.png)

USA Week Ahead:

-

Wednesday 1:30p ET: Powell Speaks at Brooking Institute

-

Wednesday 2:00p ET: FOMC minutes are released

Disclaimer: Nothing here is trading advice or solicitation.

This is for educational purposes only.

Math minded people here, pardon any typos.

TALENT CORNER - Crypto Vol. is a small space! Given the FTX meltdown taking down companies, we’re highlighting vol. traders who could be a good fit at new company.

Mark Treinkman: https://www.linkedin.com/in/mark-t-4492735a/

THE BIG PICTURE THEMES:

This week is the Thanksgiving holiday in US trading. Markets will be closed Thursday and open Friday but closing early at 1pm ET.

This means we’re expecting thin markets and potentially extended price ranges should anything material happen with Wednesday’s Fed talk.

Overall equity markets are quite calm, with VVIX pricing Vol. of Vol. very cheaply.

This factor alone may be supporting crypto assets during the carnage, but I personally still think “watching” crypto price action from a distance is the best move.

(VVIX Daily Price Chart - Below)

Crypto:

Selling vol. last week worked… but still I maintain “DON’T do it yet”. To me, this just feels like we could be stepping in front of a train.

Here’s a thread I did on Volatility Trading to explain my thinking behind this perspective (attested by Two Prime’s Nathan Cox)

Great thread on vol trading for crypto here https://t.co/5m1eardqR5

— Nate Cox (@nathanieljcox) November 15, 2022

Contagion aftershocks are still being uncovered.

-

Genesis Trading halts withdrawals

-

BlockFi said to file for bankruptcy

-

GBTC discount continues to widen (now -50%)

(people are wondering if Grayscale actually has the assets, after they tweeted assurances without disclosing their actual BTC wallet addresses… because of security concerns?!?!)

-

DCG (Grayscale parent) is looking to raise more funds to help Genesis… Sounds like they’re having “no luck” doing so.

Can't stress enough how desperate DCG is to sell Genesis' loan book. Zero takers right now. None.

— Andrew (@AP_ArchPublic) November 20, 2022

**they are approaching every possible PE/VC shop on the planet.

BTC: $16,270 -0.82%

ETH :$1,139 -6.5%

SOL: $12.23 -10.6%

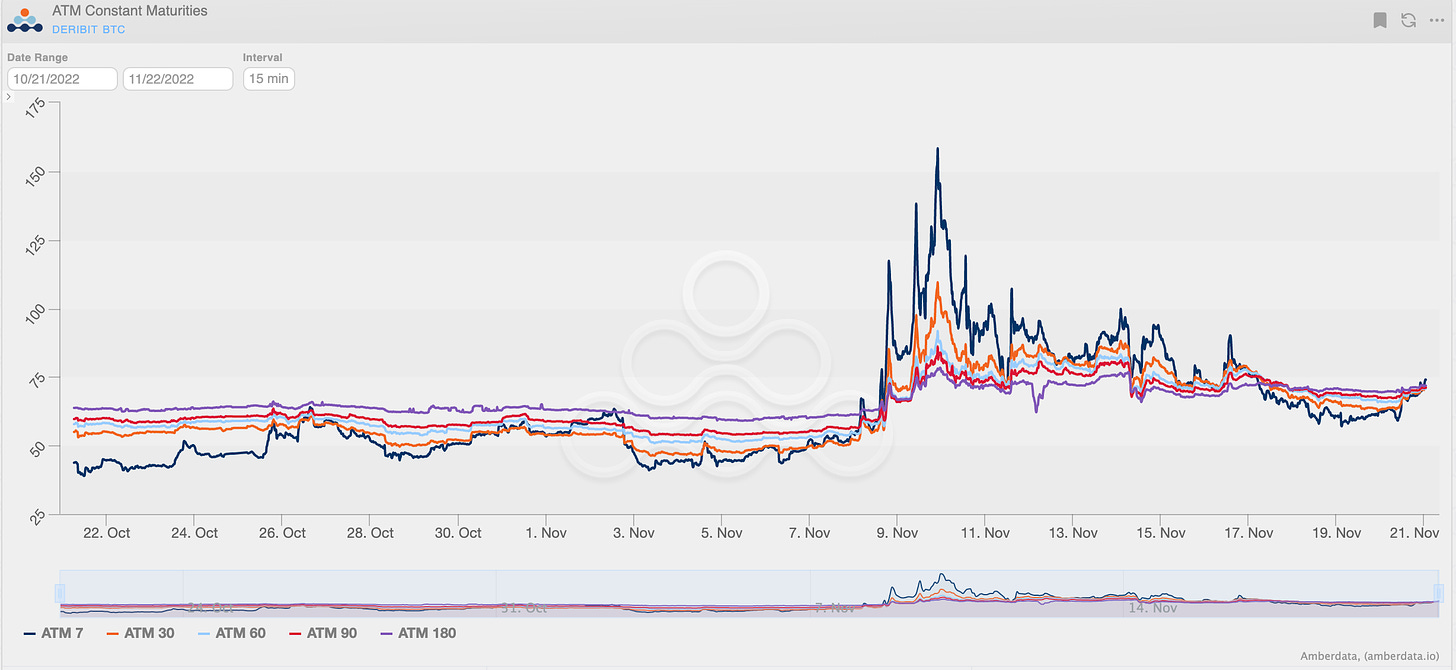

DVOL: Deribit’s volatility index

BTC - (365-days w/ spot line chart)

DVol hit levels seen during the Luna meltdown and 3AC implosion.

We’ve now retraced from those highs but remain able the “normal trading” highs.

DCG and Tether are the two catalysts to watch for potential VOL.

