest single-day volume, with a daily total of $2.26m traded.

Crab Strategy

Crab strategy saw a decline to end the week of -1.22% in USDC terms.

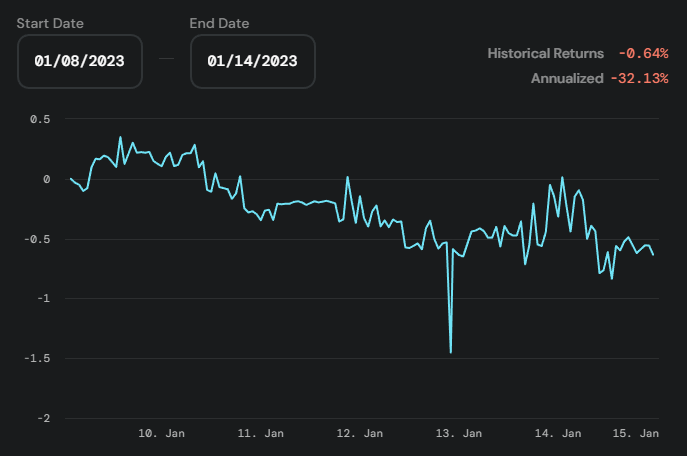

Zen-Bull Strategy

Zen-Bull returned -0.64% for depositors in ETH terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

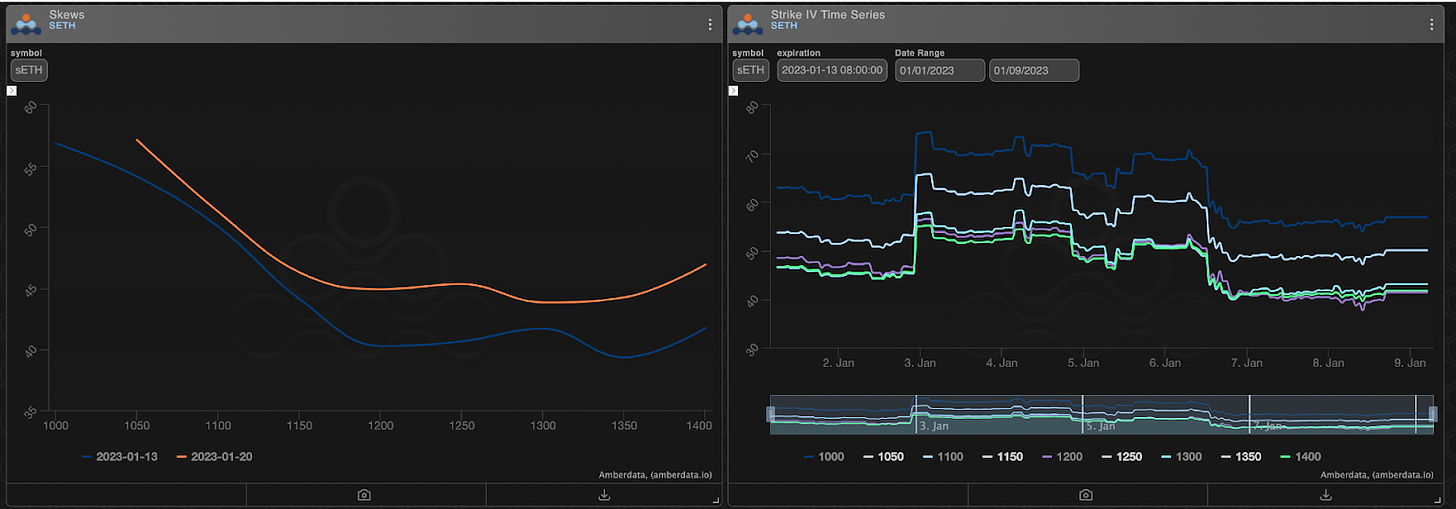

Lyra Weekly Review

Volatility

Current ATM IV is ~68% in ETH after reaching all-time lows last week. Near-term vol has seen the most significant move up 28 points on the week with the term structure briefly flipping into backwardation.

Trading

Option buyers were finally able to realize some volatility last week but if the market movement fails to continue, these IV levels may be short-lived.

