Crypto Options Analytics, Jan 7, 2024: FED Insights & ETF Anticipation

USA Week Ahead:

-

Wednesday 3:15pm ET - NY Fed President John Williams speaks

-

Thursday 8:30am ET - CPI

-

Friday 8:30am ET - PPI

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH, and Lyra and may change their holdings anytime.

CRYPTO OPTIONS MACRO THEMES:

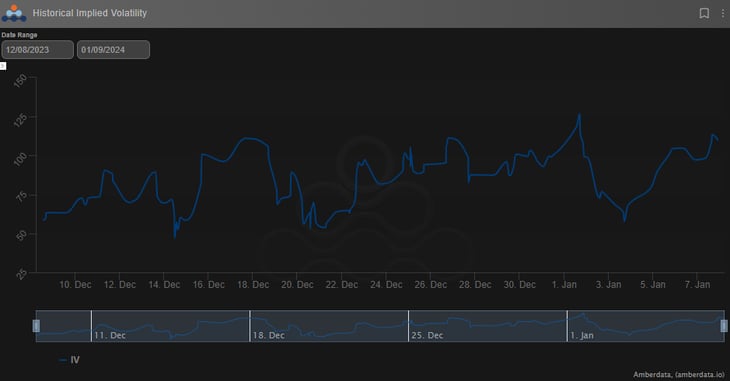

Last week, we gained deeper insights into the Federal Reserve's perspective through the release of the December 12-13th Minutes, which were made available on Wednesday, January 3rd.

The main takeaway from the Fed minutes is that, despite significant improvements in inflation, the Fed remains uncertain about the direction it should take in terms of interest rate reduction. Interestingly, the market appears to be more dovish than the current stance of the Fed.

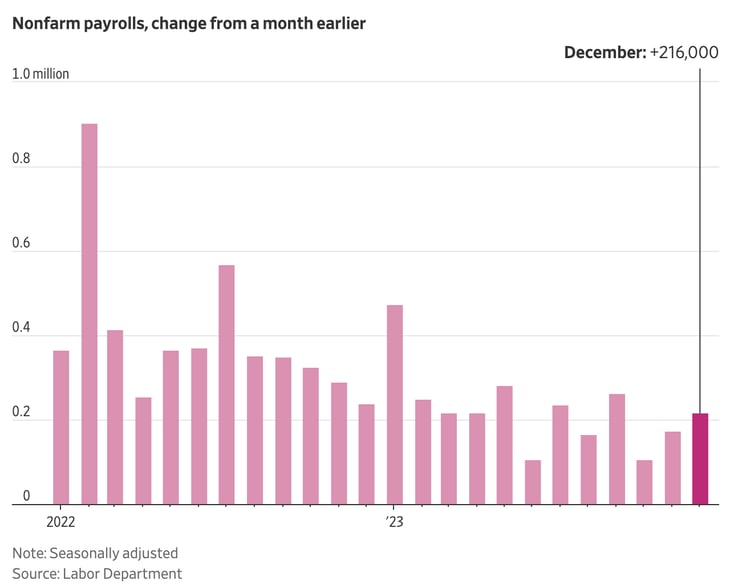

However, the impact of the Minutes release was overshadowed by the stronger-than-expected Non-Farm Payrolls (NFP) release on Friday.

The NFP report revealed a total of +216,000 new jobs, surpassing the expected +170,000. Moreover, the household survey showed that the unemployment rate remained stable at +3.7%, a historically low level.

Chart: WSJ.com

However, the most intriguing aspect was the rise in wage gains, which stood at +4.1% year-over-year (Y/Y). This figure significantly exceeds the current inflation rates. Historically, wage-price spirals tend to be persistent elements of inflation psychology, which will likely compel the Fed to maintain flexibility in its policy decisions going forward.

This week, we are anticipating two vital macroeconomic indicators: the Consumer Price Index (CPI) on Thursday and the Producer Price Index (PPI) on Friday. Both of these figures are crucial for providing context to the robust labor force and its potential impact on inflation.

BTC: $43,958 (+3.4% / 7-day)

ETH :$2,227 (-3.3% / 7-day)

While macroeconomics holds some initial intrigue at the beginning of 2024, nothing can quite match the anticipation surrounding the "ETF DECISION WEEK" in the world of Bitcoin.