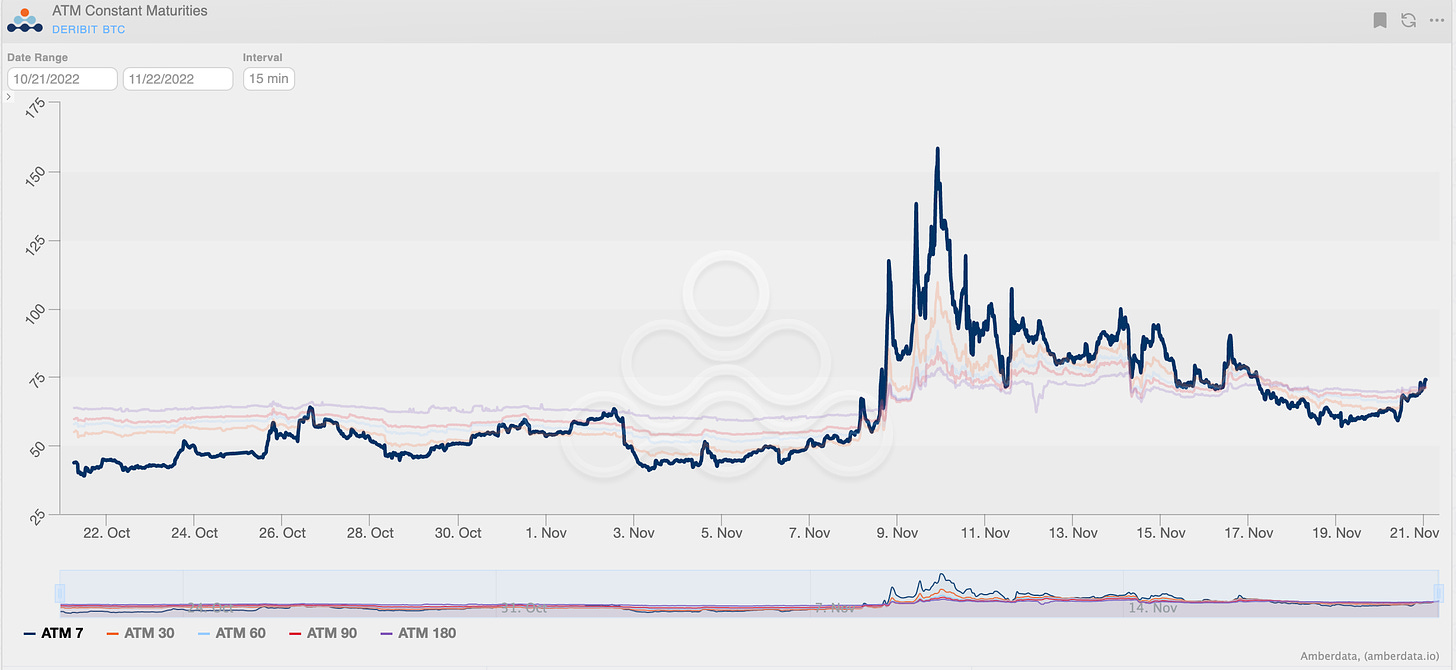

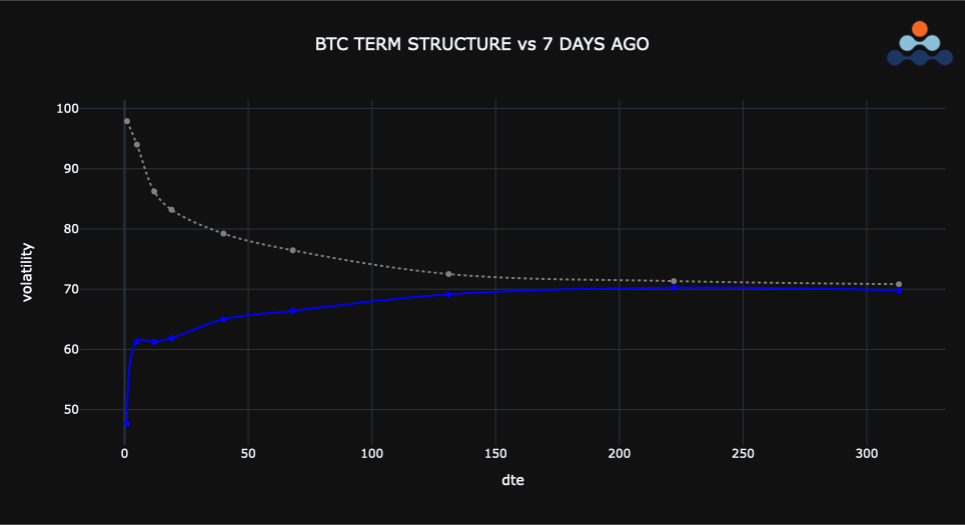

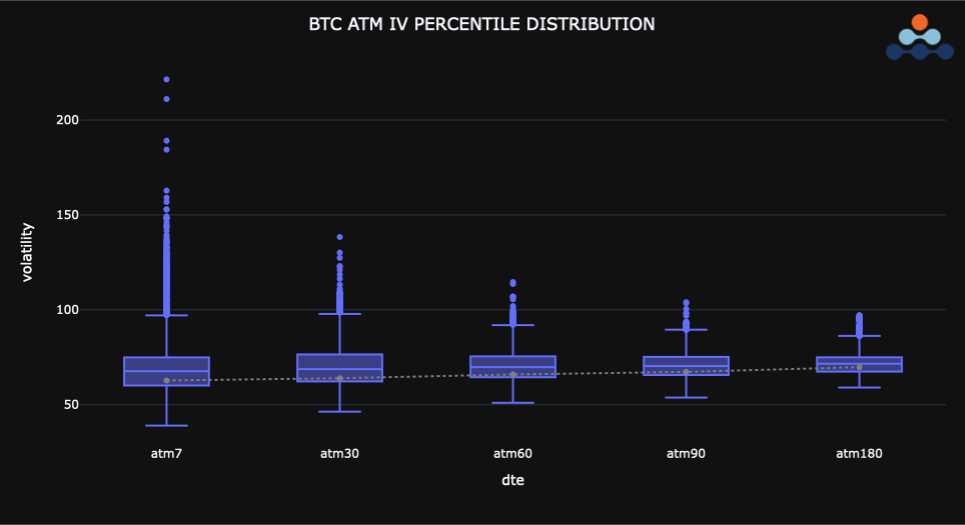

TERM STRUCTURE

(Nov. 20th, 2022 - BTC Term Structure - Deribit)

(7-day highlight)

The term structure is back at “interquartile” levels and in Contango shape again.

