Amberdata Digital Assets Snapshot: SEC Clash & BTC Halving

With the upcoming year anticipating the Bitcoin halving, Bitcoin (and other digital assets) Spot ETFs, and a U.S. Presidential election, 2024 is already shaping up to be historic.

Coinbase has filed a lawsuit against the SEC following their response to the exchange’s request for more transparent crypto rules and regulations. The ongoing case of the SEC vs Coinbase continues to draw public attention. Massachusetts Senator Elizabeth Warren has drafted a bill to crack down on crypto that cites money laundering and drug trafficking. Responses online have cited GovTrack (bill-tracking platform) which shows that only 11 of the Senator’s 330 bills introduced have been enacted. One of the bill’s co-sponsors (Senator Roger Marshall) has since revealed that it was written and sponsored by the American Bankers Association (ABA) banking lobby.

Meanwhile, the CFTC acknowledges that “under existing law, many of the tokens constitute commodities” and US Congressional Bill HR 8950 is set for a final vote in January 2024 to cement crypto as a commodity. In addition, new accounting standards for certain crypto assets passed by the FASB (Financial Accounting Standards Board in the United States) improve corporate reporting by requiring fair value reporting as opposed to taking impairment losses as long-lived assets. This opens the door for corporate treasuries to better report their holdings in a more transparent manner.

A major exploit of Ledger emerged last week, and although it was quickly patched in three hours, it put a major halt to several dApps as commonly used web3 connectors were affected. Thankfully it doesn’t seem as if many wallets or dApps suffered from the exploit. Still, with the ThirdWeb exploit that affected several hundred (if not thousands) of contracts, NFTs, and protocols, security will be a major trend to watch next year as exploits have shown that they can affect a wide set of protocols rather than being contained events.

Spot Market

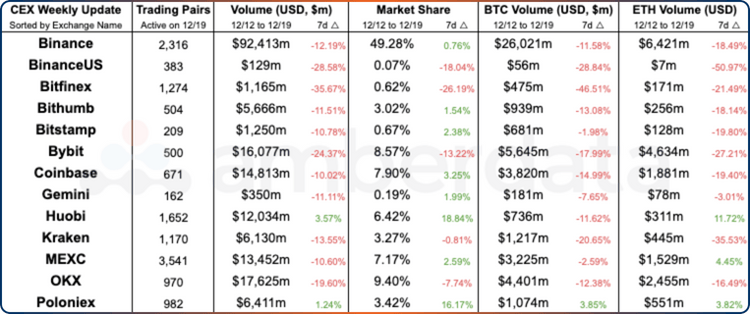

Centralized Exchange (CEX) comparisons from weeks 12/6/2023 and 12/19/2023

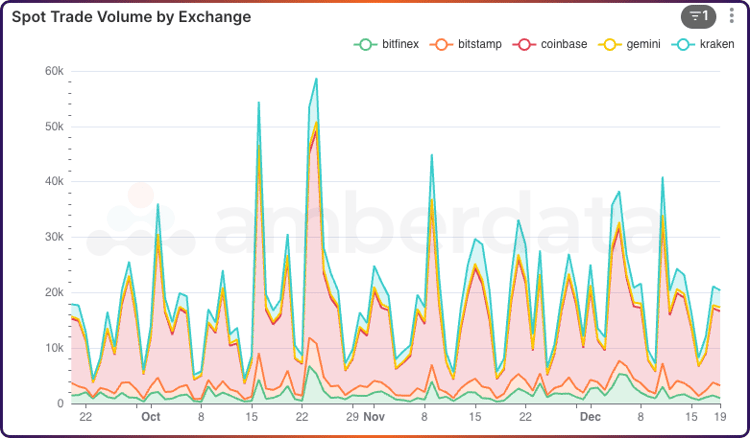

Centralized Exchange (CEX) spot trading volumes by exchange for BTC/USD over the last 30 days

USD onboarding into BTC continues to be strong and shows consistently high daily volumes between October and December, though daily peaks in October hitting as high as $60k in volume still overshadow December’s peaks. Coinbase’s dominance in trading volume holds firm while other BTC/USD trading pair exchanges maintain strong positions during the current market.

