Amberdata Crypto Snapshot: Rumors, Legal Battles, and Market Trends

Hopium has returned just in time for the annual “How’s Bitcoin?” Thanksgiving conversation. This week’s Bitcoin boost is all the rage. Multiple start-stop rumors of Bitcoin spot ETF approvals served as the first stage in the rumor mill, which continued with the U.S. Clearing House Depository Trust and Clearing Corporation (DTCC) listing BlackRock’s ETF under the ticker IBTC. The listing does not indicate approval. It is also worth mentioning that the BlackRock iShares Bitcoin Trust ETF was added in August 2023 and is only now getting attention on social media.

In regulatory news, the SEC has thrown in the towel and has dropped their lawsuit against Ripple XRP executives. They are likely to focus on the issuer’s ongoing case appeal. Meanwhile, Gemini, Genesis, and Digital Currency Group (DCG) were sued by the New York Attorney General for defrauding investors. The case charges Gemini for lying to investors on Gemini Earn, in partnership with Genesis. The suit also charges former Genesis CEO Soichiro Moro and DCG’s CEO Barry Silbert with defrauding investors and concealing $1.1 billion in losses.

The trial against Sam Bankman-Fried continues with the FTX founder and former CEO set to testify on the stand any day now. Previous testimonies from Alameda Research’s former CEO and ex-girlfriend Caroline Ellison, FTX’s former head of engineering Nishad Singh, and FTX co-founder Gary Wang brought to light several incidents around SBF’s willingness and motivation to break the law. All three pleaded guilty to fraud.

Lastly, a WSJ article citing Elliptic data and claiming that Hamas affiliate PIJ raised $93M in crypto was refuted by Chainalysis after Senator Elizabeth Warren used it to accrue over 100 Congress votes calling for Biden to crack down on crypto. The Senator has been using an anti-crypto stance as one of her main flagpole agenda items. It seems like crypto will continue to be a wedge issue during the lead-up to the 2024 Presidential Election.

Spot Market

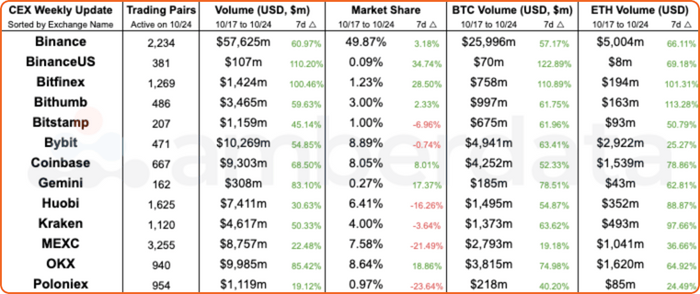

Centralized Exchange (CEX) comparisons from weeks 10/17/2023 and 10/24/2023.

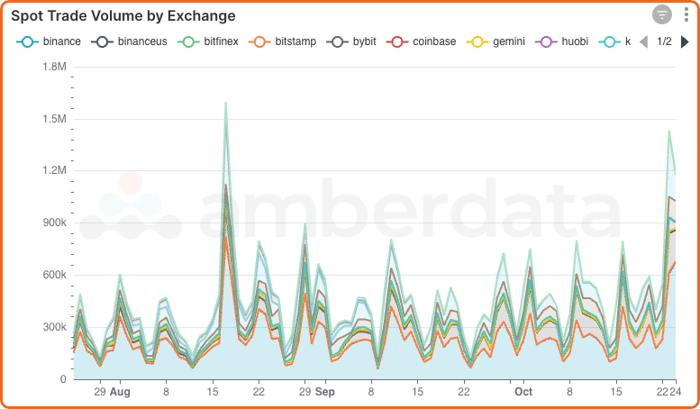

Centralized Exchange (CEX) trading volumes by exchange over the last 90 days.

Throughout the year, we have observed slight gains in cryptocurrency prices followed by low trading volume, resulting in declining prices as supply outstripped demand and no real traction was gained.

The events this week that led to Bitcoin’s rise had strong volumes across multiple exchanges. Some of these volumes can be explained by short liquidations and position re-hedging, which indicates a new and hopeful trend.