We can see the short-term vol. begin to climb again as BTC nears $16k.

I think the option market was very quick to discount vol. again but who knows for sure, time will tell.

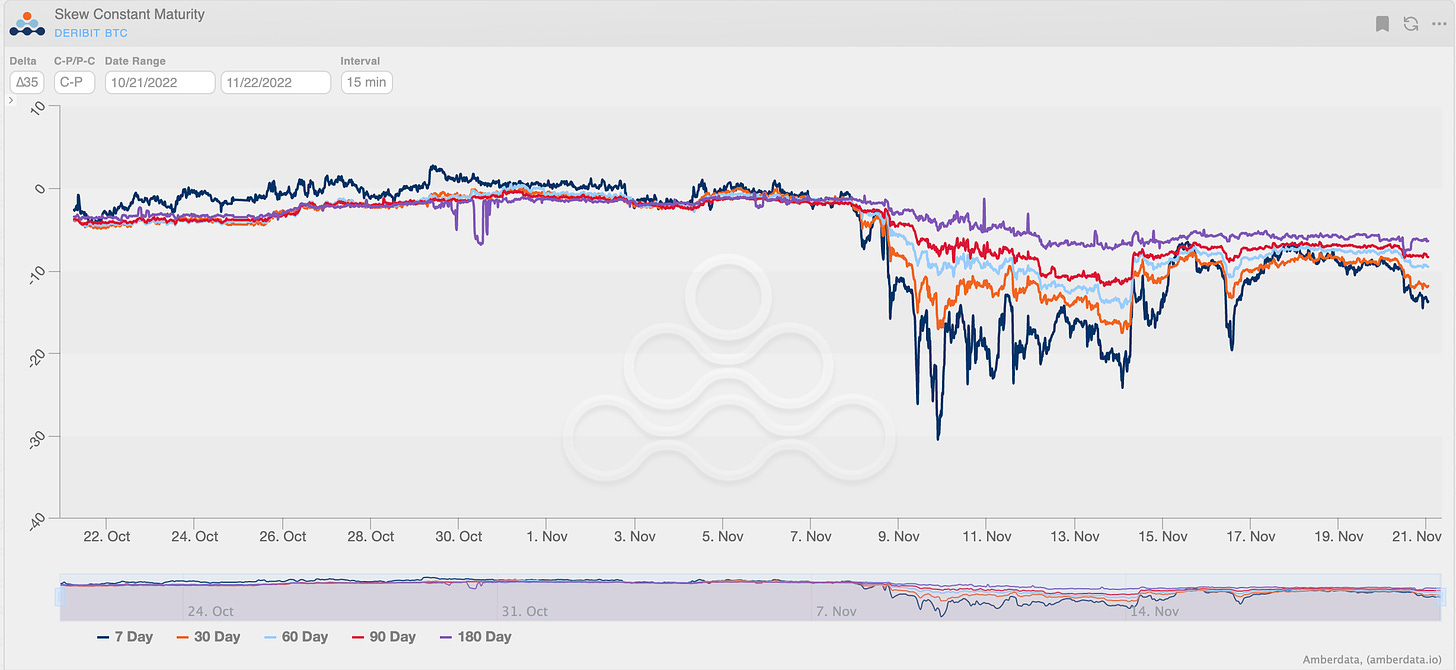

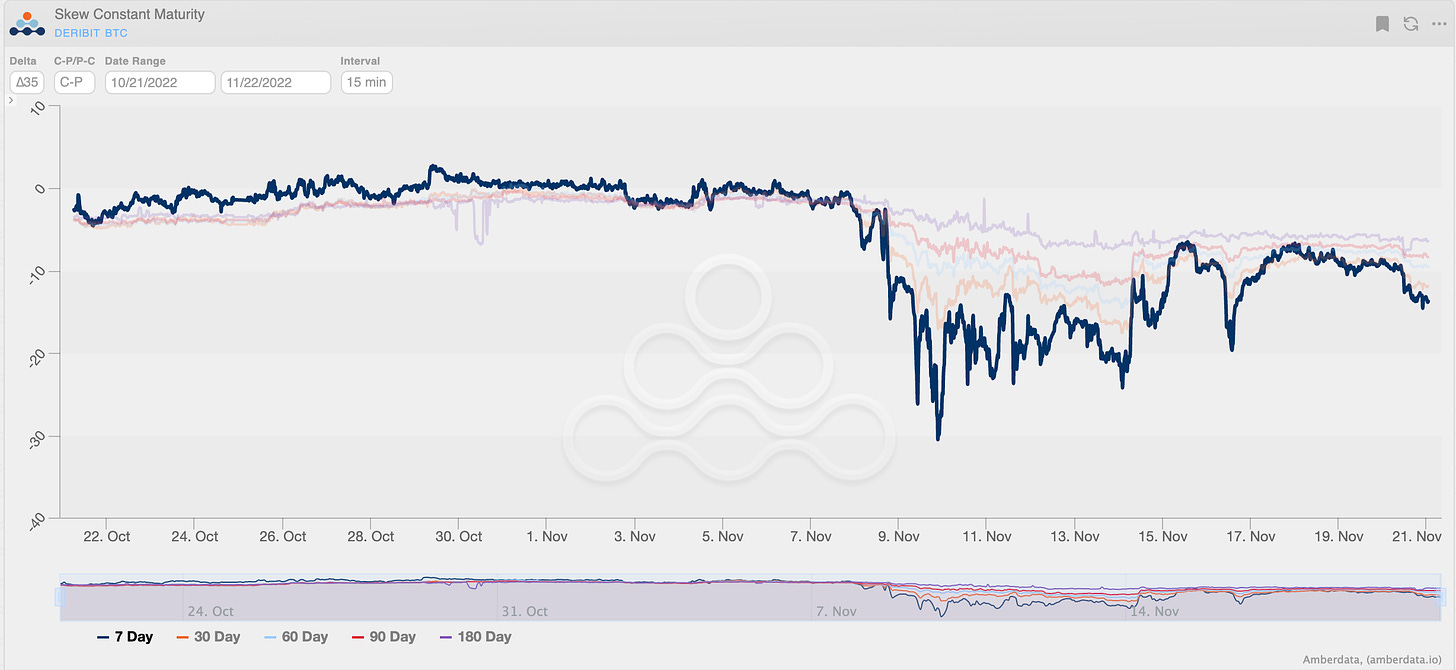

SKEWS

(Nov. 20th, 2022 - BTC RR SKEW (C-P) ∆25 - Deribit)

(7-day highlight)

Skew remains bid to the puts.

We can see the BTC RR-Skew has retraced from extreme lows, but the market continues to associate increase in volatility with downside spot activity.

This is CLEARLY the right intuition.

The extent of RR-Skew being negative is really going to depend on a major catalysts spooking the market.

If Tether, for example, is really a fraud and worth pennies on the dollar… then RR-skew is underpricing puts here.