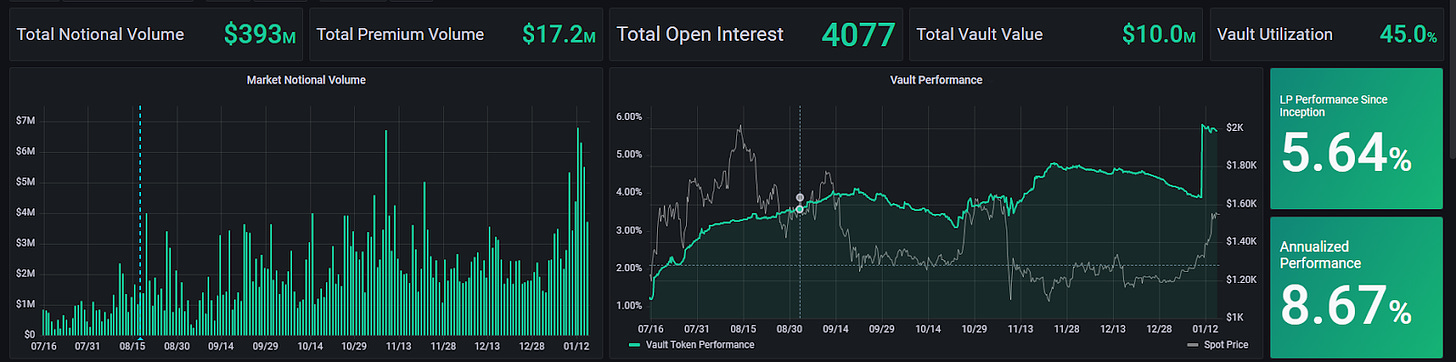

ETH Market-Making Vault

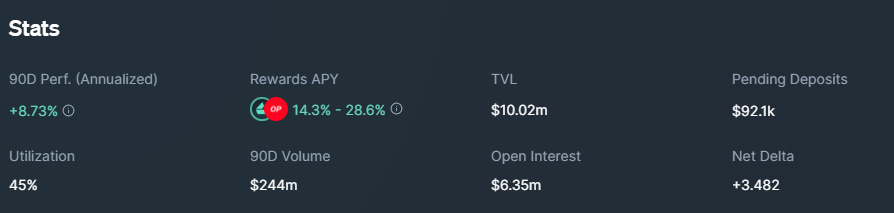

The ETH MMV has returned +5.64% since its inception (June 28th, 2022) representing a weekly change of +1.73%. A fee rebate is responsible for the large spike in performance this week. The MMVs periodically receive rebates from Synthetix for trades that it makes to hedge and collateralize its option positions.

The 90-day performance annualized is +8.73%, annualized performance since inception is +8.67%. Depositors earn an additional 14.3% rewards APY (boosted up to 28.6% for LYRA Stakers).

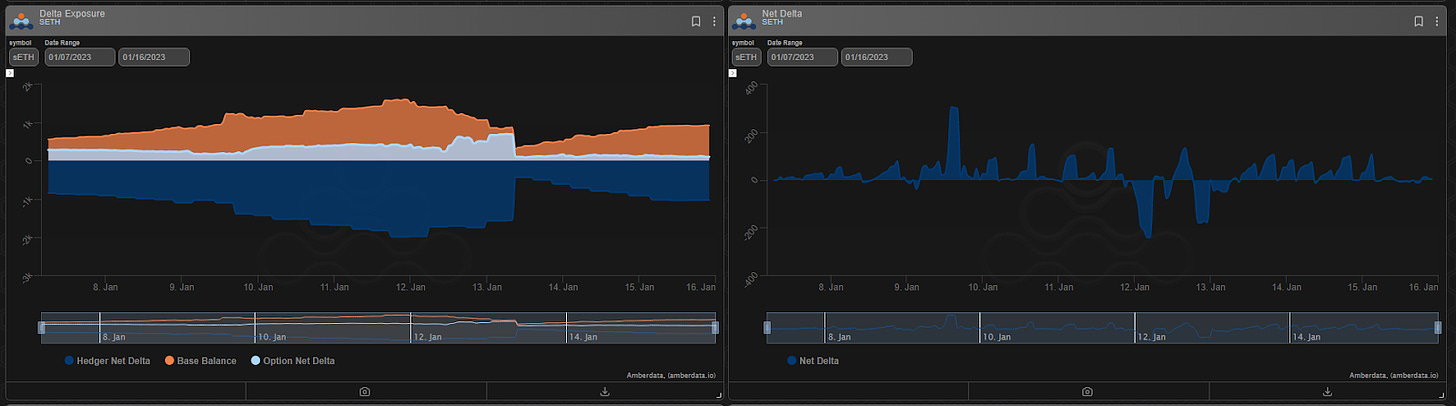

Net MMV Exposure:

BTC Volatility

BTC Market-Making Vault

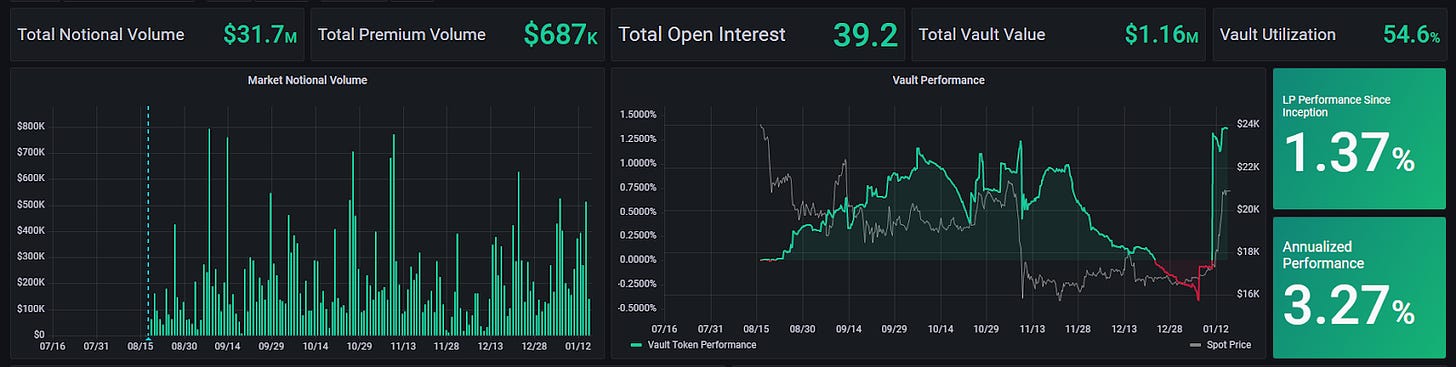

Lyra’s BTC MMV has returned +1.37% since its inception (August 16th, 2022). This represents a weekly change of +1.437%.

Depositors earn an additional 13.57% rewards APY (boosted up to 27.15% for LYRA Stakers)

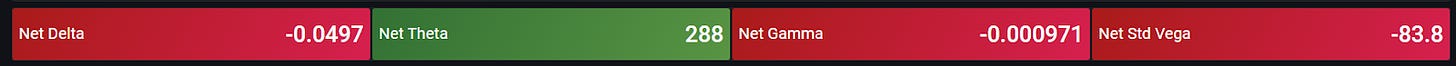

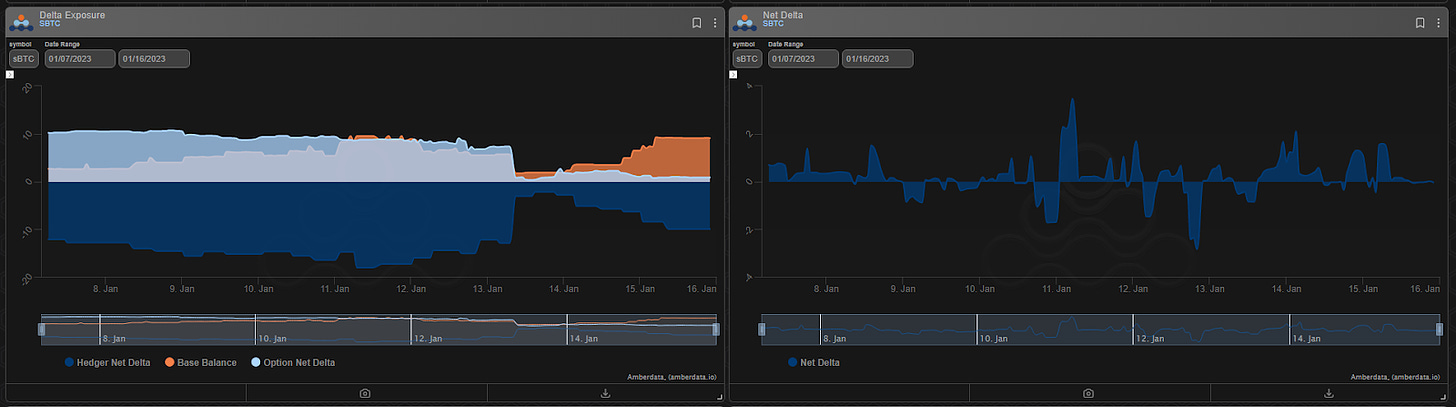

Net MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...