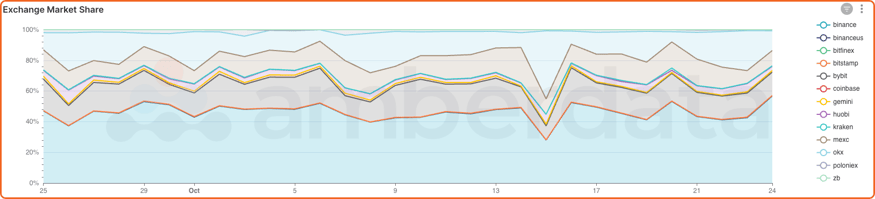

Centralized Exchange (CEX) trading volume market share over the last 30 days.

Binance leads the way with this latest Bitcoin rally, earning a solid 10% trading volume market share increase. Volumes have been generally low in 2023. However, all exchanges have seen their share of trading volumes grow this week. Coinbase and OKX have benefited the most from this week’s rally and each captured over 8% of the overall market.

DeFi DEXs

Decentralized Exchange (DEX) protocol from weeks 10/17/2023 and 10/24/2023.

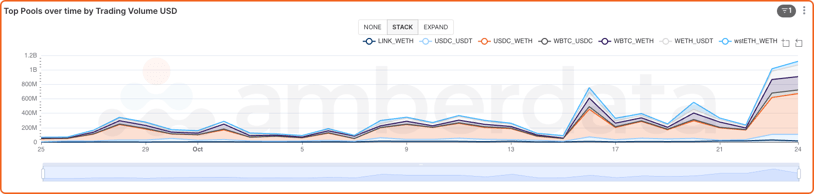

Decentralized Exchange (CEX) trading volume over the last 30 days.

Similar to CEXs, decentralized exchanges have also seen a sudden and significant growth in trading volume over the last week. Trading volume for USDC/WETH pools grew from last week’s daily average of $1.5M to over $5M, while WBTC/WETH pools had daily average trading volumes grow from roughly $50M to $180M.

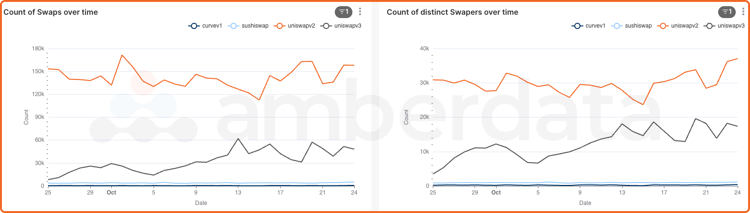

Decentralized Exchange (CEX) trading counts and users over the last 30 days.

DEX trading volumes also differed from trends over the past year. While CEX trading saw prices grow on high volume, DEX trading volume came through new swappers. In the past, price increases on DEXs often came from transaction count growth with the number of users (swappers) remaining fairly flat. This week, transaction counts remained fairly flat, but new swappers entering the fray give some hope that organic demand is growing.

DeFi Lending/Borrowing

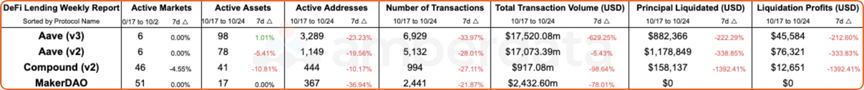

DeFi Lending protocol comparisons from weeks 10/17/2023 and 10/24/2023.

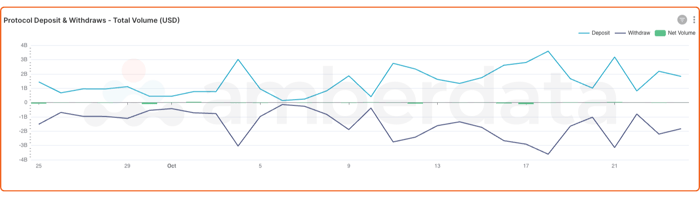

DeFi Lending overall deposit and withdrawal volume over the last 30 days.

In DeFi lending, not a lot has changed. Lenders have yet to give up their yield-generating opportunities for the riskier trading opportunities but this will be an important figure to watch. If lenders adjust their appetite for yield, it could signal trading opportunities. Lenders would then be aware that higher yields can be generated from trading.

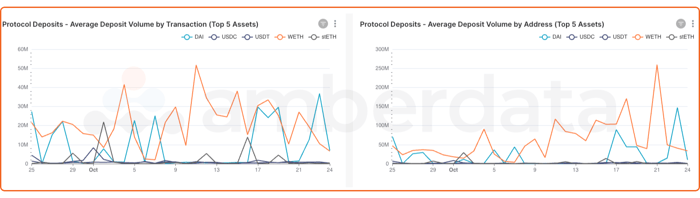

DeFi Lending pool average deposit volumes by transaction and by address over the last 30 days.