I don’t hate buying puts (or put spreads here).

Especially with a Contago term structure.

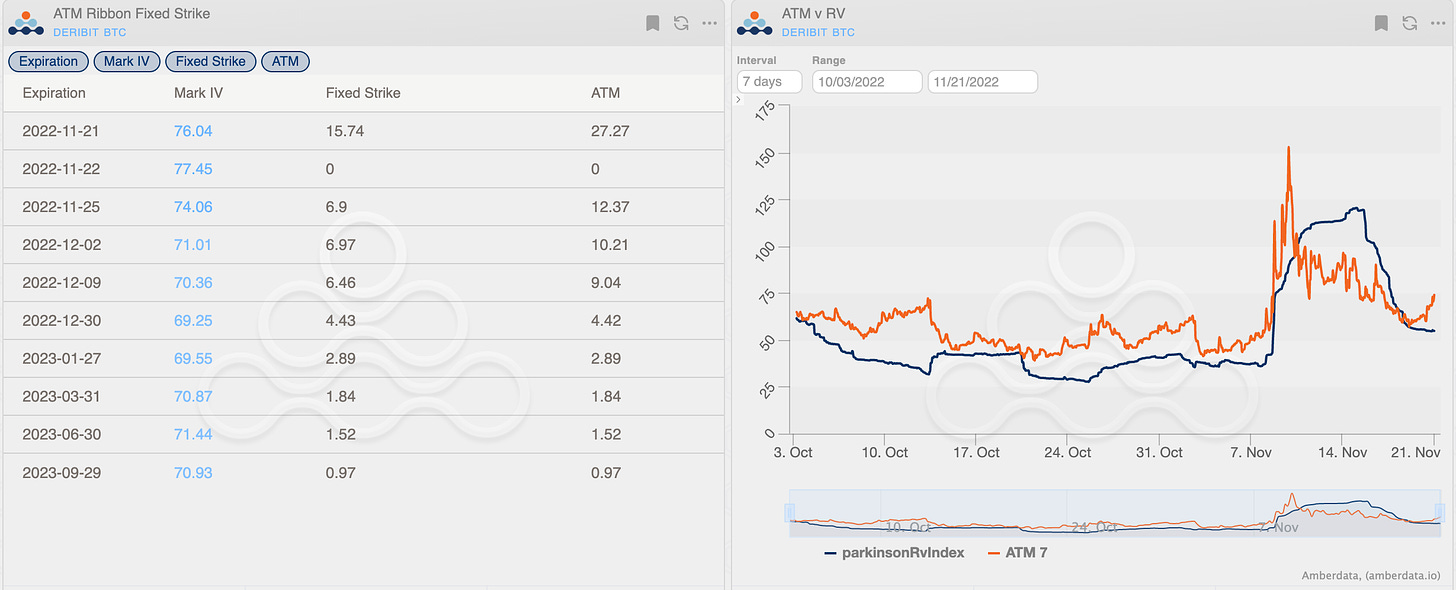

VOLATILITY PREMIUM

(Nov. 20th, 2022 - BTC IV-RV)

The VRP is slightly positive again.

HV is in the “middle of the road” and could go either direction given fundamentals.

Given the uncertain environment, picking a direction for HV (and hence VRP) is a coin-flip right now.

Coin flips aren’t a bad environment for long vol. puts or put spreads.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @fb_gravitysucks

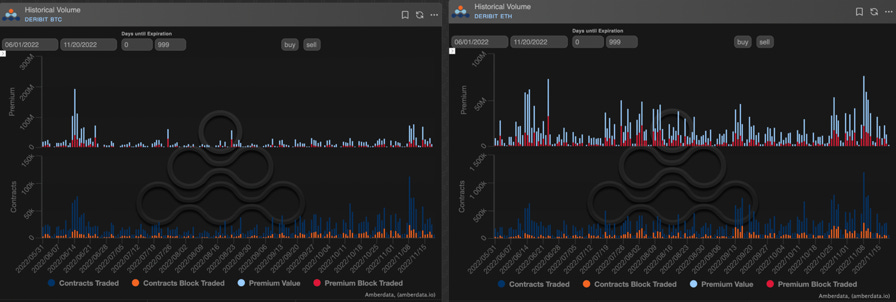

Above-average volumes also this week, although down from the previous peak. Bitcoin still dominates the flow with $ notional +50% compared to ethereum.