This week, we eagerly await the SEC's decision regarding the possibility of a spot Bitcoin ETF. This event has been factored into the options market's pricing since October, creating a heightened sense of anticipation.

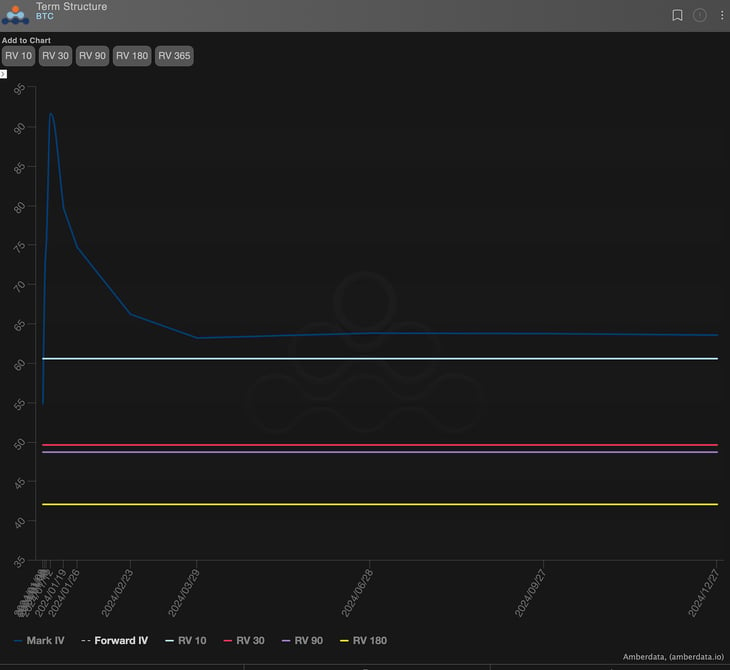

Taking a look at the current Term Structure, it becomes evident that there is a favorable premium over realized volatility, accompanied by a Backwardation trend as weekly options take the lead in shaping the volatility curve.

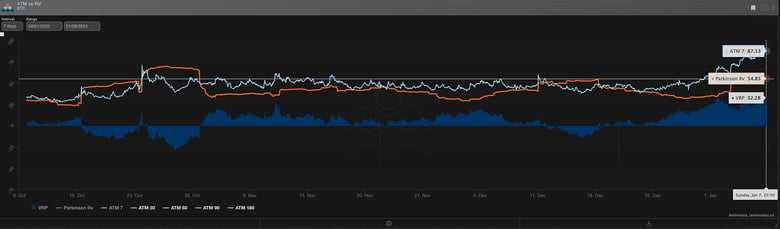

Chart: 7-day VRP

Chart: BTC ATM Term Structure with Various RV measurements (horizontal)

Last week, the Bitcoin market witnessed two significant daily price swings. First, there was a bullish breakout above the $45,000 mark, followed by a subsequent breakdown to the $41,000 handle.

These price movements managed to push the 10-day realized volatility slightly higher. However, they were not substantial enough to narrow down the Volatility Risk Premium (VRP), as traders are anticipating significant price swings in response to the SEC's decision.

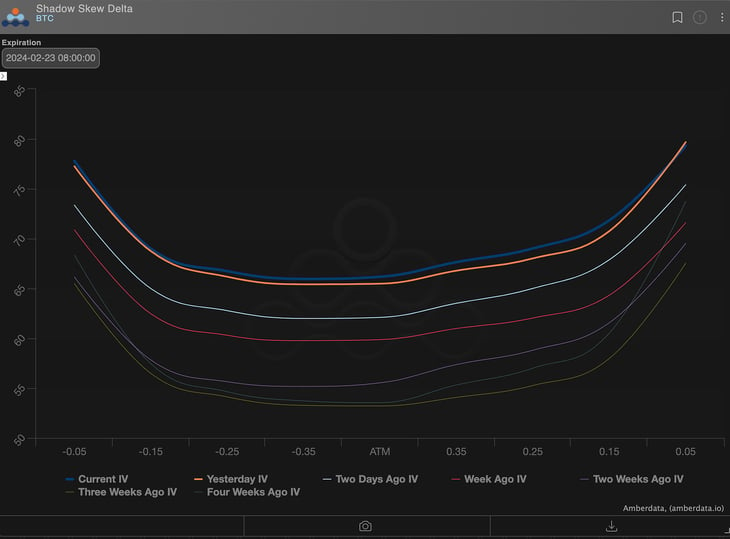

What's particularly intriguing is the absence of a downside reaction in Bitcoin's RR-Skew.