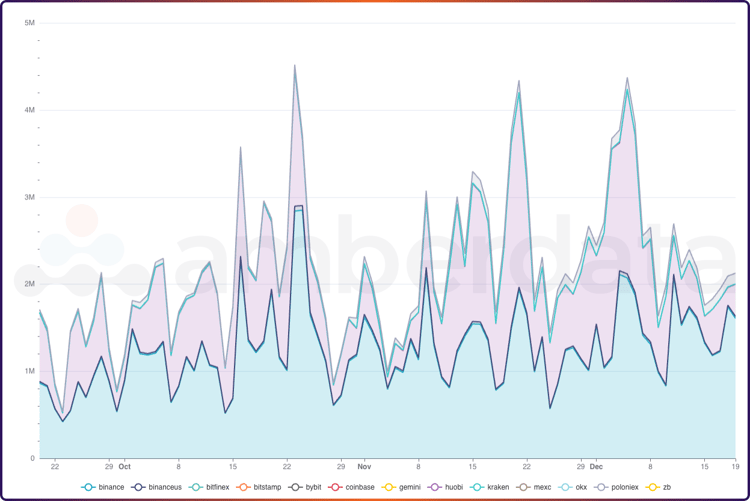

Centralized Exchange (CEX) spot trading volumes by exchange for BTC/USDT over the last 30 days

Looking at BTC/USDT trading volumes, December has been shining with daily trading volumes consistently trending upwards since October.

Centralized Exchange (CEX) spot trading volumes by exchange for BTC / USDT over the last 30 days

One measure of the market state, Bitcoin Yardstick, has been positively trending upwards and crossed our “cheap” range in May. However, we still find ourselves a long way from conclusive “risky” or “expensive” territory.

DeFi DEXs

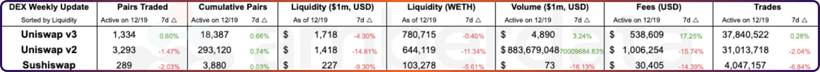

Decentralized Exchange (DEX) protocol from weeks 12/6/2023 and 12/19/2023

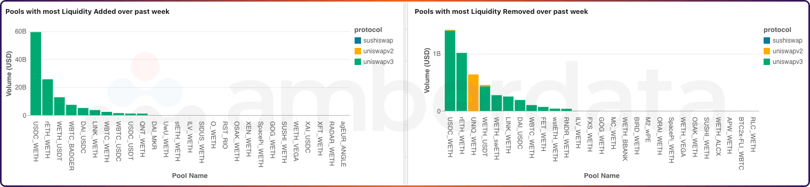

Top DEX pools for liquidity added and removed over the last week

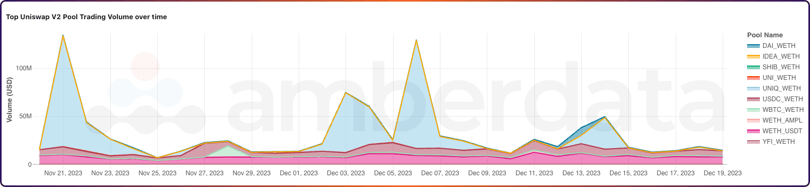

Over the past month, UNIQ_WETH experienced some large movement in liquidity removal, clocking in at the third pool with most liquidity removed by USD volume. Looking at a breakdown of Uni v2 pool trading volume reveals large spikes in trades in UNIQ_WETH week, as well as several smaller spikes over the past month.

Uniswap v2 top pools by trading volume in the last 30 days

But what is UNIQ? UNIQ is a token that powers the Uniqly platform, an NFT marketplace for wearable NFTs. Some brief investigation into the big liquidity drop revealed that the user who removed the tokens is the Uniqly creator himself (transaction: https://etherscan.io/tx/0x7bdadc03cf0313680bde8e6b7b8a8e5e41622355e2ae0a656efb90c239d53700). Curious to see if this was a rug, we dug a bit deeper and found that Uniqly is going through a token migration (https://uniqly.medium.com/uniqly-token-migration-bd4d24caac01). December 16th was the final date before migration, which explains the high movement in UNIQ trading volume over the past month as users moved to either dump or obtain UNIQ tokens in preparation. It is fascinating how token protocol changes can influence the macro environment, and capturing this with visualization can give an edge on burgeoning alpha opportunities.