(Deribit Historical - Historical volume - BTC vs ETH)

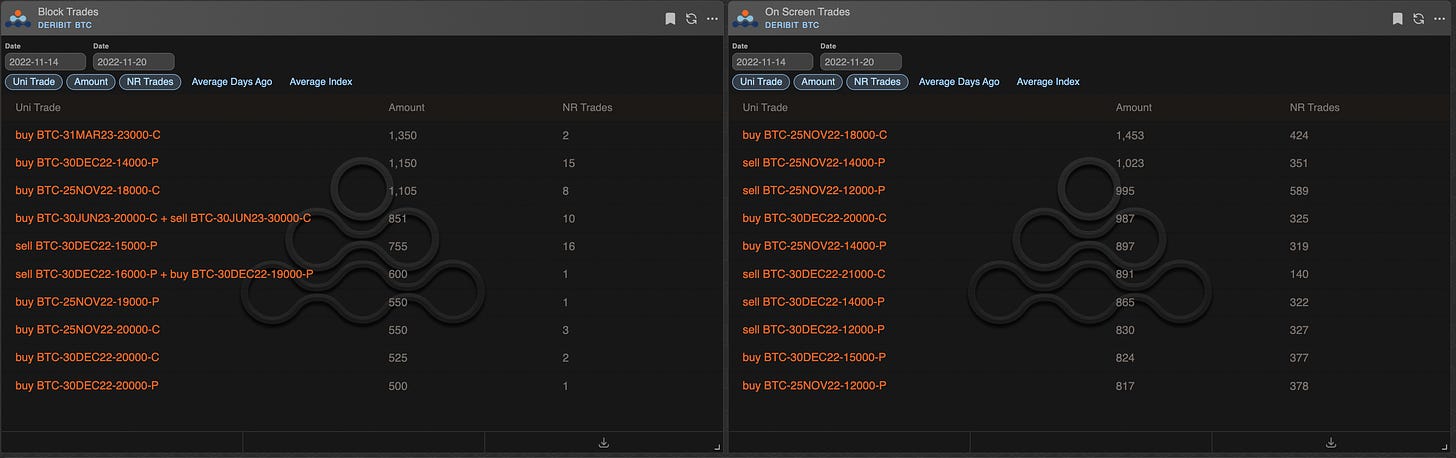

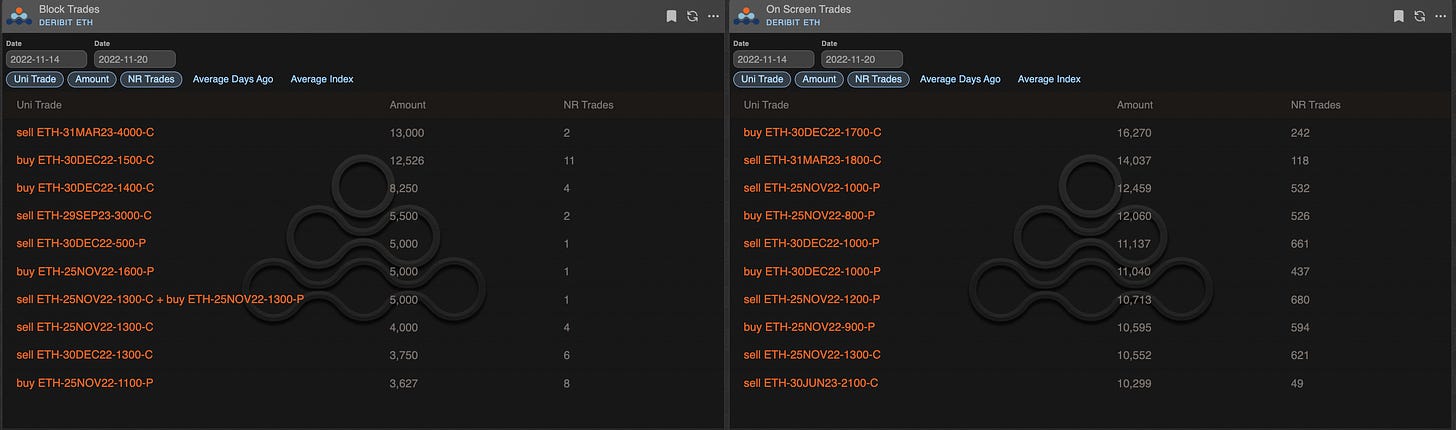

The tape continues to be eclectic and difficult to read. Many trades we are reading lead to a decrease in open interest: it is difficult to determine whether it is closures of positions previously opened by traders or inventory unwinding of market makers. Both themes that have been evident over the past 10 days.

(BTC Gvol direction table with uni_trade - Options Scanner section)

(ETH Gvol direction table with uni_trade - Options Scanner section)

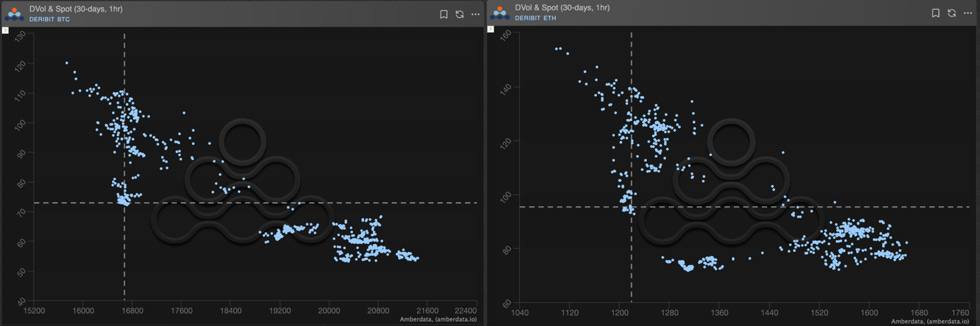

In the last newsletter I spoke about “suspended time” opening up to a scenario of low realized volatility. I think many have been surprised to see already this week a minimum of 16% on the daily (and a weekly at pre-FTX levels). Collecting theta was a winning strategy.

