Crypto Options Analytics, Aug 6th, 2023: Navigating Volatility Trends

USA Week Ahead:

-

Thursday 8:30am - CPI

-

Friday 8:30am - PPI

CRYPTO OPTIONS MACRO THEMES:

This week we got a mixed NFP print that sent treasury bond yields lower while the stock market reaction, initially bullish, was to close lower on the day.

The July payroll print came in at +187k (+200k exp) along with downward revisions for the previous months. Yet the unemployment rate dropped to 3.5% (from 3.6%) and hourly wages gained +4.4% although hours worked decreased.

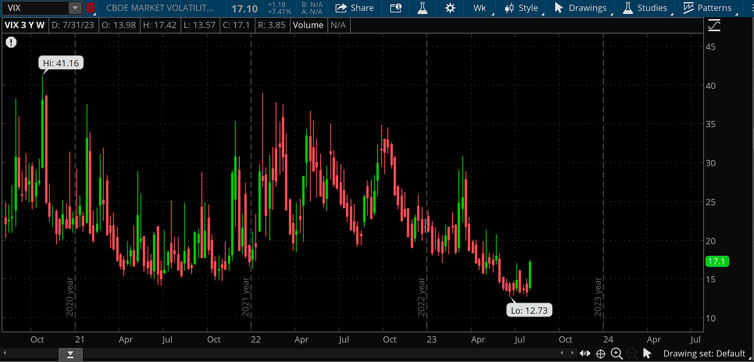

Overall, VIX moved higher on the week as the stock market dropped, but given the current vol trends and August seasonality I doubt this isn’t something that drops back down this week.

We have CPI this Thursday and PPI on Friday, these two data points will help clarify the mixed bag we saw with NFP on Friday.

Crypto, overall, has remained very quiet.

BTC closed within a $100 week-over-week.

Upside volatility likely remains far-away, unless BTC can take new YTD highs. The clearest catalyst for this currently revolves around a BTC spot ETF.

BTC: $29,042 (-1.1% / 7-day)

ETH :$1,829 (-2.5% / 7-day)

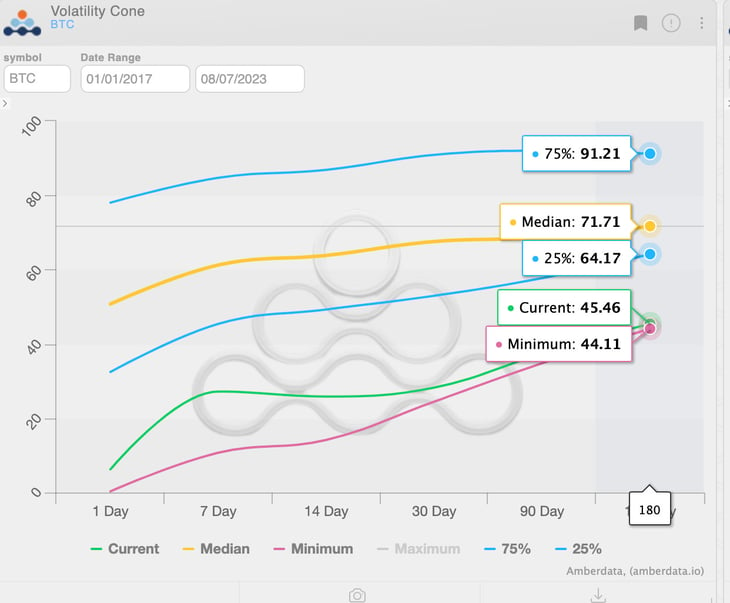

I continue to believe the “base case” in this environment is to lean towards the short-vol bias, (in the near term) given the expensive “carry”, low realized vol and the fundamental catalysts for volatility (the ETF) being a ways away.