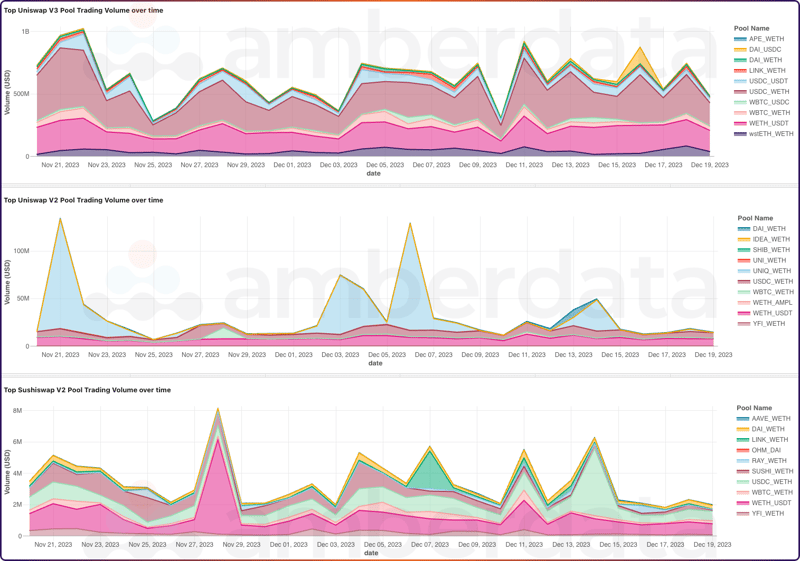

Top pools by trading volumes by DEX in the last 30 days

Lastly, as we draw close to the end of 2023, let’s briefly look at DEX trading volumes over the past year. It was a tumultuous year for the DEX world, especially in March when Silicon Valley Bank collapsed. This truly tested the mettle of the DEX ecosystem, with $5.47B in trade volume for USDC_WETH on March 12th, and a total trade volume of over $10B for that day. Uniswap v3 also remains the clear winner in terms of usage, with roughly $1B in daily trading volume, while old protocols such as Uniswap v2 and Sushiswap v2 trade in the low millions. Across all three protocols, the top pools are stablecoin pools, showing the ecosystem’s hesitance to bet on more volatile options. If the current bull market signs continue to ramp up as we move into 2024, we should expect to see less of a stablecoin pool domination in the top DEX spots.

DeFi Borrow/Lend

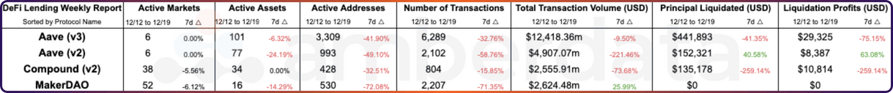

DeFi Lending protocol comparisons from weeks 12/6/2023 and 12/19/2023

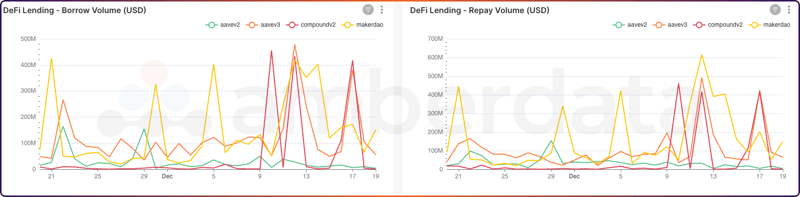

DeFi Lending - Total Borrow and Repayment volumes over the last 30 days

DeFi Lending protocols have been seeing more activity on the borrowing side, with volumes reaching over $1B in daily volume twice over the last two weeks across Aave v3, Aave v2, Compound v2, and MakerDAO. Activity is often highest when the market is bullish and borrowing rates are low as users often use loans to speculate on alt-coins or recursively lend on other protocols for yield arbitrage.

Borrow and Repayment volumes by protocol over the last 30 days

Splitting these volumes by exchange, we can see that there have been several extremely high volume days on Compound in December, which has caused this overall spike in borrowing volumes.