In the following days I think we will be able to see the end of this suspension condition. The directionality of the movement will greatly affect the general levels of implied volatility. Beware of the skew.

(DVol DSpot correlation - “Deribit DVol” section)

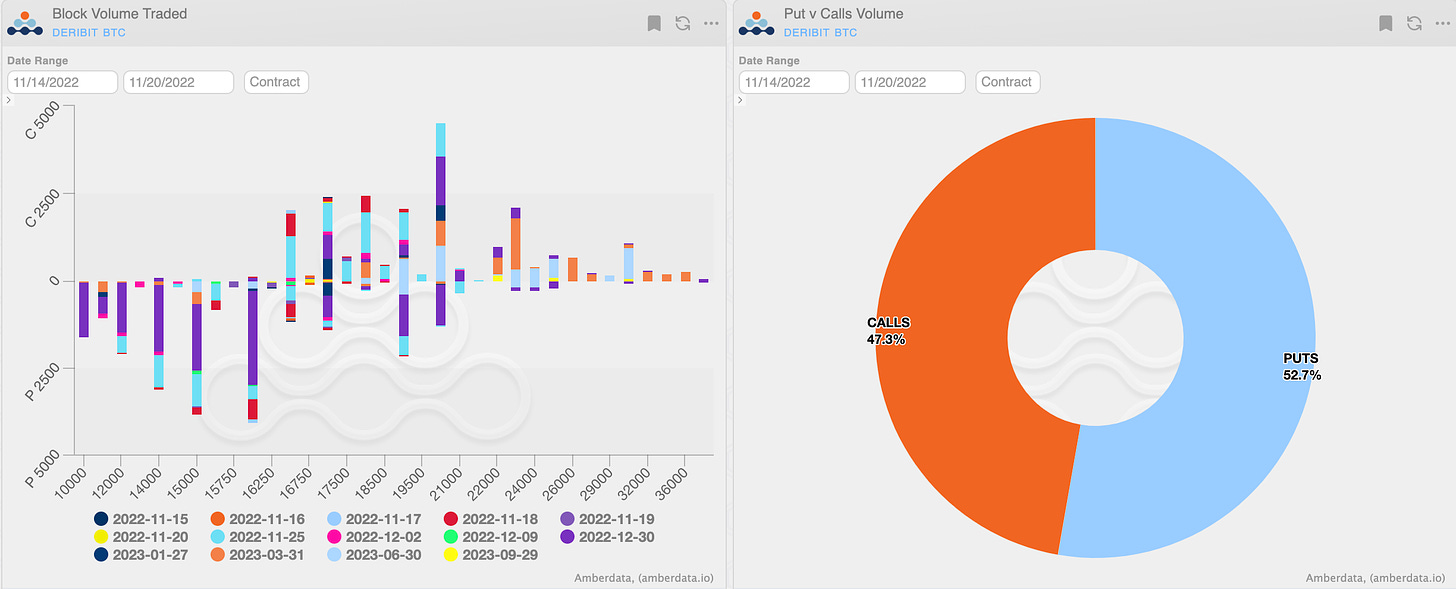

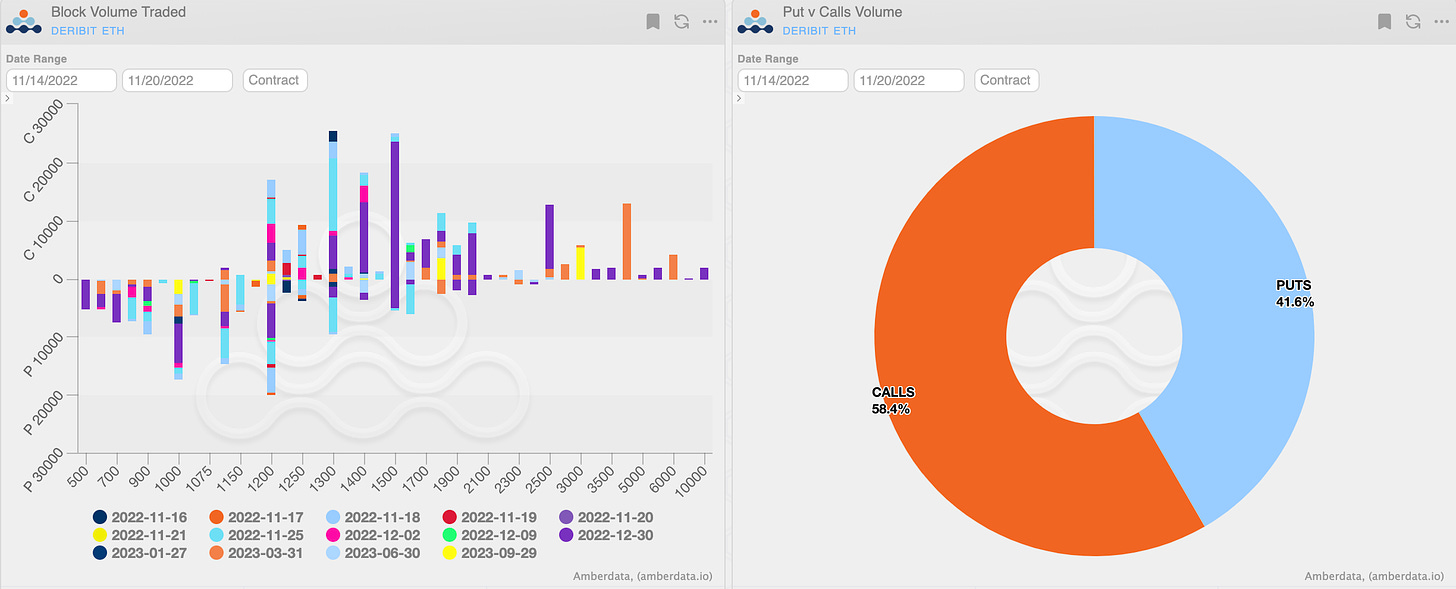

Paradigm Block Insights (14 Nov - 20 Nov)

The price of BTC rose 4% this week, holding firm above $16,000, with ETH down 1% breaking through the 1200 psychological support level.

