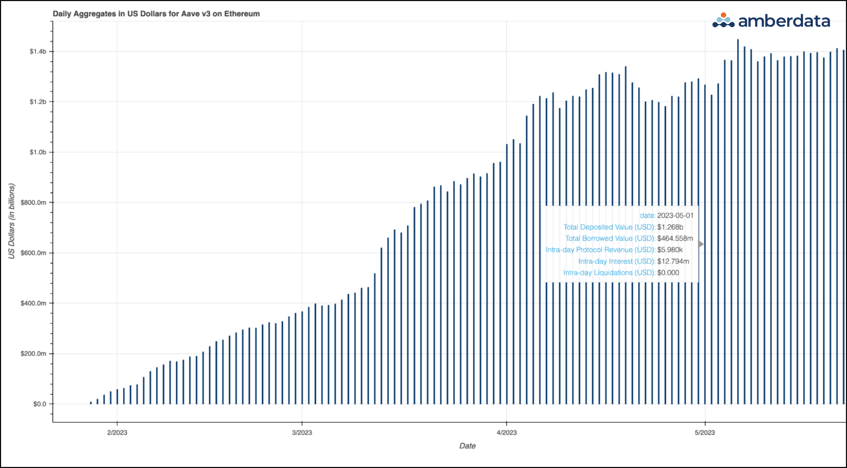

New Product Update: Lending and Borrowing Summary Metrics

Amberdata’s new lending and borrowing summary metrics offer multi-chain inter-day and intra-day aggregations of activity of popular lending protocols. This expanded coverage also complements Amberdata’s DeFi Lenses, which breaks lending and borrowing protocols down at the wallet, asset/pool, protocol, and protocol governance level.

With the Lending Protocol Summary Metrics, get detailed insights into the amount borrowed, deposited, and revenue earned across an entire lending protocol. Use inter-day and intra-day aggregate metrics across multiple chains to power TVL or lending activity dashboards. For example, the chart below shows how deposits dramatically increased to $1.4B once Aave v3 launched on Ethereum.

(Daily Aggregates in US Dollars for Aave v3 on ETH)

(Daily Aggregates in US Dollars for Aave v3 on ETH)

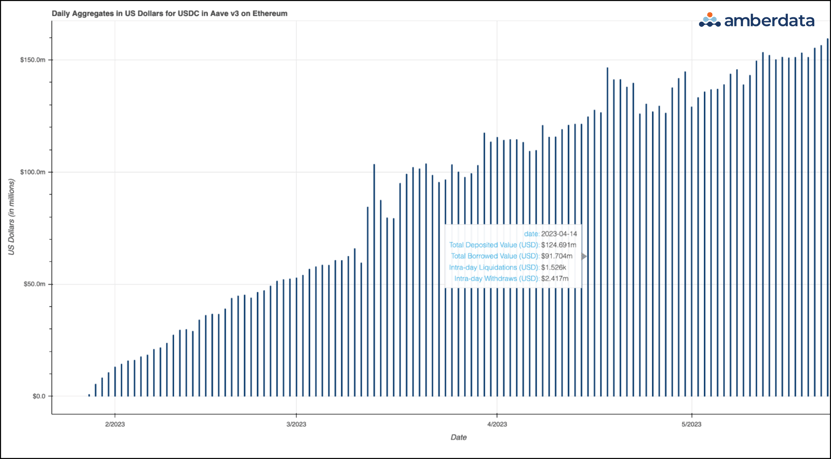

With the Lending Asset Summary Metrics, go deeper into lending protocols and see how a specific asset is performing. Leverage daily aggregate data on deposits, borrows, liquidations, and withdrawals to investigate the health and activity of an asset like USDC on popular lending protocols like Aave and Compound. Build dashboards like the one below to quickly analyze asset performance and trading volume.

(Daily Aggregates in US Dollars for USDC in Aave v3 on ETH)

(Daily Aggregates in US Dollars for USDC in Aave v3 on ETH)

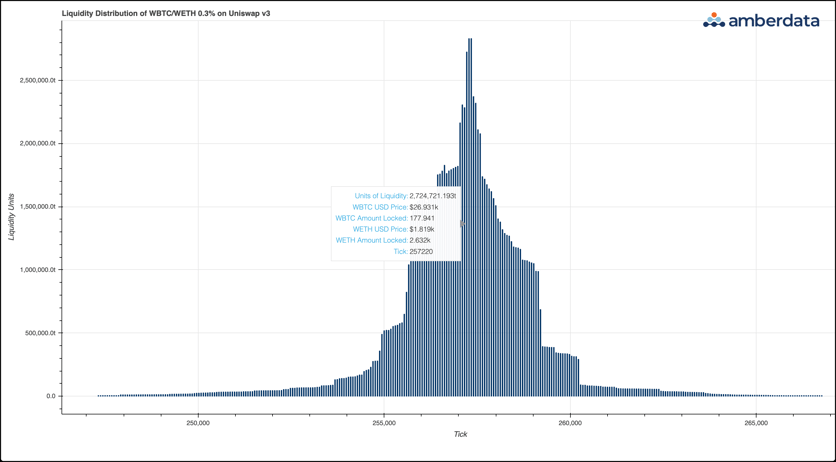

New Product Update: Uniswap v3 Liquidity Distribution

Uniswap v3 is a decentralized exchange (DEX) that allows LPs to concentrate their liquidity within a custom price range to maximize the use of their pooled assets. This gives individual LPs more control over where their capital is allocated and allows them to put far less capital at risk.

With Amberdata’s Uni v3 liquidity distribution data, view where liquidity is concentrated across the price range for a pool. Understand where sentiment is regarding price and its movements to elevate liquidity provider strategies.

(Liquidity Distribution of WBTC/WETH on Uniswap v3)

(Liquidity Distribution of WBTC/WETH on Uniswap v3)

For more information on Amberdata’s product offerings, please contact us at hello@amberdata.io or schedule a demo here.

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...