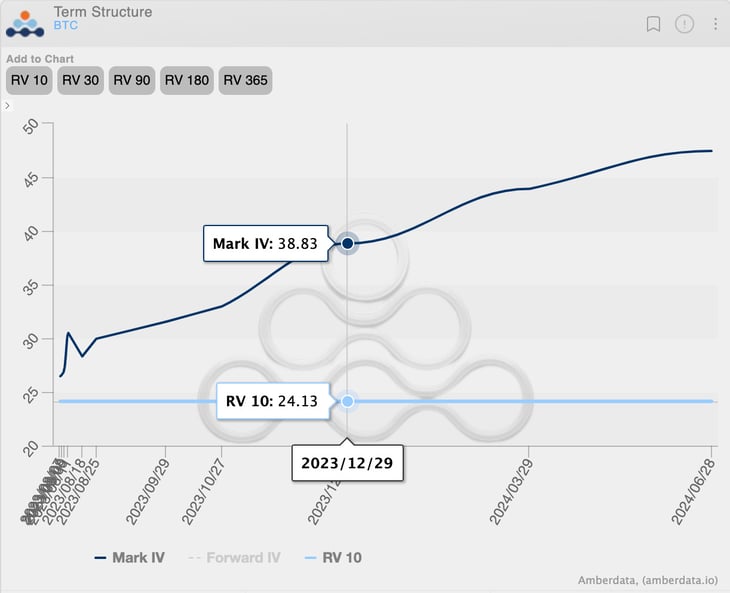

Given the steep term structure and even lower realized. There’s a lot of cost (carry) for long vol players assuming nothing happens until an ETF decision.

Realized continues to be dismal, as spot is trading in tight daily ranges.

A move above $32k however could be sharp bringing both a bullish spot trend and an explosion in vol with it.

Buying LT OTM call “tails” is an interesting way to hedge a short-vol (near/medium term maturity) play. Theres likely a decent diagonal to be done, given that if things change LT OTM tails (which are less liquid) could quickly reprice higher.

Tails are often the hardest instruments to price, and historically speaking, crypto vol can be explosive.

Current 180-day RV is at the minimum level since 1/1/2017.

Something to consider… Especially if there’s a massive “institutional” catalysts such as the spot ETF.

My thinking is…

Buy the low liquidity stuff, while it’s historically low and finance it with the (easier to price) meaty near dated options.