BTC +4% / ETH -1% / NDX -0.3%

🧵1/7

—-------

🌊 BTC Flows

Somewhat muted activity across the board as players wait for the dust to settle.

Flows in BTC saw buying of downside via puts in the 30 Dec bucket, with both the 14k and 15k strikes bot earlier in the week and subsequently unwound a few days later.

1650x 30-Dec-22 14000 Put traded

1180x 30-Dec-22 15000 Put traded

🧵2/7

—-----------

🌊 BTC Flows (cont.)

In further dated expiries we saw a focus on upside in March and June, in addition to new positioning in Nov.

1450x 31-Mar-23 23000 Call bot

1155x 25-Nov-22 18000 Call bot

744.25x 30-Jun-23 20000/30000 Call Spread traded

🧵3/7

—--------------------------------

🌊ETH Flows

On the ETH side, the top blocks on Paradigm were heavily focused on calls with a mix of establishing new long positions in Dec, adding to short positions in Nov, and unwinds in March and Sept.

15026x 30-Dec-22 1500 Call bot

13000x 31-Mar-23 4000 Call bot

8500x 30-Dec-22 1400 Call bot

6250x 25-Nov-22 1300 Call sold

5500x 29-Sep-23 3000 Call sold

🧵4/7

—-----

Despite the uncertainty going forward, 1M constant maturity vol is trading close to its 200 day average.

🧵5/7

—-----

🎀A successful @ribbonfinance auction on @tradeparadigm 🎉🎉

💥Average comparable beats to screen of 10% 🔥🔥 Boosting those vault yields 💪

🥳Congrats to our winners who mostly ANON 🤫

Winners 🏆

🥇 @OrBit_Markets

🥇 Various ANON

Same time next week 🫡

🧵6/7

—-------------

Hit us up on Telegram! 🙏

Daily Commentary✍️ http://pdgm.co/cmmntry

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

🧵7/7

BTC

ETH

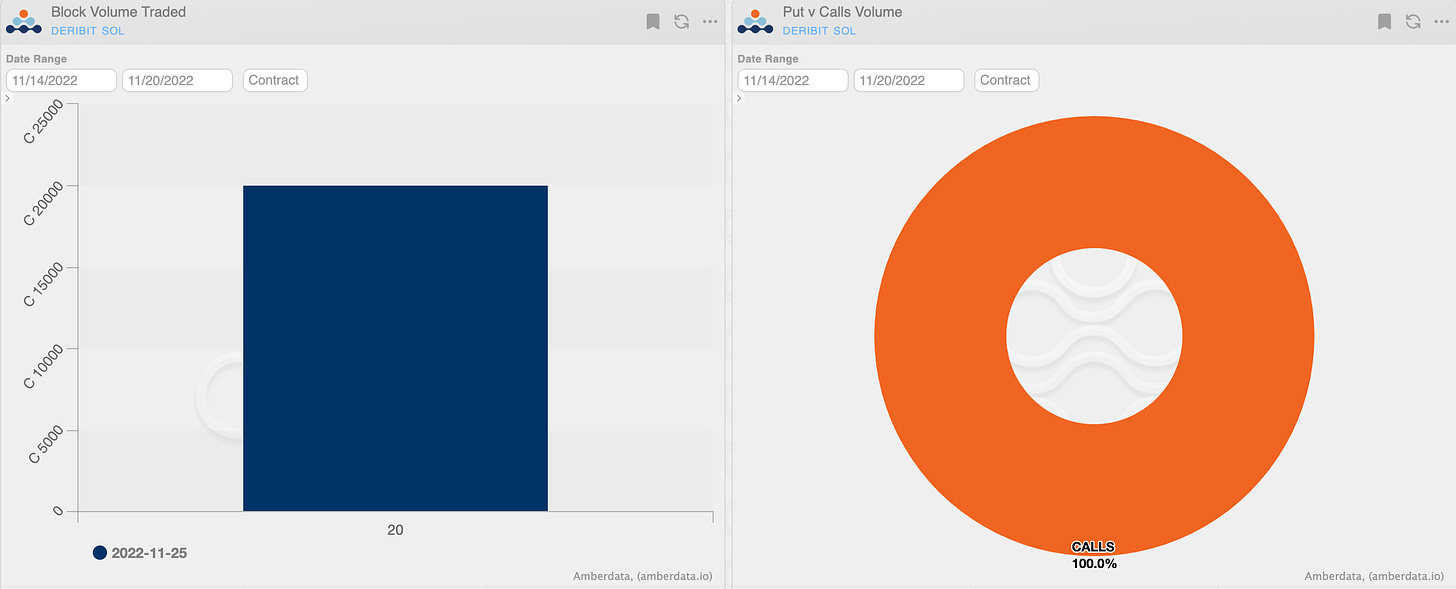

SOL

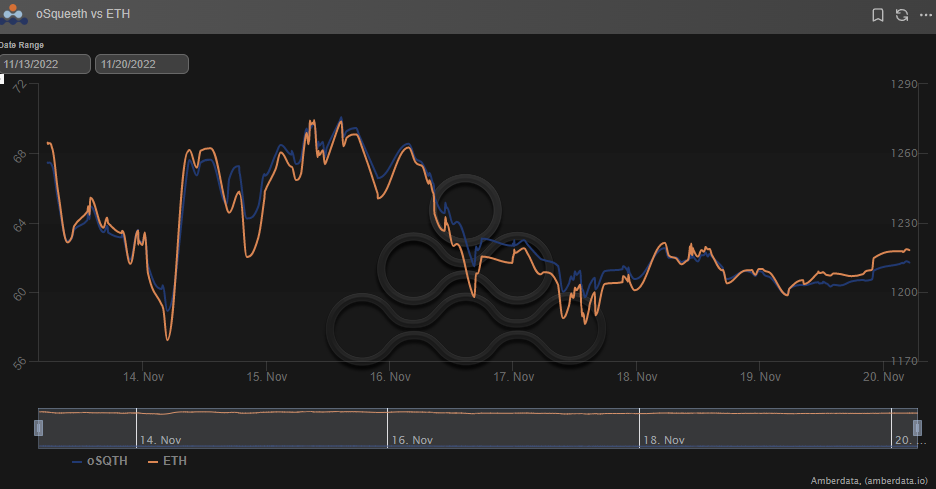

Squeeth: a Week in Review

After last week's volatility explosion, markets remained relatively quiet this week. ETH ended the week down 3.68%, oSQTH ended the week down 8.55%.