Another area to watch is the average deposit volume decline in the last week. Farmers, or users generating farming yield through lending pools, appear hesitant to throw more funds into lending pools and are either running out of new liquidity or saving up for other opportunities.

Networks

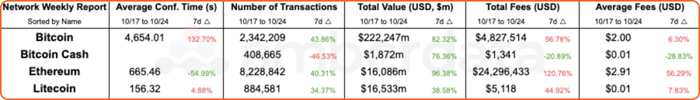

Network comparisons from weeks 10/17/2023 and 10/24/2023.

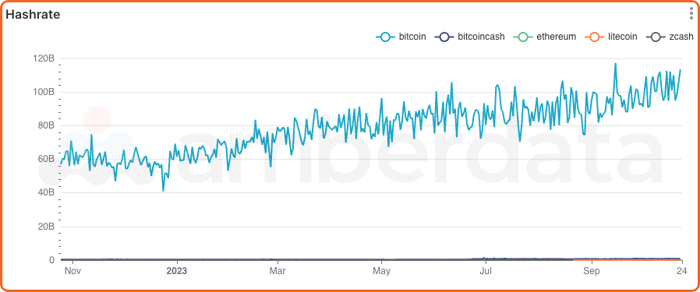

Network hash rate trends over the last year.

Bitcoin’s hash rate continued to climb, steadily growing to almost double the hash rate from a year prior.

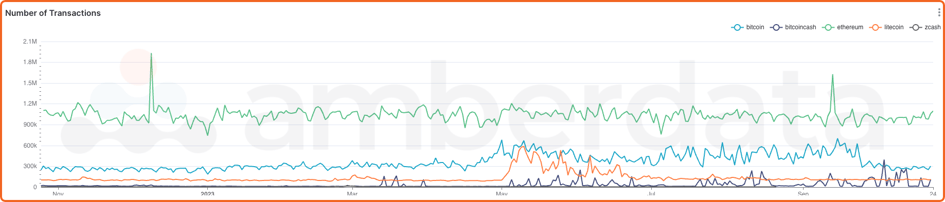

Network transaction count trends over the last year.

Meanwhile, transaction counts have been declining on Bitcoin in recent weeks, with the Bitcoin network seeing a steep decline since mid-September 2023, a return to November - December 2022 levels.

Links

Recent Coverage

- PR Web: Amberdata Receives Three Awards Recognizing Excellence in Digital Assets

- Amberdata’s third stablecoin primer: Becoming an Algorithmic Stablecoin Maxi

- Moody’s Data Story with Amberdata: Stablecoins have been unstable. Why?

- Amberdata Product Announcement:Amberdata Launches Datasets on Snowflake Marketplace

- CoinDesk: Bitcoin Eyes $31K as Gold Offers Bullish Cues

- Coinspeaker: Bitcoin (BTC) Price Eyes Move to $31,000 Along with Gold Rally

Spot Market

Spot market charts were built using the following endpoints:

- https://docs.amberdata.io/reference/market-metrics-exchanges-volumes-historical

- https://docs.amberdata.io/reference/market-metrics-exchanges-assets-volumes-historical

- https://docs.amberdata.io/reference/get-market-pairs

- https://docs.amberdata.io/reference/get-historical-ohlc

Futures

Futures/Swaps charts were built using the following endpoints:

- https://docs.amberdata.io/reference/futures-exchanges-pairs

- https://docs.amberdata.io/reference/futures-ohlcv-historical

- https://docs.amberdata.io/reference/futures-funding-rates-historical

- https://docs.amberdata.io/reference/futures-long-short-ratio-historical

- https://docs.amberdata.io/reference/swaps-exchanges-reference

- https://docs.amberdata.io/reference/swaps-ohlcv-historical

- https://docs.amberdata.io/reference/swaps-funding-rates-historical

DeFi DEXs

DeFi DEX charts were built using the following endpoints:

- https://docs.amberdata.io/reference/defi-dex-liquidity

- https://docs.amberdata.io/reference/defi-dex-metrics

DeFi Borrow/Lend

DeFi lending charts were built using the following endpoints:

- https://docs.amberdata.io/reference/defi-lending-protocol-lens

- https://docs.amberdata.io/reference/defi-lending-asset-lens

Networks

Network charts were built using the following endpoints:

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...