Chart: BTC RR-Skew 15min

The spot price dropped below $42,000 but failed to push the RR-Skew into negative territory. It was only during the weekend's trading activity in the past 48 hours that the 7-day RR-Skew briefly dipped into negative values.

The long-term Skew (180 days) is notably bullish, indicating that the market anticipates higher upside volatility and a likely continuation of the bull market in 2024.

For those interested in volatility strategies, the +30-day volatility and skew could hold significant appeal, as its vol is elevated due to the ETF event and there’s enough time duration to make the $ value of premium juicy.

Chart: Feb 23rd expiration

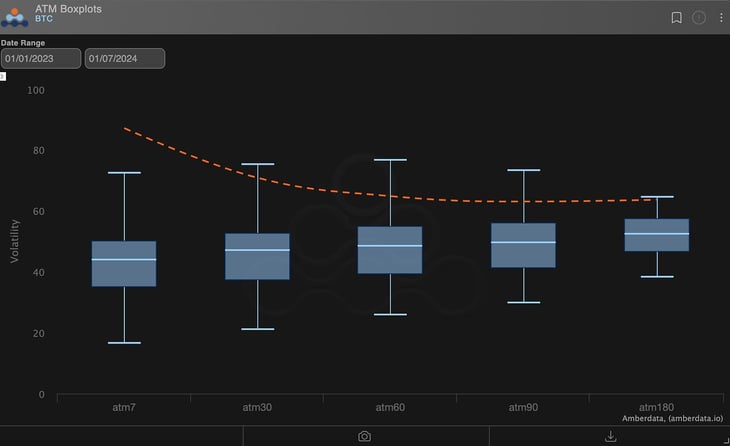

Chart: Current Term Structure measured against 2023

We've observed that the ATM (At-The-Money) volatility in February, which stands at approximately +70%, has consistently risen over the past two weeks. Furthermore, today's term structure surpasses both the shape and levels witnessed in 2023.

In my view, this event is favorable for the spot price but unfavorable for volatility. What some refer to as "sell the news," I see as "sell the volatility news." I don't anticipate a sudden crash in spot prices, but I do believe that the realized volatility might fall short of expectations. This perspective is particularly influenced by my observation of the September 2022 ETH Proof-of-Stake (POS) "volatility event," where the realized volatility turned out to be disappointing.

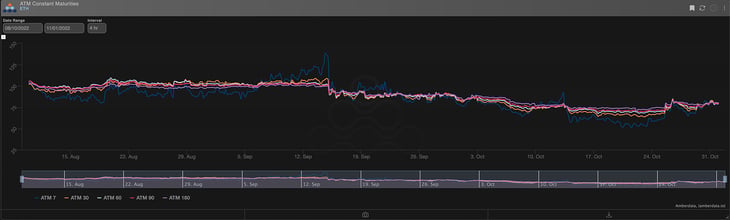

Chart: ETH term structure Sept 2022 POS vol event

@Gravity5ucks

The perp premium is completely gone and leverage is so low that hasn't been seen in months. And the risk of liquidation is only to the upside. If someone had told me that these would be the pre-announcement conditions, I wouldn't have believed it. It seems healthy to me. Bet more.

The perp premium completely gone and leverage so low that hasn't been seen in months.

— GravitySucks (@Gravity5ucks) January 5, 2024

And the risk of liquidation is only to the upside.

If someone had told me that these would be the pre-announcement conditions, I wouldn't have believed it.

It seems healthy to me.