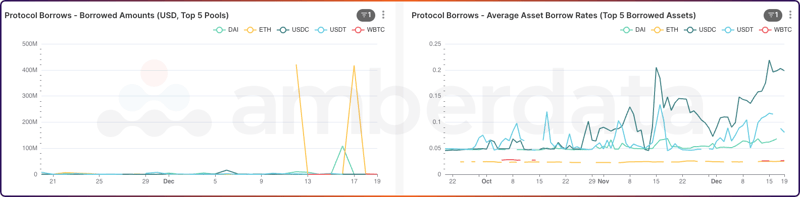

Compound v2 borrowing volumes and average borrow rates over the last 30 days

Zooming in on the volumes, ETH is far and away the highest borrowed token. Given the growing borrow rates (or the cost to borrow) for stablecoins on Compound v2, it’s likely that users are swapping their stablecoin loans for ETH loans and taking advantage of the ETH token price run-up and significantly lower rates to borrow. This allows users to capture the price upside of ETH (whereas holding stablecoins often has no price volatility benefits due to its price stability) and use this leverage elsewhere for long periods given the low rates on the platform.

Networks

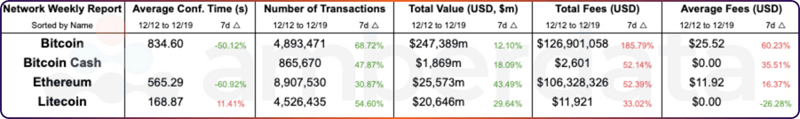

Network comparisons from weeks 12/6/2023 and 12/19/2023

Network comparisons from weeks 12/6/2023 and 12/19/2023

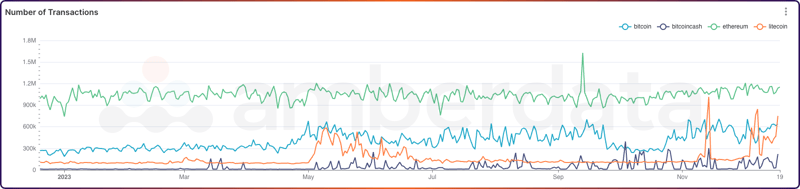

Network transactions continue at healthy levels, though Litecoin is seeing sudden waves of transactions on the network. This new influx of transactions has led to a new milestone for the network: surpassing daily Bitcoin volumes.

Links

Recent from Amberdata

Spot Market

Spot market charts were built using the following endpoints:

- https://docs.amberdata.io/reference/market-metrics-exchanges-volumes-historical

- https://docs.amberdata.io/reference/market-metrics-exchanges-assets-volumes-historical

- https://docs.amberdata.io/reference/get-market-pairs

- https://docs.amberdata.io/reference/get-historical-ohlc

Futures

Futures/Swaps charts were built using the following endpoints:

- https://docs.amberdata.io/reference/futures-exchanges-pairs

- https://docs.amberdata.io/reference/futures-ohlcv-historical

- https://docs.amberdata.io/reference/futures-funding-rates-historical

- https://docs.amberdata.io/reference/futures-long-short-ratio-historical

- https://docs.amberdata.io/reference/swaps-exchanges-reference

- https://docs.amberdata.io/reference/swaps-ohlcv-historical

- https://docs.amberdata.io/reference/swaps-funding-rates-historical

DeFi DEXs

DeFi DEX charts were built using the following endpoints:

- https://docs.amberdata.io/reference/defi-dex-liquidity

- https://docs.amberdata.io/reference/defi-dex-metrics

DeFi Borrow/Lend

DeFi lending charts were built using the following endpoints:

- https://docs.amberdata.io/reference/defi-lending-protocol-lens

- https://docs.amberdata.io/reference/defi-lending-asset-lens

Networks

Network charts were built using the following endpoints:

Amberdata

Amberdata is the leading provider of global financial infrastructure for digital assets. Our institutional-grade solutions deliver data, analytics and comprehensive tools and insights that empower financial institutions to research, trade, and manage risk and compliance in digital assets. Amberdata serves as a...