Something like that.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

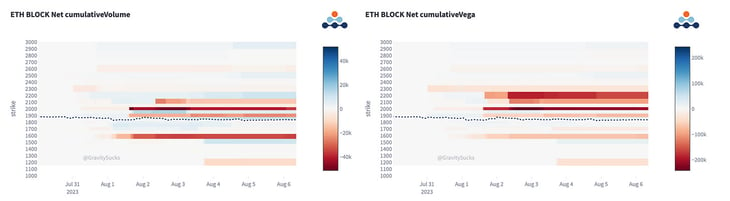

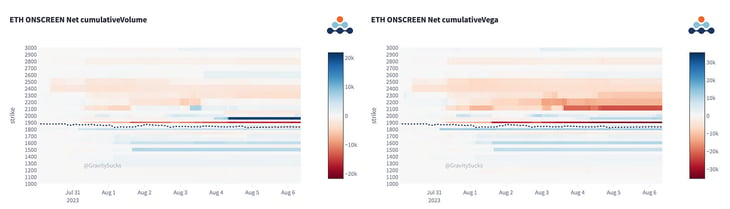

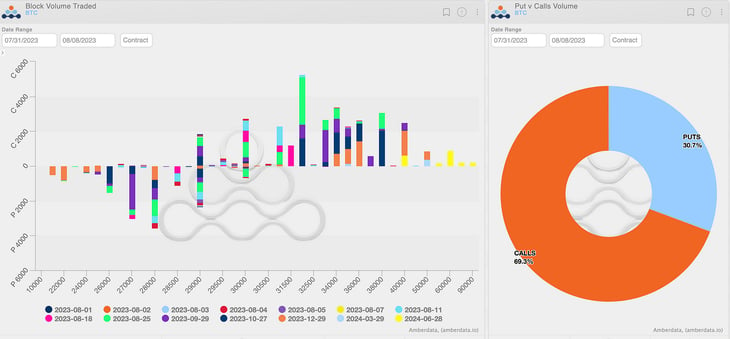

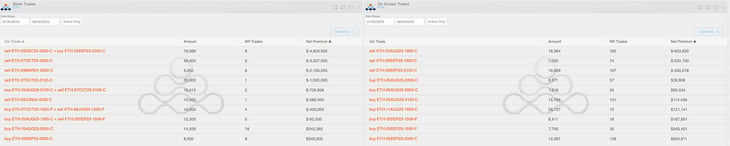

The flow is dominated by block activity, with some of the themes from the previous week continuing (long RR).

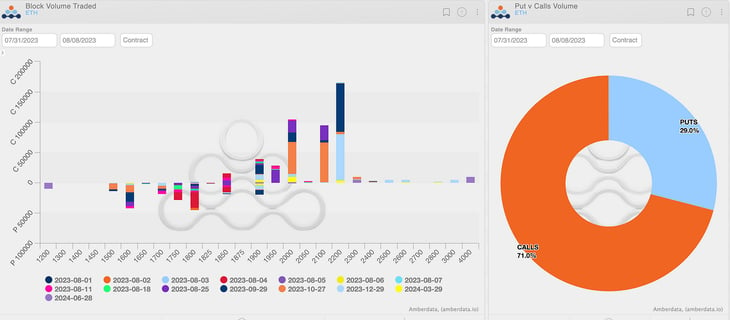

Generally, trading activity has been bullish on blocks with puts sold and calls bought while on-screen, despite the lighter volumes, we’ve seen a more cautious approach.

More coherent flows have been seen in ETH, where sellers are still dominating. Huge $2.2k roll-over from September (buy to close) to December (sell to open).

Paradigm Block Insights

🔥Continued bullish momentum this week on Paradigm with volatility towards all-time lows.

📉 NDX correction sends VIX over $17, up 30% over the week

👉 Continued pressure in DeFi on major liquidity protocols Curve and Aave.

BTC +.2% / NDX -3% / ETH -1.7%

🌊BTC

Outright upside lifted shows traders expecting substantial gains into EOY.

1. 1955x 27-Oct-23 38000 Call bought

2. 1375x 29-Dec-23 36000 Call bought

3. 1105x 18-Aug-23 31500 Call bought

4. 1025x 27-Oct-23 36000 Call bought

5. 900x 28-Jun-24 60000 Call sold

December claims the largest BTC open interest expiry on Paradigm with 12.5k contracts, largely comprised of the Dec 40k calls bought on Paradigm ~9k times. To put this in perspective, the second largest strike is less than half this size!

ETH 🌊

ETH flows mixed this week and focused on the front end of the curve.

1. 17500x 4-Aug-23 1800 Put bought

2. 14809x 25-Aug-23 2000 Call bought

3. 11835x 4-Aug-23 1750 Put bought

4. 10000x 27-Oct-23 1500 / 28-Jun-24 1200 Put Calendar sold

5. 10000x 28-Jun-24 4000 Call sold

If you missed it be sure to checkout the latest podcast with GSR

The Great Reversal of ETH Option Vega Flows

Hit us up on Telegram! 🙏

Daily Commentary✍️ http://pdgm.co/edge

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

Bybit x Paradigm Futures Spread Trade Tape: https://t.me/paradigm_bybit_fspd

BTC

ETH

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.

Greg Magadini

Greg Magadini is the Director of Derivatives at Amberdata. Previously, he co-founded Genesis Volatility (later acquired by Amberdata). Greg Magadini started his career as a proprietary trader for DRW and Chopper Trading in Chicago IL. Greg has nearly 15-years of options trading experience and has been active in the...