Bet more. pic.twitter.com/dZDcbEUM46

Paradigm's Week In Review

Chart: BTC +4.4% / ETH -1.6% / NDX -2.0%

Paradigm Top Trades this Week ⬇️

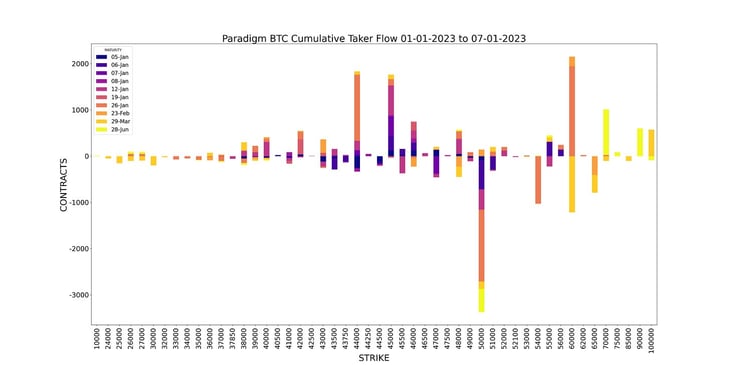

Weekly BTC Cumulative Taker Flow 🌊

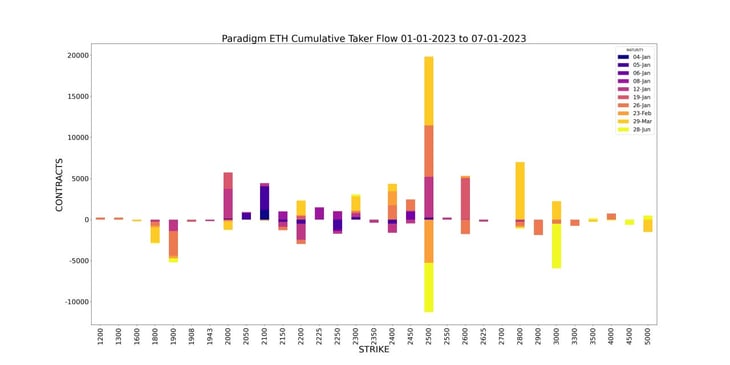

Weekly ETH Cumulative Taker Flow 🌊

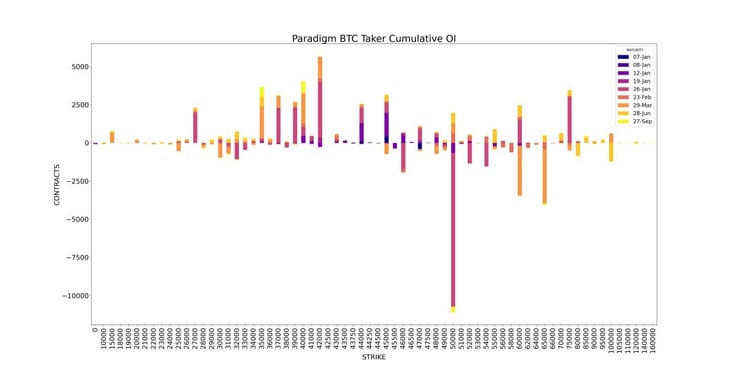

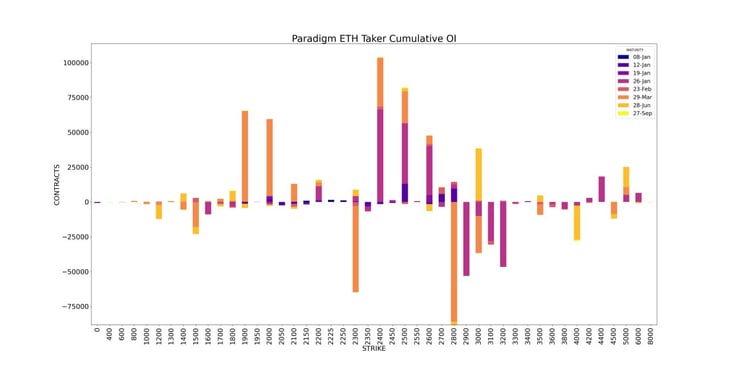

BTC Cumulative OI

ETH Cumulative OI

Paradex hit $100m in 24hr volume 🔥

Crushing it and making it look good😎👇

$100m in 24hr volume 🔥🔥

— Paradex (@tradeparadex) January 4, 2024

Crushing it and making it look good😎👇

SOUND ON🎧🔊 pic.twitter.com/wj3hgfGFwN

The first #TBP of the new year just dropped! 🎉

Kelly Greer talks about how the pending ETF approval is driving $BTC volatility and liquidations.