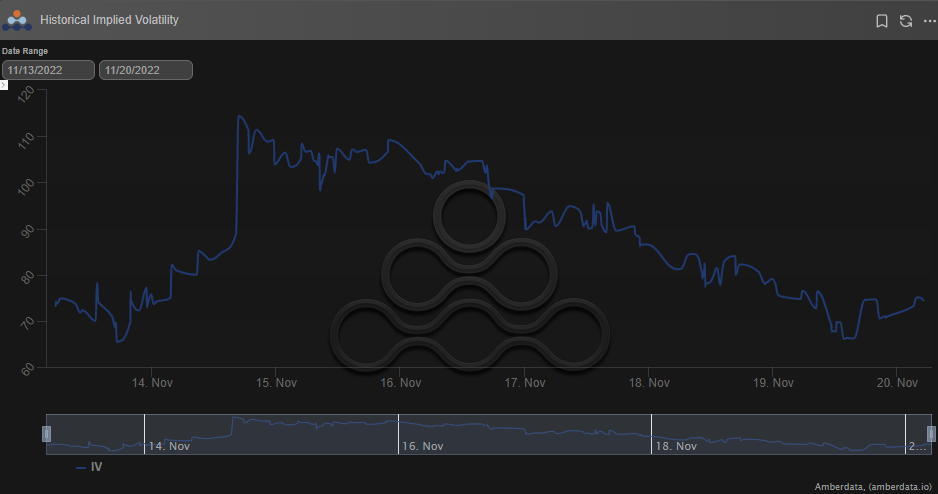

Volatility

Squeeth vol found a bid early and peaked mid-week at 114.36%, and slowly reverted back to the 70s. oSQTH continues to present unique opportunities both intra-week and on a longer time frame for volatility traders.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $4.62m. November 14th saw the highest single day volume, with a daily total of $1.76m traded.

Crab Strategy

With markets digesting last week's moves, Crab depositors were rewarded. Crab returned +1.45% in USD terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

Lyra Weekly Review

Volatility

Current ATM IV has normalized ~90% in ETH while we wait to see just how far the contagion has spread. Near-term vol has let some air out, off nearly 30 points from last the end of last week and the term structure is fairly flat.

Trading

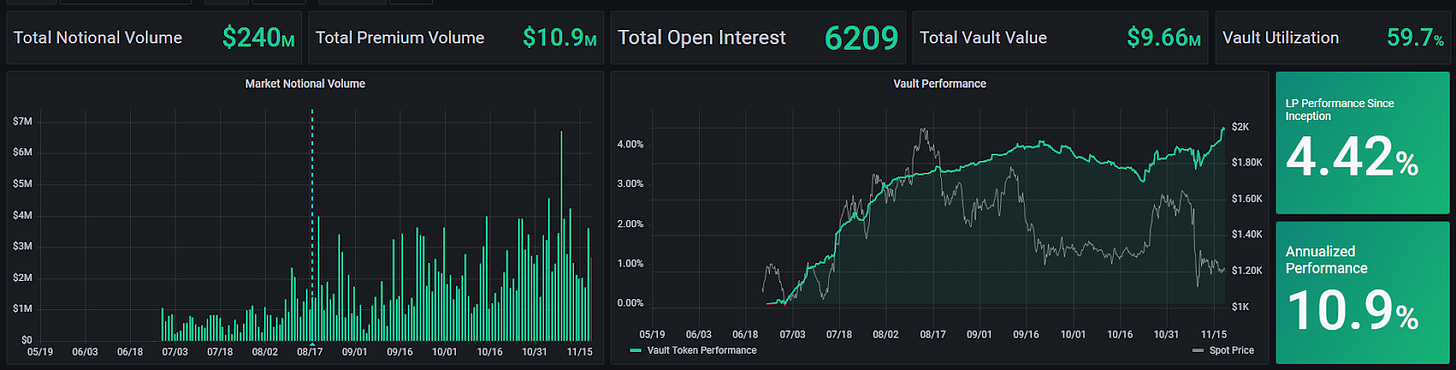

Lyra quickly surpassed $10 mil in premium and $250 mil in notional volume traded with last week's activity. Lyra IVs are showing a significant premium to CEX options creating some potential arb opportunities.

ETH Market-Making Vault

After some variance in returns last week, The ETH MMV has rebounded to +4.42% since its inception (June 28th, 2022) representing a weekly change of +.59%.

The 90-day performance annualized is +4.276%, annualized performance since inception is +10.9%. Depositors earn an additional 9.53% rewards APY (boosted up to 19.05% for LYRA Stakers).

Net MMV Exposure:

SOL Market-Making Vault

Lyra’s governance has elected to pause new listings on SOL options while we evaluate potential future liquidity. All open positions may still be closed with the AMM.

Check out the latest updates from Lyra’s community call last week!

Lyra Community Call #12 Notes:

— The Lyra Short Put (@lyrashortput) November 11, 2022

- Recent Market Events

- AMM Performance

- New Education/Builder Grants

- LEAP 36 - Cash Collateralized AMMhttps://t.co/zHe4M4QJPi pic.twitter.com/lvv2EiGLJ1

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...