As always you can hit us up from the below

Hit us up on Telegram! 🙏

Paradigm Edge: Daily Commentary✍️ http://pdgm.co/edge

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

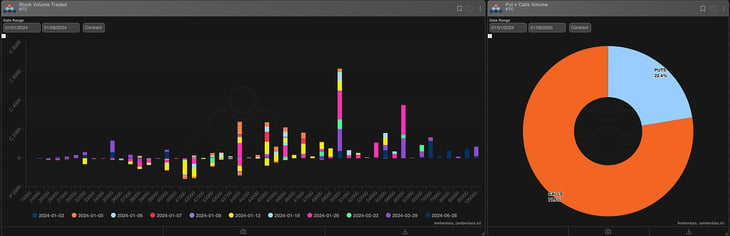

BTC

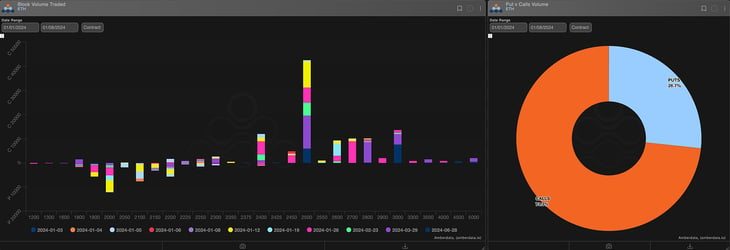

ETH

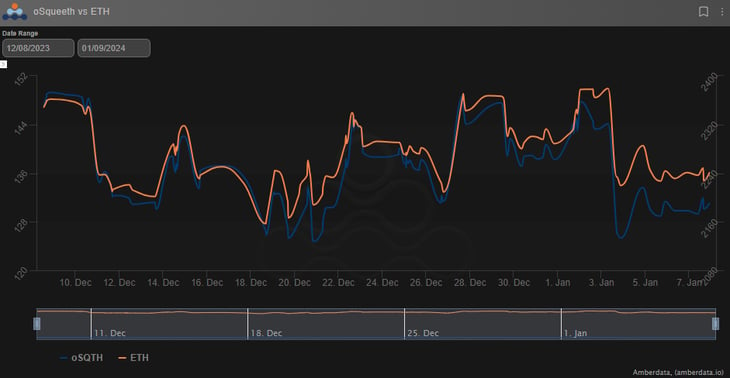

The Squeethcosystem Report

Crypto markets found their way lower throughout the week. ETH ended the week -2.55%, and oSQTH ended the week -5.30%.

Volatility

oSQTH IV remained active this week trading near 50 and reverting back to over 100.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $989.81k

January 5th saw the most volume, with a daily total of $343.77k traded.

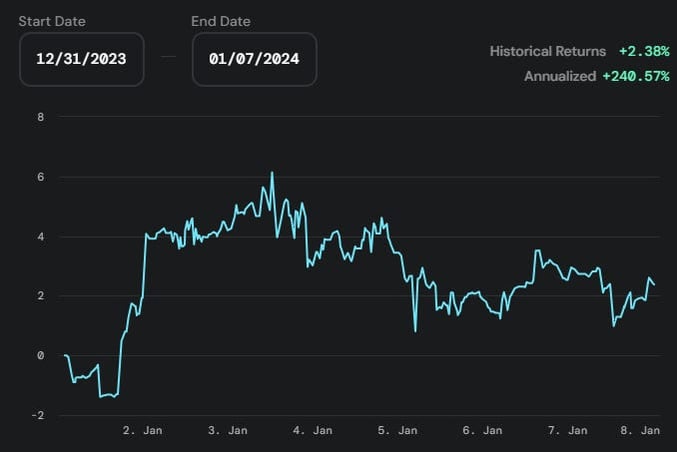

Crab Strategy

Crab saw gains during the week ending at +2.38% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...